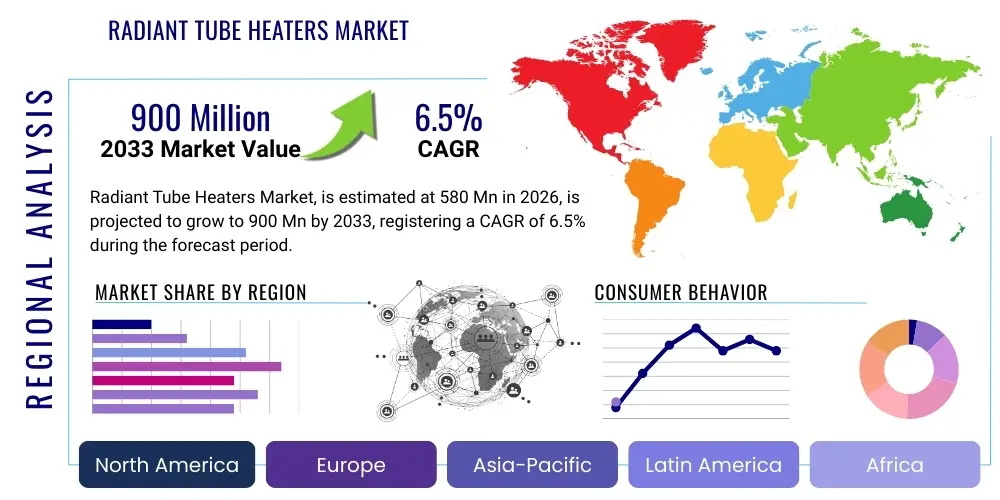

Radiant Tube Heaters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441134 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Radiant Tube Heaters Market Size

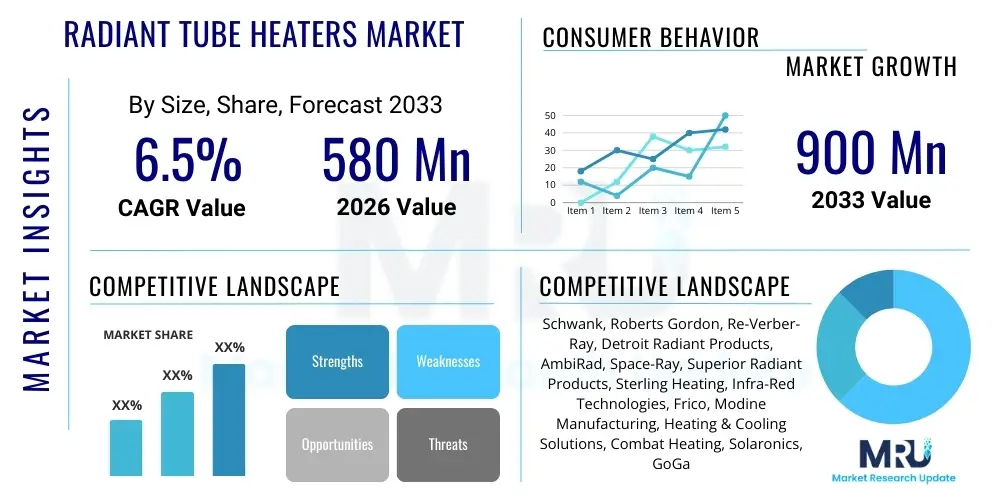

The Radiant Tube Heaters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 900 Million by the end of the forecast period in 2033.

Radiant Tube Heaters Market introduction

Radiant tube heaters represent a highly efficient category of heating solutions designed primarily for high-ceiling or open spaces where conventional forced-air systems are inefficient or impractical. These systems operate by heating a tube (usually made of steel) via combustion, which then emits infrared energy (radiant heat) that travels through the air and directly warms objects, floors, and people, rather than heating the air itself. This mechanism makes them exceptionally effective in large industrial settings, such as warehouses, manufacturing plants, aircraft hangars, and agricultural buildings, offering significant energy savings and improved comfort levels compared to convective heating methods.

The core products within this market are typically categorized into low-intensity (non-luminous) and high-intensity (luminous) radiant heaters, differentiated by their operating temperature and heat output characteristics. Low-intensity heaters employ an internal fan to pull combustion gases through a long tube, distributing heat evenly across a wide area at relatively lower surface temperatures. Conversely, high-intensity heaters use ceramic burners that operate at much higher temperatures, emitting light and intense heat over a localized area. Major applications span climate control in large commercial retail spaces, specialized zone heating in automotive repair garages, and maintaining optimal temperatures in agricultural environments like poultry and hog farms, ensuring product quality and animal welfare.

The primary benefits driving the market adoption include superior energy efficiency due to minimal heat loss through stratification or drafts, excellent localized heating capabilities, and reduced maintenance needs compared to boiler-based systems. Key driving factors propelling market expansion are the escalating demand for cost-effective heating solutions in newly industrialized regions, stringent regulatory mandates emphasizing energy conservation in industrial and commercial construction, and the technological evolution leading to more precise, modulating controls that optimize fuel consumption based on real-time environmental conditions. Furthermore, the inherent durability and long operational lifespan of these systems contribute positively to the overall cost of ownership for end-users, solidifying their position as a preferred heating technology.

Radiant Tube Heaters Market Executive Summary

The Radiant Tube Heaters Market is poised for substantial growth, underpinned by robust global industrial expansion and a critical industry shift towards sustainable, energy-efficient infrastructure. Business trends indicate a strong move toward systems integrated with smart heating controls, allowing for remote monitoring, predictive maintenance, and highly precise temperature modulation, addressing the increasing operational complexities of modern facilities. Manufacturers are heavily investing in developing advanced burner technologies and specialized tube materials to enhance thermal efficiency and reduce nitrous oxide (NOx) emissions, aligning with tightening global environmental standards, which is proving to be a critical competitive differentiator.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by rapid urbanization and massive infrastructure investments in manufacturing and logistics, particularly in China and India. North America and Europe, characterized by mature industrial sectors, focus primarily on replacing older, less efficient systems with high-efficiency condensing radiant heaters that offer significant reductions in operational costs. Moreover, the demand in cooler climate zones globally remains consistent, with a growing focus on agricultural applications where maintaining stable, uniform temperatures is vital for crop and livestock productivity, influencing regional supply chain logistics and distributor specialization.

Segmentation trends reveal that the Non-Luminous (Low-Intensity) segment commands the largest market share due to its versatility and suitability for total building heating in diverse industrial settings like large warehouses and distribution centers. Conversely, the Electric-powered radiant tube heater segment is witnessing the highest CAGR, driven by decarbonization efforts and favorable governmental incentives promoting the use of clean electricity sources, especially in sensitive commercial environments where combustion gases are restricted. The application segment growth is dominated by "Total Building Heating," but "Process Heating" applications are gaining traction, especially in specialized manufacturing sectors like painting, drying, and curing processes where consistent, non-contact heating is essential for material integrity and production throughput, driving demand for specialized burner design and controls.

AI Impact Analysis on Radiant Tube Heaters Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Radiant Tube Heaters Market frequently revolve around optimizing energy consumption, predictive failure analysis, and integrating radiant systems within broader smart building management platforms. Consumers are keen to understand how AI can move these traditionally simple heating units into the realm of complex, data-driven climate control systems. Key concerns include the necessity of retrofitting existing installations, the cost implications of implementing sophisticated sensors and algorithms, and the actual quantifiable Return on Investment (ROI) derived from AI-managed heating schedules. Users expect AI to translate operational data into actionable insights, leading to optimized zone heating and proactive maintenance scheduling, thereby minimizing downtime and maximizing fuel efficiency in large-scale industrial operations.

The core expectation is that AI will transcend basic thermostat control, enabling the radiant systems to dynamically respond to factors like external weather forecasts, internal occupancy levels (through computer vision or occupancy sensors), and the specific thermal mass characteristics of the structure. This level of predictive control moves away from fixed scheduling towards real-time optimization, ensuring heat is only applied precisely when and where it is needed. Furthermore, AI is crucial for processing the massive influx of data generated by networked heater components—such as monitoring combustion efficiency, flue gas temperatures, and tube surface integrity—to predict potential component failure long before operational issues occur, fundamentally changing the service and maintenance paradigm.

This integration is not just about heating efficiency; it’s about asset management and regulatory compliance. AI models can simulate different operational scenarios to ensure compliance with strict energy usage limits or NOx emission caps, offering manufacturers a powerful tool for system design and end-users a verification method for reporting. The adoption curve is currently focused on new, high-value industrial and logistics construction projects where the upfront investment in AI-enabled Building Management Systems (BMS) can be justified by long-term energy savings and enhanced operational reliability, setting a new benchmark for system performance in the sector.

- Predictive Maintenance: AI algorithms analyze vibration, temperature, and combustion data to forecast component failure (e.g., igniters, fans), maximizing uptime.

- Dynamic Optimization: Integration with BMS and real-time environmental sensors to adjust heater output based on occupancy and external temperature, ensuring peak energy efficiency.

- Automated Commissioning: AI assists in the rapid self-calibration and fine-tuning of heating zones during initial installation and commissioning processes.

- Enhanced Emissions Control: Utilizing machine learning to modulate air-fuel ratios dynamically, ensuring optimal combustion efficiency and minimal pollutant output.

- Energy Auditing & Reporting: Automated generation of highly accurate, granular energy consumption reports required for compliance and sustainability certifications.

- Smart Zone Control: Using deep learning to manage complex, multi-zone installations, prioritizing heat distribution based on operational needs (e.g., high-traffic loading docks vs. static storage areas).

DRO & Impact Forces Of Radiant Tube Heaters Market

The dynamics of the Radiant Tube Heaters Market are fundamentally shaped by the interplay of energy efficiency imperatives, infrastructural investment cycles, and evolving environmental regulations. Drivers strongly favor market growth, particularly the documented superior efficiency of radiant systems in high-bay applications compared to forced-air alternatives, resulting in significant operational cost reductions for large industrial consumers. Opportunities lie primarily in the technological advancement toward condensing models and the integration of digital controls, which tap into the burgeoning smart factory and logistics warehouse markets. However, high initial capital expenditure and strict, localized emission standards in certain developed regions pose persistent restraints, influencing purchasing decisions and necessitating continuous R&D investment by key manufacturers to maintain market viability and competitive edge in sensitive markets.

Segmentation Analysis

The Radiant Tube Heaters Market is comprehensively segmented based on parameters critical to end-user selection, including the operational mechanism (Type), the energy source utilized (Fuel Type), the specific environment where they are deployed (End-Use Industry), and the intended heating goal (Application). This multifaceted segmentation allows for precise market sizing and identification of high-growth niches. For instance, the distinction between luminous and non-luminous types dictates suitability for specific ceiling heights and heat distribution requirements, while the increasing adoption of electric fuel types reflects broader industry trends toward electrification and reduced carbon emissions, impacting strategic supply chain decisions and product development pipelines for global manufacturers navigating diverse energy market landscapes.

- By Type:

- Luminous Heaters (High Intensity)

- Non-Luminous Heaters (Low Intensity/Tube Heaters)

- By Fuel Type:

- Natural Gas

- Propane (LPG)

- Electric

- Oil/Diesel

- By End-Use Industry:

- Industrial (Manufacturing, Warehousing & Logistics, Automotive)

- Commercial (Retail, Sports Facilities, Garages)

- Agricultural (Poultry Farms, Greenhouses, Dairy)

- By Application:

- Spot Heating

- Total Building Heating

- Process Heating (Drying, Curing, Preheating)

Value Chain Analysis For Radiant Tube Heaters Market

The value chain for the Radiant Tube Heaters Market initiates with upstream activities involving the sourcing and processing of core raw materials, predominantly high-quality steel alloys for the tubes and specific ceramics/refractory materials for the burners and reflectors. Upstream profitability is sensitive to global commodity prices and specialized metallurgy required to withstand high operational temperatures and corrosive environments. Manufacturers must manage complex sourcing logistics for specialized components like modulating gas valves, high-efficiency fans, and sophisticated electronic controls, often involving global supply partnerships to ensure component quality and reliability under continuous thermal cycling.

The midstream phase involves the core manufacturing process, encompassing precision fabrication of the heat exchanger tubes, assembly of burners, reflectors, and control systems, followed by rigorous testing and certification (e.g., CSA, CE standards). This stage is highly critical as efficiency and safety certifications dictate market access. Downstream activities involve distribution channels, which are typically bifurcated into direct sales for major industrial projects requiring bespoke engineering solutions, and indirect distribution through established HVAC wholesalers, specialized heating contractors, and engineering consulting firms who specify the systems for commercial clients. The efficiency of the downstream network, particularly the ability of distributors to provide localized installation and aftermarket support, heavily influences market penetration and customer satisfaction.

Direct distribution is favored for large, complex industrial installations where customization, engineering input, and system integration with existing building management systems are necessary. Indirect channels, which rely on established HVAC distributors, are essential for reaching the broader commercial and small-to-medium enterprise (SME) markets, capitalizing on the distributors' existing logistics networks and relationships with local mechanical contractors. The effectiveness of the value chain is increasingly measured by the quality of after-sales service, including rapid provision of spare parts and skilled technical support, which ensures the prolonged operational life and performance reliability of the installed radiant heating infrastructure across diverse climatic zones.

Radiant Tube Heaters Market Potential Customers

The primary end-users and buyers of radiant tube heaters are institutions and businesses operating in large-volume, high-ceiling environments where maintaining thermal comfort and process temperature efficiently is critical. The industrial segment, encompassing global logistics firms managing vast warehousing and distribution centers, heavy machinery manufacturing plants, and automotive service facilities, represents the largest customer base. These entities prioritize low operating costs and reliable, uniform heat distribution across expansive floor areas, making the localized, non-stratifying heat profile of radiant systems highly attractive, especially when ceiling heights exceed 15 feet where forced-air systems lose significant efficiency.

The commercial sector serves as a significant growth area, including large retail outlets, aircraft maintenance hangars, ice arenas, and various sports facilities requiring specific climate control without generating disruptive air movement. Furthermore, the specialized agricultural industry constitutes a rapidly growing customer segment, utilizing radiant tube heaters extensively in modern, climate-controlled greenhouses and intensive livestock rearing facilities (e.g., large poultry houses). In these agricultural settings, radiant heat provides focused warmth directly to the animals or plants without overheating the surrounding air, which helps in maintaining lower humidity levels and optimizing growth conditions, ultimately leading to higher yields and reduced operational risk related to environmental stress.

Procurement decisions are typically driven by a combination of factors: the long-term energy savings achieved, compliance with local environmental regulations regarding emissions, and the durability and expected lifespan of the equipment. Consulting engineers and mechanical contractors often act as key influencers and specifiers, recommending systems based on detailed thermal load calculations and adherence to industry best practices, thereby linking manufacturers directly to the end-user’s specific requirements. Consequently, manufacturers must focus their marketing efforts on establishing strong relationships with these technical specifiers, providing them with robust performance data and comprehensive product training to ensure market confidence in the provided heating solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 900 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schwank, Roberts Gordon, Re-Verber-Ray, Detroit Radiant Products, AmbiRad, Space-Ray, Superior Radiant Products, Sterling Heating, Infra-Red Technologies, Frico, Modine Manufacturing, Heating & Cooling Solutions, Combat Heating, Solaronics, GoGas, Airwood, Reznor, Cambridge Engineering |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radiant Tube Heaters Market Key Technology Landscape

The current technology landscape in the Radiant Tube Heaters Market is defined by a strong focus on enhancing thermal efficiency, improving modulation capabilities, and minimizing environmental impact, primarily driven by innovations in burner and heat exchanger design. A key technological advancement is the rise of condensing radiant tube heaters. These systems capture residual heat from flue gases, which would normally be expelled, increasing overall thermal efficiency significantly—often reaching 90% or higher. This process requires specialized materials, such as stainless steel heat exchangers, to resist condensation corrosion, positioning these systems as the premium, energy-saving choice for green buildings and facilities aiming for maximum energy credit compliance.

Another crucial area of innovation is in burner technology. Manufacturers are increasingly adopting two-stage or fully modulating burners that allow the heat output to precisely match the required thermal load, preventing the efficiency losses associated with frequent on/off cycling common in older models. This modulation capability, coupled with sophisticated electronic ignition and flame monitoring systems, ensures safer and more consistent operation while drastically reducing fuel consumption. Furthermore, the development of low NOx (Nitrous Oxide) burners is mandatory in many regulated markets, necessitating advanced combustion chamber design and specialized air-fuel mixing techniques to comply with stringent air quality regulations imposed by regional and national environmental protection agencies.

The integration of digital control systems and connectivity (IoT) represents a paradigm shift, moving these heaters from simple mechanical devices to integral components of smart Building Management Systems (BMS). Modern radiant systems utilize sophisticated microprocessors and digital interfaces for zone control, scheduling, fault detection, and remote diagnostics. This allows facility managers to monitor and adjust performance parameters remotely, gather historical usage data, and implement predictive maintenance schedules, drastically enhancing operational efficiency and system reliability. The combination of high-efficiency components and intelligent control systems solidifies the market’s technological trajectory towards automation, data optimization, and sustainability, setting new performance benchmarks for industrial heating infrastructure.

Regional Highlights

- North America: A mature but replacement-driven market, characterized by strict energy efficiency standards (especially in states like California and provinces in Canada) that favor high-efficiency condensing units. The large concentration of logistics, automotive manufacturing, and aerospace sectors drives consistent demand for robust, high-performance radiant heating solutions suitable for massive facilities.

- Europe: Highly regulated market focused intensely on emissions control (Low NOx). Western Europe is defined by mandatory decarbonization targets, propelling the growth of electric radiant solutions and highly efficient gas-fired condensing technology. Germany, the UK, and France are key consumers, driven by industrial modernization and warehousing expansion necessitated by e-commerce growth.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive infrastructure development, industrialization, and rapidly expanding logistics networks in emerging economies like China, India, and Southeast Asian nations. While price sensitivity remains a factor, increasing awareness of long-term energy savings is driving the adoption of medium to high-efficiency models in new industrial parks.

- Latin America (LATAM): A developing market with demand concentrated in industrialized zones of Mexico and Brazil, primarily driven by foreign direct investment in manufacturing and localized agricultural needs. Market growth is sporadic but steady, focusing on durable, cost-effective solutions capable of handling varying fuel quality and climatic conditions.

- Middle East and Africa (MEA): A niche market, where demand is localized to areas with significant temperature fluctuations (desert environments requiring heating at night) and specific industrial applications such as oil and gas processing facilities and large-scale agricultural operations (greenhouses). Investment is tied closely to large governmental and private infrastructure projects focusing on maximizing energy resource utilization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radiant Tube Heaters Market.- Schwank

- Roberts Gordon

- Re-Verber-Ray

- Detroit Radiant Products

- AmbiRad

- Space-Ray

- Superior Radiant Products

- Sterling Heating

- Infra-Red Technologies

- Frico

- Modine Manufacturing

- Heating & Cooling Solutions

- Combat Heating

- Solaronics

- GoGas

- Airwood

- Reznor

- Cambridge Engineering

Frequently Asked Questions

Analyze common user questions about the Radiant Tube Heaters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary energy efficiency advantages of radiant tube heaters over forced-air systems?

Radiant tube heaters heat objects and surfaces directly, bypassing the need to heat large volumes of air. This prevents heat stratification (heat rising to the ceiling) and minimizes energy loss through air drafts, resulting in verified energy savings typically ranging from 30% to 50% in high-bay industrial and commercial environments, drastically lowering operating costs.

What is the main difference between luminous (high-intensity) and non-luminous (low-intensity) radiant heaters?

Luminous heaters operate at very high temperatures (up to 1800°F), emitting visible light and focused heat over a specific, localized area. Non-luminous tube heaters operate at lower temperatures (around 800°F to 1200°F), utilizing a closed tube system to distribute uniform, gentle heat over a much wider area, making them suitable for total building comfort heating.

Are electric radiant tube heaters becoming a viable alternative to traditional gas-fired units?

Yes, the electric segment is growing rapidly, driven by global decarbonization efforts and mandates limiting combustion emissions indoors. Electric units offer precise control, zero on-site emissions, and simplified installation in regions with high electricity availability or where natural gas infrastructure is restricted, providing a clean alternative for various commercial and industrial applications.

What key maintenance aspects should facility managers monitor for optimal radiant heater performance?

Facility managers must prioritize regular cleaning of reflectors to maximize radiant heat output, annual inspection of burners for efficient combustion (checking air-fuel mixture), and checking for structural integrity of the heat exchanger tubes. Proactive monitoring of the ignition system and fan performance is crucial for ensuring reliable startup and maintaining high thermal efficiency throughout the heating season.

How do smart controls and IoT integration enhance the functionality of modern radiant tube heating systems?

Smart controls enable sophisticated zonal heating, allowing managers to tailor heat output based on real-time occupancy and operational schedules. IoT connectivity facilitates remote monitoring, automated fault detection, and predictive maintenance scheduling, ensuring optimized energy usage and maximizing uptime by addressing potential mechanical issues before they lead to system failure.

Detailed Market Analysis: Radiant Tube Heaters Segment Performance and Future Outlook

The core strength of the Radiant Tube Heaters Market lies in its differentiated approach to heating large, non-standard volumes of space, positioning it as a mandatory technology solution in logistics and manufacturing sectors globally. The market analysis reveals that continued technological refinement, specifically concerning energy recovery and emission reduction, will be the primary determinant of long-term commercial success. Manufacturers focusing on condensing technology are expected to capture the premium segment, especially in regions with high energy costs and strict environmental penalties for non-compliance. The versatility of these systems, capable of providing both comfort heating and specialized process heating (e.g., drying industrial coatings or warming large engine components), insulates the market from fluctuations in general construction cycles by maintaining essential demand from specialized industrial consumers who require non-contact heating methods for quality control.

Market Drivers Deep Dive: Efficiency and Industrial Expansion

One of the most potent drivers for the Radiant Tube Heaters Market is the unrelenting pressure on industrial and commercial enterprises to minimize operational costs, particularly energy expenditures. In high-ceiling buildings, conventional air heating systems must heat the entire volume of air, leading to significant thermal loss through stratification where heated air collects uselessly near the roofline. Radiant heating counters this inefficiency by transferring energy directly to the floor and occupants, resulting in immediate and measurable fuel savings, which often provides a compelling investment case with short payback periods. This economic advantage is increasingly crucial as global energy prices remain volatile and subject to geopolitical risk, reinforcing the value proposition of high-efficiency systems.

Coupled with efficiency is the enormous global expansion of warehousing and logistics infrastructure, driven largely by the exponential growth of e-commerce. Modern distribution centers and mega-warehouses require precise, yet economical, heating solutions for vast, dynamically used spaces. Radiant tube heaters are perfectly suited for these environments, allowing for targeted heating of specific zones, such as packing areas or loading docks, while maintaining minimum temperatures in static storage zones. This direct correlation between the growth of global trade infrastructure and the demand for radiant heating systems ensures a foundational and ongoing source of market revenue, particularly in rapidly developing logistic hubs across Asia and Eastern Europe, where new facility construction is outpacing traditional industrial growth.

Restraints and Challenges: Capital Cost and Regulatory Compliance

Despite the long-term operational savings, the relatively high initial capital expenditure (CAPEX) associated with purchasing and installing sophisticated radiant tube heating systems acts as a significant restraint, especially for smaller enterprises or facilities undergoing budget-constrained renovations. While the equipment itself represents a considerable investment, the installation process, which often involves complex venting and gas line extensions for high-intensity systems, further contributes to the upfront financial barrier, pushing some cost-sensitive buyers towards cheaper, less efficient, short-term solutions.

Furthermore, navigating the labyrinth of regional and national environmental regulations presents a continuous challenge for manufacturers. Stringent mandates regarding NOx emissions, particularly in dense urban areas or regions like the European Union and specific North American states, necessitate expensive R&D into cleaner burning technologies. Non-compliance is not an option, forcing manufacturers to continually upgrade product lines. This regulatory pressure, while promoting cleaner air, often increases the complexity and cost of the units, potentially slowing market penetration in regions where regulatory enforcement is nascent or less strict, creating heterogeneous market demands across different geographies.

Opportunities: IoT and Condensing Technology Adoption

The clearest opportunity for market expansion lies in the adoption of Internet of Things (IoT) technologies and smart controls. Integrating radiant heaters into interconnected building management systems allows for unprecedented operational insight and control. Facilities can leverage data analytics to optimize heating cycles, predict component failure, and automatically adjust output based on factors like weather changes or inventory movement. This level of smart operation significantly enhances the overall value proposition beyond simple heating, positioning the product as a data-generating asset contributing to overall facility efficiency management.

A secondary, yet crucial, opportunity is the widespread replacement cycle of aging, conventional heating equipment with high-efficiency condensing radiant systems. As energy costs rise and sustainability mandates become more pervasive, businesses are increasingly finding the economic case for replacing older, sub-70% efficient systems with condensing models offering efficiencies above 90% undeniable. This replacement market, particularly strong in mature industrial economies, provides a stable, high-value revenue stream as businesses seek to green their operations and lock in lower long-term utility expenses, cementing the condensing segment as a future market leader in innovation and sales volume.

Detailed Segmentation Analysis by Fuel Type

The segmentation by fuel type—Natural Gas, Propane (LPG), Electric, and Oil/Diesel—reflects diverse energy infrastructures and pricing structures globally. Natural Gas remains the dominant fuel source due to its general affordability and established supply networks across North America and parts of Europe, leading to the highest volume sales in this segment. Manufacturers continue to optimize gas burners for maximum efficiency and minimum emissions to maintain this dominance in the face of competing energy sources.

Propane (LPG) heaters cater primarily to remote industrial locations or agricultural facilities where natural gas lines are unavailable. While offering portability and flexibility, the higher storage and unit cost of LPG compared to piped natural gas limits its overall market share but guarantees its niche importance. The Electric radiant heater segment, although historically smaller, is surging due to favorable climate policies promoting electrification. These heaters are simple to install, require minimal venting, and are often preferred in enclosed environments like specialized clean rooms or specific commercial retail spaces where combustion byproducts are strictly prohibited, driving their high growth rate.

In-Depth Value Chain Component Breakdown

The manufacturing complexity of radiant tube heaters necessitates meticulous control over the upstream supply chain. Specialized steel, particularly aluminized or stainless steel alloys, must be sourced to prevent thermal stress fractures and corrosion induced by condensation or combustion byproducts. The quality of insulation and reflector materials, which are crucial for directing the radiant heat downwards, directly impacts the system's overall performance and longevity. Suppliers of these core materials hold considerable leverage, as specifications for temperature resistance and durability are extremely high, requiring specialized production processes.

The downstream distribution network relies heavily on trained and certified HVAC contractors who possess the technical expertise required for complex installation and precise commissioning, especially for modulating and condensing units. Because radiant heating involves specialized knowledge (e.g., proper tube length calculation, required suspension heights, and specific venting configurations), manufacturer training programs for distributors and installers are critical components of the value chain. Successful market players invest heavily in these technical training programs to ensure proper installation, which minimizes warranty claims and maximizes customer satisfaction and system efficiency over the long operational lifespan of the heating equipment.

Focus on End-Use Industry: Industrial vs. Agricultural Applications

The Industrial segment, primarily encompassing large-scale warehousing and manufacturing, is the pillar of the Radiant Tube Heaters Market. These environments require significant thermal output capacity to maintain stable working conditions across thousands of square feet, often necessitating multi-unit system installations. The key driver here is the need for highly reliable, low-maintenance heating systems that can operate continuously under challenging conditions, such as high ceilings, frequent door opening (loading docks), and environments with dust or specialized industrial processes.

The Agricultural sector, particularly large greenhouse operations and poultry/livestock farms, offers distinct demand characteristics. In greenhouses, radiant heat is used to warm the plants and soil directly, minimizing air temperature fluctuation and reducing disease vectors associated with high humidity, thereby optimizing yield. For animal husbandry, radiant heat provides direct comfort to young animals (chicks, piglets) on the floor level, reducing energy waste and improving welfare outcomes. This specialized utility makes the agricultural segment highly resilient to economic downturns, as stable food production requires consistent, climate-controlled environments, ensuring steady demand for smaller, more specialized radiant heater models designed for lower installation heights and specific humidity tolerances.

Technology Deep Dive: Low NOx Burners and Modulating Controls

Low NOx technology is rapidly moving from a desirable feature to a regulatory requirement in many advanced industrial markets. Modern radiant tube heaters achieve low NOx levels through innovative burner design that controls the flame temperature and oxygen interaction, specifically using techniques like staged combustion or the use of ceramic fiber inserts to manage heat transfer and reduce peak flame temperatures, thereby inhibiting the formation of nitrogen oxides. This engineering focus requires high precision manufacturing and advanced control systems to ensure the delicate air-fuel balance is maintained across all output levels.

Modulating controls represent the state-of-the-art in energy management for radiant systems. Instead of a simple ON/OFF function, modulating heaters can infinitely vary their heat output, often from 40% to 100% capacity, based on the instantaneous demand reported by zone sensors. This continuous operation eliminates the energy spikes and efficiency losses associated with cycling, maintaining a much more consistent and comfortable temperature. Integration with smart thermostats and environmental sensors allows these modulating systems to utilize predictive algorithms, adjusting the burner intensity in anticipation of temperature drops, thus achieving superior energy performance and higher user comfort levels, justifying the premium price point for these technologically advanced systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager