Railway Infrastructure Maintenance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440938 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Railway Infrastructure Maintenance Market Size

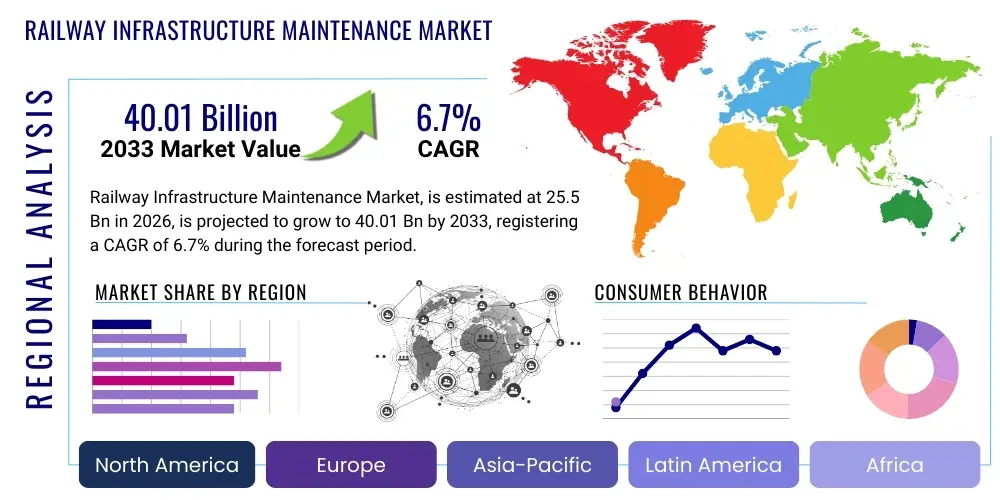

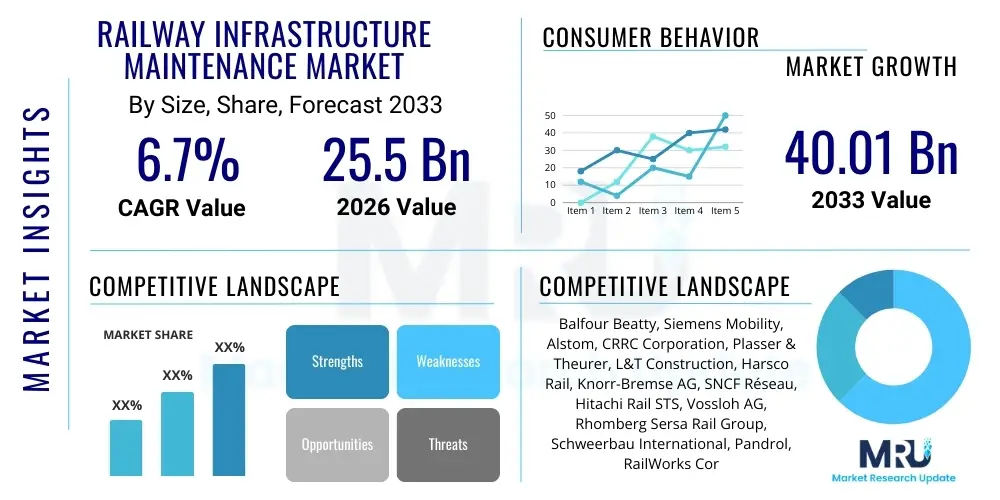

The Railway Infrastructure Maintenance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.01 Billion by the end of the forecast period in 2033. This robust expansion is fueled by increasing global investment in high-speed rail networks, the critical need for safety compliance, and the accelerating adoption of advanced digital maintenance technologies, including predictive analytics and remote sensing systems, across mature and emerging economies seeking enhanced operational efficiency and reduced lifecycle costs for railway assets.

Railway Infrastructure Maintenance Market introduction

The Railway Infrastructure Maintenance Market encompasses all necessary services, products, and technologies required to monitor, preserve, repair, and upgrade railway assets, including tracks, bridges, tunnels, signaling systems, electrification infrastructure, and rolling stock interfaces. These maintenance activities are crucial for ensuring operational safety, reliability, and network availability. The primary applications involve scheduled preventative maintenance (e.g., track grinding, ballast cleaning), corrective maintenance (e.g., emergency repairs), and increasingly, condition-based and predictive maintenance enabled by IoT sensors and big data analysis. Key benefits derived from effective maintenance include extended asset lifespan, minimized service disruptions, adherence to stringent governmental regulations, and improved passenger and freight throughput capacity. The market expansion is significantly driven by global efforts to modernize aging infrastructure, coupled with technological advancements that enhance the precision and efficiency of maintenance protocols, such as automated inspection systems and specialized heavy maintenance machinery.

Railway Infrastructure Maintenance Market Executive Summary

The global railway maintenance landscape is undergoing a profound transformation characterized by digitalization and automation, driving significant business trends towards outsourced maintenance contracts and performance-based logistics models. Regional trends indicate that Asia Pacific, spearheaded by massive infrastructure projects in China and India, represents the fastest-growing market due to rapid urbanization and network expansion, while Europe and North America remain key markets focusing heavily on adopting sophisticated predictive maintenance solutions to maximize efficiency within existing, often heavily utilized, networks. Segment trends show a clear shift from conventional time-based maintenance practices toward condition-monitoring and advanced diagnostics, particularly within the track and civil infrastructure segment, spurred by the need to manage rising operational costs and minimize system downtime. Furthermore, increasing regulatory pressures concerning safety and interoperability across international railway corridors necessitate continuous investment in high-quality maintenance services and sophisticated non-destructive testing (NDT) technologies, ensuring sustained market growth across all geographic and service segments.

AI Impact Analysis on Railway Infrastructure Maintenance Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) algorithms are being leveraged to transition railway maintenance from reactive or time-based models to highly efficient, proactive, and predictive strategies. Common concerns revolve around the reliability of AI-driven defect detection, the cost of integrating AI infrastructure (sensors, data pipelines), and the requirement for specialized skill sets to interpret complex algorithmic outputs. Expectations are high regarding AI's potential to dramatically reduce unforeseen failures, optimize maintenance schedules based on real-time asset degradation data, and improve safety by automatically identifying critical track and component defects that human inspectors might miss. The consensus suggests AI will revolutionize resource allocation, shifting expenditures from reactive repairs to targeted, high-value preventative interventions, thereby significantly enhancing network efficiency and lifetime asset value across the global rail sector.

- AI-driven Predictive Maintenance (PdM) forecasts component failure probability using historical and real-time sensor data, minimizing unplanned downtime.

- Automated defect recognition via computer vision and deep learning models analyzes high-definition imagery and video collected by inspection trains, enhancing detection accuracy for track geometry and civil structure integrity.

- Optimization of scheduling and logistics using ML algorithms determines the ideal timing and location for maintenance crews, factoring in network congestion and weather patterns.

- Digital twins of critical railway assets (e.g., bridges, tunnels) utilize AI to simulate the long-term effects of operational stress, guiding refurbishment and replacement strategies.

- Natural Language Processing (NLP) aids in analyzing voluminous maintenance reports and historical fault logs to identify systemic issues and recurring failure patterns more rapidly than manual review processes.

DRO & Impact Forces Of Railway Infrastructure Maintenance Market

The Railway Infrastructure Maintenance Market is primarily driven by the escalating global need for reliable public and freight transportation, forcing network operators to invest heavily in asset integrity and safety compliance; simultaneously, regulatory mandates concerning operational safety and environmental sustainability necessitate continuous infrastructure upgrades. However, the market faces significant restraints, chiefly high capital expenditure required for adopting advanced monitoring technologies (such as NDT and advanced data processing platforms) and a persistent shortage of skilled technical labor capable of managing highly digitalized maintenance workflows. Opportunities abound through the integration of emerging technologies like AI, IoT, and drones for automated inspection, alongside governmental initiatives globally promoting large-scale railway expansion and modernization projects, particularly in emerging markets. These factors collectively create a strong impact force: the critical reliance on sophisticated technological solutions to meet rising safety standards and maximize the operational lifespan of increasingly complex railway systems, effectively pushing the industry toward a condition-based and predictive maintenance paradigm.

The major drivers include government funding allocations aimed at rejuvenating outdated rail networks and expanding high-speed routes, particularly across dense urban corridors and major freight arteries, recognizing rail transport's lower environmental footprint compared to road transport. The increasing volume and velocity of both passenger and freight traffic put immense pressure on existing infrastructure, demanding more frequent and precise maintenance interventions to prevent catastrophic failure or service reduction. Furthermore, the push for standardization and interoperability, especially in cross-border European and Asian rail linkages, necessitates sophisticated maintenance protocols that meet diverse national safety standards, propelling the demand for globally certified maintenance service providers and standardized technological tools.

Conversely, restraining forces include the immense complexity of coordinating maintenance windows in highly utilized networks, often leading to service disruptions and public backlash, thereby limiting maintenance duration. Furthermore, the integration challenges associated with legacy infrastructure, where incorporating modern sensors and communication protocols is prohibitively costly and technically complex, often slows the pace of technological adoption. The high initial investment required for specialized heavy machinery (e.g., high-performance track renewal trains, advanced ballast profilers) and the long procurement cycles for these specialized assets act as substantial financial barriers, particularly for smaller network operators, impacting the rapid scaling of state-of-the-art maintenance practices across all tiers of the industry.

Segmentation Analysis

The Railway Infrastructure Maintenance Market is comprehensively segmented based on the type of service provided, the specific component of the infrastructure being maintained, and the nature of the maintenance approach utilized. This detailed segmentation allows market participants to tailor their offerings—from specialized rail grinding services to integrated signaling system diagnostics—to specific customer needs, which vary significantly based on network age, operational load, and regional regulatory environment. Understanding these segments is crucial for analyzing growth trajectories, with the Service Type segment dominating due to the operational necessity of specialized external contractors, while the component segmentation highlights the increasing technological focus on maintaining highly complex systems like catenary and overhead line equipment (OLE) infrastructure, critical for electrified networks.

- By Service Type: Track Maintenance (Rail Grinding, Ballast Cleaning, Sleeper Replacement), Signaling & Telecommunication Maintenance, Electrification Maintenance (Catenary/Overhead Lines), Civil Engineering Maintenance (Bridges, Tunnels, Earthworks).

- By Component: Track (Rail, Sleepers, Ballast, Fasteners), Rolling Stock Interface Systems, Signaling Systems (Interlocking, Train Control Systems), Power Supply & Catenary.

- By Maintenance Type: Corrective Maintenance (Breakdown Repair), Preventive Maintenance (Scheduled Inspections), Predictive Maintenance (Condition Monitoring, Diagnostics).

- By End User: Passenger Rail, Freight Rail, Urban Transit (Metro/Tram).

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Value Chain Analysis For Railway Infrastructure Maintenance Market

The value chain for railway infrastructure maintenance begins upstream with specialized equipment manufacturers (heavy machinery, inspection systems, NDT tools) and raw material suppliers (steel, concrete, ballast). These suppliers are pivotal in providing the high-quality, certified materials and technology required for enduring infrastructure. Midstream activities involve the core service providers, who execute the maintenance work, ranging from large multinational infrastructure conglomerates offering integrated solutions (e.g., planning, execution, and asset management) to highly specialized local contractors focusing on niche services like ultrasonic rail testing or specialized welding. The distribution channels are predominantly direct, involving long-term, high-value contracts between Infrastructure Managers (IMs) or network owners and the maintenance service providers, often negotiated through competitive public tenders. Indirect channels are less common but may include technology integrators or consultancies that facilitate the adoption of new digital maintenance platforms, acting as intermediaries between software developers and railway operators.

Upstream analysis reveals that technological innovation in materials (e.g., fatigue-resistant rails, high-durability polymers for sleepers) and sophisticated machinery (e.g., autonomous track renewal systems) dictates the cost structure and quality of maintenance outcomes. Key players in this phase focus on R&D to enhance product longevity and reduce installation time, thereby influencing the total lifecycle cost of the railway assets. Strong relationships with certified component suppliers are essential to ensure adherence to strict safety and quality standards, which are non-negotiable in the rail sector. Furthermore, the supply chain for specialized spare parts, particularly for aging or customized rolling stock and signaling components, remains a complex and often constrained element of the upstream market, leading operators to seek solutions focused on component refurbishment and modular design.

Downstream analysis centers on the asset owners and operators (IMs and rail companies) who are the ultimate buyers of maintenance services. Their primary objective is maximizing network availability and safety while controlling operational expenditure. The trend is moving toward performance-based contracts, where maintenance providers are incentivized to guarantee specific levels of reliability and uptime, shifting the risk associated with asset failure to the service contractor. The effective management of maintenance data—including condition monitoring outputs and failure history—is a crucial downstream activity, as this data feeds directly into strategic planning for future maintenance cycles and capital investment decisions. The success of the downstream market relies heavily on the integration capability of the service providers to deliver cohesive solutions across diverse infrastructure types, necessitating strong project management and technical expertise.

Railway Infrastructure Maintenance Market Potential Customers

The primary customers in the Railway Infrastructure Maintenance Market are the owners and operators of rail networks, collectively referred to as Infrastructure Managers (IMs) or rail authorities. These entities include national railway organizations responsible for main lines (e.g., Network Rail in the UK, Deutsche Bahn in Germany, various state-owned railways in APAC), private freight carriers operating dedicated networks (particularly prevalent in North America for heavy haul operations), and urban transit operators managing metro, light rail, and tram systems. These customers continuously require specialized services, from preventative track alignment and inspection services to complex, multi-year contracts for signaling system upgrades and preventative maintenance on civil structures. Their procurement decisions are heavily influenced by regulatory compliance mandates, asset age, budget constraints, and the imperative to minimize operational disruption, leading them to prioritize suppliers offering proven safety records and technologically advanced, efficiency-enhancing solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.01 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Balfour Beatty, Siemens Mobility, Alstom, CRRC Corporation, Plasser & Theurer, L&T Construction, Harsco Rail, Knorr-Bremse AG, SNCF Réseau, Hitachi Rail STS, Vossloh AG, Rhomberg Sersa Rail Group, Schweerbau International, Pandrol, RailWorks Corporation, Progress Rail (Caterpillar), TATA Projects, Voestalpine VAE, Geismar, Colas Rail. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Railway Infrastructure Maintenance Market Key Technology Landscape

The technological landscape of railway infrastructure maintenance is rapidly evolving, moving away from manual inspection and time-based servicing towards highly automated and data-driven solutions. Key technologies driving this shift include advanced sensor technology, such as Fiber Optic Sensing (FOS) embedded directly in the track structure, and Internet of Things (IoT) devices attached to critical components like switch points and level crossings, enabling continuous condition monitoring and real-time data capture. Furthermore, the use of Unmanned Aerial Vehicles (UAVs or drones) equipped with high-resolution thermal and visual cameras is transforming aerial inspection of large civil structures, such as bridges and OLE, significantly reducing inspection time and risk exposure for human crews. These sophisticated data collection mechanisms feed into powerful central data platforms, where Machine Learning and AI algorithms process the massive datasets to generate precise maintenance prescriptions, forming the backbone of truly predictive maintenance systems that optimize labor and machinery deployment with unprecedented accuracy.

A crucial technological area is Non-Destructive Testing (NDT) methodologies, specifically advanced ultrasonic testing (UT) and eddy current techniques, which are becoming mandatory for detecting internal flaws and fatigue cracks within rails before they become structurally critical. Automation in NDT is achieved through specialized inspection vehicles that can assess hundreds of kilometers of track daily at high speeds. This high-speed inspection capability is coupled with sophisticated data analysis software that geolocates defects precisely, enabling targeted maintenance interventions. Simultaneously, the digitalization of signaling and control systems necessitates specialized maintenance tools, often involving proprietary software diagnostics and remote fault finding capabilities, ensuring the high integrity and security of these vital electronic systems.

The industry is also seeing widespread adoption of specialized heavy maintenance machinery integrated with geospatial and satellite navigation systems (GNSS) for enhanced precision during activities like tamping, dynamic track stabilization, and rail welding. These machines use automated controls guided by pre-programmed track geometry data to execute corrective actions with sub-millimeter precision, leading to superior quality track geometry and extended periods between necessary maintenance cycles. Furthermore, the emerging use of digital twins—virtual replicas of the physical rail network—allows operators to run complex simulations of maintenance scenarios and track degradation under various operational loads, providing an invaluable tool for strategic asset management and capital planning, further solidifying the shift towards data-centric operational models.

Regional Highlights

- Asia Pacific (APAC): Dominates the growth trajectory, driven by massive new high-speed rail construction projects in China, extensive metro expansion across India (e.g., Delhi, Mumbai), and modernization efforts in Japan and South Korea. This region requires both greenfield construction maintenance services and robust technology transfer for adopting modern monitoring techniques to manage its rapidly growing and increasingly complex networks.

- Europe: Characterized by highly mature, integrated, and heavily utilized networks, Europe is the leading region in adopting sophisticated predictive maintenance technologies and condition monitoring systems. Key focus areas include cross-border interoperability maintenance (e.g., TEN-T corridors) and the refurbishment of aging infrastructure under stringent EU safety standards, with countries like Germany, France, and the UK leading technological adoption.

- North America: Driven primarily by the massive heavy-haul freight networks in the US and Canada, this region exhibits high demand for durable track components and efficiency-focused maintenance practices to handle extreme loads and long-distance operation. Investments are strong in autonomous track inspection technologies and asset management software solutions to optimize long segments of low-density track.

- Latin America (LATAM): Growth is concentrated in key markets like Brazil and Mexico, fueled by increased mining and commodities rail transport, necessitating investment in heavy-duty track maintenance equipment. The region shows emerging potential for passenger rail expansion, gradually increasing demand for urban transit maintenance services, though infrastructure investment remains subject to governmental stability and funding availability.

- Middle East and Africa (MEA): Marked by significant investment in new rail corridors and large-scale projects (e.g., Gulf Cooperation Council (GCC) rail network, new lines in Saudi Arabia and UAE), driving demand for specialized construction-related maintenance services and technology to handle harsh desert environments, particularly focusing on mitigating sand erosion and extreme temperature effects on track components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Railway Infrastructure Maintenance Market.- Balfour Beatty plc

- Siemens Mobility GmbH

- Alstom SA

- CRRC Corporation Limited

- Plasser & Theurer Export von Bahnbaumaschinen Gesellschaft m.b.H.

- Harsco Rail (A division of Harsco Corporation)

- Knorr-Bremse AG

- Vossloh AG

- Rhombus Sersa Rail Group

- Hitachi Rail STS

- Progress Rail (A Caterpillar Company)

- Colas Rail (Bouygues Group)

- Pandrol (A subsidiary of Delachaux Group)

- L&T Construction (Larsen & Toubro Limited)

- Schweerbau International GmbH & Co. KG

- Geismar

- TATA Projects Ltd.

- Voestalpine VAE GmbH

- SNCF Réseau

- Egis Group

Frequently Asked Questions

Analyze common user questions about the Railway Infrastructure Maintenance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Predictive Maintenance (PdM) in railway infrastructure?

The primary driver for PdM adoption is the need to significantly reduce unplanned service disruptions and catastrophic failures, which are costly and compromise safety. PdM, powered by IoT and AI, allows Infrastructure Managers to intervene precisely when components show early signs of degradation, maximizing asset utilization and minimizing costly emergency repairs.

Which geographical region exhibits the fastest growth rate in the railway infrastructure maintenance market?

Asia Pacific (APAC) demonstrates the highest growth rate, primarily fueled by extensive governmental investment in new high-speed rail lines and urban metro networks across key nations like China, India, and Southeast Asian countries. This rapid expansion necessitates sustained investment in both initial and operational maintenance services.

How is digitalization changing traditional railway track inspection methods?

Digitalization is replacing manual track walking with high-speed automated inspection systems, utilizing sensor-equipped trains, UAVs, and specialized vehicles that deploy advanced Non-Destructive Testing (NDT) techniques (e.g., ultrasonic and eddy current testing) combined with computer vision for highly accurate and efficient defect detection.

What are the main challenges hindering the growth of the railway infrastructure maintenance market?

Key challenges include the substantial upfront capital investment required for modern inspection and maintenance machinery, the integration difficulties with older, legacy rail infrastructure systems, and a persistent global shortage of skilled technical personnel capable of managing advanced digital maintenance platforms and complex data analytics.

What role do environmental factors play in railway infrastructure maintenance requirements?

Environmental factors necessitate specialized maintenance approaches, particularly concerning extreme weather events (e.g., temperature variation, flooding, heavy snow). This drives demand for climate-resilient materials, automated monitoring of civil structures susceptible to ground movement, and customized ballast and track maintenance to prevent heat-related rail buckling or cold-related component failure.

The imperative for sustainable rail operations is significantly influencing the market dynamics, particularly in Europe, where the European Union Agency for Railways (ERA) drives harmonization and stringent safety performance requirements. The adoption of the European Rail Traffic Management System (ERTMS) across the continent mandates considerable maintenance and upgrade work on signaling and telecommunication infrastructure, representing a substantial sub-segment opportunity. This shift towards standardized digital signaling ensures enhanced interoperability but simultaneously requires specialized maintenance contracts focused on software integrity, cyber security, and sophisticated system diagnostics. Infrastructure managers are increasingly adopting Reliability-Centered Maintenance (RCM) methodologies, moving beyond simple time-based schedules to prioritize maintenance actions based on the functional importance and failure modes of individual assets. This structured approach demands high-fidelity data collection and analytical tools, further solidifying the position of technology providers in the value chain. The complexity of maintaining high-speed rail (HSR) assets, where operational speeds demand exceptional track geometry precision and zero-tolerance for defects, drives premium pricing for specialized HSR maintenance services and equipment, acting as a high-value niche within the overall market. Service providers focused on this area invest heavily in specialized tamping, grinding, and inspection trains capable of operating at high efficiency and precision during narrow maintenance windows.

Within the track component segment, the maintenance of rail welds and insulated rail joints (IRJs) is critically important. Failures in these areas are common causes of derailments and track circuit disruptions. The market sees continuous innovation in welding technology, moving towards faster, higher-quality flash-butt and thermite welding techniques, alongside advanced inspection tools dedicated solely to monitoring weld integrity. Sleeper maintenance, especially the transition from traditional wood and concrete to composite and polymer sleepers, introduces new maintenance requirements, favoring contractors skilled in installation and monitoring of these specialized, often more durable, materials. Ballast cleaning and renewal are fundamental aspects of track maintenance, ensuring proper drainage and load bearing capacity. The trend is toward massive, self-propelled ballast cleaning machines that recycle and re-profile the existing ballast, minimizing waste and material consumption, thus aligning with environmental sustainability goals increasingly championed by regulatory bodies and public opinion. The integration of Building Information Modeling (BIM) methodologies into railway infrastructure projects is beginning to influence maintenance planning, offering a 3D digital repository of asset information that can be used throughout the asset lifecycle, simplifying repair planning, spare parts management, and crew deployment logistics.

The electrification maintenance segment, encompassing OLE/catenary systems, substations, and power supply networks, is expanding rapidly due to the global trend towards railway electrification for decarbonization. Maintenance here is highly specialized, requiring insulated equipment and specialized personnel. Condition monitoring of catenary wire wear and tension using laser-based measurement systems mounted on diagnostic vehicles is becoming standard practice, drastically improving the efficiency of overhead line maintenance compared to traditional manual methods. Furthermore, ensuring the resilience of power supply infrastructure against external factors, such as lightning strikes or grid fluctuations, involves sophisticated predictive diagnostics on transformer stations and switching gear, a high-growth area for electrical engineering service providers within the rail domain. The long-term contracts associated with maintaining these highly technical systems provide stable revenue streams for key market players. The freight rail segment, particularly in North America, places intense scrutiny on track stability and component longevity due to extremely heavy axle loads. This necessitates robust component design and frequent, preventative maintenance schedules focused on rail wear, curve lubrication systems, and the structural integrity of bridges and culverts under constant heavy stress. This demand profile fosters a market for heavy-duty maintenance equipment designed for high throughput and rugged reliability.

Regulatory harmonization, particularly in the European context through the implementation of Technical Specifications for Interoperability (TSIs), acts as both a driver and a complexity factor for maintenance service providers. Adhering to these common standards ensures market access but requires significant investment in training and certified equipment. The global market is seeing a fragmentation of service offerings, where large multinational companies offer comprehensive, integrated Asset Management Services (AMS), covering everything from planning and data analysis to execution, while smaller, regional specialists focus on highly technical niche areas like specialized non-destructive testing, acoustic monitoring for wheel defects, or geotechnical stabilization services for earthworks and embankments. The increasing focus on railway security, particularly against physical sabotage and cyber threats targeting critical signaling infrastructure, is creating a new adjacent market segment for security and resilience maintenance, including physical security hardening of control centers and continuous monitoring of SCADA systems for malicious intrusion attempts. This is particularly relevant in high-density urban transit networks where downtime poses a major societal risk. Customer procurement strategies are increasingly focusing on Total Cost of Ownership (TCO) rather than just initial contract price, favoring maintenance partners who can demonstrate proven capability to extend asset life, minimize operational delays, and reduce long-term structural repair costs through proactive, data-informed intervention. This paradigm shift benefits technology-enabled service providers who can deliver quantifiable performance improvements backed by detailed analytical evidence.

Further analysis of the value chain shows that data processing and analytical services are rapidly becoming the highest-value segment. The sheer volume of data generated by modern railway inspection technologies (terabytes per day from sensor trains) requires sophisticated cloud computing infrastructure, specialized data scientists, and bespoke analytical software to transform raw sensor outputs into actionable maintenance intelligence. Companies that successfully bridge the gap between physical engineering expertise and advanced data science are positioned for maximum market growth. The complexity of asset registration and maintenance history tracking, often handled through sophisticated Enterprise Asset Management (EAM) or Computerized Maintenance Management Systems (CMMS), ensures that software vendors and system integrators play an increasingly crucial role in the overall market structure. The rise of Public-Private Partnerships (PPPs) in infrastructure financing worldwide is altering the risk profile of maintenance contracts, often leading to performance guarantees spanning several decades, requiring maintenance providers to adopt highly robust and long-term asset integrity management plans. The workforce challenge remains acute, pushing companies to invest heavily in virtual reality (VR) and augmented reality (AR) training solutions to rapidly upskill maintenance technicians in complex diagnostic procedures and equipment operation, addressing the generational knowledge gap present in many mature rail organizations. The demand for green rail solutions extends to maintenance, focusing on reducing the environmental impact of maintenance activities through noise reduction techniques during track work, minimizing hazardous waste from oil and lubricants, and optimizing vehicle fleet fuel consumption through efficient route planning using advanced telematics. These sustainability pressures are expected to become major contractual requirements in future maintenance tenders across Europe and increasingly in North America. The market for spare parts and specialized components, crucial for maintenance, is subject to global supply chain volatility, emphasizing the need for robust inventory management systems and strategic regional stockpiling by major network operators to ensure rapid response capabilities during emergency corrective maintenance situations, underscoring the importance of logistics and supply chain optimization as a key competitive factor for service providers.

The evolution of signaling maintenance, especially with the migration to communication-based train control (CBTC) systems common in metro environments, introduces challenges related to high-frequency component replacement and software updates. Maintenance cycles are often dictated by software vendor releases and require specialized knowledge to ensure system integrity and security protocols are met. Furthermore, the integration of 5G connectivity along railway corridors facilitates real-time data transmission from moving assets and enhances the capability for remote diagnostics and software patching, drastically improving the responsiveness of the maintenance ecosystem. The market for specialized tools used in overhead line maintenance, such as remotely operated inspection robots and dedicated aerial platforms, is growing due to the need to minimize track possessions and maximize safety when working at heights under live wires. In civil engineering maintenance, the use of advanced monitoring systems like ground-penetrating radar (GPR) for assessing the structural integrity of embankments, cuttings, and bridge foundations is becoming standard. This provides non-invasive methods to detect subsurface issues, such as water ingress or settlement, allowing for preventative geotechnical stabilization before visible structural damage occurs. The Latin American market, while smaller in size, presents unique operational challenges related to geological instability and high humidity, requiring localized maintenance expertise and specialized anti-corrosion materials, creating a niche market for regional experts. Overall, the market remains highly competitive, with differentiation achieved primarily through technological innovation, proven safety performance, and the ability to offer comprehensive, long-term asset management partnerships rather than single-service contracts, demonstrating the increasing sophistication required to succeed in the modern railway maintenance industry.

Advanced data analytics and sophisticated simulation tools are increasingly utilized not just for identifying immediate maintenance needs but for strategic capacity planning. Railway operators leverage insights from maintenance data to understand how infrastructure degradation affects overall network capacity and speed restrictions, allowing for proactive scheduling adjustments and capital investment prioritization to eliminate bottlenecks. The concept of ‘Smart Rail’ infrastructure relies heavily on the seamless flow of maintenance data across different operational silos—from track geometry monitoring to power consumption and signaling diagnostics—ensuring a unified view of asset health. This necessitates robust integration platforms, which themselves require specialized maintenance and upgrade services. Key market players are investing in merger and acquisition activities to acquire specialized expertise in niche technological areas, such as cybersecurity for operational technology (OT) systems and sensor-based monitoring for critical assets like points and crossings, recognizing that specialized skills are vital for future market leadership. The shift towards electrification also impacts civil maintenance, as specialized requirements for earthing and bonding systems need continuous verification and maintenance to comply with safety regulations. Maintenance procedures related to noise and vibration reduction—important for urban areas—are also driving specific service demands, including the installation and upkeep of noise barriers and specialized low-vibration track forms. The long-term viability of high-speed rail networks depends critically on continuous maintenance of the ballastless track systems often employed, requiring specialized machinery and highly precise installation and maintenance tolerances that exceed those of conventional ballasted track. This segment offers premium growth opportunities for highly specialized service providers. This detailed segmentation and analysis confirms the market’s deep reliance on technological integration and the shift towards sophisticated, data-driven service models across all geographic regions and infrastructure components, justifying the strong forecasted growth rate. The market size projections are conservative given the accelerating global commitment to rail as a sustainable transport mode, pushing infrastructure integrity to the forefront of operational strategy.

The intersection of maintenance planning and sustainability mandates is leading to the procurement of quieter, more energy-efficient maintenance equipment, such as hybrid or fully electric track maintenance vehicles, particularly in densely populated European and Asian cities where night-time track work is essential but noise sensitive. Suppliers demonstrating a commitment to reducing the carbon footprint of their operations are gaining a competitive edge in major tenders. Furthermore, resource efficiency in material usage, specifically maximizing the lifespan of rail sections through advanced rail grinding profiles that minimize material removal while correcting geometry, is a high-value maintenance service that directly contributes to sustainability goals and cost reduction. The integration of geospatial data, including satellite imagery and LiDAR mapping, into maintenance planning systems provides Infrastructure Managers with detailed insights into the surrounding environment, such as vegetation encroachment or potential rockfall risks, enabling preventative maintenance actions beyond the immediate track area. This holistic approach to asset protection is becoming increasingly critical in challenging terrain and aging corridors. The demand for transparency and auditability in maintenance operations is driving the adoption of blockchain-like technologies for securely recording maintenance activities and component provenance, especially for high-value safety-critical parts, ensuring compliance and reducing the risk of counterfeit components entering the supply chain. This technological layer adds another dimension to the required maintenance expertise. The sheer volume of data involved, including high-frequency vibrations, temperature readings, and visual inspection outputs, makes advanced data compression and edge computing essential elements of the technology stack, allowing for preliminary processing of maintenance data on-board inspection vehicles before transmission to central analytical platforms. This capability ensures that high-priority defects are flagged immediately, dramatically improving response times for critical corrective actions and enhancing overall network safety. The complexity of managing these interconnected systems ensures that system integrators and providers of comprehensive data platforms will capture an increasing share of the maintenance budget going forward. The market's structural evolution confirms a strong, sustained shift towards value-added services built on advanced technological platforms rather than commodity labor contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Passenger Railway Infrastructure Maintenance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Railway Infrastructure Maintenance Market Size Report By Type (Track, Signaling, Other), By Application (Renewal, Maintenance), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Passenger Railway Infrastructure Maintenance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Track, Signaling, Civils, Other), By Application (Renewal, Maintenance), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager