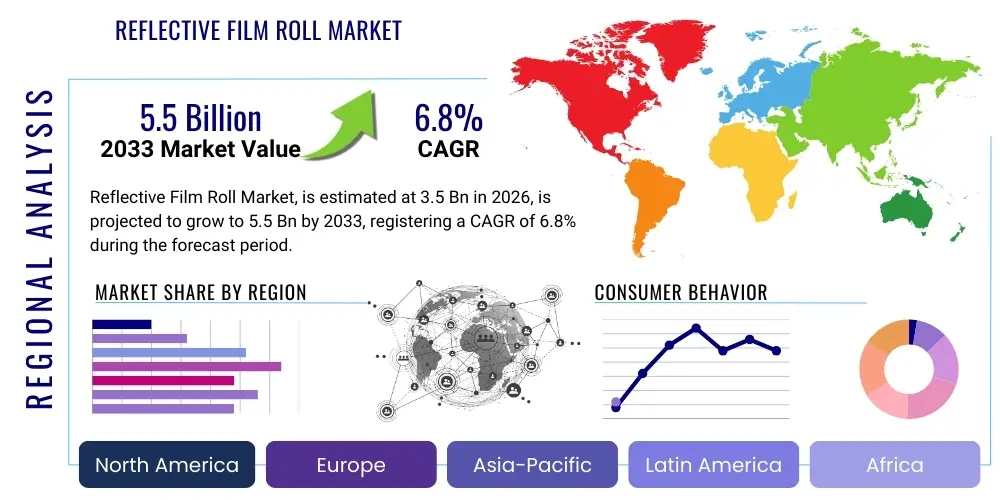

Reflective Film Roll Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441488 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Reflective Film Roll Market Size

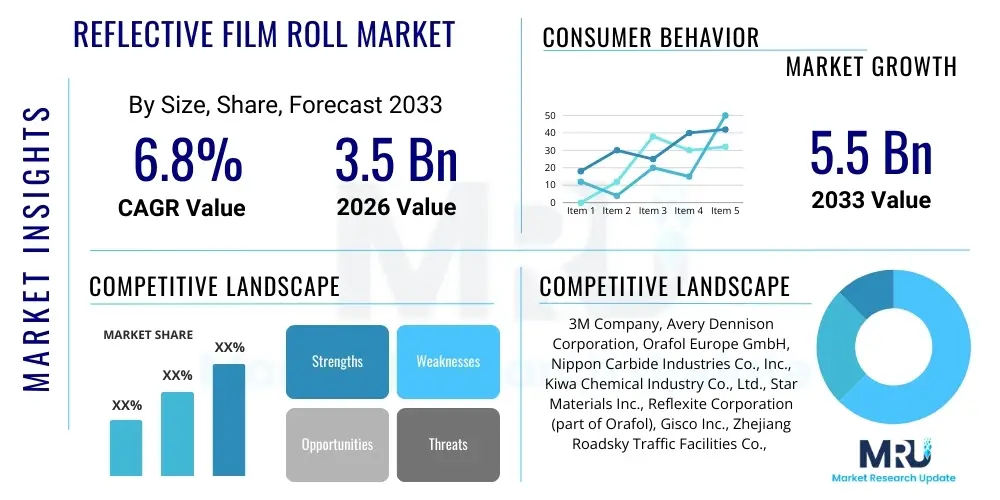

The Reflective Film Roll Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by stringent governmental regulations globally mandating high-visibility materials for traffic safety, industrial environments, and personal protective equipment. The increasing urbanization rates, coupled with massive investments in public infrastructure projects, particularly in emerging economies across the Asia Pacific and Latin America, further solidify the demand for durable and high-performance reflective films, ensuring long-term market sustainability and revenue growth.

Reflective Film Roll Market introduction

The Reflective Film Roll Market encompasses the manufacturing, distribution, and application of specialized films engineered to retroreflect light back to its source, significantly enhancing visibility, especially in low-light conditions or nighttime scenarios. Reflective films are complex multilayered products, often utilizing technologies such as micro-prismatic structures or embedded glass beads encapsulated within highly durable polymer matrices like PVC, PET, or acrylic. These films are critical safety components across diverse end-use sectors, functioning primarily to prevent accidents, guide navigation, and adhere to global safety compliance standards, thereby offering immense societal and commercial benefits by reducing operational risks and improving logistical efficiency.

Major applications of reflective film rolls span across infrastructure, automotive, signage, and personal safety equipment. In the infrastructure domain, they are indispensable for road traffic signs, construction zone delineation, work zone materials, and license plate visibility enhancements. The automotive sector utilizes these films extensively for vehicle conspicuity tapes, internal gauge clusters, and safety markings on commercial fleets. The intrinsic benefits of reflective films include exceptional longevity, resistance to weather elements (UV radiation, moisture, temperature extremes), ease of application due to pressure-sensitive adhesives, and their ability to maintain photometric performance over extended periods, which is vital for compliance with certification standards like ASTM and EN specifications.

Driving factors propelling market growth are intrinsically linked to global safety mandates and escalating infrastructural development. Governments worldwide are consistently updating minimum requirements for retroreflectivity, particularly concerning highly automated driving environments where machine vision relies heavily on consistent and reliable signage visibility. Furthermore, the rising adoption of reflective films in non-traditional sectors, such as high-end apparel, sports gear, and flexible electronics displays, is expanding the market footprint beyond traditional traffic management systems. The demand for highly durable, flexible films with enhanced wide-angle reflectivity characteristics presents ongoing growth opportunities for manufacturers investing in advanced material science and micro-replication technologies.

Reflective Film Roll Market Executive Summary

The Reflective Film Roll Market is characterized by robust business trends centered on technological innovation, emphasizing the transition from conventional glass bead technology to superior micro-prismatic film structures which offer higher brightness and angularity, thereby driving premiumization within the product portfolio. Key regional trends indicate that the Asia Pacific is emerging as the dominant growth engine, driven by massive government-led initiatives in smart city development and extensive highway construction projects in countries like China and India, necessitating vast quantities of regulatory signage materials. Conversely, developed markets in North America and Europe focus intensely on the replacement cycle of older infrastructure signage and the adoption of advanced, highly durable reflective films designed for multi-year warranty periods and high-speed road networks, coupled with stringent regulation compliance.

Segment trends reveal that the Traffic Safety application segment maintains the largest market share, directly correlated with rising global motorization rates and the ensuing necessity for robust road safety measures. Within material segmentation, PET (Polyethylene Terephthalate) based films are experiencing accelerated adoption due to their superior environmental stability, tensile strength, and compatibility with sophisticated printing techniques, positioning them as an effective alternative to traditional PVC films in many high-performance applications. Furthermore, the increasing penetration of specialized reflective films in the electronics sector, particularly for display backlighting and flexible circuits, signifies a high-growth, niche market segment that requires ultra-thin and precision-engineered film properties, attracting specialized investment and focused R&D efforts from major industry players.

Overall, the market landscape is moderately consolidated, with major global players leveraging deep vertical integration and expansive distribution networks to maintain competitive advantage. Strategic acquisitions and collaborative partnerships focused on next-generation adhesion technology and environmentally friendly manufacturing processes are defining the competitive approach. The primary challenge remains managing the volatile pricing of petrochemical-derived raw materials and adhering to increasingly complex regional environmental disposal regulations. The market’s future is intrinsically tied to global infrastructure spending, regulatory stringency regarding safety standards, and continuous material science advancements aimed at extending film longevity and performance under adverse environmental conditions.

AI Impact Analysis on Reflective Film Roll Market

Analysis of common user questions regarding AI's impact on the Reflective Film Roll Market reveals significant interest in three primary areas: optimization of the manufacturing process, AI-driven quality assurance, and the role of reflective materials in supporting autonomous vehicle infrastructure. Users frequently inquire about how AI can minimize material waste during lamination and slitting processes, whether computer vision systems can replace manual inspection for defect detection (e.g., inconsistencies in prism geometry or coating thickness), and how AI-enabled infrastructure sensors utilize reflective films for enhanced data collection and autonomous navigation reliability. These questions underscore a clear expectation that AI will primarily drive operational efficiency, enhance product quality consistency, and fundamentally integrate reflective materials into the broader ecosystem of smart transportation systems, moving the films beyond static safety applications into dynamic, data-generating components of modern infrastructure.

The implementation of AI and machine learning algorithms is poised to revolutionize the highly precise manufacturing of micro-prismatic films, where geometrical accuracy is paramount for achieving specified retroreflectivity levels. Predictive maintenance powered by AI models analyzing sensor data from coating and lamination machines can anticipate equipment failure, drastically reducing unexpected downtime and ensuring consistent production output. Furthermore, AI-driven demand forecasting, synthesizing data from construction project timelines, regulatory changes, and economic indicators, allows manufacturers to optimize inventory levels and adjust production schedules with unprecedented accuracy, minimizing overstocking and improving supply chain responsiveness. This shift toward intelligent manufacturing not only lowers operating costs but also accelerates the time-to-market for new, highly customized reflective film solutions required by complex governmental infrastructure contracts.

In the end-use environment, the integration of reflective film rolls into smart road and autonomous vehicle infrastructure is a major transformative application driven by AI. High-performance reflective markings and signs provide reliable, high-contrast visual input essential for vehicle-mounted cameras and LiDAR systems, particularly under adverse weather or lighting conditions. AI algorithms utilized by autonomous vehicles are trained using vast datasets that include images of these reflective markers; therefore, the quality and standardized performance of the reflective films directly impact the safety and reliability of self-driving technology. Manufacturers are thus collaborating with automotive tech companies to develop 'digital-ready' reflective films that optimize reflectance spectra for machine vision systems, ensuring seamless integration into the future of transportation controlled and optimized by artificial intelligence platforms.

- AI-powered predictive maintenance optimizes manufacturing equipment uptime and reduces production inconsistencies.

- Computer vision systems enhance quality control by identifying microscopic defects in reflective coatings and prismatic structures instantly.

- Machine learning algorithms improve supply chain efficiency through highly accurate demand forecasting based on infrastructure project data.

- Reflective films serve as critical visual inputs for autonomous vehicle AI systems (cameras, LiDAR), requiring optimized spectral reflectivity.

- Generative Design AI assists in engineering novel micro-prismatic geometries for superior retroreflection performance.

- AI models analyze real-time road condition data captured via reflective markers, supporting adaptive traffic management systems.

DRO & Impact Forces Of Reflective Film Roll Market

The Reflective Film Roll Market is primarily propelled by strict global enforcement of safety and visibility regulations (Drivers) stemming from international bodies and local transportation authorities, alongside massive governmental expenditures on critical infrastructure updates and expansion, especially in emerging economies seeking to modernize road networks. However, the market faces significant headwinds (Restraints) from the volatile raw material pricing of petrochemical derivatives (polymers and adhesives) and increasing environmental scrutiny directed at non-biodegradable plastics like PVC used in certain film constructions, prompting a difficult balance between durability and sustainability goals. Opportunities are abundant (Opportunity) in developing specialized films for nascent sectors such as smart roads, flexible electronics, and highly customized industrial safety products, while the market is shaped by fundamental impact forces like technological obsolescence pressure, competitive pricing strategies influenced by Asian manufacturers, and the constant need for product certification compliance across varied international standards.

Key drivers include the global push for Vision Zero initiatives aimed at eliminating traffic fatalities, necessitating higher grades of retroreflective sheeting on roads, vehicles, and construction sites. The ongoing development of mega-infrastructure projects, including high-speed rail networks, bridges, and extensive highway systems across APAC, guarantees sustained long-term demand for high-performance safety signage and delineation materials. Furthermore, the standardization efforts by international organizations like ISO and ASTM continually elevate the performance benchmarks required for reflective films, compelling manufacturers to innovate and adopt superior technologies such as full cube corner micro-prismatic sheeting, which in turn drives market value.

Restraints center predominantly on cost pressures associated with the manufacturing inputs. Fluctuations in the global oil and gas markets directly impact the cost of polymer resins (PET, PVC, acrylic), which form the structural basis of the films. This volatility often squeezes profit margins, especially for films sold under fixed, long-term government contracts. Additionally, the complex and proprietary manufacturing processes required for high-grade prismatic films necessitate substantial capital expenditure in specialized replication and coating equipment, raising the barrier to entry for smaller players. The search for environmentally responsible, high-performance bio-based or recyclable polymers that can match the durability and photometric consistency of traditional materials remains a significant technical challenge and market restraint.

Opportunities for market expansion are strongly concentrated in the intersection of safety and technology. The development of specialized reflective films compatible with digital printing technology allows for faster production of customized signage and high-resolution graphics, opening new avenues in advertising and architectural design. Moreover, the demand for highly specialized retroreflective films designed for military applications, airspace marking, and specialized electronics (e.g., reflective polarizer films) presents high-margin growth segments. Impact forces like regulatory changes (e.g., mandatory implementation of high-intensity reflective conspicuity tape on all commercial vehicles) and swift technological changes (e.g., advancements in adhesive chemistry to improve cold-weather application) continuously reshape competitive dynamics and influence procurement decisions across major end-user verticals, emphasizing the critical role of certification and compliance in market access.

Segmentation Analysis

The Reflective Film Roll Market is comprehensively segmented based on technology, material, application, and geographical region, reflecting the diverse requirements and performance specifications mandated across various end-use industries. Technology segmentation distinguishes between simpler glass bead technologies, suitable for lower-intensity, general applications, and the more advanced micro-prismatic films, which dominate high-intensity, long-distance visibility requirements. This segmentation allows suppliers to target specific market needs, ranging from cost-sensitive temporary road markings to high-durability, long-warranty permanent freeway signage. The core differentiation across these segments is performance grading, typically measured by retroreflectivity values (Type I to Type XI), which directly correlates with pricing structure and application suitability.

Material composition segmentation is crucial, identifying films made predominantly of Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), and Acrylic, each offering distinct advantages regarding flexibility, weather resistance, printability, and cost. PVC films historically held a large share due to their flexibility and ease of use, particularly for vehicle wraps and curved surfaces, but they are increasingly challenged by PET and Acrylic due to environmental concerns and the superior long-term UV resistance offered by the latter materials, making them preferred for permanent outdoor infrastructure. The application segmentation clearly highlights traffic safety and vehicle conspicuity as the dominant market consumers, emphasizing the reliance of global transportation infrastructure on these materials for regulatory compliance and public safety.

Detailed analysis of the application segments shows that the increasing volume of commercial freight transportation worldwide is a key determinant for the growth in the Vehicle Conspicuity Tapes segment, driven by regulations like the US Department of Transportation (DOT) and European UNECE standards. Meanwhile, the consumer and industrial safety sector, including reflective materials for worker vests and protective gear, represents a stable, recurring demand segment linked to occupational health and safety regulations. The ability of manufacturers to offer specialized product lines that meet narrow, industry-specific standards (e.g., specific colors, minimum viewing angles, and adhesion characteristics) across these distinct segments is vital for securing market share and ensuring portfolio diversification against potential downturns in specific end-user verticals.

- By Technology:

- Glass Bead Reflective Films

- Micro-Prismatic Reflective Films

- High-Intensity Prismatic (HIP) Films

- Diamond Grade Films

- By Material Type:

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Acrylic

- Polyurethane (PU)

- By Application:

- Traffic Safety Signage (Permanent & Temporary)

- Vehicle Conspicuity Tapes and Markings

- License Plates

- Personal Protective Equipment (PPE)

- Commercial Graphics and Advertising

- Electronics and Displays (e.g., backlighting)

- By Durability Grade:

- Engineer Grade (EG)

- High Intensity Grade (HI)

- Super High Intensity Grade (SHIP)

- Diamond Grade (DG)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Reflective Film Roll Market

The value chain for the Reflective Film Roll Market is highly structured, beginning with the upstream supply of specialized raw materials, moving through complex midstream manufacturing processes, and concluding with sophisticated distribution networks tailored to B2G (Business-to-Government) and B2B procurement models. The upstream segment is dominated by petrochemical companies providing polymer resins (PVC, PET, Acrylic), specialized chemicals for adhesives and coatings, and suppliers of glass microspheres or tooling for micro-prismatic replication. Price volatility and quality control at this initial stage significantly impact the downstream production costs and final film performance, necessitating strong procurement management and often long-term supply contracts to ensure material consistency and availability.

The midstream involves highly specialized manufacturing, focusing on three core processes: resin formulation, micro-replication (for prismatic films), and precision coating/lamination. Manufacturing advanced micro-prismatic films requires significant investment in tooling and mastering technology to ensure precise geometry, which is crucial for achieving specific retroreflective indices. Downstream operations are focused on conversion (slitting and rolling into customer-specified dimensions), complex logistics, and distribution. Given that a large portion of the market is driven by governmental or municipal contracts for road signage, the distribution channel must be adept at handling large tenders, long lead times, and rigorous quality assurance inspections often executed by certified converters or specialized sign fabricators.

The distribution channel is generally bifurcated into direct sales to large governmental bodies (e.g., state transportation departments or defense agencies) and indirect sales through specialized distributors and certified sign makers. Direct channels are common for large volume, standardized products, allowing manufacturers greater control over branding and pricing. Indirect channels leverage regional expertise and localized customer relationships, particularly important in fragmented markets or for smaller-volume, customized applications like commercial vehicle conspicuity tapes or retail PPE. The effectiveness of the distribution strategy, coupled with the rigorous management of product certifications, is critical, as failure to meet precise governmental specifications can result in contract loss and significant financial penalty, underscoring the necessity of a highly reliable and traceable supply chain.

Reflective Film Roll Market Potential Customers

The Reflective Film Roll Market serves a distinct array of end-users whose purchasing decisions are typically governed by regulatory compliance, durability requirements, and long-term cost-effectiveness. The primary cohort of buyers includes national and regional transportation authorities and government departments responsible for road safety, infrastructure development, and maintenance. These buyers, representing the largest volume demand, procure massive quantities of reflective sheeting for permanent and temporary traffic signs, road delineation, and work zone barriers, prioritizing films certified to meet specific national standards (e.g., AASHTO, DOT, or European directives) and often requiring long-term material warranties (7–12 years) due to the critical safety function of the products.

A secondary, but highly influential, customer base is the automotive and transportation industry, particularly fleet operators, commercial vehicle manufacturers (OEMs), and logistics companies. These entities are mandatory consumers of reflective films in the form of conspicuity tapes to comply with vehicle safety standards designed to enhance nighttime visibility and reduce rear-end and side collisions involving large vehicles. Procurement in this segment is driven by stringent quality audits, adhesive performance (resistance to washing and harsh environments), and compatibility with diverse vehicle substrates, favoring films that are easy to apply and highly resistant to abrasion and fuel spills.

Further potential customers are found in specialized industrial safety sectors, including construction, mining, and oil and gas operations, which mandate the use of reflective materials for high-visibility apparel (PPE) and site-specific hazard markings. Additionally, the electronics and consumer goods industries are emerging as high-growth potential customers, utilizing precision reflective films for applications such as specialized backlighting units in LCD and LED displays to improve brightness and efficiency, and for decorative or functional safety elements in high-end consumer products. For these niche applications, buyers prioritize ultra-thin films, specific optical properties, and often unique aesthetic characteristics rather than sheer volume, focusing on technical specifications and integration capability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Avery Dennison Corporation, Orafol Europe GmbH, Nippon Carbide Industries Co., Inc., Kiwa Chemical Industry Co., Ltd., Star Materials Inc., Reflexite Corporation (part of Orafol), Gisco Inc., Zhejiang Roadsky Traffic Facilities Co., Ltd., Viz Reflectives, Nikkalite (Nippon Carbide), Uniflex Inc., Changzhou Hua R Sheng Reflective Material Co., Ltd., Euro-Supplies, Swarco AG, YGM Reflective Material Co., Ltd., China Lucky Group Corporation, and DAOXIN Reflective Material Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reflective Film Roll Market Key Technology Landscape

The Reflective Film Roll Market's technology landscape is defined by the ongoing competition and evolution between two primary retroreflective mechanisms: glass bead systems and micro-prismatic systems. Glass bead technology, characterized by embedded microscopic glass spheres that act as lenses to reflect light, remains a cost-effective solution for Engineer Grade (EG) and lower-intensity applications where wide viewing angles are necessary. However, the dominant technological shift is towards advanced micro-prismatic sheeting (e.g., High-Intensity Prismatic and Diamond Grade), which utilizes precision-engineered, cubic-corner reflectors replicated onto the film surface. This prismatic structure dramatically increases retroreflectivity, offering superior brightness and performance over longer distances, which is essential for high-speed roadways and critical safety signage, driving premium pricing and market differentiation.

Significant technological advancements are also evident in the development of specialized adhesive systems and durable film coatings. Modern reflective films utilize pressure-sensitive adhesives (PSAs) engineered for superior bonding to various substrates (aluminum, plastic, painted metal) and for application in extreme temperature ranges (both hot and cold), ensuring longevity and minimizing delamination risk under harsh environmental exposure. Furthermore, the development of non-metallic reflective layers and specific color coatings ensures that the retroreflective performance is maintained across a spectrum of standardized colors (white, red, yellow, green) while adhering to strict chromaticity standards mandated by transportation bodies. Manufacturers are continuously refining anti-graffiti and self-cleaning topcoats to maintain optical performance throughout the film's intended lifespan.

In response to environmental concerns and the demand for flexible application, next-generation technologies focus on non-PVC materials and multilayer optical films (MOFs). The transition from solvent-based printing compatibility to films optimized for digital printing, especially UV-curing inkjet systems, allows for faster, more customizable production of complex graphics and variable message signs without compromising reflectivity. The future of the technology landscape is heavily invested in incorporating 'smart' properties, such as films embedded with radio-frequency identification (RFID) or materials specifically tuned to reflect wavelengths utilized by autonomous vehicle sensors, positioning the reflective film as a foundational component in the emerging infrastructure of interconnected and intelligent transportation systems.

Regional Highlights

The Reflective Film Roll Market exhibits diverse growth trajectories across major geographical regions, heavily correlated with local infrastructure spending cycles and the stringency of safety regulations. North America, comprising the United States and Canada, represents a mature but highly regulated market characterized by a consistent demand for high-performance, long-durability films (Diamond Grade and higher) driven primarily by replacement cycles for existing highway signage and federal mandates for vehicle conspicuity. The region benefits from established standardization bodies (ASTM, FHWA) that ensure quality and create a reliable procurement environment. Growth here is steady, focusing on premium products and technological upgrades necessary to support increasing automation in transportation and maintain compliance with evolving federal safety codes, particularly concerning commercial fleet visibility.

The Asia Pacific (APAC) region is unequivocally the fastest-growing market globally, fueled by unprecedented investments in infrastructure development, including the expansion of massive road networks, urbanization, and the implementation of numerous smart city projects across China, India, and Southeast Asian nations. These countries are rapidly adopting international safety standards, leading to substantial initial procurement of reflective materials for new construction projects. The APAC market is characterized by high volume demand and a competitive pricing environment, where local manufacturers, while often offering lower-cost glass bead films, are increasingly investing in micro-prismatic technology to meet the rising specifications for major governmental contracts and export requirements, solidifying the region's position as both a major consumer and a critical global manufacturing hub.

Europe maintains a strong focus on regulatory compliance and environmental sustainability, driving the demand for non-PVC reflective films and materials with optimized energy efficiency in manufacturing. The European market is highly segmented by country, each adhering to specific road safety standards (e.g., EN standards), resulting in a preference for specialized film characteristics and certified converters. The Middle East and Africa (MEA), while currently smaller in market size, are poised for significant expansion, particularly the Gulf Cooperation Council (GCC) countries, due to massive planned urban development and road connectivity projects ahead of major international events. Latin America's growth is moderate but consistent, driven by modernization efforts in key economies like Brazil and Mexico, where improved infrastructure is essential for supporting growing industrial and agricultural export logistics, emphasizing the immediate need for durable road markings and safety signage.

- North America: Mature market, high adoption of premium prismatic films, driven by federal regulations (DOT, FHWA) and replacement cycles; focuses on technology integration for autonomous vehicle systems.

- Asia Pacific (APAC): Highest growth rate, driven by urbanization and massive new infrastructure development (China, India); focus on high-volume procurement and increasing adoption of micro-prismatic technology for quality upgrades.

- Europe: Highly regulated market, strong emphasis on sustainability (non-PVC films) and compliance with strict EN and ISO standards; stable demand driven by vehicle safety and worker protection mandates.

- Latin America (LATAM): Steady growth fueled by modernization of regional highways and investment in commercial vehicle safety standards in key economies like Brazil and Mexico.

- Middle East & Africa (MEA): Emerging high-growth potential due to extensive urban and infrastructure projects (e.g., Saudi Vision 2030), particularly requiring highly weather-resistant films suitable for desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reflective Film Roll Market.- 3M Company

- Avery Dennison Corporation

- Orafol Europe GmbH

- Nippon Carbide Industries Co., Inc.

- Kiwa Chemical Industry Co., Ltd.

- Star Materials Inc.

- Reflexite Corporation (part of Orafol)

- Gisco Inc.

- Zhejiang Roadsky Traffic Facilities Co., Ltd.

- Viz Reflectives

- Nikkalite (Nippon Carbide)

- Uniflex Inc.

- Changzhou Hua R Sheng Reflective Material Co., Ltd.

- Euro-Supplies

- Swarco AG

- YGM Reflective Material Co., Ltd.

- China Lucky Group Corporation

- DAOXIN Reflective Material Co. Ltd.

- Huangshan Xingwei Reflective Material Co., Ltd.

- Jessup Manufacturing Company

Frequently Asked Questions

Analyze common user questions about the Reflective Film Roll market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between glass bead and micro-prismatic reflective films?

The primary difference lies in light redirection efficiency and brightness. Glass bead films use spherical lenses for reflection and are suitable for lower intensity (Engineer Grade) applications. Micro-prismatic films utilize precision-engineered cube-corner structures, providing significantly higher retroreflectivity (High Intensity or Diamond Grade) crucial for high-speed roadways and critical safety signage due to enhanced angularity and long-distance visibility.

Which reflective film technology is most commonly mandated for commercial vehicle conspicuity marking?

High-Intensity Prismatic (HIP) films are most commonly mandated for commercial vehicle conspicuity tapes in regions like North America and Europe. These films meet stringent regulations (e.g., DOT C2, UNECE R104) due to their superior durability, consistent long-term performance, and mandatory compliance with minimum retroreflectivity levels necessary for nighttime collision prevention.

How is environmental sustainability impacting the Reflective Film Roll Market?

Environmental sustainability is driving a material shift away from traditional PVC films toward more sustainable alternatives like PET and Acrylic, which offer comparable durability and superior UV resistance without the associated environmental concerns of chlorine-based polymers. Manufacturers are also focusing on solvent-free adhesive systems and recyclable product designs to meet evolving regulatory and consumer demands, particularly in European markets.

What role do Reflective Film Rolls play in the development of Smart City infrastructure?

Reflective Film Rolls are essential components in Smart City infrastructure by providing reliable visual cues for both human drivers and AI-powered autonomous vehicle systems (LiDAR and camera sensors). High-performance reflective signage ensures that machine vision systems receive consistent, high-contrast feedback, guaranteeing the safety and navigational accuracy required for intelligent transportation systems and adaptive traffic management.

What are the key certification standards reflective films must adhere to globally?

Globally, reflective films must adhere to standards such as ASTM D4956 (grading reflective sheeting types I through XI), Federal Highway Administration (FHWA) standards in the US, and various European Norms (EN 12899-1 for traffic signs) regarding photometric performance, color specifications, and durability. Compliance with these specifications is mandatory for bidding on government infrastructure projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager