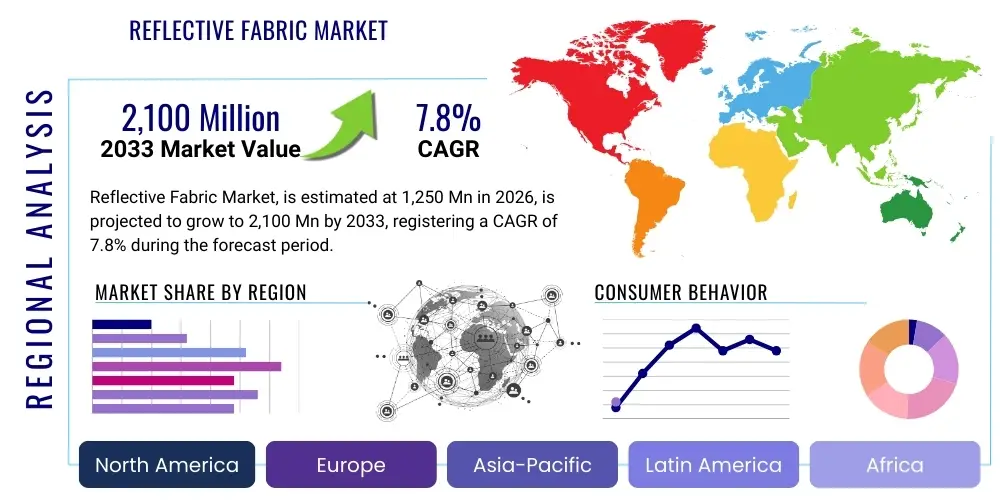

Reflective Fabric Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441953 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Reflective Fabric Market Size

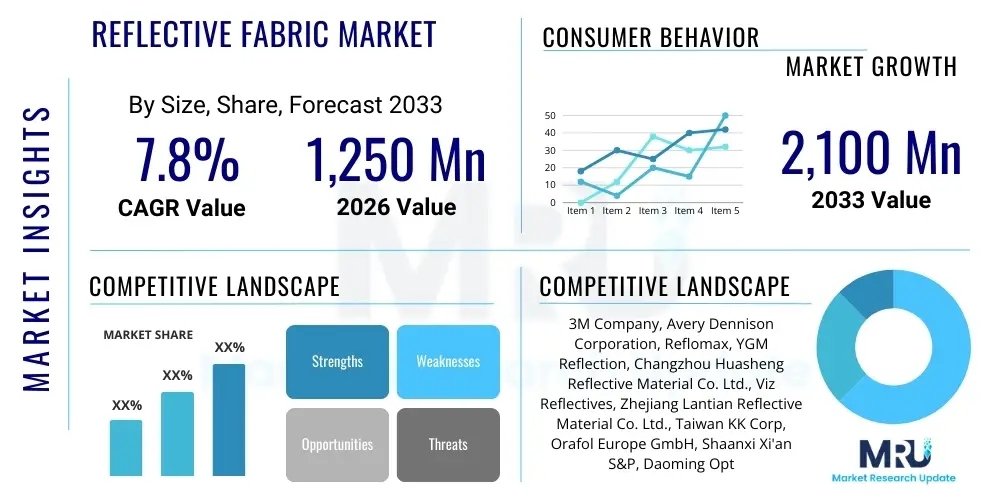

The Reflective Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1,250 Million in 2026 and is projected to reach $2,100 Million by the end of the forecast period in 2033.

Reflective Fabric Market introduction

The Reflective Fabric Market encompasses specialized textile materials engineered to enhance visibility in low-light conditions through retroreflection. These fabrics utilize various technologies, predominantly glass microspheres or micro-prismatic structures, embedded within a polymer matrix applied to a base textile. The primary function is to return light directly back to its source, significantly increasing the conspicuousness of the wearer or object, thereby serving a crucial role in preventative safety across numerous high-risk environments. This fundamental characteristic drives their widespread adoption, particularly in sectors where compliance with stringent safety regulations is mandatory, such as construction, mining, and public safety.

Reflective fabrics are categorized based on their backing material (e.g., polyester, aramid, cotton), the reflective technology used, and their intended application durability (wash resistance, abrasion resistance). Major applications span Personal Protective Equipment (PPE), sportswear, industrial workwear, road signage, and automotive safety trim. The benefit derived is primarily the reduction of occupational and traffic-related accidents. The inherent effectiveness of these materials in mitigating risk, coupled with increasing government mandates for high-visibility clothing (HVC), solidifies their market necessity. Continuous advancements in reflectivity standards and material flexibility are enabling greater integration into mainstream fashion and durable outdoor gear, expanding the market reach beyond traditional safety niches.

Key driving factors fueling market expansion include evolving international safety protocols, heightened awareness regarding workplace safety standards (particularly in developing economies undergoing rapid industrialization), and technological innovation leading to more breathable, lighter, and aesthetically pleasing reflective products. Furthermore, the rising demand for sophisticated sportswear that incorporates reflective elements for nighttime running and cycling contributes substantially to non-industrial segment growth. The transition towards sustainable and eco-friendly reflective materials, driven by corporate social responsibility initiatives, is also beginning to shape investment and product development trajectories within the industry.

Reflective Fabric Market Executive Summary

The global Reflective Fabric Market is characterized by robust growth, primarily fueled by strict governmental regulations regarding occupational safety and the burgeoning demand for high-visibility apparel in the infrastructure and construction sectors. Business trends indicate a strong focus on merging functionality with aesthetics, particularly as major manufacturers invest heavily in developing segment reflective tape and highly flexible materials suitable for sportswear without compromising durability or breathability. Furthermore, supply chain resilience is a growing strategic imperative, with companies seeking dual sourcing strategies to mitigate risks associated with fluctuating raw material prices for glass beads and specialized polymer films, while simultaneously optimizing production processes for greater cost efficiency.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, driven by massive infrastructure projects in China and India, coupled with increasing manufacturing bases for protective clothing. North America and Europe, while mature, maintain dominance in terms of value, owing to stringent adherence to international safety standards (such as ANSI/ISEA and EN ISO) and high per capita expenditure on premium, durable PPE. Strategic mergers, acquisitions, and partnerships focused on consolidating market share and achieving technological superiority, especially concerning micro-prismatic film technology versus traditional glass bead technology, are key competitive activities defining the landscape in these established regions.

Segment trends highlight the dominance of the PPE application segment, though the fashion and leisure wear segment is exhibiting superior growth potential due to lifestyle changes promoting outdoor activities. By material type, polyester-backed reflective fabric retains the largest volume share due to its cost-effectiveness and versatility, while aramid-backed fabrics command higher value due to their inherent flame-retardant properties crucial for specialized environments like firefighting and petrochemical operations. Innovation in transfer film technology, offering lighter weight and higher reflectivity for specialized applications, is gradually challenging traditional sew-on material dominance, indicating a market shift towards high-performance integration methods.

AI Impact Analysis on Reflective Fabric Market

User queries regarding the impact of Artificial Intelligence on the Reflective Fabric Market primarily revolve around how AI can optimize supply chain logistics, predict demand fluctuations based on seasonal safety trends or regulatory updates, and enhance quality control in manufacturing processes. There is significant interest in using AI-driven image recognition systems to automatically inspect reflective material quality, ensuring uniform retroreflectivity across large production batches, thereby reducing defects and meeting stringent compliance requirements like minimum photometric performance standards. Furthermore, consumers and industry professionals are exploring the potential of predictive analytics to forecast the lifespan and degradation rate of reflective garments under varying environmental conditions, allowing for proactive replacement scheduling and optimizing inventory management for maintenance cycles in large industrial organizations, thus impacting demand forecasting for suppliers.

- AI-driven optimization of material cutting patterns, minimizing waste of expensive reflective film and achieving cost efficiencies in mass production.

- Predictive maintenance analytics for reflective garment replacement cycles based on wear patterns, environmental exposure, and regulatory compliance timelines.

- Enhanced quality assurance through AI vision systems analyzing reflective performance and adhesion strength of materials post-production, ensuring compliance accuracy.

- AI algorithms for dynamic demand forecasting, linking production schedules directly to seasonal trends in construction and public safety needs.

- Intelligent inventory management systems optimizing stock levels of various reflective grades (e.g., wash cycles ratings) across global distribution centers.

- Development of personalized reflective gear designs using generative AI, tailored to specific occupational hazard profiles or aesthetic demands in sportswear.

DRO & Impact Forces Of Reflective Fabric Market

The Reflective Fabric Market is strongly influenced by a combination of drivers stemming from mandatory safety regulations and technological progress, balanced against restraints such as material cost volatility and standardization challenges, while opportunities arise from emerging economies and sustainable product development. Key drivers include stringent enforcement of occupational health and safety (OHS) standards, particularly in high-growth industrial sectors like infrastructure development and renewable energy installations, which necessitate continuous investment in high-visibility PPE. Conversely, significant restraints involve the relatively high production cost of micro-prismatic technology compared to glass bead alternatives and the difficulty in achieving universal material standards globally, which complicates international trade and multi-regional compliance for manufacturers.

Impact forces within the market are predominantly defined by the bargaining power of major PPE manufacturers and the increasing focus on advanced material science. Buyers, often large industrial organizations or government agencies procuring equipment, exert considerable downward pressure on pricing, demanding bulk discounts while simultaneously requiring adherence to the highest international durability and reflectivity metrics. Supplier power is moderate; while raw materials like specialized optical films and high-refractive index glass beads are concentrated among a few specialized suppliers, manufacturers increasingly diversify their sourcing and internalize some processes to maintain cost control and protect proprietary formulations, thus mitigating undue supplier influence.

Significant opportunities exist in the development of multi-functional fabrics that incorporate reflectivity alongside other protective properties such as flame retardancy, anti-static characteristics, or UV resistance, catering to complex safety requirements in niche industries (e.g., oil and gas, utilities). Furthermore, the shift towards greater sustainability, driven by consumer preference and regulatory pressure in Europe, offers manufacturers an opening to innovate using recycled base materials and solvent-free lamination processes. These opportunities promise not only revenue growth but also differentiation in a competitive market landscape heavily influenced by strict performance and compliance criteria.

Segmentation Analysis

The Reflective Fabric Market segmentation provides a granular view of diverse end-use applications, material technologies, and composition types that define product functionality and market dynamics. Understanding these segments is critical for manufacturers aiming to align their product development strategies with specific industry requirements, ranging from high-performance industrial safety applications to everyday consumer wearables. Segmentation aids in identifying areas of high growth, such as micro-prismatic technology, which offers superior reflectivity compared to traditional glass beads, and pinpointing regional demand patterns, such as the preference for flame-retardant composites in the Middle East due to extreme climate and industry presence.

- By Technology:

- Glass Bead Technology

- Micro-Prismatic Technology

- By Application:

- Personal Protective Equipment (PPE)

- Sportswear and Leisure Wear

- Traffic and Road Safety (Signage and Road Barriers)

- Automotive and Transportation

- Others (e.g., Pet Accessories, Fashion Accessories)

- By Product Type:

- Reflective Tapes/Trims (Sew-on, Heat Transfer)

- Reflective Films

- Reflective Yarns/Threads

- Reflective Sheeting

- By Backing Material:

- Polyester

- Aramid

- Cotton

- Vinyl

- Others (e.g., Nylon blends)

Value Chain Analysis For Reflective Fabric Market

The Reflective Fabric market value chain initiates with upstream activities focused on the procurement and processing of specialized raw materials. This includes securing high-refractive index glass microspheres, optical-grade polymer films (like PVC, PU, or PET), and base textile materials (polyester, cotton, aramid). Key challenges upstream involve maintaining the quality and consistency of these specialized components, as slight variations in particle size or film clarity directly impact the final product’s retroreflectivity. Suppliers of these core elements wield moderate power, necessitating strong, long-term relationships between fabric manufacturers and specialized material providers to ensure supply stability and cost predictability for critical inputs like micro-prismatic resins.

The core manufacturing process involves coating, lamination, and conversion, where the reflective elements are precisely bonded to the base fabric. Midstream, manufacturers invest heavily in advanced lamination technologies and quality control systems to meet stringent certification standards (e.g., EN ISO 20471, ANSI/ISEA 107). Distribution channels are diverse; direct distribution is common for large-volume industrial PPE orders, where manufacturers supply directly to corporate end-users or government tender winners. Indirect distribution utilizes specialized industrial safety distributors, textile wholesalers, and increasingly, e-commerce platforms, particularly for retail and small-to-medium-sized enterprise (SME) purchases of specialized sportswear or custom trims.

Downstream analysis focuses on end-user segmentation. The final products, whether high-durability safety vests or specialized reflective jogging gear, are consumed by sectors ranging from construction and oil & gas to consumer sports. The high criticality of the product (life-saving function) dictates that performance metrics and compliance certifications are paramount for downstream acceptance. The trend towards integrating reflectivity into fashion and casual wear is reshaping the downstream market, demanding faster innovation cycles and aesthetic flexibility from reflective material suppliers, thereby broadening the scope beyond traditional industrial safety outlets.

Reflective Fabric Market Potential Customers

Potential customers for reflective fabric are highly varied, yet largely concentrated within industries governed by occupational safety mandates. The primary end-users are entities responsible for ensuring worker safety in high-risk environments, including governmental agencies, large infrastructure development companies, and industrial conglomerates operating in sectors like construction, mining, utilities, and transportation. These entities often procure reflective materials indirectly through specialized PPE manufacturers who integrate the fabric into final garments, or directly in large quantities for standardization across their workforce uniforms, making compliance procurement managers key decision-makers.

Beyond traditional industrial sectors, the fastest-growing customer segments include manufacturers of sportswear and active lifestyle apparel. Companies focusing on running, cycling, hiking, and general outdoor recreation increasingly integrate highly visible elements into their product lines, driven by consumer demand for increased personal safety during low-light activities. Furthermore, the automotive sector uses reflective fabrics and films for vehicle trim, temporary signage, and emergency kit components, while local municipalities rely heavily on reflective sheeting for permanent and temporary road signage, positioning public safety procurement teams as substantial, though often price-sensitive, buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250 Million |

| Market Forecast in 2033 | $2,100 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Avery Dennison Corporation, Reflomax, YGM Reflection, Changzhou Huasheng Reflective Material Co. Ltd., Viz Reflectives, Zhejiang Lantian Reflective Material Co. Ltd., Taiwan KK Corp, Orafol Europe GmbH, Shaanxi Xi'an S&P, Daoming Optics & Chemical Co. Ltd., Safe Reflections Inc., Unitika Ltd., DM Reflective, Jinhao Reflective Material Co. Ltd., Alsico Group, Kurt Eiholzer AG, Jessup Manufacturing Company, Fargotex, Krosz Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reflective Fabric Market Key Technology Landscape

The technology landscape of the Reflective Fabric Market is dominated by two primary retroreflection methods: Glass Bead Technology and Micro-Prismatic Technology. Glass bead technology, the traditional and more cost-effective method, involves embedding tiny, high-refractive-index glass spheres onto a fabric surface via a binder system. While effective and widely adopted for basic compliance, its primary limitation lies in lower overall brightness and susceptibility to performance degradation after multiple wash cycles or abrasion. Innovations in this area focus on improving the bonding matrix and sphere size consistency to enhance durability and initial Coefficient of Retroreflection (RA), aiming to retain competitive viability against newer, more advanced solutions.

Micro-Prismatic Technology represents the technological forefront, utilizing microscopic plastic prisms arranged in a precise configuration to reflect light more efficiently than glass beads. These prisms offer significantly higher brightness values and superior performance consistency, often preferred for critical safety applications requiring maximum visibility, such as traffic signage and high-end industrial PPE. Manufacturers are constantly refining the geometric precision of these prisms and developing softer, more flexible backing materials to allow the use of micro-prismatic films in complex textile applications without compromising garment drape or comfort. The move towards segment reflective tapes, which utilize narrow strips of reflective material with gaps, is a design innovation that improves breathability while maintaining adequate visibility compliance.

Further technological advancements include the development of highly specialized flame-retardant (FR) reflective materials, often utilizing Aramid or specialized cotton blends as backing materials, crucial for sectors like oil & gas and utilities. There is also an ongoing push towards digital printing capabilities on reflective surfaces, allowing for custom logos and designs while maintaining required retroreflectivity levels. Moreover, sustainability-focused technology involves using recycled polyester (rPET) for the base fabric and developing solvent-free or water-based binders and lamination processes, addressing the growing environmental scrutiny within the global textile supply chain and providing a distinct competitive edge in European and North American markets.

Regional Highlights

North America is a mature yet critically important market, characterized by stringent enforcement of ANSI/ISEA 107 standards, which dictates the performance requirements for high-visibility safety apparel. The region exhibits high demand for premium, durable reflective fabrics, largely driven by mandatory safety protocols in the construction, oil and gas, and utility sectors. The market is primarily value-driven, with end-users emphasizing longevity and compliance over initial cost, leading to strong adoption rates for high-performance micro-prismatic materials. Continuous investment in public infrastructure, particularly in the United States and Canada, ensures a steady baseline demand for road safety and worker visibility products, maintaining the region's position as a significant consumer of technologically advanced reflective solutions.

Europe represents a highly regulated market, driven by the comprehensive EN ISO 20471 standard, which sets benchmarks for high-visibility clothing used in high-risk professional environments. Scandinavian countries and Germany often lead in adopting innovative, sustainable reflective materials, reflecting a strong regional preference for eco-friendly manufacturing processes and recycled content. The European market sees strong integration of reflective elements not only in industrial workwear but also in consumer goods, propelled by the popularity of cycling and outdoor sports across the continent. Regulatory updates, such as those related to chemical restrictions (REACH), significantly influence material formulation and force manufacturers to continuously upgrade their product portfolios to ensure compliance and market access.

Asia Pacific (APAC) is projected to be the fastest-growing region, primarily fueled by rapid industrialization, massive urban development, and expansion of manufacturing hubs in countries like China, India, and Southeast Asian nations. Although price sensitivity remains a key characteristic in certain segments, the adoption of international safety standards is accelerating, driven both by local government mandates and the demands of multinational corporations operating in the region. China is not only a major consumer but also the largest global manufacturing base for reflective fabrics, influencing global pricing and supply dynamics. The immense scale of infrastructure projects, including massive road and rail networks, ensures substantial, continuous demand for both low-cost glass bead materials and high-end micro-prismatic reflective sheeting for signage.

Latin America and Middle East & Africa (MEA) collectively represent emerging markets with substantial potential. The MEA region, particularly the Gulf Cooperation Council (GCC) states, demands specialized high-performance reflective fabrics that can withstand extreme heat and UV exposure, often requiring inherent flame-retardant properties due to the prevalence of oil, gas, and large-scale construction activities. Investment in mega-projects and safety legislation related to occupational hazards are key drivers here. Latin America’s growth is more localized but is being positively affected by improving road safety infrastructure investments and the gradual harmonization of regional safety standards, although economic volatility in some countries can occasionally dampen major procurement cycles for high-cost protective equipment.

- North America: Driven by strict ANSI/ISEA 107 compliance, high demand for durable, high-visibility PPE, and significant spending on infrastructure projects.

- Europe: Highly regulated by EN ISO 20471; emphasis on sustainable materials, strong growth in consumer sportswear integration, and high adoption of advanced materials.

- Asia Pacific (APAC): Highest growth rate due to rapid industrial expansion, large-scale infrastructure development, and status as a major global manufacturing hub for reflective products.

- Middle East & Africa (MEA): Focus on specialized flame-retardant and heat-resistant reflective materials essential for the petrochemical and heavy construction sectors.

- Latin America: Emerging market characterized by increasing road safety focus and gradual standardization of protective gear, though growth can be sensitive to economic fluctuations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reflective Fabric Market.- 3M Company

- Avery Dennison Corporation

- Reflomax Co., Ltd.

- YGM Reflection

- Changzhou Huasheng Reflective Material Co. Ltd.

- Viz Reflectives

- Zhejiang Lantian Reflective Material Co. Ltd.

- Taiwan KK Corp

- Orafol Europe GmbH

- Shaanxi Xi'an S&P

- Daoming Optics & Chemical Co. Ltd.

- Safe Reflections Inc.

- Unitika Ltd.

- DM Reflective

- Jinhao Reflective Material Co. Ltd.

- Alsico Group

- Kurt Eiholzer AG

- Jessup Manufacturing Company

- Fargotex Sp. z o.o.

- Krosz Inc.

- Toray Industries, Inc.

- Schoeller Textil AG

- International Reflective Company (IRC)

- Halo Reflective Material Co., Ltd.

- Retroreflective Material Manufacturing (RMM)

- Nippon Carbide Industries Co., Inc.

- Swicofil AG

- Honeywell International Inc. (PPE Division)

- Lakeland Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Reflective Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Glass Bead and Micro-Prismatic reflective technology?

The key distinction lies in retroreflectivity efficiency and durability. Glass Bead technology utilizes spherical particles to return light, offering a cost-effective solution commonly used in mid-range PPE. Micro-Prismatic technology employs precisely engineered cube-corner prisms, providing significantly higher brightness (Coefficient of Retroreflection, RA) and better performance retention after washing, making it the preferred choice for high-specification and high-risk applications demanding maximum visibility compliance.

Which safety standards primarily govern the use and quality of reflective fabrics globally?

Globally, the market is governed by regional standards. In North America, the primary standard is ANSI/ISEA 107, which classifies garments based on material quantity and performance (Type P, R, O). In Europe, the critical standard is EN ISO 20471, which specifies photometric requirements and minimum coverage areas for high-visibility clothing. Adherence to these standards is mandatory for market entry and product acceptance in professional safety applications, requiring rigorous third-party certification and testing for all materials.

How is the growing emphasis on sustainability impacting the Reflective Fabric Market?

Sustainability is driving innovation towards eco-friendly alternatives. This includes the utilization of recycled content, such as rPET (recycled polyester) for base fabrics, and the shift toward more environmentally benign manufacturing processes, specifically water-based or solvent-free lamination binders. European regulations, coupled with consumer demand for responsible sourcing, are accelerating the adoption of these greener reflective materials, positioning sustainability as a key competitive differentiator, particularly for high-end brands.

What are the typical end-use applications driving the highest market demand for reflective fabric?

The highest demand is consistently driven by the Personal Protective Equipment (PPE) segment, which includes safety vests, jackets, trousers, and specialized uniforms for construction workers, emergency responders, and utility personnel. Secondary, high-growth applications include sportswear and activewear (e.g., reflective running gear and cycling apparel) and traffic control applications, specifically temporary and permanent road signage sheeting, where material performance is critical for nighttime driver safety.

Are heat transfer reflective films replacing traditional sew-on reflective tapes in specialized garment manufacturing?

Heat transfer films are increasingly gaining traction, particularly in performance-focused sportswear and specialized technical garments. These films offer superior flexibility, lighter weight, and better breathability compared to traditional sew-on tapes, improving garment comfort and reducing bulk while maintaining high retroreflectivity. However, sew-on tapes remain crucial in heavy-duty industrial workwear, especially aramid-based FR garments, where the physical durability and resilience of stitching are necessary to withstand harsh environments and repeated aggressive industrial laundering cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager