Rare Disease Diagnostics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441764 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Rare Disease Diagnostics Market Size

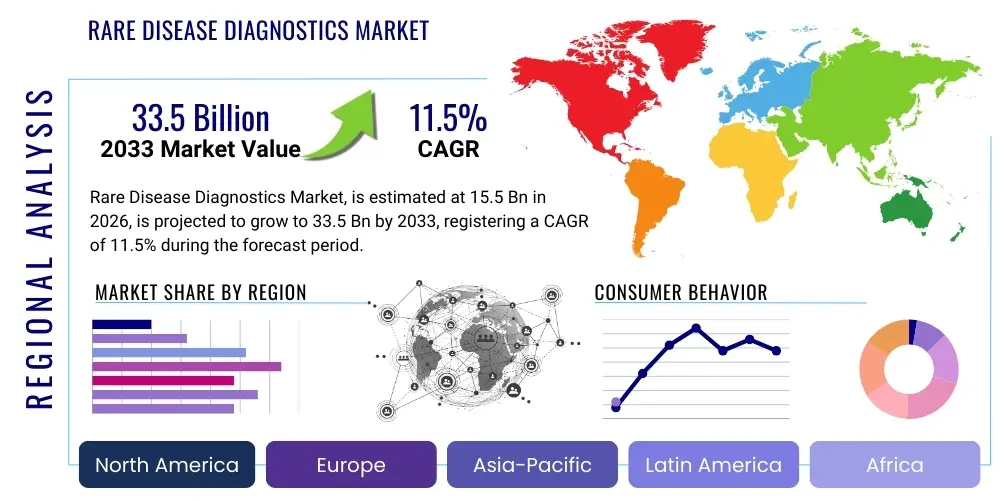

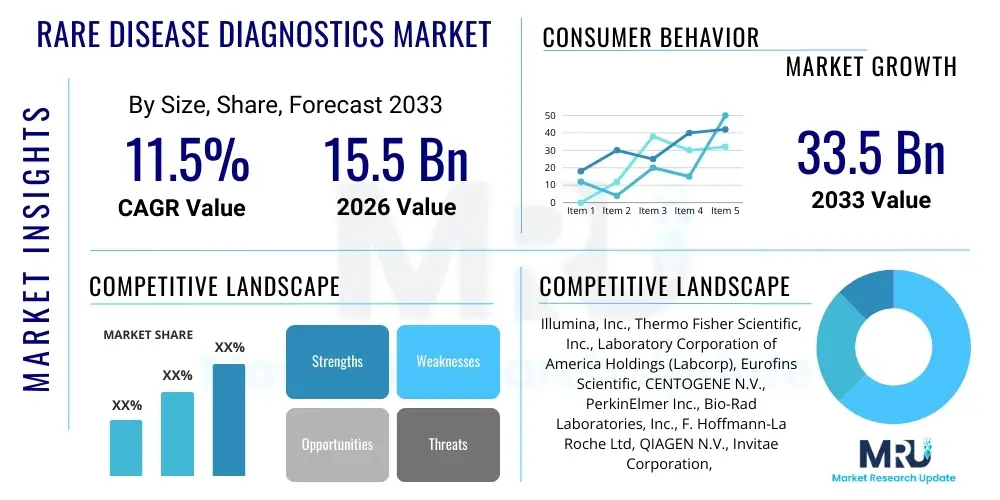

The Rare Disease Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $33.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by advancements in genomic sequencing technologies, particularly Next-Generation Sequencing (NGS), which significantly reduces the diagnostic odyssey for patients suffering from ultra-rare or undiagnosed conditions. The increasing global awareness campaigns and favorable government initiatives aimed at identifying and treating rare diseases also contribute substantially to market acceleration.

The valuation reflects the critical need for timely and accurate diagnosis in this therapeutic area. Rare diseases, defined in the US as affecting fewer than 200,000 people, often present heterogeneous symptoms, leading to prolonged misdiagnosis, a critical issue known as the "diagnostic odyssey." Modern diagnostic methods are shifting away from traditional biochemical tests towards molecular and genetic analyses, enabling earlier intervention and personalized treatment strategies. Investments in translational research and public-private partnerships focusing on orphan drug development further stimulate the demand for precise diagnostic tools.

Furthermore, the integration of advanced bioinformatics and data analytics platforms plays a pivotal role in interpreting complex genomic data generated by high-throughput sequencing instruments. These computational tools assist clinicians in correlating specific genetic variants with clinical phenotypes, drastically improving diagnostic yield. North America and Europe currently dominate the market share due to established healthcare infrastructures, high adoption rates of advanced diagnostics, and substantial research funding allocated to genomic medicine. However, the Asia Pacific region is expected to exhibit the highest growth potential, fueled by improving healthcare access and rising prevalence screening programs.

Rare Disease Diagnostics Market introduction

The Rare Disease Diagnostics Market encompasses technologies and services utilized for the identification and characterization of diseases affecting a small percentage of the population, often having complex genetic origins. These diagnostic tools are essential for cutting short the often lengthy and emotionally taxing diagnostic journey faced by patients, typically relying on cutting-edge molecular techniques such as Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and advanced cytogenetic analyses. The primary goal is to provide precise, early detection, which is critical given that approximately 80% of rare diseases have a genetic basis and are severe, chronic, and life-threatening.

The major applications of rare disease diagnostics include newborn screening (NBS), carrier screening, prenatal testing, and definitive diagnosis for symptomatic individuals. Early detection through comprehensive screening programs, particularly NBS, allows for the timely initiation of treatment, significantly improving patient outcomes, especially for metabolic disorders like Phenylketonuria (PKU) or Spinal Muscular Atrophy (SMA). The market benefits directly from the global push towards precision medicine, where diagnostic insights inform targeted therapeutic interventions, making treatment regimens more effective and less invasive. The high unmet medical need and the subsequent financial incentives provided by governments for orphan drug and diagnostic development act as strong driving factors for market proliferation.

Key benefits derived from this market include improved patient quality of life, reduced overall healthcare expenditure associated with chronic misdiagnosis, and accelerated drug development cycles. Technological miniaturization and cost reduction in sequencing have democratized access to complex genomic diagnostics, shifting these tests from specialized research labs to mainstream clinical settings. This market is fundamentally driven by the increasing incidence of rare genetic disorders, continuous technological innovation in genomic analysis, and growing regulatory support for rare disease initiatives globally, ensuring a sustained growth trajectory throughout the forecast period.

Rare Disease Diagnostics Market Executive Summary

The Rare Disease Diagnostics Market exhibits robust business trends characterized by intense competition centered around technological superiority, specifically the adoption of whole-exome sequencing (WES) and whole-genome sequencing (WGS) as first-line diagnostic tests. Strategic collaborations between sequencing providers, bioinformatics firms, and clinical laboratories are becoming commonplace to create end-to-end diagnostic solutions that integrate sample collection, data generation, interpretation, and clinical reporting. Furthermore, business models are evolving to incorporate direct-to-consumer (DTC) testing for carrier screening and preventative genetics, although clinical utility remains the core focus, driving partnerships with established hospitals and specialized clinics.

Regionally, North America maintains its dominance due to substantial government funding for genomic research, the presence of major key players, and high public acceptance of genetic testing. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by increasing healthcare infrastructure investment in countries like China and India, expanding access to subsidized genetic testing, and rising patient populations demanding definitive diagnoses. European trends focus heavily on standardized genetic testing protocols facilitated by multinational consortia and the effective integration of diagnostics into national healthcare systems, often driven by centralized rare disease registries and coordinated care networks.

Segment-wise, the Next-Generation Sequencing (NGS) technology segment retains the largest market share and is projected to demonstrate the fastest growth rate, owing to its scalability, comprehensive coverage, and decreasing operational cost. In terms of application, the segment focused on neurological and metabolic disorders remains prominent, reflecting the high prevalence and complexity of these conditions among rare diseases. End-user trends indicate a strong shift towards specialized diagnostic laboratories and academic research centers, which are capable of handling the highly complex workflows and data interpretation requirements associated with rare disease genomic testing, cementing their role as primary consumers of advanced diagnostic technologies.

AI Impact Analysis on Rare Disease Diagnostics Market

User queries regarding the impact of Artificial Intelligence (AI) on Rare Disease Diagnostics predominantly revolve around AI's ability to shorten the diagnostic odyssey, improve diagnostic accuracy through vast data correlation, and streamline complex genomic data interpretation. Key themes include how AI can assist in differential diagnosis when symptoms are ambiguous, the effectiveness of machine learning algorithms in identifying novel disease-gene associations, and the integration of deep learning for automated analysis of medical images (e.g., facial phenotyping or radiological scans) that might indicate a rare condition. Users are particularly concerned with the validation, clinical utility, and regulatory oversight of AI-driven diagnostic tools, seeking assurance that these systems are robust, unbiased, and seamlessly integrated into existing clinical workflows to manage the overwhelming volume of genetic and clinical data.

AI’s transformative influence is most pronounced in bioinformatics and clinical decision support systems (CDSS). Machine learning models are uniquely capable of processing millions of genetic variants, clinical notes, literature references, and patient phenotypes simultaneously, far surpassing human capabilities in pattern recognition across disparate data sets. This capability is paramount in rare disease diagnostics, where the pathogenicity of specific genetic variants is often poorly understood. By training on large, anonymized cohorts, AI can prioritize variant candidates, flag suspicious genomic regions, and suggest potential diagnoses, thereby drastically accelerating the time from sample collection to definitive diagnosis, sometimes reducing the process from years to mere weeks.

Furthermore, AI facilitates the integration of multi-omic data—including genomics, proteomics, and metabolomics—providing a holistic view of the disease pathology. Deep learning algorithms are particularly adept at handling complex image analysis in dysmorphology, using facial recognition technology to screen for characteristic features associated with hundreds of rare syndromes, a rapid, non-invasive screening technique increasingly used in pediatric settings. This enhancement in data integration and automation is driving the next wave of precision diagnostics, making previously intractable cases solvable and expanding the scope of treatable rare conditions, thereby solidifying AI's role as a critical component in future diagnostic pathways.

- Accelerated variant prioritization and interpretation in Next-Generation Sequencing (NGS) data.

- Enhanced differential diagnosis by correlating complex clinical phenotypes with vast genomic databases.

- Automated image analysis, including facial phenotyping for rapid syndrome identification.

- Development of sophisticated Clinical Decision Support Systems (CDSS) for clinicians.

- Improved identification of novel gene-disease associations through unsupervised machine learning.

- Optimization of diagnostic workflows, reducing laboratory turnaround time and cost.

- Integration and analysis of multi-omic data (genomics, proteomics, metabolomics) for comprehensive diagnosis.

DRO & Impact Forces Of Rare Disease Diagnostics Market

The Rare Disease Diagnostics Market is significantly shaped by a confluence of driving factors, restrictive barriers, and strategic opportunities, collectively defining the impact forces influencing its trajectory. Primary drivers include the declining cost of genomic sequencing technologies, increasing governmental and non-profit organization funding for rare disease research, and growing global awareness, which collectively accelerate the adoption of advanced diagnostic modalities. However, the market faces constraints such as the scarcity of trained genetic counselors and bioinformaticians necessary to interpret complex data, coupled with significant ethical and regulatory hurdles surrounding genetic data privacy and consent. Opportunities lie predominantly in integrating Artificial Intelligence (AI) for enhanced diagnostic efficiency and expanding access to screening programs in emerging economies, promising to unlock substantial untapped market potential.

Drivers: The most significant driver is the rapid advancement and cost reduction of Next-Generation Sequencing (NGS). The cost of sequencing a whole human genome has plummeted, making WES and WGS clinically viable options rather than just research tools. This accessibility enables earlier and more comprehensive testing. Furthermore, legislative mandates and financial incentives, such as the Orphan Drug Act in the US and similar frameworks in Europe (Regulation (EC) No 141/2000), stimulate investment in both therapeutics and companion diagnostics. Growing patient advocacy and the success of rare disease day initiatives increase the urgency for early diagnosis, putting pressure on healthcare systems to integrate advanced testing capabilities. Finally, the proven efficacy of personalized medicine approaches, dependent on accurate genetic diagnosis, reinforces the commercial demand for these sophisticated tools.

Restraints: Despite technological advances, significant restraints persist. A major barrier is the lack of standardized clinical guidelines and reimbursement policies across different geographies, leading to inconsistent access to diagnostics. The challenge of interpreting Variants of Unknown Significance (VUS) generated by high-throughput sequencing often complicates diagnosis, requiring extensive follow-up studies and expert opinion, thus extending the diagnostic timeline and increasing costs. Data privacy concerns, particularly when sharing large genomic datasets across international borders for research, pose regulatory difficulties (e.g., GDPR compliance). Additionally, the workforce shortage in specialized areas like genetic counseling limits the ability of healthcare systems to effectively deploy and communicate the results of complex genetic tests to patients.

Opportunities: Strategic opportunities abound in leveraging advanced computation. Integrating Machine Learning and AI to automate variant classification, improve phenotypic matching, and correlate genetic findings with clinical outcomes represents a massive avenue for growth and efficiency improvement. Expansion of newborn screening (NBS) panels to include a broader range of treatable rare diseases is another key opportunity, driven by technological ability to process vast numbers of samples quickly and accurately. Furthermore, geographical expansion into underserved markets in Latin America and Asia Pacific, coupled with the development of affordable, decentralized diagnostic platforms (e.g., based on real-time PCR or targeted sequencing), will unlock new patient populations and revenue streams, overcoming existing infrastructural barriers.

Impact Forces: The market is subject to intense impact forces stemming from technological breakthroughs and regulatory pressures. The accelerating pace of scientific discovery continually introduces new gene-disease associations, rendering existing diagnostic panels quickly obsolete and driving continuous R&D investment. Regulatory harmonization, particularly in the European Union, is creating a larger, more unified market, streamlining the approval process for novel diagnostic tests. Economically, the move toward value-based healthcare emphasizes the importance of diagnostics in preventing expensive, unnecessary interventions, thereby positioning rare disease diagnostics as a cost-effective element in the overall patient management pathway. These combined forces mandate constant innovation and responsiveness from market participants to maintain competitive relevance.

Segmentation Analysis

The Rare Disease Diagnostics Market is intricately segmented based on technology, application, and end-user, reflecting the diverse approaches required to identify a wide spectrum of rare conditions. The technology segmentation is dominated by molecular techniques, necessitated by the genetic basis of most rare diseases, with Next-Generation Sequencing (NGS) being the cornerstone due to its ability to analyze multiple genes simultaneously or even the entire genome. Application segmentation is crucial for understanding patient workflow, ranging from newborn screening for immediate life-saving intervention to prenatal testing and definitive diagnosis for individuals presenting with symptoms. End-users primarily consist of specialized institutions that possess the necessary infrastructure and expertise to handle complex genomic data and interpret highly technical results, ensuring clinical accuracy and utility.

The segmentation by technology clearly shows a shift from older, single-gene methods like PCR and standard Sanger sequencing toward high-throughput, comprehensive genomic analysis. While Sanger sequencing remains essential for validation and targeted analysis, the trend towards WES and WGS is undeniable, offering the highest diagnostic yield in complex, undiagnosed cases. Furthermore, non-genomic methods, such as mass spectrometry for metabolic screening and microarrays for copy number variation detection, still play vital supporting roles, often preceding or complementing sophisticated genomic tests. The continuous integration of informatics solutions is essential across all technology segments to manage the data generated, transforming raw sequencing data into actionable clinical reports, thereby linking the technological sophistication directly to clinical applicability.

Analyzing the application segments reveals that definitive diagnosis for symptomatic patients holds the largest current market share, driven by the sheer volume of individuals struggling through the diagnostic odyssey. However, preventative and preemptive applications, specifically expanded newborn screening and carrier screening, are poised for the highest growth. This growth is spurred by public health initiatives aimed at preventing disease manifestation rather than just reacting to symptoms. The structure of the market is thus dynamic, balancing the need for deep, complex analysis for diagnosed patients with the requirements for rapid, scalable, and cost-effective screening programs for population health management.

- By Technology:

- Next-Generation Sequencing (NGS)

- Microarrays

- Polymerase Chain Reaction (PCR)

- Fluorescence In Situ Hybridization (FISH)

- Mass Spectrometry

- Sanger Sequencing

- By Application:

- Newborn Screening (NBS)

- Carrier Screening

- Prenatal Testing

- Definitive Diagnosis

- Preimplantation Genetic Diagnosis (PGD)

- By Disease Type:

- Neurological Disorders (e.g., SMA, Fragile X Syndrome)

- Metabolic Disorders (e.g., PKU, Urea Cycle Disorders)

- Hematological Disorders (e.g., Thalassemia, Hemophilia)

- Immunological Disorders (e.g., SCID)

- Oncology-Related Rare Diseases

- By End-User:

- Diagnostic Laboratories

- Hospitals and Clinics

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Rare Disease Diagnostics Market

The value chain for the Rare Disease Diagnostics Market is complex, beginning with upstream suppliers of high-purity reagents and sequencing instrumentation, moving through the core diagnostic service providers, and concluding with the downstream clinical application and patient management. Upstream activities involve significant Research and Development (R&D) focused on improving sequencing chemistry, reducing sequencing error rates, and developing advanced bioinformatics algorithms necessary for data interpretation. Key players here include instrumentation manufacturers (like Illumina and Thermo Fisher Scientific) and specialized software developers. Efficiency in this phase hinges on the integration of hardware and software platforms to ensure cost-effectiveness and high throughput, which directly impacts the accessibility and pricing of the final diagnostic service.

The core of the value chain is the diagnostic service delivery itself, primarily conducted by specialized diagnostic laboratories and large reference laboratories. This stage involves sample preparation, sequencing, and the critical step of data analysis and clinical reporting. Distribution channels are varied: direct distribution occurs when large companies sell sequencing platforms directly to major hospital systems or research institutions, while indirect channels involve third-party distributors or clinical laboratory networks that process samples sent from smaller clinical practices. The quality and accuracy of the diagnostic report, heavily reliant on expert clinical interpretation and genetic counseling, define the value perceived by the downstream customers, necessitating stringent quality control and accreditation.

Downstream activities center on the end-users—hospitals, clinics, and pharmaceutical companies—who leverage the diagnostic information for patient care and drug development. Direct consumers of the diagnostic tests are the patients and healthcare providers seeking definitive answers. Indirect beneficiaries include pharmaceutical companies that use the diagnostic data (e.g., companion diagnostics or population genetics) to stratify patient cohorts for clinical trials or to target orphan drug marketing efforts. Effective collaboration across the value chain, particularly between laboratories and clinicians, is essential to ensure that highly technical genomic results are translated into clear, actionable treatment plans, shortening the time to therapy and maximizing the clinical utility of the diagnostic test.

Rare Disease Diagnostics Market Potential Customers

The primary potential customers and end-users of Rare Disease Diagnostics products and services are highly specialized entities within the global healthcare ecosystem, predominantly driven by the need for complex testing capabilities and stringent regulatory compliance. Hospitals and large clinical centers represent a foundational customer base, particularly those with specialized genetics departments, pediatric units, and tertiary care facilities that manage high volumes of patients with complex, undiagnosed conditions. These institutions require robust, reliable, and high-throughput diagnostic platforms, often purchasing sequencing instruments and associated reagent kits directly from manufacturers, aiming to centralize testing for better quality control and faster turnaround times. They are the frontline users integrating diagnostic results into patient care protocols and treatment pathways.

Specialized Diagnostic Laboratories, including reference laboratories and commercial genomic testing providers (e.g., Invitae, Eurofins), constitute the largest purchasing segment in terms of testing volume. These laboratories act as outsourced providers for smaller clinics and international clients, utilizing massive sequencing capacity and proprietary bioinformatics pipelines to achieve economies of scale. Their potential as customers is significant because they drive the adoption of emerging technologies, such as advanced data analytics and specialized genetic panels, pushing market innovation. Their business model relies on efficient processing of complex genetic samples and delivering comprehensive, clinically validated reports to healthcare providers globally, making them essential intermediaries in the diagnostic process.

Furthermore, Academic and Research Institutions are critical, not only as end-users consuming diagnostic tools for basic and translational research but also as key opinion leaders that validate new tests and drive clinical adoption. They are heavy users of whole-genome sequencing and customized genetic panels for cohort studies aimed at identifying new rare disease genes and understanding disease mechanisms. Finally, Pharmaceutical and Biotechnology Companies are increasingly important customers, utilizing rare disease diagnostics as companion diagnostics to select suitable patients for targeted therapies, and incorporating genetic screening early in their drug development pipeline to stratify rare disease populations for clinical trials, thereby streamlining the path to regulatory approval for orphan drugs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $33.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Illumina, Inc., Thermo Fisher Scientific, Inc., Laboratory Corporation of America Holdings (Labcorp), Eurofins Scientific, CENTOGENE N.V., PerkinElmer Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, QIAGEN N.V., Invitae Corporation, Blueprint Genetics (a part of Quest Diagnostics), Natera, Inc., Agilent Technologies, Inc., BioMarin Pharmaceutical Inc., Guardant Health, BGI Genomics Co., Ltd., GeneDx (a part of BioReference Laboratories), ARUP Laboratories, PacBio, and PreventionGenetics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rare Disease Diagnostics Market Key Technology Landscape

The technological landscape of the Rare Disease Diagnostics Market is dominated by high-throughput molecular biology platforms designed to analyze the human genome with high fidelity and speed. Next-Generation Sequencing (NGS) is the foundational technology, enabling comprehensive analysis through Whole-Exome Sequencing (WES) and Whole-Genome Sequencing (WGS). WES is currently the most commonly adopted definitive diagnostic test, offering a cost-effective method to sequence the protein-coding regions responsible for about 85% of known genetic diseases. WGS is gaining traction due to its ability to detect structural variations and non-coding mutations often missed by WES, crucial for ultra-rare conditions. The continuous innovation in NGS lies in reducing run times, increasing throughput, and improving the accuracy of base calling, making it suitable for high-volume clinical applications.

Beyond sequencing, Polymerase Chain Reaction (PCR) remains indispensable, particularly in screening and targeted analysis. Techniques such as quantitative PCR (qPCR) and droplet digital PCR (ddPCR) are utilized for rapid, sensitive detection of known mutations, carrier screening, and confirmation of variants identified through NGS, particularly in time-sensitive applications like newborn screening. Furthermore, cytogenetic techniques, notably Fluorescence In Situ Hybridization (FISH) and Chromosomal Microarrays (CMA), continue to play a crucial role in detecting large chromosomal rearrangements, aneuploidies, and copy number variations (CNVs) that are characteristic of certain rare syndromes. These established methods provide essential orthogonal confirmation to the data generated by sequencing technologies, ensuring diagnostic robustness.

The integration of advanced informatics platforms constitutes the third pillar of the technological landscape. As sequencing throughput increases, the limiting step shifts to data interpretation and variant classification. Bioinformatics tools leverage Artificial Intelligence (AI) and Machine Learning (ML) to filter, annotate, and prioritize millions of genetic variants, comparing them against large clinical databases (e.g., ClinVar, HGMD). Specialized software for phenotype-driven analysis, which correlates clinical symptoms with potential gene mutations, significantly reduces the time required for expert review, thereby shortening the overall diagnostic cycle. Future advancements are expected to focus on long-read sequencing technologies (like PacBio and Oxford Nanopore) which can resolve complex structural variants and repetitive regions often associated with challenging rare diseases, promising a further boost to diagnostic yields.

Regional Highlights

Geographical analysis of the Rare Disease Diagnostics Market reveals significant disparities in adoption, technological maturity, and regulatory environments, influencing regional growth dynamics. North America, comprising the United States and Canada, currently holds the largest market share. This dominance is attributed to high expenditure on healthcare, the presence of major genomics companies (Illumina, Labcorp, Quest Diagnostics), favorable reimbursement policies for genetic testing, and robust government funding through initiatives like the National Institutes of Health (NIH) Rare Diseases Clinical Research Network. The region benefits from early adoption of WES/WGS as standard clinical practice, strong patient advocacy groups, and advanced bioinformatics infrastructure necessary for complex data handling.

Europe represents the second-largest market, driven by coordinated efforts across the European Union to tackle rare diseases through centralized registries (e.g., Orphanet) and harmonized regulatory frameworks. Countries such as Germany, the UK, and France are leaders in implementing genetic screening programs and incorporating high-throughput sequencing into national healthcare systems. The establishment of European Reference Networks (ERNs) aims to ensure high-quality specialized care and diagnostics are available across borders, supporting growth. However, market fragmentation due to varying national reimbursement rates and ethical guidelines slightly hampers uniform market expansion compared to the US.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily fueled by improving healthcare infrastructure in populous countries like China, India, and Japan, increasing disposable incomes, and rising awareness regarding the benefits of early diagnosis. Government initiatives focusing on genetic screening for high-risk populations, particularly in metropolitan areas, are boosting demand. While the region currently lags in terms of advanced infrastructure compared to the West, rapid investment in genomic facilities and increasing collaboration with Western diagnostic providers are quickly closing this gap, signaling vast untapped potential. Growth in Latin America and the Middle East & Africa (MEA) remains slower, constrained by budgetary limitations and less comprehensive regulatory frameworks, though targeted investments in specialized centers are emerging.

- North America: Market leader due to high research investment, favorable regulatory environment (FDA approvals), and widespread clinical adoption of WES/WGS. Focus on personalized medicine initiatives.

- Europe: Strong market presence driven by centralized rare disease registries, established European Reference Networks (ERNs), and government support for subsidized genetic testing in key countries like the UK and Germany.

- Asia Pacific (APAC): Fastest-growing region, characterized by increasing healthcare spending, large patient population base, and growing technological adoption in countries such as China, India, and South Korea.

- Latin America (LATAM): Emerging market with increasing public awareness and governmental efforts to expand newborn screening panels, though restricted by economic volatility and infrastructure development challenges.

- Middle East & Africa (MEA): Growth focused on specialized medical tourism centers and specific genetic testing programs for common regional rare diseases (e.g., thalassemia), with significant disparities in access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rare Disease Diagnostics Market.- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Laboratory Corporation of America Holdings (Labcorp)

- Eurofins Scientific

- CENTOGENE N.V.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

- Invitae Corporation

- Blueprint Genetics (a part of Quest Diagnostics)

- Natera, Inc.

- Agilent Technologies, Inc.

- BioMarin Pharmaceutical Inc.

- Guardant Health

- BGI Genomics Co., Ltd.

- GeneDx (a part of BioReference Laboratories)

- ARUP Laboratories

- PacBio

- PreventionGenetics

Frequently Asked Questions

Analyze common user questions about the Rare Disease Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the Rare Disease Diagnostics Market?

The primary technology propelling growth is Next-Generation Sequencing (NGS), encompassing Whole-Exome Sequencing (WES) and Whole-Genome Sequencing (WGS). NGS allows for rapid, comprehensive analysis of multiple genes simultaneously, significantly accelerating the identification of genetic mutations responsible for rare diseases, thereby reducing the diagnostic delay.

Which geographical region dominates the rare disease diagnostics market share?

North America currently dominates the market, primarily due to substantial funding for genomic research, advanced healthcare infrastructure, the presence of key industry players, and high adoption rates of cutting-edge diagnostic technologies in clinical settings.

What are the main restraints impacting the expansion of the diagnostics market?

Key restraints include the high cost of advanced sequencing platforms, the lack of standardized global reimbursement policies for genetic testing, and the critical shortage of skilled genetic counselors and bioinformaticians required to interpret complex genomic data accurately.

How is Artificial Intelligence (AI) influencing rare disease diagnosis?

AI is transforming the field by significantly improving diagnostic efficiency. AI tools are used to process and analyze vast amounts of genomic and phenotypic data, prioritize pathogenic variants, and correlate ambiguous clinical symptoms with known disease patterns, thereby drastically shortening the diagnostic odyssey.

What are the fastest-growing application segments in this market?

The fastest-growing application segments are Expanded Newborn Screening (NBS) and Carrier Screening. These preventative applications are gaining momentum due to technological advancements enabling broader, cost-effective screening and increased public health focus on early intervention for treatable rare conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager