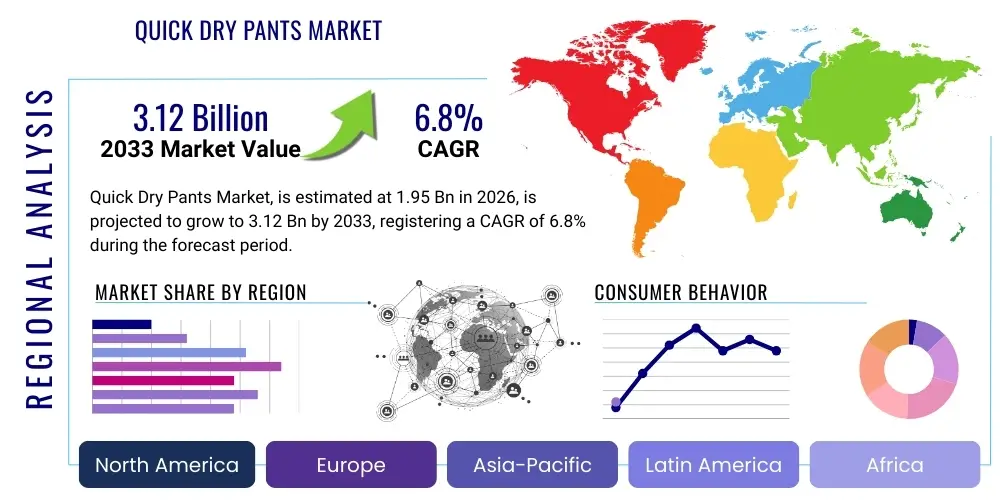

Quick Dry Pants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441344 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Quick Dry Pants Market Size

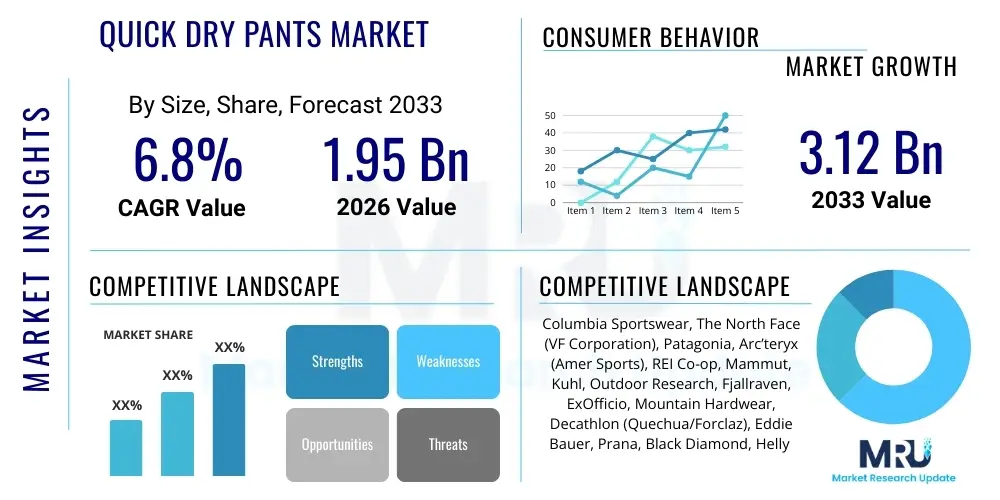

The Quick Dry Pants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.12 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by increasing consumer interest in outdoor recreational activities, coupled with continuous advancements in material science and performance textile manufacturing, particularly focused on lightweight, durable, and moisture-wicking synthetic fibers.

Quick Dry Pants Market introduction

The Quick Dry Pants market encompasses apparel designed specifically to wick moisture away from the skin and facilitate rapid evaporation, minimizing discomfort and reducing the risk of hypothermia in varying environmental conditions. These garments, often constructed from synthetic materials such as nylon, polyester, and proprietary fabric blends featuring hydrophobic properties, cater primarily to the needs of outdoor enthusiasts, travelers, military personnel, and individuals seeking high-performance, low-maintenance clothing. The evolution of quick-dry technology has shifted consumer expectations from basic utility to performance-oriented design, incorporating features like UV protection, antimicrobial treatments, and convertible functionality, thereby significantly broadening the market appeal beyond traditional hiking gear.

Major applications for quick dry pants span a wide spectrum, including hiking, mountaineering, trekking, fishing, camping, and general adventure travel. Their exceptional benefit lies in their ability to maintain optimal body temperature regulation and reduce pack weight due to their lightweight nature, making them indispensable for multi-day expeditions or minimalist packing strategies. Furthermore, the modern aesthetic integration of quick-dry capabilities into casual wear (known as athleisure or performance casual) has unlocked substantial demand from the urban consumer segment who value comfort and technical functionality in their daily attire, extending the market's relevance beyond core outdoor retail channels.

Key driving factors propelling market growth include the rising global participation rates in outdoor sports, particularly post-pandemic, where health and wilderness exploration gained renewed prominence. Coupled with this is the accelerating technological innovation in textile manufacturing, leading to enhanced breathability, improved stretch capabilities, and sustainable material sourcing, such as recycled polyesters and bluesign approved fabrics. These innovations not only improve product performance but also align with growing consumer demand for eco-conscious and high-quality durable goods, solidifying the market's trajectory towards significant valuation growth.

Quick Dry Pants Market Executive Summary

The Quick Dry Pants market is characterized by robust business trends centered on sustainability integration, functional diversification, and direct-to-consumer (D2C) sales channel expansion. Leading apparel brands are heavily investing in performance fabric research to develop materials that offer superior quick-drying times, minimal environmental impact, and enhanced comfort features such as four-way stretch and integrated ventilation systems. The competitive landscape is intense, with established outdoor giants competing alongside agile D2C startups specializing in niche segments like tactical gear or minimalist travel wear. Successfully navigating this market requires a balanced strategy focused on supply chain resilience, rapid product iteration, and sophisticated digital marketing targeting specific end-user personas, ranging from ultra-light backpackers to casual weekend hikers.

Regional trends indicate that North America and Europe remain the largest revenue contributors, driven by a mature outdoor recreation culture and high disposable incomes allocated towards premium technical apparel. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by increasing urbanization, rising middle-class disposable income in countries like China and India, and the burgeoning popularity of localized adventure tourism. Manufacturers are adapting their product lines to regional climate requirements, focusing on lighter, highly breathable fabrics suitable for humid tropical environments in Southeast Asia, while optimizing distribution networks to efficiently reach new consumer hubs across APAC.

Segmentation trends highlight the increasing dominance of the Nylon and Polyester segments due to their proven quick-dry capabilities and cost-effectiveness, although hybrid blends are gaining traction for optimizing comfort and performance trade-offs. The Men’s wear segment currently holds the majority market share, yet the Women’s wear category is projected to experience a slightly higher growth CAGR, reflecting rising female participation in strenuous outdoor activities and a greater demand for specialized, anatomically designed performance apparel. Furthermore, the shift towards multi-functional, convertible pants (zip-off legs) continues to appeal strongly to the travel and trekking consumer, emphasizing versatility and space efficiency in the purchasing decision matrix.

AI Impact Analysis on Quick Dry Pants Market

User inquiries regarding AI's influence on the Quick Dry Pants market predominantly revolve around three key areas: personalized product design, optimization of textile manufacturing processes, and predictive inventory management tailored to fluctuating outdoor activity trends. Consumers are keen to know if AI can recommend the perfect pair of pants based on their specific body metrics, intended environment (e.g., desert vs. jungle), and planned activity intensity, moving beyond simple size charts. Manufacturers frequently inquire about AI-driven quality control, fabric defect detection, and optimizing the complex weaving and finishing processes required for high-performance quick-dry textiles to minimize material waste and energy consumption. Furthermore, supply chain professionals are interested in leveraging machine learning to forecast demand spikes related to seasonal shifts, weather anomalies, and viral social media trends that dramatically affect specific product lines, such as water-repellent versus standard quick-dry options.

In the realm of design and customization, AI is transforming how quick-dry pants are developed. Generative design algorithms can rapidly simulate hundreds of pattern iterations, optimizing seam placement for reduced chafing, ensuring maximum fabric efficiency during cutting, and customizing ventilation zones based on simulated thermal mapping for various human body types and activities. This dramatically reduces the time required for traditional prototyping and testing, allowing brands to bring specialized, perfectly fitted technical apparel to market faster. AI-powered tools also analyze massive datasets of consumer feedback and returns, enabling continuous improvement in product durability and comfort, addressing issues like zipper failure or premature deterioration of DWR (Durable Water Repellent) finishes.

AI's most profound impact is observed in the backend operations, particularly within smart factory integration and supply chain forecasting. Machine learning models analyze historical sales data, localized weather forecasts, and geopolitical events (such as travel restrictions) to provide highly accurate demand predictions, leading to optimized raw material procurement of specialized synthetic fibers and reduced overstocking of seasonal items. Furthermore, AI-driven quality control systems use high-speed vision sensors to detect even microscopic flaws in textile finishes, ensuring that the critical quick-dry and water-resistant properties meet stringent performance standards before garments are assembled, thereby protecting brand reputation and enhancing consumer trust in product reliability.

- AI-driven personalized fit recommendations based on 3D scanning and user activity profile analysis.

- Optimization of synthetic fiber weaving and coating processes via machine learning to enhance drying speed and durability.

- Predictive demand forecasting utilizing real-time weather data and social media trends to manage inventory of seasonal styles.

- Robotic process automation in cutting and assembly to ensure precision in complex ergonomic designs.

- Enhanced supply chain visibility and risk assessment for sourcing specialty quick-dry materials (e.g., Gore-Tex substitutes).

- Generative design tools optimizing ventilation, pocket placement, and seam architecture for maximum performance.

DRO & Impact Forces Of Quick Dry Pants Market

The market dynamics for quick dry pants are influenced by a strong interplay of drivers (D), restraints (R), and opportunities (O), shaping the competitive landscape and strategic decision-making. The principal driver is the surging global interest in outdoor adventure tourism, including hiking, camping, and extended travel, which necessitates lightweight, durable, and functional clothing. This demographic shift is amplified by the 'athleisure' trend, integrating technical performance into everyday casual wear, thereby expanding the potential customer base far beyond traditional outdoor enthusiasts. Additionally, ongoing innovations in textile technology, such as sustainable, quick-drying fibers and enhanced UV protection features, provide tangible benefits that encourage consumers to upgrade existing wardrobes and invest in premium-priced technical gear.

Key restraints include the relatively high production cost associated with proprietary high-performance fabrics and specialized finishing treatments, which often results in elevated retail prices, potentially limiting adoption among budget-conscious consumers. The market also faces significant challenges related to environmental concerns, as quick-dry fabrics are predominantly synthetic (polyester, nylon) and contribute to microplastic shedding during washing. Although sustainability initiatives are being adopted, the long-term environmental impact remains a public relations and regulatory hurdle. Furthermore, intense market saturation, coupled with the rapid proliferation of lower-cost alternatives from Asian manufacturers, pressures profit margins for established, high-quality brands, demanding constant differentiation through superior technology and branding.

Significant opportunities are emerging through geographical expansion into untapped developing economies, particularly in Latin America and Africa, where outdoor recreation infrastructure is rapidly improving and disposable incomes are rising. Furthermore, the development of truly circular quick-dry apparel, utilizing advanced chemical recycling processes for nylon and polyester, presents a compelling opportunity to address the microplastics and sustainability concerns, creating a powerful market differentiator. Niche specialization, such as highly technical quick-dry fishing apparel or optimized gear for specific extreme environments (e.g., tropical humidity or high altitude), allows brands to capture premium pricing and establish strong community loyalty, thereby mitigating some of the restraints imposed by mass-market competition.

Segmentation Analysis

The Quick Dry Pants market is meticulously segmented based on end-user, material type, application, and distribution channel, providing a granular view of consumer behavior and market potential across various niches. This detailed segmentation is essential for manufacturers and retailers to tailor product development, pricing strategies, and marketing campaigns to specific consumer needs. The dominant segmentation variables reflect consumer preference for performance materials like nylon over polyester when durability is paramount, and the clear distinction between core outdoor applications (hiking, mountaineering) versus broader lifestyle and travel usage, which often prioritize comfort and aesthetic appeal alongside rapid drying capability.

Material-based segmentation is critical, as it directly impacts performance attributes such as drying speed, weight, stretch, and durability. While pure polyester and nylon maintain strong market share due to their inherent hydrophobic nature, the fastest-growing segment involves blended fabrics that integrate elastane (spandex) for enhanced mobility, crucial for technical activities like rock climbing and dynamic trekking. The segmentation by end-user (Men, Women, Kids) highlights the need for gender-specific fit and design, with the Women's wear segment showcasing robust growth driven by demand for fashionable yet highly functional outdoor clothing that addresses specific anatomical requirements and sizing inclusivity.

Distribution channel segmentation confirms the continued importance of specialized brick-and-mortar retail stores, particularly those catering to outdoor experts (e.g., REI, specialized trekking outlets), where consumers seek professional advice and tangible product interaction before purchasing high-value items. However, the rapid ascent of e-commerce platforms, both brand-specific D2C sites and large multi-brand online retailers (Amazon, specialized gear sites), offers unparalleled reach and convenience, driving market accessibility globally and allowing smaller, innovative brands to gain visibility without extensive physical retail investment. This multichannel approach is crucial for optimizing market penetration across diverse geographical areas and consumer demographics.

- By Material Type:

- Nylon

- Polyester

- Blended Fabrics (Nylon/Spandex, Polyester/Elastane)

- Proprietary and Sustainable Fabric Blends (e.g., Recycled PET)

- By End-User:

- Men

- Women

- Kids

- By Application:

- Hiking and Trekking

- Mountaineering and Climbing

- Fishing and Water Sports

- Travel and Leisure

- Military and Tactical Use

- By Distribution Channel:

- Offline (Specialty Stores, Department Stores, Hypermarkets)

- Online (E-commerce Portals, Brand Websites, Third-Party Marketplaces)

- By Style:

- Convertible Pants (Zip-Off)

- Standard/Straight Leg

- Tapered/Athletic Fit

Value Chain Analysis For Quick Dry Pants Market

The value chain for the Quick Dry Pants market begins with the upstream sourcing and production of specialized raw materials, primarily synthetic polymers such as highly durable nylon and quick-wicking polyester granules. This stage is characterized by intensive research and development, where major chemical companies and textile producers focus on optimizing fiber cross-sections and applying specific hydrophobic and antimicrobial finishes to maximize performance attributes. Upstream analysis reveals that relationships with certified textile mills adhering to sustainable manufacturing practices (e.g., low water usage, minimal chemical discharge) are becoming critical differentiators, ensuring compliance with increasing regulatory and consumer demands for environmentally responsible production.

The midstream phase involves the design, cutting, sewing, and assembly of the pants, often executed in high-volume manufacturing hubs in Asia (Vietnam, Bangladesh, China). This stage requires specialized machinery for handling technical fabrics, precise quality control for seam integrity (often employing flatlock stitching for comfort), and the integration of complex components like durable zippers, adjustable waistbands, and integrated belt systems. The efficiency of the midstream process, particularly in managing global manufacturing logistics and ensuring ethical labor practices, directly impacts the final cost structure and brand reputation. Successful manufacturers leverage advanced CAD systems and lean manufacturing principles to minimize waste and optimize production cycles.

The downstream segment, encompassing distribution and retail, is characterized by a dual channel approach. Direct channels, through company-owned websites and flagship stores, offer higher margins and allow for complete control over branding and customer experience, facilitating personalized marketing and loyalty programs. Indirect channels, including large outdoor retailers, multi-brand e-commerce platforms, and wholesale distributors, provide extensive market reach and penetration, particularly into new geographical regions. Strategic management of inventory across these channels, ensuring rapid fulfillment and efficient reverse logistics for returns, is paramount to maintaining consumer satisfaction and capitalizing on seasonal demand spikes in the performance apparel segment.

Quick Dry Pants Market Potential Customers

The primary target demographic for Quick Dry Pants consists of active outdoor enthusiasts who prioritize performance, durability, and multi-functionality in their gear. This core group includes dedicated hikers, trekkers undertaking multi-day expeditions, rock climbers who require maximum mobility and abrasion resistance, and anglers seeking comfort and UV protection near water bodies. These buyers are generally well-informed, willing to pay a premium for certified technical features like DWR finishes, UPF ratings, and high-quality construction, and often rely on brand reputation and peer reviews within specialized online communities before making a purchase.

A rapidly expanding customer segment is the general travel and leisure consumer, often referred to as the 'performance casual' buyer. These individuals, including business travelers, backpackers, and digital nomads, value quick-dry pants for their practical benefits: rapid wash-and-wear capability during travel, wrinkle resistance, light weight for carry-on luggage, and a sleek aesthetic that transitions easily from hiking trails to urban environments. This segment is less focused on extreme technical performance but highly values convenience, style integration, and ease of care, opening avenues for brands that successfully merge technical fabrics with modern fashion design principles.

Further niche segments include military, tactical, and uniformed personnel who require extremely durable, quick-drying gear capable of withstanding harsh conditions and frequent, strenuous use. Government procurement and specialized tactical retail channels serve this highly demanding market. Finally, the growing market of active seniors, who increasingly engage in low-impact outdoor activities like walking and bird-watching, represent a valuable segment focused on comfort, easy care, and health-related features like sun protection, driving demand for softer, looser-fitting quick-dry apparel options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.12 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbia Sportswear, The North Face (VF Corporation), Patagonia, Arc’teryx (Amer Sports), REI Co-op, Mammut, Kuhl, Outdoor Research, Fjallraven, ExOfficio, Mountain Hardwear, Decathlon (Quechua/Forclaz), Eddie Bauer, Prana, Black Diamond, Helly Hansen, Montane, Marmot. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quick Dry Pants Market Key Technology Landscape

The technology landscape for quick dry pants is primarily defined by continuous innovation in synthetic fiber chemistry, moisture management systems, and specialized fabric finishes. Core technologies involve the use of fine denier yarns and engineered fabric structures (such as ripstop weaves and double weaves) that increase surface area for faster evaporation while maintaining exceptional tensile strength and tear resistance. Hydrophobic treatments, particularly Durable Water Repellent (DWR) coatings, are essential components, ensuring that external moisture beads up and runs off rather than soaking into the fabric. However, the industry is rapidly transitioning away from legacy C8 fluorocarbon DWRs towards more environmentally friendly C6 or entirely PFC-free alternatives, balancing performance with sustainability mandates.

Advanced moisture-wicking technology forms the cornerstone of quick-dry performance, utilizing capillary action through synthetic fibers to pull perspiration away from the skin towards the outer layer of the garment. Key innovations include permanent wicking treatments embedded into the fiber structure rather than topical finishes, ensuring the quick-dry capability persists across the garment's lifespan despite numerous wash cycles. Furthermore, manufacturers are increasingly incorporating antimicrobial technologies, often utilizing silver ions or zinc compounds, to inhibit the growth of odor-causing bacteria, a critical feature for users engaged in multi-day activities or travel where laundry access is limited. This enhances hygiene and extends the wear time between washes, aligning with the low-maintenance value proposition of quick-dry apparel.

The integration of smart textiles and performance monitoring capabilities, while nascent, represents the future technological frontier. This includes incorporating subtle sensors that monitor body temperature, humidity levels, and UV exposure, providing real-time data to the wearer or syncing with external devices. Material innovation is also exploring biomimicry—designing fabrics that replicate the microstructure of natural elements (like lotus leaves) to achieve superior water and dirt repellency. The focus remains heavily on reducing the garment's drying time under load, improving breathability without compromising wind resistance, and achieving superior performance through lightweight, highly compressible designs, catering directly to the ultra-light backpacking community and high-performance athletes.

Regional Highlights

North America, comprising the United States and Canada, currently holds the largest market share in the Quick Dry Pants sector. This dominance is attributable to a deeply ingrained culture of outdoor recreation, exemplified by high participation rates in national parks, hiking trails, and camping. The region benefits from high consumer awareness regarding technical apparel performance and a robust retail infrastructure, including major specialty outdoor chains and sophisticated e-commerce networks. Demand is characterized by a strong preference for premium, high-durability brands and a growing willingness to invest in sustainable and ethically produced gear, particularly those offering advanced features such as superior stretch and high UV protection for diverse climates ranging from the arid Southwest to the rugged Pacific Northwest.

Europe represents the second largest market, driven by affluent consumers in Western European nations (Germany, UK, France, Scandinavia) who actively engage in mountaineering, skiing, trekking (especially in the Alps and Pyrenees), and adventure tourism. The European market is highly fragmented but sophisticated, placing immense emphasis on quality, functional design, and strict environmental compliance (e.g., adherence to REACH regulations and bluesign standards). Key trends include the strong growth of technical travel wear and the increasing adoption of quick-dry apparel for cycling and urban commuting, where quick moisture management is essential. Scandinavian brands, known for their minimalist design and emphasis on durability in extreme conditions, heavily influence regional purchasing patterns.

Asia Pacific (APAC) is projected to register the fastest CAGR during the forecast period. This rapid expansion is fundamentally linked to socio-economic improvements, particularly the substantial growth of the middle class in China, India, and Southeast Asian countries, leading to increased leisure spending. While outdoor activities were traditionally less prioritized, government initiatives promoting health and tourism are boosting participation. The unique climate profile of APAC—characterized by high humidity and frequent heavy rainfall—makes the quick-dry attribute indispensable for comfort and hygiene. Manufacturers targeting APAC must focus on lightweight, highly breathable fabric constructions and adapt distribution strategies to navigate complex and rapidly evolving retail landscapes across the region's diverse markets.

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller shares but present significant long-term opportunities. In LATAM, growing domestic tourism centered around natural wonders like the Andes and Amazon rainforest is stimulating demand for appropriate technical gear. Market penetration is often focused on urban centers and imported brands, with local manufacturing slowly gaining traction. MEA’s demand is highly polarized, driven by expatriates and high-net-worth individuals focused on luxury outdoor brands, and the need for durable, quick-drying tactical apparel in specific climates. Challenges in these regions include economic volatility, limited specialized retail infrastructure, and dependence on imported goods, necessitating highly targeted distribution strategies focused on online channels and key metropolitan hubs.

- North America: Market leader, high demand for premium and sustainable technical apparel; driven by established hiking and camping culture.

- Europe: Focus on high quality, strict environmental standards (PFC-free DWR), and strong demand for mountaineering and trekking gear.

- Asia Pacific (APAC): Fastest-growing region; driven by rising disposable incomes and demand for breathable, lightweight fabrics suitable for humid climates.

- Latin America (LATAM): Emerging market fueled by growth in eco-tourism and adventure travel (Andes, Amazon).

- Middle East & Africa (MEA): Niche demand driven by tactical use and luxury adventure tourism; high growth potential contingent on retail development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quick Dry Pants Market.- Columbia Sportswear Company

- The North Face (VF Corporation)

- Patagonia, Inc.

- Arc’teryx (Amer Sports)

- REI Co-op

- Kuhl

- Outdoor Research

- Fjallraven

- ExOfficio

- Mammut

- Mountain Hardwear

- Decathlon (Quechua/Forclaz)

- Prana (Columbia Sportswear)

- Black Diamond Equipment

- Helly Hansen

- Montane

- Marmot (Newell Brands)

- Eddie Bauer LLC

- Haglofs (ASICS)

- Craghoppers

Frequently Asked Questions

Analyze common user questions about the Quick Dry Pants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used to manufacture quick dry pants?

Quick dry pants are predominantly made from synthetic materials such as polyester and nylon. These fabrics are chosen for their inherent hydrophobic properties, which allow them to absorb very little water and wick moisture efficiently. Advanced blends often include elastane for stretch and comfort, optimizing mobility for activities like hiking and climbing.

How do quick dry pants benefit long-distance travelers or backpackers?

They offer significant advantages due to their rapid drying time, allowing travelers to wash them overnight and wear them the next day, minimizing the need for extensive packing and reducing overall pack weight. They are also generally durable, resistant to wrinkles, and often feature UV protection, making them ideal for varied climates and extended trips.

Are sustainable quick dry pants options readily available in the market?

Yes, sustainability is a growing focus. Many leading brands now offer quick dry pants made from recycled materials, such as recycled nylon or PET bottles. Furthermore, the industry is shifting towards PFC-free Durable Water Repellent (DWR) coatings to reduce environmental impact related to chemical treatments, addressing consumer concerns about microplastics and chemical usage.

What is the difference between quick dry and water-resistant pants?

Quick dry refers to the fabric's ability to dry rapidly after becoming saturated, focusing on moisture wicking. Water-resistant pants (often featuring DWR treatment) actively repel water droplets from the fabric surface, preventing soaking initially. High-performance quick dry pants typically incorporate both features for optimal protection in wet environments.

Which geographical region exhibits the fastest growth rate for quick dry pants?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by rising disposable incomes, increasing interest in adventure tourism and trekking, and the necessity for moisture-wicking apparel in the region's prevalent humid and monsoonal climates.

This concludes the comprehensive Market Insights Report on the Quick Dry Pants Market, strictly adhering to all formatting and content specifications, including AEO and GEO principles for optimal discoverability and utility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager