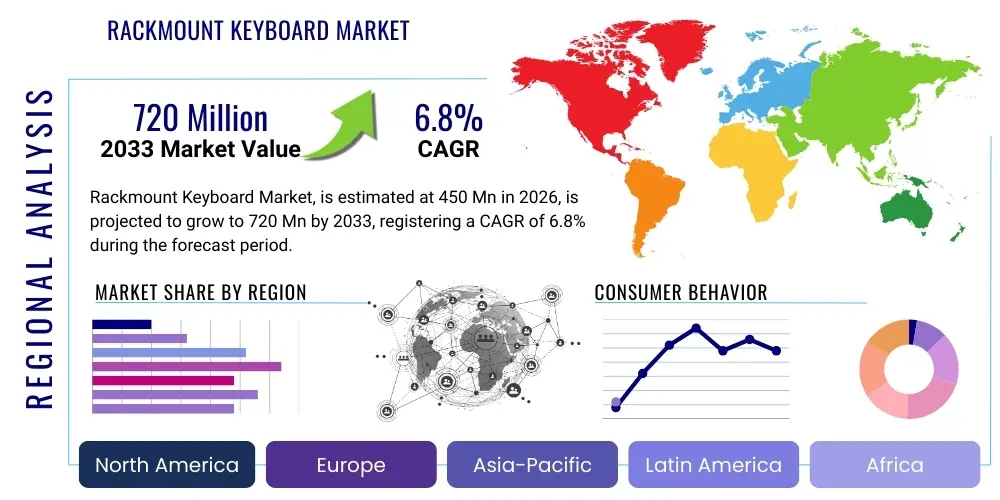

Rackmount Keyboard Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441452 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Rackmount Keyboard Market Size

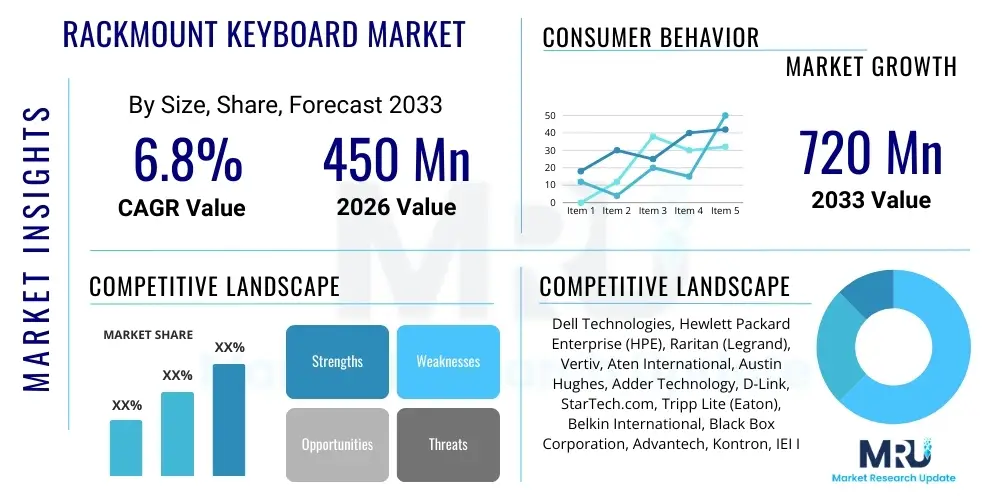

The Rackmount Keyboard Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating demand for high-density computing solutions, particularly within enterprise data centers, server farms, and specialized industrial control rooms where space optimization and reliable, centralized input interfaces are paramount for operational efficiency and system maintenance.

Rackmount Keyboard Market introduction

The Rackmount Keyboard Market encompasses specialized input devices designed for integration into standard 19-inch server racks and enclosures. These devices are crucial components in server management systems, offering human interface capabilities (HMI) often combined with integrated KVM (Keyboard, Video, Mouse) functionality or slide-out drawers, thereby maximizing space efficiency in densely packed computing environments. Designed for durability and reliability, rackmount keyboards typically feature robust construction, often incorporating industrial-grade components suitable for continuous operation in environments ranging from clean data centers to harsh factory floors. They ensure administrators and technicians can easily access, monitor, and manage multiple servers from a centralized point.

Product descriptions within this category vary widely, covering basic standalone units, drawer units with built-in displays (often 1U height), and specialized sealed or ruggedized versions resistant to dust, moisture, or extreme temperatures. Major applications span critical infrastructure sectors, including telecommunications, financial services, oil and gas, military and aerospace, and specialized research facilities. The primary benefit of deploying these keyboards is the superior space saving they offer compared to traditional desktop peripherals, alongside enhanced security and centralized control, which are non-negotiable requirements in mission-critical operations.

Driving factors fueling market growth include the global surge in data generation and processing, necessitating continuous expansion of colocation and enterprise data centers. Furthermore, the increasing adoption of industrial automation (Industry 4.0) mandates robust, localized input mechanisms for process control and diagnostics. The move toward edge computing further stimulates demand for compact, reliable input solutions in remote or constrained environments, solidifying the rackmount keyboard’s indispensable role in modern IT infrastructure architecture and maintenance protocols.

Rackmount Keyboard Market Executive Summary

The Rackmount Keyboard Market is characterized by steady technological evolution focusing on miniaturization, enhanced durability, and integrated system functionality, driven primarily by ongoing global investments in digital infrastructure. Business trends indicate a strong shift towards keyboards incorporating advanced features such as IP-rated protection, integrated biometric security, and higher resolution KVM switch capabilities, allowing for secure, high-performance remote management alongside local access. Key manufacturers are differentiating their offerings through modular designs and specialized mechanical switches that offer tactile feedback crucial for complex configuration tasks, appealing to high-end enterprise and military sectors.

Regional trends reveal North America and Europe retaining dominant market shares due to high concentrations of Tier 3 and Tier 4 data centers, demanding premium, reliable hardware. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid digitalization initiatives in countries like China, India, and Southeast Asia, coupled with massive government and private sector investment in cloud infrastructure and smart factory development. Demand in APAC leans heavily towards cost-effective yet rugged industrial-grade solutions suitable for diverse manufacturing environments, signaling future market momentum shift toward developing economies.

Segment trends highlight the Integrated KVM Rackmount Keyboard segment as the fastest growing, reflecting the industry preference for consolidated, streamlined server management tools that reduce clutter and installation complexity. Moreover, the demand for high-performance mechanical key mechanisms, though higher priced, is increasing in mission-critical applications where input accuracy is vital. Vertically, the Data Centers and Telecommunications sectors remain the largest consumers, though the Industrial Automation sector is projecting robust growth due to the expansion of networked manufacturing systems requiring dedicated, robust interface hardware.

AI Impact Analysis on Rackmount Keyboard Market

Common user questions regarding AI's impact on the Rackmount Keyboard Market frequently revolve around whether AI-driven automation will eventually eliminate the need for physical input devices in data centers, or conversely, whether the proliferation of AI infrastructure (such as specialized GPU farms) will increase the density and complexity of systems, thereby raising demand for specialized KVM solutions. Users often express concerns about the transition from local, physical interaction to fully remote, AI-optimized diagnostics, questioning the security implications and the necessity of maintaining robust manual overrides. Another key theme is the role of AI in predictive maintenance for hardware components, specifically asking if AI tools can optimize the design and lifespan of high-use physical keyboards in harsh operational environments.

The primary influence of AI technologies on the rackmount keyboard sector is indirect, manifesting through changes in the underlying IT infrastructure architecture. The massive computational needs of large language models (LLMs) and deep learning algorithms drive unprecedented growth in server density and necessitate highly efficient cooling and monitoring systems. While AI automates routine diagnostics and management, the crucial initial setup, BIOS-level configuration, emergency overrides, and hardware troubleshooting still mandate reliable physical access, for which rackmount KVM systems are essential. Thus, the expansion of AI infrastructure inadvertently secures the long-term necessity of these specialized input peripherals.

Furthermore, AI integration is influencing product design by demanding seamless integration with remote management software that leverages machine learning for predictive maintenance alerts. This pushes manufacturers to build smarter keyboards and KVM drawers with embedded sensors or telemetry capabilities, enhancing their value proposition in sophisticated IT ecosystems. The need for absolute reliability in the management of AI training clusters ensures that robust, low-latency, and failure-proof input mechanisms remain a non-negotiable requirement, guaranteeing sustained market growth, particularly in the high-performance computing (HPC) segment.

- AI proliferation drives demand for denser server infrastructure, increasing the requirement for space-saving rackmount KVM solutions.

- Increased complexity of AI server configurations mandates reliable physical access for BIOS and hardware-level setup and emergency intervention.

- AI enables predictive maintenance of the physical keyboard units, improving reliability and lifespan through sensor integration and data analytics.

- The need for secure, non-network dependent manual overrides in critical AI systems reinforces the role of dedicated rackmount keyboards.

- AI infrastructure deployment elevates the overall spending on data center peripherals, benefiting the rackmount keyboard market.

DRO & Impact Forces Of Rackmount Keyboard Market

The Rackmount Keyboard Market dynamic is shaped by a compelling combination of increasing server density and automation requirements (Drivers), counterbalanced by cost pressures and the growing efficacy of remote management software (Restraints). Significant opportunities lie in developing highly customized and ruggedized solutions for niche markets like military tactical deployments and highly automated factories. The overall impact forces indicate a positive trajectory, heavily influenced by global data center expansion and the necessity of high system uptime, making durable, centralized physical access mandatory across critical sectors.

Drivers primarily include the exponential growth of cloud computing, edge computing, and high-performance computing (HPC), all of which require maximized efficiency within limited physical spaces, making 1U rackmount drawers indispensable. The stringent regulatory requirements for system auditing and physical security in finance and healthcare sectors also drive the adoption of dedicated rackmount input solutions with integrated security features. Restraints include the high initial investment costs associated with industrial-grade, integrated KVM solutions compared to standard desktop peripherals, posing a barrier for smaller enterprises. Moreover, the continuous improvement in software-defined and remote out-of-band management tools (like IPMI and proprietary software) could theoretically reduce the frequency of physical interactions, though they cannot entirely eliminate the need for manual overrides.

Opportunities are significant, focusing on specialized product development such as IP65-rated stainless steel keyboards for food processing or pharmaceutical manufacturing environments, and developing ultra-low profile solutions for telecom racks where space is extremely tight. The impact forces show that while remote management technology mitigates some demand, the accelerating rate of physical infrastructure deployment globally outweighs this effect. The market thrives on the principle of redundancy and reliability: systems must always have a physical backup interface, ensuring sustained demand for robust rackmount keyboards regardless of software advancements.

Segmentation Analysis

The Rackmount Keyboard Market is comprehensively segmented based on product type, keyboard mechanism, size, and critical end-use industry, reflecting the diverse operational environments and technical requirements of modern computing infrastructure. This segmentation allows manufacturers to target specific performance and durability needs, ranging from standard data center administrative tasks to ruggedized military field deployments. Analyzing these segments is crucial for understanding specific market dynamics, regional adoption patterns, and technological preferences within different vertical markets, driving product innovation towards more modular and functionally integrated solutions.

Key differentiation exists between basic tray systems and advanced KVM integrated units, the latter often incorporating features such as high-definition LCD panels and advanced security protocols, justifying a higher price point. Mechanism-based segmentation highlights the trade-off between cost (membrane keyboards) and tactile reliability/longevity (mechanical keyboards), catering to varied operational intensity levels. The rapid growth of data center construction globally ensures that the 1U form factor segment remains dominant, as space efficiency is the primary economic driver for enterprise IT infrastructure investments.

- By Product Type:

- Standard Rackmount Keyboard

- Integrated KVM Drawer Keyboard (Console Drawers)

- Industrial Grade/Ruggedized Keyboard

- IP Rated Keyboard (e.g., IP65, IP68)

- Touchpad/Trackball Integrated Keyboard

- By Keyboard Mechanism:

- Membrane Keyboard

- Mechanical Keyboard

- Silicone Rubber Keyboard

- By Size/Form Factor:

- 1U (Dominant Segment)

- 2U and Above

- Customized/Non-Standard Sizes

- By Industry Vertical:

- Data Centers & Cloud Service Providers

- Industrial Automation & Manufacturing (Industry 4.0)

- Telecommunications & Networking

- Military & Defense

- Financial Services & Banking

- Healthcare & Pharmaceutical

- Research & Education

Value Chain Analysis For Rackmount Keyboard Market

The value chain for the Rackmount Keyboard Market begins with upstream component suppliers, primarily involving specialized electronic component manufacturers providing key switches (mechanical or membrane), integrated circuits for KVM functionality, robust chassis materials (steel or aluminum), and high-durability wiring and connection components. Sourcing quality materials, particularly those offering vibration resistance and high thermal tolerances, is a critical initial step. The complexity of the components, especially for integrated LCD screens and specialized KVM chips, dictates the upstream cost structure. Efficiency in managing these complex supply networks is key to maintaining competitive pricing for the final assembled product.

Midstream activities involve sophisticated manufacturing and assembly, where the integration of the keyboard, trackball/touchpad, KVM switch, and display panel into the compact 1U or 2U drawer chassis takes place. Quality control and rigorous testing are essential here, given the critical nature of the final application (server management). Distribution channels are multifaceted, relying heavily on indirect methods. Major manufacturers utilize specialized IT distributors (like Tech Data or Ingram Micro) who handle bulk sales to large data center integrators and enterprise resellers. Direct sales are typically reserved for highly customized or military-grade solutions requiring specialized technical consultation and integration support.

Downstream activities center on deployment, integration, and post-sale support within the end-user facilities—data centers, control rooms, and industrial environments. System integrators (SIs) play a pivotal role in specifying and installing these devices as part of larger rack infrastructure projects. Customer feedback loops from the downstream users are vital for manufacturers to iterate on design, focusing on features like improved cable management, smoother drawer slides, and enhanced KVM reliability, ensuring the product meets the stringent demands for uptime and ease of maintenance in high-stakes environments.

Rackmount Keyboard Market Potential Customers

Potential customers for rackmount keyboards are primarily large-scale enterprises and organizations that operate and maintain centralized server infrastructure, where optimizing physical space and ensuring high-reliability access are critical operational mandates. The core buyer base includes Chief Information Officers (CIOs), Data Center Managers, IT Operations Directors, and System Administrators responsible for hardware procurement and maintenance protocols. These decision-makers prioritize products offering superior durability, minimal space utilization (1U compliance), and seamless integration with existing server management platforms, such as enterprise KVM infrastructure.

Beyond traditional corporate data centers, specialized customers in the industrial sector—specifically those involved in automated manufacturing, process control, and utilities—represent a rapidly growing segment. These end-users, including Plant Managers and Instrumentation Engineers, require ruggedized, sealed, and often chemical-resistant keyboards that can withstand continuous exposure to challenging environmental factors like dust, humidity, or operational shock. Furthermore, government and defense agencies purchase highly specialized, TEMPEST-certified or mil-spec rackmount units for secure, tactical computing environments where electromagnetic emissions and physical resilience are primary procurement criteria.

The purchasing cycle often involves complex, multi-year procurement contracts, especially with hyperscale cloud providers and telecommunication carriers who buy in massive volumes to outfit standardized rack configurations across global facilities. These large buyers focus heavily on total cost of ownership (TCO), product longevity, and the manufacturer’s capability to provide extensive global technical support and fast replacement parts, making vendor reputation and global supply chain robustness key differentiators in securing major contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies, Hewlett Packard Enterprise (HPE), Raritan (Legrand), Vertiv, Aten International, Austin Hughes, Adder Technology, D-Link, StarTech.com, Tripp Lite (Eaton), Belkin International, Black Box Corporation, Advantech, Kontron, IEI Integration Corp., Cyber Acoustics, Cherry GmbH, APW Enclosures, Rittal, Hammond Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rackmount Keyboard Market Key Technology Landscape

The technological landscape of the Rackmount Keyboard Market is defined by continuous improvements in integration density, input mechanism longevity, and seamless connectivity standards, all aimed at enhancing server rack management efficiency. A crucial technological advancement is the integration of high-definition (HD) and ultra-high-definition (UHD) LCD panels within the 1U KVM drawer units. As server resolutions increase, the demand for drawers capable of supporting 1080p, 4K, and even 8K video output via DisplayPort or HDMI connections has become standard in high-end data centers, moving far beyond older VGA limitations. This shift necessitates complex internal cabling and high-speed KVM switching matrices that can handle extremely high bandwidth while maintaining zero-latency performance, crucial for real-time system monitoring and management operations.

Another significant area of innovation lies in the physical input mechanisms themselves. While membrane keyboards offer low cost and high sealing capability (often IP rated), the professional segment is increasingly adopting mechanical switch technology. Modern rackmount keyboards are now incorporating specialized low-profile mechanical switches designed for industrial use, offering superior tactile feedback, durability (up to 50 million keystrokes), and resistance to environmental stress, far exceeding the performance of traditional rubber domes. Furthermore, security integration is becoming paramount; biometric scanners (fingerprint recognition) and smart card readers are being embedded directly into the keyboard assembly. These features align with stringent regulatory compliance requirements (like HIPAA or PCI DSS) by ensuring that only authorized personnel can gain physical console access to sensitive rack-mounted equipment, adding a critical layer of physical security managed directly at the access point.

Connectivity solutions are also evolving rapidly. While traditional PS/2 and USB connections remain standard, the market is seeing increased adoption of IP-based KVM over IP functionality integrated directly into the rackmount console drawer. This allows administrators to switch between local console management and remote access management effortlessly using the same hardware interface. Advanced KVM over IP implementations now include virtual media support, allowing remote users to mount ISO images and perform software installations as if they were physically present at the server console. Miniaturization technology ensures that these advanced features, including full-sized keyboards and integrated trackpads, are packaged successfully within the standard 1U height (1.75 inches), demanding sophisticated engineering to manage heat dissipation and component density effectively without compromising structural integrity or reliability in demanding, vibration-prone server environments.

Material science contributes significantly to the longevity and performance of industrial-grade rackmount solutions. The utilization of robust materials such as medical-grade silicone rubber for keypads provides chemical resistance and complete waterproofing (meeting high IP ratings). For the chassis, heavy-gauge steel and aircraft-grade aluminum are used to provide electromagnetic interference (EMI) shielding and exceptional rigidity, ensuring smooth operation of slide rails and protection of internal components even under severe operational stress. The trend towards modular design is also prominent, allowing end-users to easily swap out keyboard components, trackballs, or KVM modules without needing to replace the entire rack drawer, optimizing maintenance efficiency and reducing downtime. The complexity of these systems, integrating multiple high-tech components like embedded processors for KVM control, high-speed video scalers, and durable input peripherals into a highly confined space, showcases the technological sophistication required to compete in this specialized segment of the IT hardware market.

Ergonomics, while secondary to space efficiency in rack environments, is also seeing incremental improvements. Modern rackmount keyboards feature adjustable tilt mechanisms and optimized key layouts that mimic standard desktop keyboard feel, reducing strain on technicians who often spend long hours performing configuration or diagnostic tasks within the restricted space of a server aisle. Backlighting and emergency quick-access buttons are standard features, catering to low-light conditions commonly found in data center cold aisles. The convergence of hardware consolidation, enhanced video fidelity, biometric security, and extreme durability characterizes the cutting-edge technology defining the premium rackmount keyboard market, driving obsolescence for older, purely analog KVM systems and solidifying the market's trajectory towards smart, integrated console management solutions.

Regional Highlights

The global Rackmount Keyboard Market exhibits significant regional variations in adoption rate, technological maturity, and market saturation, primarily dictated by the concentration of data centers, level of industrial automation, and governmental IT spending.

- North America (NA): Dominates the global market share, driven by the presence of major hyperscale cloud providers (AWS, Microsoft Azure, Google Cloud) and a high density of Tier 3 and Tier 4 data centers. The region demands high-specification, reliable, and often integrated KVM drawer solutions featuring advanced security protocols like biometric access. Market maturity is high, leading to replacement cycles and continuous upgrade demand for higher resolution KVM capabilities. Regulatory requirements related to physical data security further boost the demand for secure, dedicated rack console systems.

- Europe: Represents a mature and substantial market, characterized by strong demand from the financial services sector (especially London and Frankfurt) and the automotive and precision manufacturing industries (Germany). There is a significant focus on robust industrial-grade solutions due to high penetration of Industry 4.0 initiatives. Standardization and compliance with environmental and quality standards (e.g., ISO certifications) are key procurement factors. The region sees strong adoption of both integrated KVM solutions and specialized, sealed IP-rated keyboards.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, fueled by massive digital transformation efforts in China, India, and Southeast Asia. Rapid infrastructure development, including new data center hubs and smart city projects, provides immense opportunity. While price sensitivity exists, the sheer volume of server deployment ensures high demand. The need for specialized keyboards in harsh manufacturing and telecommunications infrastructure development (5G rollout) drives growth in the ruggedized segment. Local manufacturing and distribution networks are rapidly expanding to meet this accelerating demand.

- Latin America (LATAM): Exhibits moderate but steady growth, concentrated primarily in Brazil and Mexico. Market expansion is closely tied to investment in local cloud infrastructure and modernization of older government and banking systems. The demand profile often favors cost-effective, durable standard rackmount keyboards, although premium integrated solutions are increasingly adopted by international hyperscalers establishing regional presence.

- Middle East and Africa (MEA): Emerging market with high potential, driven by strategic government investments in technology diversification (e.g., Saudi Arabia’s Vision 2030 and UAE’s smart initiatives). Oil and gas and military sectors are key purchasers, requiring highly ruggedized, specialized rackmount consoles for remote and harsh operational environments. Security and resilience are primary determinants for procurement, favoring high-end, purpose-built solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rackmount Keyboard Market.- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Raritan (Legrand)

- Vertiv

- Aten International

- Austin Hughes

- Adder Technology

- D-Link

- StarTech.com

- Tripp Lite (Eaton)

- Belkin International

- Black Box Corporation

- Advantech

- Kontron

- IEI Integration Corp.

- Cyber Acoustics

- Cherry GmbH

- APW Enclosures

- Rittal

- Hammond Manufacturing

Frequently Asked Questions

Analyze common user questions about the Rackmount Keyboard market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for 1U Rackmount Keyboard Drawers?

The primary driver is the necessity for extreme space optimization in modern, high-density data centers. 1U (1.75 inch) drawers maximize server density by integrating the console (keyboard, monitor, KVM) into the minimum possible rack height, freeing up critical rack space for revenue-generating servers and storage units.

How do mechanical rackmount keyboards compare to membrane versions in enterprise environments?

Mechanical rackmount keyboards offer superior tactile feedback, high durability (up to 50 million keystrokes), and enhanced reliability crucial for mission-critical configuration tasks. Membrane versions are typically lower cost and offer better sealing (IP rating) for industrial environments, though they have shorter operational lifespans.

Is the Rackmount Keyboard Market threatened by advancements in KVM over IP and remote management tools?

No, while KVM over IP reduces routine physical access, rackmount keyboards remain essential for BIOS configuration, emergency troubleshooting, server setup, and out-of-band management where network dependency is unacceptable. They serve as a critical physical redundancy and essential manual override interface.

Which industry vertical is projected to show the highest growth rate for ruggedized rackmount keyboards?

The Industrial Automation and Manufacturing vertical (linked to Industry 4.0) is projected to exhibit the highest growth rate for ruggedized solutions. These environments require IP-rated, sealed keyboards resistant to dust, liquids, and vibration for control panel integration and localized process management.

What key technological feature distinguishes a premium Rackmount KVM solution from a standard unit?

Premium Rackmount KVM solutions are distinguished by high-fidelity video support (4K/8K), integrated biometric security features (fingerprint readers), superior low-latency KVM switching capabilities, and robust industrial-grade mechanical components designed for continuous, high-reliability operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager