Rebar Tie Wire Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443156 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Rebar Tie Wire Market Size

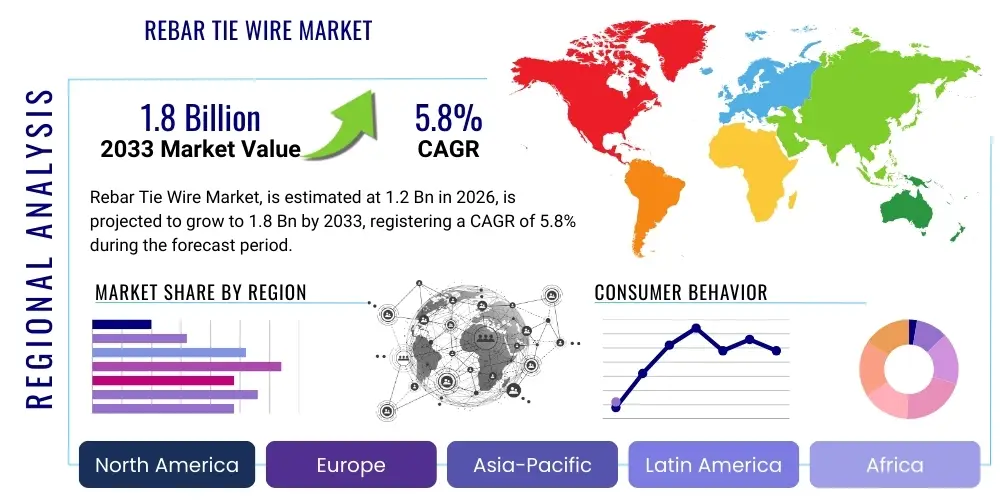

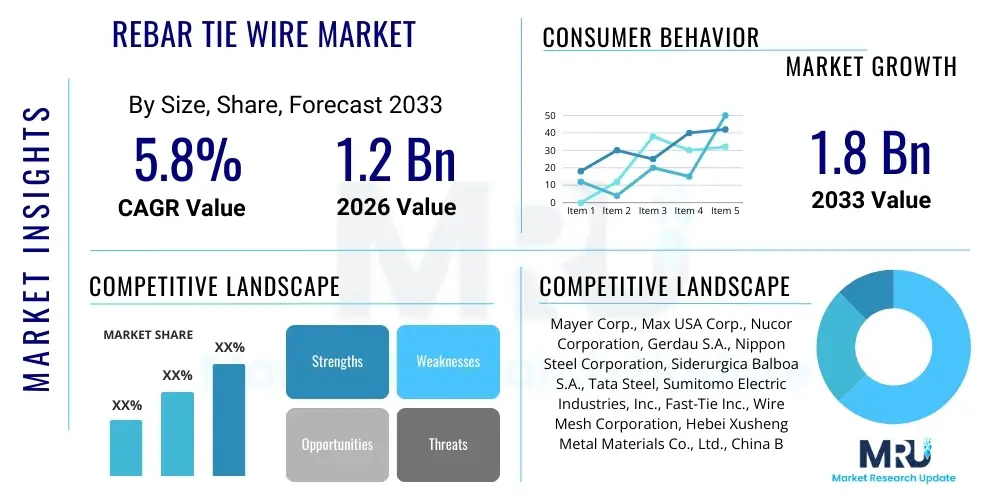

The Rebar Tie Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Rebar Tie Wire Market introduction

The Rebar Tie Wire Market encompasses the global production and distribution of various types of annealed, galvanized, and epoxy-coated wire primarily utilized to secure reinforcing bars (rebar) at intersection points within concrete structures. This crucial construction consumable ensures the structural integrity and stability of the steel cage prior to concrete pouring, preventing displacement during construction activities. Key product attributes sought by the construction industry include tensile strength, ductility, corrosion resistance, and ease of application, whether manually or through automated tying tools. The fundamental purpose of rebar tie wire is to maintain the specified spacing and orientation of the steel reinforcement matrix, which is paramount for meeting stringent engineering and building codes across residential, commercial, and massive infrastructure projects.

Major applications for rebar tie wire span across civil engineering, general building construction, and specialized precast concrete manufacturing. The inherent benefits of using high-quality tie wire include enhanced construction speed, reduced labor costs when using automated systems, and most importantly, guaranteeing the load-bearing capacity of the finished concrete element. The market growth is fundamentally driven by escalating global investments in public infrastructure—including bridges, highways, and utility systems—particularly in rapidly urbanizing economies. Furthermore, increasing regulatory requirements demanding higher seismic resistance and structural longevity are accelerating the adoption of specialized, corrosion-resistant wire types, such as PVC-coated or stainless steel options, particularly in coastal or harsh environmental conditions. The transition toward greater construction efficiency and safety remains a pivotal factor sustaining market momentum.

Rebar Tie Wire Market Executive Summary

The Rebar Tie Wire Market demonstrates robust growth propelled by concurrent expansion in global residential, commercial, and public infrastructure sectors. Key business trends indicate a shift towards advanced manufacturing techniques focusing on automated wire production and enhanced corrosion protection coatings to improve product durability and streamline on-site handling. Manufacturers are increasingly integrating vertical operations, from raw material sourcing (steel wire rods) to final distribution, to mitigate volatility in steel prices and ensure stable supply chains. The competitive landscape is characterized by established global wire manufacturers vying with regional specialists, often focusing on product innovation, particularly in developing tie wires optimized for high-speed automated tying machines, thereby capitalizing on labor efficiency trends.

Regionally, the Asia Pacific (APAC) continues its dominance, driven by extensive urbanization projects and large-scale government infrastructure investments in China, India, and Southeast Asia. North America and Europe, while mature, exhibit high growth potential in the premium segment, favoring environmentally compliant, high-tensile strength wires and rapid adoption of construction automation technologies. Segment-wise, the black annealed wire segment maintains the highest volume share due to its cost-effectiveness and widespread utility, but the galvanized and PVC-coated segments are experiencing above-average growth rates, fueled by demand from infrastructure projects requiring extended lifespan and superior resistance to environmental degradation. Overall market trajectory is closely correlated with global GDP performance and governmental expenditure on large-scale capital projects.

AI Impact Analysis on Rebar Tie Wire Market

Analysis of common user questions regarding AI's influence on the Rebar Tie Wire Market reveals primary concerns centered on supply chain optimization, predictive demand forecasting, and the integration of smart tools. Users are keen to understand how AI can minimize raw material price risk, optimize inventory levels for highly volatile materials like steel, and improve project scheduling accuracy for tie wire delivery. A significant theme is the expected impact of AI-driven construction management platforms (like BIM integrated with machine learning) on material procurement efficiency, specifically questioning if AI can predict the exact quantities and types of tie wire needed, thereby reducing waste and overstocking. Furthermore, there is growing interest in utilizing AI to analyze performance data from automated rebar tying robots to improve maintenance schedules and operational uptime, translating directly into tangible labor productivity gains on large construction sites.

The implementation of AI algorithms in manufacturing processes is already starting to optimize the steel wire drawing and annealing phases, ensuring stricter quality control and consistency, which is critical for compatibility with high-speed automated tying equipment. AI-driven logistics platforms are enhancing route optimization for delivery, reducing transportation costs, and improving the 'just-in-time' delivery model essential for minimizing inventory holding costs on complex construction sites. While AI does not directly alter the chemical composition or fundamental function of the tie wire product itself, its pervasive role in upstream manufacturing efficiency, downstream demand predictability, and integrated construction workflow management is fundamentally reshaping the economics of the market.

- AI-driven Predictive Analytics: Enhancing accuracy in forecasting steel demand and inventory management, minimizing raw material price exposure.

- Supply Chain Optimization: Utilizing machine learning for dynamic logistics routing and scheduling, enabling just-in-time delivery to construction sites.

- Manufacturing Quality Control: Employing AI vision systems to detect minute defects in wire drawing and coating processes, ensuring higher product consistency.

- Automated Tying Tool Maintenance: ML algorithms analyze operational telemetry from automated tyers to predict maintenance needs, reducing construction downtime.

- BIM Integration: AI leverages Building Information Modeling (BIM) data to automate precise tie wire quantity calculation, reducing material waste by up to 10-15%.

DRO & Impact Forces Of Rebar Tie Wire Market

The Rebar Tie Wire Market is powerfully driven by global infrastructural development cycles and intensified urbanization, particularly across emerging economies, creating sustained demand for reliable construction materials. However, this growth is significantly constrained by the inherent volatility of steel wire rod prices, a primary raw material, which directly impacts manufacturing margins and end-user pricing stability. Opportunities emerge predominantly through technological innovation, specifically the widespread adoption of automated rebar tying tools, which necessitates specialized, high-performance tie wire tailored for machine compatibility, opening premium market segments. Impact forces, therefore, include the macro-economic stability influencing public infrastructure budgets, stringent building codes requiring higher quality and corrosion-resistant materials, and continuous pressure from construction firms seeking solutions to rising labor costs through mechanization.

A crucial restraint involves environmental regulations pertaining to steel production and waste management, pushing manufacturers toward more sustainable processes and materials, sometimes involving higher initial costs. Simultaneously, the market is opportunistic, driven by the replacement cycle of aging infrastructure in developed nations, which demands high-specification, long-lasting tie wire solutions. The collective impact forces dictate that market participants must strategically balance cost-efficiency (driven by raw material constraints) with innovation (driven by automation and structural safety requirements) to achieve sustainable growth and capture value in specialized segments.

Segmentation Analysis

The Rebar Tie Wire Market is segmented rigorously based on crucial attributes including material composition, product type, diameter range, and primary application, providing a granular view of market dynamics and specialized user needs. Material segmentation differentiates between traditional black annealed wire, which is cost-effective but susceptible to corrosion, and galvanized or epoxy-coated wires, offering superior corrosion resistance essential for outdoor or marine environments. Segmentation by product type addresses the diverse methods of application, differentiating between loop tie wires, which facilitate manual and semi-automatic tying, and coil wires designed for high-speed, fully automated rebar tying machines. Understanding these segment dynamics is critical for manufacturers to align production capabilities with evolving construction methodologies and project specifications globally.

Further analysis considers segmentation by diameter, which impacts both tensile strength and suitability for specific rebar gauges, ranging typically from 16 to 20 gauge. Application segmentation is crucial, breaking down end-use into heavy infrastructure (bridges, dams, tunnels), commercial real estate (office buildings, retail centers), and residential construction (single-family homes, multi-story residential towers). The highest growth rates are projected in segments catering to advanced infrastructure projects and utilizing automated technology, driving higher consumption of specialized, precision-engineered coil wire products. This multi-faceted segmentation allows for targeted marketing strategies and the identification of high-value niche opportunities, particularly in regions prioritizing long-term structural integrity and rapid construction timelines.

- By Material:

- Black Annealed Wire

- Galvanized Wire

- PVC Coated Wire

- Epoxy Coated Wire

- Stainless Steel Wire

- By Type:

- Loop Tie Wire

- Coil Wire/Spool Wire

- Bar Tie/Cut Wire

- Twist Tie Wire

- By Gauge/Diameter:

- 16 Gauge

- 17 Gauge

- 18 Gauge

- 20 Gauge & Others

- By Application/End-Use:

- Residential Construction

- Commercial Construction

- Infrastructure (Bridges, Roads, Tunnels, Utilities)

- Industrial Construction

- Precast Concrete Manufacturing

Value Chain Analysis For Rebar Tie Wire Market

The value chain for the Rebar Tie Wire Market commences with upstream activities centered on the procurement and processing of raw materials, primarily steel wire rod, sourced from large steel producers. This stage is crucial as the quality and cost of the wire rod dictate the final product's performance and margin. Midstream activities involve the specialized manufacturing process, including drawing the rod down to the required gauge, annealing (to enhance ductility), and applying surface treatments like galvanization or PVC coating. Efficiency in these processes, particularly energy consumption and waste reduction, determines competitive positioning.

Downstream activities focus heavily on distribution and delivery channels. Products are typically moved through a complex network involving primary distributors, specialized construction material wholesalers, and local retailers or hardware stores. Direct distribution channels are often employed for large infrastructure projects or when supplying major construction companies directly, particularly for customized or high-volume orders, ensuring prompt supply and technical support. Indirect channels, utilizing wholesalers, allow for wider market penetration and serving smaller contractors and residential builders. The efficiency of this downstream logistics is vital, as construction projects operate on strict timelines, making reliable supply a significant competitive differentiator. The final link is the end-user, the construction contractor or precast manufacturer, whose adoption of automated tying tools influences the demand for specific wire types (e.g., spool wire over loop tie wire).

Rebar Tie Wire Market Potential Customers

The primary consumers of Rebar Tie Wire are entities engaged in structural construction and specialized concrete fabrication across various scales. Large general contractors and civil engineering firms constitute a significant segment, particularly those undertaking major public works such as highway systems, metro rail projects, and utility infrastructure, where massive quantities of rebar cages require secure tying. These customers prioritize high tensile strength, guaranteed quality, and reliable, bulk supply contracts, often demanding specifications compatible with robotic or semi-automated tying systems to maximize on-site labor efficiency.

Another critical customer base includes residential and commercial building developers. While their individual project volumes may be smaller than infrastructure projects, their cumulative demand for standard annealed wire is substantial. Precast concrete manufacturers also represent a specialized, high-volume segment, utilizing tie wire in controlled factory settings to construct elements like beams, columns, and slabs before transport. These customers emphasize precise wire gauge, consistency, and corrosion resistance, as the durability of the precast elements is often critical to their service life. Market strategies must address the distinct purchasing requirements of these diverse groups, ranging from cost-sensitive residential builders to quality-focused infrastructure giants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mayer Corp., Max USA Corp., Nucor Corporation, Gerdau S.A., Nippon Steel Corporation, Siderurgica Balboa S.A., Tata Steel, Sumitomo Electric Industries, Inc., Fast-Tie Inc., Wire Mesh Corporation, Hebei Xusheng Metal Materials Co., Ltd., China Baowu Steel Group, Bekaert, Mid-States Wire, Shenyang Huayi Wire Co., Ltd., Henan Jinyuan Wire Co., Ltd., Shandong Xingfu Iron & Steel Co., Ltd., Shaanxi Heavy Metal Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rebar Tie Wire Market Key Technology Landscape

The technological landscape of the Rebar Tie Wire Market is increasingly defined by two parallel innovations: advancements in material science for corrosion mitigation and the widespread adoption of automated tying equipment. Material science progress focuses on developing specialized coatings, such as higher-grade PVC compounds and dual-layer epoxy systems, which offer superior adhesion and resistance to chemical attack, extending the structural lifespan in challenging environments like tunnels or coastal regions. Furthermore, manufacturers are employing micro-alloying techniques during the wire drawing process to achieve higher tensile strength and consistent ductility, essential characteristics for flawless operation in high-speed mechanical tyers, minimizing breakages and construction delays.

The most transformative technology remains the evolution of automated rebar tying tools. These battery-operated handheld devices and, increasingly, semi-autonomous rebar tying robots, demand precision-wound spool wire (coil wire) engineered to strict tolerances. Technological development here includes integrating IoT sensors within the tying tools to monitor wire usage, tensioning force, and battery life, feeding data back into construction management systems. This integration minimizes material waste and ensures compliance with structural specifications. The shift towards automation is not merely a labor-saving measure; it represents a commitment to predictable quality and accelerated project delivery times, fundamentally altering the specifications and packaging requirements for tie wire products globally.

Regional Highlights

The global consumption and production landscape of Rebar Tie Wire is marked by distinct regional characteristics concerning demand drivers, product specifications, and competitive intensity.

- Asia Pacific (APAC): Dominates the global market volume due to unparalleled levels of infrastructure development and rapid urbanization, particularly in emerging economies such as China, India, and Indonesia. These regions exhibit high demand for traditional black annealed wire due to cost constraints, alongside accelerating consumption of specialized wire for large-scale public transit and energy projects. Government initiatives focusing on smart city development and robust residential housing construction are the primary growth accelerators.

- North America: Characterized by high labor costs, leading to aggressive adoption of automated rebar tying technologies, which drives premium demand for precision-engineered coil wire. The market emphasizes high-quality standards and corrosion-resistant materials (galvanized and epoxy-coated wire) due to stringent building codes and a focus on long-term infrastructure durability and seismic resilience in regions like California and the Eastern Seaboard.

- Europe: Exhibits mature but stable growth, highly regulated by environmental standards and quality certifications. Demand is strong for sustainable and specialty wires, reflecting emphasis on green building practices and the renovation of existing infrastructure. Scandinavian countries and Germany often lead in adopting advanced galvanized and stainless steel options for longevity and minimal environmental impact.

- Middle East & Africa (MEA): Growth is fueled by large-scale mega-projects in the GCC nations (Saudi Arabia, UAE), focusing on futuristic cities and diversified economies. The harsh desert and coastal environments necessitate high consumption of heavily coated and galvanized wires to withstand extreme temperatures and salinity, driving demand in the high-performance segment.

- Latin America: The market displays moderate growth, heavily influenced by government stability and investment cycles. Brazil and Mexico are key markets, showing a mix of demand for cost-effective annealed wire in residential projects and high-specification materials for large mining and energy sector construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rebar Tie Wire Market.- Mayer Corp.

- Max USA Corp.

- Nucor Corporation

- Gerdau S.A.

- Nippon Steel Corporation

- Siderurgica Balboa S.A.

- Tata Steel

- Sumitomo Electric Industries, Inc.

- Fast-Tie Inc.

- Wire Mesh Corporation

- Hebei Xusheng Metal Materials Co., Ltd.

- China Baowu Steel Group

- Bekaert

- Mid-States Wire

- Shenyang Huayi Wire Co., Ltd.

- Henan Jinyuan Wire Co., Ltd.

- Shandong Xingfu Iron & Steel Co., Ltd.

- Shaanxi Heavy Metal Co., Ltd.

- Keystone Steel & Wire Company

- Leggett & Platt, Incorporated

Frequently Asked Questions

Analyze common user questions about the Rebar Tie Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Rebar Tie Wire Market?

The central driver is the substantial increase in global governmental expenditure on public infrastructure development, coupled with rapid urbanization across emerging economies, necessitating robust residential and commercial construction.

How does the adoption of automated rebar tying technology influence product demand?

Automation significantly shifts demand from traditional loop ties to specialized, precision-wound coil wire (spool wire). This technology mandates higher product quality consistency and promotes growth in premium, machine-compatible wire segments.

Which material segment holds the largest market share, and why?

Black Annealed Wire retains the largest volume share globally due to its superior cost-effectiveness, ease of use in basic manual tying operations, and suitability for temporary or internal structural applications where corrosion resistance is not the primary requirement.

What are the main regional markets for Rebar Tie Wire consumption?

The Asia Pacific region (APAC), led by China and India, represents the largest consumer base due to vast infrastructure and housing projects. North America and Europe are key markets for high-value, corrosion-resistant and automated-tying wire products.

What is the most significant restraint affecting market profitability?

The most persistent restraint is the extreme price volatility of steel wire rod, the essential raw material. Fluctuations in steel commodity prices directly impact manufacturing margins and necessitate sophisticated hedging and inventory management strategies across the value chain.

How are environmental concerns impacting the tie wire industry?

Environmental regulations are pushing manufacturers toward sustainable material sourcing and low-VOC (Volatile Organic Compound) coatings. This includes increasing demand for PVC and epoxy-coated wires that offer extended service life, reducing the need for premature material replacement and waste.

What role does gauge (diameter) play in segment preference?

Gauge size determines the wire's tensile strength and compatibility with rebar sizes. 16 and 17 gauge wires are typically preferred for heavy construction and automated tying due to their optimal balance of strength and flexibility, while thinner gauges are often used for light-duty residential projects.

Beyond construction, what is a key niche application for rebar tie wire?

Precast concrete manufacturing is a crucial niche application. In factory settings, tie wire secures the rebar cage within molds for modular concrete elements, demanding high precision and often utilizing specialized wire types compatible with automated in-house fabrication machinery.

How does the shift to modular construction affect tie wire demand?

Modular construction often relies heavily on precast elements, which centralizes tie wire demand within manufacturing plants. This reduces on-site consumption but drives higher volume, high-precision demand from precast manufacturers who require consistent coil wire supply.

What technological advancements are key to competitive advantage?

Competitive advantages are secured through advanced coating technologies for superior corrosion resistance and the development of high-speed, precision-drawn wire optimized specifically for flawless operation in modern robotic and handheld automated tying tools.

Who are the main buyers of high-specification galvanized tie wire?

High-specification galvanized and epoxy-coated tie wires are primarily purchased by civil engineering firms and large governmental bodies for infrastructure projects exposed to harsh elements, such as bridges, marine structures, wastewater treatment plants, and coastal defenses.

What is the difference between loop tie wire and coil wire?

Loop tie wire is primarily used for manual or semi-manual twisting with a tie tool and is pre-cut with loops at the ends. Coil wire (spool wire) is a continuous roll designed specifically to feed into high-speed, battery-powered automated tying machines, maximizing speed and efficiency.

How does AI contribute to supply chain efficiency in this market?

AI utilizes machine learning to analyze historical data and current project pipelines to predict material requirements accurately, reducing inventory costs for manufacturers and minimizing delays for contractors through optimized logistics and just-in-time delivery models.

What impact do building codes have on material selection?

Increasingly stringent building codes, especially those related to seismic resistance and structural longevity, necessitate the use of higher-tensile strength and superior corrosion-resistant tie wires (galvanized, stainless steel), displacing standard black annealed wire in sensitive applications.

Which geographic region presents the highest growth rate opportunity?

While APAC is the volume leader, specific regions within the Middle East (due to mega-projects) and parts of Latin America undergoing massive infrastructure upgrades are expected to show the highest compound annual growth rates (CAGR) in the forecast period.

Is stainless steel tie wire a viable segment?

Yes, stainless steel tie wire is a niche but high-value segment, used specifically in highly corrosive environments, such as nuclear facilities, certain chemical plants, and highly critical marine infrastructure, where conventional coatings are insufficient for required longevity.

How do manufacturers ensure wire compatibility with automated tools?

Manufacturers utilize advanced drawing and annealing processes to ensure extremely tight dimensional tolerances, consistent ductility, and precision spooling. This consistency is critical for uninterrupted feeding and securing within high-speed automated tying mechanisms.

What is the role of distributors in the Rebar Tie Wire value chain?

Distributors and wholesalers serve as crucial intermediaries, managing inventory risk and providing essential last-mile delivery services to thousands of small and medium-sized contractors who require materials quickly and in manageable quantities.

What is the future outlook for the traditional black annealed wire segment?

While its market share will decline marginally due to the rise of specialized alternatives and automation, black annealed wire will maintain substantial volume demand, especially in developing economies and non-structural applications where cost remains the paramount concern.

How is the market addressing concerns regarding material waste?

Waste reduction is addressed through two strategies: utilizing AI-driven BIM analysis to calculate exact material requirements, and implementing high-efficiency automated tying systems that minimize off-cuts and broken wires compared to manual processes.

What are the key performance indicators (KPIs) for tie wire quality?

Key quality KPIs include consistent tensile strength, guaranteed minimum elongation (ductility) to prevent breakage during tying, uniform gauge diameter, and robust adhesion and uniformity of protective coatings (galvanization or epoxy).

Why is manufacturing consistency important for coil wire?

Inconsistency in coil wire density, diameter, or spooling tension can cause jamming or premature breakage in high-speed automated tying tools. Manufacturing consistency ensures operational reliability, which is a major purchasing criterion for high-volume users.

What factors influence a customer's choice between PVC coated and galvanized wire?

PVC coated wire is typically chosen when chemical resistance (e.g., acid or alkali exposure) is critical, or when color coding is desired. Galvanized wire is preferred for maximum mechanical protection and general resistance to oxidation and humidity in standard outdoor applications.

Are raw material suppliers integrated into the final product manufacturing?

Yes, significant consolidation and vertical integration exist where large steel producers (e.g., Nucor, Gerdau) operate downstream wire drawing and coating facilities to control the raw material quality, price, and supply chain reliability for the end-use market.

What is the market expectation regarding labor efficiency gains?

The primary expectation is that widespread adoption of automated rebar tying systems will yield labor efficiency gains of 3x to 5x compared to manual tying, significantly offsetting high labor costs in developed markets and accelerating overall project timelines.

How do currency fluctuations affect the Rebar Tie Wire Market?

Currency fluctuations significantly impact international trade, particularly the import of steel wire rod and the pricing of finished products, creating competitive pressure for non-vertically integrated manufacturers reliant on globally priced commodities.

What is the typical lifespan of galvanized rebar tie wire in construction?

Standard galvanized wire is designed to last the typical duration of the concrete curing process and construction phase. In protected internal applications, it offers decades of service life, but its primary function is temporary securement until the concrete sets, ensuring rebar positioning.

Does the residential sector prefer direct or indirect procurement channels?

The residential sector, dominated by smaller contractors, heavily utilizes indirect channels such as hardware stores and regional construction material wholesalers for convenient, smaller-volume purchases of standard tie wire products.

What are the implications of digital transformation for distributors?

Digital transformation requires distributors to invest in e-commerce platforms and sophisticated inventory tracking systems to meet customer expectations for quick online ordering, precise tracking, and reliable, expedited delivery schedules.

How is competition managed between global manufacturers and regional players?

Global manufacturers often compete on bulk scale, technological sophistication (e.g., coating quality), and comprehensive supply chain reliability. Regional players compete effectively by focusing on specialized local product requirements, faster lead times, and aggressive local pricing strategies for standard products.

What are the key technical challenges in producing high-quality coil wire?

The main technical challenges include achieving perfectly uniform annealing for optimal ductility, precision winding the coil under controlled tension to prevent tangling (birds-nesting), and ensuring the gauge remains consistent throughout the entire spool length.

Is there a trend toward thicker or thinner tie wire gauges?

There is a bifurcated trend: some cost-sensitive markets are optimizing toward thinner, higher-tensile gauges (e.g., 20G) for manual applications, while automated tying technology drives preference for robust, reliable middle gauges (16G, 17G) that minimize machine jams.

How do fluctuating energy costs influence the market?

Energy costs are substantial in the wire drawing and annealing processes. High energy prices directly increase the cost of goods sold for manufacturers, often leading to price increases passed on to the construction industry, impacting overall market stability.

What influence does Building Information Modeling (BIM) have on material sales?

BIM integration provides precise material quantification early in the design phase. This ensures contractors purchase exactly the right type and quantity of tie wire, reducing uncertainty for suppliers but increasing pressure for customized, just-in-time delivery.

What is the growth forecast for the Precast Concrete application segment?

The precast segment is forecasted to experience above-average growth, driven by the increasing global adoption of modular and prefabricated construction techniques, which rely heavily on controlled factory environments for rebar cage assembly and subsequent tying.

How important is the tensile strength specification for different applications?

Tensile strength is critically important; higher strength is required for securing heavy, large-diameter rebar used in massive infrastructure projects. Lower tensile strength wire is acceptable for lighter residential meshes, provided the ductility is sufficient for manual twisting.

What safety concerns are driving the shift toward automated tying?

Automated tying reduces physical strain on workers (reducing wrist and back injuries associated with manual twisting) and accelerates the process, minimizing worker exposure time in active construction zones, thereby enhancing overall site safety compliance.

How does the quality of steel wire rod affect the final product?

The initial quality and chemical composition of the high-carbon steel wire rod determine the final product's ductility, cleanability for coating adhesion, and ultimate tensile capacity after the drawing and annealing processes are complete.

What strategic move are companies taking to mitigate steel price risk?

Companies are adopting forward purchasing contracts, establishing long-term agreements with raw material suppliers, and increasing vertical integration to own key parts of the steel processing cycle, providing a buffer against immediate price spikes.

In the US, what regulations heavily influence tie wire standards?

Standards set by organizations like the American Society for Testing and Materials (ASTM) and local building codes (e.g., IBC) heavily dictate the required corrosion resistance, gauge, and quality certifications necessary for structural tie wire materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager