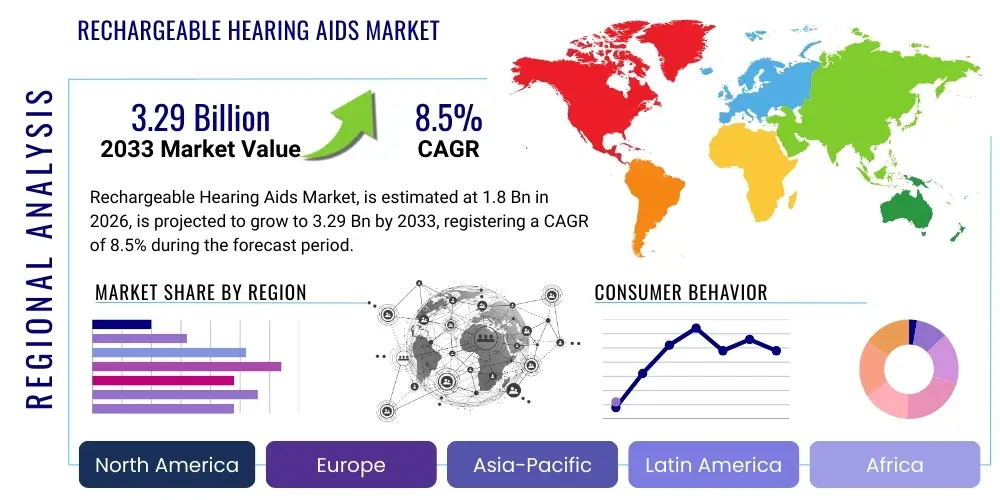

Rechargeable Hearing Aids Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442021 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Rechargeable Hearing Aids Market Size

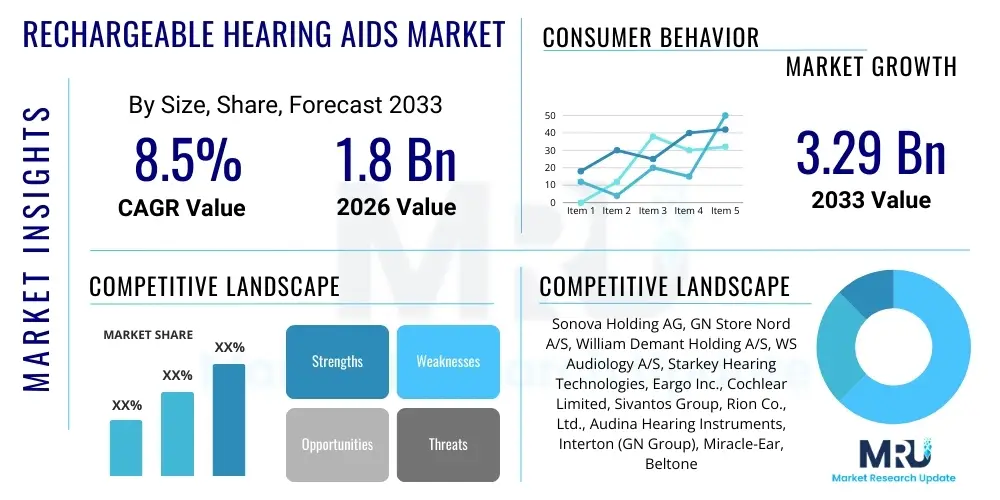

The Rechargeable Hearing Aids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.29 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global aging demographic, heightened consumer preference for convenience and sustainable technology solutions, and continuous advancements in lithium-ion battery technology optimized for miniaturized medical devices. The shift away from traditional disposable batteries minimizes maintenance inconvenience for end-users, thereby accelerating adoption rates globally, particularly in developed healthcare economies where technological integration is standardized.

Rechargeable Hearing Aids Market introduction

The Rechargeable Hearing Aids Market encompasses sophisticated electronic medical devices designed to improve hearing by converting sound waves into electrical signals, amplifying them, and delivering them to the ear, characterized fundamentally by their integrated, non-replaceable, rechargeable power source, typically utilizing lithium-ion technology. These products represent a significant evolution from traditional hearing aids, eliminating the recurring cost and physical difficulty associated with replacing zinc-air batteries. Major applications include addressing sensorineural hearing loss, conductive hearing loss, and mixed hearing loss across mild, moderate, severe, and profound categories, primarily targeting the burgeoning geriatric population globally. Key benefits revolve around enhanced user convenience, environmental sustainability dueility, and consistent performance levels compared to disposable alternatives, which often decline in efficacy as the battery depletes. Driving factors fueling market momentum include the rising prevalence of hearing impairment globally, technological miniaturization allowing for more discreet and powerful devices, supportive government initiatives promoting hearing health, and the introduction of over-the-counter (OTC) regulatory pathways in key regions, expanding consumer access significantly.

The product description spans across various form factors, including Receiver-in-the-Canal (RIC), which currently dominates due to its balance of discretion and power; Behind-the-Ear (BTE), known for robust power suitable for severe hearing loss; and smaller, custom-fit options like In-the-Ear (ITE) and Completely-in-the-Canal (CIC). These devices increasingly feature advanced digital signal processing (DSP) chips, Bluetooth connectivity for streaming and remote adjustments, and integration with smartphone applications. The market's growth trajectory is inextricably linked to advancements in energy efficiency, allowing smaller battery units to sustain high-demand features like wireless streaming and complex noise reduction algorithms for extended periods, meeting the daily usage demands of consumers without requiring midday recharging. Furthermore, the market is benefiting from increased public awareness campaigns and reduced social stigma associated with wearing hearing assistance devices, transforming them into wearable health technology.

The technological synergy between hearing aid manufacturers and battery providers has created a high-value ecosystem focused on miniaturization and efficiency. This shift has not only improved the user experience but also facilitated the incorporation of sophisticated features previously constrained by power requirements. The ability to charge devices overnight, similar to smartphones, simplifies the daily routine for users, particularly those with dexterity issues. Moreover, the long-term cost savings, despite a higher initial purchase price, appeal to a growing segment of the population concerned with total cost of ownership. The market is also experiencing disruptive forces from non-traditional players focusing on direct-to-consumer models, leveraging the rechargeable platform to offer affordable, high-quality alternatives, thus democratizing access to hearing health solutions and driving overall market penetration.

Rechargeable Hearing Aids Market Executive Summary

The Rechargeable Hearing Aids Market is characterized by robust growth, driven primarily by favorable demographic trends and aggressive technological innovation focused on digital health integration and user experience. Business trends indicate a strong move towards consolidation among major manufacturers, simultaneous investment in R&D to enhance AI-driven sound processing, and a strategic pivot towards leveraging e-commerce and direct-to-consumer channels, particularly following regulatory changes supporting the Over-The-Counter (OTC) category. This shift is lowering barriers to entry and fundamentally altering traditional distribution models reliant exclusively on audiology clinics. Regionally, North America and Europe maintain dominance due to established healthcare infrastructure, high consumer purchasing power, and high penetration rates of advanced digital hearing aids, while the Asia Pacific region is emerging as the fastest-growing market, propelled by rapidly increasing geriatric populations, improving healthcare spending, and heightened awareness initiatives in populous nations like China and India. Segment trends reveal that the Receiver-in-the-Canal (RIC) product type commands the largest market share due to its aesthetic appeal and technological capacity, while the digital technology segment is universally adopted, offering superior sound quality and advanced features like directional microphones and adaptive noise reduction. Distribution through audiology clinics remains the primary revenue channel, although the E-commerce segment is showing exponential growth, positioning itself as a major disruption force.

Furthermore, the executive overview highlights the critical role of battery longevity and fast-charging capabilities as competitive differentiators, pushing manufacturers to continuously improve lithium-ion cell density and charging infrastructure. Sustainability is becoming a key purchase criterion, with rechargeable devices aligning strongly with environmental responsibility goals, appealing to younger demographics and institutional buyers. Financial metrics across the industry reflect healthy profit margins, supported by the high-value proposition of convenience and advanced features. Strategic alliances between traditional hearing aid companies and tech firms specializing in computational audio and battery management are becoming increasingly common, aiming to integrate superior noise filtering and connectivity standards seamlessly. The market trajectory is further influenced by reimbursement policies; although rechargeable devices typically carry a premium, increasing coverage and favorable government schemes in developed economies are ensuring broader accessibility, particularly for vulnerable populations facing mobility constraints or dexterity challenges.

In terms of competitive intensity, the market remains highly consolidated among the "Big Five" manufacturers, who control the majority of patented technology and distribution networks. However, innovation from startups focusing on lower-cost, high-tech alternatives, often leveraging smartphone-based audiometry and self-fitting capabilities, is putting pricing pressure on the mid-to-low tier segments. The future growth narrative will be dominated by the successful deployment of deep learning algorithms for real-time acoustic scene analysis, leading to hearing aids that adapt almost instantaneously to complex sound environments, making the listening experience more natural and less fatiguing for the user. Regional growth disparities will narrow as APAC and Latin American markets mature, driven by increased government investment in public health infrastructure and rising disposable incomes, suggesting a global shift in manufacturing and consumer focus over the forecast period. Understanding the interplay between regulatory landscapes, particularly the rollout of OTC guidelines, and technological readiness will be crucial for strategic market positioning.

AI Impact Analysis on Rechargeable Hearing Aids Market

User queries regarding the impact of Artificial Intelligence (AI) on the Rechargeable Hearing Aids Market overwhelmingly center on three core themes: enhanced sound personalization and clarity, the future of remote fitting and telehealth capabilities, and concerns surrounding data privacy and security. Users are keen to understand how AI algorithms, specifically deep learning and machine learning, can move beyond traditional digital signal processing (DSP) to offer true real-time, context-aware acoustic scene classification, thereby significantly reducing listening effort and combating auditory fatigue, particularly in challenging environments like crowded restaurants. Expectations are high for personalized sound profiles that adapt dynamically based on learned user preferences and environment signatures. Additionally, there is intense interest in how AI facilitates remote professional services, allowing for sophisticated calibration and adjustments without in-person clinic visits. Concerns are primarily focused on the ethical use and transmission of sensitive acoustic and biometric data collected by these sophisticated devices, alongside the perceived high cost associated with integrating such advanced computational power, especially in devices that require long battery life.

- AI algorithms enable advanced acoustic scene classification, automatically distinguishing and prioritizing speech over background noise (Computational Auditory Scene Analysis).

- Machine Learning facilitates personalized amplification profiles that learn individual hearing needs and environmental preferences over time, optimizing sound delivery.

- Deep Neural Networks (DNNs) are being integrated into chips to process sound more naturally and rapidly, improving clarity and reducing cognitive load for the user.

- AI-driven telehealth platforms allow for precise remote fine-tuning and diagnostics, significantly reducing the necessity for physical clinic appointments.

- Predictive maintenance and self-diagnostic features, powered by AI, enhance device reliability and lifespan by flagging potential issues proactively.

- AI is crucial for enhancing battery efficiency by intelligently managing power consumption based on real-time activity and environmental demands.

- The development of self-fitting or OTC rechargeable hearing aids is heavily reliant on AI to automate the initial audiometric testing and calibration processes accurately.

DRO & Impact Forces Of Rechargeable Hearing Aids Market

The Rechargeable Hearing Aids Market dynamic is defined by the synergistic interplay of compelling drivers, persistent restraints, disruptive opportunities, and powerful external impact forces. A primary driver is the undeniable consumer preference for convenience and sustainability, underpinned by the rapidly expanding global population of individuals aged 65 and over who disproportionately experience hearing loss and often face dexterity challenges when manipulating small disposable batteries. The restraint matrix is dominated by the high initial acquisition cost of advanced rechargeable models compared to standard battery-operated devices, coupled with complex regulatory approval pathways in emerging markets, which slow down market entry and product diffusion. Significant opportunities are emerging from the integration of telehealth services and remote fitting capabilities, enabled by robust connectivity and AI, alongside the major market expansion offered by the regulatory approval of the Over-The-Counter (OTC) hearing aid category in jurisdictions like the US. These dynamics are further shaped by impact forces such as stringent medical device regulations ensuring safety and efficacy, intense competitive pressure leading to rapid technological obsolescence, and the macroeconomic influence of healthcare expenditure trends and insurance reimbursement policies.

Drivers are strongly influenced by advancements in battery chemistry, specifically high-density lithium-ion cells tailored for medical implants, offering longer wear times and shorter charging cycles, thus removing a key historical barrier to adoption. Furthermore, the increasing integration of hearing aids as general health monitoring devices (e.g., tracking steps, heart rate) leverages the rechargeable power platform, elevating their value proposition beyond mere amplification. However, restraints include the potential lifespan limitation of the integrated rechargeable battery, which, unlike traditional devices, necessitates professional replacement or device exchange after several years, adding to the long-term maintenance cost perception among consumers. Additionally, the need for specialized charging infrastructure poses a minor inconvenience, particularly during travel. Overcoming these restraints requires manufacturers to focus on modular design and transparent battery warranty policies to build consumer confidence.

The opportunistic landscape is vast, particularly in leveraging the digital health ecosystem. The development of direct-to-consumer rechargeable models bypasses the traditional, often costly, clinic-centric distribution model, opening up vast untapped segments of consumers with mild-to- moderate hearing loss who were previously reluctant to seek professional help due to cost or stigma. The most potent impact forces include rapid intellectual property evolution and patent expiration cycles, which dictate the market entry of generic or highly similar products, leading to accelerated price erosion in mature technology segments. Furthermore, global supply chain volatility, particularly concerning critical components like microprocessors and specialized battery cells, acts as a continuous operational force that manufacturers must mitigate through strategic sourcing and diversification. The market equilibrium is perpetually shifting based on how effectively industry players can capitalize on OTC opportunities while managing the complexity and high investment required for continuous AI and power efficiency R&D.

Segmentation Analysis

The Rechargeable Hearing Aids Market is meticulously segmented based on Product Type, Technology, Distribution Channel, and End-User, each segment exhibiting unique growth trajectories and competitive dynamics. Product segmentation is crucial, differentiating between form factors that cater to varying degrees of hearing loss, aesthetic preferences, and lifestyle needs, with the RIC category leading due to its versatility and discretion. Technology segregation reinforces the market’s digital revolution, confirming the near-universal adoption of advanced digital processing over outdated analog systems, which enables sophisticated sound management features essential for consumer satisfaction. The distribution channel analysis provides insight into market access strategies, highlighting the sustained importance of professional audiology clinics for complex fittings while underscoring the disruptive potential of e-commerce and retail channels, particularly in the emerging OTC category. End-user segmentation validates the market's primary focus on the adult and geriatric population, though pediatric applications are growing, necessitating robust and durable rechargeable devices.

The dominance of the digital technology segment is not merely about amplification but about leveraging computational power to offer features such as binaural processing, tinnitus masking, and automated environmental adaption, all of which require consistent, high-power delivery that rechargeable batteries provide effectively. Geographically, segmentation reveals significant disparities in market maturity and penetration rates; North America leads in adopting premium, high-feature rechargeable devices, whereas Asian markets show higher volume growth potential in mid-range offerings. Strategic manufacturers are tailoring their product portfolios to address these segmented demands, focusing on high-end customization for clinical channels and standardized, self-fitting simplicity for direct-to-consumer distribution models, ensuring maximum market coverage and efficient resource allocation across the diverse global landscape. The analysis of these segments is vital for understanding competitive positioning and identifying granular growth pockets.

- Product Type:

- Receiver-in-the-Canal (RIC)

- Behind-the-Ear (BTE)

- In-the-Ear (ITE)

- Completely-in-the-Canal (CIC) and Invisible-in-the-Canal (IIC)

- Technology:

- Digital Hearing Aids

- Analog Hearing Aids (Minimal Share)

- Distribution Channel:

- Audiology Clinics/Hospitals

- Retail Stores (e.g., Costco, Walmart)

- E-commerce and Online Direct Sales

- End-User:

- Adult Population (60+ yrs)

- Working Adult Population (18-59 yrs)

- Pediatric Population

Value Chain Analysis For Rechargeable Hearing Aids Market

The value chain of the Rechargeable Hearing Aids Market is characterized by high technological specialization and structured distribution channels, starting from highly specialized upstream component manufacturing, moving through complex assembly and programming, and concluding with critical downstream clinical fitting and after-sales service. Upstream analysis highlights the dependence on a concentrated group of suppliers providing critical components: custom digital signal processing (DSP) microchips, miniature microphones and receivers (speakers), high-density lithium-ion battery cells optimized for medical use, and sophisticated wireless communication modules (Bluetooth LE). Innovation at this stage is focused on component miniaturization and energy efficiency. The core manufacturing phase involves precision assembly, rigorous quality control, and the integration of proprietary software algorithms, resulting in the final medical device. This stage requires significant capital investment and highly skilled technical personnel, often concentrated within the "Big Five" global players.

The downstream analysis focuses heavily on the market access and distribution strategy. Traditionally, the primary distribution channel has been indirect, leveraging independent or branded audiology clinics and licensed hearing healthcare professionals. These professionals are crucial for conducting comprehensive hearing assessments, precisely fitting and programming the devices (crucial for complex digital instruments), and providing long-term support and maintenance. This model ensures optimal patient outcomes but contributes significantly to the final device cost. However, the rise of e-commerce and retail distribution (Direct Channel) is disrupting this structure, particularly for entry-level and OTC rechargeable models. These direct channels reduce intermediary costs but rely heavily on consumer self-testing and self-fitting capabilities, often facilitated by smartphone apps and AI-driven remote adjustment tools. The choice of channel reflects the complexity of the product and the target customer demographic.

The final element of the value chain involves service and support, which is paramount given the nature of hearing health. This includes warranties, professional repairs, software updates, and battery replacement services. The integrated, non-removable battery in rechargeable models means that end-of-life battery replacement is typically a high-level service provided by the manufacturer or authorized clinic, contributing to customer lock-in and long-term revenue streams. Effective management of the distribution channel, balancing the necessity of clinical expertise with the cost efficiency of direct-to-consumer models, is the critical strategic imperative for market leaders. Furthermore, strong relationships with upstream suppliers are essential to mitigate risks associated with the highly specialized and globally constrained supply chain for advanced microelectronics and custom battery solutions.

Rechargeable Hearing Aids Market Potential Customers

The primary potential customers and end-users of rechargeable hearing aids are individuals experiencing hearing impairment, dominated significantly by the global adult and geriatric population (60 years and older). This demographic segment accounts for the vast majority of hearing loss cases, and their preference for rechargeable technology is high due to the convenience it offers, mitigating challenges related to fine motor skills required to handle tiny disposable batteries. Beyond this core segment, potential customers include working adults (18-59 years) seeking discreet, high-tech devices that seamlessly integrate with modern professional and personal lives, valuing Bluetooth streaming capabilities and connectivity to smartphones. This younger cohort often has mild-to-moderate hearing loss and is highly receptive to the self-fitting, direct-to-consumer rechargeable models emerging in the market.

A growing, though smaller, segment comprises the pediatric population. While children's hearing aids historically prioritized robust design and replaceable batteries for continuous power security, advanced rechargeable BTE models are gaining traction due to improved safety features, durability, and the environmental benefits of avoiding disposable battery waste in schools and homes. Furthermore, institutions such as nursing homes and assisted living facilities represent significant organizational buyers, as rechargeable devices simplify inventory management, reduce operational costs associated with bulk purchasing of disposable batteries, and streamline staff tasks related to device maintenance and use for multiple residents. The introduction of OTC models is also creating a new class of potential customers—the proactive, tech-savvy individual with perceived or initial hearing decline who is exploring solutions outside the traditional medical route, drawn by the ease of purchase and the technological appeal of rechargeability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.29 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sonova Holding AG, GN Store Nord A/S, William Demant Holding A/S, WS Audiology A/S, Starkey Hearing Technologies, Eargo Inc., Cochlear Limited, Sivantos Group, Rion Co., Ltd., Audina Hearing Instruments, Interton (GN Group), Miracle-Ear, Beltone (GN Group), Unitron (Sonova), Phonak (Sonova), Oticon (Demant), Siemens Healthineers, ReSound (GN Group), Listen Technologies, Zound Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rechargeable Hearing Aids Market Key Technology Landscape

The technological landscape of the Rechargeable Hearing Aids Market is defined by three converging innovation streams: advanced power management, sophisticated digital signal processing (DSP), and seamless wireless connectivity, all optimized for miniaturization. The cornerstone is the lithium-ion rechargeable battery technology, which has evolved to offer higher energy density, faster charging times (often providing a full day's use in under 3 hours), and longer overall operational lifecycles (typically 4–5 years before replacement). This efficiency is critical as modern hearing aids demand substantial power to run complex features like advanced AI algorithms and continuous Bluetooth streaming. Manufacturers are also exploring inductive charging and specialized contact charging solutions to enhance user safety and simplify the charging ritual, often integrating the charger case as a portable power bank.

In terms of signal processing, the transition to smaller, more powerful System-on-a-Chip (SoC) platforms is fundamental. These chips support multi-core processing, enabling complex functions such as adaptive directional microphones, acoustic feedback cancellation, and real-time noise reduction using deep neural network architectures. This computational power ensures the hearing aid can analyze the acoustic environment hundreds of times per second, distinguishing between speech, music, and various types of noise. Furthermore, the integration of Bluetooth Low Energy (LE) Audio is rapidly becoming standard, allowing for robust, low-latency, and power-efficient audio streaming from smartphones, televisions, and public assistive listening systems directly to the rechargeable devices, significantly enhancing the user's communication and entertainment experience without compromising battery life.

Another pivotal technology is Telehealth and Remote Adjustment software. These cloud-based platforms leverage AI and high-speed encryption to allow audiologists to remotely fine-tune a patient's rechargeable hearing aids, gathering real-world usage data and making adjustments based on user feedback via a proprietary smartphone application. This technology is vital for the success of both clinical and OTC models, providing professional support regardless of geographical barriers. The future of this landscape involves further integration of biometric sensors (e.g., fall detection, heart rate monitoring) into the rechargeable platform, transforming hearing aids into multi-functional health wearables that rely on consistent, reliable power, further cementing the necessity of rechargeable solutions over disposable batteries.

Regional Highlights

The global Rechargeable Hearing Aids Market demonstrates significant regional variation in terms of maturity, penetration rates, regulatory influence, and growth potential. North America (NA) currently leads the market in terms of revenue and early adoption of premium, high-feature rechargeable devices. This dominance is attributed to a high prevalence of hearing loss, sophisticated healthcare infrastructure, favorable private insurance coverage for advanced devices, and high consumer awareness and purchasing power. Crucially, the US market is undergoing a major transformation with the implementation of the FDA’s Over-The-Counter (OTC) regulatory pathway, which is expected to catalyze exponential growth in the direct-to-consumer rechargeable segment over the forecast period. Canada also maintains strong growth driven by technological acceptance and governmental hearing health programs. The region is a key hub for R&D, focusing heavily on AI integration, telehealth capabilities, and seamless connectivity, positioning it at the forefront of market innovation and value.

Europe constitutes the second-largest market, characterized by strong governmental support for hearing health and extensive public reimbursement systems in countries like Germany, the UK, and Scandinavian nations. This region exhibits high penetration rates, often focused on providing reliable, high-quality rechargeable digital hearing aids through subsidized schemes. The market is highly mature, with consumers demanding devices that offer aesthetic appeal and long battery life to match active lifestyles. Regulatory frameworks, particularly the stringent CE marking requirements, ensure high product quality and safety standards. Western European nations, in particular, show a preference for RIC and ITE rechargeable models, reflecting a demand for discreet solutions. Economic stability and a rapidly aging population guarantee steady, sustained growth throughout the forecast period, emphasizing quality of service and accessibility.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by the sheer volume of its aging population in countries like China, Japan, and India, coupled with rapid urbanization and improving disposable incomes. While penetration rates have historically been lower compared to NA and Europe, increasing awareness, coupled with improving healthcare infrastructure and government initiatives aimed at promoting hearing health (e.g., subsidized programs in China), are accelerating adoption. The APAC market is characterized by a high demand for cost-effective, durable rechargeable BTE models initially, although RIC adoption is quickly catching up in urban centers. Local manufacturing capabilities are also developing rapidly, leading to competitive pricing structures that democratize access to rechargeable technology. Furthermore, Latin America and the Middle East & Africa (MEA) are emerging markets experiencing foundational growth, primarily concentrated in urban economic centers, driven by private healthcare investment and rising public health campaigns targeting undiagnosed hearing loss.

- North America (NA): Market leader by revenue; high adoption of premium, AI-integrated rechargeable devices; exponential growth expected from the OTC segment; strong focus on telehealth integration.

- Europe: High penetration rates driven by robust public reimbursement systems; strong demand for discreet RIC devices; regulatory focus on high safety standards and quality of service.

- Asia Pacific (APAC): Fastest-growing market by volume; driven by massive aging populations and improving healthcare spending; increasing local manufacturing and demand for cost-effective models.

- Latin America (LATAM) & MEA: Nascent markets showing growth, concentrated in major economies (Brazil, Mexico, UAE, South Africa); growth tied to expansion of private healthcare infrastructure and increasing awareness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rechargeable Hearing Aids Market.- Sonova Holding AG

- GN Store Nord A/S

- William Demant Holding A/S

- WS Audiology A/S

- Starkey Hearing Technologies

- Eargo Inc.

- Cochlear Limited

- Sivantos Group (now part of WS Audiology)

- Rion Co., Ltd.

- Audina Hearing Instruments

- Interton (GN Group)

- Miracle-Ear

- Beltone (GN Group)

- Unitron (Sonova)

- Phonak (Sonova)

- Oticon (Demant)

- Siemens Healthineers (now largely integrated into WS Audiology)

- ReSound (GN Group)

- Listen Technologies

- Zound Industries

Frequently Asked Questions

Analyze common user questions about the Rechargeable Hearing Aids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical battery life and overall lifespan of rechargeable hearing aids?

Most modern rechargeable hearing aids provide 20 to 30 hours of continuous use on a single full charge, allowing for a full day's wear, even with extensive streaming. The internal lithium-ion battery typically lasts 4 to 5 years before requiring professional replacement or device upgrade, a factor considered acceptable by most users.

Are rechargeable hearing aids more expensive than traditional models?

The initial purchase price of rechargeable models is generally higher due to the integrated advanced battery technology, specialized charging units, and the complex internal power management systems. However, the higher initial cost is often offset by the elimination of recurring expenditures on disposable batteries and enhanced convenience over the device's lifespan.

How do the new OTC rechargeable hearing aids compare to prescription models?

OTC rechargeable hearing aids are generally intended for adults with perceived mild-to-moderate hearing loss, focusing on simplicity and self-fitting via user-friendly apps. Prescription models, conversely, offer customized fitting by an audiologist, are designed for all levels of loss (including severe), and provide more powerful processing, connectivity, and complex features, justifying the premium pricing and clinical support.

What are the primary benefits of using rechargeable hearing aids?

The key benefits include superior convenience by eliminating the need to frequently change tiny disposable batteries, better environmental sustainability through reduced battery waste, enhanced dexterity for older users, and consistent, high-performance power delivery necessary to run modern advanced features like wireless streaming and AI noise reduction.

Is it safe to wear rechargeable hearing aids while sleeping or in the shower?

Rechargeable hearing aids should always be removed before sleeping and showering. While many are rated IP68 (highly water-resistant), they are not designed to be submerged. They should be placed in their charging station overnight, which is also an ideal time for necessary drying and maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager