Reflective Insulation Material Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443158 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Reflective Insulation Material Market Size

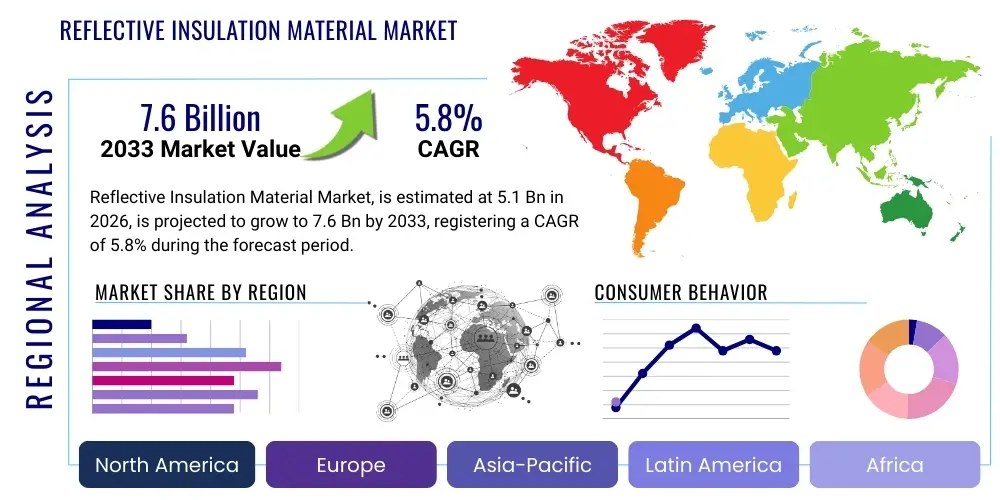

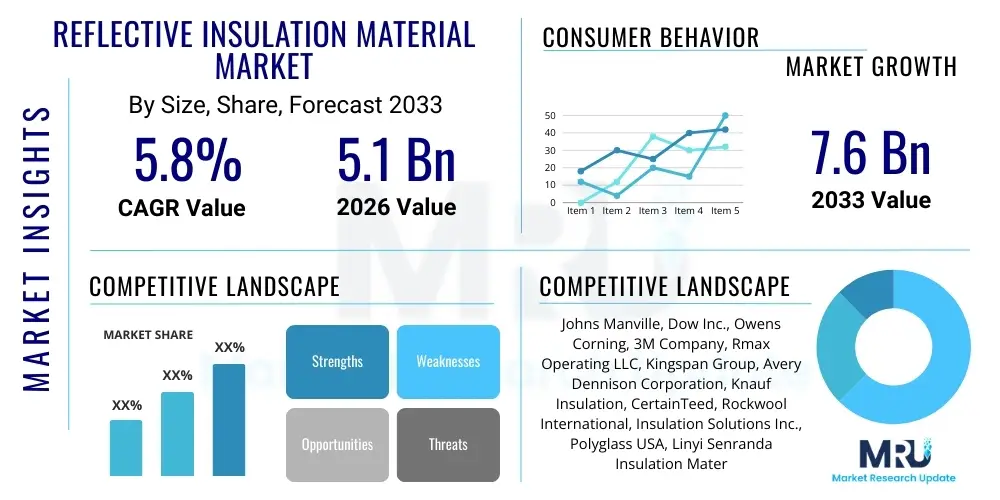

The Reflective Insulation Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is primarily driven by global governmental initiatives promoting energy-efficient construction practices and the increasing consumer demand for sustainable building solutions aimed at reducing long-term operational costs. Reflective insulation plays a critical role in managing heat transfer, particularly radiant heat, which is highly prevalent in building envelopes, making it essential for passive house standards and net-zero energy buildings.

The market is estimated at $5.1 Billion in 2026, benefiting from widespread adoption in residential and commercial infrastructure projects across developed and rapidly urbanizing economies. The initial market valuation reflects the foundational demand stemming from high-temperature industrial applications and cold chain logistics, which prioritize weight reduction and superior thermal barrier performance provided by reflective systems. Regulatory compliance concerning thermal performance in new construction significantly bolsters the market's initial size and stability.

The Reflective Insulation Material Market is projected to reach $7.6 Billion by the end of the forecast period in 2033. This substantial forecast increase is attributed to technological advancements leading to multi-layer, high-performance reflective barriers with enhanced fire safety ratings and durability. Furthermore, the rising integration of reflective insulation into prefabricated building components and modular construction systems ensures easier installation and greater market penetration, particularly in regions facing skilled labor shortages, solidifying the long-term upward trend.

Reflective Insulation Material Market introduction

The Reflective Insulation Material Market encompasses a range of products designed primarily to reduce radiant heat transfer, distinguishing them fundamentally from mass insulation materials that primarily resist conductive and convective heat flow. These materials typically consist of highly reflective low-emissivity (low-e) surfaces, often aluminum foil, laminated onto substrates like polyethylene bubbles, foam, or kraft paper. Their efficacy is derived from their ability to reflect infrared radiation away from the building interior during summer or back into the interior during winter, thereby stabilizing internal temperatures and significantly reducing the energy load required for HVAC systems. The product description emphasizes thin profiles, lightweight characteristics, and inherent vapor resistance, making them ideal for applications where space is limited or moisture control is critical.

Major applications for reflective insulation span the residential sector, where they are widely used in attics, walls, and crawl spaces; the commercial sector, primarily in metal buildings, warehouses, and roof assemblies; and specialized industrial applications suching as pipe insulation and high-temperature equipment cladding. A crucial benefit of using these materials is the immediate and measurable reduction in energy consumption, leading to lower utility bills and a reduced carbon footprint for the structure. Beyond energy savings, reflective barriers also offer supplementary benefits like acting as effective moisture barriers, improving indoor comfort levels by mitigating temperature fluctuations, and providing a clean, non-fibrous insulation alternative suitable for sensitive environments.

The market is currently being driven by several powerful macro and microeconomic factors. Chief among these are stringent global building codes and energy performance standards, such as LEED certification requirements and prescriptive mandates for minimum R-values or maximum U-factors in building envelopes. The increasing cost of energy worldwide compels end-users—both residential consumers and large industrial operators—to seek cost-effective, long-term solutions for thermal management. Additionally, the rapid pace of construction activity, particularly in emerging economies in Asia Pacific, coupled with the growing trend toward sustainable and green building methodologies, provides substantial impetus for the adoption and innovation within the reflective insulation material sector.

Reflective Insulation Material Market Executive Summary

The Reflective Insulation Material Market is characterized by dynamic business trends focused on product innovation, particularly the development of hybrid systems that combine reflective surfaces with mass insulation cores to offer holistic thermal performance tailored to diverse climatic conditions. Business trends indicate a strong move toward customization and modular integration, allowing manufacturers to serve the burgeoning prefabricated construction market efficiently. Furthermore, strategic partnerships between insulation manufacturers and large-scale construction firms are accelerating the adoption cycle, while increasing raw material price volatility, specifically for aluminum and polymer films, remains a key challenge necessitating optimized supply chain management and forward purchasing strategies among market leaders.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing region, driven by massive infrastructure investments in China, India, and Southeast Asian nations where rapid urbanization demands quick, cost-effective, and climate-resilient building solutions. North America and Europe, characterized by mature markets, exhibit strong demand primarily through retrofitting older, energy-inefficient building stocks, propelled by government subsidies and tax incentives aimed at energy conservation. The Middle East and Africa (MEA) show specialized growth, focusing on reflective barriers to combat extreme solar heat gain in commercial roofing and specialized industrial facilities, positioning high-performance, weather-resistant products for premium pricing in these regions.

Segmentation trends reveal that the multi-layer product segment is projected to gain significant market share, as these composite systems offer superior R-value equivalence and enhanced protection against air infiltration and moisture damage, meeting stringent contemporary building standards. In terms of application, the building and construction segment, particularly residential roofing and wall systems, dominates the market, yet the cold chain logistics sector is experiencing rapid proportional growth due to the increasing global trade of temperature-sensitive pharmaceuticals and perishable goods, demanding specialized, lightweight reflective liners for shipping containers and packaging solutions to maintain critical temperature stability during transit.

AI Impact Analysis on Reflective Insulation Material Market

Common user inquiries concerning AI's impact on the Reflective Insulation Material Market often center on how digital tools can optimize the material’s performance verification, streamline complex supply chains, and enhance the predictability of installation outcomes. Users are keen to understand if AI can simulate real-world thermal performance under dynamic weather conditions, helping specifiers choose the most effective reflective product configuration (e.g., number of layers, airspace requirements) for a specific geographic location. Key themes emerging from user concerns include optimizing manufacturing processes to reduce waste, ensuring material quality consistency, and utilizing AI for predictive maintenance in industrial insulation applications to prevent catastrophic heat loss or gain, thereby reducing overall energy costs and improving safety standards across various construction and industrial domains.

- AI-driven simulation and modeling predict the dynamic thermal performance of various reflective insulation assemblies under diverse climatic conditions, optimizing product selection for specific architectural designs.

- Predictive maintenance algorithms utilize sensor data embedded in insulation systems to monitor potential thermal breaches or moisture accumulation, notifying facility managers before efficiency degradation occurs.

- Optimization of manufacturing processes is achieved using machine learning, which fine-tunes lamination speeds, coating thickness, and material cutting patterns, thereby minimizing material waste and ensuring precise product dimensions.

- AI enhances supply chain efficiency by forecasting demand fluctuations for raw materials (aluminum, polymers) and optimizing logistical routes for just-in-time delivery to large-scale construction sites globally.

- Automated quality control systems employ computer vision to rapidly inspect the low-emissivity coating integrity and lamination bond strength during production, ensuring adherence to strict performance specifications.

DRO & Impact Forces Of Reflective Insulation Material Market

The market dynamics of the Reflective Insulation Material sector are fundamentally shaped by a confluence of accelerating regulatory pressures and intrinsic material advantages, coupled with persistent challenges related to market acceptance and installation protocols. Drivers predominantly revolve around the global shift toward stringent energy efficiency mandates and the rapid expansion of green building initiatives, which view highly reflective surfaces as a cost-effective method to achieve necessary thermal envelope requirements without significantly increasing wall or roof thickness. Opportunities are abundant in the retrofitting segment, targeting older structures that lack modern insulation, and in specialized niches like cold storage and high-temperature processing where conventional materials struggle. Conversely, restraints involve misconceptions about the product’s true R-value (often confused with system R-value, which includes the required air space) and the necessity for specific installation training, which can impede wider adoption, particularly among smaller contractors.

Key drivers include the pervasive need for energy cost reduction across industrial and residential sectors globally, making the rapid payback period offered by reflective insulation highly attractive to end-users. Legislative frameworks promoting decarbonization and climate resilience act as a powerful external impact force, mandating the inclusion of high-performance thermal barriers in new developments. Furthermore, the inherent benefits of reflective materials—being lightweight, mold-resistant, and serving as a simultaneous vapor barrier—make them superior choices in environments prone to high humidity or where structural load limitations are a concern, thus reinforcing their market position against traditional fiberglass or mineral wool products, particularly in regions prone to seismic activity where lighter building envelopes are preferred.

Impact forces currently influencing the market include the volatility of polymer and aluminum prices, which affects manufacturing costs and final product pricing. However, the dominant positive impact force remains the sustained growth of the global construction industry, particularly in developing economies, driving sheer volume demand. Opportunities arise from innovation in hybrid reflective systems, such as incorporating phase change materials (PCMs) or nanotechnology coatings to improve overall thermal mass and fire resistance, addressing previous limitations associated with certain reflective film compositions. Successfully overcoming restraints, such as educating the construction industry on the critical importance of proper air space maintenance adjacent to the reflective surface, will be crucial for sustained, exponential market growth and ensuring optimal energy savings performance is achieved in the field.

Segmentation Analysis

The Reflective Insulation Material Market is comprehensively segmented based on product type, application, and end-use sector, providing a detailed understanding of consumer preferences and technological trajectories across various geographical landscapes. The segmentation allows manufacturers to target specific market needs, such as differentiating between highly flexible, lightweight products suitable for packaging and robust, fire-rated assemblies required for commercial building envelopes. Analyzing these segments helps stakeholders identify high-growth areas, such as multi-layer insulation in the building and construction sector, and tailor their research and development efforts to meet evolving regulatory and performance demands, thereby maximizing market penetration and profitability across the value chain.

- By Product Type:

- Foam Insulation (e.g., Polyethylene foam laminated with reflective surfaces)

- Bubble Insulation (Polyethylene air bubbles sandwiched between reflective layers)

- Multi-layer Insulation (Composite systems incorporating multiple reflective foils and separating layers)

- Reflective Foil/Film (Single-layer reflective material used as a radiant barrier)

- By Application:

- Roofing Systems (Attics, flat roofs, metal building roofs)

- Wall Systems (Exterior walls, internal partitioning)

- Flooring Systems (Crawl spaces, slab insulation)

- Pipes and HVAC Systems (Ductwork insulation, piping wraps)

- By End-Use Sector:

- Building & Construction (Residential, Commercial, Industrial Buildings)

- Cold Chain Logistics and Packaging (Shipping containers, insulated packaging, pharmaceutical transport)

- Automotive and Transportation (Vehicle insulation, thermal barriers)

- Industrial and OEM (High-temperature industrial equipment, specialized machinery)

Value Chain Analysis For Reflective Insulation Material Market

The value chain for the Reflective Insulation Material Market begins with the upstream procurement of specialized raw materials, primarily high-purity aluminum foil, various polymer films (like polyethylene or polyester), and adhesives used for lamination. Upstream analysis focuses on ensuring stable supply and quality consistency of these components, as fluctuations in metal and oil prices directly impact manufacturing costs. Manufacturers often engage in long-term contracts with key suppliers to mitigate volatility. Efficiency in the upstream segment relies heavily on optimized sourcing and inventory management, critical for maintaining cost-competitiveness in the final product and ensuring the low-emissivity properties of the finished product are not compromised by impurities or substandard lamination processes.

The midstream phase involves the core manufacturing and conversion processes, including lamination, coating application, bonding of materials (e.g., bubble or foam core insertion), and cutting/slitting into final product forms such as rolls or panels. This phase requires significant capital investment in highly automated machinery to ensure precise layering and high production throughput. Optimization here focuses on reducing manufacturing defects, maximizing the reflective surface area integrity, and adhering strictly to fire safety standards and building code compliance. Innovation in the midstream often involves creating proprietary adhesive systems that maintain structural integrity under extreme thermal cycling and developing composite products that offer multi-functionality, such as integrated fire resistance or sound dampening capabilities.

The downstream segment encompasses distribution channels, installation, and interaction with the final end-users. Distribution is multifaceted, involving direct sales to large construction companies, specialized distributors catering to HVAC and roofing contractors, and big-box retail channels for DIY residential consumers. Both direct and indirect channels are critical; direct sales allow for technical consultation and customized bulk orders, while indirect channels provide market reach and convenience. Potential customers include general contractors, specialized insulation installers, architects, and facility managers, all relying on strong technical support and verifiable product performance data. The effectiveness of the distribution network, coupled with well-trained professional installers, dictates the product’s successful application and subsequent market reputation.

Reflective Insulation Material Market Potential Customers

The primary potential customers and end-users of Reflective Insulation Material are highly diversified, extending across the entire built environment and specialized industrial applications. General contractors and large-scale residential builders constitute a major buying segment, driven by the need to meet increasingly stringent energy efficiency requirements (such as Passive House or Net-Zero standards) while controlling construction costs. These users prioritize products that offer easy installation, predictable performance, and strong warranty assurances. Architects and structural engineers are also key influencers, specifying reflective systems early in the design phase for aesthetic, weight, and thermal performance benefits, particularly in metal building construction where traditional insulation is less effective against radiant heat transfer.

A second crucial group of potential customers includes specialized contractors focused on roofing, HVAC ductwork, and cold storage installation. For roofing contractors, reflective insulation, often used as a radiant barrier in attics, provides a high-impact solution to reduce solar heat gain, which is vital in hot climates. HVAC installers utilize reflective wraps to minimize thermal losses or gains in duct systems, enhancing the overall efficiency of air handling units. In the cold chain sector, logistics companies and pharmaceutical distributors are rapidly adopting reflective liners for shipping containers and insulated boxes to maintain precise, stable temperature profiles, minimizing spoilage and ensuring product efficacy during long-distance transit.

Finally, industrial facilities, including petrochemical plants, power generation stations, and large manufacturing complexes, represent a specialized but high-value customer segment. These end-users require high-performance reflective jackets and pipe wraps designed to withstand harsh industrial environments, high temperatures, and chemical exposure, focusing on minimizing heat loss in processes or preventing heat gain in critical infrastructure. Furthermore, the burgeoning demand for sustainable packaging solutions means that food and beverage manufacturers, along with e-commerce retailers, are increasingly becoming end-users of reflective packaging materials to ensure product quality from warehouse to consumer, providing a continuous growth opportunity outside the traditional construction sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.1 Billion |

| Market Forecast in 2033 | $7.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johns Manville, Dow Inc., Owens Corning, 3M Company, Rmax Operating LLC, Kingspan Group, Avery Dennison Corporation, Knauf Insulation, CertainTeed, Rockwool International, Insulation Solutions Inc., Polyglass USA, Linyi Senranda Insulation Material Co., Ltd., IDI Distributors, Thermawrap, Resisto, Reflectix, Inc., Pactiv LLC, Foiltek, Inc., Fi-Foil Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reflective Insulation Material Market Key Technology Landscape

The Reflective Insulation Material Market is undergoing continuous technological refinement focused primarily on enhancing the emissivity performance, improving fire safety ratings, and integrating multi-functional properties into single products. A key technology involves advanced lamination techniques that ensure the long-term integrity of the reflective layer, preventing delamination or oxidation which can severely compromise the material's low-e properties over time. Manufacturers are investing in vacuum deposition processes or specialized sputtering techniques to apply ultra-thin, highly reflective metal coatings, often aluminum, to polymer films, maximizing radiant heat reflection while ensuring flexibility and durability for various building applications, including complex geometries like curved ductwork or irregularly shaped roof areas.

A significant technological advancement is the development of multi-layer and hybrid reflective insulation systems. These systems strategically combine the radiant barrier properties of reflective foils with the conductive resistance of materials like closed-cell foam or proprietary fiber cores. This hybridization allows products to offer a higher effective R-value system while maintaining the lightweight and thin-profile benefits of traditional reflective insulation. Furthermore, innovations are focused on fire resistance; new polymer substrates and additive technologies are being developed to achieve Class A fire ratings, overcoming historical regulatory hurdles associated with early generations of plastic-based reflective materials, thereby enabling their safe use in high-rise commercial structures and heavily regulated industrial zones.

Material science is also contributing through the integration of phase change materials (PCMs) within reflective insulation assemblies, particularly for cold chain logistics and temperature-critical storage. PCMs can absorb and release significant amounts of latent heat during phase transition, providing a stable temperature buffer that dramatically improves the performance of reflective packaging and transport containers over extended periods, especially during unexpected delays. Finally, ongoing advancements in digital integration include the use of QR codes or RFID tags embedded in the insulation materials, enabling easier tracking of installation processes, verification of material provenance, and providing immediate access to technical specifications and performance data for building inspectors and facility maintenance teams, supporting smarter building management systems.

Regional Highlights

- Asia Pacific (APAC): This region dominates the market growth trajectory due to massive urbanization and government initiatives in China, India, and Southeast Asia to implement modern building codes focused on energy efficiency. The high concentration of industrial manufacturing and booming residential construction provide a fertile ground for high-volume reflective insulation adoption, particularly in metal building construction and cost-sensitive housing projects where its simplicity and low material cost are highly valued.

- North America: Characterized by stringent energy performance mandates (e.g., California’s Title 24) and a vast market for building retrofits, North America maintains a strong leadership position. Demand is driven by attic radiant barriers in hot climates (Sun Belt states) and high-performance hybrid insulation systems used in commercial roofing and HVAC duct applications throughout the continent.

- Europe: The European market is highly mature and innovation-focused, propelled by ambitious EU directives aimed at decarbonization and achieving near-zero energy buildings (NZEB). The focus here is on premium, multi-functional reflective products that meet strict thermal, fire safety, and acoustic standards, widely utilized in passive house construction and specialized applications like conservatory roofing and historic building renovation projects.

- Latin America (LATAM): Market growth is moderate but consistent, driven by residential construction growth in countries like Brazil and Mexico. The need for cooling solutions in tropical and sub-tropical regions makes reflective insulation an attractive, low-cost option for mitigating intense solar radiation, primarily utilized in mass-market housing and agricultural storage facilities.

- Middle East and Africa (MEA): This region offers significant opportunities for specialized high-temperature reflective systems. The extreme climatic conditions necessitate highly efficient radiant barriers for roofing and exterior wall systems to reduce air conditioning load dramatically. Large-scale infrastructure projects and industrial facilities in the GCC countries are major consumers, demanding products with exceptional UV resistance and durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reflective Insulation Material Market. These companies are instrumental in setting industry standards, driving technological innovation, and expanding global market penetration through strategic investments and product portfolio diversification.- Johns Manville

- Dow Inc.

- Owens Corning

- 3M Company

- Rmax Operating LLC

- Kingspan Group

- Avery Dennison Corporation

- Knauf Insulation

- CertainTeed

- Rockwool International

- Insulation Solutions Inc.

- Polyglass USA

- Linyi Senranda Insulation Material Co., Ltd.

- IDI Distributors

- Thermawrap

- Resisto

- Reflectix, Inc.

- Pactiv LLC

- Foiltek, Inc.

- Fi-Foil Company

- Innovative Energy, Inc.

- Enviro-Tec

Frequently Asked Questions

Analyze common user questions about the Reflective Insulation Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of reflective insulation material?

The primary function of reflective insulation is to minimize radiant heat transfer by utilizing a low-emissivity (low-e) surface, typically aluminum foil, to reflect infrared heat radiation. This differs from mass insulation, which primarily resists conductive and convective heat flow. Reflective insulation is most effective when facing an air space.

How does the R-value of reflective insulation compare to traditional insulation?

Reflective insulation does not have a single, static R-value like mass insulation. Its performance is measured by the total system R-value, which includes the air space required adjacent to the reflective surface. When installed correctly with adequate air space, its performance can be equivalent to several inches of traditional insulation, especially in managing downward heat flow (e.g., in attics).

Which end-use sector is driving the highest demand for reflective insulation materials?

The Building & Construction sector, particularly residential and commercial roofing and wall applications, currently accounts for the largest share of demand. However, the Cold Chain Logistics and Packaging sector is exhibiting the fastest growth rate due to the global expansion of temperature-sensitive goods transport (e.g., pharmaceuticals and perishable foods).

What are the key advantages of using multi-layer reflective insulation over single-layer radiant barriers?

Multi-layer reflective insulation offers superior performance by incorporating multiple reflective foils separated by air or foam layers, creating a more effective thermal break and improving resistance to conductive heat flow. These systems often provide better structural integrity, act as integrated vapor barriers, and achieve higher effective system R-values.

Is reflective insulation affected by moisture or condensation?

High-quality reflective insulation often utilizes laminated polymer films, making it inherently resistant to moisture and functioning effectively as a vapor barrier, which helps prevent condensation within wall or roof cavities. Unlike fibrous insulation, its thermal performance is generally unaffected by moisture, making it advantageous in high-humidity environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager