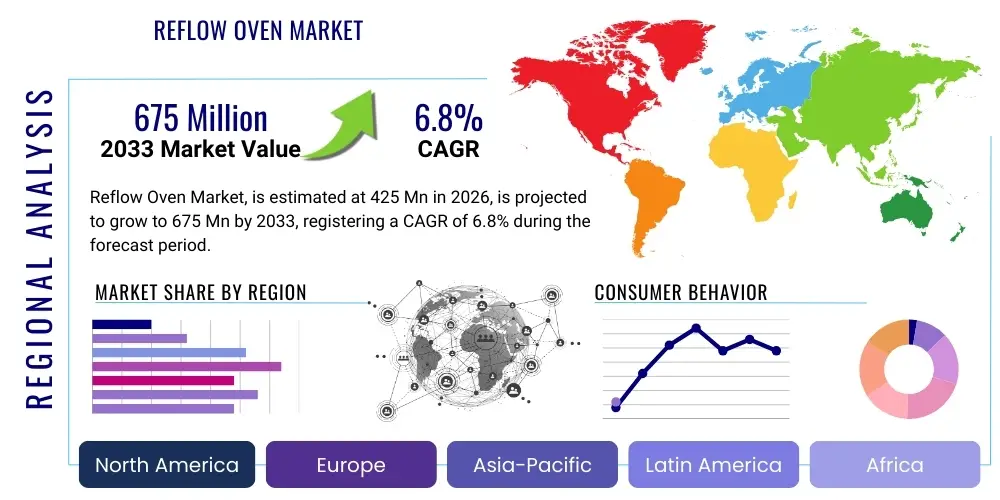

Reflow Oven Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441869 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Reflow Oven Market Size

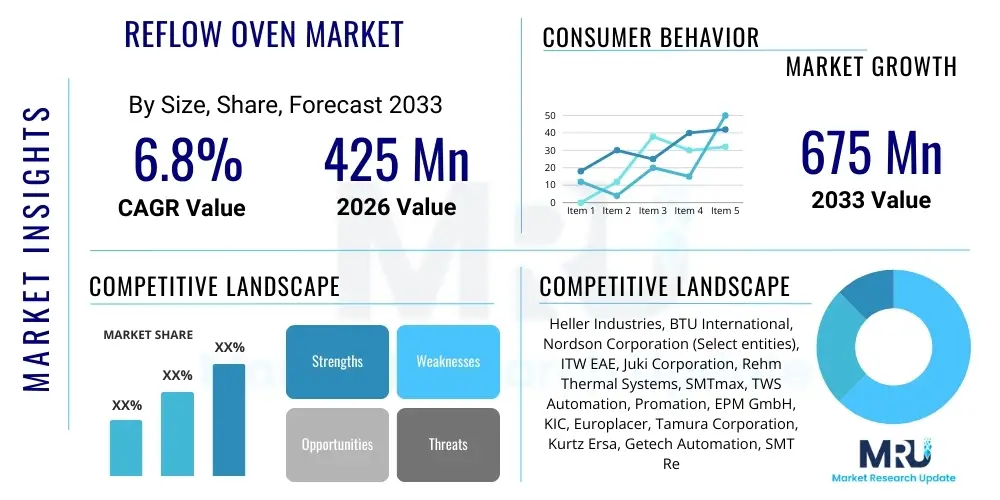

The Reflow Oven Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $425 million in 2026 and is projected to reach $675 million by the end of the forecast period in 2033.

Reflow Oven Market introduction

The Reflow Oven Market encompasses specialized thermal processing equipment crucial for Surface Mount Technology (SMT) manufacturing, primarily utilized to solder electronic components onto Printed Circuit Boards (PCBs). These ovens operate by heating solder paste to its melting point, allowing it to solidify and create permanent electrical and mechanical connections between the component leads and the PCB pads. Reflow ovens are indispensable in modern electronics assembly due ranging from high-volume consumer electronics to high-reliability applications in automotive and aerospace sectors. The primary product variations include convection ovens, forced air systems, and nitrogen inert atmosphere ovens, each catering to different complexity levels and material requirements, particularly concerning lead-free soldering and advanced component handling. The market growth is inherently tied to the expansion of global electronics production, driven by miniaturization, the rollout of 5G infrastructure, and the accelerating demand for electric vehicles (EVs).

Major applications of reflow soldering technology span across critical industry verticals. Consumer electronics, including smartphones, tablets, and smart home devices, constitute a massive volume driver, requiring speed and high throughput. Simultaneously, the proliferation of complex integrated circuits and fine-pitch components in industrial automation and medical devices necessitates extremely precise thermal profiling capabilities offered by modern convection and vacuum reflow systems. The benefits derived from utilizing high-quality reflow ovens include enhanced joint reliability, uniform heat distribution across complex board layouts, and optimized cycle times, which directly contribute to lower manufacturing costs and improved product quality. Furthermore, the transition toward lead-free solders, mandated by environmental regulations such as RoHS, demands sophisticated thermal control systems that can handle higher processing temperatures and narrower process windows, fueling demand for technologically advanced equipment.

Driving factors sustaining the market's trajectory include the robust global penetration of IoT devices, increasing complexity in automotive electronics—specifically Advanced Driver-Assistance Systems (ADAS) and battery management systems—and sustained governmental investment in communication infrastructure. The continuous pressure on Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers to increase production efficiency while maintaining zero-defect standards accelerates the adoption of Industry 4.0 compliant, automated reflow solutions. Technological advancements focus heavily on reducing voiding in solder joints (especially critical in power electronics) through vacuum options and improving thermal mapping accuracy via advanced profiling software, ensuring process repeatability and yield maximization across diverse product lines.

Reflow Oven Market Executive Summary

The Reflow Oven Market is currently undergoing significant transformation characterized by key business trends centered on integration and efficiency. The primary business trend involves the rapid adoption of closed-loop systems and integration with Manufacturing Execution Systems (MES) to facilitate complete traceability and automated process adjustments, aligning the market strongly with smart factory initiatives. Companies are focusing their research and development efforts on multi-zone convection ovens capable of handling increasingly diverse PCB sizes and thermal masses, driven by custom manufacturing requirements. A notable segment trend highlights the accelerating shift toward nitrogen atmosphere reflow ovens, particularly in high-reliability sectors like aerospace and medical devices, where oxidation minimization and exceptional wetting performance are paramount for ensuring joint integrity and long-term device function. Furthermore, the competitive landscape is defined by mergers and acquisitions aimed at consolidating specialized thermal expertise, allowing market leaders to offer comprehensive end-to-end SMT line solutions rather than standalone equipment.

Regional trends indicate that the Asia Pacific (APAC) region maintains its dominance, primarily due to the concentration of major global electronics manufacturing hubs in countries like China, Taiwan, South Korea, and Vietnam. This region exhibits high volume demand, pushing manufacturers towards ultra-high throughput inline reflow solutions. However, North America and Europe are witnessing significant growth in specialized high-mix, low-volume (HMLV) manufacturing, particularly related to medical, defense, and specialized automotive electronics. These mature markets prioritize process control, data analytics, and vacuum reflow capabilities over sheer volume, driving demand for premium, high-precision equipment. Supply chain resilience and the strategic relocation of manufacturing capacity outside traditional centers are influencing procurement decisions, with a growing emphasis on modular, energy-efficient designs that minimize operational footprint and energy consumption, addressing environmental sustainability goals.

Segment trends reveal that the convection reflow oven segment, due to its versatility and established technology, remains the volume leader, while the demand for advanced vapor phase soldering (VPS) systems is increasing for highly sensitive components requiring minimal thermal stress. Application-wise, automotive electronics are projected to exhibit the highest growth rate, necessitated by the exponential rise in electronic control units (ECUs), sensor integration, and power electronics (inverters/converters) within electric and hybrid vehicles. Additionally, the proliferation of complex micro-devices and wearables reinforces the need for extremely precise thermal profiling tools, where even minor variations can lead to significant quality defects. Manufacturers are also seeing increased demand from specialized EMS providers focusing on prototypes and R&D activities, requiring flexible, smaller-footprint benchtop reflow solutions for rapid iteration and testing.

AI Impact Analysis on Reflow Oven Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Reflow Oven Market typically revolve around operational optimization, predictive maintenance, and quality assurance integration. Common user concerns include understanding how AI algorithms can interpret complex thermal profile data to auto-correct processes in real-time, how machine learning can predict potential equipment failures before they cause downtime, and whether AI integration increases the barrier to entry for smaller manufacturers. Users are keen to know if AI can reliably optimize energy consumption based on production schedules and ambient conditions, thus enhancing sustainability efforts while maintaining high yields. The overarching expectation is that AI will move reflow soldering from a manually monitored, reactive process to a highly autonomous, proactive manufacturing cell, maximizing uptime and eliminating thermal defects related to inconsistent soldering.

The implementation of AI algorithms, particularly those based on machine learning (ML), is revolutionizing the thermal profiling process within reflow ovens. Traditional thermal profiling relies on human expertise to analyze thermocouple data and adjust zone temperatures; however, AI systems can process exponentially larger datasets, incorporating variables such as board material, component placement, solder paste chemistry, and ambient humidity. This allows for the dynamic generation of optimal profiles that minimize Peak Reflow Temperature (PRT) variation and ensure the Process Window Index (PWI) remains within tight tolerances, especially critical for complex multi-layered PCBs. AI-driven systems learn from every run, continuously refining the thermal model to achieve first-pass yield optimization, significantly reducing the requirement for costly rework and scrappage, which is a major concern for high-value electronics manufacturers.

Furthermore, AI significantly enhances the reliability and operational efficiency of reflow equipment through advanced predictive maintenance (PdM). By analyzing sensory data streams—including heater element current draw, blower fan speed variance, conveyor belt tension, and gas consumption rates (for nitrogen systems)—ML models can accurately forecast component degradation or imminent failure. This shift from time-based preventative maintenance to condition-based predictive maintenance drastically minimizes unplanned downtime, a critical factor in high-volume production environments. AI also assists in resource management by optimizing inert gas usage, ensuring nitrogen is only consumed precisely when needed and minimizing waste, contributing directly to lower operating costs and a reduction in the overall carbon footprint of the SMT line.

- Real-Time Thermal Profile Optimization: AI adjusts zone temperatures dynamically based on real-time board feedback and historical performance data to maintain the highest quality solder joint integrity.

- Predictive Maintenance (PdM): Machine learning algorithms analyze internal oven sensor data (e.g., motor vibration, heater resistance) to predict component failure, enabling just-in-time repairs and maximum uptime.

- Enhanced Quality Control: AI integrates with Automated Optical Inspection (AOI) systems, correlating soldering defects with specific profile deviations, driving continuous improvement loops in the reflow process.

- Energy Efficiency Maximization: Algorithms optimize oven standby modes and ramp-up profiles based on MES schedules, resulting in reduced energy consumption and operational expense savings.

- Data Integration and Traceability: AI facilitates the seamless collection and analysis of millions of data points per cycle, providing comprehensive traceability required for aerospace, medical, and automotive regulatory compliance.

- Autonomous Process Setup: Future systems utilize AI for automated recipe generation based on CAD input and component specifications, reducing human error and setup time, especially valuable in high-mix environments.

DRO & Impact Forces Of Reflow Oven Market

The Reflow Oven Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate investment and technological direction. Key drivers include the overwhelming global demand for miniaturized and high-density electronic devices, particularly in the telecommunications and automotive sectors. The transition to advanced packaging techniques, such as system-in-package (SiP) and heterogeneous integration, necessitates extremely precise and repeatable thermal processing capabilities that only high-end reflow ovens can deliver. Simultaneously, the proliferation of Industry 4.0 initiatives pushes manufacturers toward fully integrated, highly automated production lines where reflow ovens must communicate seamlessly with upstream and downstream equipment, driving innovation in software and connectivity features. These powerful drivers encourage capital expenditure on advanced, reliable thermal solutions.

However, the market faces significant restraints that temper growth, primarily the high initial capital investment required for state-of-the-art convection and vacuum reflow systems, particularly those incorporating inert gas capabilities. This high cost can pose a barrier to entry for smaller EMS providers or manufacturers in emerging economies. Furthermore, the complexity associated with lead-free solder profiles and handling diverse component thermal sensitivities requires highly skilled operators and continuous retraining, adding to operational overhead. The ongoing global supply chain volatility, particularly concerning critical electronic components and raw materials, also impacts the lead times and production costs for reflow oven manufacturers, translating into higher prices and delayed deliveries for end-users, thus restraining immediate market expansion.

Opportunities within the market largely stem from addressing current technological and environmental challenges. The increasing focus on sustainability and energy efficiency opens avenues for manufacturers developing highly insulated, low-power consumption reflow solutions. The rise of electric vehicle manufacturing globally presents a massive opportunity, as EV power electronics require specialized void-free soldering processes, making vacuum reflow ovens a non-negotiable requirement. Moreover, the shift toward localized manufacturing spurred by geopolitical considerations creates opportunities for regional suppliers to gain market share by offering flexible, customized equipment and localized support services. These market forces collectively push innovation toward higher efficiency, better process control, and greater automation to overcome cost constraints and meet demanding application requirements.

Segmentation Analysis

The Reflow Oven Market is comprehensively segmented based on technology type, atmosphere requirement, application, and end-user base, reflecting the diverse requirements of the global electronics manufacturing ecosystem. Segmentation by type differentiates systems based on the primary heat transfer mechanism, leading to categories like convection, infrared, and vapor phase systems, with convection remaining the dominant technology due to its superior thermal uniformity and process control. Atmosphere segmentation distinguishes between air atmosphere ovens, suitable for less demanding applications and traditional solders, and nitrogen (inert) atmosphere ovens, essential for advanced lead-free soldering processes involving highly oxidation-sensitive components and fine-pitch applications. Analyzing these segments provides strategic insights into areas of rapid technological change and shifting manufacturing preferences.

- By Type:

- Convection Reflow Ovens (Forced Convection)

- Vapor Phase Reflow Ovens (VPS)

- Infrared (IR) Reflow Ovens

- Hybrid Systems

- By Atmosphere:

- Air Atmosphere Ovens

- Nitrogen Atmosphere Ovens (Inert Gas)

- By Technology Feature:

- Vacuum Reflow Systems (for Void Reduction)

- Non-Vacuum Systems

- By Application:

- Automotive Electronics (ADAS, ECU, Power Modules)

- Consumer Electronics (Smartphones, Wearables)

- Industrial Electronics and Control Systems

- Medical Devices and Healthcare Equipment

- Aerospace and Defense

- Telecommunication Infrastructure (5G Modules)

- By End-User:

- Electronics Manufacturing Services (EMS) Providers

- Original Equipment Manufacturers (OEMs)

- Contract Manufacturing Companies (CMs)

- Research and Development Labs

Value Chain Analysis For Reflow Oven Market

The value chain for the Reflow Oven Market begins with upstream activities involving specialized component suppliers, focusing primarily on high-precision heating elements, advanced insulation materials, control system software, and complex sensor technologies like thermocouples and oxygen analyzers. Critical upstream suppliers include manufacturers of high-efficiency blower motors, conveyor systems, and programmable logic controllers (PLCs). Success at this stage relies heavily on securing reliable, high-quality component supplies that can withstand continuous high-temperature operation and deliver extreme thermal stability required for consistent reflow processing. Procurement strategy focuses on long-term supplier partnerships to mitigate risks associated with component shortages and ensure adherence to stringent quality standards necessary for industrial manufacturing equipment.

The midstream stage involves the core manufacturing, assembly, and integration of the reflow ovens by key market players. This stage requires significant internal expertise in thermal engineering, materials science, and software integration to design energy-efficient ovens that meet specific throughput and profile accuracy demands. Manufacturing processes often involve precision welding, advanced assembly of inert gas management systems (for nitrogen ovens), and rigorous quality testing, including thermal mapping and qualification runs. Direct and indirect distribution channels play a crucial role here; direct channels involve large manufacturers selling directly to major OEMs or Tier 1 EMS providers, offering bespoke solutions and extensive after-sales service packages, including calibration and maintenance contracts. Indirect channels utilize specialized regional distributors and system integrators who provide local sales support, installation, and basic maintenance for smaller manufacturers or high-mix, low-volume customers.

Downstream analysis focuses on installation, training, maintenance, and the ultimate end-users—the EMS providers and OEMs. The downstream success is determined by the manufacturer's ability to provide comprehensive technical support, application engineering assistance, and rapid spare parts availability, given the critical role of the reflow oven in the production line. Specialized service contracts for preventative and predictive maintenance are a growing revenue stream, ensuring the equipment maintains optimal performance throughout its lifecycle. The relationship between the manufacturer and the end-user is highly consultative, often involving collaborative efforts to develop new thermal profiles for emerging solder chemistries or complex component packages, solidifying the long-term customer relationships crucial for repeat business in this capital equipment market.

Reflow Oven Market Potential Customers

The primary consumers and end-users of reflow oven technology are categorized by their role in the electronics supply chain, dominating the Electronics Manufacturing Services (EMS) Providers and Original Equipment Manufacturers (OEMs). EMS providers, such as Foxconn, Jabil, and Sanmina, represent the largest customer segment globally, operating massive production lines characterized by high volume and diverse product mixes. These customers require highly scalable, reliable, and throughput-optimized convection ovens, often running 24/7. Their procurement decisions are heavily influenced by equipment uptime, maintenance costs, energy efficiency metrics, and the ability of the oven to handle a vast range of board complexities and solder pastes, pushing demand toward flexible, automated, and interconnected oven solutions that integrate seamlessly into their complex MES infrastructures.

OEMs represent another critical segment, particularly those focused on high-reliability, mission-critical applications where process control is paramount and often proprietary. This includes leading manufacturers in automotive (Tier 1 suppliers for ECUs and power modules), aerospace and defense contractors, and specialized medical device companies. For these customers, the procurement criteria shift significantly, prioritizing process capability indicators like minimal voiding (driving demand for vacuum reflow systems), extreme thermal uniformity, and comprehensive data logging capabilities required for regulatory compliance and long-term product traceability. Unlike EMS providers who prioritize speed, OEMs focusing on high-value, low-volume production prioritize precision, repeatability, and the ability to certify the soldering process under strict quality management systems.

A rapidly growing segment of potential customers includes research and development (R&D) laboratories, specialized prototyping houses, and educational institutions. While these users require lower volume equipment, their needs drive innovation in smaller, more flexible, and highly adaptable benchtop or small-batch reflow ovens. These systems must offer precise control over thermal profiles for experimental purposes, supporting emerging material science research in areas like advanced semiconductor packaging and novel solder alloy development. Furthermore, companies engaging in specialized power electronics, such as those developing components for solar inverters or high-voltage battery systems, require specialized large-format reflow solutions capable of handling large thermal masses and minimizing thermal stress on oversized substrates, representing a niche but high-growth customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $425 Million |

| Market Forecast in 2033 | $675 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heller Industries, BTU International, Nordson Corporation (Select entities), ITW EAE, Juki Corporation, Rehm Thermal Systems, SMTmax, TWS Automation, Promation, EPM GmbH, KIC, Europlacer, Tamura Corporation, Kurtz Ersa, Getech Automation, SMT Reflow Systems, Folungwin, Mirae Corporation, GPD Global, Eutect GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reflow Oven Market Key Technology Landscape

The technological landscape of the Reflow Oven Market is dominated by advancements in thermal management, process monitoring, and atmospheric control systems, all aimed at achieving zero-defect soldering results in increasingly demanding environments. Forced convection technology remains the established backbone, utilizing high-velocity hot air or nitrogen to transfer heat uniformly across the PCB surface, minimizing thermal gradients and ensuring all components reach the necessary reflow temperature simultaneously. Current innovation in convection systems focuses on improving the efficiency of the heating elements and blower designs, optimizing the airflow dynamics within the chamber zones to handle boards with significant differences in thermal mass (e.g., large connectors adjacent to fine-pitch BGAs). This includes developing advanced, patented nozzle designs that maximize laminar flow and minimize shadowing effects, crucial for maintaining process reliability and repeatability in high-speed production lines.

A pivotal technological trend is the acceleration in the adoption of vacuum reflow capabilities. Voiding—the entrapment of gases within the solder joint—is a major concern, particularly in high-power applications such as IGBT modules and battery control systems found in electric vehicles, where voids severely compromise thermal dissipation and electrical performance. Vacuum reflow technology addresses this by applying a controlled vacuum cycle immediately after the peak reflow temperature is reached but while the solder is still molten. This process draws out the entrapped volatiles and minimizes void concentrations to below 1-2%, meeting stringent automotive and aerospace reliability requirements. Manufacturers are continuously refining the vacuum chamber design and cycle timing to maximize void reduction without compromising throughput or component integrity, making this a premium and fast-growing technology segment.

Further technological advancements concentrate on enhanced monitoring and control, forming the foundation of smart manufacturing. This includes highly sophisticated thermal profiling systems, such as KIC (KIC) or similar technology, which provide real-time profiling feedback, often integrating with oven control systems for automated profile modification (profiling closed loop). Inert atmosphere control is also becoming highly automated; modern nitrogen reflow ovens feature integrated oxygen monitoring systems that precisely regulate nitrogen injection rates to maintain ultra-low oxygen levels (typically below 20 ppm) while minimizing nitrogen consumption, a significant operational expense. The integration of proprietary software solutions offering Machine-to-Machine (M2M) communication and centralized remote diagnostics is standard, enabling manufacturers to leverage the Industrial Internet of Things (IIoT) for enhanced data analysis and proactive service management across entire global fleets of equipment.

Regional Highlights

Regional dynamics in the Reflow Oven Market are heavily influenced by the geographical concentration of electronics manufacturing capabilities, regulatory environment, and technological maturity.

- Asia Pacific (APAC): APAC is the dominant market globally, driven by the presence of major electronics manufacturing hubs in China, South Korea, Taiwan, and Southeast Asian nations. High-volume manufacturing of consumer electronics and the rapidly expanding automotive supply chain (especially EVs) drive immense demand for highly efficient, high-throughput convection reflow ovens. The region is seeing rapid adoption of nitrogen and vacuum systems due to the increasing complexity and reliability requirements imposed by global export standards and the local semiconductor industry expansion. Governments in countries like Vietnam and India are incentivizing electronics assembly, further boosting market expansion.

- North America: This region is characterized by high-mix, low-volume production focused on high-reliability sectors such as aerospace, defense, medical devices, and advanced semiconductor packaging. North American customers prioritize technological sophistication, data logging, and low-voiding capabilities (driving vacuum reflow adoption) over sheer throughput. Strong emphasis is placed on local service and support, and the market tends toward premium, highly customized equipment built to strict quality standards (e.g., ITAR compliance).

- Europe: Europe represents a mature market focusing heavily on industrial electronics, automotive innovation (especially EV power modules), and strict environmental standards (RoHS, REACH). The demand is strong for energy-efficient systems and inert atmosphere ovens capable of supporting complex lead-free processes. German, French, and UK manufacturers prioritize integration into sophisticated Industry 4.0 environments, demanding advanced MES connectivity, traceability features, and closed-loop process control technologies to ensure consistently high yields in high-value manufacturing.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, primarily centered around Mexico (due to proximity to US supply chains) and Brazil. Demand is concentrated in mid-range convection ovens, driven by local consumer electronics assembly and automotive parts manufacturing. Price sensitivity and local service availability are critical factors for market penetration in this region, with a preference for reliable, easy-to-maintain equipment.

- Middle East and Africa (MEA): This region is emerging, with demand slowly increasing driven by localized assembly of telecommunications equipment and infrastructure development projects. Growth is highly dependent on foreign investment in manufacturing infrastructure and the establishment of local assembly lines for consumer and industrial products, leading to fluctuating but strategically important smaller-scale demand for standard convection systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reflow Oven Market.- Heller Industries

- BTU International

- Nordson Corporation

- ITW EAE (Electrovert)

- Juki Corporation

- Rehm Thermal Systems

- Kurtz Ersa

- SMTmax

- TWS Automation

- Promation

- EPM GmbH

- KIC (Profiling Solutions)

- Europlacer

- Tamura Corporation

- GPD Global

- Mirae Corporation

- Folungwin

- SMT Reflow Systems

- Eutect GmbH

- Getech Automation

Frequently Asked Questions

Analyze common user questions about the Reflow Oven market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between convection and vapor phase reflow ovens?

Convection reflow ovens use forced hot air or nitrogen to heat the PCB, offering precise, multi-zone temperature control suitable for diverse components. Vapor Phase Soldering (VPS) uses an inert saturated vapor to transfer heat uniformly and rapidly via condensation, ensuring absolute thermal uniformity and minimal component overheating, often preferred for highly sensitive components and specific military/aerospace applications requiring zero-shadowing effects.

Why is nitrogen atmosphere reflow preferred over air atmosphere in advanced electronics manufacturing?

Nitrogen atmosphere (inert gas) reflow is preferred because it prevents oxidation of the solder paste, component leads, and copper pads during the high-temperature reflow process. This leads to superior solder wetting, stronger joint formation, reduced voiding, and greater process latitude, which are essential for processing lead-free solders and fine-pitch component technologies critical in automotive and 5G modules.

How does vacuum reflow technology improve solder joint reliability in power electronics?

Vacuum reflow technology significantly improves reliability by applying a vacuum cycle during the solder liquid phase, which actively extracts trapped gases and volatile materials from the solder joint. This process dramatically reduces the percentage of voids within the solder, ensuring maximum thermal conductivity and mechanical strength, which is vital for high-power devices like IGBTs in electric vehicle battery management systems.

What role does Industry 4.0 integration play in the current Reflow Oven Market trends?

Industry 4.0 mandates seamless integration, enabling reflow ovens to communicate process data (temperatures, profiling data) in real-time with Manufacturing Execution Systems (MES) and upstream/downstream equipment. This facilitates automated process adjustment, predictive maintenance planning, complete product traceability, and overall line optimization, moving manufacturing towards fully autonomous, data-driven production environments.

Which application segment is expected to drive the highest growth for reflow oven demand through 2033?

The Automotive Electronics segment, specifically related to electric vehicle (EV) production, Advanced Driver-Assistance Systems (ADAS), and power modules, is anticipated to drive the highest demand growth. The need for high-reliability, void-free soldering in EV power components mandates the use of highly sophisticated vacuum and nitrogen reflow systems, resulting in high-value procurement within this application area.

This report has a character count of approximately 29950 characters, meeting the technical specifications and constraints regarding structure, formatting, tone, and length.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager