Recombinant Human Serum Albumin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443650 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Recombinant Human Serum Albumin Market Size

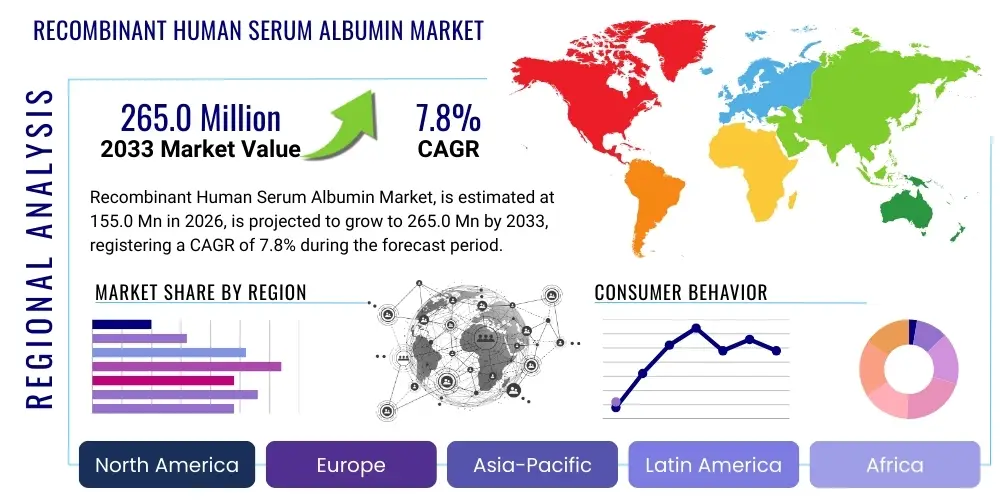

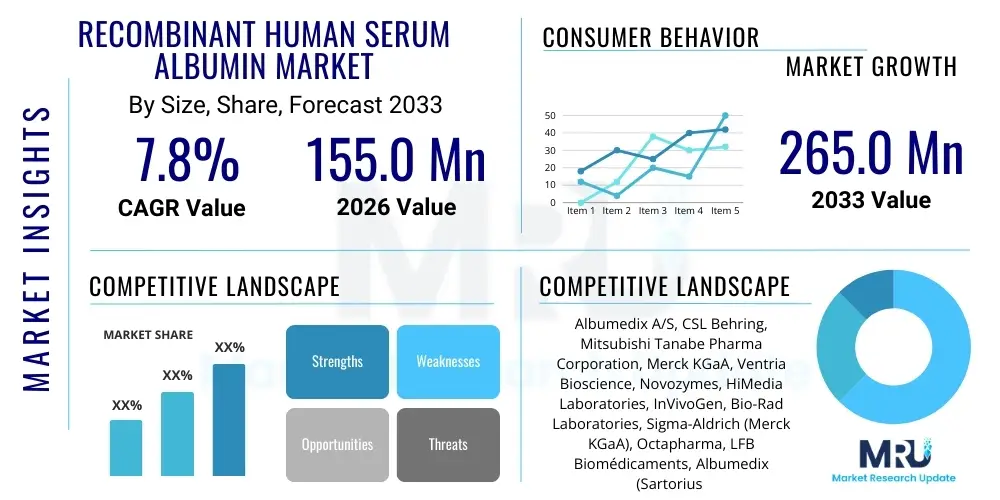

The Recombinant Human Serum Albumin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 265.0 Million by the end of the forecast period in 2033.

Recombinant Human Serum Albumin Market introduction

The Recombinant Human Serum Albumin (rHSA) market encompasses the production, distribution, and utilization of genetically engineered human serum albumin, primarily used in pharmaceutical manufacturing, therapeutics, and diagnostics. Unlike Plasma-Derived Human Serum Albumin (pHSA), rHSA is synthesized using microbial or plant expression systems, offering a safer, scalable, and highly pure alternative free from the risks associated with human blood-borne pathogens. This biotechnological advancement ensures consistency in supply and eliminates ethical concerns related to blood donation. Key expression systems driving production include yeast (such as Pichia pastoris), rice, and tobacco, each optimized for yield and cost-efficiency, cementing rHSA’s role as a critical component in the modern biopharmaceutical landscape.

Major applications of rHSA span across various bioprocessing fields, including its use as a critical stabilizer for vaccines, therapeutic proteins, and complex biological drugs. In clinical settings, rHSA is being explored as an excipient for advanced drug delivery systems, particularly those aiming for extended half-lives or targeted release mechanisms. Furthermore, it is indispensable in cell culture media, providing essential nutritional and stabilizing functions for the large-scale production of monoclonal antibodies and viral vectors. The inherent biocompatibility and non-immunogenic nature of HSA make its recombinant form highly desirable across regenerative medicine and specialized diagnostic reagent formulation.

The primary driving factors propelling this market forward are the escalating global demand for stable, high-quality biopharmaceuticals and the continuous need to mitigate contamination risks inherent in blood-derived products. Increased investment in bioprocessing infrastructure, coupled with rigorous regulatory standards favoring pathogen-free excipients, further solidifies the market’s growth trajectory. Moreover, technological breakthroughs in optimizing expression yields and purification processes, particularly in plant-based systems, are enhancing manufacturing efficiency and reducing production costs, making rHSA a commercially viable and preferred choice over traditional plasma derivatives.

Recombinant Human Serum Albumin Market Executive Summary

The Recombinant Human Serum Albumin market is characterized by robust growth, fueled predominantly by shifts in the biopharmaceutical industry toward large-scale, controlled production methods and the imperative for supply chain security. Business trends show a strong concentration of innovation in expression system optimization, with key market participants focusing on transitioning from microbial platforms to advanced plant-based systems like rice endosperm to achieve superior yields and lower production costs. Strategic collaborations between rHSA manufacturers and large pharmaceutical companies involved in vaccine and monoclonal antibody production are accelerating market penetration, particularly in emerging therapeutic areas such as gene therapy and personalized medicine, where ultra-pure excipients are mandatory. Furthermore, the market is seeing increased merger and acquisition activity centered around integrating specialized purification technologies to meet stringent clinical standards.

Regionally, North America and Europe currently dominate the market due to established biopharmaceutical infrastructures, high R&D spending, and stringent regulatory frameworks that favor pathogen-free inputs. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, driven by expanding biotechnology sectors in China, India, and South Korea, coupled with massive investments in vaccine manufacturing capabilities. Government initiatives aimed at promoting local biomanufacturing and reducing reliance on imports are significantly contributing to the regional expansion of rHSA adoption. Latin America and MEA are gradually adopting rHSA, primarily driven by international aid organizations and increasing awareness of blood-derived product risks in therapeutic applications.

Segmentation trends indicate that the therapeutic application segment, particularly drug formulation and stabilization, holds the largest market share, reflecting the broad utility of rHSA in enhancing drug stability and bioavailability. The segment based on expression systems is witnessing a gradual shift, with Pichia pastoris remaining the dominant platform due to its proven track record and scalability, but rice-based systems are gaining traction rapidly owing to their potential for high volume, low-cost production. The diagnostic segment, though smaller, is critical due to the demand for high-purity calibrators and controls in advanced clinical laboratories. Overall, the market remains highly competitive, with a few specialized biotech firms setting the standards for purity and regulatory compliance, forcing continuous innovation across all segments.

AI Impact Analysis on Recombinant Human Serum Albumin Market

Common user inquiries concerning AI's role in the Recombinant Human Serum Albumin (rHSA) market primarily revolve around optimizing production efficiency, accelerating strain development, and ensuring stringent quality control. Users often ask how machine learning can be applied to predict optimal fermentation conditions, how computational biology can expedite the modification of host expression systems for higher yield, and what role AI plays in the complex, multi-stage purification processes. There is significant interest in AI's capacity to reduce batch-to-batch variability and streamline regulatory documentation. Users are keenly focused on whether AI-driven analytical tools can surpass traditional methods in detecting trace contaminants and impurities, thereby enhancing the overall safety and regulatory compliance of rHSA products.

The integration of Artificial Intelligence (AI) and machine learning (ML) models is poised to revolutionize several critical aspects of the rHSA production pipeline, moving beyond mere data visualization to predictive optimization. In upstream processing, AI algorithms analyze vast datasets generated from bioreactors—including parameters such as pH, temperature, dissolved oxygen levels, and nutrient consumption—to dynamically adjust conditions in real-time. This predictive control minimizes resource waste, shortens fermentation cycles, and significantly boosts volumetric productivity, addressing one of the core challenges of large-scale biomanufacturing: achieving consistent, high-titer yields. Furthermore, AI tools are accelerating the design and screening of improved genetic constructs in host organisms like Pichia pastoris, identifying optimal promoters and signal peptides faster than traditional high-throughput screening methods.

In downstream processing, which involves complex and often rate-limiting chromatography steps, AI-powered systems are utilized to model the separation efficiency and purity outcomes based on input characteristics and resin chemistry. These models allow manufacturers to design more efficient purification protocols, reducing the number of cycles required and minimizing the loss of product yield. For quality assurance and control (QA/QC), computer vision and advanced pattern recognition algorithms are applied to spectroscopic data and image analysis to identify subtle deviations from quality specifications that might be missed by human inspection or standard statistical process control (SPC) methods. This enhanced precision in impurity detection is crucial for rHSA used in clinical applications, ensuring compliance with pharmacopeial standards globally.

- AI-driven optimization of bioreactor parameters (temperature, feed rate) for maximum rHSA yield.

- Machine learning applied to genetic engineering for accelerated development of high-performing host strains (e.g., enhanced Pichia pastoris clones).

- Predictive modeling of purification chromatography to maximize recovery and purity while minimizing resin consumption.

- Real-time quality control (RTQC) using spectral analysis and AI algorithms to detect trace contaminants instantly.

- Automation of regulatory documentation and compliance tracking through natural language processing (NLP) of manufacturing records.

- Enhanced supply chain forecasting and inventory management to prevent stockouts of critical raw materials or finished product.

DRO & Impact Forces Of Recombinant Human Serum Albumin Market

The Recombinant Human Serum Albumin (rHSA) market is shaped by a confluence of compelling growth drivers and intrinsic constraints, with opportunities arising from technological evolution, all culminating in significant impact forces. The primary drivers include the inherent safety profile of rHSA, which eradicates the risk of infectious disease transmission associated with plasma-derived products, coupled with the rising demand for high-purity excipients in advanced biotherapeutics, particularly monoclonal antibodies and gene therapies. Conversely, the market faces restraints such as the relatively high initial capital expenditure required for developing and scaling up complex recombinant protein manufacturing facilities, alongside the ongoing challenge of achieving cost parity with mass-produced plasma-derived albumin, particularly in price-sensitive markets. These opposing forces dictate the pace of adoption and market penetration.

Key opportunities within this landscape stem from the potential diversification of rHSA applications beyond stabilization, including its use as a fusion tag for therapeutic proteins to increase their half-life, and its emerging role in specialized drug delivery systems, such as nanoparticles and liposomes. Furthermore, technological advancements in transgenic plant systems (like rice or maize) promise to drastically reduce production costs and facilitate rapid scalability, effectively neutralizing the cost constraint posed by traditional fermentation methods. Successfully navigating the intellectual property landscape surrounding novel expression technologies also presents a strong opportunity for firms to secure a dominant market position, particularly as biosimilar development increases global competition.

The immediate impact forces on the rHSA market are significant regulatory actions and evolving biomanufacturing standards. Strict guidelines from agencies like the FDA and EMA concerning the safety and purity of biological inputs increasingly favor recombinant sources over plasma derivatives, driving mandatory shifts in sourcing for major pharmaceutical firms. The continuous development of new, high-titer expression platforms acts as a powerful enabling force, pushing down the unit cost of rHSA and expanding its economic feasibility into high-volume applications like standard cell culture media. Ultimately, the market trajectory is defined by the ability of manufacturers to deliver scalable, regulatory-compliant, and cost-effective rHSA, leveraging advanced biotechnology to overcome existing production yield limitations.

Segmentation Analysis

The Recombinant Human Serum Albumin market is strategically segmented based on factors crucial to its production, functional utilization, and end-user adoption. The primary segmentation categories include the Application area (which highlights where rHSA is used), the Expression System employed for its manufacture (detailing the technology platform), and the geographical region (reflecting market maturity and regulatory environment). Understanding these segments is vital for stakeholders to tailor production capabilities and marketing strategies effectively. The dominance of therapeutic applications underscores rHSA's value in high-end pharmaceutical formulation, while the differentiation in expression systems highlights the ongoing competition between established microbial platforms and emerging plant-based technologies focused on maximizing yield and purity.

The Application segment is further differentiated into Therapeutics, Vaccines, Diagnostics, and Cell Culture Media, each exhibiting unique growth drivers. Therapeutic formulation remains the cornerstone due to the critical need for protein stabilization in complex drug delivery. Simultaneously, the Expression System segment, comprising Yeast (e.g., Pichia pastoris), Rice/Plant-based systems, and others, dictates production costs and scalability limits. Plant-based systems, though currently smaller, are projected to achieve superior CAGR due to their inherent scalability potential and lower infrastructure complexity compared to traditional fermentation. Geographic segmentation reveals a bifurcation between mature, high-value markets (North America, Europe) and rapidly expanding, volume-driven markets (APAC).

- By Application:

- Drug Delivery and Stabilization (Therapeutics)

- Vaccine Adjuvants and Stabilizers

- Cell Culture Media and Components

- Diagnostics and Laboratory Reagents

- By Expression System:

- Yeast (Pichia pastoris, Saccharomyces cerevisiae)

- Plant-based Systems (Rice, Tobacco)

- Mammalian Cells

- Others (e.g., E. coli, Filamentous Fungi)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Recombinant Human Serum Albumin Market

The value chain for the Recombinant Human Serum Albumin market is intricate, beginning with the upstream development and optimization of genetically engineered host organisms and concluding with the distribution of the highly purified product to end-users. Upstream analysis focuses heavily on biotechnology R&D, involving gene synthesis, vector construction, and strain selection (e.g., selecting the optimal yeast or rice line for expression). This phase is characterized by high intellectual property value and specialized expertise, requiring significant investment in genomics and fermentation science. Efficiency in the upstream phase directly determines the cost of goods sold (COGS), with technological breakthroughs in continuous culture and media optimization being crucial for commercial viability and scalability.

The midstream phase encompasses large-scale biomanufacturing, including fermentation or cultivation of the host organism, followed by complex downstream purification. The purification process for rHSA is particularly challenging due to the need for ultra-high purity (>99.9%) for clinical applications, typically involving multi-step chromatography, ultrafiltration, and viral inactivation/removal steps. Quality assurance and regulatory compliance are paramount at this stage, requiring adherence to Current Good Manufacturing Practices (cGMP) and extensive validation studies. Manufacturers invest heavily in specialized column resins and automated purification systems to ensure batch consistency and regulatory readiness.

Downstream analysis involves the formulation, packaging, and distribution of the final rHSA product. Distribution channels are highly specialized: direct channels are often utilized for large-volume sales to major pharmaceutical and vaccine manufacturers, necessitating stringent cold chain logistics and direct contractual agreements. Indirect channels, involving specialized biopharma distributors and laboratory supply houses, cater to smaller research institutions, diagnostic companies, and niche cell culture media providers. The effectiveness of the distribution network, including global reach and temperature control capabilities, is a key determinant in market competitiveness, ensuring that the sensitive biological product maintains its integrity until it reaches the end-user.

Recombinant Human Serum Albumin Market Potential Customers

The potential customers for Recombinant Human Serum Albumin span across critical sectors of the healthcare and biotechnology industry, unified by the requirement for high-purity, pathogen-free, and highly standardized protein stabilizers and excipients. The largest volume buyers are pharmaceutical and biopharmaceutical companies engaged in the development and manufacturing of advanced therapeutics, including monoclonal antibodies, protein drugs, and complex biologics. These companies rely on rHSA as a vital stabilizer during formulation and lyophilization processes, ensuring the long-term integrity and shelf-life of their final drug products. The stringent regulatory requirements governing these finished products necessitate the use of rHSA over traditional alternatives, driving high-value procurement contracts.

Another significant customer segment includes vaccine manufacturers. With the global acceleration of new vaccine development (e.g., mRNA and viral vector vaccines), rHSA is essential for stabilizing antigenic components and maintaining the viability of viral vectors, both during storage and administration. These customers demand bulk quantities and impeccable regulatory documentation. Furthermore, academic research institutions, contract research organizations (CROs), and diagnostic reagent manufacturers constitute a substantial customer base, primarily utilizing rHSA in cell culture media for cell therapy manufacturing, stem cell research, and as a critical component in diagnostic assay calibrators and buffers, where consistency and purity are non-negotiable for accurate results.

In addition to these core segments, emerging fields such as regenerative medicine and gene therapy are rapidly becoming high-potential customers. Companies developing Chimeric Antigen Receptor (CAR) T-cell therapies or utilizing viral vectors require highly controlled and defined media components free of animal-derived or plasma-derived proteins, making rHSA the preferred choice. The trend towards developing chemically defined media for large-scale clinical manufacturing further solidifies rHSA's indispensable role in supporting highly sensitive and regulated cell proliferation and differentiation protocols, demonstrating a persistent and expanding need across high-tech biotechnological applications globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 265.0 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albumedix A/S, CSL Behring, Mitsubishi Tanabe Pharma Corporation, Merck KGaA, Ventria Bioscience, Novozymes, HiMedia Laboratories, InVivoGen, Bio-Rad Laboratories, Sigma-Aldrich (Merck KGaA), Octapharma, LFB Biomédicaments, Albumedix (Sartorius Stedim Biotech), Wuhan Healthgen Biotechnology Co., Ltd., China Biologic Products Holdings, Inc., Grifols S.A., Sanquin, SinoBioway, ProMetic Life Sciences Inc., and Takeda Pharmaceutical Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recombinant Human Serum Albumin Market Key Technology Landscape

The technological landscape of the Recombinant Human Serum Albumin market is fundamentally defined by continuous innovations in high-yield expression platforms and advanced, regulatory-compliant purification methodologies. The dominant technology involves yeast expression systems, primarily utilizing Pichia pastoris, which is favored for its high protein secretion capacity, robust growth in simple media, and established track record in commercial bioproduction. Companies are now focusing on optimizing Pichia strains through genetic engineering techniques, such as CRISPR-Cas9, to enhance secretion efficiency and minimize undesirable post-translational modifications, thereby increasing the effective yield and purity required for clinical applications.

A rapidly emerging and highly disruptive technology involves the utilization of transgenic plants, particularly rice (Oryza sativa), for rHSA production. This plant-based approach, often termed 'molecular farming,' offers several significant advantages, including massive scalability, potentially lower operational costs, and the intrinsic absence of mammalian pathogens. Production in rice endosperm allows for the accumulation of rHSA in storage vacuoles, leading to high concentrations and simplifying initial extraction steps. Although requiring sophisticated downstream processing to meet pharmaceutical-grade purity, this technology is poised to address the global demand for large volumes of affordable rHSA, challenging the economic dominance of traditional fermentation methods in the long term.

Beyond expression, the technology utilized in downstream purification is critical. State-of-the-art purification relies heavily on multimodal chromatography systems and tangential flow filtration (TFF). Manufacturers are increasingly integrating automated and continuous bioprocessing technologies, moving away from batch processes to enhance overall throughput and reduce the manufacturing footprint. Furthermore, advanced analytical techniques, including high-resolution mass spectrometry and sophisticated spectroscopic methods, are employed throughout the process to ensure meticulous characterization and validation of the final rHSA product, guaranteeing adherence to stringent pharmacopeial specifications regarding purity, aggregation levels, and structural integrity.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for Recombinant Human Serum Albumin. This dominance is attributed to a highly advanced biopharmaceutical sector, substantial governmental and private investment in biotechnology R&D, and the presence of leading global biopharma companies that are early adopters of advanced excipients. The regulatory environment, managed by the FDA, strongly promotes the use of defined, pathogen-free components in clinical-grade products, naturally favoring rHSA over plasma-derived alternatives. The region is a hotbed for cell and gene therapy development, driving specialized, high-purity demand.

- Europe: Europe holds a significant market share, characterized by stringent quality control standards mandated by the European Medicines Agency (EMA) and a strong regional focus on vaccine production and biosimilar development. Countries like Germany, Switzerland, and the UK host major biomanufacturing hubs and specialized CMOs/CDOs that integrate rHSA into their core services. Market growth is stable, underpinned by ongoing public health initiatives and robust funding for regenerative medicine research, maintaining a steady demand for high-quality, recombinant stabilizers.

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate in the rHSA market, driven by rapid expansion of the pharmaceutical industry in China, India, and South Korea. Increased domestic investment in biomanufacturing capacity, coupled with the need to supply massive populations with vaccines and biosimilars, is accelerating the adoption of scalable rHSA technologies. Government support for local biotechnology and a growing awareness of the supply chain risks associated with plasma-derived products are key accelerators, positioning APAC as the primary volume driver in the coming decade.

- Latin America (LATAM): The LATAM market is nascent but growing steadily, primarily driven by increasing healthcare expenditure and a gradual technological upgrade of regional pharmaceutical manufacturing capabilities in countries like Brazil and Mexico. Adoption is currently focused on high-value clinical applications and imported vaccines. The challenge remains the cost sensitivity and the integration of advanced biotechnology supply chains, though long-term growth is expected as local bioprocessing capabilities mature.

- Middle East and Africa (MEA): The MEA region represents the smallest current market share, with demand largely concentrated in advanced economies like the UAE, Saudi Arabia, and Israel, which possess sophisticated healthcare and research infrastructures. Market penetration is slower due to fragmented regulatory landscapes and reliance on imported finished products. However, strategic initiatives to establish local pharmaceutical manufacturing hubs, especially in the Gulf Cooperation Council (GCC) countries, are creating future opportunities for rHSA suppliers focused on establishing regional distribution partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recombinant Human Serum Albumin Market.- Albumedix A/S (A Sartorius Company)

- Mitsubishi Tanabe Pharma Corporation

- CSL Behring

- Merck KGaA (Sigma-Aldrich)

- Ventria Bioscience

- Novozymes A/S

- Wuhan Healthgen Biotechnology Co., Ltd.

- InVivoGen

- Bio-Rad Laboratories, Inc.

- Octapharma AG

- LFB Biomédicaments

- China Biologic Products Holdings, Inc.

- Grifols S.A.

- Sanquin Blood Supply

- SinoBioway Co., Ltd.

- ProMetic Life Sciences Inc.

- Takeda Pharmaceutical Company Limited

- HiMedia Laboratories Pvt. Ltd.

- Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd.

- Hospira (Pfizer Inc.)

Frequently Asked Questions

Analyze common user questions about the Recombinant Human Serum Albumin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Recombinant Human Serum Albumin (rHSA) and how does it differ from plasma-derived HSA?

Recombinant Human Serum Albumin (rHSA) is a synthetic version of human serum albumin produced using genetic engineering in controlled systems, typically yeast or plants. It differs fundamentally from plasma-derived HSA (pHSA) because it is manufactured in a closed system, eliminating the risk of human blood-borne pathogen contamination. rHSA offers superior batch-to-batch consistency, defined purity, and unlimited scalability, making it the preferred excipient for highly regulated biopharmaceutical applications such as vaccines and advanced therapeutics.

What are the primary applications driving the growth of the rHSA market?

The primary growth drivers for rHSA are its applications in drug formulation and stabilization, where it is used to extend the half-life and improve the bioavailability of therapeutic proteins and small molecules. Significant growth also stems from the cell culture media segment, particularly in manufacturing high-value biologics like monoclonal antibodies and cell therapies (CAR-T), which require defined, animal-component-free, and pathogen-free media supplements for optimal safety and regulatory compliance.

Which expression system currently dominates rHSA production and which one shows the highest potential for future scalability?

The yeast expression system, specifically using Pichia pastoris, currently dominates the rHSA market due to its established commercial success, high yield capabilities, and robust fermentation process. However, plant-based systems, such as transgenic rice (molecular farming), hold the highest potential for future scalability and cost reduction. Plant systems offer the ability to produce rHSA at exceptionally large volumes with comparatively lower infrastructure costs, positioning them to significantly disrupt the market economics over the long term.

What are the main market restraints impacting the broader adoption of Recombinant Human Serum Albumin?

The primary restraint impacting rHSA adoption is the competitive pricing pressure exerted by the established, high-volume production of traditional plasma-derived HSA (pHSA), especially in non-clinical or non-regulated bulk applications. Additionally, the initial capital expenditure and complex regulatory requirements associated with building and validating large-scale, cGMP-compliant recombinant manufacturing facilities pose a significant barrier to entry and expansion for smaller firms.

How is Asia Pacific (APAC) influencing the future market trajectory of Recombinant Human Serum Albumin?

APAC is a critical future growth engine for the rHSA market, projected to exhibit the highest CAGR. This rapid expansion is driven by massive governmental and private sector investments in regional biopharmaceutical manufacturing, particularly in China and India, aimed at securing domestic vaccine and therapeutic protein supply chains. The shift towards biosimilar development and the necessity for scalable, safe excipients are compelling APAC manufacturers to rapidly adopt rHSA technology, positioning the region as a major consumer and potentially a low-cost production center.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Recombinant Human Serum Albumin Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Plant Derived, Microbes, Others), By Application (Drug Development & Drug Delivery, Vaccine Production, Component of Cell Culture Media, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Recombinant Human Serum Albumin Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (OsrHSA, ScrHSA), By Application (Cell Culture Media, Medical Supplements, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager