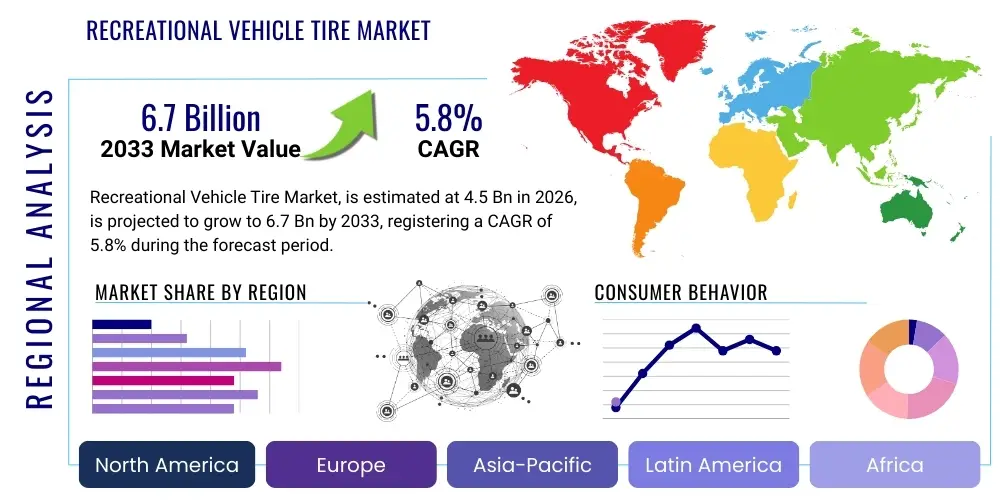

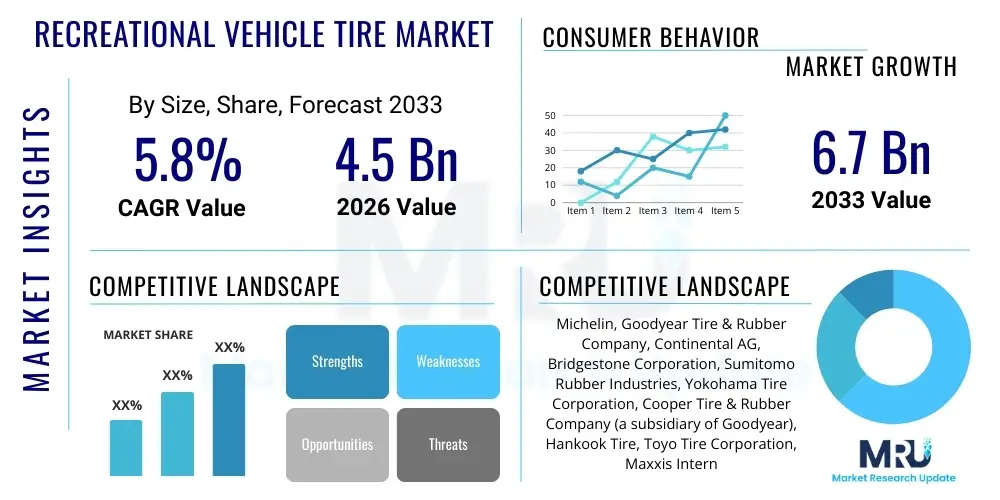

Recreational Vehicle Tire Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441833 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Recreational Vehicle Tire Market Size

The Recreational Vehicle Tire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Recreational Vehicle Tire Market introduction

The Recreational Vehicle (RV) Tire Market encompasses the production, distribution, and sale of specialized tires engineered for various types of recreational vehicles, including Class A, B, and C motorhomes, travel trailers, fifth-wheel trailers, and pop-up campers. These tires are fundamentally different from standard passenger vehicle tires as they are designed to handle specific, rigorous operational requirements unique to RVs, such as prolonged periods of static storage followed by immediate deployment under maximum load, demanding exceptional durability, high load index capacity, and robust resistance to UV degradation and sidewall stress. The unique operational profile of RVs—low annual mileage combined with high, sustained weight loads—necessitates tires that prioritize carcass integrity and longevity over sheer tread life.

Major applications for these specialized tires fall into two main categories: Original Equipment Manufacturer (OEM) installation on newly produced RV units and the significantly larger aftermarket replacement sector, driven by time-based tire aging rather than mileage alone. The increasing global popularity of experiential travel, outdoor recreation, and the nomadic lifestyle, catalyzed by demographic trends like active retirement and the normalization of remote work, are key drivers bolstering market demand. High-quality RV tires provide crucial benefits, including enhanced safety through improved stability and reduced risk of catastrophic failure under full load, marginal improvements in fuel efficiency due to optimized rolling resistance, and greater operational longevity, which collectively reduces the overall cost of ownership for RV users.

Driving factors propelling the growth of the RV tire industry include the robust and sustained growth in the global RV manufacturing sector, particularly across North America and Western Europe, coupled with the inherent requirement of the vast, aging RV fleet for mandatory replacement cycles. Technological advancements are increasingly focused on integrating smart tire technologies, such as enhanced Tire Pressure Monitoring Systems (TPMS) and embedded sensors, which not only boost safety compliance but also drive consumers towards higher-value, digitally integrated products in the replacement market. Furthermore, regulatory tightening around vehicle safety and minimum load specifications across major markets continues to pressure manufacturers toward continuous material science innovation and superior product performance.

Recreational Vehicle Tire Market Executive Summary

The global Recreational Vehicle Tire Market is experiencing stable and predictable growth, primarily fueled by a sustained increase in consumer interest in outdoor leisure activities and the necessary cyclical replacement demand generated by the large installed base of RVs globally. Key business trends indicate a concentrated effort by leading manufacturers to innovate in materials science, particularly focusing on developing specialized rubber compounds designed to mitigate internal heat build-up—a major threat to heavily loaded RV tires—and enhancing resistance to ozone cracking, which commonly afflicts vehicles stored outdoors for extended durations. Moreover, major industry players are strategically consolidating and optimizing their multichannel distribution networks, prioritizing online retail and specialized RV service centers to efficiently capture the lucrative and high-volume aftermarket replacement segment.

From a geographical standpoint, North America maintains its position as the dominant market, attributable to the mature RV culture, extensive network of suitable road infrastructure, and the highest per capita concentration of RV ownership globally, driving demand for heavy-duty, commercial-grade tires. In contrast, the Asia Pacific region, specifically led by the rapid development of domestic tourism and increasing middle-class discretionary spending in territories like Australia and China, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), offering significant expansion opportunities. European market growth remains steady, often influenced by environmental sustainability trends and a regional preference for smaller, more compact RV units, which dictates specific demand profiles for tire sizes and rolling resistance standards.

Analysis of market segmentation highlights the overwhelming preference for radial tires over older bias-ply construction, driven by the former’s superior operational characteristics, including enhanced vehicle stability, reduced heat generation, and improved fuel economy across nearly all RV classes. The aftermarket replacement segment remains the undeniable engine of market volume, consistently outpacing Original Equipment Manufacturer (OEM) sales, reinforcing the critical need for manufacturers to focus research and development efforts on maximizing tire durability and longevity under intermittent, heavy-load conditions. Specifically, the segment demanding high-load, all-season tires designed for heavy towing applications, such as large fifth-wheel and travel trailers, is a high-value category attracting substantial product innovation and heightened competitive rivalry.

AI Impact Analysis on Recreational Vehicle Tire Market

Analysis of common user questions related to AI's influence in the RV Tire Market reveals that consumer interest is highly concentrated on applications concerning proactive safety, manufacturing precision, and optimized maintenance protocols. Users express a strong expectation that AI-driven analytics will enable highly sophisticated predictive maintenance capabilities, allowing systems to flag subtle indicators of potential tire failures, such as minor air leaks, irregular wear patterns, or the early stages of structural fatigue, far earlier than conventional human inspection or rudimentary TPMS alerts. The vision widely held is that AI will facilitate the creation of truly ‘intelligent’ tires capable of transmitting detailed operational metrics directly to the RV’s control systems, enabling dynamic adjustments to parameters like optimal inflation based on highly granular data concerning real-time load distribution, ambient temperature, and varying road surface conditions. A recurring concern relates to the integration costs associated with these advanced sensors and the management of extensive data streams, alongside issues of consumer data privacy.

Within the core manufacturing landscape, AI is being deployed primarily to bolster quality control mechanisms and optimize complex operational efficiencies. Advanced deep learning algorithms are utilized to meticulously analyze microscopic variations and defects during critical production stages, particularly the rubber compounding and curing processes, ensuring absolute uniformity and uncompromising adherence to the extremely high load rating specifications mandated for heavy RV applications. This predictive quality assurance loop drastically minimizes the incidence of manufacturing defects, significantly lowering scrap material rates, and critically enhancing the safety and reliability profile of the final product, directly addressing central consumer safety imperatives. Furthermore, AI systems are instrumental in optimizing the global supply chain, employing sophisticated forecasting models to predict precise seasonal shifts in regional RV usage and subsequent tire demand, thus ensuring the timely availability of specialized and often low-volume specialty tire sizes, minimizing costly inventory surpluses while maximizing immediate market responsiveness during peak travel periods.

On the end-user side, AI-powered digital applications are increasingly being introduced to provide RV owners with highly personalized operational advice. These systems analyze specific historical driving data, typical cargo payloads, and frequently traversed topographical profiles to precisely recommend optimized tire pressure settings or determine the mathematically ideal timing for tire rotation and replacement. This level of personalization significantly transcends static, generalized manufacturer guidelines, providing tailored performance benefits and markedly contributing to the extension of usable tire life. The integration of neural network technology within next-generation TPMS architectures allows for extremely subtle anomaly detection, enabling the system to accurately distinguish between benign pressure changes caused by variations in altitude or ambient temperature and genuine, developing air leaks, thereby critically increasing the reliability and functional utility of these fundamental safety devices for the modern RV community.

- AI-driven predictive maintenance systems extending tire lifespan and preventing catastrophic failures through early fault identification.

- Optimization of complex rubber compounding and curing processes using machine learning for enhanced structural durability and uniformity.

- Integration of advanced smart sensors and AI analytics into TPMS for real-time, load-sensitive inflation and pressure adjustment recommendations.

- Automated quality inspection leveraging computer vision systems to ensure precise adherence to stringent load index specifications during production.

- Supply chain efficiency enhanced through AI forecasting of regional seasonal demand peaks for specialized, low-volume RV tire sizes.

- Development of personalized tire maintenance scheduling and replacement recommendations based on granular analysis of individual driver behavior and vehicle usage profiles.

DRO & Impact Forces Of Recreational Vehicle Tire Market

The operational dynamics of the Recreational Vehicle Tire Market are fundamentally shaped by a complex and often conflicting set of demand drivers, inherent industrial restraints, and significant technological opportunities, all contributing to the sector's overall growth trajectory. Primary drivers include the robust, sustained increase in global RV ownership and utilization, largely catalyzed by profound demographic shifts favoring active retirement lifestyles and the widespread corporate acceptance of remote work models, leading to greater discretionary travel. Opportunities are strongly linked to innovation in advanced material science, with intensive focus on engineering sustainable, high-performance rubber compounds that not only enhance tire longevity and rolling resistance (improving fuel efficiency) but also minimize the environmental impact of manufacturing. However, the market faces inherent and persistent restraints, chiefly stemming from the global volatility and price fluctuation of key raw materials, predominantly natural and synthetic rubber, alongside the absolute requirement for adherence to highly stringent regulatory environments governing required load ratings, speed indices, and overall tire safety standards.

A central and non-negotiable driver supporting perpetual market volume is the inescapable necessity of cyclical tire replacement; irrespective of the accumulated mileage, RV tires are inherently susceptible to ‘time out’ failure mechanisms, primarily resulting from ozone-induced sidewall cracking (weather checking) and internal structural degradation caused by extended periods of static storage and intermittent use under full static load. This ensures a consistent, large-scale replacement demand that forms the economic backbone of the aftermarket segment. Furthermore, the increasing global regulatory mandate for vehicle safety features, such as the mandatory fitting of TPMS across numerous jurisdictions, directly incentivizes RV owners to adopt technologically compatible and advanced replacement tires, thus benefiting high-value segments. Conversely, a substantial restraint involves the aftermarket consumer tendency, especially for towable RVs, to seek out and install lower-cost, unoptimized light truck (LT) tires that may compromise the sustained static load capacity required for specialty trailer use, although enhanced consumer education and focused marketing campaigns are steadily mitigating this detrimental trend.

The most powerful contemporary impact forces driving structural change within the market include rapid technological progress, exemplified by the exploration of advanced features like run-flat technology for niche premium RV applications, and the intensification of the competitive landscape, which compels major manufacturers to differentiate their offerings through extended warranty periods and specialized, proprietary designs tailored for extreme load-carrying profiles. Economic impact forces, such as significant fluctuations in global oil prices and resulting gasoline costs, indirectly influence the market by affecting discretionary travel budgets; extremely high fuel prices may temporarily curb usage-related replacement demand. Nonetheless, the pervasive long-term societal trend towards experiential travel and localized touring ensures that the underlying market demand for robust, safe RV tires maintains profound resilience against short-term economic headwinds.

Segmentation Analysis

The Recreational Vehicle Tire Market utilizes comprehensive segmentation based on several critical dimensions, including product structure, specific vehicle typology, end-use application, and methods of distribution, providing a meticulous, layered view of market mechanisms and differing consumer purchasing behaviors across the spectrum of RV operations. This detailed segmentation analysis is fundamentally crucial, enabling manufacturers to precisely tailor targeted product research and development, refine dynamic pricing strategies, and effectively target distinct consumer cohorts, acknowledging the wide disparity in operational requirements, which range from the heavy-duty specifications of integrated Class A motorhomes to the lightweight handling needs of simple towable pop-up trailers. The structural segmentation based on construction type, specifically the distinction between superior radial tires and legacy bias ply technology, is especially vital, reflecting crucial differences in performance metrics and safety adherence, with radial technology dominating due to its better handling, lower heat generation, and superior fuel efficiency.

The segmentation by Vehicle Class is foundational, recognizing that the performance and safety demands of a large 30,000-pound Class A motorhome require fundamentally different tire specifications compared to a small, agile Class B campervan. Class A vehicles frequently demand commercial truck tires adapted for RV use (often 19.5 or 22.5 inches), while towable RVs necessitate specialty trailer (ST) tires engineered specifically to withstand lateral scrubbing and high static loads. Furthermore, the segmentation by End Use, distinguishing between the Original Equipment Manufacturer (OEM) segment and the dominant Aftermarket Replacement segment, is critical for understanding volume dynamics and pricing power. OEM segment sales are characterized by high volume but lower margins, whereas the aftermarket replacement segment offers significantly higher profit margins and constitutes the bulk of annual revenue due to the inherent time-out cycle of RV tires.

Finally, the segmentation by Distribution Channel highlights the evolving pathway of sales, where traditional Independent Tire Dealers and OEM Dealerships are facing increasing competitive pressure from rapidly expanding Online Retail platforms and specialized, customer-focused RV Service Centers. The rise of online channels allows consumers to meticulously compare highly technical tire specifications (load index, speed rating, ply rating) and pricing across a wide range of brands, increasing transparency and driving competitive pricing among distributors. Specialty RV Service Centers, however, retain a vital role by offering expert, high-weight installation and maintenance services, which are critical for safe mounting of large motorhome tires, thus serving as crucial indirect sales points and brand ambassadors for premium tire manufacturers across key North American and European markets.

- By Type:

- Radial Tires (Dominant construction type due to performance)

- Bias Tires (Niche use, primarily in older or specific utility trailers)

- By Vehicle Class:

- Class A Motorhomes (Requires commercial/bus chassis grade tires)

- Class B Motorhomes (Requires van/light truck adapted tires)

- Class C Motorhomes (Requires cutaway chassis/light truck grade tires)

- Towable RVs (Travel Trailers, Fifth Wheels - Requires Special Trailer (ST) tires)

- By End Use:

- Original Equipment Manufacturer (OEM) (New vehicle installations)

- Aftermarket Replacement (Majority of market volume)

- By Distribution Channel:

- Online Retail (Fastest growing channel for comparison shopping)

- Independent Tire Dealers (Traditional sales and service point)

- OEM Dealerships (Captive channel for new vehicle owners)

- Specialty RV Service Centers (Critical for installation of large tires)

Value Chain Analysis For Recreational Vehicle Tire Market

The comprehensive value chain for the Recreational Vehicle Tire Market commences with highly specialized upstream activities, which are dominated by the global procurement of critical raw materials. This includes securing consistent supplies of natural rubber latex, various synthetic polymers (such as Styrene-Butadiene Rubber, SBR, and Butadiene Rubber, BR), carbon black for reinforcement, high-tensile steel cord for belts, and a wide array of specialized curing chemicals and additives. Given the specialized requirements for RV tires—demanding extremely high load ratings and exceptional resistance to permanent deformation under sustained static load—the uniformity, purity, and consistency of these sourced materials are non-negotiable. Major manufacturers frequently establish strategic, long-term procurement contracts with verified, specialized global suppliers to safeguard against supply disruptions and maintain stringent quality controls over material inputs.

Midstream activities represent the highly complex manufacturing phase, encompassing compounding, precision molding, intensive curing, and rigorous, multi-stage quality assurance testing. This segment requires significant capital investment in advanced machinery and specialized molds tailored to RV-specific tire sizes and profiles. A disproportionate amount of midstream effort is directed toward reinforcing the sidewalls and optimizing the bead area—components crucial for managing the intense pressures and heavy weights typical of RV operation. Quality testing, often involving sophisticated ultrasound and X-ray analysis, focuses intensely on verifying the structural integrity of the carcass and ensuring absolute adherence to the mandated Load Index and speed rating, which are critical regulatory benchmarks for RV tire safety across major operating regions.

The downstream segment, focused on market distribution, is characterized by its dual structure: the high-volume OEM channel and the high-margin aftermarket channel. OEM distribution involves complex contractual agreements and often necessitates demanding just-in-time (JIT) delivery systems to major RV production facilities (e.g., in Elkhart County, Indiana, USA). The aftermarket distribution network is vastly more extensive and influential, relying heavily on a sophisticated matrix of large regional wholesalers, nationwide independent tire dealership chains, and specialized RV-focused service centers that integrate both sales and critical installation expertise. The growing direct-to-consumer online distribution platform represents a strategic shift, allowing manufacturers to bypass some traditional intermediaries, exert greater control over brand messaging, and capture higher margins, especially for premium, high-tech tire lines.

Recreational Vehicle Tire Market Potential Customers

The market for Recreational Vehicle Tires is fundamentally supported by three primary categories of buyers: the major manufacturers of recreational vehicles (constituting the OEM segment), the vast global population of individual RV and trailer owners (driving the replacement segment), and significant commercial fleet operators, including large-scale RV rental corporations and specialized mobile hospitality providers. RV manufacturers represent a high-volume procurement category, prioritizing supply chain consistency, absolute cost-efficiency, and assured conformity to mandated vehicle specifications. For suppliers, securing OEM contracts necessitates rigorous quality audits, competitive long-term pricing, and often requires collaborative product development, positioning the tire as an integral, safety-critical component influencing the overall market perception and quality of the finished vehicle.

Individual RV owners constitute the overwhelming majority of the replacement volume in the aftermarket, and their purchasing decisions are centered on obtaining tires that offer exceptional longevity, dependable load handling stability, and maximum resistance to common degradation issues such as sidewall weathering caused by prolonged inactivity. This consumer base places immense value on perceived safety and relies heavily on expert guidance obtained from specialty RV dealers, digital community forums, and professional third-party reviews. Their choice is highly sensitive to brand reputation, strong warranty provisions against premature failure, and the recommendation of specific tire construction types (e.g., all-steel construction, specific ST trailer ratings) proven to be optimized for their particular travel style, whether demanding off-road excursions or high-speed inter-state highway cruising.

Commercial fleet operators, including major global RV rental franchises and specialized tour providers, represent a distinct and critical high-frequency replacement market segment. These buyers are primarily motivated by the minimization of Total Cost of Ownership (TCO), seeking tires that deliver superior durability, extended functional tread life, and robust carcass integrity capable of enduring constant, punishing use and variable driver performance profiles. To serve this demanding segment effectively, tire suppliers often partner with fleet managers, offering tailored services such as comprehensive on-site inspection programs, dedicated maintenance support, and customized bulk purchasing agreements, all designed to maximize vehicle utilization time and dramatically reduce revenue-critical tire-related downtime across the operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Goodyear Tire & Rubber Company, Continental AG, Bridgestone Corporation, Sumitomo Rubber Industries, Yokohama Tire Corporation, Cooper Tire & Rubber Company (a subsidiary of Goodyear), Hankook Tire, Toyo Tire Corporation, Maxxis International, Kumho Tire, Double Coin Holdings Ltd., Giti Tire, Sailun Group, Trelleborg AB, Cheng Shin Rubber Ind. Co. Ltd., Shandong Linglong Tire Co. Ltd., Zhongce Rubber Group Co. Ltd. (ZC Rubber), Apollo Tires Ltd., Titan International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recreational Vehicle Tire Market Key Technology Landscape

The technological landscape within the Recreational Vehicle Tire Market is undergoing a fundamental transformation, evolving beyond standard material enhancements to focus heavily on comprehensive digital integration, predictive analytics, and proactive safety features. A primary area of core technological focus remains the continuous refinement of rubber compounds and complex tire construction methodologies, specifically through the utilization of advanced silica incorporation and optimized synthetic polymer blends. The objective is twofold: to significantly minimize rolling resistance for improved fuel efficiency—an important consideration for heavy RVs—while simultaneously enhancing the critical high load-bearing capacity and robust puncture resistance required for continuous, heavy-duty operation. Manufacturers are heavily investing in developing advanced multi-ply construction and proprietary cooling technologies that effectively manage and dissipate the severe heat generated internally under sustained heavy loads, thereby substantially mitigating the historical safety risk associated with structural fatigue and sudden catastrophic blowouts, particularly prevalent in large motorhomes.

A crucial and accelerating technological trend is the pervasive implementation of 'smart tire' technology across all premium RV segments. This technology involves the strategic embedding of sophisticated sensors, often deeply integrated with and augmenting the functionality of the standard Tire Pressure Monitoring System (TPMS), directly into the tire's inner lining or carcass structure. These advanced sensors perform continuous, real-time monitoring of crucial operational parameters, including instantaneous pressure and temperature readings, and, increasingly, provide high-fidelity data on critical metrics such as actual tread depth, dynamic load distribution across the axle, and evolving wear patterns. The extensive data stream generated by these sensors is transmitted wirelessly to the RV's central vehicle management system or a dedicated smartphone application, providing the owner with highly granular, predictive maintenance warnings and specific, actionable maintenance insights, dramatically enhancing safety and ensuring proactive tire longevity management for a user base prone to overlooking routine manual checks.

Furthermore, significant technological innovation is dedicated to creating highly specialized tire typologies, such as those explicitly engineered for demanding trailer applications (often designated with the 'ST' marking for Special Trailer). These designs utilize unique, optimized tread geometry, substantially reinforced steel belts, and specialized bead packages to effectively resist lateral scrubbing forces during tight maneuvers and improve high-speed directional stability while towing heavy loads. Technology is also fundamentally revolutionizing manufacturing precision; the use of advanced robotics, computer-aided design (CAD) optimization for mold structures, and automated inspection systems incorporating high-resolution ultrasound and industrial X-ray imaging during the curing and finishing phases ensures that every single unit complies perfectly with the specified, non-negotiable load index and speed rating, a level of quality assurance critical for minimizing the severe safety risks associated with construction defects in heavy RV applications.

Regional Highlights

The global Recreational Vehicle Tire Market exhibits profoundly distinct regional market dynamics, which are a direct reflection of varying levels of RV adoption maturity, quality and extent of local road infrastructure, and prevailing consumer disposable income levels. North America, encompassing the sprawling markets of the United States and Canada, remains the indisputable global market leader, primarily driven by the deeply established, pervasive cultural tradition of RV touring, highly favorable demographic shifts (such as the high density of Baby Boomers entering active retirement), and the existence of a robust, highly competitive domestic manufacturing and distribution infrastructure. The region's preference for significantly large average vehicle sizes, particularly heavy Class A motorhomes and vast fifth-wheel trailers, fuels intense demand for the largest, most heavy-duty tires, frequently requiring commercial-grade radial tires adapted for RV use and specialized ST tires, solidifying North America as the single most critical strategic focus area for premium tire manufacturers seeking high volume and high-value sales revenue.

Europe constitutes the world's second-largest RV tire market, characterized by a more fragmented operational landscape and a pronounced regional preference for smaller, more compact, and highly agile RVs and campervans, better suited to navigating the continent's narrower roads and mitigating the effects of higher prevailing fuel costs. Market growth across Europe is steady and structurally underpinned by rigorous regulatory mandates focused on vehicle safety, leading to consistently high adoption rates of advanced TPMS-integrated tires and specialized seasonal tires. The European market places considerable emphasis on tires optimized for diverse, rapidly changing seasonal conditions, often requiring M+S (Mud and Snow) rating certification even for standard touring RV tires. Demand remains consistently strong across major touring nations, including Germany, France, and the UK, benefiting significantly from the high volume of cross-border touring activities and the sustained expansion of the professional RV rental market.

The Asia Pacific (APAC) region is strategically positioned to register the fastest growth trajectory globally throughout the forecast period, albeit from a current smaller market base. This rapid future expansion is robustly fueled by several concurrent socioeconomic factors, including dramatically rising middle-class disposable incomes, accelerating urbanization pressures encouraging nature-based recreational escapes, and substantial governmental investments in modern road and tourism infrastructure development in key countries such as Australia, China, and New Zealand. Australia, with its unique requirement for long-distance travel across extensive and often rugged terrains, generates particularly high demand for specialized, exceptionally durable all-terrain RV and off-road trailer tires. Consequently, leading international manufacturers are intensifying efforts to establish strong local production capabilities, or securing robust distribution and strategic partnership networks within APAC, aiming to swiftly capitalize on the relatively nascent, but rapidly maturing, RV ownership and touring culture emerging across the region.

- North America (USA, Canada): Dominant market share fueled by large-scale, long-standing RV culture; high volume in aftermarket replacement sales; specific high-value demand for heavy-duty commercial-grade radial tires (19.5" and 22.5") for Class A motorhomes.

- Europe (Germany, UK, France): Stable, high-value growth driven by niche preferences for smaller campervans and regulated safety mandates; high market penetration of TPMS-compatible and seasonally optimized (M+S rated) radial tires.

- Asia Pacific (APAC) (Australia, China, New Zealand): Fastest-growing region, stimulated by rising domestic tourism and infrastructure investment; strong localized demand for highly rugged, all-terrain tires capable of handling demanding road conditions.

- Latin America and Middle East & Africa (MEA): Smaller, developing markets characterized by gradual growth tied to localized tourism expansion; current focus primarily on utility-based trailers and price-sensitive, standard replacement options, with long-term potential linked to economic stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recreational Vehicle Tire Market.- Michelin

- Goodyear Tire & Rubber Company

- Continental AG

- Bridgestone Corporation

- Sumitomo Rubber Industries

- Yokohama Tire Corporation

- Cooper Tire & Rubber Company (a subsidiary of Goodyear)

- Hankook Tire

- Toyo Tire Corporation

- Maxxis International

- Kumho Tire

- Double Coin Holdings Ltd.

- Giti Tire

- Sailun Group

- Trelleborg AB

- Cheng Shin Rubber Ind. Co. Ltd.

- Shandong Linglong Tire Co. Ltd.

- Zhongce Rubber Group Co. Ltd. (ZC Rubber)

- Apollo Tires Ltd.

- Titan International

Frequently Asked Questions

Analyze common user questions about the Recreational Vehicle Tire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor influencing RV tire replacement schedules?

The most critical factor is time, often referred to as 'aging out,' rather than accumulated mileage. RV tires, due to long periods of stationary storage and continuous UV exposure, are highly susceptible to ozone-induced sidewall cracking and internal structural degradation, necessitating mandatory replacement typically every 5 to 7 years, regardless of residual tread depth, to reliably maintain certified safety and load capacity ratings.

How do modern radial tires offer performance advantages over traditional bias tires for recreational vehicles?

Radial tires represent the superior, modern standard, delivering enhanced performance, significantly better fuel efficiency due to their inherently lower rolling resistance, and crucially, vastly reduced heat generation under sustained high-speed, heavy-load highway operation. Bias tires, now used primarily for specific low-speed or vintage applications, generate greater heat and offer less responsive handling, establishing radials as the fundamentally safer and higher-performing choice for all contemporary RV classes.

Why is strict adherence to the Load Range/Index absolutely essential for RV tire selection?

The Load Index specifies the maximum weight capacity that a single tire can safely support when inflated to the manufacturer’s designated pressure. RVs routinely operate at or extremely close to their maximum Gross Vehicle Weight Rating (GVWR), making precise compliance with the required load range non-negotiable for preventing catastrophic structural failures, ensuring optimal vehicle stability, and meeting legal safety requirements, especially vital for massive Class A motorhomes and heavily laden fifth-wheel trailers.

Is it regulatory mandatory to use specialized 'ST' (Special Trailer) tires on towable RVs and trailers?

While the regulatory mandate is not universal across all jurisdictions, the use of purpose-built ST tires is universally and highly recommended for all travel trailers and fifth wheels. ST tires are structurally engineered specifically to withstand the unique vertical loads and extreme lateral (side-to-side) scrubbing forces inherent to heavy towing, featuring reinforced sidewalls and specialized rubber compounds that ensure superior handling stability and safety compared to standard Light Truck (LT) tires.

How does the integration of smart tire technology significantly benefit the daily operations of RV owners?

Smart tire technology, which embeds advanced TPMS and analytical sensors, provides RV owners with highly accurate, real-time data on critical operational metrics like tire pressure, internal temperature, and detailed wear characteristics. This sophisticated data enables highly proactive maintenance, facilitates dynamic optimization of inflation levels based on current vehicle load, and dramatically reduces the risk of sudden, catastrophic tire failures, ultimately resulting in enhanced fuel economy, reduced maintenance costs, and substantially improved overall road safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager