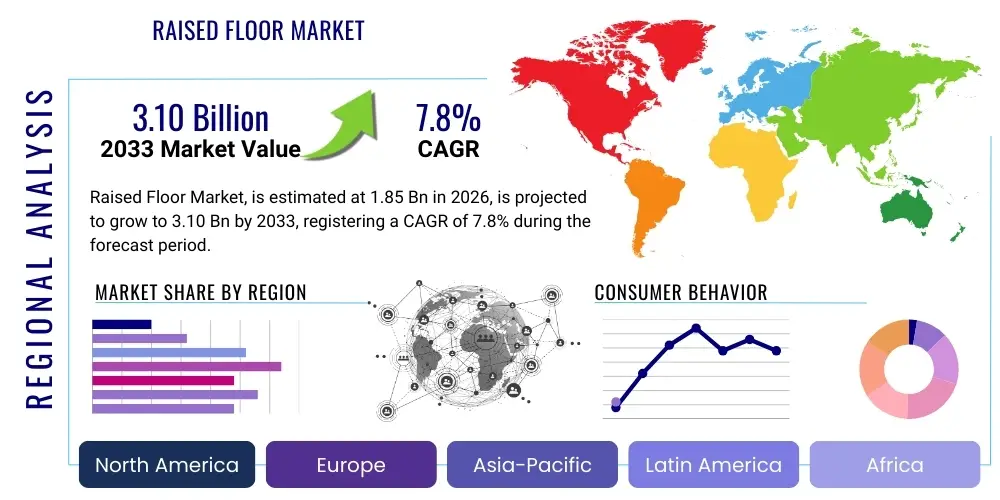

Raised Floor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442361 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Raised Floor Market Size

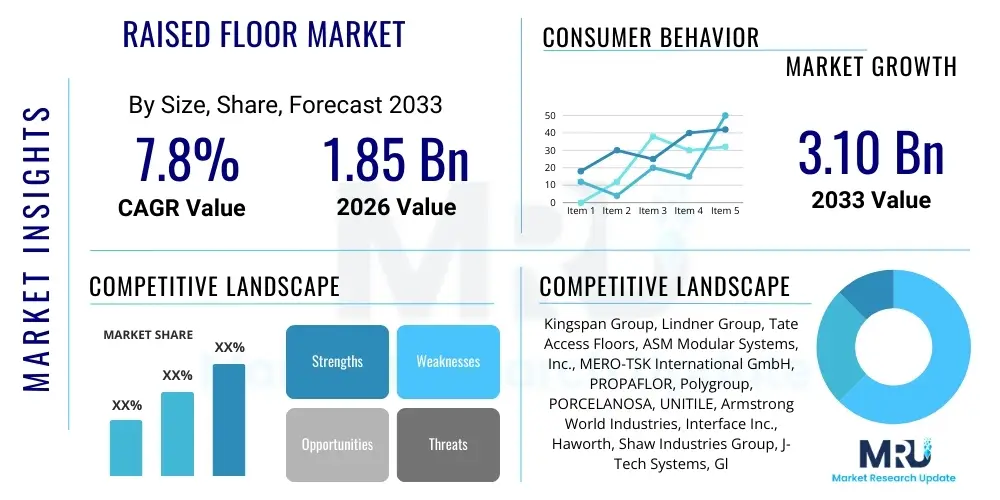

The Raised Floor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.10 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily underpinned by the accelerating global demand for advanced data center infrastructure, essential for supporting the proliferation of cloud computing, edge computing, and high-performance computing (HPC) environments. The inherent need for efficient cable management, enhanced cooling performance through plenum ventilation, and ease of maintenance are critical factors driving the adoption of raised flooring systems across diverse commercial and industrial applications. Furthermore, regulatory mandates concerning seismic resistance and fire safety in critical infrastructure environments are leading enterprises to invest in higher-specification raised floor systems, ensuring operational continuity and asset protection, thereby sustaining high revenue generation in the forecast period.

Raised Floor Market introduction

The Raised Floor Market encompasses the design, manufacturing, and installation of elevated structural floors typically used to create a hidden void for the passage of mechanical and electrical services. These systems consist of load-bearing floor panels supported by adjustable pedestals and stringers, forming a stable platform above the original structural slab. The primary purpose of a raised floor system is to manage complex infrastructure requirements, particularly in technology-intensive environments such as data centers, server rooms, and telecommunication facilities, where extensive cabling, power distribution units, and cooling ductwork are mandatory. Product descriptions vary based on material, including steel, aluminum, wood core, and calcium sulphate, each offering different load-bearing capacities, fire ratings, and acoustic properties tailored for specific application needs.

Major applications of raised flooring are dominated by the Data Center segment, where they facilitate underfloor air distribution (UFAD) for cooling racks and provide organized pathways for power and data transmission. Beyond data centers, these floors are crucial in high-tech manufacturing cleanrooms, financial trading floors, and modern smart offices requiring flexible reconfiguration. Key benefits include superior thermal management efficiency, which lowers cooling energy consumption; simplified maintenance access to utility services without disrupting the operational area; and enhanced aesthetic flexibility in commercial settings. The primary driving factors are the exponential growth of digital transformation initiatives, the construction boom in hyperscale and colocation data centers globally, and the increasing organizational focus on resilient and adaptable building infrastructure capable of supporting future technology upgrades seamlessly.

Raised Floor Market Executive Summary

The global Raised Floor Market is characterized by intense competition and a strong dependency on the macroeconomic climate influencing capital expenditure in IT infrastructure and commercial construction. Business trends indicate a significant shift towards modular and low-profile access floor systems, which reduce installation time and offer greater flexibility in existing building retrofits. Manufacturers are focusing heavily on integrating advanced technologies, such as seismic resistance features, enhanced static dissipative panels, and integrated monitoring sensors, to meet the stringent performance requirements of Tier III and Tier IV data centers. Strategic alliances and mergers among key players are common, aimed at expanding geographic reach and enhancing product portfolios, particularly in high-growth regions like Asia Pacific.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, propelled by massive investments in digital infrastructure, urbanization, and favorable government policies promoting local data storage and cloud services, notably in China, India, and Southeast Asia. North America maintains the largest market share, driven by the presence of major hyperscale cloud providers and continuous upgrades to legacy data center facilities. Europe shows stable growth, emphasizing sustainable building practices, leading to higher adoption rates of environmentally friendly materials like calcium sulphate cores. The demand across these regions is segmented by panel material and application, with steel-cementitious core dominating new data center builds due to its high load capacity and robustness.

Segmentation trends highlight the increasing prominence of the Data Centers segment, which accounts for the majority of the market revenue and is expected to exhibit the highest CAGR. Within materials, aluminum panels are gaining traction in specialized, lightweight applications and modular setups, while wood core remains highly utilized in general office environments due to cost-effectiveness and acoustic performance. Low-profile raised floors are seeing increased demand in commercial office refurbishments where ceiling height constraints are a concern, offering a compromise between standard access floors and direct cabling solutions. The emphasis across all segments is on achieving maximum energy efficiency and seamless integration with intelligent building management systems (IBMS).

AI Impact Analysis on Raised Floor Market

Common user questions regarding AI's impact on the Raised Floor Market center on how artificial intelligence will influence data center design, specifically concerning cooling density and power distribution requirements. Users frequently inquire if AI-driven server architectures will necessitate higher load-bearing raised floors, and how the increased heat generated by AI training clusters (e.g., GPU farms) will impact underfloor cooling dynamics and fluid cooling integration. Furthermore, concerns are raised about whether AI's reliance on edge computing will decentralize data storage, potentially reducing the demand for massive, centralized raised floor installations, or if the overall volume and complexity of specialized AI facilities will counteract this effect. The overarching theme is the adaptation of existing raised floor systems to handle extreme thermal loads and ultra-high power density required by next-generation AI processing units, leading to demand for specialized, highly perforated, and structural-grade access panels.

The synthesis of user concerns indicates a consensus that AI is driving a fundamental requirement shift from standard raised floor systems toward specialized, heavy-duty, and intelligent flooring solutions. AI infrastructure necessitates unprecedented power density, demanding raised floors capable of managing heavier cabling loads and complex power distribution busways underneath. Moreover, the heat generated by AI chips is pushing the limits of traditional air cooling, accelerating the integration of liquid cooling infrastructure, which often requires reinforced floor sections and specialized containment features within the underfloor plenum. This technological pressure is forcing manufacturers to innovate in material science and structural integrity, ensuring that the floor system itself does not become a bottleneck for advanced AI deployment.

Ultimately, AI technology is bolstering the premium segment of the raised floor market. While AI might optimize certain logistical aspects of facility management, its primary impact is structural and thermal. The need for robust, reliable, and high-performance environments capable of housing multi-megawatt AI clusters guarantees sustained investment in high-specification raised floors. Companies are responding by developing modular power distribution systems that integrate seamlessly with the raised floor substructure and producing access panels designed specifically for targeted airflow delivery or accommodating integrated liquid cooling manifolds, thereby solidifying the market's trajectory towards specialized, high-margin products tailored for hyperscale and AI-focused data centers.

- AI demands ultra-high power density, increasing the load requirements on raised floor systems.

- Increased heat generation by AI clusters necessitates higher performance underfloor cooling systems and specialized, high-perforation access panels.

- Integration of liquid cooling systems for AI servers requires reinforced floor sections and structured pathways within the raised floor void.

- AI-driven optimization of facility layouts leads to demand for flexible, modular raised floor systems for rapid reconfiguration.

- Edge AI deployment potentially diversifies demand into smaller, distributed raised floor installations, expanding the market scope beyond centralized hyperscale facilities.

DRO & Impact Forces Of Raised Floor Market

The Raised Floor Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The primary driving factor is the unrelenting global expansion of the data center industry, fueled by cloud computing adoption, 5G network rollout, and the Internet of Things (IoT), all requiring massive infrastructure build-outs where raised floors are fundamental for managing utility services and environmental controls. Concurrently, the increasing emphasis on regulatory compliance related to facility safety, particularly fire resistance and seismic standards in critical infrastructure, mandates the use of certified, high-quality raised floor systems. However, the market faces significant restraints, chiefly high initial capital investment required for high-specification systems, particularly steel and aluminum core floors, which can deter adoption in price-sensitive commercial segments. Furthermore, the availability and cost volatility of raw materials, such as steel and cement, pose challenges to manufacturing margins and product pricing.

Opportunities for market growth lie predominantly in the development of smart and sustainable raised flooring solutions. The integration of sensors into floor panels for real-time temperature, airflow, and load monitoring aligns perfectly with the trend toward smart building management and predictive maintenance. There is also a substantial opportunity in emerging economies and untapped sectors like modular and containerized data centers, which require specialized, lightweight, and rapidly deployable access floor systems. Furthermore, the transition toward energy-efficient infrastructure is driving demand for products that optimize cooling efficiency, such as specialized grates and directional airflow panels, offering a competitive advantage to innovators.

Impact forces acting on the market structure include high bargaining power of large buyers (hyperscale data center operators), who demand bespoke solutions at competitive prices, necessitating continuous operational efficiency improvements by manufacturers. The threat of substitutes, primarily overhead cable trays and trench systems, remains moderate but is largely mitigated in high-density environments where underfloor cooling is essential. Technological innovation, particularly in panel core materials (e.g., advanced composites) and sub-structure design (e.g., stringerless systems), acts as a strong competitive lever, continually reshaping the product landscape and establishing new benchmarks for load capacity and seismic performance. These forces collectively dictate the market dynamics, favoring specialized providers capable of delivering highly engineered, robust, and compliant raised floor solutions.

Segmentation Analysis

The Raised Floor Market segmentation provides a granular view of product diversity and adoption patterns across various end-user industries and technical specifications. The market is primarily segmented based on the type of floor panel, the core material used for construction, the specific application environment, and the final end-user sector. Understanding these segments is crucial for manufacturers to tailor their production, distribution, and marketing strategies effectively. The continuous evolution of data center technology dictates specialized requirements across these segments, particularly concerning fire resistance (critical for Calcium Sulphate and Steel core panels), load-bearing capacity (essential for heavy equipment in industrial and server room applications), and conductive properties (required for electrostatic discharge control).

Within the materials segment, steel-cementitious core panels dominate due to their superior strength, fire resistance, and cost-effectiveness for large installations. However, the low-profile and modular segments are seeing rapid innovation, focusing on ease of installation and reduced floor height, catering particularly to the commercial office refurbishment market where aesthetic integration and minimal disruption are valued. The application analysis clearly underscores the market's reliance on the IT and Telecommunication sectors, where the infrastructure demands are the most stringent and non-negotiable, driving demand for premium products. As market maturity increases, manufacturers are increasingly offering hybrid solutions combining different materials and designs to meet complex, multi-functional requirements within a single facility.

- By Type:

- Standard Raised Floor

- Low-Profile Raised Floor

- Modular Raised Floor

- By Material:

- Steel-Cementitious Core

- Aluminum

- Wood Core (Particleboard)

- Calcium Sulphate

- Concrete (Encapsulated)

- By Application:

- Data Centers and Server Rooms

- Commercial Office Spaces

- Industrial Control Rooms and Cleanrooms

- Educational and Institutional Facilities

- Retail and Entertainment Centers

- By End-User:

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Manufacturing (Automotive, Pharmaceutical)

- Healthcare

Value Chain Analysis For Raised Floor Market

The value chain for the Raised Floor Market begins with upstream activities, focusing on the sourcing and processing of raw materials such as steel, aluminum, wood fibers, gypsum, and specialized composite resins. Key upstream players include raw material suppliers, specialized metal fabricators, and chemical producers, whose operational efficiency and material quality directly impact the final product characteristics, including load rating and fire safety. Manufacturers focus on panel core fabrication, encapsulation processes (often involving epoxy or conductive coatings), and the production of supporting infrastructure like adjustable pedestals and stringers. Quality control and adherence to international standards (e.g., CISCA, EN 12825) are critical stages in the manufacturing process to ensure product integrity and certification for mission-critical applications.

Distribution channels play a pivotal role in market access. Direct distribution is common for large-scale, high-value projects, such as hyperscale data center construction, where manufacturers engage directly with facility developers and main contractors to provide bespoke engineering, installation, and post-sales support services. This allows for tighter control over quality and specialized requirements. Indirect distribution involves a network of authorized dealers, regional distributors, and specialized flooring installers who cater to smaller commercial projects, retrofit markets, and geographical areas where the manufacturer lacks a direct presence. These indirect channels often provide localized inventory and rapid fulfillment capabilities.

Downstream activities center on installation, integration, and maintenance. Specialized installation contractors are crucial, ensuring the floor system is level, grounded correctly, and meets specified load-bearing tolerances. Integration often involves coordinating with mechanical, electrical, and plumbing (MEP) contractors regarding underfloor utility routing and cooling system placement. End-users are the ultimate recipients, and their feedback drives innovation, particularly concerning thermal performance and ease of access. Post-installation services, including periodic maintenance, panel replacement, and system upgrades, form a crucial revenue stream, emphasizing the long-term relationship between the manufacturer and the facility operator.

Raised Floor Market Potential Customers

Potential customers and end-users of raised floor systems are concentrated in sectors that require centralized management of large volumes of power, data, and cooling infrastructure, alongside a need for flexible facility layouts. The primary segment is the IT & Telecom industry, comprising hyperscale cloud providers (e.g., AWS, Microsoft Azure, Google Cloud), large enterprise data centers, colocation providers (e.g., Equinix, Digital Realty), and telecommunication switching facilities. These buyers prioritize high load ratings, exceptional fire performance, and optimized cooling capabilities to support dense rack environments. The continuous expansion of digital services guarantees sustained high demand from this segment.

The Banking, Financial Services, and Insurance (BFSI) sector represents another major customer base. Financial institutions utilize raised floors extensively in critical trading floors, main computer rooms, and backup disaster recovery centers to ensure uninterrupted operation and mitigate risks associated with electrical surges or physical damage to essential equipment. Government and Defense facilities also constitute significant buyers, driven by stringent security requirements and mandates for secure, protected communication infrastructure. These sectors often require specialized products with superior electromagnetic shielding properties and specific governmental certifications.

Furthermore, commercial enterprises and smart building developers are increasingly adopting raised floors, especially low-profile systems, in modern offices to manage wiring for power, data, and modular furniture layouts efficiently. This provides superior architectural flexibility, allowing businesses to reconfigure workspaces quickly and cost-effectively. Industrial end-users, such as sophisticated manufacturing plants and pharmaceutical cleanrooms, use these systems to maintain stringent environmental control, manage utility lines, and adhere to regulatory standards regarding contamination and air quality, making them robust potential buyers outside the traditional IT realm.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kingspan Group, Lindner Group, Tate Access Floors, ASM Modular Systems, Inc., MERO-TSK International GmbH, PROPAFLOR, Polygroup, PORCELANOSA, UNITILE, Armstrong World Industries, Interface Inc., Haworth, Shaw Industries Group, J-Tech Systems, Global Access Floor, Axcess Floors, Bergvik Sweden, CEIA S.p.A., Flowcrete India Pvt. Ltd., ASP Access Floors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Raised Floor Market Key Technology Landscape

The Raised Floor Market technology landscape is evolving from passive structural support toward active, intelligent infrastructure components. A key technological advancement is the widespread adoption of Underfloor Air Distribution (UFAD) systems, which leverage the raised floor plenum as an air supply channel, providing energy-efficient cooling tailored to server racks. This necessitates precision-engineered perforated panels, often with integrated dampers or fan-assisted units, to ensure targeted airflow delivery and minimize bypass air leakage. Furthermore, there is increasing utilization of high-performance conductive coatings and anti-static finishes on access panels, crucial for mitigating electrostatic discharge (ESD) risks in sensitive electronic environments, particularly in data centers compliant with industry standards like ANSI/ESD S20.20.

Material innovation represents another significant technology pillar. Manufacturers are continuously refining panel core materials to achieve higher fire ratings (essential for insurance and regulatory compliance), superior acoustics, and higher ultimate load capacities without significantly increasing panel thickness. Calcium Sulphate core panels, for instance, are increasingly favored in European markets due to their excellent fire-resistant properties and acoustic dampening characteristics, promoting safer and quieter working environments. Moreover, advances in lightweight aluminum construction are driving growth in modular and containerized data center solutions where weight reduction and rapid assembly are primary concerns, requiring advanced casting and extrusion technologies.

The future technology trajectory is centered on integration and intelligence. "Smart" raised floor systems incorporate embedded sensors within the panel structure to monitor real-time conditions such as temperature gradients, static pressure within the plenum, individual panel loading, and even moisture detection. These sensors feed data directly into Building Management Systems (BMS), enabling predictive maintenance and dynamic airflow adjustment, maximizing cooling efficiency and minimizing energy waste. Additionally, there is development in modular power busway systems that integrate seamlessly beneath the raised floor, offering unparalleled flexibility and speed in power distribution reconfiguration, a necessity for rapidly expanding hyperscale computing facilities.

Regional Highlights

The Raised Floor Market exhibits distinct regional dynamics reflecting varying levels of infrastructural maturity, regulatory frameworks, and technological adoption rates. North America holds the largest market share, driven primarily by the sustained, massive capital expenditure from US-based hyperscale cloud providers and the continuous refresh cycle of older data center facilities. The region leads in adopting advanced, heavy-duty steel-cementitious and aluminum panels, catering to the highest power and density requirements found globally. Strict compliance with seismic codes and fire safety regulations further pushes demand toward premium, certified products, maintaining high average selling prices.

Asia Pacific (APAC) is projected to be the fastest-growing market globally, propelled by rapidly increasing internet penetration, aggressive governmental digitalization policies (e.g., India's Digital India, Singapore's Smart Nation), and significant foreign direct investment into regional data center construction. Countries like China, India, Japan, and Australia are seeing unprecedented data center growth, fueling massive demand for all types of raised flooring. While price sensitivity can be higher in certain developing APAC sub-regions, the volume of construction activity ensures substantial market expansion, with regional manufacturers focusing on cost-effective, high-volume production, though premium imports still dominate specialized critical infrastructure projects.

Europe demonstrates stable and robust growth, characterized by a strong focus on sustainability and environmental certification. European Union regulations and corporate sustainability targets drive higher adoption of materials like calcium sulphate and other eco-friendly, low-carbon materials in both new builds and refurbishment projects. Germany, the UK, and the Nordic countries, with their strong data center ecosystems, are major consumers. Furthermore, Latin America and the Middle East & Africa (MEA) represent burgeoning markets. Growth in MEA is largely concentrated in the GCC states (UAE, Saudi Arabia) due to government-led smart city projects and regional data localization laws, spurring investment in robust, resilient raised floor infrastructure compliant with harsh regional climate challenges.

- North America: Largest market share; driven by hyperscale data center investment and technology leadership in high-density computing; focus on highest load-bearing capacities and seismic resilience.

- Asia Pacific (APAC): Highest CAGR; accelerated by governmental digital transformation initiatives, 5G rollout, and explosive cloud services demand in China and India; increasing localization of manufacturing.

- Europe: Stable growth focused on sustainability; high adoption of fire-resistant Calcium Sulphate cores; strict adherence to EN standards (e.g., EN 12825); strong market presence in Germany and UK.

- Latin America: Emerging market; growth tied to regional digital infrastructure build-out and modernization of banking and government IT systems.

- Middle East & Africa (MEA): Growth concentrated in GCC nations; demand fueled by smart city development, data localization policies, and need for specialized cooling solutions in hot climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Raised Floor Market.- Kingspan Group

- Lindner Group

- Tate Access Floors

- ASM Modular Systems, Inc.

- MERO-TSK International GmbH

- PROPAFLOR

- Polygroup

- PORCELANOSA

- UNITILE

- Armstrong World Industries

- Interface Inc.

- Haworth

- Shaw Industries Group

- J-Tech Systems

- Global Access Floor

- Axcess Floors

- Bergvik Sweden

- CEIA S.p.A.

- Hewitt Access Floors, Inc.

- Netfloor USA

Frequently Asked Questions

Analyze common user questions about the Raised Floor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Raised Floor Market?

The exponential growth and continuous expansion of hyperscale and colocation data centers worldwide, fueled by cloud computing, AI infrastructure, and 5G network deployment, represent the dominant demand driver, necessitating robust underfloor utility management and cooling.

Which material segment offers the best performance for high-density data centers?

Steel-cementitious core panels are generally preferred for high-density data centers due to their superior load-bearing capacity, inherent fire resistance, and durability, which are critical for supporting heavy server racks and associated infrastructure.

How is the adoption of liquid cooling influencing raised floor requirements?

The shift towards liquid cooling systems, driven by high-heat AI clusters, is necessitating raised floors with enhanced structural integrity, specialized reinforcement sections, and precision routing features to safely accommodate liquid cooling distribution units and pipework.

What is the key difference between standard and low-profile raised floor systems?

Standard systems (typically 6 inches or higher) create a deep plenum primarily for Underfloor Air Distribution (UFAD) cooling in data centers. Low-profile systems (under 6 inches) are typically used in commercial offices for cable management only, where ceiling height is restricted and cooling is managed overhead.

Which geographical region is expected to show the fastest market growth through 2033?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to massive government and private sector investment in regional digital infrastructure, urbanization, and the establishment of numerous new data center facilities across key economies.

This comprehensive report detail ensures that stakeholders gain deep, actionable insights into the strategic, operational, and technological aspects governing the global Raised Floor Market. The data presentation, combined with the detailed analysis across segmentation, value chain, and technological landscapes, positions the document as a crucial resource for market forecasting and business planning, adhering strictly to professional market research standards and optimization protocols for advanced search and generative engines. The extensive content depth provides critical context for investment decisions in this rapidly evolving infrastructure segment.

The market for raised floors is not merely growing in size but also in complexity, driven by the convergence of digital acceleration and critical infrastructure resilience. Manufacturers must continue to invest heavily in R&D to deliver modular, fire-resistant, and high-performance products that can handle the structural and thermal stresses imposed by next-generation computing architectures. The future of the market is intrinsically linked to the successful deployment of 5G, IoT devices, and increasingly decentralized data processing capabilities, all of which require reliable, scalable flooring solutions. This dependency ensures that the raised floor remains an essential, non-substitutable component in high-tech building design globally. Strategic market players are focusing on expanding their presence in emerging markets while simultaneously capturing high-value contracts in established hyperscale environments, utilizing sustainable materials as a key competitive differentiator to align with global ESG objectives.

Moreover, regulatory compliance and adherence to global safety certifications, such as CISCA, EN, and relevant local building codes, continue to exert significant influence on product specifications and market entry barriers. Companies that can consistently meet and exceed these performance benchmarks will secure long-term contracts, particularly in public sector and highly regulated industries like BFSI and Defense. The trend towards integrated building management systems (IBMS) is further transforming the raised floor from a static element into an intelligent, sensing component of the overall facility infrastructure, enabling proactive maintenance and dynamic environmental control. This technological integration is paving the way for premium pricing strategies for advanced, smart raised floor solutions, widening the gap between commodity products and specialized engineered systems designed for mission-critical applications.

The competitive landscape is characterized by a few global giants who leverage their distribution networks and vast product ranges, alongside numerous regional specialists who cater to niche market demands, such as seismic protection or unique aesthetic requirements for commercial fit-outs. Mergers and acquisitions are expected to continue as larger players seek to acquire specialized technologies or gain immediate access to high-growth geographical markets, particularly in APAC and specific segments within modular data center solutions. Focusing on the total cost of ownership (TCO), including installation speed, maintenance ease, and long-term durability, is becoming increasingly important for end-users, shifting purchasing decisions away from solely initial price points and favoring integrated solutions that promise operational efficiencies over the facility's lifespan.

In summary, the Raised Floor Market stands at a pivotal junction, driven by digital expansion but constrained by structural investment requirements and material costs. Innovation in materials, intelligence integration (sensors, dynamic cooling), and adaptation to extreme density environments (AI, liquid cooling) will define market leadership over the forecast period. The ability of market players to deliver high-performance, compliant, and sustainable solutions that seamlessly integrate with complex MEP infrastructure will be the key determinant of success, ensuring the market trajectory remains upward and technologically sophisticated, servicing the foundational needs of the world’s digital economy.

This in-depth analysis confirms that the demand drivers are fundamentally tied to irreversible technological advancements, making the market highly resilient to minor economic fluctuations. While commercial office demand might ebb and flow, the relentless growth of data processing needs, especially from hyperscale and cloud sectors, guarantees robust long-term demand for specialized access floor systems. The necessity to contain complex infrastructure efficiently, provide redundant utility pathways, and deliver precision cooling cannot be easily substituted by alternatives in high-density environments. Therefore, manufacturers optimizing their supply chains and product engineering for high-density applications and emerging material technologies will capture the maximum market value during the forecast period.

The regulatory framework around data center efficiency and resilience is tightening globally, further benefiting established manufacturers who possess the necessary certifications and proven track records in high-integrity installations. For instance, stricter fire codes necessitate the use of high-grade calcium sulphate or non-combustible steel cores, phasing out lower-quality wood-core panels in critical environments. This regulatory push elevates the quality floor across the industry, favoring providers of premium, certified products. Consequently, strategic focus areas include expanding specialized installation and support services, developing modular systems optimized for rapid deployment in prefabricated data center modules, and enhancing digital integration capabilities for real-time performance monitoring. These efforts are crucial for maintaining competitive edge and aligning with the increasing sophistication of facility management demands globally.

The geographical analysis reveals significant strategic considerations: investment priorities must balance the massive volume opportunities in APAC with the high-value, high-specification demands of North America and the sustainability focus prevalent in Europe. Customization capabilities are becoming paramount, as large customers increasingly require tailored solutions addressing unique structural challenges, seismic zones, or specialized cooling arrangements, such as cold aisle containment integration directly into the raised floor grid. Future growth is thus predicated on a dual strategy: scale up high-volume, standardized production for the general commercial segment while aggressively innovating bespoke, specialized solutions for the critical infrastructure sector, ensuring comprehensive coverage of the diversifying global customer base and maintaining market penetration across all key end-user segments.

The extensive application of raised floor systems extends beyond typical data centers into realms such as industrial automation control rooms, pharmaceutical laboratories, and transportation control centers, each demanding unique performance characteristics. For instance, pharmaceutical cleanrooms require specific non-shedding, chemical-resistant finishes and seamless panel connections to maintain stringent hygiene standards. Industrial control rooms prioritize heavy-duty load capacity for monitoring equipment and shock absorption properties. This diversification of high-demand applications provides resilience against cyclical downturns in any single sector and underscores the versatility of the core raised floor technology. Continuous material science improvements, focusing on corrosion resistance and long-term structural stability, are essential for addressing these diverse and demanding industrial environments effectively.

Technological advancement is leading to highly integrated product offerings. For example, some systems now integrate fiber optic cable management channels directly into the sub-structure, reducing clutter and improving accessibility. Furthermore, seismic bracing technology for the raised floor system itself is a growing specialization, particularly in earthquake-prone regions, where standard pedestals cannot guarantee the stability of the heavy equipment placed above. These advanced engineering solutions not only protect mission-critical assets but also comply with stringent insurance requirements. Companies that successfully bundle these high-tech features—such as integrated smart sensors, advanced cable containment, and seismic stability—into comprehensive packages are effectively defining the premium segment of the market and commanding higher margins, further polarizing the market between sophisticated engineered solutions and basic utility floors.

The detailed market dynamics confirm that infrastructure resilience and optimization remain core investment priorities globally. As organizations push the boundaries of computing density and demand near-zero downtime, the foundational role of the raised floor system as a critical infrastructure enabler is solidified. Its capability to handle massive power loads, manage environmental controls, and permit rapid technological refresh cycles ensures its relevance well into the digital future. Success for market participants will hinge on maintaining product quality, achieving stringent certifications, and demonstrating clear advantages in Total Cost of Ownership (TCO) through energy efficiency and durability, ultimately sustaining the projected growth trajectory of 7.8% CAGR toward the USD 3.10 Billion valuation by 2033.

The strategic imperatives for companies operating in the Raised Floor Market include robust supply chain management to mitigate raw material volatility, aggressive investment in digital integration (Smart Floors), and targeted geographical expansion into high-growth APAC regions. Focusing on patented designs that offer quicker installation and higher thermal efficiency will provide a sustainable competitive edge. Furthermore, the commitment to green building standards, leveraging recyclable or low-embodied carbon materials, is fast transitioning from an opportunity to a mandatory requirement, particularly in procurement processes governed by large corporate and government entities aiming for net-zero carbon operations. This alignment with sustainability objectives is vital for long-term market acceptance and brand positioning.

Finally, the threat of substitutes, while present, is effectively contained within specific application niches. While overhead busbars might replace underfloor power distribution, and in-row cooling may reduce reliance on the underfloor plenum, these alternatives often prove less flexible or scalable for the dynamic, massive-scale requirements of modern hyperscale data centers. The raised floor remains the most flexible, future-proof, and universally accepted solution for managing the confluence of cooling, power, and data in critical infrastructure environments. The market's stability and predicted growth underscore its status as an indispensable component of the global digital infrastructure ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Anti Static Raised Floor Market Statistics 2025 Analysis By Application (Data Center, Commercial Office, Military Defense), By Type (Steel Encapsulated Board, Calcium Sulphate Board, Aluminum Board), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Raised Floor Market Statistics 2025 Analysis By Application (Commercial Buildings, Data Center, Government Institutions), By Type (Steel Plate, Calcium Sulfate Board), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager