Railcar Mover Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443305 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Railcar Mover Market Size

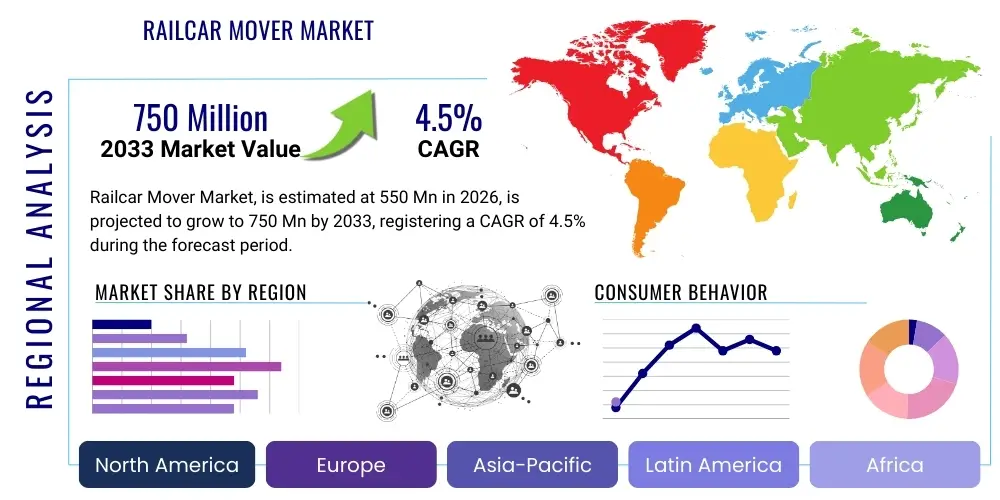

The Railcar Mover Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Railcar Mover Market introduction

Railcar movers are specialized industrial machines engineered for the efficient and safe positioning (shunting or spotting) of railway cars within confined industrial environments such as ports, manufacturing plants, and terminal yards. These versatile machines, which include mobile road/rail units and fixed car pullers, are designed to replace the need for traditional, high-cost mainline locomotives for short-distance movements. Their primary applications span critical logistics functions across the chemical, oil and gas, mining, and general manufacturing sectors, where they are vital for loading, unloading, and maintenance processes. Key benefits derived from their use include significantly improved operational efficiency, reduced environmental impact due to the shift towards electric models, enhanced worker safety through advanced controls, and substantial cost savings by eliminating reliance on external switching services, collectively driving sustained market growth.

Railcar Mover Market Executive Summary

The Railcar Mover Market is positioned for stable expansion, buoyed by global infrastructure investments and a pervasive industrial need to optimize internal rail logistics. Key business trends highlight a decisive shift toward environmentally sustainable and digitally integrated equipment, prompting leading manufacturers to prioritize the development of advanced electric and hybrid propulsion systems. This technological pivot is supported by the expansion of service agreements that incorporate predictive maintenance and telematics, transforming vendors into comprehensive logistics support providers. Geographically, North America currently holds the largest market share, characterized by high replacement demand and early adoption of safety technologies, while the Asia Pacific (APAC) region is forecasted to achieve the highest CAGR, fueled by rapid industrialization and major port modernization projects across China and India.

Segmentation analysis reveals that Mobile Railcar Movers, known for their road/rail versatility, dominate the market based on type, proving essential for dynamic, widespread industrial complexes. Concurrently, the propulsion segment is rapidly evolving, with Electric Railcar Movers capturing increasing market share at the expense of traditional Diesel units, primarily due to global mandates concerning emission reduction and the resultant lower Total Cost of Ownership (TCO) offered by electric models. End-user demand is particularly robust from high-volume throughput industries such as Mining & Metals and the Oil & Gas sector, which require robust, high-capacity movers to manage complex raw material and finished product flows efficiently. This dynamic combination of technological innovation and escalating global logistical needs ensures positive market momentum through 2033.

AI Impact Analysis on Railcar Mover Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Railcar Mover Market primarily center on three themes: enhanced safety protocols, the feasibility of full autonomy, and optimization of operational logistics. Users frequently ask how AI can prevent derailments or collisions, whether autonomous railcar movers are ready for complex industrial settings, and how machine learning algorithms can minimize maintenance downtime and fuel consumption. The key concerns revolve around the cybersecurity risks associated with connected equipment and the significant upfront capital investment required for adopting advanced AI-driven systems. Overall, the expectation is that AI will revolutionize shunting operations by enabling predictive decision-making, significantly boosting efficiency, and establishing new benchmarks for industrial rail safety, moving railcar movers from basic mechanical tools to sophisticated, data-driven logistical assets.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast equipment failures, minimizing unexpected downtime and optimizing repair scheduling, thereby increasing asset utilization rates.

- Autonomous Railcar Operations: Implementing computer vision and advanced navigation algorithms to enable driverless or remote-controlled shunting, significantly reducing labor costs and eliminating human error in repetitive tasks.

- Optimized Route Planning and Scheduling: AI algorithms analyze yard capacity, track status, and loading/unloading schedules to determine the most efficient movement patterns, reducing idle time and optimizing energy consumption.

- Enhanced Safety Systems: Integrating AI for real-time hazard detection (e.g., proximity to workers, obstacles on the track) and automated emergency braking, surpassing basic safety interlocks.

- Telematics and Data Analytics: AI processes large volumes of operational data (speed, load, fuel usage) to provide actionable insights for fleet managers, leading to better procurement and operational strategies.

DRO & Impact Forces Of Railcar Mover Market

The Railcar Mover Market is fundamentally driven by the need for enhanced operational efficiency in industrial logistics and the imperative to comply with increasingly stringent safety and environmental regulations. These factors create robust demand (Drivers). However, the high initial capital expenditure associated with purchasing modern, technologically advanced movers, coupled with the specialized training required for operators, acts as a significant constraint (Restraints). Opportunities (Opportunities) are abundant in developing markets through infrastructure expansion and the integration of advanced technologies like electrification and automation. The competitive landscape and technological shifts, such as the rise of telematics, exert significant influence (Impact Forces), shaping product development and market penetration strategies across key geographical areas.

Specifically, market growth is propelled by the globalization of supply chains, necessitating faster turnaround times at intermodal facilities and manufacturing plants. The replacement cycle for aging railcar mover fleets, particularly in mature markets like North America and Europe, provides steady revenue streams. Furthermore, the integration of Industry 4.0 principles, where seamless data flow and automation are paramount, drives the development of smart railcar movers equipped with IoT capabilities. However, market restraints are reinforced by the economic sensitivity of capital goods procurement, meaning global economic slowdowns can quickly dampen investment decisions, leading to deferred purchases by end-users in volatile sectors like mining and construction.

The primary opportunity lies in the burgeoning trend of electrification. As battery technology improves and costs decrease, electric railcar movers offer a compelling alternative to traditional diesel engines, providing lower total cost of ownership (TCO) and compliance with zero-emission zone policies in urban industrial hubs. Additionally, the fragmented nature of rail yard logistics in some regions presents an opportunity for manufacturers to offer integrated software solutions alongside hardware. Impact forces are predominantly shaped by competitive pressure, forcing rapid innovation in battery efficiency, power output, and connectivity features to maintain market relevance and achieve differentiation in a highly specialized equipment sector.

Segmentation Analysis

The Railcar Mover Market segmentation provides a detailed structural breakdown based on critical operational and technological criteria, allowing for granular analysis of demand patterns and growth vectors. Key segmentation criteria include the type of machine (Mobile vs. Stationary), the mode of propulsion (Diesel, Electric, Hybrid), and the operational capacity (e.g., light-duty, heavy-duty). This structured approach helps stakeholders understand which product features are gaining traction, such as the accelerating shift toward electric propulsion driven by sustainability mandates, and where the highest demand originates, primarily from large industrial complexes and Class I rail facilities. The analysis confirms that segmentation based on capacity closely correlates with end-user industry requirements, with mining and metals demanding high-capacity models, while petrochemical and food & beverage facilities often utilize medium-capacity units for precise spotting tasks.

- By Type:

- Mobile Railcar Movers (Road/Rail Units)

- Stationary Railcar Movers (Trackmobile/Car Pullers)

- By Propulsion:

- Diesel

- Electric (Battery-Powered)

- Hybrid

- By Operating Capacity:

- Light Duty (< 20,000 lbs Tractive Effort)

- Medium Duty (20,000 lbs to 40,000 lbs Tractive Effort)

- Heavy Duty (> 40,000 lbs Tractive Effort)

- By End-User Industry:

- Mining & Metals

- Oil & Gas and Chemical

- Logistics & Ports (Intermodal Facilities)

- Food & Beverage and Agriculture

- Manufacturing (Automotive, Heavy Machinery)

- Utilities and Waste Management

Value Chain Analysis For Railcar Mover Market

The value chain for the Railcar Mover Market is complex, beginning with upstream activities focused on the procurement of specialized components. Upstream involves sourcing critical materials like high-grade steel for chassis and rail wheels, acquiring advanced powertrain systems (diesel engines, electric batteries, and related controls), and securing sophisticated hydraulic and braking systems. Key suppliers in this stage include specialized automotive and heavy equipment component manufacturers (e.g., engine suppliers, battery developers, and axle providers). The efficiency and reliability of these upstream suppliers directly influence the final quality, cost of production, and lead time of the railcar mover.

The core manufacturing and assembly stage involves the integration of these components, rigorous testing, and quality control checks, ultimately creating the specialized road-rail or purely rail-based equipment. Downstream activities focus heavily on sales, distribution, and critical post-sale support. Distribution channels are predominantly indirect, relying on a network of highly specialized regional distributors and dealers who possess local market knowledge, technical expertise, and capability for maintenance and warranty servicing. Direct sales are typically reserved for large, established global clients or bulk governmental tenders where manufacturers maintain dedicated account management teams.

The distribution network strategy is paramount for market success. Indirect channels offer the advantage of localized inventory, quicker response times for maintenance, and tailored sales strategies based on regional regulatory specifics. Service and support, including spare parts availability, scheduled maintenance, and technological upgrades, represent a significant revenue stream in the downstream segment, often guaranteeing long-term customer relationships and high customer lifetime value. Furthermore, the increasing adoption of telematics necessitates robust remote diagnostic capabilities within the downstream support framework, ensuring minimal operational downtime for end-users relying on 24/7 internal logistics.

Railcar Mover Market Potential Customers

Potential customers for railcar movers are primarily large industrial entities that operate captive rail sidings, requiring frequent and precise movement of railcars for operational processes, loading, and unloading. These end-users are characterized by high volume throughput and stringent safety requirements. The primary buyers include multinational corporations in the petrochemical sector, which move massive quantities of chemicals and fuel, requiring reliable and explosion-proof equipment for handling hazardous materials within regulated zones. Similarly, major utility companies, particularly those operating coal or gas-fired power plants, rely on movers to position bulk commodity delivery cars efficiently.

Beyond the heavy process industries, major logistics hubs, ports, and intermodal freight terminals represent a rapidly growing customer segment. These facilities require agile and high-capacity mobile railcar movers capable of transferring intermodal containers between shipside cranes or truck terminals and classification yards. The automotive and heavy machinery manufacturing sectors also constitute significant buyers, using these movers to position raw material cars (e.g., steel coils) and finished vehicles within assembly plants and distribution centers. The purchasing decision for these entities is driven by factors such as total cost of ownership (TCO), tractive effort capabilities, adherence to regional safety standards (e.g., OSHA, FRA), and the availability of responsive, comprehensive service contracts.

A crucial emerging customer base includes large agricultural processing facilities, such as grain elevators and large-scale food processors, which handle seasonal bulk commodities requiring fast and efficient car spotting to meet delivery timelines. Furthermore, railway maintenance and repair depots are consistent buyers, utilizing smaller, specialized railcar movers to maneuver disabled or damaged rolling stock within confined maintenance bays. The ongoing trend towards digitalization and automation suggests that the ideal customer profile is evolving to prioritize movers that integrate seamlessly with existing warehouse management systems (WMS) and enterprise resource planning (ERP) platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordco Inc., Trackmobile, LLC, Shuttlewagon, Inc., Calbrandt, Inc., Toyota Industries Corporation (through specific subsidiaries), Railquip, Inc., Socofer S.A.S., Zwiehoff GmbH, K.W. Rail System, R.J. Corman Railroad Group, Simplex, Mitchell Rail Gear, Rail King (Stewart & Stevenson), EZ Rail, Badger Railcar Mover |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railcar Mover Market Key Technology Landscape

The technological evolution within the Railcar Mover Market is centered on enhancing operational safety, improving energy efficiency, and integrating digital connectivity. A primary technological focus is the transition from conventional hydraulic and mechanical systems to advanced electrical and electronically controlled drives. Modern movers incorporate sophisticated Programmable Logic Controllers (PLCs) and robust telematics hardware, enabling real-time remote diagnostics, performance monitoring, and secure data transmission for fleet management. The shift toward Electric Railcar Movers mandates continuous innovation in battery technology, specifically focusing on increasing energy density, improving charging speeds, and extending battery life to meet the demanding duty cycles typical of industrial shunting operations.

Furthermore, safety technology represents a crucial competitive differentiator. Contemporary railcar movers are equipped with advanced proximity sensors, LiDAR, and high-definition cameras to provide 360-degree visibility and implement Collision Avoidance Systems (CAS). These systems often integrate GPS and machine vision to map the rail yard environment, ensuring the mover operates within predefined safe zones. The development of automated and semi-autonomous capabilities, leveraging Artificial Intelligence for precise spotting and coupling operations, is rapidly progressing, driven by the desire to minimize risk in high-hazard environments and optimize operational precision.

Innovations also extend to the mechanical design, particularly in dual road/rail technology. Manufacturers are constantly refining the mechanisms for seamless transition between rubber tires on pavement and steel wheels on tracks, enhancing versatility and reducing cycle times. Hybrid propulsion systems are gaining traction, combining the high torque of electric motors with the sustained power of small diesel generators, offering a bridge solution that addresses range anxiety while capitalizing on fuel efficiency benefits. Overall, the technology landscape is moving towards fully connected, environmentally sustainable, and highly automated equipment, fundamentally transforming rail yard efficiency and safety standards across global industrial sectors.

Regional Highlights

- North America (USA and Canada): Dominant market share due to the highly extensive Class I rail network and high volume of freight movement across diverse industries (Energy, Chemical, Automotive). Characterized by high replacement demand for existing fleets and early adoption of heavy-duty, hybrid, and fully electric movers driven by stringent EPA regulations and safety standards (FRA). The market here is mature but constantly innovating, with a strong emphasis on service contracts and comprehensive maintenance packages from key vendors.

- Europe (Germany, UK, France): A mature, highly regulated market focused on sustainability and compact design. The rapid implementation of strict emission standards (Euro Stage V) drives high demand for battery-electric and compact stationary movers, particularly in densely populated industrial areas and ports. Germany, with its robust manufacturing sector, remains a critical hub for high-specification railcar mover manufacturing and technological deployment, emphasizing precision engineering and integrated safety features.

- Asia Pacific (APAC) (China, India, Japan): Fastest-growing region, powered by explosive infrastructure spending, port expansion projects, and massive industrialization across various sectors, particularly mining, heavy manufacturing, and logistics. China and India are experiencing significant greenfield demand, prioritizing cost-effectiveness alongside increasing requirements for basic automation and higher-capacity movers to handle growing domestic and international trade volumes. Regulatory compliance, though lagging behind Western markets, is catching up, creating future opportunities for high-spec equipment.

- Latin America (Brazil, Mexico): Emerging market driven by commodity exports (mining, agriculture) and automotive manufacturing. Demand is project-specific and often tied to foreign direct investment in large-scale infrastructure and mining operations. Cost sensitivity is high, leading to a strong preference for robust, reliable diesel movers, though environmental pressures are slowly introducing electric alternatives in modern facilities, especially near urban centers.

- Middle East and Africa (MEA): Primarily focused on energy (Oil & Gas) and port infrastructure development. Demand is concentrated in regions undertaking significant logistical upgrades (e.g., UAE, Saudi Arabia) to support non-oil industrial diversification. The operating environment often requires movers designed for extreme temperatures and harsh conditions, favoring robust mechanical systems and specialized safety ratings for hazardous material handling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railcar Mover Market.- Nordco Inc.

- Trackmobile, LLC

- Shuttlewagon, Inc.

- Calbrandt, Inc.

- Toyota Industries Corporation

- Railquip, Inc.

- Socofer S.A.S.

- Zwiehoff GmbH

- K.W. Rail System

- R.J. Corman Railroad Group

- Simplex

- Mitchell Rail Gear

- Rail King (Stewart & Stevenson)

- EZ Rail

- Badger Railcar Mover

- Boss Railcar Movers

- Hoist Liftruck Mfg., Inc.

- United Tractors Tbk (Specific regional distribution/assembly)

- General Electric (GE Transportation Services - legacy/components)

- HARSCO Corporation (Infrastructure focused)

Frequently Asked Questions

Analyze common user questions about the Railcar Mover market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Mobile Railcar Mover and a Traditional Locomotive?

Mobile Railcar Movers are smaller, highly maneuverable road-rail vehicles designed for short-distance switching (spotting/shunting) within private industrial facilities, offering better fuel efficiency and lower operating costs than large, heavy locomotives used for long-haul mainline freight transport.

Which factors are driving the shift towards Electric Railcar Movers?

The primary drivers are stringent global emission regulations, the need to reduce noise pollution in industrial areas, significantly lower long-term operating costs (TCO) compared to diesel, and corporate sustainability mandates favoring zero-emission industrial equipment.

How is AI technology being applied to improve Railcar Mover safety?

AI is applied through sophisticated sensor fusion systems, LiDAR, and computer vision to enable real-time hazard detection, precise positioning, and predictive maintenance scheduling, significantly reducing the likelihood of collisions and unexpected mechanical failures.

What is the projected CAGR for the Railcar Mover Market?

The Railcar Mover Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033, driven mainly by infrastructure investments in APAC and increased automation demand globally.

Which end-user industries represent the largest market for Heavy Duty Railcar Movers?

The largest markets for Heavy Duty (> 40,000 lbs Tractive Effort) Railcar Movers are the Mining & Metals sector, large-scale Oil & Gas and Chemical processing plants, and major intermodal port facilities requiring the movement of multiple loaded railcars simultaneously.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager