Recycled Rubber Roofing Shingle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441936 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Recycled Rubber Roofing Shingle Market Size

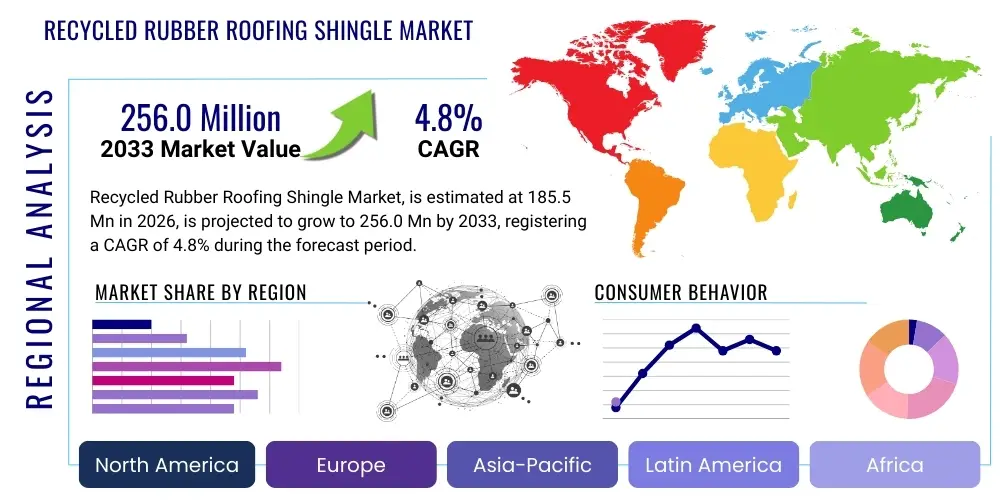

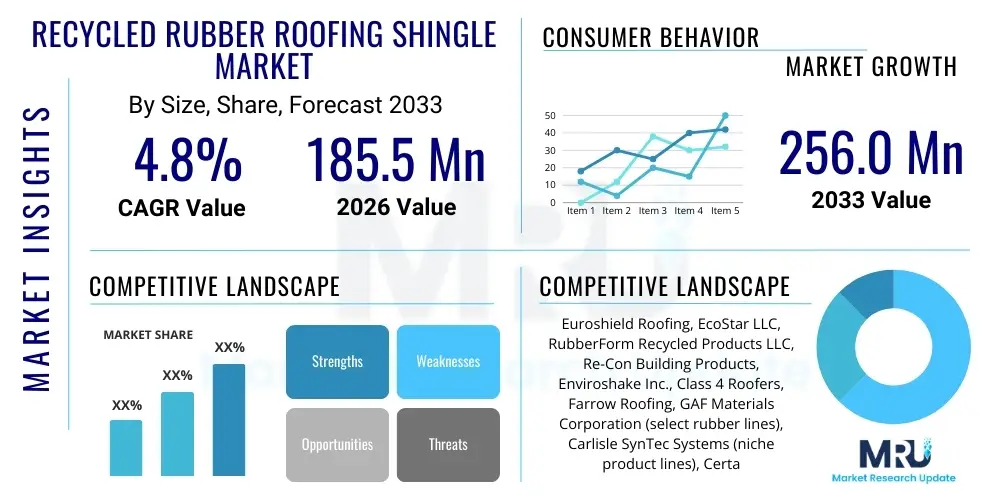

The Recycled Rubber Roofing Shingle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $185.5 million in 2026 and is projected to reach $256.0 million by the end of the forecast period in 2033.

Recycled Rubber Roofing Shingle Market introduction

The Recycled Rubber Roofing Shingle Market encompasses the manufacturing, distribution, and installation of roofing materials primarily derived from recycled tire rubber and other elastomer waste streams. This segment addresses the dual challenges of end-of-life tire management and the growing demand for sustainable, high-performance building materials. These shingles offer superior durability, resistance to impact, fire, and UV degradation compared to traditional asphalt or wood shakes, positioning them as a premium, eco-friendly alternative in both residential and commercial construction sectors. The manufacturing process involves sophisticated grinding, purification, and molding techniques to ensure product integrity and aesthetic appeal, often mimicking the look of slate or cedar.

Major applications for recycled rubber roofing shingles span across residential retrofitting, new sustainable construction projects, and commercial buildings that require highly resilient and low-maintenance roofing systems. The intrinsic properties of rubber—specifically its flexibility and water resistance—make these shingles particularly attractive in regions prone to extreme weather events such as hail, heavy snowfall, or high winds. Furthermore, the increasing stringency of building codes related to sustainability and fire safety in urban environments is significantly bolstering the adoption rate of these specialized roofing products. The market growth is also intrinsically linked to public awareness regarding green building practices and the availability of government incentives promoting the use of recycled content.

Key benefits driving market adoption include their exceptional longevity (often warrantied for 50 years or more), significant reduction in construction waste sent to landfills, and enhanced thermal insulation capabilities, which contribute to improved energy efficiency in buildings. The driving factors are multifaceted, including rising environmental regulatory pressures on waste disposal, consumer preference shifts towards aesthetically pleasing and environmentally responsible building materials, and technological advancements that reduce the production costs associated with preparing and processing waste rubber into viable shingle feedstock. These elements collectively establish a strong foundation for sustained market expansion over the forecast period.

Recycled Rubber Roofing Shingle Market Executive Summary

The Recycled Rubber Roofing Shingle Market is characterized by robust business trends centered on sustainability integration and material innovation. Manufacturers are increasingly focused on optimizing recycling logistics to secure consistent, high-quality feedstock, moving towards closed-loop systems where possible. A critical business trend involves strategic partnerships between rubber recyclers and specialized construction material producers to enhance supply chain efficiency and product quality standards. Furthermore, digitalization in construction (BIM) is facilitating easier specification of these sustainable materials, pushing them into mainstream architectural design. The competitive landscape is slowly shifting from niche providers to major roofing companies incorporating recycled lines, driven by corporate social responsibility goals and market demand for green products, emphasizing durability and aesthetic variety (color and texture consistency).

Regionally, North America remains the dominant market segment, primarily due to established waste tire recycling infrastructure, a strong cultural emphasis on resilience against severe weather (especially hail belts), and supportive governmental policies encouraging sustainable construction practices. Europe, particularly Northern and Western countries, is experiencing rapid growth, fueled by stringent EU directives on circular economy and ambitious net-zero emission targets in the building sector. Asia Pacific is emerging as a high-potential region, driven by rapid urbanization and increasing environmental awareness in economies like Japan and South Korea, though infrastructure limitations regarding feedstock collection present initial barriers. Emerging markets, conversely, are slower to adopt due to the higher initial cost relative to traditional materials, requiring ongoing educational and incentive programs to stimulate growth.

Segment trends indicate a strong preference for high-end aesthetic imitation products, such as those replicating natural slate or cedar shakes, where the recycled rubber offers the visual appeal without the maintenance burden or vulnerability of natural materials. The residential retrofitting segment continues to dominate demand, capitalizing on the 50-year plus life cycle advantage, which appeals strongly to homeowners seeking long-term value. Technology advancement is yielding lighter-weight, easier-to-install shingles, reducing labor costs and broadening their appeal to DIY and smaller contractor markets. Furthermore, segmentation based on composition, specifically the proportion of recycled content and blending with polymers for added UV stability, is becoming a key differentiator, appealing to consumers focused on specific sustainability metrics and performance guarantees.

AI Impact Analysis on Recycled Rubber Roofing Shingle Market

User queries regarding AI's influence in the Recycled Rubber Roofing Shingle Market commonly revolve around themes of material quality control, optimization of manufacturing processes, and predictive maintenance for roofing longevity. Consumers and industry professionals frequently ask how AI can ensure consistent purity and quality of the recycled rubber feedstock, which is notoriously variable. Key concerns also focus on utilizing machine learning to predict the performance lifespan of shingles under specific climate conditions, allowing manufacturers to issue more precise warranties and refine product formulations. Expectations center on AI-driven logistics for tire collection and processing, dramatically improving supply chain efficiency and reducing the variable cost of materials. This analysis summarizes the anticipation that AI will transition recycled rubber shingle production from an artisanal, material-dependent process to a highly standardized, data-driven manufacturing system, thereby increasing scalability and reducing overall product costs, making sustainable roofing more competitive.

- AI optimizes sorting and purification of waste rubber feedstock, enhancing material consistency.

- Machine learning algorithms predict material degradation rates based on environmental exposure data, refining product lifespan warranties.

- Predictive maintenance analytics for manufacturing equipment minimizes downtime and operational costs in rubber processing plants.

- AI-driven supply chain management optimizes the collection and distribution logistics of end-of-life tires (ELTs).

- Generative design tools utilize AI to model new shingle geometries for improved wind uplift resistance and water runoff efficiency.

- AI assists in market forecasting by analyzing construction trends, regulatory shifts, and consumer preferences, guiding inventory and production planning.

- Quality control systems leveraging computer vision automatically detect defects in molded shingles during high-speed production.

DRO & Impact Forces Of Recycled Rubber Roofing Shingle Market

The Recycled Rubber Roofing Shingle Market is fundamentally shaped by powerful environmental drivers and material durability advantages, counterbalanced by persistent cost and perception barriers. Key drivers include stringent waste management regulations, particularly those targeting end-of-life tires (ELTs), which mandate recycling and create a robust supply of feedstock. The demand for resilient building materials in climate-vulnerable areas further fuels growth, as rubber shingles exhibit superior resistance to hail, fire, and high winds compared to conventional materials. However, a significant restraint is the initial high cost of these premium shingles relative to standard asphalt, which creates purchase hesitancy, particularly in price-sensitive segments. Furthermore, lack of contractor familiarity and sporadic regional availability of specialized installation expertise pose logistical challenges, slowing broader market penetration. The primary opportunity lies in expanding market acceptance through standardization, demonstrating long-term cost savings (low maintenance, long lifespan), and capitalizing on government incentives for green building materials and tax credits for sustainable home improvements, creating a favorable total cost of ownership proposition.

Impact forces currently favoring market acceleration include the rapidly maturing technology for rubber devulcanization and processing, which is improving material performance and lowering production volatility. Regulatory forces, particularly the increasing adoption of mandates for recycled content in public works and infrastructure projects, provide a stable foundation for demand growth. Conversely, the impact of fluctuating crude oil prices, which influences both the cost of competing asphalt products and the energy required for rubber processing, introduces cyclical instability. The environmental impact force is overwhelmingly positive; the market directly addresses a massive global waste problem (ELTs) while providing a sustainable alternative, strongly aligning with consumer and governmental sustainability goals. Social acceptance is improving as product aesthetics evolve to closely mimic high-end traditional materials like slate, overcoming previous resistance related to the perceived appearance of recycled products.

The synergy between environmental benefits and practical performance constitutes the core growth impetus. The durability factor—often leading to product warranties of 50 years or more—significantly reduces the lifecycle cost of the roofing system, which increasingly resonates with both institutional investors managing large property portfolios and discerning homeowners. Market stakeholders must focus efforts on overcoming the initial capital outlay barrier through innovative financing models and targeted communication that emphasizes the ROI derived from reduced energy bills, lower insurance premiums (due to impact resistance), and elimination of mid-lifecycle replacement costs. By converting the restraint of high initial cost into a long-term investment opportunity, the market can unlock its full potential, driven by powerful ecological and performance demands.

Segmentation Analysis

The Recycled Rubber Roofing Shingle Market is segmented based on critical characteristics including the type of application (Residential and Commercial), the specific material composition used in the shingle formulation (100% Recycled Rubber, Rubber Composites), and the type of construction activity (New Construction, Reroofing/Replacement). This layered segmentation allows manufacturers to tailor product offerings to specific end-user needs, addressing variances in required durability, fire ratings, aesthetic preferences, and budget constraints. The residential segment historically accounts for the largest market share, driven primarily by replacement cycles and the increasing focus on sustainable home improvements. The composite segment, blending rubber with other polymers or mineral fillers, is growing rapidly as it allows for specialized performance characteristics, such as enhanced UV resistance or reduced weight, thereby balancing cost and performance effectively across different climate zones and structural requirements.

The Reroofing/Replacement activity segment holds substantial market dominance, reflecting the fact that rubber shingles are frequently chosen as a long-term upgrade during major home renovation cycles. Their low maintenance and long lifespan make them ideal for existing structures seeking resilience and reduced environmental footprint. Within material composition, the pure recycled rubber segment appeals most strongly to customers prioritizing maximum recycled content and extreme durability, typically commanding a premium price point. Conversely, the composite segment offers a pathway to wider market acceptance by providing a mid-range price option while still offering significant environmental and performance advantages over standard asphalt shingles. Strategic marketing focuses on differentiating products within these segments, highlighting the unique value proposition each formulation provides, whether it is maximum sustainability credentials or optimized weather resistance.

- By Application:

- Residential

- Commercial

- By Material Composition:

- 100% Recycled Rubber

- Rubber Composites (Blended with Plastics or other Polymers)

- By Construction Activity:

- New Construction

- Reroofing/Replacement

- By End-User:

- Homeowners

- Contractors/Developers

- Government/Institutional

Value Chain Analysis For Recycled Rubber Roofing Shingle Market

The value chain for recycled rubber roofing shingles is fundamentally rooted in the efficient and sustainable management of waste rubber, primarily focusing on end-of-life tires (ELTs). The upstream segment begins with raw material sourcing, involving tire collection and aggregation centers, where ELTs are gathered, sorted, and transported. This is followed by critical processing steps, including shredding, grinding (into crumb rubber), and devulcanization or pyrolysis to prepare the material feedstock. Effective upstream management heavily relies on regulatory compliance and robust logistical networks to ensure a steady supply of high-quality, contaminant-free crumb rubber, which is essential for final product quality consistency. Investment in advanced devulcanization technology represents a key area of differentiation in the upstream sector, improving material integrity and reducing the need for virgin binders.

The core manufacturing and production stage involves blending the processed crumb rubber with pigments, UV stabilizers, and binding agents (in the case of composites) and molding them under high pressure and heat into the final shingle forms. Quality control at this stage is paramount, focusing on dimensional stability, impact resistance ratings (e.g., UL 2218 Class 4), and fire resistance ratings. The downstream segment encompasses distribution, which typically utilizes a hybrid model. Direct sales channels are often employed for large commercial projects or specialized architectural firms, ensuring technical specifications are met precisely. Indirect channels involve established networks of building material distributors, specialized roofing suppliers, and big-box retailers, which facilitate wider market reach and availability to smaller contractors and homeowners, necessitating effective inventory management and point-of-sale technical support.

The market relies heavily on a strong intermediary relationship between manufacturers and professional roofing contractors for installation, as specialized knowledge, although minimal, is sometimes required compared to standard asphalt installation. Effective distribution requires educating the contractor base on the material's unique properties, installation techniques, and handling best practices. The value added at the downstream level is derived not just from the product itself, but from the bundled services, including extended warranties, technical consultation, and assistance in navigating environmental certifications. Overall efficiency in the value chain is measured by the ability to transform a low-value waste material into a high-performance, premium construction product while minimizing material waste and energy input across all processing stages, thus reinforcing the product's environmental narrative and maximizing profit margins.

Recycled Rubber Roofing Shingle Market Potential Customers

The primary potential customers and buyers of recycled rubber roofing shingles are segmented based on their purchasing drivers, encompassing residential homeowners, commercial property developers, and institutional entities focused on sustainability and asset protection. Residential homeowners, particularly those in high-income brackets or situated in extreme weather zones (e.g., areas prone to high wind, heavy hail, or freeze/thaw cycles), are critical buyers. Their motivation stems from the desire for high durability, low long-term maintenance costs, aesthetic appeal (mimicking slate or cedar), and strong environmental credentials. This group often performs extensive research and is willing to pay a premium for a product with a 50-year plus warranty, viewing the roofing system as a long-term capital investment that enhances property value and insurance benefits.

Commercial and institutional buyers, including operators of multi-family housing complexes, educational facilities, government buildings, and commercial warehouses, represent a rapidly growing customer base. For these entities, the purchasing decision is largely driven by lifecycle cost analysis (LCCA), risk mitigation, and compliance with corporate sustainability goals (ESG reporting). The Class 4 impact rating and superior fire resistance of rubber shingles are significant advantages in risk management, potentially reducing commercial insurance costs. Furthermore, developers pursuing LEED certification or other green building standards actively seek out products with high recycled content like rubber shingles to gain accreditation points, demonstrating commitment to environmental stewardship and attracting environmentally conscious tenants or investors.

A third significant customer segment includes professional roofing contractors and home improvement retailers who act as crucial intermediaries. Contractors specializing in high-end or sustainable building projects are potential partners who, once educated on the product's advantages and installation efficiency, become powerful advocates and repeat buyers. Retail chains provide accessibility to the broader market, making product availability and competitive pricing essential to capturing the DIY and smaller contractor segments. Ultimately, the market success hinges on convincing these diverse buyer groups of the superior total cost of ownership and performance of recycled rubber shingles over traditional materials, effectively bridging the gap between initial cost and long-term value creation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $256.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Euroshield Roofing, EcoStar LLC, RubberForm Recycled Products LLC, Re-Con Building Products, Enviroshake Inc., Class 4 Roofers, Farrow Roofing, GAF Materials Corporation (select rubber lines), Carlisle SynTec Systems (niche product lines), CertainTeed (limited recycled elastomer products), Greenstone Roofing, Shake and Slate, PlyGem, IKO Industries, OmniShake, American Recycled Products, A&D Materials, Northstar Polymers, Q&Q Rubber Solutions, Green Rubber Tile Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Rubber Roofing Shingle Market Key Technology Landscape

The technological landscape of the Recycled Rubber Roofing Shingle Market is defined by advancements aimed at enhancing feedstock quality, improving manufacturing efficiency, and broadening product aesthetics. The most critical technological breakthroughs relate to the pre-processing of waste rubber, specifically devulcanization techniques. Traditional recycling relies on simple grinding into crumb rubber, but modern thermal and chemical devulcanization methods are increasingly employed. These sophisticated processes break down the sulfur cross-links in the rubber molecules without destroying the underlying polymer structure, resulting in a more malleable, higher-quality recycled material that exhibits improved bonding characteristics with virgin polymers and additives. This technological refinement directly addresses the primary industry restraint: the inconsistency and variability of waste rubber feedstock, leading to shingles with superior structural integrity and longevity, competitive with virgin polymer products.

Further technological integration focuses on the manufacturing process itself, particularly in precision molding and coloration. Manufacturers are adopting advanced injection molding and compression techniques that ensure precise shingle dimensions, which is vital for seamless installation and weather sealing. Automated quality control systems, often incorporating vision systems and sensor technology, monitor the curing process to prevent inconsistencies like blistering or uneven thickness, ensuring that every batch meets stringent impact resistance and fire safety standards. Another key area of innovation is the development of non-toxic, highly durable pigments and UV stabilizers specifically formulated for rubber composites, allowing shingles to maintain their aesthetic appeal—crucial for mimicking natural materials like slate—without fading or degrading under prolonged solar exposure, thereby protecting the substantial investment made by property owners.

The future technology landscape is leaning heavily towards integrated digital solutions, including traceability and material science informatics. Blockchain technology is emerging as a method for tracking the source of the waste rubber, ensuring ethical sourcing and validating the recycled content claims, which is a significant factor for environmentally conscious consumers and auditors. Simultaneously, material science research is focusing on developing hybrid composite formulations that reduce the density of the shingles, making them lighter and easier to install, while retaining the essential Class 4 impact resistance. These innovations, covering everything from initial feedstock preparation to final aesthetic customization, are crucial for scaling production, lowering the total installed cost, and increasing the market's competitive edge against cheaper, less sustainable alternatives, thereby accelerating the transition to mainstream construction material status.

Regional Highlights

- North America: The largest and most established market, primarily driven by the stringent impact resistance requirements (Class 4 certifications) necessary in hail-prone regions of the US and Canada. North America boasts mature recycling infrastructure for end-of-life tires (ELTs) and high consumer acceptance of premium, sustainable building materials. Government initiatives and homeowner insurance rebates for using impact-resistant roofing further solidify this region's dominance. Innovation here often focuses on aesthetic variety and extreme weather performance, leveraging the 50-year warranty advantage extensively in marketing efforts.

- Europe: Characterized by rapid growth, spurred by the European Union’s Circular Economy Action Plan and national commitments to waste reduction and recycling targets. Western European nations, such as Germany, the Netherlands, and the UK, are early adopters, driven by strong environmental consciousness and high material quality expectations. The focus in Europe is heavily on certified recycled content and thermal performance, aligning shingle properties with strict energy efficiency mandates for buildings. However, varied national building codes pose complexity for continent-wide market standardization.

- Asia Pacific (APAC): An emerging powerhouse, anticipated to exhibit the highest growth rate during the forecast period. This growth is linked to accelerated urbanization, massive new construction volumes, and increasing public awareness regarding sustainability in rapidly developing economies like India and China, alongside mature markets like Japan and South Korea, which have robust recycling capabilities. Key drivers include government investment in waste management infrastructure and growing middle-class demand for high-quality, resilient materials capable of withstanding monsoon seasons and typhoons, though price sensitivity remains a limiting factor requiring competitive pricing strategies.

- Latin America (LATAM): Growth is steady but constrained by economic instability and less developed waste collection infrastructure compared to North America and Europe. Market penetration is concentrated in upscale residential projects and specific commercial sectors in countries like Brazil and Mexico, where demonstration projects emphasizing longevity and thermal benefits are gaining traction. Regulatory frameworks supporting recycling are nascent but developing, offering long-term market potential once feedstock supply becomes more reliable and consistent.

- Middle East and Africa (MEA): Currently the smallest market share, with adoption primarily focused on high-profile, sustainable mega-projects in the GCC countries (e.g., UAE, Saudi Arabia) driven by national diversification and sustainability visions (e.g., Saudi Vision 2030). The extreme heat and UV exposure in the region necessitate highly specialized shingle formulations with exceptional UV stability. In Africa, growth is hampered by high logistics costs and the high initial price point, confining use to specialized import markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Rubber Roofing Shingle Market.- Euroshield Roofing

- EcoStar LLC

- RubberForm Recycled Products LLC

- Re-Con Building Products

- Enviroshake Inc.

- Class 4 Roofers

- Farrow Roofing

- GAF Materials Corporation (select rubber lines)

- Carlisle SynTec Systems (niche product lines)

- CertainTeed (limited recycled elastomer products)

- Greenstone Roofing

- Shake and Slate

- PlyGem

- IKO Industries

- OmniShake

- American Recycled Products

- A&D Materials

- Northstar Polymers

- Q&Q Rubber Solutions

- Green Rubber Tile Manufacturing

Frequently Asked Questions

Analyze common user questions about the Recycled Rubber Roofing Shingle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and warranty period for recycled rubber roofing shingles?

Recycled rubber roofing shingles typically offer a significantly longer lifespan than traditional materials, often exceeding 50 years. Manufacturers commonly provide transferable limited lifetime warranties, with some offering guarantees specifically covering impact resistance and material defects for half a century, positioning them as a robust, long-term investment.

Are recycled rubber shingles cost-effective compared to traditional asphalt or slate?

While the initial material cost of recycled rubber shingles is generally higher than standard asphalt, they are cost-competitive with premium materials like natural slate or cedar. Their cost-effectiveness is realized through a lower Total Cost of Ownership (TCO), driven by reduced maintenance needs, potential insurance savings due to Class 4 impact resistance, and a replacement cycle often three to five times longer than asphalt.

How do recycled rubber shingles perform in extreme weather, particularly hail and fire?

Recycled rubber shingles demonstrate exceptional performance in extreme weather. They are highly resilient and consistently achieve the highest industry rating for impact resistance (UL 2218 Class 4), minimizing damage from large hail. Furthermore, they are manufactured to meet stringent fire safety standards, often obtaining Class A fire ratings when installed with appropriate underlayment, making them highly protective and suitable for diverse climates.

What percentage of recycled content is typically used in these roofing shingles?

The percentage of recycled content varies by manufacturer and product line, typically ranging from 75% to 100% recycled rubber, primarily sourced from end-of-life tires (ELTs). Consumers should verify the specific product documentation, as manufacturers often utilize high recycled content as a key marketing differentiator and for securing green building certifications like LEED points.

Is specialized installation required for recycled rubber roofing shingles?

Recycled rubber shingles are generally designed to be installed using standard roofing tools and techniques. However, some composite formulations or larger slate-imitation styles may require specific fastening patterns or greater attention to detail compared to basic asphalt shingles. Manufacturers recommend using contractors certified or familiar with their specific product lines to ensure warranty validity and optimal performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager