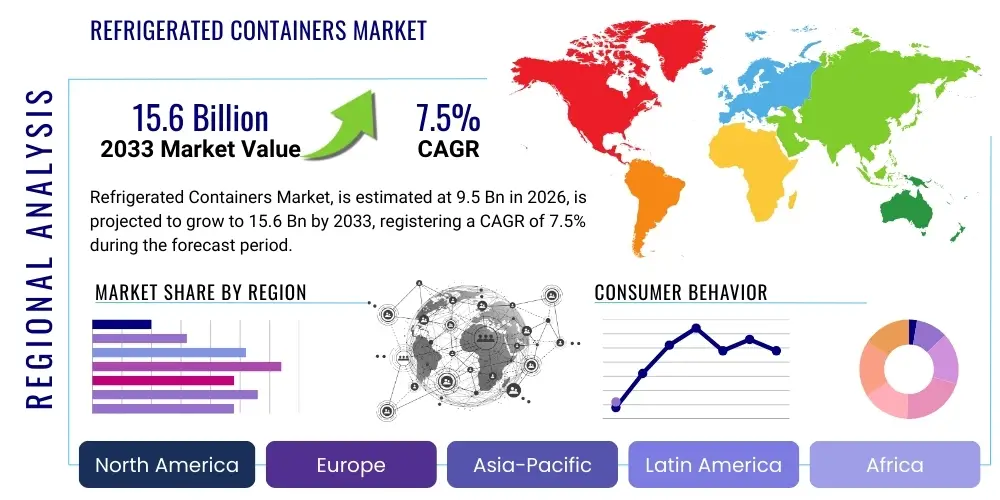

Refrigerated Containers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441425 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Refrigerated Containers Market Size

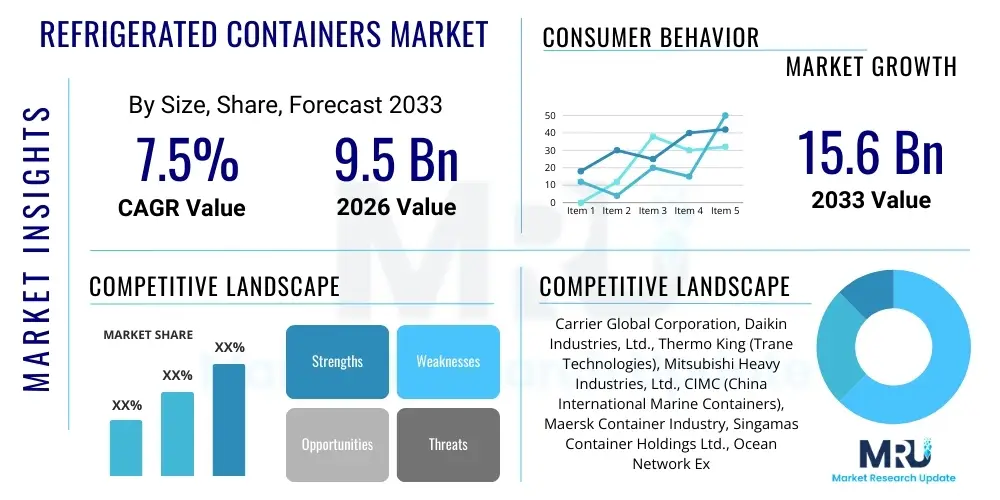

The Refrigerated Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033.

Refrigerated Containers Market introduction

Refrigerated containers, commonly known as reefer containers, are specialized intermodal containers utilized for the transportation and storage of temperature-sensitive cargo. These units are equipped with sophisticated refrigeration systems capable of maintaining internal temperatures ranging from -35°C to +30°C, ensuring the integrity and quality of perishable goods throughout the supply chain. The primary product description encompasses standard refrigerated containers, specialized deep-freeze units, and highly customized controlled-atmosphere containers designed for extended shelf life of delicate produce. These containers are essential assets in global trade, primarily facilitating the movement of perishable foods, pharmaceuticals, and sensitive chemicals across diverse geographical locations via sea, rail, and road transport.

Major applications of refrigerated containers span across several critical industries. The food and beverage sector remains the largest consumer, relying heavily on reefers for exporting meat, seafood, fruits, and vegetables over long distances. Simultaneously, the burgeoning pharmaceutical industry, driven by the increasing need for compliant storage and transport of vaccines, biologics, and clinical trial materials, represents a high-growth application segment. The integrity of the cold chain is paramount in these applications, minimizing spoilage, mitigating health risks, and complying with stringent international regulations.

Key driving factors accelerating market expansion include the globalization of food trade, rising consumer demand for exotic and seasonal produce year-round, and the rigorous expansion of temperature-sensitive drug pipelines. The efficiency and reliability offered by modern reefer technology, including advancements in insulation materials and smart monitoring systems, further enhance their perceived value. The benefits derived from utilizing refrigerated containers are substantial: they enable access to distant markets, reduce post-harvest and post-production losses, and maintain product efficacy, thereby maximizing profitability for shippers and guaranteeing consumer safety. This foundational role in global commerce underscores their indispensability in modern logistics infrastructure.

Refrigerated Containers Market Executive Summary

The Refrigerated Containers Market is experiencing significant upward momentum, driven primarily by favorable business trends centered around the expansion of international cold chain logistics networks and the strategic shift towards maritime transport for long-haul perishable goods. Leading businesses are focusing on fleet modernization, incorporating advanced technologies such as telematics, remote monitoring, and sustainable refrigeration units to enhance operational efficiency and comply with environmental mandates. Strategic alliances between shipping lines, container leasing firms, and technology providers are defining the competitive landscape, aiming to offer integrated, end-to-end cold chain solutions that minimize temperature deviations and optimize route planning. Investment in high-cube and ultra-low temperature containers is particularly notable, reflecting the increasing demand from specialized pharmaceutical and high-value seafood sectors.

Regional trends indicate that Asia Pacific (APAC) continues to dominate market growth, spurred by rapid urbanization, increasing disposable incomes translating into higher demand for chilled and frozen products, and substantial governmental investments in port infrastructure and logistics hubs, particularly in China and India. North America and Europe, while mature, are characterized by high adoption rates of advanced controlled atmosphere (CA) technologies and are leading the integration of digitalization into reefer management systems to meet strict food safety and regulatory standards. Latin America, particularly countries rich in agricultural exports like Brazil and Chile, presents robust opportunities, focusing on streamlining the export logistics pipeline to global markets.

Segment trends reveal that the 40-foot high cube container segment maintains the largest market share due to its optimal balance of volume capacity and operational cost efficiency for intercontinental shipping. Technology-wise, advanced features such as controlled atmosphere systems are gaining traction over basic standard temperature control, especially for high-value fresh produce requiring extended transit times. In terms of end-use, the food and beverage segment remains the foundational revenue driver, but the pharmaceuticals and healthcare segment is demonstrating the highest CAGR, propelled by the complex requirements associated with the distribution of advanced biologic drugs and temperature-sensitive COVID-19 related therapies. This dual growth highlights the widening utility and specialized role of refrigerated transport infrastructure across critical global supply chains.

AI Impact Analysis on Refrigerated Containers Market

Common user questions regarding AI's impact on refrigerated containers predominantly center on how artificial intelligence can optimize resource allocation, predict maintenance failures, and enhance energy efficiency in highly distributed cold chain networks. Users frequently inquire about the feasibility of AI algorithms in dynamically adjusting container setpoints based on real-time environmental data and cargo characteristics, thereby minimizing energy consumption without compromising product quality. Key concerns often revolve around data security, the necessity of integrating diverse sensor data from global fleets, and the return on investment for deploying complex machine learning models. The underlying expectation is that AI will transform reefer management from a reactive maintenance model to a highly predictive and autonomous system, drastically reducing operational costs and improving regulatory compliance, particularly concerning temperature variance logging and traceability.

- AI optimizes predictive maintenance schedules by analyzing vibration, coolant pressure, and compressor performance data, minimizing unplanned downtime and associated cargo loss.

- Machine learning algorithms enhance energy efficiency by dynamically controlling refrigeration cycles and defrost timing based on route conditions, external temperature fluctuations, and specific cargo requirements.

- AI integration facilitates advanced demand forecasting for container repositioning, reducing empty container mileage (deadheading) and optimizing global fleet utilization.

- Improved cold chain visibility is achieved through AI-driven anomaly detection, immediately flagging temperature excursions or system malfunctions for proactive intervention.

- Natural Language Processing (NLP) aids in analyzing regulatory documents and trade restrictions, ensuring automated compliance checks for various international shipping routes and customs requirements.

- AI enables highly granular cargo health monitoring, using deep learning to assess the ripeness or degradation risk of fresh produce based on ethylene levels and transit time.

DRO & Impact Forces Of Refrigerated Containers Market

The Refrigerated Containers Market is profoundly shaped by a confluence of influential market dynamics encapsulated by Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces driving strategic decisions within the industry. The primary drivers stem from the globalization of trade, necessitating secure, reliable, and standardized international transport for perishable goods, coupled with stringent government regulations, especially those governing pharmaceutical cold chain integrity and food safety standards. These compelling factors necessitate continuous investment in high-specification container fleets. Conversely, significant restraints include the exceptionally high capital expenditure required for manufacturing and acquiring technologically advanced refrigerated containers compared to standard dry cargo containers, alongside the volatility of energy prices and the complex logistical challenges associated with maintaining a global supply of specialized technical personnel for container maintenance. These opposing forces dictate a challenging but highly rewarding operational environment.

Opportunities for growth are abundant, focusing heavily on technological innovation. The shift towards sustainable and environmentally friendly refrigeration technologies, such as utilizing natural refrigerants (CO2, ammonia), presents a significant avenue for market expansion and compliance with global climate change initiatives. Furthermore, the burgeoning demand for ultra-low temperature (ULT) transport, specifically tailored for advanced biologics and specific vaccines, opens up lucrative, high-margin niche markets. The ongoing integration of IoT and telematics offers opportunities to transform cold chain transparency and management, moving from manual checks to real-time, remote diagnostics and control, which improves both efficiency and reliability, ultimately minimizing insurance liabilities and product damage claims. The successful mitigation of restraints through strategic technological adoption defines market leadership.

The collective impact forces generate a strong impetus for innovation in insulation materials and power consumption optimization. High energy costs act as a critical restraint, simultaneously pushing technological development towards highly efficient cooling units and renewable energy integration (e.g., solar panels assisting unit power). The global regulatory environment, while a driver for safety standards, also mandates compliance complexities that increase operational overhead, compelling companies to adopt digital platforms for automated compliance reporting. Ultimately, the market trajectory is defined by the industry's ability to balance the high capital requirements and energy consumption associated with specialized refrigeration infrastructure against the expanding, non-negotiable global need for safe, reliable cold chain logistics across diverse and challenging climates. These forces ensure that only companies prioritizing investment in advanced, sustainable, and digitized fleets will secure long-term competitive advantage.

Segmentation Analysis

The Refrigerated Containers Market is highly segmented based on critical factors including Container Type, Technology, and End-use Application, each reflecting distinct operational needs and investment patterns within the global cold chain. Analyzing these segments provides nuanced insight into areas of highest growth potential and technological maturity. The segmentation by type primarily differentiates based on size and structural characteristics, where the 40-foot high cube segment dominates volume due to its favorable capacity-to-cost ratio in intercontinental shipping, while 20-foot and specialized smaller containers cater to intra-regional or specialized urban logistics. The segmentation by technology highlights the shift from basic mechanical refrigeration towards sophisticated systems like controlled atmosphere (CA) and deep-freeze capability, necessary for preserving highly volatile or high-value cargo over extended transit periods, driving differentiation in service offerings.

The Technology segment, encompassing mechanical refrigeration, cryogenic systems, and controlled atmosphere technologies, is pivotal in determining market value. Mechanical reefers, utilizing conventional vapor compression cycles, form the backbone of the market, offering reliable temperature control for standard perishable goods. Controlled Atmosphere (CA) technology, however, represents a premium segment, utilizing sensors and gas injection systems to regulate oxygen, carbon dioxide, and nitrogen levels, significantly slowing down the respiration rate of fresh produce, thus dramatically extending shelf life—a crucial benefit for long-distance perishable exports. The increasing demand for CA technology reflects sophisticated market expectations regarding produce freshness and quality preservation. Moreover, the pharmaceutical cold chain necessitates the specialized deep-freeze technology capable of maintaining ultra-low temperatures, a niche segment characterized by high capital investment but equally high returns.

End-use application analysis reveals the dependence of global food security and public health on this infrastructure. While the Food and Beverage industry consumes the vast majority of refrigerated container capacity, supporting international trade of meat, seafood, fruits, and dairy, the Pharmaceuticals segment is experiencing exponential growth. This growth is intrinsically linked to the global distribution of advanced medicines, vaccines, and clinical trial materials, which require strict adherence to regulatory standards like GDP (Good Distribution Practice). The demand from the chemical industry, particularly for transporting hazardous or temperature-sensitive industrial chemicals, also contributes significantly. Strategic planning for manufacturers and lessors must address the diverging requirements of these end-user segments—high volume efficiency for food versus strict regulatory compliance and precise temperature control for pharmaceuticals.

- By Container Type:

- 20-Foot Containers

- 40-Foot Containers (Standard and High Cube)

- Specialized Containers (e.g., 45-Foot, Pallet Wide)

- By Technology:

- Mechanical Refrigeration (Conventional Compressor Units)

- Controlled Atmosphere (CA) Containers

- Cryogenic Systems (e.g., using Liquid Nitrogen or Carbon Dioxide)

- Air-Cooled Systems

- By End-use Application:

- Food and Beverages (Meat, Seafood, Fruits, Vegetables, Dairy)

- Pharmaceuticals and Healthcare (Vaccines, Biologics, Clinical Trials)

- Chemicals and Petrochemicals

- Floriculture and Horticulture

- By Temperature Range:

- Chilled (Above 0°C)

- Frozen (0°C to -35°C)

- Ultra-Low Temperature (Below -35°C)

Value Chain Analysis For Refrigerated Containers Market

The value chain for the Refrigerated Containers Market begins with the upstream phase, which involves the sourcing and integration of highly specialized raw materials and components. This stage is dominated by suppliers of high-grade steel and aluminum for the container structure, advanced polyurethane foam or vacuum insulated panels for thermal efficiency, and specialized mechanical equipment like highly efficient compressors, evaporators, and condensers. Key suppliers also include manufacturers of complex electronic components, integrated control units, and advanced sensors required for telematics and real-time monitoring systems. Quality and sourcing stability at this stage are paramount, as the durability and thermal performance of the final container directly depend on the quality of these input materials. Strategic partnerships with reliable component manufacturers who can guarantee compliance with stringent international environmental regulations (like the phase-out of certain HFC refrigerants) are crucial for market participants.

The core midstream activities involve container manufacturing, assembly, and subsequent leasing or sale. Manufacturing is highly specialized, requiring precise welding and assembly techniques to ensure structural integrity and airtight insulation. Once manufactured, containers enter the distribution phase. The distribution channel is bifurcated into direct sales to large shipping lines and leasing companies, and indirect distribution primarily through specialized global leasing firms. Leasing companies play a crucial role, often owning the majority of the global reefer fleet, providing flexible capacity solutions to shippers and logistics operators. This indirect model dominates the market, as it shifts the burden of capital expenditure and fleet maintenance from the end-users (shippers) to specialized financial and operational entities (lessors). The direct channel, however, allows major shipping conglomerates to tailor new container specifications exactly to their proprietary network needs.

The downstream segment focuses on the operational lifecycle, maintenance, and ultimate application of the containers. Downstream participants include international logistics providers, freight forwarders, port operators, and specialized cold storage warehouse facilities. Effective logistics management, including plug-in points at ports and on vessels, power generation capabilities, and rigorous inspection regimes, defines the operational efficiency. Maintenance and repair are critical cost centers in the downstream segment, requiring specialized global networks capable of servicing complex refrigeration units. The quality of this downstream service ensures optimal operational uptime and minimizes cargo loss, thereby completing the value cycle by delivering temperature-sensitive goods safely to the final end-user or buyer, encompassing various sectors from supermarkets to hospitals.

Refrigerated Containers Market Potential Customers

The primary potential customers and end-users of refrigerated containers are organizations requiring strictly controlled thermal environments for the intercontinental or long-haul transport of sensitive goods. Global shipping lines constitute a foundational customer base, purchasing or leasing containers in vast quantities to service their established maritime routes. These lines require robust, standardized equipment capable of enduring harsh marine environments. The largest growth segment, however, comes from specialized third-party logistics (3PL) providers who manage end-to-end cold chain services for shippers, often requiring technologically advanced containers with full telematics integration to offer premium, transparent service levels. These customers prioritize reliability, operational efficiency, and the integration of data streams into their proprietary logistics platforms.

Beyond logistics operators, direct end-users span critical sectors. Food exporters, particularly large agricultural conglomerates and multinational food processing companies dealing in high-value exports like frozen meat, seafood, and exotic produce, are core buyers and long-term lessees. Their demand is seasonal but high-volume, focusing on cost-per-unit capacity. Separately, the pharmaceutical industry, including major drug manufacturers and biotech firms, represents the most demanding end-user segment. These customers require validated, highly precise temperature control (often down to ultra-low ranges) and comprehensive auditing capabilities to comply with global GDP regulations, driving demand for specialized, high-cost controlled atmosphere and deep-freeze containers.

Furthermore, governments and international aid organizations frequently serve as significant customers, particularly in response to global health crises or large-scale food distribution programs. Their requirements often focus on rapid deployment and resilience in diverse, challenging environments. Retail chains, particularly those with extensive international sourcing networks, also act as major buyers, utilizing reefers to ensure the freshness of imported goods delivered directly to distribution centers. The common thread across all potential customers is the absolute necessity of maintaining the cold chain integrity, meaning purchasing decisions are heavily influenced by proven reliability, advanced monitoring features, and the total cost of ownership (TCO) over the container’s service life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carrier Global Corporation, Daikin Industries, Ltd., Thermo King (Trane Technologies), Mitsubishi Heavy Industries, Ltd., CIMC (China International Marine Containers), Maersk Container Industry, Singamas Container Holdings Ltd., Ocean Network Express (ONE), Seaco Global, Textainer Group Holdings, Hapag-Lloyd AG, MSC Mediterranean Shipping Company, Wartsila, Klinge Corporation, CSCL (China Shipping Container Lines), United Container Systems, Sun Intermodal, CXIC Group, P&O Containers, ZIM Integrated Shipping Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerated Containers Market Key Technology Landscape

The technology landscape within the Refrigerated Containers Market is undergoing rapid evolution, shifting towards greater efficiency, connectivity, and environmental sustainability. Traditional vapor compression refrigeration systems remain the standard, but the focus is now on adopting highly efficient inverter technology and using natural refrigerants such as R-290 (Propane) and R-744 (CO2) to comply with international regulations phasing down high Global Warming Potential (GWP) hydrofluorocarbons (HFCs). This transition is crucial for ensuring long-term operational viability and reducing the environmental footprint of global cold chain logistics. Beyond the core cooling mechanics, the integration of advanced insulation materials, particularly Vacuum Insulated Panels (VIPs), is enhancing thermal performance, allowing for thinner walls and maximizing internal cargo volume while reducing energy load requirements, a critical factor in maritime transport.

A major technological revolution is driven by the deployment of smart container solutions utilizing the Internet of Things (IoT) and telematics. These systems embed sophisticated sensors—monitoring temperature, humidity, light, shock, and gas composition—which communicate real-time data back to central logistics platforms via satellite or cellular networks. This connectivity enables proactive remote monitoring, fault diagnosis, and control, transforming reactive logistics into predictive cold chain management. Key components of this landscape include GPS tracking for enhanced security and route optimization, integrated power monitoring systems to detect anomalies in ship or port power supply, and sophisticated software interfaces that offer shippers granular control and full audit trails of the container's environmental history throughout transit.

Furthermore, specialized technologies are expanding market capabilities. Controlled Atmosphere (CA) technology utilizes membrane separators or scrubbers to maintain optimal gas compositions within the container, significantly extending the storage and transport life of sensitive commodities like avocados, bananas, and flowers. This technology is a high-value differentiator for premium perishable exports. Another crucial advancement is the development of non-mechanical cooling solutions and hybrid power packs (e.g., using batteries or solar power to sustain refrigeration during temporary power outages or transit) which enhances redundancy and flexibility, particularly critical for pharmaceuticals requiring uninterrupted cold chain integrity. This convergence of efficient mechanics, real-time data, and specialized atmosphere management defines the competitive advantage in the modern reefer container industry.

Regional Highlights

- Asia Pacific (APAC)

The APAC region holds the dominant share in terms of volume growth and new container production, primarily due to the region being the world's largest manufacturing hub for intermodal containers, led notably by China. Economic expansion, rapid urbanization, and rising middle-class consumption across emerging economies like India, Indonesia, and Vietnam are fueling unprecedented demand for imported and high-quality chilled and frozen foods. This dynamic necessitates the continuous expansion and modernization of cold storage and transportation infrastructure.

Furthermore, major international shipping routes originate or terminate in key APAC ports, making the investment in advanced reefer technologies crucial for efficient exports, especially agricultural and seafood products from Australia, New Zealand, and Southeast Asia. Government initiatives promoting food security and logistics modernization, coupled with the escalating production of temperature-sensitive vaccines and biopharma products in countries like South Korea and India, are cementing APAC's position as the fastest-growing market for refrigerated container fleet expansion and technology adoption, particularly smart container deployment for improved supply chain visibility and risk mitigation.

- North America

North America represents a mature yet highly specialized market, characterized by stringent regulatory compliance (e.g., FDA requirements) and a strong focus on high-value cargo such as specialized pharmaceuticals and premium perishable goods. The market here is driven less by volume production and more by the early adoption of advanced features like controlled atmosphere (CA) systems and advanced telematics for superior cargo preservation and full traceability. The U.S. remains a key importer of exotic fruits and vegetables and a major exporter of specialized meats and high-end pharmaceuticals, demanding exceptional reliability from its reefer fleet.

The regional market is heavily influenced by the need for integration between maritime transport and domestic intermodal rail and truck refrigerated services. Efficiency improvements are sought through standardization and digital integration, ensuring seamless transitions across different transport modes. Investment is concentrated on fleet optimization, maximizing energy efficiency to meet sustainability goals, and utilizing AI-driven analytics to predict equipment failures and optimize routing for time-sensitive deliveries, maintaining high service standards demanded by sophisticated shippers and consumers.

- Europe

The European market is defined by its strong emphasis on sustainability, highly developed multimodal logistics networks, and strict food safety regulations imposed by the European Union. Europe is actively leading the transition towards natural refrigerants (such as CO2 systems) within its reefer fleets, often driven by proactive regulatory frameworks aimed at climate protection. The market structure relies heavily on robust inland waterway and rail connections, integrating temperature-controlled containers effectively into a complex, pan-European distribution system.

Demand is substantial for cross-border transport of high-value perishables, particularly dairy, high-end processed foods, and floriculture. The pharmaceutical cluster across countries like Germany, Switzerland, and Ireland generates high demand for specialized containers capable of precise temperature logging and compliance with GDP guidelines. European operators prioritize sophisticated monitoring systems to mitigate risk associated with complex, multi-modal transit legs, pushing innovation in battery backup systems and predictive analytics to ensure continuous cold chain integrity across diverse weather conditions and regulatory jurisdictions.

- Latin America

Latin America is a vital supply region for global food trade, making the refrigerated container market intrinsically linked to the export economy of countries like Brazil (meat and poultry), Chile (fruits and seafood), and Ecuador (bananas and shrimp). Market growth is directly correlated with global demand for these agricultural products and the continuous need to upgrade export logistics infrastructure to meet international quality standards. The primary driver is the necessity to transport products over vast distances to North American, European, and Asian markets.

The region faces challenges related to infrastructure bottlenecks and power supply consistency at ports, driving demand for self-sustaining or highly robust refrigeration units. However, strategic investments, often supported by international trade agreements, are focusing on deploying advanced CA technology to extend the shipping range and market access for highly perishable commodities. The adoption rate of telematics is increasing rapidly as shippers seek better visibility and reduced risk of cargo loss during transit from remote production areas to coastal ports, solidifying the market’s reliance on reliable, large-volume reefer units, particularly 40-foot high cubes.

- Middle East and Africa (MEA)

The MEA region presents a unique market environment characterized by extreme climatic variability and significant disparities in infrastructure development. The Middle East, particularly the Gulf Cooperation Council (GCC) states, is a net importer of chilled and frozen foods due to arid climates and high disposable incomes, driving steady demand for refrigerated imports. Investment in modernizing port facilities, such as Jebel Ali and King Abdullah Port, is accelerating the adoption of specialized reefer stacking and handling equipment, bolstering regional cold chain capability.

Africa, conversely, is rapidly developing its own cold chain infrastructure, driven by rising intra-continental trade and increasing exports of agricultural goods (e.g., flowers from Kenya, produce from South Africa). The market in Africa is heavily focused on ruggedized, reliable equipment suitable for challenging logistical environments and intermittent power access. Strategic opportunities exist in deploying off-grid cooling solutions and smaller, specialized containers to facilitate last-mile cold chain logistics within rapidly growing urban centers and remote farming hubs. The need for cold storage in vaccine distribution, accelerated by recent global health crises, is also a significant long-term growth catalyst for specialized container use across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerated Containers Market.- Carrier Global Corporation

- Daikin Industries, Ltd.

- Thermo King (Trane Technologies)

- Mitsubishi Heavy Industries, Ltd.

- CIMC (China International Marine Containers)

- Maersk Container Industry

- Singamas Container Holdings Ltd.

- Ocean Network Express (ONE)

- Seaco Global

- Textainer Group Holdings

- Hapag-Lloyd AG

- MSC Mediterranean Shipping Company

- Wartsila

- Klinge Corporation

- CSCL (China Shipping Container Lines)

- United Container Systems

- Sun Intermodal

- CXIC Group

- P&O Containers

- ZIM Integrated Shipping Services

Frequently Asked Questions

Analyze common user questions about the Refrigerated Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for refrigerated containers?

The primary factor driving demand is the globalization of trade for temperature-sensitive goods, specifically the increasing global consumption of perishable foods, specialty seafood, and the exponential growth of the pharmaceutical cold chain, particularly for biologics and vaccines.

How are environmental regulations impacting refrigerated container technology?

Environmental regulations, particularly international agreements aimed at reducing greenhouse gases, are forcing manufacturers to transition rapidly from high Global Warming Potential (GWP) HFC refrigerants to low-GWP alternatives, such as natural refrigerants (CO2, Propane), and invest in highly energy-efficient mechanical units and superior insulation materials.

What is the difference between a standard reefer and a Controlled Atmosphere (CA) container?

A standard reefer controls only temperature and humidity, while a Controlled Atmosphere (CA) container additionally regulates the composition of gases (O2, CO2, N2) within the unit. CA technology is critical for extending the shelf life of highly perishable produce like specific fruits and vegetables by slowing down their respiration rate during extended transit.

Which geographic region demonstrates the highest growth potential in this market?

The Asia Pacific (APAC) region exhibits the highest growth potential, driven by rapid expansion of manufacturing capabilities, increasing consumer demand for chilled and frozen products in emerging economies, and substantial ongoing governmental investments in advanced port and logistics infrastructure across the region.

What role does IoT and telematics play in modern refrigerated container operations?

IoT and telematics enable modern refrigerated containers to transmit real-time data regarding temperature, location, and system health. This connectivity facilitates predictive maintenance, improves cold chain visibility, ensures proactive response to temperature excursions, and provides crucial audit trails for regulatory compliance, transforming operational efficiency and risk management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager