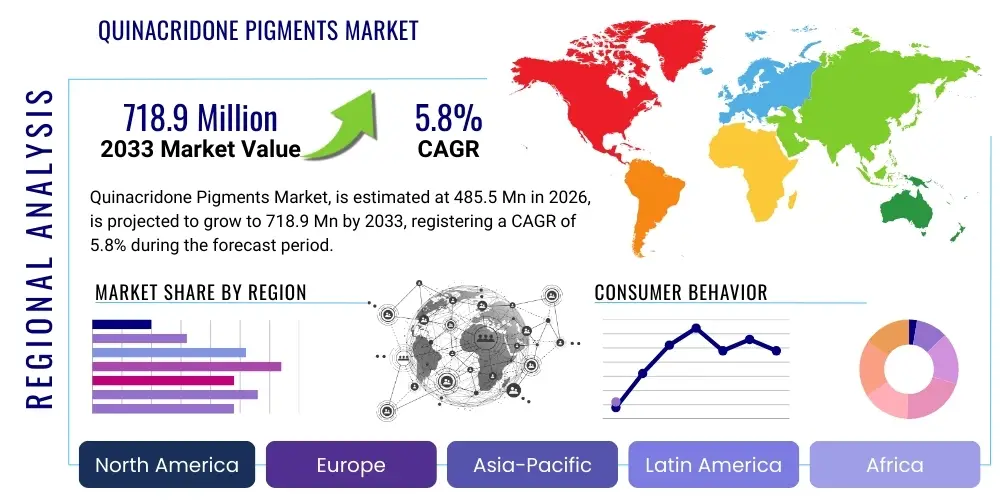

Quinacridone Pigments Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441184 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Quinacridone Pigments Market Size

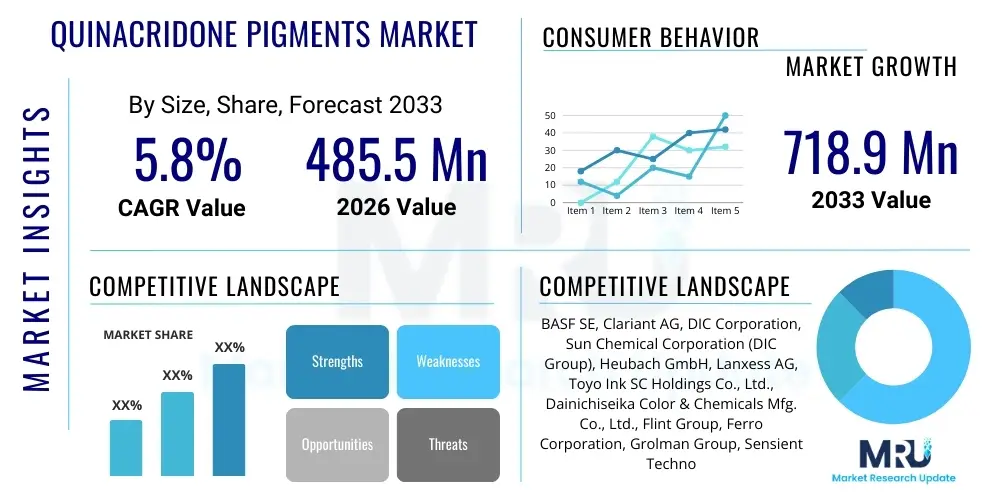

The Quinacridone Pigments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 485.5 Million in 2026 and is projected to reach USD 718.9 Million by the end of the forecast period in 2033.

Quinacridone Pigments Market introduction

Quinacridone pigments represent a class of high-performance organic compounds renowned for their exceptional color saturation, superior light fastness, and excellent weather resistance. Chemically characterized by a linear polycyclic structure, these pigments are primarily synthesized through the reaction of 2,5-dianilino-3,6-dihydroterephthalic acid with sulfuric acid, yielding highly crystalline structures. Their robust chemical stability makes them indispensable in demanding applications where color integrity under harsh environmental conditions is paramount. The market expansion is intrinsically linked to the growth of high-value manufacturing sectors that prioritize long-lasting aesthetic and functional properties, specifically within the automotive and aerospace industries.

The core product offerings within the quinacridone spectrum include Pigment Violet 19 (PV 19), Pigment Red 122 (PR 122), and Pigment Red 202 (PR 202), among others, providing shades ranging from deep violets to brilliant magentas and reds. These unique color characteristics, coupled with high tinting strength, position quinacridones as premium solutions compared to conventional inorganic and lower-grade organic pigments. The versatility of quinacridone pigments allows for their utilization across diverse matrices, including solvent-borne, water-borne, and powder coating systems, catering to stringent environmental and performance standards globally.

Driving factors for sustained market growth include the rising global production of passenger vehicles, especially in emerging economies, necessitating high-durability OEM coatings. Furthermore, the proliferation of specialized plastics for consumer electronics and construction materials, where resistance to UV degradation is critical, significantly boosts demand. The increasing preference for digital textile printing and high-definition packaging inks, requiring pigments with precise color control and thermal stability, further solidifies the market trajectory of quinacridone compounds over the forecast period.

Quinacridone Pigments Market Executive Summary

The global Quinacridone Pigments Market exhibits robust growth driven primarily by advancements in the automotive coatings sector and increasing demand for specialized plastic coloration. Key business trends indicate a strategic focus among major manufacturers on expanding production capacity in Asia Pacific (APAC), leveraging lower operational costs and proximity to rapidly industrializing end-use markets, particularly China and India. Technological innovation centered on particle size control and surface treatment of pigment particles is a crucial competitive edge, enabling superior dispersibility and enhanced performance in advanced coating formulations, thereby supporting premium pricing strategies across the market.

Regionally, Asia Pacific maintains its dominance, not only as a manufacturing hub but also as the largest consuming region, fueled by massive infrastructure development and the surging middle-class purchasing power translating into higher vehicle sales and demand for durable consumer goods. North America and Europe, while characterized by mature manufacturing sectors, demonstrate stable demand focused primarily on high-end niche applications, such such as aerospace coatings, specialized industrial finishes, and sophisticated art materials, driven by rigorous regulatory requirements mandating non-toxic, high-performance coloration solutions. Regulatory pressures, particularly concerning solvent usage in coatings, are concurrently promoting the adoption of quinacridones in water-borne systems, influencing regional sales dynamics.

Segment trends highlight the Pigment Red 122 and Pigment Violet 19 segments as primary revenue generators, owing to their extensive usage in automotive clear coats and high-performance plastics. The coatings segment remains the principal application area, though the plastics segment is projected to record the highest compound annual growth rate due to the increasing incorporation of high-durability pigments in polyolefin, PVC, and engineering plastics used in outdoor applications. Strategic consolidation, including mergers and acquisitions aimed at securing supply chains for critical raw materials like 2,5-dianilino-3,6-dihydroterephthalic acid intermediates, is an ongoing theme shaping the competitive landscape.

AI Impact Analysis on Quinacridone Pigments Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Quinacridone Pigments Market reveals concentrated interest in three primary areas: predictive quality control, optimization of complex synthesis processes, and enhancing supply chain resilience. Users are keen to understand how AI algorithms can predict color shade consistency based on reaction parameters, thus reducing batch-to-batch variability—a historical challenge in high-performance pigment manufacturing. Furthermore, concerns revolve around how machine learning models can manage the highly sensitive and expensive raw material inputs, ensuring efficient inventory management and minimizing waste during intricate chemical synthesis steps. The expectation is that AI integration will lead to higher purity products, shortened R&D cycles for new pigment formulations, and superior compliance with global color matching standards.

AI’s influence is manifesting in the ability to simulate and predict the photostability and thermal performance of new quinacridone derivatives before costly lab synthesis is initiated, accelerating the product development lifecycle significantly. By utilizing deep learning models trained on vast spectroscopic and environmental datasets, manufacturers can rapidly screen thousands of potential molecular structures and polymorphs, identifying the most promising candidates for specific applications, such as high heat resistance in engineering plastics or extreme weather resistance in architectural coatings. This shift from trial-and-error chemistry to data-driven synthesis is fundamentally changing the cost structure and time-to-market for specialized quinacridone products.

In operational aspects, AI and advanced analytics are being deployed for real-time monitoring of crystallization processes and milling operations. Optimizing these steps is crucial for achieving the desired particle size distribution and crystal morphology, which directly dictate the pigment's performance characteristics, including gloss, opacity, and tinting strength. Predictive maintenance utilizing AI algorithms also ensures maximum uptime for specialized high-pressure and high-temperature reactors, minimizing unplanned shutdowns and maintaining the continuous, quality-controlled production required to meet stringent customer specifications in automotive and aerospace applications.

- AI-driven optimization of complex quinacridone synthesis routes to maximize yield and purity.

- Predictive modeling of pigment performance (e.g., light fastness, thermal stability) before physical synthesis.

- Automated quality control systems using machine vision and spectroscopic analysis for real-time color consistency checks.

- Enhanced supply chain visibility and risk prediction for critical raw materials procurement.

- Acceleration of R&D through rapid screening of molecular structures and polymorph variations.

- Optimization of energy consumption in manufacturing processes via machine learning controls.

DRO & Impact Forces Of Quinacridone Pigments Market

The Quinacridone Pigments Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by significant impact forces from regulatory environments and macroeconomic trends. Primary drivers include the surging global demand for high-performance coatings, particularly in the automotive OEM refinish sectors, where the requirement for long-term color durability and premium aesthetics is non-negotiable. The inherent stability and brilliant hue of quinacridones satisfy these high standards, solidifying their market position. Concurrently, the increasing use of specialized plastics in aerospace, construction, and consumer electronics, which demand pigments capable of withstanding prolonged exposure to UV radiation and thermal stress, provides sustained growth impetus.

However, the market faces notable restraints, chiefly the relatively high manufacturing cost associated with quinacridone pigments. The intricate, multi-step synthesis process, requiring specialized high-pressure equipment and high-purity intermediates, contributes to a higher price point compared to standard organic and inorganic alternatives. This cost factor limits their adoption in price-sensitive, low-end applications, channeling the demand towards specialty markets exclusively. Furthermore, stringent environmental regulations in mature markets concerning chemical waste disposal and energy consumption during production pose compliance challenges and necessitate ongoing capital investments in sustainable manufacturing technologies, potentially slowing expansion for smaller players.

Opportunities for market expansion are centered on the burgeoning adoption of digital printing technologies, including inkjet and electrophotography, which require highly specialized, fine-particle quinacridone dispersions for superior print quality and durability. The development of next-generation, environmentally friendly formulations, specifically water-borne and solvent-free pigment preparations, presents a critical avenue for market penetration in regions transitioning away from traditional solvent systems. The strong impact force of continuous innovation in material science, focusing on encapsulating pigment particles to further enhance performance metrics like chemical resistance and dispersion ease, ensures that quinacridones remain the material of choice for demanding applications, despite cost pressures.

Segmentation Analysis

The Quinacridone Pigments Market is comprehensively segmented based on product type, application, and geographical region, providing a structured framework for market assessment and strategic planning. Segmentation by product type primarily categorizes the market into Pigment Violet 19 (PV 19), Pigment Red 122 (PR 122), and other variants like PR 202 and PV 42. PV 19 and PR 122 collectively dominate the revenue landscape due to their widespread acceptance and versatility across core end-use industries, particularly automotive coatings and high-performance plastics. Understanding the nuanced demand for specific shades and performance profiles drives investment decisions within these product segments, reflecting the specialized nature of the high-performance pigment industry.

From an application perspective, the market is dissected into Coatings, Plastics, Inks, and Others (including cosmetics and art materials). The coatings segment holds the largest market share, predominantly driven by the robust demand from the transportation industry for durable, fade-resistant exterior finishes. Within coatings, the automotive OEM and refinish sectors are the largest consumers. The plastics segment, however, is projected to show accelerated growth, mirroring the increasing regulatory requirements for pigment stability in materials subjected to outdoor weathering, such as window profiles, garden furniture, and specialized packaging, often requiring customized pigment masterbatches.

Geographical segmentation divides the market into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is the powerhouse for both manufacturing and consumption, characterized by rapid industrialization and expansion of its automotive and construction sectors. Strategic market assessment necessitates a clear understanding of the regulatory landscape and consumer preferences within each region, as factors like permissible toxicity levels and color trend cycles significantly influence segment performance and overall market dynamics.

- By Product Type:

- Pigment Red 122 (PR 122)

- Pigment Violet 19 (PV 19)

- Pigment Red 202 (PR 202)

- Others (PV 42, etc.)

- By Application:

- Coatings (Automotive OEM, Refinish, Industrial, Architectural)

- Plastics (Polymer compounding, Engineering Plastics, PVC)

- Inks (Printing Inks, Digital Inks, Specialty Inks)

- Others (Textiles, Cosmetics, Art Materials)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Quinacridone Pigments Market

The value chain for the Quinacridone Pigments Market is complex and highly integrated, beginning with the upstream sourcing of key chemical precursors and intermediate raw materials, primarily based on petrochemical derivatives. The critical raw material is 2,5-dianilino-3,6-dihydroterephthalic acid (DHQ), which undergoes multiple rigorous chemical reactions, including cyclization and oxidation steps, to form the crude quinacridone. Suppliers of these high-purity intermediates often possess specialized chemical expertise, and supply chain stability here is paramount, as disruptions can significantly impact production costs and final pigment purity. Key upstream processes also involve the synthesis of specific solvents and catalysts necessary for the high-temperature and high-pressure reactions inherent to quinacridone manufacturing.

The core manufacturing stage involves the synthesis, conditioning, and finishing of the pigment. Conditioning is a crucial step where the crude pigment is processed to achieve the desired particle size distribution and crystal modification (polymorph), which dictates the final shade, tinting strength, and dispersibility. Manufacturers in this segment, representing the core value addition, utilize proprietary techniques and specialized equipment for milling, dispersion, and surface treatment (often using resins or surfactants) to customize the pigment for specific end-use applications, such as liquid dispersion concentrates for inks or powder for masterbatch compounding in plastics. This phase requires high capital investment and technical know-how.

Downstream activities involve the distribution channel, which utilizes both direct sales models for large-volume customers (like major automotive coating manufacturers) and indirect channels through specialized distributors and agents, particularly for smaller orders or regional reach. Distributors often provide technical support, local inventory, and formulation expertise to end-users in coatings, plastics, and ink formulation houses. The final end-users—automotive original equipment manufacturers (OEMs), plastic compounders, and ink producers—then incorporate these high-performance pigments into final products, validating the pigment’s performance according to strict industry standards (e.g., ISO, ASTM). The efficiency of this downstream logistics network, ensuring timely supply of customized, high-value pigments, is critical to sustaining market competitiveness.

Quinacridone Pigments Market Potential Customers

The primary potential customers for Quinacridone Pigments are large-scale industrial consumers requiring superior color performance and durability beyond the capabilities of standard organic or inorganic pigments. Automotive coating manufacturers represent the largest and most critical customer base, relying heavily on quinacridones for automotive OEM basecoats and clear coats, particularly in the high-demand red and violet color spaces, where resistance to sunlight and weathering is essential for maintaining vehicle resale value. These customers demand extremely tight color tolerances and rely on consistent batch-to-batch quality, often entering into long-term supply agreements with established pigment producers.

Another significant segment comprises high-end plastics compounders and masterbatch producers who service industries like construction (durable outdoor materials), consumer electronics (UV-stable casings), and specialized packaging. Quinacridones are integrated into engineering plastics such as polyamides and polyolefins to impart vibrant, long-lasting color that resists fading and thermal degradation during processing and service life. These customers are seeking pigments that offer high tinting strength, minimizing the required loading while maximizing color intensity and complying with stringent food contact or medical device regulations where applicable.

Furthermore, specialty ink manufacturers, particularly those focusing on high-definition digital printing and premium security inks, constitute a growing potential customer group. The exceptional particle fineness and stable dispersion characteristics achievable with sophisticated quinacridone preparations make them ideal for inkjet applications requiring non-clogging performance and high light fastness on various substrates. Additionally, niche markets like high-quality artist paints and specialized industrial textile coatings also contribute to the customer portfolio, emphasizing performance over sheer volume in their purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 718.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, DIC Corporation, Sun Chemical Corporation (DIC Group), Heubach GmbH, Lanxess AG, Toyo Ink SC Holdings Co., Ltd., Dainichiseika Color & Chemicals Mfg. Co., Ltd., Flint Group, Ferro Corporation, Grolman Group, Sensient Technologies Corporation, Trust Chem Co., Ltd., Zhejiang Longsheng Group Co., Ltd., Hangzhou Dikai Chemical Co., Ltd., Cathay Industries, Penn Color, Inc., Chromaflo Technologies, Sheen Color Chem. Pvt. Ltd., Kolorjet Chemicals Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Quinacridone Pigments Market Key Technology Landscape

The technology landscape for the Quinacridone Pigments Market is characterized by continuous refinement of synthesis and finishing techniques aimed at enhancing performance and optimizing resource utilization. A critical technological focus is on polymorphism control, which involves manipulating the crystallization process to produce specific crystal structures (e.g., alpha, beta, gamma, delta forms of PV 19). Different polymorphs exhibit distinct color characteristics and functional properties, such as transparency or opacity, which are essential for meeting varied application requirements, particularly in automotive clear coats where high transparency is desired, or in plastics where opacity might be necessary for hiding power. Advanced solvent-based and non-solvent conditioning methods, often utilizing high-shear milling and temperature cycling, are employed to achieve highly stable and application-ready pigment forms.

Another major technological advancement involves surface treatment and encapsulation technologies. Pigment particles, especially those intended for water-borne or high-solids formulations, require specialized surface modification to ensure optimal dispersibility and long-term stability within the matrix. Microencapsulation techniques, utilizing polymeric shells or specialized surfactants, prevent flocculation and aid in achieving high gloss and color strength. Nanopigment technology, focusing on extremely fine particle sizes (below 100 nm), is increasingly crucial for high-performance digital printing inks and specialized thin-film applications, requiring sophisticated, continuous flow reactors and precise particle grinding mechanisms to maintain narrow particle size distribution.

Furthermore, process intensification and green chemistry are increasingly defining the manufacturing technology landscape. Manufacturers are investing in highly automated, continuous processing systems to replace traditional batch reactors, leading to improved energy efficiency, reduced waste generation, and higher consistency in product quality. Adoption of closed-loop systems for solvent recovery and utilization of environmentally benign solvents are key areas of technological differentiation, aligning with global sustainability initiatives and stricter chemical regulations, thereby reducing the environmental footprint associated with high-performance pigment production.

Regional Highlights

The regional dynamics of the Quinacridone Pigments Market demonstrate significant divergence in terms of production capability, regulatory environment, and demand characteristics across major continents.

- Asia Pacific (APAC): APAC is the global leader in both production capacity and consumption volume, driven by the massive scale of the automotive manufacturing sector in China, India, Japan, and South Korea. Rapid urbanization and infrastructure spending fuel demand for industrial and architectural coatings. The region benefits from lower operating costs and governmental support for chemical manufacturing, though competition among local and international players is intense. The high demand for durable consumer plastics and rising aesthetic standards further propels market expansion, making it the fastest-growing region.

- Europe: Europe represents a mature market characterized by extremely stringent regulatory frameworks, notably REACH regulations, which favor high-quality, traceable, and environmentally compliant pigments. Demand is stable, primarily focused on high-end specialized applications, including luxury automotive finishes, aerospace coatings, and high-performance industrial equipment. Technological innovation is centered around developing water-borne and solvent-free quinacridone dispersions to meet environmental targets, sustaining premium pricing in the niche segments.

- North America: Similar to Europe, North America is a mature market driven by replacement demand and emphasis on high-performance formulations. The automotive refinish and OEM sectors, along with the resilient construction and aerospace industries, are the primary consumers. Market growth is underpinned by stringent quality requirements and a preference for pigments offering extended warranty life in outdoor applications. Strategic sourcing and supply chain resilience are key focuses for customers in this region.

- Latin America (LATAM): The LATAM market exhibits moderate growth potential, tied closely to economic stability and performance of key industrial sectors, particularly automotive assembly in Brazil and Mexico. Price sensitivity is higher in certain segments, but increasing foreign investment in high-quality manufacturing is gradually elevating the demand for high-performance quinacridone pigments, particularly in coatings and inks.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven primarily by construction projects and infrastructure development in the Gulf Cooperation Council (GCC) nations. The extremely harsh climatic conditions (high temperature and intense UV exposure) necessitate the use of highly durable pigments like quinacridones for architectural and industrial coatings, ensuring long-term color integrity and material protection in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Quinacridone Pigments Market.- BASF SE

- Clariant AG

- DIC Corporation

- Sun Chemical Corporation (DIC Group)

- Heubach GmbH

- Lanxess AG

- Toyo Ink SC Holdings Co., Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Flint Group

- Ferro Corporation

- Grolman Group

- Sensient Technologies Corporation

- Trust Chem Co., Ltd.

- Zhejiang Longsheng Group Co., Ltd.

- Hangzhou Dikai Chemical Co., Ltd.

- Cathay Industries

- Penn Color, Inc.

- Chromaflo Technologies

- Sheen Color Chem. Pvt. Ltd.

- Kolorjet Chemicals Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Quinacridone Pigments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Quinacridone Pigments?

Quinacridone pigments are predominantly utilized in high-performance applications such as automotive OEM and refinish coatings, high-end industrial coatings, specialized engineering plastics that require excellent UV and thermal stability, and premium printing inks, including digital and security formulations.

Why are Quinacridone Pigments considered high-performance?

They are classified as high-performance due to their superior resistance properties, including exceptional light fastness, high weather resistance, thermal stability, and solvent resistance. This durability ensures long-lasting, vibrant color in demanding exterior environments where standard pigments would quickly degrade.

Which geographical region dominates the consumption of Quinacridone Pigments?

The Asia Pacific (APAC) region currently holds the largest share of Quinacridone Pigment consumption, driven by robust industrial growth, particularly in the automotive and construction sectors across key economies like China and India.

What is the main restraint impacting the Quinacridone Pigments Market growth?

The primary restraint is the relatively high manufacturing cost. The complex, multi-step synthesis process for quinacridones requires specialized equipment and high-purity, expensive intermediates, resulting in a higher price point compared to commodity pigment alternatives.

How is technological advancement influencing Quinacridone Pigment production?

Technological advancements are focused on polymorphism control to achieve specific shades and properties, surface treatment for enhanced dispersibility in advanced coating systems (especially water-borne), and the integration of AI for optimizing synthesis yields and quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager