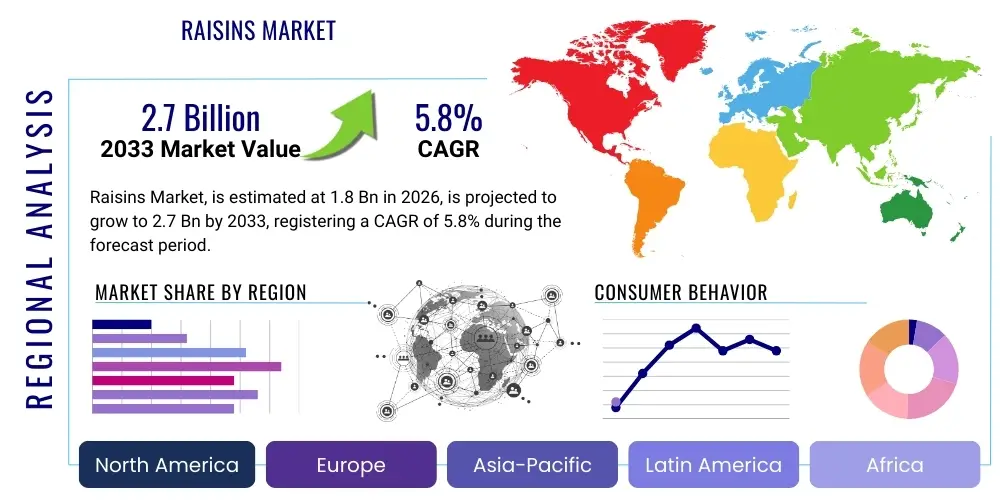

Raisins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442956 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Raisins Market Size

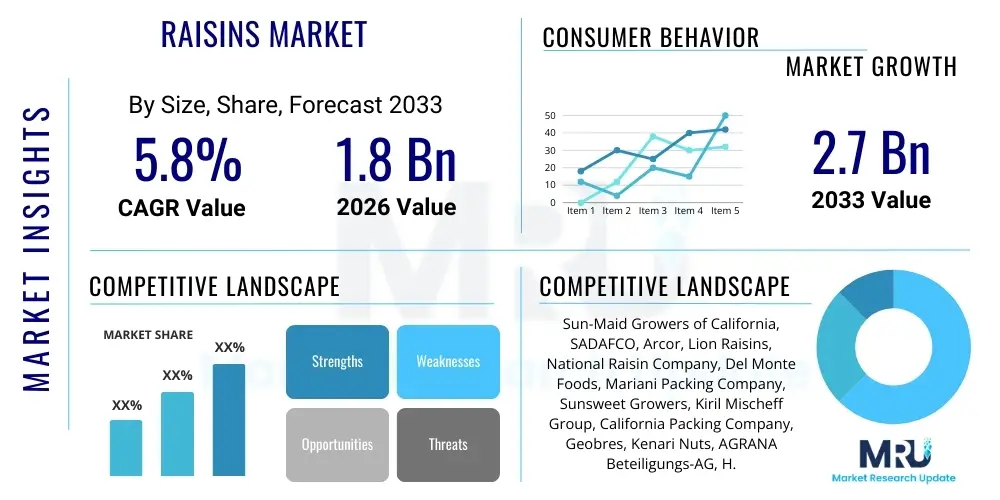

The Raisins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033.

Raisins Market introduction

The global Raisins Market encompasses the production, processing, distribution, and consumption of dried grapes, recognized universally for their natural sweetness, nutritional value, and versatility in culinary applications. Raisins, produced primarily by sun drying or mechanical dehydration of various grape varieties such as Thompson Seedless, Black Corinth (Currants), and Flame Seedless, serve as a foundational ingredient across the food and beverage industry, spanning sectors from baked goods to breakfast cereals and direct consumption as a snack. The product’s inherent characteristics—being fat-free, cholesterol-free, and rich in fiber, antioxidants, and essential minerals—position it favorably within the surging global trend toward health-conscious eating and natural food ingredients, solidifying its essential role in modern food supply chains globally.

Major applications of raisins are incredibly diverse, driven by their ability to provide texture, natural sweetness, and moisture retention in final products. The bakery and confectionery sector constitutes a significant consumption base, where raisins are integral to bread, cookies, cakes, and energy bars, contributing both flavor complexity and nutritional density. Furthermore, the rising popularity of clean-label products and the desire to replace refined sugars with natural alternatives are substantial driving factors. Consumers increasingly value ingredients that are minimally processed and provide tangible health benefits, pushing manufacturers to integrate raisins into innovative product lines like gourmet snacks, health drinks, and specialized dietary meals, further diversifying the market landscape.

Key driving factors propelling the expansion of the raisins market include escalating awareness regarding the health benefits of consuming dried fruits, particularly among aging populations and fitness enthusiasts seeking natural sources of energy and dietary fiber. Simultaneously, continuous product innovation by leading food manufacturers, involving the introduction of organic, fortified, and flavored raisin varieties, caters to niche consumer demands and expands market penetration into premium segments. Supply chain efficiency improvements, coupled with effective international trade agreements facilitating easier movement of bulk and packaged raisins across continents, also contribute significantly to the sustained upward trajectory of the global raisins market, ensuring consistent supply meets robust demand.

Raisins Market Executive Summary

The global Raisins Market exhibits resilient growth, primarily fueled by shifting consumer preferences towards functional foods and natural sweeteners, particularly in developed economies. Business trends highlight a strong emphasis on sustainable sourcing and traceability, compelling major producers to invest in advanced drying technologies and organic farming practices to meet stringent quality standards and ethical consumer expectations. The competitive landscape is characterized by consolidation and strategic partnerships, where established global players leverage their distribution networks while smaller, specialized firms focus on premium or niche organic offerings. Technological advancements in packaging, such as modified atmosphere packaging, are crucial for extending shelf life and maintaining product integrity, supporting expansion into high-growth import markets like China and India.

Regionally, the market demonstrates varied consumption patterns and growth rates. Asia Pacific (APAC) is emerging as the fastest-growing region, driven by large population bases, rising disposable incomes, and the increasing integration of Western dietary habits, particularly in urban centers where packaged snacks and ready-to-eat foods are gaining prominence. North America and Europe, while mature, maintain substantial market shares due to high per capita consumption in bakery products and strong demand for natural health snacks, bolstered by robust supply chains originating primarily from the USA and Turkey. Conversely, production dominance remains concentrated in specific regions, primarily California (USA), Turkey, Iran, and South Africa, making geopolitical and climatic factors in these regions critical determinants of global supply and pricing stability.

Segment trends indicate that the Type segment is dominated by Thompson Seedless raisins due to their widespread availability and versatility, though specialized varieties like Black Corinth (Currants) are gaining traction in gourmet and premium segments. In terms of Application, the Bakery and Confectionery sector remains the largest consumer, but the Sweet & Savory Snacks segment is poised for rapid growth, reflecting the convenience and health attributes desired by modern consumers. Furthermore, the rising influence of online retail channels (e-commerce) is transforming the Distribution Channel segment, offering greater accessibility and transparency to consumers globally, especially for niche and imported raisin products, thereby decentralizing traditional distribution structures and enhancing market competitiveness.

AI Impact Analysis on Raisins Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Raisins Market predominantly center on how technology can mitigate climate risk, enhance supply chain transparency, and optimize processing efficiencies. Consumers and industry stakeholders are keen to understand AI's role in predictive yield forecasting, particularly crucial given the raisins industry's high sensitivity to weather variations and pest infestations. Key concerns revolve around the implementation cost of advanced automation systems in traditional farming setups and how AI-driven analytics can ensure optimal moisture content during the drying process, a critical factor for raisin quality and shelf life. The overarching expectation is that AI will introduce a level of precision farming and logistical optimization necessary to stabilize the global supply of high-quality raisins amidst increasing global demand and environmental volatility.

AI’s influence extends beyond cultivation into post-harvest processing and market dynamics. Stakeholders frequently inquire about AI-powered quality sorting using computer vision systems to detect defects and foreign materials with higher accuracy and speed than manual methods. Furthermore, predictive modeling driven by machine learning is expected to revolutionize demand forecasting, allowing producers and distributors to optimize inventory levels and reduce spoilage, which is a major financial burden in the perishable goods sector. The application of sophisticated algorithms for optimizing shipping routes, managing cold storage infrastructure, and tracking product lineage via blockchain integration, often enabled by AI, addresses the growing demand for sustainable and transparent food systems.

The integration of AI also provides opportunities for enhanced breeding programs. Users explore how AI can analyze vast genomic data related to grape varieties to develop strains that are more resistant to drought, disease, and high temperatures, ensuring the long-term viability of raisin production. While the primary production stage remains labor-intensive, the adoption of robotic harvesting and automated pruning systems, often guided by AI spatial data, is gradually transforming vineyard management, promising lower operational costs and increased resource efficiency, thus fundamentally altering the production economics of the raisins market over the next decade.

- AI-driven predictive analytics for climate change mitigation and yield forecasting in vineyards.

- Implementation of AI and Computer Vision systems for automated, high-speed quality sorting and defect detection in processing plants.

- Optimization of irrigation and fertilization schedules using AI-powered sensor data for precision agriculture, reducing resource consumption.

- Machine learning models for dynamic demand forecasting, inventory management, and minimizing post-harvest losses throughout the distribution network.

- Enhancement of supply chain traceability and transparency through AI integrated with blockchain technology, ensuring product authenticity.

- Use of robotics and automation, guided by AI, for efficient vineyard tasks like pruning and harvesting, addressing labor shortages.

- AI application in research and development to breed resilient grape varieties suitable for raisin production in challenging environments.

DRO & Impact Forces Of Raisins Market

The Raisins Market is fundamentally influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively shape the impact forces (I) dictating its growth trajectory and stability. A primary driver is the widespread consumer preference for natural, nutrient-dense snack alternatives, actively supported by global public health campaigns promoting the reduction of refined sugar intake, where raisins serve as an ideal, naturally sweet solution. This trend is amplified by the expansion of the functional food sector and the rising incorporation of dried fruits into health bars, breakfast mixes, and specialized dietary products across Asia and the Americas. Conversely, the market faces significant restraints, chiefly rooted in the highly volatile nature of raw material supply, dependent heavily on specific climatic conditions in key production zones, leading to unpredictable price fluctuations that challenge long-term procurement planning for industrial users. The intense price competition from substitute natural sweeteners and alternative dried fruits also continually pressures profit margins across the value chain.

Opportunities in the raisins market are substantial and primarily center on penetrating untapped consumer bases in emerging economies through innovative packaging and aggressive marketing focused on convenience and affordability. The shift towards certified organic and ethically sourced raisins presents a premiumization opportunity, allowing market players to differentiate their offerings and capture higher profit margins from discerning consumers in developed markets who prioritize sustainability and quality assurance. Furthermore, technological innovation in drying techniques, such as microwave vacuum drying or osmotic dehydration, offers prospects for improved product quality, reduced energy consumption, and preservation of nutritional integrity, addressing concerns related to traditional sun drying methods that can be slow and weather-dependent. These technological advances, if widely adopted, could significantly stabilize the annual yield quality irrespective of variable weather patterns.

The impact forces within the market environment are strong and multifaceted. Economic factors, such as currency fluctuations in major exporting countries (e.g., Turkey, Iran), directly impact global pricing strategies and trade viability, forcing buyers to constantly monitor exchange rate dynamics. Regulatory forces, particularly concerning pesticide residue standards and import tariffs imposed by key consuming nations (e.g., EU, USA), establish high barriers to entry and necessitate rigorous compliance, influencing sourcing decisions. Social forces, notably the global push towards plant-based diets and sustainable consumption, provide a tailwind for market growth. The convergence of these drivers and opportunities, while navigating the persistent restraints related to climate dependency and substitutes, defines the competitive intensity and operational complexity characterizing the raisins market landscape.

Segmentation Analysis

The Raisins Market is systematically analyzed based on critical segmentation parameters—Type, Application, and Distribution Channel—to provide a granular understanding of consumer behavior, industry demand profiles, and regional market specificities. This segmentation allows stakeholders to accurately gauge the attractiveness of various sub-markets and tailor production, marketing, and distribution strategies accordingly. The dominance of specific grape varietals (Type) dictates flavor profile and intended use, while the Application segment reveals where the bulk of demand originates—industrial usage versus direct consumption. Furthermore, analyzing the Distribution Channel sheds light on evolving consumer purchasing habits, emphasizing the transition from traditional retail to modern e-commerce platforms.

The segmentation by Type is crucial as different raisin varieties possess distinct characteristics affecting their suitability for various end-use applications. For instance, Thompson Seedless (Sultanas) are highly popular globally due to their light color and balanced sweetness, making them ideal for baked goods and general snacking. Conversely, Black Corinth (Currants) are smaller, darker, and possess a more tart flavor, favored in specialized confectioneries and gourmet cooking. Understanding these varietal preferences allows growers and processors to optimize their sourcing and production pipelines to align with regional consumer demands and industrial formulation requirements, thereby maximizing efficiency and market responsiveness across the supply chain.

The breakdown by Application is particularly important for B2B stakeholders, indicating the primary revenue streams. While the Bakery & Confectionery industry remains the foundational consumer due to raisins' functional properties as a natural sweetener and humectant, the fastest expansion is observed in the Sweet & Savory Snacks and Breakfast Cereals segments. This growth reflects the convenience factor and the prevailing consumer trend towards on-the-go nutritious eating. Distribution Channel analysis highlights the pivotal role of Supermarkets/Hypermarkets in volume sales, yet the accelerating growth of the Online Retail channel underscores a significant opportunity for direct-to-consumer (D2C) brands specializing in premium, organic, or ethically sourced raisin products, bypassing traditional intermediaries and enhancing margin potential.

- By Type: Thompson Seedless (Sultanas), Black Corinth (Currants), Fiesta, Muscat, Flame Seedless, Others (including specialty and regional varieties).

- By Application: Bakery & Confectionery, Breakfast Cereals, Dairy Products (Yogurt, Ice Cream), Sweet & Savory Snacks (Trail Mixes, Bars), Desserts, Beverages, Home Use (Direct Consumption).

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Traditional Grocery Stores, B2B (Industrial/Food Service).

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA).

Value Chain Analysis For Raisins Market

The Raisins Market value chain begins with the upstream segment encompassing grape cultivation and harvesting, which is heavily reliant on specific geographic and climatic conditions, concentrated in regions like California, Turkey, Iran, and South Africa. This stage involves significant investment in irrigation infrastructure, pest control, and labor management, making it highly sensitive to regulatory changes and environmental factors. Following harvesting, the grapes undergo pre-treatment and the crucial drying process, which can be sun-drying (traditional and cost-effective) or mechanical drying (faster, quality-controlled). Processor relationships with growers are foundational, focusing on securing high-quality raw materials under long-term contracts to ensure consistent supply volume, mitigating risks associated with crop variability and price volatility inherent in agricultural commodities.

The midstream operations involve extensive processing activities, including cleaning, sorting, grading, and packaging. Modern processors utilize advanced equipment, often incorporating AI-driven optical sorters, to meet stringent quality and safety standards required by international buyers, particularly in Europe and North America. Packaging ranges from bulk industrial quantities (B2B) to smaller retail packages, requiring specialized materials to maintain moisture content and extend shelf life. Distribution channels are highly fragmented yet critical for market reach. Direct distribution often targets large industrial consumers (e.g., major cereal and baking companies), while indirect distribution leverages wholesalers, distributors, and finally, retailers and online platforms to reach the final consumer globally. Efficiency in logistics, cold storage, and inventory management is paramount due to the nature of the product.

The downstream analysis focuses on the final end-users and consumption patterns. The distribution mechanism flows through both direct and indirect channels. Direct sales are primarily B2B, where processors supply food manufacturers directly for industrial applications in mass production of cereals, confectioneries, and processed snacks. Indirect channels include the movement of packaged raisins through large Supermarkets/Hypermarkets, which dominate retail sales volumes, and increasingly, through Online Retail platforms, which cater to specialized organic or imported varieties, offering consumers greater choice and convenience. The performance of the downstream sector is intrinsically linked to consumer health trends, economic factors influencing disposable income, and the promotional activities undertaken by major food brand partners incorporating raisins into their flagship products, thereby dictating overall market velocity and consumption volume.

Raisins Market Potential Customers

Potential customers for the Raisins Market span a broad spectrum of the food industry, ranging from global multinational food conglomerates to individual household consumers. The largest volume buyers are typically industrial users, specifically those operating in the Bakery and Confectionery sector, who utilize raisins as a functional ingredient for texture, sweetness, and shelf-life extension in bread, muffins, cookies, and chocolate-coated products. Manufacturers of Breakfast Cereals and Energy/Granola Bars also represent a significant customer base, leveraging the natural energy and fiber content of raisins to appeal to health-conscious consumers seeking nutritious morning or on-the-go options. These institutional buyers prioritize consistent quality, bulk supply capacity, and competitive long-term pricing, necessitating robust B2B relationships with major raisin producers and exporters globally.

In addition to large-scale industrial buyers, the market features substantial demand from the Food Service segment, including institutional kitchens, catering services, and specialized health food producers. Restaurants and cafes incorporate raisins into salads, side dishes, and gourmet preparations, seeking premium varieties that offer unique flavor profiles. Furthermore, the burgeoning demand from the Dairy Products sector, where raisins are added to yogurts, ice creams, and specialized cheese pairings, indicates a diversified customer interest in enhancing product appeal and nutritional value. These customers often require customized cuts, coatings, or specific moisture levels tailored to their processing equipment and formulation requirements, driving demand for specialized processing services.

The final significant customer segment is the direct consumer (Home Use), reached primarily through retail and online channels. These buyers are increasingly segmented by purchasing criteria, including demand for conventional, organic, or fair-trade certified raisins. Modern consumers are focused on convenience, driving the popularity of single-serve snack packs and resealable bags. Marketing efforts targeting this group emphasize the nutritional benefits—such as fiber and antioxidant content—and the versatility of raisins as a healthy snack for children and adults. Geographical customer segmentation shows high per capita consumption in North America and Europe, while demand growth acceleration is primarily concentrated among the rapidly urbanizing populations of the Asia Pacific region, creating diverse customer profile requirements across different global markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sun-Maid Growers of California, SADAFCO, Arcor, Lion Raisins, National Raisin Company, Del Monte Foods, Mariani Packing Company, Sunsweet Growers, Kiril Mischeff Group, California Packing Company, Geobres, Kenari Nuts, AGRANA Beteiligungs-AG, H. B. S. Foods Ltd., Australian Dried Fruits, Angas Park, Raisin Processing Company of Iran, Saraband Farms. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Raisins Market Key Technology Landscape

The processing and preservation of raisins are constantly evolving, driven by the necessity to enhance efficiency, maintain high quality, and extend product shelf life globally. A cornerstone of the technological landscape is the advancement in drying techniques, moving beyond traditional sun drying, which is susceptible to weather and contamination risks, towards more controlled methods. Modern processors increasingly employ sophisticated mechanical drying systems, including belt dryers and tunnel dryers, which allow for precise control over temperature and humidity, ensuring uniform moisture content critical for quality and preventing microbial growth. Furthermore, niche technologies such as microwave vacuum drying (MVD) and osmotic dehydration are being explored, offering faster processing times and superior retention of nutritional compounds and color, catering specifically to the premium segment that demands minimal degradation of natural characteristics.

Another crucial technological area is post-harvest handling and quality assurance, where automation and digital technologies are playing a transformative role. The adoption of high-resolution optical sorting machines equipped with advanced vision systems (often leveraging AI algorithms) has dramatically improved the efficiency and accuracy of defect removal, eliminating foreign materials, immature berries, and damaged raisins that manual sorting often misses. These systems operate at high speeds, significantly reducing labor costs and ensuring compliance with stringent international food safety standards, particularly for export markets like the European Union. Implementation of sensors for real-time moisture monitoring during processing is equally vital, ensuring every batch meets specific moisture percentage requirements, which is a key factor governing shelf stability and texture.

Furthermore, technology is redefining packaging and supply chain management. Modified Atmosphere Packaging (MAP) technology is widely used to control the gas composition surrounding the raisins, inhibiting oxidation and mold growth, thereby extending the natural shelf life significantly, which is crucial for long-distance international shipping. On the supply chain front, the integration of Internet of Things (IoT) sensors and data loggers allows for continuous monitoring of temperature and humidity during transit and storage, providing end-to-end traceability and accountability. This digital infrastructure, often combined with blockchain technology for secure data logging, addresses the growing industry and consumer demand for transparency regarding the origin, processing history, and quality control checkpoints of the raisins, mitigating risks related to adulteration and ensuring product integrity from farm to fork.

Regional Highlights

- North America (NA): North America holds a dominant position in the global raisins market, primarily driven by the significant production capacity in California, which is a global benchmark for quality and scale. The region exhibits high per capita consumption, fueled by established food habits that incorporate raisins heavily into breakfast cereals, baked goods, and as an essential component of school and health-focused snacking programs. The market here is characterized by high demand for certified organic and premium varieties, and innovation in packaging (e.g., single-serve portions) drives retail sales. Strong regulatory frameworks ensure high product quality, maintaining consumer trust, but producers face constant pressure from labor costs and water management challenges unique to the region. The US market dictates global trends in processing standards and branding efforts.

- Europe: Europe represents a crucial consumer market for raisins, heavily reliant on imports from Turkey, Iran, and the USA. The region is known for its rigorous food safety standards and a strong preference for specific varieties like Sultanas and Currants, often used in traditional baking, Christmas puddings, and specialized confectioneries. Western European countries, particularly the UK and Germany, are major buyers, focusing strongly on sustainability, fair trade, and traceability certifications. Compliance with EU regulations regarding maximum residue limits (MRLs) for pesticides is a key determinant for market access. Consumption growth is steady, bolstered by the clean-label trend and demand for natural sweetness in prepared foods, despite intense competition from local fruit producers.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market globally, driven by demographic expansion, rising urbanization, and increasing Westernization of diets, particularly in China and India. While traditionally consumed in parts of the region, the modern market growth is spurred by the incorporation of raisins into packaged foods, breakfast cereals, and snack mixes catering to busy urban populations. India is both a significant producer and consumer, while China represents a massive import opportunity due to growing middle-class spending power and demand for high-quality imported food products. The low penetration of packaged food in rural areas, however, presents a significant untapped growth potential, requiring market players to adapt their distribution strategies to local infrastructure.

- Latin America (LAMEA): This region shows moderate growth, supported by steady domestic consumption and a modest export footprint, particularly from countries like Chile and Argentina. Raisins are often incorporated into regional desserts and snacks. The economic volatility in several Latin American countries, however, often impacts purchasing power, leading consumers to prioritize affordability. Market development relies on stabilizing economic environments and integrating raisins more aggressively into local industrial food manufacturing processes to reduce reliance on imported ingredients and enhance regional self-sufficiency in processed food production.

- Middle East and Africa (MEA): The MEA region is vital both as a producer (Iran, South Africa) and as a substantial consumer, particularly in the Middle Eastern countries where dried fruits are deeply embedded in traditional culinary and festive practices. South Africa is a key exporter, particularly targeting premium markets in Europe and North America with its high-quality offerings. Consumption patterns are robust, often related to direct snacking and traditional usage. Growth challenges include geopolitical instability and fluctuating logistics costs, but increasing retail modernization and urbanization in regions like the UAE and Saudi Arabia are creating new channels for packaged raisin products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Raisins Market.- Sun-Maid Growers of California

- SADAFCO

- Arcor

- Lion Raisins

- National Raisin Company

- Del Monte Foods

- Mariani Packing Company

- Sunsweet Growers

- Kiril Mischeff Group

- California Packing Company

- Geobres

- Kenari Nuts

- AGRANA Beteiligungs-AG

- H. B. S. Foods Ltd.

- Australian Dried Fruits

- Angas Park

- Raisin Processing Company of Iran

- Saraband Farms

- Vitis Foods

- The Valley Fig Growers

Frequently Asked Questions

Analyze common user questions about the Raisins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the global Raisins Market?

The market growth is fundamentally driven by increasing consumer awareness regarding the health benefits of dried fruits, coupled with the global trend favoring natural sweeteners and functional foods over refined sugars. High integration of raisins into the expanding bakery, confectionery, and healthy snack industries further accelerates demand globally.

Which geographical region dominates the Raisins Market in terms of revenue?

North America currently holds the largest revenue share in the Raisins Market, primarily due to high domestic consumption, sophisticated processing capabilities, and large-scale production concentrated in California, setting global quality and supply standards. Europe also maintains a significant market presence as a major importing region.

What are the primary challenges facing the supply side of the Raisins Market?

The market faces significant supply challenges stemming from its high reliance on specific, stable climatic conditions. Volatility in raw material yield due to unpredictable weather patterns, alongside intense price competition from substitute dried fruits and fluctuation in exchange rates in exporting countries, constantly pressures processor margins and global supply consistency.

How is technology impacting the quality and safety of raisin processing?

Technology significantly enhances quality through the implementation of AI-driven optical sorting systems for superior defect detection and contaminant removal. Additionally, advanced mechanical drying methods and Modified Atmosphere Packaging (MAP) technology ensure optimal moisture content, extend shelf life, and maintain high food safety standards for international distribution.

Which application segment shows the highest growth potential in the forecast period?

While the Bakery and Confectionery sector remains the largest consumer by volume, the Sweet & Savory Snacks segment, including trail mixes and energy bars, is anticipated to exhibit the fastest growth rate. This is driven by consumer demand for convenient, portable, and nutritious on-the-go food options compatible with modern busy lifestyles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager