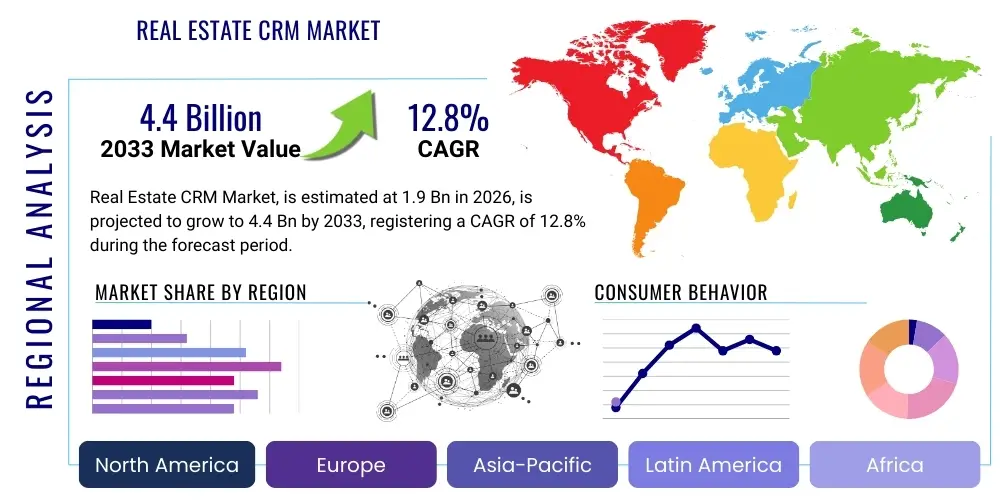

Real Estate CRM Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442900 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Real Estate CRM Market Size

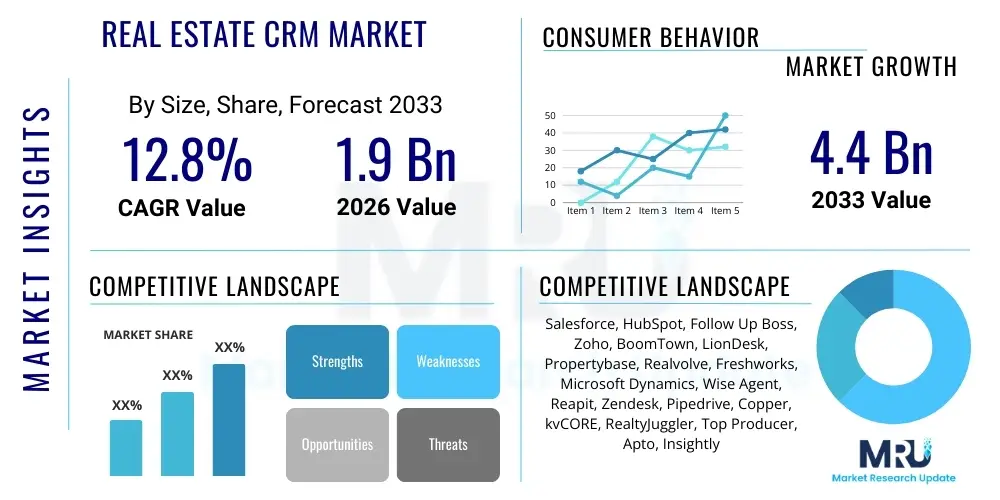

The Real Estate CRM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 4.4 Billion by the end of the forecast period in 2033. This substantial expansion is driven by the increasing digital transformation within the property sector, where agents and brokers are prioritizing streamlined operations, enhanced lead management, and personalized client experiences to maintain competitive advantage in complex and rapidly changing housing markets globally.

Real Estate CRM Market introduction

The Real Estate Customer Relationship Management (CRM) Market encompasses software solutions specifically designed to help real estate professionals manage client interactions, streamline sales cycles, organize transactions, and automate marketing efforts. These platforms integrate features such as lead tracking, contact management, task automation, property listing management, and robust reporting capabilities tailored to the unique demands of the real estate industry, covering both residential and commercial sectors. The core product description revolves around a centralized database system that offers a 360-degree view of the customer journey, from initial inquiry to post-sale follow-up.

Major applications of Real Estate CRM systems span across various organizational sizes, from independent agents and small brokerages (SMEs) requiring straightforward, cost-effective solutions to large enterprise firms necessitating complex integrations with MLS databases, accounting software, and proprietary transaction management systems. The widespread adoption is propelled by the need for efficiency gains, reducing the time spent on administrative tasks, and ensuring compliance with regional regulatory frameworks. Furthermore, the shift towards remote work and increased reliance on digital communication channels have accelerated the demand for robust, cloud-based CRM solutions that offer mobility and accessibility.

Key benefits driving the market include superior lead nurturing capabilities, which translate directly into higher conversion rates, improved client retention through personalized communication strategies, and enhanced overall team productivity. Driving factors encompass the rising adoption of cloud computing, the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, and the global trend toward professionalization and standardization of real estate services. Regulatory compliance mandates, particularly concerning data privacy and consumer protection, also necessitate the use of sophisticated CRM tools capable of secure data handling and audit trails.

Real Estate CRM Market Executive Summary

The Real Estate CRM Market is characterized by vigorous innovation and intense competition, driven primarily by technological advancements in AI and automation. Business trends highlight a pronounced shift towards specialized, niche CRM solutions that cater specifically to property management, commercial real estate (CRE), or luxury segments, moving beyond generic sales platforms. Key strategic priorities for vendors include developing deep integrations with third-party tools (e.g., social media platforms, automated valuation models (AVMs), and communication apps) and offering flexible pricing models suitable for both scaling startups and established enterprises. Mergers and acquisitions are common, as larger technology firms seek to incorporate specialized real estate functionalities and acquire established customer bases.

Regional trends indicate North America currently dominates the market share due to the high technological maturity of its real estate sector, significant investment in proptech, and a complex competitive environment demanding sophisticated lead management tools. Asia Pacific (APAC) is projected to exhibit the highest growth rate (CAGR), fueled by rapid urbanization, increasing disposable incomes, and the digitization of real estate processes in emerging economies like India and Southeast Asia. Europe remains a stable market, characterized by strong regulatory requirements (e.g., GDPR), fostering demand for data privacy and compliant CRM platforms, with the UK, Germany, and France being primary revenue contributors.

Segment trends reveal that the Cloud Deployment model is overwhelmingly favored across all regions due to its scalability, lower upfront costs, and ease of deployment, significantly overshadowing the traditional on-premise solutions. Furthermore, the Small and Medium-sized Enterprises (SMEs) segment holds the largest share in terms of volume of adoption, primarily because CRM tools offer immediate improvements in efficiency and lead organization for smaller teams. From a component perspective, the emphasis is shifting from basic Software features to specialized Professional Services, which include implementation, customization, and continuous support necessary for maximizing the effectiveness of complex CRM ecosystems.

AI Impact Analysis on Real Estate CRM Market

Common user questions regarding the impact of AI on Real Estate CRM center heavily on topics such as predictive lead scoring accuracy, the automation capabilities of routine tasks (e.g., scheduling, initial client qualification), and the integration of large language models (LLMs) for enhanced client communication and content generation. Users frequently express concerns about data privacy implications of feeding extensive client and transaction data into AI models, the cost of implementing and maintaining AI features, and the potential displacement of human roles, particularly in basic administrative support. Expectations are high regarding AI’s ability to generate actionable market insights, optimize property pricing, and personalize the buying/selling experience to an unprecedented degree.

The introduction of Artificial Intelligence and Machine Learning algorithms represents a paradigm shift within the Real Estate CRM sector, moving the platforms from mere organizational tools to strategic, predictive systems. AI enables sophisticated lead qualification by analyzing behavioral data, property viewing habits, and historical conversion rates to accurately score potential clients, allowing agents to prioritize the highest-value opportunities. This shift enhances the efficiency of sales teams significantly and drastically reduces time spent on unqualified leads, leading to improved resource allocation and quicker transaction closures. Furthermore, AI-powered chatbots and virtual assistants are increasingly handling initial client inquiries 24/7, providing instantaneous responses and gathering crucial preliminary information before escalation to a human agent.

Beyond lead management, AI is transforming market analysis and document management within CRM platforms. Predictive analytics use external market data, neighborhood demographics, and economic indicators to help agents advise clients on optimal listing prices and potential investment returns, transforming the agent from a facilitator to a strategic consultant. Moreover, advanced AI features are being deployed for automated contract generation, compliance verification, and data entry, significantly minimizing the risk of human error and ensuring regulatory adherence. These integrations position Real Estate CRM systems as central intelligence hubs, essential for navigating complex market volatilities and achieving data-driven decision-making in the modern property sector.

- Enhanced Lead Scoring: AI algorithms analyze behavior and historical data for superior prioritization of high-value prospects.

- Automated Communication: Chatbots and virtual assistants handle routine inquiries and scheduling, improving response times.

- Predictive Market Analytics: Offering data-driven insights on pricing, neighborhood trends, and investment potential.

- Task Automation: Streamlining administrative functions such as data entry, compliance checks, and document processing.

- Personalized Client Experience: AI tailors marketing content and communication strategies based on individual client preferences and stage in the transaction pipeline.

- Risk Mitigation: Automated monitoring of transaction documents for regulatory and contractual compliance.

DRO & Impact Forces Of Real Estate CRM Market

The dynamics of the Real Estate CRM Market are shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which together constitute the primary Impact Forces (I) determining market evolution and competitive landscapes. The overall trajectory is strongly positive, largely driven by the imperative for digital transformation within traditionally slow-to-adapt real estate agencies globally. This necessitates the adoption of specialized technological tools that can manage high volumes of transactions and complex client relationships efficiently, positioning CRM as essential infrastructure rather than a discretionary expense.

Primary drivers include the exponential growth in global residential and commercial property transactions, which mandates scalable management solutions, alongside the competitive necessity for personalization in customer service to build trust and loyalty in a crowded marketplace. Simultaneously, the proliferation of PropTech investment encourages continuous innovation in CRM features, specifically centered around mobile access and cloud deployment. However, the market faces restraints, chiefly the initial high cost of implementation and training for robust enterprise CRM solutions, particularly for small and mid-sized brokerages that operate on thin margins. Furthermore, resistance to change among established real estate agents and concerns regarding data security and system interoperability pose substantial hurdles to widespread adoption.

Opportunities are abundant, particularly in the integration of emerging technologies such as blockchain for secure transaction records, advanced AI for highly nuanced predictive modeling, and integration with virtual reality (VR) and augmented reality (AR) platforms for immersive client tours managed through the CRM. The growing need for specialized CRM catering to niche markets—such as international property investment, fractional ownership, or specific asset classes (e.g., industrial warehouses)—presents significant avenues for market penetration and differentiation. The impact forces overwhelmingly favor growth, as the benefits of operational efficiency, regulatory compliance, and enhanced sales conversion outweigh the inertia and initial financial investment restraints, ensuring continuous market acceleration.

Segmentation Analysis

The Real Estate CRM Market segmentation provides a detailed structural breakdown based on various critical parameters, including deployment model, component type, enterprise size, and specific application areas. This granular analysis is crucial for understanding specific demands within the ecosystem and for identifying high-growth segments where strategic investment yields maximum returns. The market is increasingly polarizing between highly generalized, robust CRM platforms (often offered by major technology vendors) and specialized, industry-specific solutions that deeply integrate real estate-centric features like MLS integration, transaction management workflows, and appraisal tools. Understanding these segments helps providers tailor their features and marketing efforts to precise customer needs.

The segmentation by deployment model clearly indicates market maturity, with the Software as a Service (SaaS) or Cloud model dominating due to its accessibility, flexibility, and reduced need for dedicated IT infrastructure maintenance. Component segmentation reflects the evolving nature of the software, where the Professional Services component (including consulting, implementation, and training) is gaining rapid traction as real estate firms seek custom solutions and seamless integration with existing technology stacks. Finally, application segmentation confirms that the Residential sector remains the largest consumer of Real Estate CRM, though the Commercial segment is poised for accelerated growth, driven by the increasing complexity and value of commercial property deals requiring more sophisticated portfolio management tools.

- By Deployment Model:

- Cloud-based (SaaS)

- On-premise

- By Component:

- Software

- Services (Implementation, Training, Consulting, Support)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application/End-User:

- Residential Real Estate

- Commercial Real Estate (CRE)

- Property Management Firms

- Investment & Syndication Companies

Value Chain Analysis For Real Estate CRM Market

The value chain for the Real Estate CRM Market commences with the upstream analysis involving core technology providers and software developers responsible for creating the foundational platform architecture. This stage includes sourcing specialized components such as cloud infrastructure (AWS, Azure, Google Cloud), securing robust database management systems, and developing advanced features like AI modules and predictive analytics engines. Key activities here focus on R&D, maintaining intellectual property, and ensuring platform security and scalability. A critical upstream dependency is access to real estate-specific data sources, such as MLS feeds and public records databases, which are essential for the functionality of real estate CRMs.

The downstream analysis focuses on the distribution channels and the ultimate consumption of the product by the end-users. The distribution channel is predominantly direct, utilizing the vendor's proprietary website, dedicated sales teams, and partner networks for software delivery and subscription management. Indirect distribution often involves strategic partnerships with major real estate franchises, technology integrators, or specialized consulting firms that bundle CRM solutions with other PropTech offerings. Marketing and sales efforts are crucial in the downstream phase, involving targeted digital campaigns and demonstrations aimed at showcasing the platform’s real estate-specific advantages to brokers, agents, and property managers.

The final value delivery involves implementation, ongoing support, and customization services, which are critical differentiators in this competitive market. Direct channels facilitate deep, personalized implementation support, ensuring the CRM is tailored to the brokerage’s specific workflows and compliance needs. Indirect channels, through specialized resellers or consultants, often manage the initial setup and integration with legacy systems. The effectiveness of the value chain is measured by the platform’s ability to generate quantifiable ROI for the end-user through improved lead conversion and operational efficiency, thereby ensuring high retention rates and minimizing customer churn within the subscription-based model.

Real Estate CRM Market Potential Customers

The potential customer base for Real Estate CRM Market solutions is highly diversified yet fundamentally centered around professional entities engaged in property transactions and management. The primary end-users or buyers include individual real estate agents and brokers who require efficient tools to manage their client pipelines, appointments, and marketing outreach. These customers typically prioritize ease of use, mobile functionality, and affordable monthly subscription costs, often opting for dedicated industry-specific CRMs that require minimal customization upon deployment.

A second major customer segment comprises large real estate brokerages and franchises that require enterprise-level solutions capable of managing hundreds or even thousands of agents, standardized reporting across multiple offices, and complex integrations with corporate accounting and human resources systems. For these buyers, scalability, advanced administrative controls, compliance features, and robust security protocols are non-negotiable requirements. They often invest in customized, on-premise or dedicated cloud deployments and extensive professional services packages for seamless integration into their corporate infrastructure.

Finally, specialized property professionals constitute a significant niche market. This includes commercial real estate firms focused on leasing and asset management, mortgage brokers needing integrated lead generation and pipeline tracking, and property management companies that require specialized features for tenant relations, maintenance tracking, and recurring billing. These specialized end-users seek CRMs that offer deep, industry-specific functionalities rather than generic sales tools, prioritizing specialized modules for portfolio analysis and financial reporting relevant to their specific asset class.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, HubSpot, Follow Up Boss, Zoho, BoomTown, LionDesk, Propertybase, Realvolve, Freshworks, Microsoft Dynamics, Wise Agent, Reapit, Zendesk, Pipedrive, Copper, kvCORE, RealtyJuggler, Top Producer, Apto, Insightly |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Real Estate CRM Market Key Technology Landscape

The technological landscape of the Real Estate CRM market is defined by rapid convergence between traditional CRM functionalities and advanced proprietary PropTech features, heavily relying on cloud infrastructure and mobile-first design principles. The foundational technology remains Software as a Service (SaaS), leveraging public or hybrid cloud environments to ensure high availability, elasticity, and immediate access to updates. Critical technologies underpinning modern Real Estate CRMs include robust API architectures that facilitate seamless integration with Multiple Listing Service (MLS) databases, third-party lead aggregators (e.g., Zillow, Realtor.com), and internal transaction management systems, which is paramount for data fidelity and workflow automation across the entire real estate lifecycle.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful emerging technologies, moving the platforms beyond simple database management. AI is employed for natural language processing (NLP) in customer communication, automated lead nurturing sequences, and predictive modeling for market valuation and churn risk assessment. Furthermore, data visualization tools and business intelligence (BI) dashboards are crucial technologies that transform raw operational data into actionable strategic insights for brokerage owners and team leaders, allowing them to monitor key performance indicators (KPIs) such as conversion rates, lead source efficiency, and agent performance in real-time. This technological sophistication is driving up the barrier to entry for new market competitors.

Finally, the growing concern over data security and regulatory compliance (like GDPR, CCPA, and regional property data regulations) mandates the utilization of advanced cybersecurity technologies, including end-to-end encryption, multi-factor authentication, and blockchain technology for immutable transaction record-keeping. The convergence of these technological layers—from secure cloud deployment and sophisticated AI tools to deep integration capabilities and robust regulatory features—is essential for any vendor aiming to maintain relevance and competitive edge in the highly dynamic Real Estate CRM ecosystem, catering to the growing expectations of digitally savvy real estate professionals.

Regional Highlights

- North America: Dominates the global market share, driven by high technological maturity, substantial PropTech investment, and a complex regulatory environment demanding robust data management. High adoption rates are seen among large brokerages and specialized commercial real estate firms seeking sophisticated AI-driven tools.

- Europe: Characterized by stringent data privacy laws (GDPR) which mandate compliance-focused CRM solutions. Market growth is stable, with key demand centers in the UK, Germany, and France, focusing on localized MLS integration and multilingual capabilities.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid urbanization, increasing middle-class income driving property purchases, and government initiatives promoting digitalization in countries like China, India, and Australia. Demand is high for cloud-based, mobile-first CRMs tailored for emerging market dynamics.

- Latin America (LATAM): Emerging market with increasing technology adoption, though often hindered by economic volatility and varying regulatory frameworks. Demand focuses on basic lead management and affordable SaaS models suitable for smaller, local agencies.

- Middle East and Africa (MEA): Shows promising growth, particularly in the UAE and Saudi Arabia, driven by mega real estate development projects and government vision plans (e.g., Vision 2030). High demand for CRMs specialized in international investor relations and high-value transactions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Real Estate CRM Market.- Salesforce

- HubSpot

- Follow Up Boss

- Zoho

- BoomTown

- LionDesk

- Propertybase

- Realvolve

- Freshworks

- Microsoft Dynamics

- Wise Agent

- Reapit

- Zendesk

- Pipedrive

- Copper

- kvCORE

- RealtyJuggler

- Top Producer

- Apto

- Insightly

Frequently Asked Questions

Analyze common user questions about the Real Estate CRM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Real Estate CRM Market?

The Real Estate CRM Market is projected to experience a Compound Annual Growth Rate (CAGR) of 12.8% between the forecast period of 2026 and 2033, driven by increasing digitalization and the need for enhanced lead management solutions globally.

How is Artificial Intelligence (AI) fundamentally changing Real Estate CRM functionality?

AI is transforming Real Estate CRM by providing advanced predictive lead scoring, automating client communication via chatbots, and delivering data-driven insights for optimal property pricing and personalized client nurturing, shifting CRM from a tracking tool to a strategic intelligence platform.

Which geographical region holds the largest market share for Real Estate CRM solutions?

North America currently holds the largest market share in the Real Estate CRM Market, attributed to high technology adoption rates, significant investments in PropTech, and a mature competitive environment demanding sophisticated client management tools.

What are the primary challenges restraining the widespread adoption of advanced CRM solutions?

Primary restraints include the significant initial investment and high implementation costs required for enterprise-level CRM platforms, particularly for small brokerages, coupled with internal resistance to change among established real estate agents regarding new technological workflows.

Which segment, by enterprise size, is the largest consumer of Real Estate CRM solutions?

Small and Medium-sized Enterprises (SMEs) constitute the largest segment of consumers by volume, as these organizations rely heavily on CRM tools to organize their lead pipelines, streamline operational inefficiencies, and compete effectively against larger, more established real estate franchises.

The continued expansion of the Real Estate CRM market is fundamentally linked to the integration capacity of these platforms with third-party PropTech applications, including virtual tour software, digital closing systems, and enhanced property valuation models. As the real estate transaction process becomes increasingly decentralized and digital, the CRM serves as the necessary central nervous system, coordinating data flow and managing the complexity of diverse digital touchpoints. This reliance on a unified system ensures consistency in customer experience and enables management to execute holistic marketing strategies that span traditional and emerging communication channels, thereby maximizing ROI on lead generation efforts. The shift towards open API standards is accelerating this trend, allowing for highly flexible and customizable CRM environments that cater to the unique needs of different regional markets and asset classes, from high-volume residential sales to complex, long-cycle commercial leases. Furthermore, the imperative for robust reporting and regulatory compliance features is becoming a major differentiator, particularly in highly regulated markets such as Europe and parts of North America, where data governance and privacy are paramount concerns. Vendors that successfully balance advanced technological capabilities with stringent compliance features are well-positioned for sustained market leadership throughout the forecast period.

The strategic deployment of cloud-based solutions remains a foundational driver of market accessibility and rapid scaling. Cloud infrastructure enables vendors to deliver continuous updates, incorporate cutting-edge AI features without requiring local hardware upgrades, and maintain compliance with regional data residency requirements through geographically distributed servers. This infrastructure allows small to medium-sized brokerages, which form the majority of the market's customer base, to access enterprise-grade functionality at a manageable subscription cost, democratizing access to powerful sales and marketing tools previously reserved for large corporations. Moreover, the mobile capabilities inherent in cloud-based CRMs are essential for real estate agents who are constantly working outside the office, facilitating real-time updates to client files, immediate response to inquiries, and on-site transaction management. The competitive advantage increasingly lies in the platform’s ability to function seamlessly across various mobile operating systems and devices, ensuring agents maintain productivity regardless of location or time of day, thereby cementing the market's preference for flexible SaaS models over traditional on-premise implementations.

Market growth is also significantly propelled by the increasing sophistication of the professional services segment. While the software component provides the necessary features, the successful deployment and maximization of a Real Estate CRM hinge upon expert implementation, customization, and user training. Brokerages are increasingly realizing that an off-the-shelf CRM, even a powerful one, often fails to meet their specific, nuanced operational requirements. Therefore, demand for consulting services that map existing workflows onto the new CRM, integrate it with legacy databases, and provide specialized training tailored to different user roles (e.g., administrative staff vs. listing agents) is skyrocketing. This professional services revenue stream provides high margins for vendors and strategic partners while simultaneously reducing customer churn by ensuring high user adoption and satisfaction. The quality and depth of ongoing customer support, including dedicated account managers and technical expertise in real estate regulatory environments, are now critical factors in vendor selection, contributing substantially to the overall value proposition of the CRM solution.

In terms of competitive dynamics, the market presents a dichotomy between generalist CRM giants like Salesforce and Microsoft, which offer highly customizable platforms, and specialized PropTech vendors (e.g., Follow Up Boss, Propertybase) that provide deep, out-of-the-box real estate functionality. The strategy for generalists involves leveraging their robust infrastructure and integration ecosystems, often partnering with specialized developers to fill real estate-specific functional gaps. Conversely, specialist vendors focus intensely on user experience tailored for agents, offering quick deployment and direct integration with regional MLS systems, which is a decisive advantage in localized markets. Innovation is heavily concentrated on developing proprietary AI tools for niche applications, such as identifying the optimal time to contact a lead based on predictive behavioral analysis or automating the creation of personalized property summaries using large language models. The competitive landscape is also witnessing consolidation, with major players acquiring smaller, innovative startups to quickly gain access to specialized technologies and expanding their geographic footprint, indicating a maturing market structure moving towards fewer, more comprehensive platforms.

The commercial real estate (CRE) segment presents a unique opportunity for market expansion, requiring CRMs distinctly different from those used in residential sales. CRE transactions involve higher values, longer sales cycles, complex financial modeling, and specialized needs for portfolio and asset management. Consequently, the demand here is for CRMs that integrate advanced financial analysis tools, leasing management modules, and robust data visualization for investment performance tracking. Vendors targeting the CRE sector must offer platforms capable of handling multi-party transactions, complex ownership structures, and regulatory compliance specific to commercial financing and leasing agreements. This specialization necessitates a deeper technological stack focusing on security, data integrity, and complex reporting capabilities tailored for institutional investors and large property developers. While residential real estate drives volume, the commercial segment promises higher average contract values (ACVs) for CRM subscriptions and professional services, making it a critical area for strategic diversification for vendors seeking premium growth opportunities in the forecast period.

Finally, the long-term sustainability of the Real Estate CRM market relies on its ability to effectively address evolving consumer expectations. Today's property buyers and sellers expect seamless, digital-first interactions, immediate access to information, and personalized service delivery. CRMs are essential in managing these high expectations by providing tools for integrated marketing automation, enabling personalized email campaigns, social media engagement tracking, and instant messaging capabilities integrated directly into the agent’s workflow. Furthermore, post-sale relationship management, facilitated by automated follow-up sequences and customer satisfaction surveys within the CRM, is crucial for fostering repeat business and securing valuable referrals. The future successful CRM will not just manage data; it will proactively orchestrate the entire client experience, ensuring every interaction is optimized for trust-building and efficiency, thereby securing the agent’s role as the central figure in an increasingly digitized property market. This emphasis on customer lifetime value (CLV) driven by superior experience management reinforces the foundational necessity of sophisticated CRM technology.

The strategic importance of data security cannot be overstated, particularly as real estate transactions involve highly sensitive personal financial information and large monetary transfers. Real Estate CRM providers must invest heavily in securing their platforms against cyber threats, utilizing advanced encryption protocols, conducting regular vulnerability assessments, and implementing strict access controls. Furthermore, adhering to evolving global data protection regulations—ranging from the European Union’s GDPR to various state-level privacy laws in the US—is mandatory, not optional. Failure to comply can result in catastrophic fines and irreversible damage to client trust. Therefore, market leaders are increasingly differentiating themselves not just through advanced features, but through certified compliance frameworks and transparent data handling policies. This focus on regulatory adherence and security is elevating the cost structure of providing enterprise-grade CRM but is simultaneously raising the competitive bar, favoring established vendors with resources dedicated to robust risk management and governance protocols, essential for long-term viability in this high-stakes industry.

The deployment segmentation, particularly the preference for cloud-based models, is also influenced by the growing integration of Internet of Things (IoT) devices within smart homes and commercial properties. Future-generation CRMs will need the capability to ingest and analyze data generated by these connected devices—such as access codes, energy usage, and maintenance alerts—to provide a comprehensive property management solution. Cloud platforms offer the necessary scalability and bandwidth to handle this massive influx of IoT data, allowing property managers and agents to offer value-added services based on real-time property health and usage statistics. This convergence of traditional CRM functions with smart building technology creates new revenue streams for vendors and increases the platform's stickiness within the end-user organizations, fundamentally changing the definition of a comprehensive real estate solution. The development of specialized APIs for seamless IoT integration is quickly becoming a necessary technological milestone for market entrants and established players alike.

Looking at the application segment, the residential sector’s dominance is expected to persist due to the sheer volume of transactions globally. However, growth in the commercial sector is projected to outpace residential growth in certain high-value urban markets. The underlying reason is the increasing institutionalization of real estate investment globally, which necessitates professional-grade asset management and financial analysis tools integrated within the CRM ecosystem. Furthermore, the specialized niche of property management firms represents a consistently strong demand source, requiring specific modules for tenant screening, lease renewal automation, maintenance request ticketing, and automated rent collection. Vendors are increasingly creating highly specialized versions of their core CRM platform to capture these distinct revenue opportunities, recognizing that a one-size-fits-all approach is insufficient to address the regulatory and operational complexities inherent in property management and commercial transactions. Strategic vendors are targeting these specialized application areas for higher-value, enterprise-level contracts.

The impact of economic factors, such as fluctuating interest rates and housing supply shortages, further reinforces the need for advanced CRM. In volatile markets, agents require highly accurate, predictive tools to advise clients, and CRMs equipped with advanced AI models analyzing economic indicators become indispensable. These systems help agents forecast market shifts, adjust pricing strategies dynamically, and manage client expectations during periods of economic uncertainty. The CRM thus acts as a vital tool for risk mitigation and strategic adaptability, ensuring that real estate professionals can maintain transaction volume even when market conditions are challenging. This shift from a purely sales-focused tool to a critical strategic forecasting instrument underlines the expanding influence and increasing market penetration of sophisticated Real Estate CRM solutions across all regions and enterprise sizes, driving continued robust growth throughout the forecast period and solidifying its essential role in the modern real estate technology stack.

The competitive nature of the Real Estate CRM market compels vendors to continually invest in user experience (UX) and user interface (UI) design. Real estate professionals, particularly independent agents and small teams, often have limited time for software training and prefer intuitive platforms that require minimal onboarding. Therefore, CRMs that offer clean dashboards, mobile accessibility, and workflows that mirror actual real estate processes gain significant market traction. Many leading vendors are incorporating gamification elements and simplified data entry methods to boost agent adoption and ensure data integrity. Furthermore, the push towards integrating communication tools—such as native SMS, email clients, and VoIP capabilities—directly within the CRM interface eliminates the need for agents to toggle between multiple applications, thereby maximizing efficiency and minimizing the risk of losing valuable lead data. This focus on seamless, user-centric design is a powerful non-price-based differentiator in the saturated SME segment.

The role of specialized third-party integrations is another pillar of the technological landscape. Real estate technology is highly fragmented, with numerous point solutions addressing specific needs, such as e-signature platforms (e.g., DocuSign), dedicated virtual staging software, and complex accounting suites. A leading Real Estate CRM must function as an effective hub, maintaining robust, certified integrations with these external systems via open APIs. The depth and reliability of these integrations determine the platform's versatility and effectiveness in handling the end-to-end transaction lifecycle. Vendors who prioritize building out comprehensive integration marketplaces not only attract a wider user base but also create a valuable ecosystem that encourages long-term platform dependency, thereby securing recurring revenue streams and strengthening their competitive position against less open, proprietary systems. The ability to seamlessly exchange data securely across the agent’s entire tech stack is now a prerequisite for market success.

Finally, global expansion and localization present significant operational and technological hurdles. As vendors seek growth in the APAC and LATAM regions, they must adapt their CRM platforms to support multiple languages, local regulatory requirements (especially regarding data handling and privacy), and unique regional business practices, such as integration with localized property portals and communication apps preferred by local consumers. A crucial localization challenge is integrating with regional Multiple Listing Services (MLS) or similar property data exchanges, which operate under vastly different technical standards and governance models globally. Vendors that invest in creating adaptable, localized versions of their core product, often through strategic regional partnerships, are best equipped to capitalize on the high growth rates projected for emerging markets. This regional specialization ensures the CRM remains relevant and legally compliant, transforming global technology into locally effective sales tools.

The current market landscape is heavily influenced by the competitive strategies of cloud software giants who view Real Estate CRM as a vertical expansion opportunity. Salesforce, for instance, leverages its massive platform and ecosystem, offering specialized real estate clouds built on top of its core CRM infrastructure, appealing to large enterprises requiring deep customization and scalability. Similarly, Microsoft Dynamics targets companies integrated into the Microsoft ecosystem. This necessitates that specialized PropTech CRMs must innovate rapidly in niche functionalities—such as AI-driven neighborhood analysis or proprietary marketing automation specific to real estate flyers and social media content—to maintain their unique value proposition and resist commoditization by the larger, more generalized competitors. This continuous technological arms race drives the overall maturity and feature richness of the Real Estate CRM sector.

The long-term outlook for the Real Estate CRM market is overwhelmingly positive, underpinned by the structural necessity for digital tools in a highly competitive, data-intensive industry. As market complexity increases, driven by fractional ownership models, blockchain applications in title transfer, and the ongoing shift to remote and hybrid work environments, the need for a unified, intelligent platform to manage client relationships, compliance, and transactions will only intensify. The market is transitioning from being about organizing contacts to being about generating actionable intelligence and providing strategic business execution, firmly establishing Real Estate CRM as the foundational technology for modern real estate operations globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager