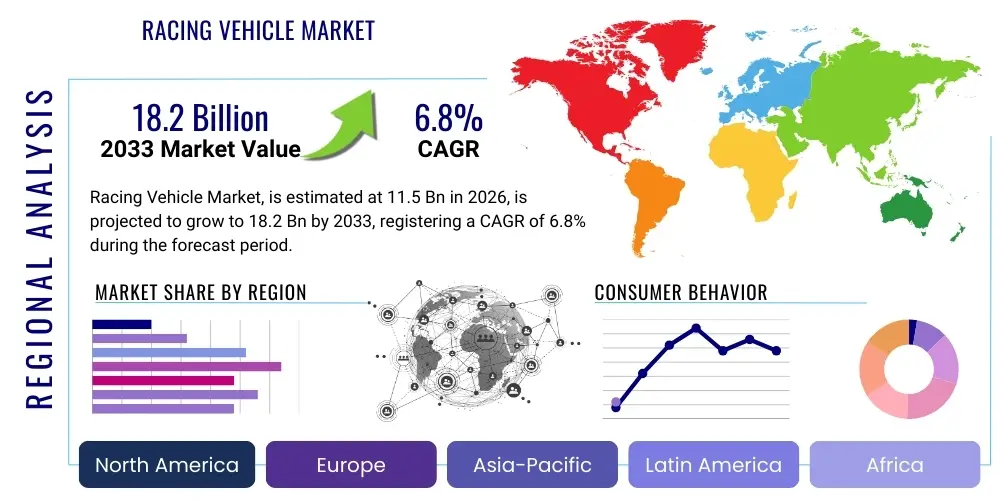

Racing Vehicle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441453 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Racing Vehicle Market Size

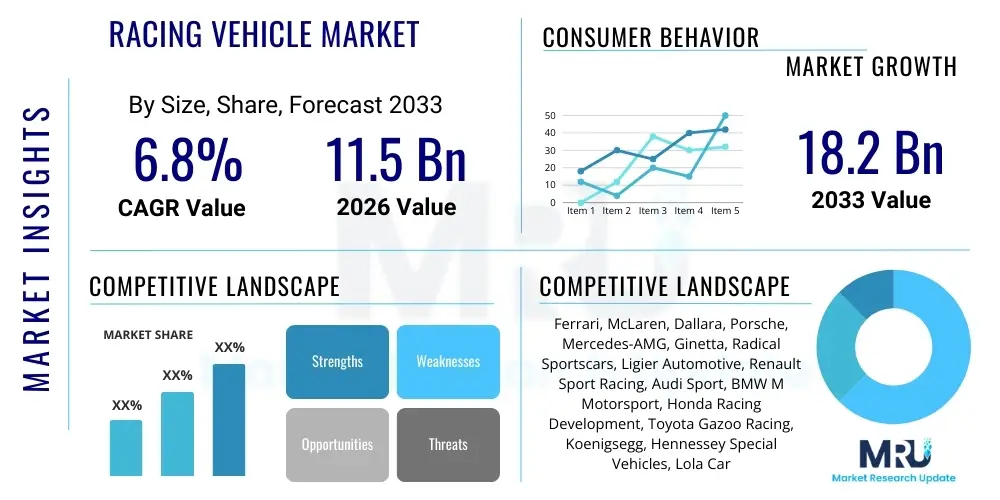

The Racing Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by increasing global investment in motorsport events, technological advancements in vehicle lightweighting and powertrain efficiency, and the expanding accessibility of amateur racing leagues and track days worldwide. The integration of electric and hybrid powertrains is rapidly transforming traditional racing segments, driving innovation in battery technology, energy management systems, and thermal efficiency, thereby creating substantial market expansion opportunities.

Racing Vehicle Market introduction

The Racing Vehicle Market encompasses the manufacturing, sales, maintenance, and technological development of specialized vehicles designed exclusively for competitive motorsport events and high-performance track usage. These vehicles span various categories, including Formula cars, touring cars, rally cars, stock cars, and purpose-built endurance prototypes. The products are characterized by extreme engineering requirements focusing on aerodynamics, power-to-weight ratio, chassis rigidity, and sophisticated safety systems designed to operate under maximum stress conditions. Major applications involve professional international racing series (like Formula 1, WEC, NASCAR), national championships, and advanced vehicle testing and simulation activities conducted by Original Equipment Manufacturers (OEMs) and private racing teams.

The primary benefits derived from this market include serving as a critical testing ground for pioneering automotive technologies—especially in electrification, advanced materials (such as carbon fiber composites), and sophisticated data analytics—which subsequently trickle down to the consumer automotive sector. Key driving factors fueling market expansion are the increasing global viewership and commercialization of motorsport, leading to greater sponsorship revenue; stringent regulatory pressures demanding enhanced safety and sustainability, prompting investment in new vehicle architectures; and the rising participation in grassroots and regional racing events globally. Furthermore, the relentless pursuit of speed and efficiency by leading automotive brands continually necessitates the development and procurement of state-of-the-art racing machinery.

Racing Vehicle Market Executive Summary

The global Racing Vehicle Market is experiencing robust growth driven by the strategic shift towards sustainable and electric racing formats, coupled with significant advancements in materials science and computational fluid dynamics (CFD). Current business trends indicate a consolidation among specialized chassis manufacturers and component suppliers, prioritizing agility and customization to meet the diverse technical specifications of different racing series. Major OEMs are leveraging motorsport participation, particularly in Formula E and electric touring car championships, as a core component of their brand marketing and technology transfer strategies, ensuring continuous, high-volume investment in R&D.

Regionally, Europe maintains its dominance, serving as the historical and technological hub for Formula and high-end prototype racing, characterized by mature regulatory frameworks and a dense concentration of specialized engineering firms. Asia Pacific, however, represents the fastest-growing region, fueled by rising disposable incomes, increasing motorsport fandom in countries like China and India, and significant governmental promotion of motorsport infrastructure development. Segment trends highlight the rapid adoption of electric and hybrid powertrains, transitioning from niche status to mainstream platforms in top-tier racing, while the component segment sees high demand for sophisticated telemetry systems and bespoke safety equipment, driven by increasingly stringent Federation Internationale de l'Automobile (FIA) standards.

AI Impact Analysis on Racing Vehicle Market

Common user questions regarding AI's impact on the Racing Vehicle Market center on how artificial intelligence is changing vehicle setup optimization, real-time strategy during races, driver training efficacy, and predictive maintenance to maximize component lifespan. Users are highly interested in the role of AI in autonomous or semi-autonomous racing series and whether data analytics driven by machine learning can provide an insurmountable competitive edge. Key themes reveal concerns about data security and the potential erosion of the human element in racing, contrasting with high expectations for performance gains through algorithmic simulation and rapid iteration of aerodynamic designs. The general consensus points toward AI becoming indispensable for managing the complexity of modern hybrid powertrains and optimizing race logistics.

AI's role extends beyond the vehicle itself, deeply influencing the fan experience through hyper-personalized content delivery and augmented reality overlays during broadcasts. For manufacturing, generative design powered by AI is enabling engineers to rapidly explore millions of design permutations for components like suspension arms and brake ducts, leading to lightweight structures that traditional methods could not conceive. This synthesis of high-fidelity data processing, predictive modeling, and rapid design iteration significantly shortens the development cycle for new racing platforms, making performance gains more incremental but sustained across seasons.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data and forecast component failure, significantly reducing DNFs (Did Not Finish) due to mechanical issues.

- Real-Time Race Strategy Optimization: AI models continuously evaluate variables (tire wear, weather changes, fuel consumption, competitor positions) to recommend optimal pit stop timing and strategic adjustments.

- Generative Design and Aerodynamics: Employing AI to create complex, high-performance aerodynamic shapes and structural components optimized for minimal weight and maximum downforce.

- Driver Performance Simulation and Training: Using deep learning to analyze driver inputs, offering personalized feedback, and creating highly realistic simulator environments for skill enhancement.

- Vehicle Dynamics Control and Tuning: AI systems managing complex settings of hybrid energy recovery (MGU-K, MGU-H) and electronic differentials in real-time for improved traction and stability.

- Autonomous Racing Development: Serving as the foundational technology for emerging autonomous motorsport categories, pushing the limits of rapid decision-making systems in dynamic environments.

DRO & Impact Forces Of Racing Vehicle Market

The Racing Vehicle Market is propelled by substantial R&D investment necessitated by fierce competition and regulatory evolution (Drivers), yet it is constrained by exceptionally high manufacturing costs, specialized regulatory hurdles, and limited mass-market applicability (Restraints). Opportunities arise primarily through the transition to electric powertrains and the commercial utilization of virtual racing (esports) platforms as marketing and talent scouting channels. These market forces collectively necessitate substantial capital expenditure in advanced materials and simulation software, pushing innovation boundaries while maintaining exclusivity and high barrier to entry for new entrants.

Key drivers include the massive financial backing from global automotive OEMs seeking brand visibility and technology validation, the increasing prevalence of sophisticated international race series demanding purpose-built machines, and the growing integration of sustainability goals into motorsport governance, mandating innovation in alternative fuels and electrification. Conversely, restraints involve the cyclical nature of sponsorship funding, high vulnerability to economic downturns which impacts private team budgets, and complex homologation requirements that drastically increase development costs and timeframes. The opportunity space is defined by the burgeoning demand for specialized components in amateur track day segments, the expansion into Asia Pacific markets, and the potential for leveraging advanced simulation technology for non-racing industrial applications.

Segmentation Analysis

The Racing Vehicle Market is highly diverse, categorized primarily by the type of vehicle, the powertrain employed, the application scope (professional vs. amateur), and the specific components utilized. Segmentation allows for a precise understanding of investment priorities; for instance, the Formula segment demands peak performance and rapid aerodynamic evolution, while the Rally segment requires extreme durability and robustness. The increasing prominence of the Electric Powertrain segment is the most transformative trend, necessitating a parallel growth in specialized battery cooling systems and high-voltage safety components. Component segmentation, particularly advanced composites and telemetry systems, demonstrates high growth due to their direct impact on safety, performance, and compliance with modern regulations.

Analyzing these segments provides strategic clarity: manufacturers specializing in ICE vehicles must pivot to hybrid or electric platforms to maintain relevance, while component suppliers need to focus on cross-series standardization where possible, or highly bespoke, lightweight solutions where performance mandates absolute customization. The professional application segment continues to command the highest revenue share due to intense R&D spending, but the amateur and grassroots segment offers consistent volume growth and lower margin, high-volume opportunities for component suppliers specializing in lower-cost, yet high-quality performance parts. This strategic differentiation is crucial for maximizing market penetration and resilience against cyclical professional racing expenditure.

- By Vehicle Type: Formula (F1, F2, F3), Touring Car (TCR, GT4), Prototype (LMP1, LMP2, Hypercar), Stock Car (NASCAR), Rally Car (WRC, Rallycross), Drag Racer, Go-Kart.

- By Powertrain: Internal Combustion Engine (ICE), Hybrid (Plug-in Hybrid, Mild Hybrid), Electric (Battery Electric Vehicle - BEV).

- By Component: Chassis (Monocoque, Tubular), Engine Systems (Turbochargers, ECU), Aerodynamics (Wings, Diffusers), Braking Systems (Carbon-Ceramic, Calipers), Safety Systems (HANS devices, Roll Cages, Fire Suppression).

- By Application: Professional Racing Series, Amateur Racing/Track Days, Testing and Development, Racing Schools and Instruction.

Value Chain Analysis For Racing Vehicle Market

The value chain for the Racing Vehicle Market is highly specialized and generally linear, beginning with highly technical upstream activities, followed by complex manufacturing and assembly, and concluding with downstream sales, distribution, and critical maintenance services. Upstream analysis focuses heavily on the procurement of raw materials, primarily specialized high-grade metals (titanium, aluminum alloys) and advanced composite materials (carbon fiber, Kevlar), often requiring highly specific aerospace-grade suppliers. This stage is characterized by low volume but extremely high quality and cost demands, driven by performance mandates and regulatory material restrictions imposed by motorsport governing bodies.

The middle stage involves specialized design, engineering, and manufacturing, predominantly performed by chassis builders (e.g., Dallara, Ligier) and dedicated motorsport divisions of OEMs (e.g., Mercedes-AMG, Porsche). Distribution channels are highly controlled; direct distribution dominates the professional segment, where chassis and complete vehicles are sold directly to established racing teams under strict contracts and confidentiality agreements. Indirect channels exist primarily for the amateur racing segment and aftermarket component sales, often involving certified specialist dealers or high-performance parts distributors who manage logistics and localized technical support.

Downstream activities are dominated by comprehensive technical support, maintenance, and race engineering services provided either by the vehicle manufacturer or independent, highly specialized service teams. The continuous need for spare parts, upgrades, and real-time trackside engineering support ensures a recurring revenue stream long after the initial sale of the vehicle. Efficiency in the downstream value chain is paramount, as race outcomes frequently depend on the speed and accuracy of diagnostics and repairs, making robust logistics and highly trained technical personnel critical competitive differentiators.

Racing Vehicle Market Potential Customers

The primary end-users and buyers in the Racing Vehicle Market are highly segmented, spanning from globally recognized professional motorsport teams with large corporate backing to independent privateers and educational institutions. The most financially significant customers are the manufacturer-backed factory teams, such as those competing in Formula 1, World Endurance Championship (WEC), and major rallying series, who require bespoke chassis, engines, and multi-year technical support packages. These entities focus on achieving maximum performance and brand validation, driving demand for the most advanced, often custom-engineered, vehicle platforms available.

A rapidly expanding customer base includes private and semi-professional racing teams participating in feeder series (like Formula 2, GT3) and national championships, who typically purchase standardized, 'customer race cars' from OEMs (e.g., Porsche 911 GT3 Cup, Audi R8 LMS). These customers prioritize reliability, parts availability, and a favorable cost-to-performance ratio. Additionally, wealthy private individuals utilizing racing vehicles for track days or participation in historical racing events represent a niche but lucrative segment demanding high-end maintenance and restoration services. Finally, racing schools and high-performance driver training academies require fleets of reliable, entry-level racing vehicles, focusing on durability and ease of maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ferrari, McLaren, Dallara, Porsche, Mercedes-AMG, Ginetta, Radical Sportscars, Ligier Automotive, Renault Sport Racing, Audi Sport, BMW M Motorsport, Honda Racing Development, Toyota Gazoo Racing, Koenigsegg, Hennessey Special Vehicles, Lola Cars. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Racing Vehicle Market Key Technology Landscape

The technology landscape within the Racing Vehicle Market is characterized by rapid iteration and the integration of highly advanced, often proprietary, systems focusing on maximizing efficiency and safety under extreme conditions. Central to this evolution is the pervasive use of advanced materials, particularly sophisticated carbon fiber monocoques and high-strength aluminum alloys, which are essential for achieving regulatory safety targets while drastically reducing vehicle mass. Furthermore, computational fluid dynamics (CFD) simulation and wind tunnel testing techniques have reached levels of unparalleled precision, allowing teams to optimize aerodynamic performance—the single most critical factor in many top-tier racing disciplines—before physical prototyping, significantly cutting R&D time and cost.

A second major pillar of technological innovation is powertrain electrification and energy management. The mandatory introduction of hybrid systems in series like Formula 1 and WEC, and pure electric platforms in Formula E, demands specialized battery technology offering high power density and advanced thermal management systems capable of sustaining performance across variable ambient temperatures. This has driven intense R&D in customized power electronics, regenerative braking systems (EBD), and sophisticated control units that manage the complex interplay between traditional combustion elements and electric motors/generators. This technological push in electrification is directly transferable to high-performance road vehicles, positioning motorsport as a crucial technology accelerator for the wider automotive industry.

Beyond vehicle components, digital technologies define the competitive edge. Advanced telemetry and data logging systems, coupled with machine learning algorithms, are standard across professional series, providing engineers with thousands of data points per second regarding vehicle dynamics, component stress, and driver input. This data analysis forms the basis for predictive maintenance, real-time setup adjustments, and strategic decisions during a race. Additionally, sophisticated simulation tools, including Driver-in-the-Loop (DIL) simulators, provide highly accurate virtual environments for driver training and vehicle development, minimizing expensive and limited track testing time. The continuous advancement in sensor technology, ranging from LiDAR for track mapping to non-contact temperature sensors, further enhances the precision and fidelity of data capture.

Regional Highlights

- North America (NA): The North American racing vehicle market is primarily dominated by the Stock Car (NASCAR) and IndyCar segments, characterized by stringent technical specifications ensuring parity among competitors. The region is seeing significant technological transformation as NASCAR transitions to hybrid powertrains and implements stricter safety mandates requiring advanced chassis and containment systems. NA also hosts a robust amateur racing scene, particularly in the sports car and drag racing segments, driving high demand for specialized aftermarket performance components and track-ready vehicles. Growth is supported by strong corporate sponsorship and high fan engagement, particularly in the US.

- Europe: Europe remains the core hub for the global racing vehicle market, commanding the largest revenue share due to the headquarters of major racing organizations (FIA), the primary base for Formula 1 and major endurance racing manufacturers, and a high concentration of specialized engineering firms (e.g., UK’s Motorsport Valley). The market here is highly technologically advanced, focusing intensely on aerodynamic efficiency, lightweight composite structures, and the rigorous development of hybrid and electric racing powertrains. Regulatory frameworks, such as those set by the European Union regarding environmental impact, are also pushing rapid innovation in sustainable materials and fuels.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, driven by expanding motorsport infrastructure in key economies such as China, Japan, and Australia, and increasing consumer interest in racing culture. Japan maintains a strong presence through major manufacturers like Toyota and Honda, who use motorsport for global brand exposure. The market expansion is characterized by rising participation in regional GT racing and national touring car series, leading to increased procurement of customer race cars and a growing need for sophisticated track support services. Government initiatives promoting domestic automotive engineering also contribute substantially to market growth.

- Latin America (LATAM): The LATAM market, while smaller in size, holds cultural significance, particularly in countries like Brazil and Argentina, which have deep historical ties to Formula racing. The market primarily focuses on supporting local touring car championships and feeder series, often relying on imported European chassis and technology. Economic volatility acts as a restraint, but sustained interest in motorsports provides a baseline demand for accessible racing platforms and associated spare parts.

- Middle East and Africa (MEA): The MEA region is characterized by high investment in hosting global racing events (e.g., F1 in UAE, Saudi Arabia, Bahrain) and the establishment of world-class racing circuits. This has created a localized demand for high-end support services, specialized race components, and vehicles used for testing and corporate hospitality events. While manufacturing capabilities are limited, the market for imported, state-of-the-art racing machinery and associated luxury performance services is substantial, driven by government funds and high-net-worth individual participation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Racing Vehicle Market.- Ferrari S.p.A.

- McLaren Group

- Dallara Automobili S.p.A.

- Porsche AG

- Mercedes-AMG Petronas F1 Team (Mercedes-Benz)

- Ginetta Cars Ltd.

- Radical Sportscars

- Ligier Automotive

- Renault Sport Racing

- Audi Sport (Volkswagen Group)

- BMW M Motorsport

- Honda Racing Development (HRD)

- Toyota Gazoo Racing

- Koenigsegg Automotive AB

- Hennessey Special Vehicles

- Lola Cars International Limited

- Oreca S.A.

- Xtrac Limited

- Williams Advanced Engineering

- Cosworth Group Holdings Limited

Frequently Asked Questions

Analyze common user questions about the Racing Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market transition toward electric powertrains in racing vehicles?

The transition is driven by stringent global emission regulations, manufacturer commitment to sustainability goals, and the need to use motorsport as a high-speed R&D platform for electric vehicle (EV) technology. Series like Formula E demonstrate the performance and marketing viability of pure electric racing, attracting major OEM investment.

How do advanced materials impact the performance and cost of racing vehicles?

Advanced materials, primarily carbon fiber and specialized alloys, are crucial for minimizing weight while maximizing structural integrity and safety. While these materials significantly boost performance and durability, their high cost and complex manufacturing processes contribute substantially to the overall expense of the racing vehicle.

Which geographical region holds the highest potential for future market growth?

Asia Pacific (APAC) is projected to be the fastest-growing region. This acceleration is attributed to rising motorsport popularity, increasing disposable incomes supporting track day culture, and continued investment in world-class racing circuits across China, Southeast Asia, and Japan.

What role does simulation technology play in the development of modern racing vehicles?

Simulation technology, including Computational Fluid Dynamics (CFD) and Driver-in-the-Loop (DIL) simulators, is indispensable. It allows teams to rapidly test and optimize vehicle setups, aerodynamics, and component durability in a virtual environment, minimizing physical testing time and cost while enhancing overall design efficiency and predictive analysis.

What are the primary restraints affecting the sustained growth of the professional racing vehicle segment?

The primary restraints include the extremely high capital investment required for homologation and R&D, heavy reliance on volatile corporate sponsorship for financial stability, and the complex, constantly changing technical regulations imposed by governing bodies, which necessitate frequent, expensive vehicle redesigns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager