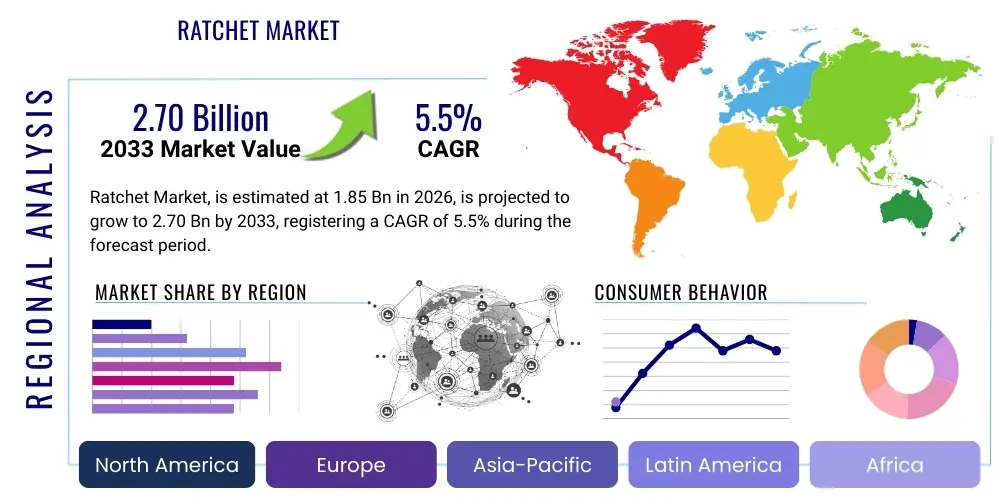

Ratchet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443104 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Ratchet Market Size

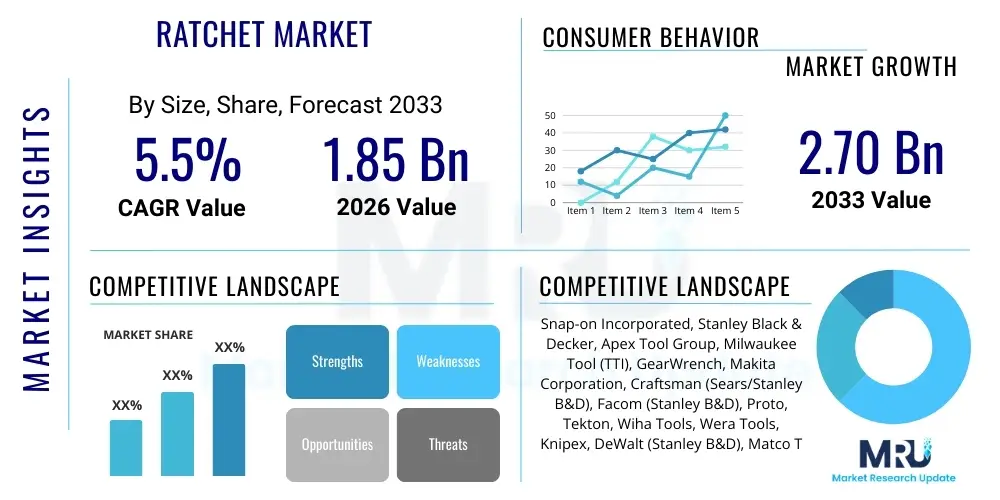

The Ratchet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.70 Billion by the end of the forecast period in 2033.

Ratchet Market introduction

The global Ratchet Market encompasses a variety of mechanical tools and components designed for controlled, one-directional rotation or tensioning, primarily focusing on hand tools like ratchet wrenches, as well as industrial components such as ratchet binders and tie-downs used in heavy-duty securing and lifting applications. The core product description centers on high-precision mechanical tools featuring a pawl mechanism that allows the tool handle to turn the fastener in one direction while permitting free movement in the opposite direction, significantly enhancing efficiency in tightening and loosening operations across confined spaces. Major applications span the automotive repair sector, industrial maintenance, repair, and overhaul (MRO), aerospace assembly, and general construction, driven by the inherent benefits of speed, accessibility, and high torque capacity offered by modern ratchet designs. Key driving factors propelling market growth include the rising global vehicle parc demanding specialized repair tools, increasing infrastructure development necessitating robust securing systems, and continuous technological advancements in metallurgy leading to lighter yet more durable tools.

Ratchet Market Executive Summary

The Ratchet Market is currently characterized by a sustained focus on durability and ergonomics, with business trends indicating a strong shift toward high tooth count mechanisms and composite materials to reduce weight and improve user comfort, consequently boosting premium product sales within professional segments. Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market due due to rapid industrialization, burgeoning automotive manufacturing hubs, and large-scale infrastructure projects in countries like China and India, whereas North America and Europe maintain dominance in terms of adopting specialized, high-performance ratchet systems for precision engineering applications. Segment trends reveal that the standard hand ratchet wrench segment continues to hold the largest market share by volume, although specialized segments like torque ratchets and pneumatic/electric-powered ratchets are experiencing higher growth rates fueled by demand for automated and precision torque control in manufacturing assembly lines, driving overall market value expansion.

AI Impact Analysis on Ratchet Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the ratchet market typically revolve around the integration of smart features into traditional mechanical tools, concerns about the obsolescence of purely manual tools, and the potential for AI-driven predictive maintenance systems to streamline tool inventory management and usage. Users are specifically keen on understanding how AI algorithms could influence manufacturing processes, optimizing material usage and tool design through generative design, as well as exploring the viability of AI in quality control systems to detect microscopic defects in high-tolerance ratchet mechanisms before they reach the market. The key themes emerging from this analysis confirm that AI's influence is less about replacing the mechanical function of the ratchet and more about augmenting its environment, enhancing manufacturing efficiency, and integrating it into smart workshops where usage data (torque applied, duration, wear patterns) is logged and analyzed for operational optimization and safety compliance.

- AI-driven Generative Design: Optimization of ratchet head geometry for maximum strength-to-weight ratio.

- Predictive Maintenance: AI algorithms analyzing sensor data (in smart tools) to predict component failure and schedule replacements.

- Automated Quality Control: High-speed machine vision systems utilizing AI for flaw detection during the manufacturing of pawl and gear mechanisms.

- Supply Chain Optimization: AI managing inventory levels and predicting regional demand shifts for specific ratchet types (e.g., specialized drive sizes).

- Ergonomic Design Enhancement: Utilizing AI simulation to optimize handle grip and weight distribution based on simulated user interaction data.

DRO & Impact Forces Of Ratchet Market

The dynamics of the Ratchet Market are complex, influenced significantly by robust global industrial growth (Driver) countered by the pervasive challenge of counterfeiting and low-quality imports (Restraint), alongside the emerging potential presented by adopting advanced materials and automation (Opportunity), which collectively form the primary Impact Forces determining market trajectory. Market growth is heavily driven by the consistent expansion of the global construction and automotive sectors, both necessitating reliable, high-torque tools for assembly and repair, coupled with the mandatory periodic maintenance schedules (MRO) across heavy industries, ensuring sustained demand for replacement and specialized ratchets. Conversely, the market faces restraints such as the relatively high cost associated with premium, high tooth count, sealed-head ratchet systems, and the increased competition from battery-powered impact drivers and wrenches that, in some applications, offer superior speed, potentially limiting the adoption rate of traditional manual ratchets in high-volume assembly settings. The main opportunity lies in integrating connectivity and intelligent features into ratchets, such as integrated torque sensors and Bluetooth synchronization for data logging, transforming traditional tools into smart maintenance devices, thereby establishing new revenue streams and justifying higher price points among professional end-users.

Segmentation Analysis

The Ratchet Market is meticulously segmented based on key functional and application parameters, allowing for detailed analysis of consumption patterns and future growth avenues across diverse industrial landscapes. Primary segmentation parameters include the type of ratchet mechanism, such as conventional pawl, gearless, and swivel head varieties, differentiating tools by operational efficiency and accessibility in tight spaces. Further differentiation occurs based on the power source, distinguishing between manual ratchets, pneumatic ratchets (air-powered), and electrically powered ratchets (corded and cordless), reflecting the varied needs for portability, torque control, and speed in specific professional environments. Application-based segmentation divides the market into high-volume end-use sectors, including Automotive & Transportation, Industrial Manufacturing, Construction, and household DIY use, each requiring specific design specifications regarding drive size, durability, and ergonomic features.

Detailed examination of segment performance reveals that the 3/8-inch drive size remains the most universally adopted size, balancing versatility and torque requirements for general mechanical work, whereas 1/2-inch drive sizes dominate heavy-duty maintenance and industrial applications due to their superior torque capabilities. Geographically, North America leads in the adoption of specialized and premium segments like electronic torque ratchets for aerospace and high-precision machinery, emphasizing investment in quality and compliance. The overall segmentation landscape suggests a maturing core market, where future growth will be disproportionately driven by the adoption of advanced, specialized tools that offer enhanced productivity, precision, and data logging capabilities, necessitating strategic product diversification by leading manufacturers to capture value in these niche segments.

- By Type:

- Standard Ratchet Wrenches

- Flex-Head/Swivel Ratchets

- Torque Ratchets (Mechanical and Electronic)

- Gearless Ratchets

- Specialty Ratchets (e.g., Palm Ratchets, Pass-Through Systems)

- By Drive Size:

- 1/4 inch

- 3/8 inch

- 1/2 inch

- 3/4 inch & Larger

- By Mechanism/Teeth Count:

- Low Tooth Count (30–60)

- High Tooth Count (72–120+)

- By Power Source:

- Manual/Hand Ratchets

- Pneumatic Ratchets

- Cordless Electric Ratchets

- By Application:

- Automotive Maintenance and Repair

- Industrial Maintenance, Repair, and Overhaul (MRO)

- Construction and Infrastructure

- Aerospace and Defense

- DIY and Household Use

Value Chain Analysis For Ratchet Market

The Ratchet Market value chain commences with the upstream analysis of raw material sourcing, predominantly focused on high-grade alloy steels (such as Chromium Vanadium and Chromium Molybdenum) necessary for ensuring the longevity and high torque resistance of the ratchet head, gear, and pawl mechanism, followed by the procurement of advanced composite materials for ergonomic handles and grips. This upstream segment is characterized by stringent quality control requirements as the performance of the final tool is directly dependent on the metallurgical integrity of the materials used in critical moving parts, demanding close collaboration between tool manufacturers and specialty steel producers. The subsequent phase involves manufacturing, encompassing precision forging, CNC machining of the gear assembly, heat treatment for durability, and rigorous quality assurance testing, which adds significant value through the conversion of raw materials into high-tolerance, functional tools ready for distribution.

Moving downstream, the value chain centers on efficient distribution channels that are critical for delivering the wide array of ratchet products to diverse end-users, differentiating between business-to-business (B2B) channels serving large industrial clients and business-to-consumer (B2C) channels targeting professional mechanics and hobbyists. Direct distribution often involves large industrial suppliers providing bulk orders of specialized pneumatic or torque ratchets directly to automotive assembly plants or aerospace manufacturers, ensuring traceability and customized supply logistics. Indirect channels, conversely, dominate the sales of standard hand tools, utilizing large retail hardware chains, specialized mechanic supply houses, and rapidly expanding e-commerce platforms, which offer broad reach and convenience, albeit introducing complexity in inventory management and pricing strategies across multiple intermediaries.

The final stage involves the end-user application and post-sale service, where the perceived value of the ratchet is ultimately determined by its durability, ease of use, and warranty support provided by the manufacturer. Effective downstream marketing focuses on demonstrating tool reliability under extreme conditions and promoting advanced features like sealed heads for dust resistance and high tooth count for minimal arc swing. Optimized distribution, balancing the high-volume, low-margin retail segment with the low-volume, high-margin specialized industrial segment, is paramount for market leaders seeking sustainable profitability and brand loyalty within the highly competitive tool industry.

Ratchet Market Potential Customers

Potential customers for the Ratchet Market are broadly categorized into four major sectors, ranging from high-volume, professional industrial users requiring stringent specifications to individual consumers focused on general utility and repair tasks. The largest segment comprises professional mechanics and repair shops within the Automotive & Transportation sector, who require an extensive inventory of reliable, durable hand ratchets, pneumatic ratchets, and specialized engine-specific tools, where purchasing decisions are often driven by brand reputation, warranty length, and ergonomic design suitable for continuous daily use. Secondly, customers in the Industrial Maintenance, Repair, and Overhaul (MRO) sector, including facilities management teams, plant operators, and heavy machinery technicians, prioritize ratchets with robust construction, high torque capacity (especially 1/2-inch and 3/4-inch drive sizes), and compliance with safety standards, often procuring through direct or authorized industrial supply distributors.

The third substantial customer base resides within the Construction and Infrastructure industries, utilizing ratchets not only for basic assembly but critically for securing heavy loads through ratchet tie-downs and load binders, demanding exceptionally strong, weather-resistant materials and reliable locking mechanisms for safety-critical applications. These users often purchase specialized industrial hardware through wholesale construction suppliers. Finally, the growing DIY and general household segment represents a consistent volume driver, characterized by price sensitivity but sustained demand for general-purpose 3/8-inch and 1/4-inch drive sets, typically purchased through major retail hardware stores and e-commerce platforms, with marketing efforts focused on introductory value, comprehensive tool kits, and brand accessibility.

Ultimately, the segmentation of potential customers dictates tailored product strategies, where industrial buyers necessitate performance documentation and technical support, while DIY consumers require accessible pricing and robust packaging. Understanding the specific procurement methods and performance expectations of each end-user group—from the precision engineer requiring electronic torque logging to the trucker needing heavy-duty cargo control—is essential for maximizing market penetration and generating targeted sales growth across the professional and consumer spectrums.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.70 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Snap-on Incorporated, Stanley Black & Decker, Apex Tool Group, Milwaukee Tool (TTI), GearWrench, Makita Corporation, Craftsman (Sears/Stanley B&D), Facom (Stanley B&D), Proto, Tekton, Wiha Tools, Wera Tools, Knipex, DeWalt (Stanley B&D), Matco Tools |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ratchet Market Key Technology Landscape

The technology landscape within the Ratchet Market is primarily defined by continuous engineering improvements focused on mechanism refinement, material innovation, and the integration of electronic precision features, aiming to enhance durability, reduce the necessary arc swing, and provide verifiable torque data. High tooth count (72 teeth and above, often reaching 144 or 180) mechanisms represent a significant technological advancement, drastically reducing the arc swing required to engage the next gear, making these tools indispensable for applications in extremely confined spaces, particularly within complex engine compartments and aerospace assembly, demanding precision manufacturing processes like fine blanking and micro-machining to ensure reliable engagement. Furthermore, advanced material technologies, specifically the adoption of premium alloy steels (e.g., S2 tool steel for internals) and composite materials for handles, are crucial in simultaneously increasing the overall tool strength while achieving substantial weight reduction and improved resistance to common workshop chemicals and corrosion.

Another major technological trend is the development and commercialization of "smart ratchets," which incorporate digital torque meters, internal sensors, and wireless connectivity (e.g., Bluetooth) to log applied torque data, vibration patterns, and usage cycles, transitioning the tool from a purely mechanical device to an intelligent component of a quality assurance and compliance system. This digital integration is particularly vital in highly regulated industries, such as aerospace and defense, where meticulous torque traceability is mandated for critical fasteners. The sealed head design, which prevents dust, dirt, and lubricants from contaminating the internal gear mechanism, represents a critical design innovation that extends tool lifespan and maintains peak performance in harsh environments, necessitating advanced sealing materials and precise housing manufacture.

The drive toward specialized mechanics, such as flexible head ratchets, pass-through socket systems, and reversible quick-release mechanisms, is also a core technology focus, solving specific access and operational challenges faced by mechanics and technicians. Manufacturers are heavily investing in patented pawl designs—like dual-pawl or offset pawl systems—to distribute torque load more evenly across the teeth, thereby enhancing durability under high stress while retaining a minimal profile. This relentless pursuit of mechanical and material excellence, coupled with the nascent adoption of digital tracking capabilities, defines the competitive edge in the contemporary ratchet tooling industry.

Regional Highlights

- North America: Market Maturity and Premiumization

North America currently holds a substantial share of the global Ratchet Market, characterized by high demand for premium, high-performance tooling driven by sophisticated manufacturing sectors, a vast aging vehicle fleet requiring extensive repair, and a strong culture of professional mechanics prioritizing durability and advanced ergonomics. The region leads in adopting digitally integrated tools, particularly electronic torque ratchets and high-tooth count systems used in automotive dealerships and aerospace manufacturing facilities. Market growth, while steady, is predominantly driven by replacement cycles and the increasing investment in specialized tools necessary for advanced vehicle technologies (e.g., electric vehicles) rather than broad industrial expansion, placing emphasis on quality and brand heritage.

- Europe: Focus on Standardization and Industrial MRO

The European market for ratchets is defined by rigorous quality standards, notably within Germany and Scandinavian countries, necessitating tools that conform to high industrial specifications (DIN, ISO). Demand is robust within the industrial Maintenance, Repair, and Overhaul (MRO) sectors, where manual and pneumatic ratchets are extensively utilized in manufacturing plants, oil and gas infrastructure, and shipbuilding. The region shows a strong preference for durable, long-life tools and an increasing trend toward environmentally compliant manufacturing processes, favoring manufacturers who utilize sustainable materials and offer robust recycling programs for retired tools. Central and Eastern Europe provide steady growth opportunities fueled by ongoing industrial modernization.

- Asia Pacific (APAC): Rapid Industrialization and Volume Growth

APAC is projected to be the fastest-growing region, primarily fueled by massive infrastructure investments, the exponential growth of automotive manufacturing bases (especially in China, India, and Southeast Asia), and rapid urbanization. While price-sensitive segments dominate the volume, the rising middle class and increasing foreign direct investment in high-tech manufacturing are simultaneously driving demand for high-quality professional tools from international brands. The market is highly competitive, characterized by a mix of low-cost domestic producers and premium global players; future growth is intrinsically linked to the scale of new construction and factory commissioning across the region, particularly in electric vehicle production facilities.

- Latin America (LATAM): Infrastructure and Resource-Driven Demand

The Latin American Ratchet Market is largely influenced by fluctuating investment in the mining, oil & gas, and construction sectors, creating cyclical demand for heavy-duty and industrial-grade ratchets and tensioning devices. Countries like Brazil and Mexico, with strong automotive assembly capabilities, represent critical consumption hubs for both manual and specialized pneumatic ratchets. Market penetration is often challenging due to complex logistics and varied regional economic stability, leading to a strong demand for cost-effective yet resilient tools that can withstand challenging environmental conditions.

- Middle East and Africa (MEA): Energy and Infrastructure Projects

Demand in the MEA region is heavily concentrated in the oil, gas, and petrochemical sectors, alongside large-scale construction and national infrastructure projects. This emphasis mandates the use of highly specialized, corrosion-resistant, and high-torque ratchets, including those designed for hazardous environments. Procurement in this region is typically dominated by industrial suppliers serving major government contracts and international energy companies, prioritizing durability, reliable warranty support, and adherence to international safety certifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ratchet Market.- Snap-on Incorporated

- Stanley Black & Decker, Inc.

- Apex Tool Group, LLC

- Techtronic Industries Co. Ltd. (Milwaukee Tool, Ryobi)

- Makita Corporation

- SK Hand Tool Corporation

- The L. S. Starrett Company

- Facom (Owned by Stanley Black & Decker)

- Knipex-Werk C. Gustav Putsch KG

- Wera Tools

- Wiha Tools

- Proto Industrial Tools (Stanley B&D)

- Matco Tools

- Tekton

- GearWrench (Apex Tool Group)

- Teng Tools

- DeWalt (Stanley B&D)

- Stahlwille

Frequently Asked Questions

Analyze common user questions about the Ratchet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the professional Ratchet Market?

The leading driver is the increasing complexity of modern machinery, particularly in the automotive and aerospace industries, which necessitates highly precise, high tooth count ratchets for confined spaces and specialized electronic torque ratchets for accurate fastener tightening compliance.

How are high tooth count ratchets changing tool usage?

High tooth count ratchets (72+ teeth) significantly reduce the necessary arc swing, allowing mechanics to operate effectively in tight, inaccessible areas where traditional ratchets with fewer teeth cannot engage, thus dramatically improving operational speed and efficiency.

What is the significance of materials in high-end ratchets?

High-end ratchets utilize specialized chrome vanadium or chrome molybdenum alloy steels for superior strength and durability against high torque loads, while composite handles are increasingly used to minimize weight, absorb vibration, and resist common workshop chemicals, improving ergonomics and tool lifespan.

Which geographic region presents the most rapid growth opportunities for ratchet manufacturers?

The Asia Pacific (APAC) region, particularly China and India, offers the highest growth potential due to massive ongoing industrialization, robust expansion in automotive production, and sustained large-scale infrastructure and construction projects.

How do power tools compete with manual ratchet wrenches?

Pneumatic and cordless electric ratchets compete strongly with manual tools in high-volume assembly lines and heavy-duty MRO due to their superior speed and consistent torque application. However, manual ratchets retain their essential role where precision, cost-effectiveness, or lack of power access are factors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chain Binder Market Size Report By Type (Ratchet Binder, Lever Binder, Others), By Application (Railway Transportation, Waterway Transportation, Highway Transportation), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Tubing Cutter Market Statistics 2025 Analysis By Application (Cut Tube, Other), By Type (Ratchet Tube Cutters, Three way Tube Cutters, Power Tube Cutters, Wheel Tube Cutters, Pivot Joint Tube Cutters, Trigger Tube Cutters, Soil and Drain Tube Cutters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Boat Ratchet Blocks Market Statistics 2025 Analysis By Application (Sailboats, Yachts, Windsurf, Others), By Type (Manual, Automatic), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Manual Ratchet Market Statistics 2025 Analysis By Application (Automobile Industry, Mechanical, Equipment Repair), By Type (Chrome Vanadium Steel, High Carbon Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ratchet Market Statistics 2025 Analysis By Application (Automobile Industry, Mechanical, Equipment Repair), By Type (Chrome Vanadium Steel, High Carbon Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager