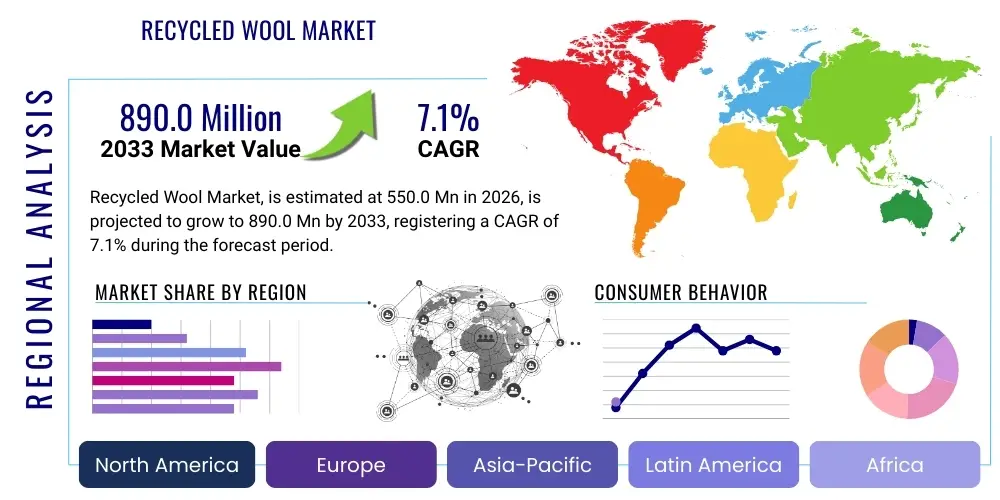

Recycled Wool Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442273 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Recycled Wool Market Size

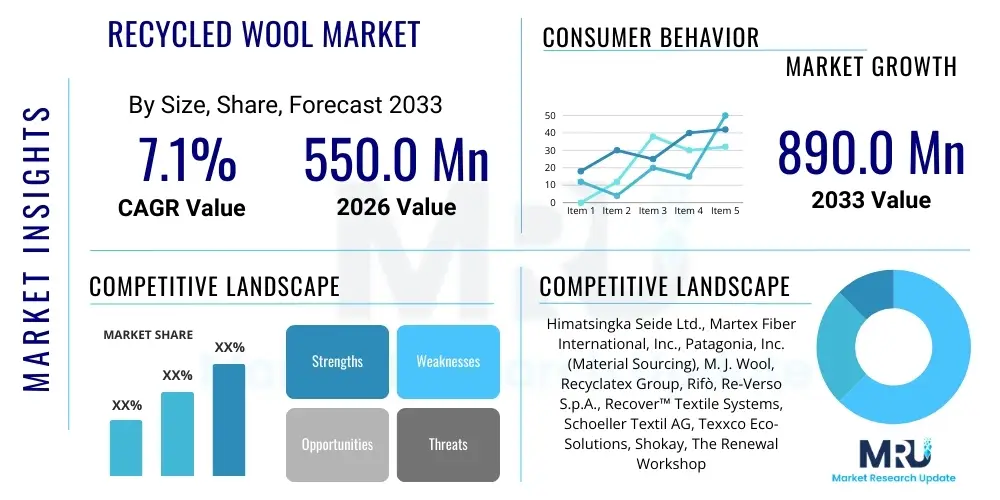

The Recycled Wool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 550.0 million in 2026 and is projected to reach USD 890.0 million by the end of the forecast period in 2033.

Recycled Wool Market introduction

The Recycled Wool Market encompasses the production and trade of wool fibers recovered from pre-consumer textile waste (such as manufacturing scraps) and post-consumer textile waste (used garments, blankets, and upholstery). This process, primarily mechanical recycling, involves sorting, shredding, and spinning the recovered fibers, often blended with virgin or synthetic fibers to enhance strength and durability, given that the recycling process typically shortens the fiber length. The resulting material significantly reduces environmental impact compared to virgin wool production, which is resource-intensive regarding water, land use, and chemical processing, positioning recycled wool as a critical component in the textile industry’s transition toward circularity and sustainable material sourcing. Major applications span high-volume consumer goods, specifically in the fast-growing sustainable fashion sector, premium outdoor wear, and increasingly in home textiles where durability and warmth are valued attributes.

The product description highlights a material prized not only for its low environmental footprint but also for maintaining the inherent thermal and breathable properties of natural wool. Recycled wool products often carry certifications or transparency markers detailing their origin and processing method, appealing directly to environmentally conscious consumers and brands committed to ESG (Environmental, Social, and Governance) goals. While historically associated with a rougher finish due to fiber breakdown, advancements in mechanical processing, de-pilling technologies, and careful blending now allow recycled wool to be used in finer gauge knits and softer textiles, expanding its utility far beyond traditional heavy outerwear and blankets. The growing consumer awareness regarding textile waste and the finite nature of natural resources serves as a fundamental catalyst driving adoption across various segments.

Key driving factors for the proliferation of recycled wool include stringent governmental regulations targeting textile waste reduction, ambitious corporate sustainability mandates established by global fashion houses, and a favorable economic equation wherein the sourcing cost of recovered textiles can be significantly lower than that of high-quality virgin wool. The benefits—reduced carbon footprint, minimized water usage, and lower chemical requirements—are substantial selling points in B2B and B2C marketing. Furthermore, the inherent need to address the massive landfill accumulation of textiles ensures a continuous and growing supply chain for recycled input materials, securing the long-term viability of this market sector and fostering investment in advanced recycling infrastructure globally.

Recycled Wool Market Executive Summary

The Recycled Wool Market is experiencing robust growth fueled by pivotal shifts in global business trends, escalating regulatory pressures, and evolving consumer demand for sustainable apparel and home goods. A central business trend involves major apparel retailers and luxury brands actively integrating recycled wool into their core collections, moving beyond small capsule collections to make it a standard part of their material portfolio, driven by public commitments to achieve fiber circularity by 2030. This demand surge is prompting significant investment in localized recycling infrastructure, particularly in Europe and North America, where sorting and mechanical processing facilities are being upgraded to handle increased volume and maintain consistent quality standards necessary for industrial applications. Furthermore, innovations in traceable supply chain management, often leveraging digital platforms, are becoming crucial in verifying the authenticity and sustainability claims associated with recycled wool products, thereby mitigating risks of greenwashing and building consumer trust in circular textiles.

Regionally, Europe maintains its dominance due to early adoption, mature textile recycling infrastructure, and pioneering legislation like the EU Waste Framework Directive and proposed Eco-design for Sustainable Products Regulation (ESPR), which places Extended Producer Responsibility (EPR) requirements on textiles. This regulatory environment incentivizes higher recycling rates and the use of secondary raw materials. Asia Pacific, particularly China and India, is emerging as the fastest-growing market, driven by its status as a massive manufacturing hub and a rapidly increasing domestic consumer base that is becoming more attuned to environmental issues. While North America shows strong demand driven by leading outdoor and lifestyle brands prioritizing performance and sustainability, the market growth relies heavily on importing high-quality recycled material, highlighting a current gap in domestic processing capacity that is slowly being addressed through new greenfield investments.

Segment trends underscore the enduring importance of mechanical recycling derived from pre-consumer waste as the primary source material, favored for its relatively clean state and higher yield quality, although post-consumer sourcing is rapidly gaining share as sorting technologies improve. Application-wise, the apparel segment, specifically outerwear, knitwear, and accessories, remains the largest consumer due to the material’s thermal properties and the high-visibility impact of sustainability claims in fashion marketing. However, the market is seeing burgeoning adoption in non-apparel sectors, including automotive interiors and specialized industrial insulation materials, where the inherent fire resistance and acoustic dampening qualities of wool fiber provide distinct technical advantages. This diversification across segment end-uses strengthens market resilience against cyclical shifts in the conventional fashion retail sector.

AI Impact Analysis on Recycled Wool Market

Analysis of common user questions regarding AI's impact on the Recycled Wool Market reveals significant interest centered around three key themes: enhanced efficiency in textile sorting and collection, improved quality control of recycled fiber batches, and the use of predictive analytics for supply chain optimization. Users are keen to understand how AI can overcome the primary limitations of recycled wool production, namely the manual complexity and variability in textile feedstock and the resulting inconsistency in fiber quality. The consensus expectation is that AI will be the foundational technology enabling true industrial scaling of textile-to-textile recycling by automating tasks currently prone to human error and inefficiency, thereby making recycled wool cost-competitive and consistently high-quality enough to satisfy major commercial buyers.

The immediate and most transformative influence of Artificial Intelligence lies in advanced sorting technologies. Machine vision, combined with deep learning algorithms, allows for the rapid and accurate identification and segregation of textile waste based on fiber type, color, and composition. This precision sorting is vital because contamination (e.g., small amounts of polyester in a wool batch) severely compromises the quality of the resulting recycled fiber. By drastically reducing contamination, AI systems ensure a higher yield of pure recycled wool, reducing processing costs and elevating the material’s standard, making it suitable for a wider range of applications previously restricted to virgin materials. This technological advancement directly addresses one of the major restraints to market growth: the variability in raw material quality.

Furthermore, AI-driven predictive modeling is enhancing inventory and supply chain management within the recycling ecosystem. These models analyze historical textile waste collection data, demographic consumption patterns, and seasonal variations to forecast the availability and type of feedstock, allowing recycling facilities to optimize their operations, reduce storage costs, and negotiate better procurement prices. In the processing stage, AI monitors machinery performance and fiber quality in real-time, adjusting shredding and carding parameters to minimize fiber damage and maximize the resulting yarn strength, ensuring that the final recycled product meets stringent industry specifications. The integration of AI thus promotes operational transparency and enhances the overall value proposition of recycled wool.

- AI-enabled near-infrared (NIR) and machine vision sorting significantly boosts the purity and consistency of pre- and post-consumer wool feedstock.

- Predictive analytics optimize raw material procurement and inventory management by forecasting textile waste streams, improving supply chain efficiency.

- Machine learning algorithms enhance quality control during mechanical recycling, minimizing fiber damage and maintaining optimal tensile strength in recycled yarn.

- AI-driven platforms facilitate traceability and compliance verification, ensuring integrity in sustainability claims for recycled wool products (GEO optimization).

- Automation of complex sorting tasks reduces labor costs and enhances the scalability of recycling operations globally.

DRO & Impact Forces Of Recycled Wool Market

The Recycled Wool Market dynamics are strongly shaped by a robust combination of compelling drivers, inherent operational restraints, and substantial opportunities that collectively define the competitive landscape and future trajectory. The primary drivers revolve around global sustainability imperatives, including mandatory corporate sustainability reporting, high-profile commitments from fashion brands (e.g., the Fashion Pact), and mounting consumer pressure favoring circular products. This external pressure is compounded by the high cost volatility and ethical concerns associated with sourcing virgin wool, making the stable, environmentally preferable option of recycled wool increasingly attractive from both a risk mitigation and economic perspective. Furthermore, evolving Extended Producer Responsibility (EPR) schemes for textiles, particularly in the EU, force producers to internalize end-of-life costs, making investment in high-quality textile recycling infrastructure, including facilities specializing in wool recovery, a necessary compliance measure rather than an optional green initiative.

Restraints primarily stem from technical challenges inherent to the mechanical recycling process and supply chain complexities. The primary technical hurdle is fiber degradation; the mechanical process of shredding and tearing recycled garments inevitably shortens the wool fibers, often resulting in a product with lower tensile strength and durability than virgin wool, necessitating blending with other fibers (virgin wool, polyester, or nylon) which dilutes the recycled content claim. Another significant restraint is the high variability and contamination levels in post-consumer textile waste, which complicates sorting and drives up processing costs, making large-scale, cost-effective recycling challenging without advanced AI sorting technology. Logistical restraints include the scattered nature of post-consumer waste collection and the energy intensity of the washing, shredding, and re-spinning processes, which must be managed effectively to maintain the material’s favorable environmental profile.

Opportunities for market expansion are significant, primarily driven by technological advancements and market diversification. The key opportunity lies in refining chemical recycling processes for wool (though challenging due to keratin structure), which could potentially yield fibers of near-virgin quality, thereby overcoming the strength limitations of mechanical recycling. Another substantial opportunity is market penetration into specialized industrial and technical textiles, such as high-performance insulation, soundproofing materials for construction, and technical felts, capitalizing on wool's inherent flame resistance and acoustic properties where fiber length is less critical than bulk and performance specifications. Finally, fostering greater transparency and traceability through blockchain or similar digital ledger technologies offers a critical competitive advantage, allowing brands to rigorously substantiate their 'recycled' claims and tap into premium consumer segments willing to pay more for verified circularity. These impact forces collectively dictate a high growth trajectory, provided the technical restraints regarding fiber integrity can be consistently overcome through process innovation and blending strategies.

Segmentation Analysis

The Recycled Wool Market is systematically segmented based on Source Type, Application, and End-Use, providing critical granularity for strategic market assessment. Segmentation by Source Type, distinguishing between Pre-Consumer Waste (industrial cutting scraps, yarn waste) and Post-Consumer Waste (used garments, textiles), is vital as it directly correlates to the quality, consistency, and average fiber length achievable, with Pre-Consumer waste generally yielding higher quality input material. The shift towards greater utilization of the vast Post-Consumer stream, driven by regulatory mandates and collection infrastructure improvements, is a defining trend. Application segmentation is crucial for identifying revenue drivers, with Apparel (including outerwear, knitwear) dominating, followed by Home Furnishings (blankets, rugs) and Industrial/Other uses, reflecting diverse thermal and acoustic performance requirements.

Further analysis into segmentation by End-Use reveals distinct consumer behaviors and procurement patterns. The 'Fast Fashion/Mass Market' segment, focusing on high volume and cost-effectiveness, uses recycled wool blended heavily with synthetics to maintain price points, while the 'Premium/Sustainable Brands' segment prioritizes higher recycled content percentages and verified traceability, often targeting niche markets like outdoor wear and certified ethical fashion. Geographical segmentation remains paramount, reflecting disparate regulatory environments and the maturity of collection infrastructure; Europe leads due to policy support, while Asia Pacific leads in manufacturing capacity. Understanding these overlaps allows stakeholders to tailor processing technologies, blending ratios, and marketing strategies to meet specific customer requirements—whether prioritizing durability for technical gear or softness for high-end knitwear.

- By Source Type:

- Pre-Consumer Waste

- Post-Consumer Waste

- By Application:

- Apparel (Outerwear, Knitwear, Accessories)

- Home Furnishings (Blankets, Upholstery, Carpets)

- Industrial (Insulation, Automotive Felts, Technical Textiles)

- By Process:

- Mechanical Recycling (Shredding and Carding)

- Chemical Recycling (Emerging)

- By End-Use Industry:

- Fashion & Apparel

- Home Textiles

- Automotive

- Construction

Value Chain Analysis For Recycled Wool Market

The Recycled Wool value chain initiates with upstream activities, primarily involving the collection, aggregation, and pre-sorting of textile waste. This stage is highly complex, relying on municipal waste management services, specialized textile collectors, and charitable organizations to gather both pre-consumer (industrial offcuts from spinning or cutting mills) and post-consumer materials. The crucial activity here is the primary grading and manual sorting of large volumes of discarded textiles, determining whether the material is suitable for reuse (resale) or recycling. Upstream innovation, particularly in AI-powered sorting facilities, is critical for increasing the volume and quality of recyclable wool feedstock and reducing manual labor dependency, directly impacting the cost structure for midstream manufacturers. Efficient logistics and robust reverse supply chain management are essential at this stage to minimize transportation costs and environmental impact before processing begins.

The midstream comprises the core recycling and manufacturing processes. Once collected and sorted, the wool textiles undergo mechanical processing: shredding or garneting to break down the fabric into fibers, followed by carding and spinning into recycled yarn. This stage often involves blending the short recycled wool fibers with longer, stronger fibers (virgin wool, polyester, or nylon) to achieve the desired tensile strength and yarn count, a necessary compromise to ensure commercial viability. Manufacturers specializing in recycled wool differentiate themselves through technological expertise in minimizing fiber damage, controlling contamination, and achieving consistent color matching, which is often done through careful pre-sorting or dyeing the recycled fiber blend. The output of the midstream is semi-finished goods—recycled wool yarn or non-woven felt—which are then sold to downstream users.

Downstream activities involve the distribution channel and the final application into consumer or industrial products. Distribution can be direct (B2B sales of yarn/felt to apparel or automotive manufacturers) or indirect, utilizing agents, yarn wholesalers, or specialized textile distributors. Direct sales channels are favored by premium brands seeking greater control over material origin and sustainability verification. Final end-users, such as major fashion houses, outdoor gear companies, and upholstery manufacturers, integrate the recycled wool materials into their finished products. The market success is highly reliant on effective marketing and communication at the downstream level, clearly conveying the environmental benefits and quality standards of the recycled material to the end consumer, thereby justifying any potential price premium associated with sustainable sourcing.

Recycled Wool Market Potential Customers

The primary end-users and potential buyers of recycled wool fibers and yarns are dominated by players within the global apparel industry, particularly those focused on outerwear and durable goods. Major fast fashion and mass-market retailers represent a significant volume demand, utilizing recycled wool, often in blended formats, to meet internal sustainability targets and offer products with a lower environmental profile to cost-conscious consumers. However, the most critical customer segment for high-quality, high-recycled content material includes premium and sustainable lifestyle brands, such as those specializing in outdoor equipment and heritage woolen goods, who rely on the material’s thermal performance and environmental story to maintain brand authenticity and capture the ethically conscious consumer segment willing to pay a premium for verified sustainable textiles.

Beyond traditional apparel, a rapidly growing customer base is found in the home furnishings sector, encompassing manufacturers of high-end blankets, rugs, throws, and upholstery fabrics. These buyers value the inherent qualities of wool, such as natural flame resistance, durability, and insulation properties, making recycled wool an economically and environmentally sound alternative to virgin materials for products where structure and bulk are prioritized over fine gauge softness. The utilization in mattresses and acoustic panels further cements this sector’s importance, offering specialized applications that leverage the wool fiber structure for technical performance attributes.

A third, high-value potential customer segment is the specialized industrial market, notably the automotive and construction sectors. Automotive manufacturers utilize recycled wool felt for sound dampening and insulation within vehicle interiors, driven by stringent standards for noise reduction and the increasing corporate mandate to use recycled and bio-based materials in vehicle components. Similarly, the construction industry utilizes highly compressed recycled wool for thermal and acoustic insulation in buildings. These industrial applications offer stable, high-volume contracts, often focusing on technical specifications rather than aesthetic appeal, providing a crucial avenue for expanding recycled wool consumption outside the traditionally volatile fashion cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 million |

| Market Forecast in 2033 | USD 890.0 million |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Himatsingka Seide Ltd., Martex Fiber International, Inc., Patagonia, Inc. (Material Sourcing), M. J. Wool, Recyclatex Group, Rifò, Re-Verso S.p.A., Recover™ Textile Systems, Schoeller Textil AG, Texxco Eco-Solutions, Shokay, The Renewal Workshop, Advanced Fiber Technologies (AFT), Kvadrat A/S, Woolmark Company (Promoter), Varteks d.d., Green Textile Co., Ltd., Ofilados Foures, S.A., Pure Waste Textiles, Lenzing AG (Blended Products). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recycled Wool Market Key Technology Landscape

The technology landscape governing the Recycled Wool Market is predominantly centered on optimizing the traditional mechanical recycling process, which involves complex steps of opening, shredding (garnetting), and carding existing textile products into reusable fibers. While mechanical recycling is highly established and the most mature technology, current innovations are focused on enhancing the machinery to minimize fiber length damage, thereby improving the quality and versatility of the resulting recycled yarn. Key advancements include specialized high-speed shredders and precision carding machines designed to gently separate fibers, along with integrated sensors and controls that monitor material flow and fiber condition in real-time, reducing material waste and maintaining consistency across large production batches. This reliance on mechanical methods ensures cost-effectiveness and scalability in the short term, but it inherently limits the ultimate quality due to the physical stress placed on the fiber structure.

A crucial technological development driving the next generation of recycled wool production involves sophisticated sorting and identification systems. Historically, manual sorting of mixed textile waste has been a significant bottleneck, being both labor-intensive and prone to high error rates regarding fiber composition. The integration of advanced sensor-based sorting (SBS) technologies, particularly using Near-Infrared (NIR) spectroscopy and hyper-spectral imaging combined with machine learning algorithms (AI impact), is revolutionizing the input stream. These systems can accurately distinguish between different fiber types (wool, cotton, synthetics) and even specific dyes or finishes at high throughput rates, guaranteeing a much cleaner and higher-purity wool feedstock for the shredding process. This technological shift is pivotal for increasing the proportion of high-quality post-consumer waste that can be recycled effectively, significantly expanding the available raw material base.

Looking toward future technological integration, the research and development pipeline includes exploring chemical recycling methods, although this remains highly challenging for wool due to its keratin protein structure, which differs significantly from the cellulose in cotton or the polymers in synthetics. Efforts are underway to develop enzymatic processes or controlled hydrolysis techniques that can depolymerize the wool fiber while preserving its molecular integrity, potentially yielding fibers of virgin quality without the inherent mechanical damage. Although chemical recycling for wool is not yet commercially viable at scale, pilot programs and academic research are focused on this area as the ultimate solution for achieving true closed-loop textile recycling. Concurrent efforts are also prioritizing micro-fiber filtration technologies within manufacturing facilities to capture fiber particulates and reduce environmental discharge, aligning with increasingly strict waste management regulations.

Regional Highlights

- Europe: Europe stands as the undisputed leader in the Recycled Wool Market, primarily driven by early adoption of circular economy principles and comprehensive regulatory frameworks. Countries like Italy (Prato region), known for its historical expertise in textile recycling, host significant manufacturing and processing infrastructure. The EU's ambitious waste targets and the upcoming textile-specific EPR legislation mandate high collection and recycling rates, creating immense domestic demand for recycled materials and incentivizing investment in sophisticated AI-driven sorting facilities. Strong consumer awareness regarding sustainable fashion also supports premium pricing for certified recycled wool products across the region, especially in Scandinavia, Germany, and the UK.

- Asia Pacific (APAC): APAC represents the fastest-growing market, largely due to its immense manufacturing capacity and expanding middle-class consumer base. China and India are major production hubs, utilizing recycled wool both for export and for their rapidly growing domestic markets. While historically focused on cost-effective, large-scale production, there is a distinct and accelerating shift towards improving the quality and ethical sourcing of recycled materials, often influenced by the demands of European and North American brand partners. Investment in modern textile collection and recycling technology, though nascent compared to Europe, is rapidly increasing, supported by local government initiatives aiming to manage vast textile waste mountains.

- North America (NA): The North American market is characterized by high demand driven by prominent outdoor and fashion brands that have made significant public commitments to sustainability (e.g., Patagonia, The North Face). Although demand is high, the region currently lags in comprehensive, integrated post-consumer textile collection and sophisticated recycling infrastructure compared to Europe, often relying on imported recycled yarn. The primary focus is on utilizing high-quality pre-consumer waste and developing localized, closed-loop systems, particularly in key textile centers. Policy development, though slower than the EU, is moving towards mandates supporting circularity, expected to spur significant localized investment post-2026.

- Latin America (LA): The Latin American market for recycled wool is emerging, largely concentrated in countries with established textile industries like Brazil and Mexico. Market growth is primarily driven by internal efforts to modernize textile production and address local waste management challenges. While consumer awareness is growing, the market often prioritizes cost efficiency, resulting in a focus on locally sourced, lower-cost recycling methods. Regional opportunities lie in establishing collaborative recycling networks capable of meeting the volume and quality demands of international brands seeking near-shore manufacturing solutions.

- Middle East and Africa (MEA): MEA remains a relatively small but developing market, primarily focused on localized circularity initiatives within industrial zones. The growth drivers here include governmental diversification strategies focusing on sustainable industrial development and leveraging lower labor costs for textile processing. While infrastructure is limited, the region presents future potential for fiber collection and initial processing hubs, especially as global textile supply chains seek diversified, sustainable sourcing locations, relying mainly on imported recycling technology and export markets for higher-value finished goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recycled Wool Market.- Martex Fiber International, Inc.

- Himatsingka Seide Ltd.

- Re-Verso S.p.A.

- Recover™ Textile Systems

- M. J. Wool

- Recyclatex Group

- Shokay

- Rifò

- Schoeller Textil AG

- The Renewal Workshop

- Advanced Fiber Technologies (AFT)

- Patagonia, Inc. (Strategic Sourcing/Usage)

- Texxco Eco-Solutions

- Kvadrat A/S (High-end textiles)

- Green Textile Co., Ltd.

- Ofilados Foures, S.A.

- Varteks d.d.

- Pure Waste Textiles

- Lenzing AG (Blended Fiber Solutions)

- Novetex Textiles Limited

Frequently Asked Questions

Analyze common user questions about the Recycled Wool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between virgin wool and mechanically recycled wool?

The key difference lies in fiber length and strength. Mechanically recycled wool fibers are inherently shorter and weaker due to the shredding process, requiring blending with virgin or synthetic fibers to achieve usable strength for spinning. Virgin wool offers superior initial strength and fiber integrity. Recycled wool, however, offers a significantly reduced environmental footprint regarding water, land, and chemical use.

How does the quality and durability of recycled wool products compare to new wool?

While pure mechanically recycled wool typically has lower durability than virgin wool, modern industrial processing and strategic blending with longer fibers (such as nylon or virgin wool) significantly mitigate this weakness. Reputable brands ensure their blended recycled wool products meet high durability standards, especially in performance outerwear, offering quality comparable to conventional alternatives while maximizing the recycled content.

Is recycled wool truly environmentally friendly, and does it require less water?

Yes, recycled wool is demonstrably more sustainable. It eliminates the need for intensive sheep rearing, land management, and significant chemical processing required for raw wool extraction and preparation. Specifically, the recycling process substantially reduces water consumption, lowers energy usage compared to producing virgin fibers, and prevents textiles from entering landfills, aligning perfectly with circular economy principles.

What are the main segments driving the growth of the Recycled Wool Market?

The Apparel sector, particularly high-end knitwear and performance outerwear brands committed to sustainability mandates, is the primary growth driver. Additionally, the Home Furnishings segment (blankets, upholstery) and specialized Industrial applications (automotive soundproofing and construction insulation) are rapidly expanding, attracted by wool's inherent acoustic, thermal, and flame-resistant properties.

How is AI specifically impacting the future of recycled wool production and supply chain?

AI is crucial for scaling the market through precision sorting. AI-enabled machine vision and NIR technology automate the segregation of mixed textile waste by fiber type and color at high speed, drastically improving the purity and consistency of the wool feedstock. This technological advancement makes the use of post-consumer waste economically viable and elevates the overall quality of the recycled fiber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager