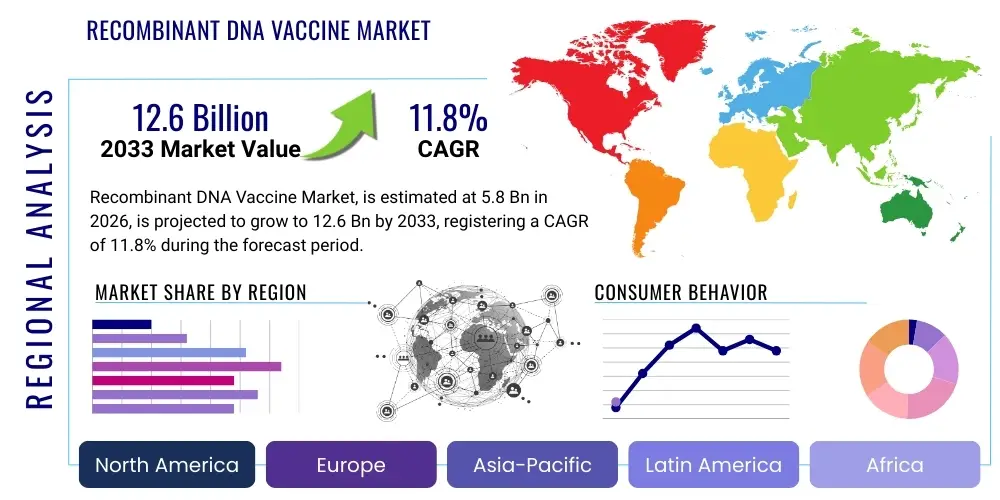

Recombinant DNA Vaccine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442248 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Recombinant DNA Vaccine Market Size

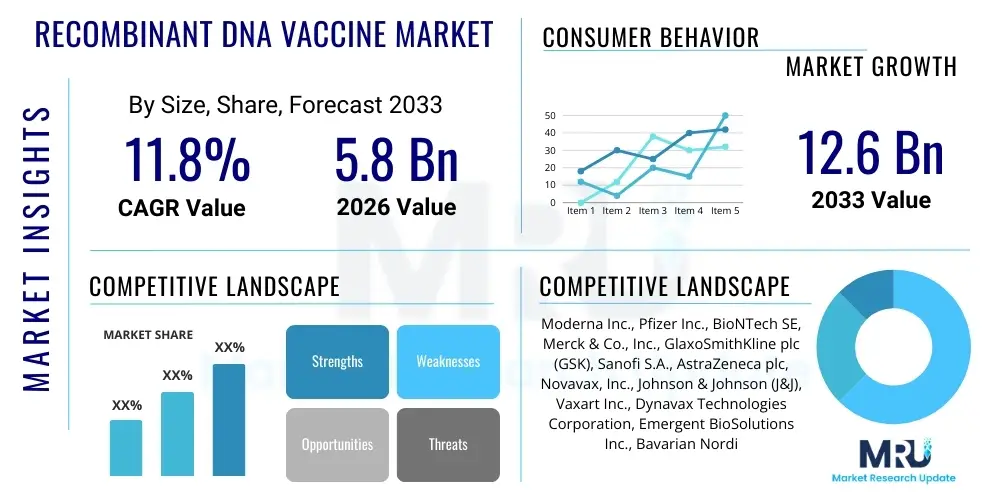

The Recombinant DNA Vaccine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Recombinant DNA Vaccine Market introduction

The Recombinant DNA Vaccine Market encompasses therapeutic and prophylactic products developed using genetic engineering techniques to generate an immune response against specific antigens. These vaccines are highly advanced biological entities that utilize the cellular machinery of the host to produce the immunizing antigen, leading to robust and durable immunity. Unlike traditional vaccines that use attenuated or inactivated pathogens, recombinant vaccines are characterized by their high safety profile, purity, and the ability to selectively target immune responses, minimizing side effects associated with whole-pathogen approaches. Key product types include subunit vaccines, DNA vaccines, and viral vector vaccines, each leveraging distinct mechanisms for antigen delivery and presentation. The market's foundational technology is the manipulation of genetic material to isolate, clone, and express specific genes encoding target antigens.

Major applications of recombinant DNA vaccines span a wide range of human and animal health challenges, predominantly focusing on infectious diseases such as influenza, Hepatitis B, HPV, and emerging pathogens like SARS-CoV-2. Furthermore, the technology is increasingly pivotal in developing specialized vaccines for non-infectious conditions, particularly therapeutic cancer vaccines and vaccines targeting chronic diseases. The primary benefits driving market adoption include enhanced specificity, the capacity for rapid design and manufacturing scale-up, especially critical during pandemics, and improved stability compared to conventional biological products. This flexibility in design allows for multi-antigen targeting and precise optimization of immune stimulation, positioning them as essential tools in modern public health strategies globally. The inherent potential for needle-free delivery systems and thermostability further enhances their logistical appeal.

Driving factors propelling market growth are fundamentally linked to the escalating global burden of infectious diseases, including resistance emergence and zoonotic spillover events, alongside significant advancements in molecular biology and gene expression systems. Substantial private and public funding dedicated to pandemic preparedness and the development of next-generation vaccination platforms accelerate innovation. Regulatory agencies are streamlining approval pathways for platform technologies, fostering faster market entry. Moreover, successful clinical outcomes demonstrated by recently approved recombinant products, particularly in the context of global health crises, have solidified investor and consumer confidence. The synergistic interplay between reduced production costs through optimized bioprocessing and increased demand for personalized medicine approaches further reinforces the upward trajectory of this specialized pharmaceutical sector.

- Product Description: Vaccines produced via genetic engineering, inserting gene sequences encoding specific antigens into host expression systems (bacteria, yeast, or mammalian cells) to elicit targeted immune responses.

- Major Applications: Prophylactic vaccines for infectious diseases (e.g., HBV, HPV, COVID-19, Influenza), and therapeutic vaccines for oncology (cancer) and chronic conditions.

- Key Benefits: High safety profile, precise antigen selection, rapid development cycles, scalability of production, and potential for targeted immunological responses (e.g., T-cell and B-cell mediated immunity).

- Driving Factors: Rising prevalence of chronic and infectious diseases, rapid technological advancements in genetic sequencing and synthetic biology, and increased public health investment in advanced vaccination platforms.

Recombinant DNA Vaccine Market Executive Summary

The Recombinant DNA Vaccine Market is experiencing robust expansion driven by unprecedented technological breakthroughs in gene delivery mechanisms, notably the refinement of viral vector and nucleic acid platforms. Business trends indicate a strong shift towards public-private partnerships, accelerating research and development efforts, particularly in response to globally prioritized disease targets and unmet medical needs in oncology. Companies are focusing on optimizing cold chain requirements and improving thermostability to enhance global distribution accessibility, especially in resource-constrained settings. Investment is heavily concentrated in optimizing manufacturing scalability using advanced bioreactor technology and continuous bioprocessing, aiming to reduce the cost of goods and improve supply reliability. Furthermore, strategic mergers and acquisitions centered around niche delivery technologies and intellectual property portfolios are shaping the competitive landscape, prioritizing innovation over sheer volume capacity in the short term.

Regional trends highlight North America and Europe maintaining dominance, primarily due to established pharmaceutical infrastructure, high expenditure on R&D, and supportive regulatory frameworks that facilitate early commercialization of novel vaccine technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, fueled by increasing government initiatives to combat endemic infectious diseases, expanding healthcare access, and the rise of domestic bio-pharmaceutical manufacturing capabilities in countries like China, India, and South Korea. Latin America and the Middle East & Africa (MEA) are also emerging as significant consumers, driven by partnerships with global health organizations and the necessity to secure stable supplies of highly efficacious, next-generation vaccines for widespread immunization campaigns. The regional variation in regulatory speed and intellectual property protection continues to influence market entry strategies and investment location decisions by multinational corporations.

Segment trends reveal that the infectious disease application segment holds the largest market share, profoundly influenced by the success of COVID-19 vaccines which validated the speed and efficacy of recombinant and nucleic acid platforms. Within product type, viral vector vaccines and protein subunit vaccines continue to command substantial revenue, but DNA vaccines and newer mRNA-based modalities (often closely related in their genetic approach) are expected to witness accelerated adoption due to their superior potential for rapid prototyping and manufacturing flexibility. End-user analysis shows that government agencies and public health programs remain the largest purchasing segment due to mass immunization requirements, though specialized oncology clinics and research institutions are increasing their expenditure on custom therapeutic recombinant candidates. The long-term segmentation growth trajectory is heavily favoring platform technologies that offer rapid plug-and-play capability for responding to emerging biological threats.

AI Impact Analysis on Recombinant DNA Vaccine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Recombinant DNA Vaccine market frequently center on three critical themes: speed, specificity, and safety optimization. Users seek to understand how AI algorithms can drastically reduce the time required for target identification and antigen design, moving beyond traditional wet-lab experimentation. Concerns often revolve around whether AI-driven design can predict immunogenicity more accurately, thereby improving vaccine specificity and reducing off-target effects. Furthermore, there is significant interest in AI’s role in optimizing clinical trial design, stratifying patient populations for maximum efficacy, and streamlining complex manufacturing processes to ensure quality control and scalability. The consensus expectation is that AI will function as a powerful accelerator, compressing the entire vaccine development lifecycle from initial discovery to commercial production, profoundly transforming the competitive landscape by rewarding companies adept at integrating sophisticated computational biology tools.

AI’s influence begins at the foundational stages of vaccine development, primarily through computational genomics and proteomics. Machine learning models analyze vast datasets of pathogen genetic sequences, host immune responses, and known epitope structures to identify the most potent and conserved antigens suitable for recombinant expression. This predictive capability dramatically reduces the number of candidate molecules that need to be synthesized and tested, effectively de-risking the early pipeline. By simulating millions of potential molecular interactions, AI can design genetically optimized constructs for higher expression yield in host cells and enhanced stability, addressing traditional bottlenecks in bioprocess development. The utilization of deep learning in structural biology enables precise modeling of antigen presentation to T-cells and B-cells, leading to the design of vaccines that elicit superior, multi-faceted immune protection.

Beyond discovery, AI is essential in optimizing manufacturing yield and maintaining stringent quality standards, which are paramount for complex biological products like recombinant vaccines. Predictive modeling is employed to fine-tune fermentation parameters, harvest timing, and purification protocols, minimizing batch variation and maximizing output efficiency. In the clinical phase, AI aids in real-time monitoring of adverse events, analyzing complex immunological data from trial participants, and creating synthetic control arms or optimizing adaptive trial designs. This integration ensures not only a faster transition from lab to clinic but also enhances the safety and regulatory compliance of the final product. Ultimately, AI systems enable a degree of precision and speed previously unattainable, solidifying its role as an indispensable tool for sustaining the future growth and innovation pipeline of the recombinant DNA vaccine industry.

- Accelerated Target Identification: AI analyzes pathogen genomes and host immune signatures to rapidly identify optimal epitopes and conserved antigens for vaccine construction.

- Optimized Antigen Design: Machine learning predicts protein folding, stability, and immunogenicity, facilitating the design of highly effective genetic constructs.

- Enhanced Manufacturing Efficiency: Predictive algorithms optimize bioreactor conditions, fermentation yields, and purification steps, improving scalability and reducing production costs.

- Streamlined Clinical Trials: AI assists in patient stratification, real-time safety monitoring, and data analysis, accelerating regulatory submission timelines.

- Improved Safety Profile: Computational models predict potential cross-reactivity or off-target effects, contributing to a safer and more specific final vaccine product.

DRO & Impact Forces Of Recombinant DNA Vaccine Market

The Recombinant DNA Vaccine Market is fundamentally shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and potent external impact forces. The primary driver is the pervasive need for rapid response capabilities against infectious disease outbreaks and pandemics, coupled with the increasing recognition of recombinant technology’s superiority in achieving this speed and scale. This is amplified by sustained global health investment and mandatory immunization programs in many nations. Conversely, significant restraints include the complex regulatory pathways required for novel biological entities, high initial capital investment for advanced manufacturing facilities (particularly for viral vectors), and public hesitancy or misinformation regarding genetically engineered medical products, which necessitates substantial public education efforts to maintain immunization uptake rates. The reliance on sophisticated cold chain logistics for many current platforms further limits widespread deployment in developing markets, though newer thermostable formulations are mitigating this challenge.

Opportunities for market expansion are vast, largely centered around the untapped potential of therapeutic vaccines, especially those targeting chronic diseases like cancer and autoimmune disorders, where conventional treatments often fall short. Advances in personalized medicine, utilizing recombinant platforms to tailor vaccines based on individual genetic profiles (e.g., neoantigen cancer vaccines), offer a high-value growth niche. Additionally, the development of multivalent vaccines, designed to protect against multiple strains or types of pathogens in a single shot, provides a significant market advantage in terms of delivery logistics and patient compliance. The ongoing technological refinement in non-viral delivery systems, such as lipid nanoparticles (LNPs) and biodegradable polymers, promises to overcome existing safety concerns associated with viral vectors and broaden the applicability of DNA and RNA vaccines to new populations and disease targets, thereby opening up new revenue streams.

The market faces several critical impact forces. Regulatory stringency, while necessary for safety, acts as a decelerator, particularly in markets demanding extensive long-term safety data for novel genetic technologies. However, global political commitment to pandemic preparedness, evidenced by organizations like the Coalition for Epidemic Preparedness Innovations (CEPI) and national stockpiling strategies, acts as a powerful accelerating force, stabilizing demand for next-generation platforms. Technological breakthroughs in synthetic biology and bioinformatics are disruptive impact forces, drastically lowering barriers to entry for specialized biotech startups. Furthermore, intellectual property conflicts, particularly concerning core platform technologies (e.g., specific LNPs or vector backbones), pose a continuous threat of litigation and market fragmentation. Navigating this dynamic interplay of scientific innovation, political mandate, and regulatory scrutiny defines the strategic complexity inherent in the recombinant DNA vaccine space.

- Drivers: Growing global burden of infectious diseases; success of rapid deployment during recent pandemics; increased funding for prophylactic and therapeutic vaccine research; advancements in genetic sequencing and synthetic biology.

- Restraints: Stringent and complex regulatory approval processes; high capital investment required for specialized biomanufacturing facilities; persistent issues related to vaccine hesitancy and public perception of genetically engineered products; challenges associated with maintaining specific cold chain requirements.

- Opportunities: Expansion into therapeutic oncology and chronic disease applications (personalized cancer vaccines); development of thermostable formulations for better distribution in emerging markets; integration of AI/ML for optimized antigen selection and design; exploration of needle-free delivery systems.

- Impact Forces: Global political mandates on pandemic preparedness (Positive); Intellectual property disputes and platform exclusivity (Neutral/Negative); Technological convergence with gene therapy (Positive); Public health policy changes regarding mandatory vaccination (Variable).

Segmentation Analysis

The Recombinant DNA Vaccine Market is systematically segmented based on Type, Application, and End-User, allowing for granular analysis of demand patterns and strategic investment areas. The segmentation by Type primarily differentiates the platform technologies utilized, which fundamentally dictates the vaccine's efficacy profile, manufacturing complexity, and cold chain requirements. This includes the dominant categories of Subunit Vaccines (relying on expressed proteins), DNA Vaccines (utilizing plasmid DNA), and Viral Vector Vaccines (employing modified viruses for delivery). Analyzing these technological segments is crucial as platform maturity and recent clinical successes strongly influence market preference and investment flows, particularly towards highly flexible and rapidly scalable technologies, thereby influencing competitive dynamics.

Segmentation by Application divides the market into Infectious Diseases and Therapeutic Vaccines (primarily Cancer and Other Non-Infectious Diseases). The Infectious Diseases segment, historically and currently the largest revenue generator, focuses on prophylactic protection against widespread pathogens. However, the Therapeutic segment, especially cancer immunotherapy, represents the fastest-growing niche, fueled by significant clinical advances and the high commercial value associated with personalized treatments. Understanding this segmentation enables stakeholders to accurately allocate R&D capital, recognizing the distinct regulatory paths, target patient populations, and reimbursement structures required for prophylactic versus therapeutic products.

The End-User segmentation categorizes the final consumers, predominantly comprising Hospitals and Clinics, Research Institutes (including academic and private research labs), and Government Agencies/Public Health Programs. Government agencies represent the most substantial purchasing power, driving mass procurement for national immunization campaigns and pandemic stockpiling. Conversely, hospitals and specialized clinics are the primary consumers for high-value therapeutic and personalized vaccines, while research institutes fuel future pipeline development. Strategic market penetration requires differentiated sales strategies tailored to the unique procurement processes, budget cycles, and regulatory compliance demands of each end-user category, especially navigating the centralized purchasing power exerted by national health authorities.

- By Type:

- Subunit Vaccines

- DNA Vaccines

- Viral Vector Vaccines

- Other Recombinant Types (e.g., Virus-Like Particles)

- By Application:

- Infectious Diseases (e.g., HPV, HBV, Influenza, COVID-19)

- Therapeutic Vaccines (e.g., Cancer/Oncology)

- Other Diseases (e.g., Allergies, Autoimmune Disorders)

- By End-User:

- Hospitals and Clinics

- Research Institutes

- Government Agencies and Public Health Programs

Value Chain Analysis For Recombinant DNA Vaccine Market

The value chain for the Recombinant DNA Vaccine Market is characterized by high complexity, intellectual property intensity, and significant reliance on specialized manufacturing infrastructure. The process begins with extensive upstream analysis, which encompasses fundamental genomic research, antigen identification (often AI-assisted), and the design and construction of the recombinant vector or plasmid DNA. This phase requires specialized skills in molecular biology, bioinformatics, and synthetic biology, leading to the creation of the Master Cell Bank (MCB) or Master Viral Seed (MVS). Key upstream suppliers include providers of high-quality raw materials such as proprietary cell lines, specialized enzymes, bioreactor consumables, and oligonucleotide synthesis services. Efficiency and security in the upstream phase are critical, as any contamination or inconsistency profoundly affects the final product quality and yield.

The midstream of the value chain is dominated by highly controlled biomanufacturing and quality control (QC). This involves large-scale fermentation or cell culture processes (depending on the expression system, e.g., yeast, insect cells, or mammalian cells) to produce the recombinant protein or replicate the viral vector. Subsequent steps involve complex, multi-stage purification (e.g., chromatography, ultrafiltration) to ensure high purity and potency, followed by formulation and sterile filling. Direct and indirect distribution channels emerge after stringent QC/QA release. Direct distribution is common for therapeutic, high-value vaccines supplied directly to specialized hospitals or clinics, often under cold chain management. Indirect distribution utilizes established pharmaceutical distributors, logistics providers, and governmental procurement networks, particularly for mass immunization campaigns where global reach and reliability are paramount.

The downstream segment involves clinical trials (Phase I to III), regulatory submission and approval, and eventual market access and post-marketing surveillance. Downstream analysis emphasizes effective demand forecasting, logistics optimization, and market adoption strategies, which are heavily influenced by national public health policies and reimbursement decisions. For recombinant vaccines, the successful navigation of global regulatory bodies like the FDA and EMA is a significant bottleneck and value generator. Distribution channels must integrate sophisticated monitoring systems (e.g., temperature logging) to maintain product integrity. The ultimate potential customers—governments, public health organizations, and specialized medical centers—drive market pull, making engagement with these groups a defining characteristic of the successful downstream strategy.

Recombinant DNA Vaccine Market Potential Customers

The primary customer base for the Recombinant DNA Vaccine Market is stratified across several key segments, each possessing unique purchasing power, decision-making criteria, and logistical needs. Government Agencies and National Public Health Programs constitute the largest volume purchasers globally. These entities prioritize vaccines for mass immunization against prevalent infectious diseases (prophylactic use) and require platforms that offer high efficacy, proven safety, and the ability to be manufactured at a massive scale quickly. Their purchasing decisions are primarily influenced by cost-effectiveness analysis, World Health Organization (WHO) recommendations, and securing national supplies, often leading to large, multi-year procurement contracts that significantly stabilize market demand for major manufacturers. The success of a recombinant vaccine hinges on its inclusion in national immunization schedules, making regulatory acceptance paramount.

Hospitals and Specialized Clinics represent the secondary, yet rapidly growing, customer segment, particularly for therapeutic applications such as cancer vaccines. These institutions serve individual patients and require customized, often personalized, vaccine formulations (e.g., neoantigen-specific vaccines). Purchasing decisions here are driven by clinical effectiveness, physician recommendation, specialized infrastructure requirements (e.g., for vaccine administration or storage), and favorable reimbursement policies. This segment demands highly specific, high-value products, differentiating it sharply from the mass-market prophylactic segment. The complexity of handling and administering these highly targeted therapies requires specialized training and close integration between pharmaceutical providers and clinical staff.

Furthermore, Research Institutes, academic centers, and major biotechnology companies purchasing for R&D purposes constitute a crucial segment, focused on early-stage, experimental, and next-generation vaccine platforms. These customers seek access to novel vector systems, customized plasmids, and specialized manufacturing services to advance their internal pipelines. Their procurement often involves smaller, specialized batches and is less sensitive to price but highly dependent on cutting-edge technology and intellectual property clearance. Sustaining engagement with this segment ensures a continuous feedback loop that drives technological refinement and future commercialization opportunities across the broader market spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moderna Inc., Pfizer Inc., BioNTech SE, Merck & Co., Inc., GlaxoSmithKline plc (GSK), Sanofi S.A., AstraZeneca plc, Novavax, Inc., Johnson & Johnson (J&J), Vaxart Inc., Dynavax Technologies Corporation, Emergent BioSolutions Inc., Bavarian Nordic, CureVac N.V., Inovio Pharmaceuticals Inc., Genocea Biosciences, Takeda Pharmaceutical Company Limited, Altimmune Inc., CSL Limited, Bharat Biotech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recombinant DNA Vaccine Market Key Technology Landscape

The technological landscape of the Recombinant DNA Vaccine market is defined by continuous innovation in three primary areas: expression systems, delivery mechanisms, and manufacturing scalability. Expression systems involve the host organisms used to synthesize the target antigen, ranging from microbial systems (bacteria, yeast) popular for producing high yields of stable protein subunits, to mammalian cell cultures offering complex post-translational modifications necessary for some viral antigens. Recent breakthroughs in transient expression systems, particularly in plant-based platforms and insect cells, offer ultra-rapid antigen production capabilities, fundamentally changing the emergency response paradigm. Optimization of these systems, often through genetic engineering of the host itself, is critical for achieving the high purity and low cost required for widespread immunization campaigns.

Delivery mechanisms represent the most dynamic area of technological advancement. While traditional subunit vaccines rely on adjuvants to boost immunogenicity, nucleic acid vaccines (DNA and mRNA) require sophisticated methods to safely and effectively traverse cell membranes and reach the cytoplasm or nucleus. Key innovations include the development of proprietary lipid nanoparticle (LNP) technology, which acts as a protective shield and efficient delivery vehicle for nucleic acids, significantly boosting their in vivo effectiveness. Furthermore, the refinement of non-replicating viral vectors, such as adenoviruses or Modified Vaccinia Ankara (MVA), ensures high transduction efficiency without posing a risk of infection. Future trends are pointing toward integrated delivery solutions, such as microneedle patches or oral formulations, aiming to remove the dependency on cold chain logistics and conventional injection methods, thereby improving global accessibility and patient compliance.

Manufacturing scalability technology focuses on translating laboratory-scale success into economically viable commercial production. The shift towards continuous bioprocessing, facilitated by single-use disposable bioreactors, minimizes cross-contamination risk and significantly reduces facility turnaround time, which is paramount in pandemic scenarios. Advanced analytics, including Process Analytical Technology (PAT), are increasingly integrated into biomanufacturing workflows to monitor critical quality attributes in real-time, ensuring batch-to-batch consistency and meeting stringent regulatory standards. The ability to rapidly switch production between different recombinant vaccine types (platform flexibility) using the same infrastructure is a major competitive advantage, allowing manufacturers to quickly pivot their pipelines in response to emerging biological threats or changing market demands. This emphasis on flexible, agile, and high-throughput production methods defines the modern recombinant vaccine ecosystem.

- Expression Systems: Microbial (E. coli, Yeast), Mammalian Cell Culture (CHO cells), Insect Cell Systems (Baculovirus), and novel Plant-based Transient Expression platforms.

- Delivery Mechanisms: Proprietary Lipid Nanoparticle (LNP) systems for nucleic acids; Replication-deficient Viral Vectors (Adenovirus, AAV); Adjuvant platforms (e.g., CpG oligodeoxynucleotides, saponin-based adjuvants).

- Manufacturing Technology: Single-use Bioreactors; Continuous Bioprocessing; Process Analytical Technology (PAT); cGMP compliant Plasmid DNA manufacturing.

- Adoption of AI/ML: Used for optimizing gene sequence design, predicting protein folding stability, and fine-tuning manufacturing parameters to maximize yield.

Regional Highlights

The global Recombinant DNA Vaccine Market exhibits significant regional disparities in terms of R&D investment, market adoption, and regulatory maturity.

- North America: Dominates the market, driven by unparalleled levels of R&D expenditure, the presence of major biopharmaceutical giants (e.g., Pfizer, Moderna, Merck), and a proactive regulatory environment (FDA) that favors fast-track designation for novel vaccine technologies. The region leads in the commercialization of therapeutic cancer vaccines and has robust government funding for preparedness and stockpiling. High healthcare spending and advanced biotechnology infrastructure solidify its leadership position.

- Europe: Represents the second-largest market, characterized by strong academic research linkages, government support through the European Medicines Agency (EMA), and established manufacturing hubs, particularly in Ireland, Germany, and Switzerland. Adoption is high, especially for established prophylactic vaccines, and there is increasing investment in decentralized manufacturing capacity to mitigate supply chain risks.

- Asia Pacific (APAC): Expected to be the fastest-growing region. Growth is primarily fueled by high disease prevalence (e.g., Hepatitis, emerging zoonoses), increasing government spending on immunization infrastructure, and the expansion of domestic manufacturing capabilities in countries like China, India, and South Korea, which are increasingly focusing on technology transfer and indigenous production to ensure self-sufficiency.

- Latin America, Middle East, and Africa (MEA): These regions show substantial potential, primarily driven by international aid initiatives, collaborations with global health organizations (GAVI, PAHO), and the necessity to address endemic infectious diseases. Market expansion is dependent on improving cold chain infrastructure and overcoming access barriers, favoring the adoption of newer, thermostable recombinant platforms where available.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recombinant DNA Vaccine Market.- Moderna Inc.

- Pfizer Inc.

- BioNTech SE

- Merck & Co., Inc.

- GlaxoSmithKline plc (GSK)

- Sanofi S.A.

- AstraZeneca plc

- Novavax, Inc.

- Johnson & Johnson (J&J)

- Vaxart Inc.

- Dynavax Technologies Corporation

- Emergent BioSolutions Inc.

- Bavarian Nordic

- CureVac N.V.

- Inovio Pharmaceuticals Inc.

- Genocea Biosciences

- Takeda Pharmaceutical Company Limited

- Altimmune Inc.

- CSL Limited

- Bharat Biotech

Frequently Asked Questions

Analyze common user questions about the Recombinant DNA Vaccine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between recombinant DNA vaccines and traditional vaccines?

Recombinant DNA vaccines use only specific genetic material or protein components of a pathogen, synthesized in a lab, avoiding the use of whole inactivated or attenuated organisms, which enhances safety, reduces side effects, and allows for precise immune targeting.

Which application segment holds the greatest growth potential in the recombinant DNA vaccine market?

The Therapeutic Vaccine segment, particularly personalized cancer vaccines targeting neoantigens, holds the highest growth potential due to ongoing breakthroughs in immunotherapy and the high unmet need for effective treatments for various solid and liquid tumors.

What are the primary logistical challenges facing the widespread adoption of recombinant DNA vaccines?

The primary logistical challenges include the strict cold chain requirements for maintaining product integrity (especially for nucleic acid platforms) and the need for highly specialized, cGMP-compliant biomanufacturing facilities, which limit production scalability in emerging economies.

How is Artificial Intelligence (AI) transforming the development lifecycle of these vaccines?

AI significantly accelerates development by rapidly identifying optimal antigens, predicting complex immunogenic responses, optimizing genetic construct design, and streamlining the parameters for efficient large-scale manufacturing and quality control.

Is the Recombinant DNA Vaccine Market subject to significant regulatory restraints?

Yes, due to the novelty and complexity of genetic engineering, these products face rigorous scrutiny and complex regulatory pathways globally, especially regarding long-term safety data and the approval of novel delivery platforms like lipid nanoparticles and viral vectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager