R502 Refrigerant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442312 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

R502 Refrigerant Market Size

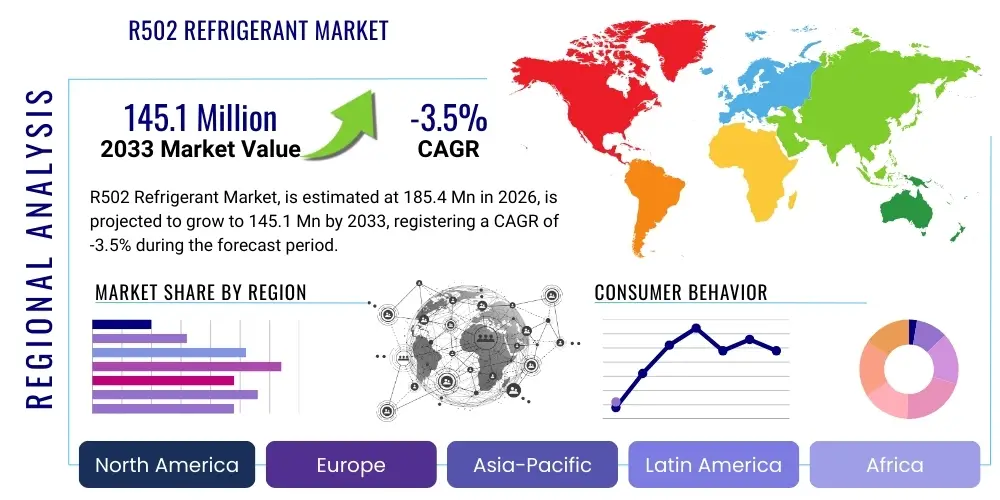

The R502 Refrigerant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of -3.5% (a measured decline) between 2026 and 2033. The market is primarily driven by servicing, reclamation, and specialized legacy applications, given its classification as an ozone-depleting substance (ODS) subject to global phase-out mandates. The inherent regulatory pressures stemming from the Montreal Protocol and subsequent amendments dictate that the volume of virgin R502 production is negligible, making the market size reflective predominantly of the highly specialized and expensive reclaimed and recycled refrigerant sector. This negative CAGR trajectory is anticipated as older equipment reaches its end-of-life and is replaced by systems utilizing compliant, lower Global Warming Potential (GWP) alternatives, mitigating the need for R502 servicing.

The market is estimated at $185.4 Million in 2026, encompassing the trading, recovery, purification, and use of existing stocks necessary to maintain critical legacy refrigeration and low-temperature systems, particularly in the industrial and maritime sectors where conversion is technically or economically prohibitive in the short term. The valuation is inflated by the high premium associated with legal, high-purity reclaimed R502, which is essential for ensuring system longevity and operational continuity until permanent conversion is feasible. This valuation also includes ancillary services such as specialized leak detection, mandatory governmental reporting, and certified decommissioning processes required for equipment utilizing this phased-out chemical.

The market is projected to reach $145.1 Million by the end of the forecast period in 2033. This consistent reduction is directly correlated with regulatory deadlines tightening across major economic zones, coupled with the natural attrition rate of systems still relying on R502. Furthermore, advancements in retrofit technology, allowing for relatively seamless transitions to non-ODS alternatives like R404A or R507A (and subsequently, their HFO replacements), accelerate the retirement of the R502 infrastructure. The residual market remaining by 2033 is expected to be hyper-focused on extremely niche, mission-critical applications where equipment lifetime exceeds the typical industrial cycle, such as specific military installations or long-term cryogenic storage facilities, justifying the extremely high cost and restricted supply chain of the remaining legally available refrigerant stock.

R502 Refrigerant Market introduction

The R502 Refrigerant Market centers around the use, handling, and eventual retirement of a historical azeotropic blend of Chlorodifluoromethane (R-22) and Chloropentafluoroethane (R-115). Historically renowned for its excellent performance in low and medium-temperature commercial and industrial refrigeration applications—such as supermarket display cases, cold storage warehouses, and large capacity blast freezers—R502 provided optimal capacity and energy efficiency across a broad operational range. However, R502 is classified as a Class I Ozone-Depleting Substance (ODS) due to its high Ozone Depletion Potential (ODP), primarily attributable to its R-22 component, leading to its inclusion in the phase-out schedule stipulated by the Montreal Protocol and various national environmental statutes globally. The current market dynamics are entirely shaped by this environmental status, shifting focus from production and sales to complex logistics of reclamation, recycling, and responsible destruction, alongside promoting conversion to suitable non-ODS refrigerants such as R-404A, R-507A, and more recently, various hydrofluoroolefin (HFO) blends.

Product Description: R502 is a synthetic refrigerant designed for stable, low-temperature operation. Its principal benefit was providing lower discharge temperatures compared to R-22 alone, enhancing compressor longevity and system reliability in deep-freeze applications. Major applications historically included large industrial chilling plants, commercial food processing, pharmaceutical storage, and specific transport refrigeration units. Today, the residual market exists solely to service these legacy systems. The environmental imperative is the dominant driving factor for the market structure; the scarcity of legally obtainable product and the high cost of compliant substitutes accelerate the retirement of R502-dependent assets. Conversely, the high capital expenditure required for system retrofitting or complete replacement acts as a temporary constraint, sustaining the demand for reclaimed R502 for essential maintenance operations.

The transition away from R502, while mandated, presents unique opportunities for companies specializing in advanced refrigerant handling, precise leak detection technologies, and certified destruction services. The market is increasingly characterized by stringent regulatory oversight, necessitating sophisticated inventory management and traceability systems to ensure that any remaining usage complies with environmental law. Benefits derived in the current context relate not to the refrigerant's cooling properties but to compliance and risk mitigation; utilizing certified reclaimed R502 ensures operators remain compliant, avoid steep environmental fines, and maintain asset operability until planned decommissioning or conversion occurs. Key driving factors include escalating reclamation costs, tightening regulatory enforcement, and technological maturation of retrofit solutions, collectively pushing the market towards complete obsolescence but simultaneously creating a high-value niche in the interim servicing phase.

R502 Refrigerant Market Executive Summary

The R502 Refrigerant Market is undergoing a rapid, managed decline driven entirely by international environmental treaties aimed at ozone layer protection. Business trends reflect a severe contraction in virgin product supply, focusing organizational activity on developing sophisticated refrigerant recovery and purification facilities. Companies are heavily investing in compliance infrastructure, certified training programs for technicians, and strategic partnerships to manage existing global inventories of R502. A crucial trend involves the commoditization of retrofit solutions and the increased adoption of low-GWP alternatives, signaling a definitive shift in the installed base. The major financial opportunities now lie not in selling the refrigerant itself, but in the associated high-margin services: specialized system maintenance, regulatory consulting, and the supply of certified, high-purity replacement gases, thereby transforming traditional chemical manufacturers into comprehensive environmental service providers.

Regional trends exhibit stark divergence based on regulatory maturity and economic development. North America and Europe, spearheaded by the U.S. EPA (under Clean Air Act) and the EU F-Gas Regulation, respectively, have largely completed the phase-out of R502, with current market activity limited almost exclusively to critical, authorized uses and managing the final stages of decommissioning. In contrast, emerging markets in Asia Pacific and Latin America, while committed to the Montreal Protocol, often face challenges related to monitoring illegal trade, slower infrastructural replacement cycles, and fragmented regulatory enforcement. These regions represent the primary areas where limited servicing demand for R502 might still persist due to the vast stock of older, less-efficient equipment, although this demand is steadily decreasing as global compliance deadlines approach and economic incentives for system replacement become stronger.

Segment trends underscore the criticality of application specificity. The Industrial Refrigeration segment, comprising large cold storage facilities and chemical processing plants, represents the highest residual demand for R502 servicing because of the high capital cost and extensive downtime associated with converting these large-scale systems. Conversely, the Commercial Refrigeration segment (e.g., supermarkets and smaller food service units) has seen a near-total conversion, driven by modular equipment design and easier access to affordable retrofit kits. The segmentation by refrigerant type is also vital, emphasizing the dominance of Reclaimed R502; the purity level and certification status of this reclaimed product dictate its price and usability, creating a highly regulated, high-barrier-to-entry supply chain necessary for legal operations. Overall, the market summarizes as a high-cost, shrinking service niche defined by regulatory compliance and asset management for mission-critical legacy infrastructure.

AI Impact Analysis on R502 Refrigerant Market

User questions concerning AI's role in the R502 market frequently revolve around how technology can assist in managing the phase-out process efficiently and economically. Common inquiries include: "Can AI predict system failures in legacy R502 equipment?", "How can AI optimize the logistics of reclaimed refrigerant supply?", and "Is AI being used to enhance compliance monitoring for systems nearing retirement?" The central theme emerging from these questions is the expectation that Artificial Intelligence and Machine Learning (ML) can transform the reactive maintenance model inherent in legacy systems into a proactive, data-driven decommissioning strategy. Users are concerned about avoiding catastrophic failures due to R502 scarcity and high maintenance costs, expecting AI to provide a technological buffer during the final years of operation for these assets.

AI's primary impact lies in enhancing the efficiency and longevity of remaining R502 infrastructure while accelerating the planned transition. Machine learning algorithms, applied to sensor data collected from industrial refrigeration units (pressure, temperature, flow rates, vibration), can establish precise baseline operational norms. By detecting minute deviations that precede significant leaks or component failures, AI enables predictive maintenance scheduling, conserving the scarce and expensive R502 stock and minimizing environmental emissions. This is crucial because replacing lost R502 with legally certified reclaimed stock is increasingly costly and complex, making system integrity paramount. Furthermore, AI-driven asset management systems can optimize the timing of retrofit investments by precisely calculating the remaining useful life (RUL) of the R502 equipment versus the payback period for conversion.

Beyond predictive maintenance, AI also plays a critical role in managing the complex, often global, supply chain for reclaimed refrigerant. Generative Engine Optimization (GEO) leverages advanced analytics to model the optimal geographical distribution and purification needs for recovered R502 inventory. This allows certified reclaimers to minimize transportation costs and energy use, maximizing the availability of high-purity gas where required for critical servicing needs. AI-enhanced surveillance systems and regulatory compliance trackers help governmental agencies and market participants monitor adherence to phase-out schedules, identifying anomalous consumption patterns that might suggest illegal trade or poor handling practices. This level of oversight ensures that the market shrinks predictably and responsibly, aligning with international environmental goals.

- AI-driven Predictive Maintenance: Reduces costly R502 leaks and system downtime in aging legacy equipment.

- Optimized Reclamation Logistics: Machine learning models forecast regional demand and optimize processing locations for recovered R502 stocks.

- Asset Retirement Planning: AI calculates the Remaining Useful Life (RUL) of R502 systems, guiding operators on optimal retrofit timing.

- Enhanced Regulatory Compliance: Automated monitoring of consumption data flags non-compliant usage or potential illegal sourcing of refrigerants.

- Leak Detection Augmentation: Advanced algorithms process sensor data to identify and localize micro-leaks far more effectively than traditional methods, preserving inventory.

DRO & Impact Forces Of R502 Refrigerant Market

The market for R502 is entirely characterized by powerful negative forces and niche positive opportunities stemming from its regulated status. The dominant Restraint is the comprehensive global ban on virgin production and import, driven by the Montreal Protocol and its amendments, which severely limits supply and drastically raises the cost of remaining certified stock. This restriction is amplified by national regulations (such as the EU F-Gas Regulation and US EPA rules) that mandate leak inspection frequency and impose stringent reporting requirements, increasing the operational burden on system owners. The primary Driver remaining in the market is the substantial existing installed base of critical industrial and commercial refrigeration equipment designed specifically for R502; the prohibitive capital cost and potential downtime associated with converting these large-scale systems maintain a temporary, essential demand for servicing using reclaimed R502.

A significant Opportunity exists in the highly specialized services sector focused on compliant decommissioning and sophisticated reclamation technologies. As phase-out deadlines approach, there is an escalating need for certified third-party companies capable of extracting R502 without emissions, purifying it to ARI 700 standards for reuse, and providing certified destruction services for contaminated or surplus stock. This opportunity is geographically biased, offering higher margins in regions with mature regulatory frameworks (North America, Western Europe) where compliance enforcement is rigorous. Furthermore, the development and deployment of high-efficiency, lower-GWP retrofit solutions, particularly proprietary blends designed for minimal component change, represent a secondary opportunity, capturing the conversion market segment as operators seek to future-proof their assets.

Impact forces are multifaceted. Regulatory Impact is the most profound, forcing market exit strategies and driving technological substitution across the globe. Economic Impact is evidenced by the massive cost differential between reclaimed R502 and modern alternatives, compelling accelerated investment in conversion projects. Technological Impact centers on the rapid maturation of non-ODS, low-GWP refrigerant options (like R448A, R449A, and various R1234yf-based blends) which outperform R502 in efficiency, reducing the economic rationale for clinging to legacy equipment. Finally, Social and Environmental Impact forces the industry toward sustainability, making non-compliance a significant corporate risk due to public scrutiny and regulatory penalties. These forces collectively ensure the continuous, albeit managed, contraction of the R502 market while simultaneously fostering a high-value service ecosystem dedicated to compliance and transition.

Segmentation Analysis

The R502 Refrigerant Market segmentation is crucial for understanding the residual demand structure, as it reflects where legacy dependence and conversion challenges are most acute. Unlike typical growth markets, segmentation here highlights pockets of resistance to phase-out (due to technical difficulty) and the logistical complexities of managing scarce resources. The market is primarily segmented based on End-User Application (differentiating between highly regulated industrial systems and smaller commercial units), Refrigerant Grade (separating high-purity reclaimed stock from low-purity, scrap material destined for destruction), and Service Type (distinguishing between routine servicing, full system retrofitting, and specialized destruction services).

Analyzing these segments reveals that the Industrial Refrigeration sector demands the most specialized and high-cost servicing due to the critical nature of operations (e.g., pharmaceuticals, large-scale food processing) and the prohibitive investment required for full system replacement. This segment relies heavily on certified Reclaimed R502 to maintain operation, sustaining demand for the highest purity grades. Conversely, the Commercial Refrigeration segment has mostly transitioned, focusing its current activity on the destruction and disposal of recovered R502 and the installation of new, compliant equipment.

The differentiation by Service Type is paramount: the market is transitioning from product sales to high-value service provision. The highest growth areas (though overall market is declining) are in Retrofit Services and Destruction Services, as these represent the final phases of the mandated transition. Companies offering comprehensive, certified end-to-end solutions—from inventory assessment and leak repair to certified retrofit kit installation and documentation—are capturing the residual value in this shrinking market. This granular segmentation allows stakeholders to target the remaining high-value service contracts and align their business models with the environmental compliance imperative.

- By End-User Application:

- Industrial Refrigeration (e.g., Cold Storage, Processing Plants)

- Commercial Refrigeration (e.g., Supermarkets, Food Service - largely transitioned)

- Transport Refrigeration (e.g., Marine Vessels, Reefer Trucks)

- By Service Type:

- Reclamation and Recycling Services

- Retrofit and Conversion Services

- System Maintenance and Leak Detection

- Certified Destruction Services

- By Refrigerant Grade:

- Certified Reclaimed R502 (ARI 700 Standard)

- Unpurified/Scrap R502 (Destruction Stock)

- By Alternative Refrigerant Adopted:

- R404A/R507A (Transitional HFCs)

- Low-GWP HFO Blends (e.g., R448A, R449A)

- Natural Refrigerants (e.g., CO2, Ammonia)

Value Chain Analysis For R502 Refrigerant Market

The value chain for the R502 market is uniquely inverted, defined by reverse logistics rather than traditional manufacturing. The upstream segment, which historically involved chemical production (R-22 and R-115 synthesis), is virtually non-existent for virgin product due to regulatory prohibitions. Instead, the upstream is dominated by the collection and recovery phase, where certified technicians extract used R502 from retired equipment. This recovered gas is then transported to specialized, highly compliant reclamation facilities. These facilities utilize sophisticated distillation and filtration processes to restore the recovered material to industry-mandated purity standards (e.g., AHRI Standard 700). The complexity and high capital expenditure associated with certified reclamation equipment and the necessary permits create a high barrier to entry at this upstream stage, concentrating power among a few large, specialized chemical companies and certified recyclers.

The midstream logistics involves the distribution of the certified reclaimed R502. Given the scarcity and regulatory requirements, the distribution channel is highly controlled and audited. Direct distribution from the reclaimer to authorized service contractors dominates, ensuring traceability and preventing diversion into illegal markets. Indirect channels, involving licensed distributors, exist but are subject to strict inventory tracking and certification checks. This controlled environment contrasts sharply with the general chemical market, emphasizing security and documented compliance over widespread commercial availability. The high cost of ensuring compliance—including detailed chain-of-custody documentation for every kilogram sold—adds significant value (and cost) at this stage.

Downstream analysis focuses on the end-use and eventual disposal. Downstream participants include certified HVAC&R maintenance contractors who perform the final service and retrofitting work, and the end-users themselves (industrial plant owners, cold storage operators). The primary downstream activity is performing essential top-ups and leak repairs on legacy systems using the scarce reclaimed gas, or executing full system conversions to alternative refrigerants. Ultimately, the very end of the value chain loops back to destruction, where certified incinerators or plasma arc facilities handle contaminated or excess R502 stocks in an environmentally compliant manner, completing the closed-loop system necessitated by the environmental regulations.

R502 Refrigerant Market Potential Customers

Potential customers for the R502 market are narrowly defined as entities operating mission-critical, high-cost, and long-lifespan refrigeration systems that were installed prior to the stringent phase-out regulations. These customers are not seeking growth or volume, but rather service continuity and regulatory compliance. The primary buyers fall into two categories: Owners of Legacy Industrial Assets and Specialized Service/Decommissioning Contractors. Owners of Legacy Industrial Assets, such as large frozen food manufacturers, pharmaceutical cold chains, and specific military or government installations, represent the captive demand for certified reclaimed R502. Their systems, often highly customized and expensive to replace, require ongoing maintenance for the next few years until budgeted replacement cycles complete. These customers prioritize guaranteed supply of certified R502, technical expertise in compliance, and detailed documentation to pass regulatory audits.

Specialized Service and Decommissioning Contractors constitute the second major segment of potential customers, although they are technically intermediaries. These firms purchase the reclaimed R502 inventory for application in client systems, but their main business is the high-value conversion and destruction services. For companies specializing in retrofit kits and low-GWP replacement blends (e.g., R448A/R449A), the potential customer base includes all owners of legacy R502 and R404A equipment globally, as these contractors facilitate the final mandatory system upgrade. The demand from this segment is driven by efficiency in executing the phase-out process, minimizing client downtime, and maximizing the recovery rate of the old refrigerant.

The end-user profile is shifting from simply procuring chemical stock to contracting for comprehensive environmental compliance management. Buyers require partners who offer complete solutions: inventory auditing, leak detection programs (often mandated by law), phased retrofit planning, and certified disposal documentation. Geographical variations exist, with critical customers in developing nations often seeking more cost-effective retrofit strategies, while those in highly regulated markets (e.g., Europe) are willing to pay a premium for guaranteed, risk-free compliance. This transition means the focus is on service contracts over product sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.4 Million |

| Market Forecast in 2033 | $145.1 Million |

| Growth Rate | -3.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Chemours Company, Daikin Industries Ltd., Arkema S.A., Linde plc, Praxair Technology Inc., Airgas Inc., A-Gas International, Hudson Technologies Inc., National Refrigerants Inc., Vencorex, Harp International, Refrigerant Solutions Ltd., Mitsubishi Chemical Corporation, Gujarat Fluorochemicals Limited, SRF Limited, China Meilan Chemical Co. Ltd., Shandong Dongyue Group, Mexichem Fluor (Koura), Refrigerant Management Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

R502 Refrigerant Market Key Technology Landscape

The technology landscape surrounding the R502 market is dominated not by the development of the refrigerant itself, but by the technologies required to manage its phase-out and replacement. A critical technology area is advanced Refrigerant Reclamation and Purification. Modern reclamation facilities employ sophisticated multi-stage distillation, molecular sieves, and catalytic converters to remove contaminants such as oil, moisture, non-condensable gases, and particulate matter, ensuring the recovered R502 meets the rigorous AHRI 700 purity standard required for legal reuse. Continuous innovation in these processes focuses on maximizing recovery efficiency and minimizing energy consumption during purification, thereby increasing the usable lifespan of the remaining global stock and reducing the pressure for illegal alternatives.

A second crucial technological field involves High-Efficiency Leak Detection and Monitoring. Given the regulatory mandates for frequent leak checks on systems containing ODS refrigerants and the high cost of replacement R502, precise leak mitigation technologies are essential. This includes advanced infrared (IR) and ultrasonic leak detectors, alongside complex centralized building management systems (BMS) that incorporate continuous refrigerant monitoring. These systems often utilize AI/ML to interpret small pressure or temperature variances as indicators of impending leaks, allowing for proactive intervention before large, costly, and environmentally damaging releases occur. This shift towards predictive integrity management is critical for legacy system operators seeking to maintain compliance and control maintenance budgets.

Finally, the technology of Retrofit and Conversion Kits is central to the market's long-term structure. While R502 systems were initially transitioned to R404A or R507A (HFCs), the current technological trend focuses on developing "drop-in" solutions utilizing lower-GWP hydrofluoroolefins (HFOs) and their blends (e.g., R448A, R449A). These kits include specialized oils, seals, and often revised expansion devices designed to operate optimally with the new refrigerant in equipment originally designed for R502, minimizing the need for expensive compressor replacement. The effectiveness and certification of these retrofit solutions determine the rate at which the residual R502 installed base is retired, making innovation in material compatibility and thermodynamic performance a key competitive differentiator.

Regional Highlights

- North America (U.S. and Canada): Highly mature market defined by strict EPA regulations (U.S.) and provincial standards (Canada) that have effectively ended the use of virgin R502. The market activity is focused on certified destruction services, sophisticated reclamation for critical uses, and mass adoption of retrofit solutions, primarily HFC and HFO blends. High cost of reclamation and rigorous enforcement drive rapid conversion.

- Europe (EU 27): Led by the stringent EU F-Gas Regulation, which mandates phased HFC reduction and has long since phased out R502/HCFCs. The market is primarily a service and compliance market, focusing intensely on preventing illegal trade of phased-out substances. There is significant technological leadership in leak detection and natural refrigerant retrofits (e.g., CO2, Ammonia) for large industrial plants originally utilizing R502.

- Asia Pacific (APAC): A highly varied region. Developed economies like Japan and South Korea follow phase-out schedules similar to the West. However, rapidly industrializing nations (China, India, Southeast Asia) represent the final major regions where R502 legacy equipment might persist. Market dynamics here include a strong focus on building domestic reclamation capabilities, combating illicit refrigerant trade, and leveraging international aid (e.g., Multilateral Fund) to subsidize conversion projects in the food cold chain.

- Latin America: Characterized by mixed enforcement levels. While officially committed to the Montreal Protocol, infrastructural and economic constraints often slow the replacement cycle of large refrigeration systems. The market is moderately reliant on imported retrofit solutions and is a key region for companies specializing in managing older, mid-sized commercial installations that still require periodic R502 servicing until total conversion is financially viable.

- Middle East and Africa (MEA): Emerging market where the phase-out timeline is generally slower, especially in less developed African nations. Demand is heavily concentrated in servicing specialized oil and gas sector refrigeration units or aging coastal transport systems. Market growth centers on building foundational capacity for technician training, certified reclamation, and importing compliant replacement gases, often skipping high-GWP HFCs entirely and moving directly toward HFO blends to avoid future phase-outs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the R502 Refrigerant Market, focusing on those involved in reclamation, alternative supply, and specialized services.- Honeywell International Inc.

- Chemours Company

- Daikin Industries Ltd.

- Arkema S.A.

- Linde plc

- Praxair Technology Inc.

- Airgas Inc.

- A-Gas International

- Hudson Technologies Inc.

- National Refrigerants Inc.

- Vencorex

- Harp International

- Refrigerant Solutions Ltd.

- Mitsubishi Chemical Corporation

- Gujarat Fluorochemicals Limited

- SRF Limited

- China Meilan Chemical Co. Ltd.

- Shandong Dongyue Group

- Mexichem Fluor (Koura)

- Refrigerant Management Services

Frequently Asked Questions

Analyze common user questions about the R502 Refrigerant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current legal status of R502 refrigerant globally?

R502 is classified as an Ozone-Depleting Substance (ODS) and its virgin production has been phased out globally under the Montreal Protocol. Current legal market activities are restricted solely to the use, trade, and recovery of certified reclaimed or recycled R502 for servicing existing legacy equipment, subject to strict regional regulations like the EU F-Gas and US EPA rules.

What are the recommended drop-in replacements or retrofit options for R502 systems?

Common transitional replacements included R404A and R507A, although these are high Global Warming Potential (GWP) HFCs and are themselves facing phase-down mandates. The current long-term recommendation involves retrofitting to low-GWP HFO-based blends such as R448A, R449A, or R407A/F, which offer improved efficiency and compliance with future environmental legislation.

Why is reclaimed R502 so expensive, despite the market shrinking?

The high cost of reclaimed R502 is due to scarcity (no new production), the complex, energy-intensive, and highly regulated process required to purify recovered gas to industry standards (AHRI 700), and the high liability associated with handling and certifying the product for legal resale in critical applications.

When will R502 be completely banned from use, even for servicing?

While the virgin production ban is complete, specific end-use phase-out dates vary significantly by country and application sector. Many developed nations have stringent deadlines (or effective bans) for use in new equipment and tight restrictions on servicing existing equipment, pushing most industrial users to convert their R502 systems within the next five to ten years to maintain regulatory compliance.

How does AI technology affect the maintenance of aging R502 refrigeration systems?

AI impacts maintenance by enabling predictive diagnostics. Machine Learning algorithms analyze operational data (pressure, temperature) to predict potential leaks or system failures in legacy R502 equipment, allowing owners to schedule proactive maintenance, conserve the limited refrigerant stock, and avoid costly, non-compliant emissions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager