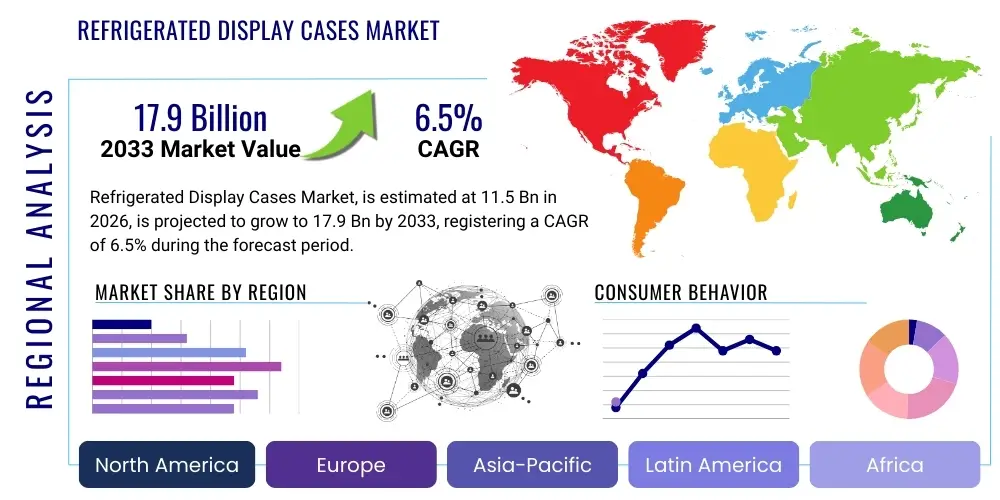

Refrigerated Display Cases Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441454 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Refrigerated Display Cases Market Size

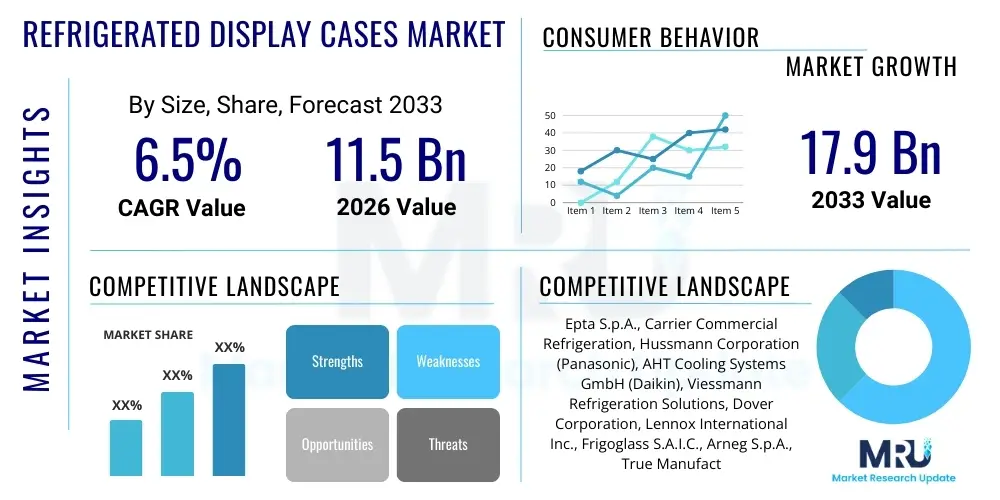

The Refrigerated Display Cases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 17.9 billion by the end of the forecast period in 2033.

Refrigerated Display Cases Market introduction

The Refrigerated Display Cases (RDCs) Market encompasses the manufacturing and distribution of specialized commercial refrigeration equipment utilized primarily in retail settings to store and showcase temperature-sensitive products, notably fresh food, dairy, beverages, and frozen goods. RDCs are indispensable assets for supermarkets, convenience stores, and quick-service restaurants, fulfilling the dual functions of preservation and merchandising. The core objective of these units is to maintain precise temperature ranges while maximizing product visibility and accessibility, thereby driving consumer purchasing decisions. Key products range from vertical multideck cases and island freezers to service counters and specialized bakery chillers, categorized broadly into plug-in (self-contained) and remote (centralized refrigeration) systems.

The market's sustained expansion is fundamentally linked to the global rise in organized retail, increasing urbanization, and evolving consumer preferences toward packaged and ready-to-eat perishable goods. Technological advancements, particularly in energy efficiency and environmental sustainability, are rapidly shaping the product landscape. Modern RDCs feature sophisticated insulation, LED lighting, and advanced compressor technologies to minimize energy consumption and reduce the operational footprint of retail establishments. Benefits derived from deploying advanced RDCs include significant reductions in energy bills, superior food quality preservation, enhanced store aesthetics, and compliance with stringent food safety regulations. Furthermore, the shift towards natural refrigerants such as CO2 (R744) and Propane (R290) is a major driving factor, compelling retailers to upgrade legacy HFC-based systems to meet global phase-down targets.

Major applications span across the entire retail spectrum, with hypermarkets and large-format supermarkets remaining the primary consumers of high-capacity remote refrigeration systems. Conversely, convenience stores and specialized food retailers often prefer plug-in units due to their flexibility and ease of installation. Driving factors also include the proliferation of cold-chain logistics networks, particularly in emerging economies, enabling the consistent distribution of temperature-sensitive products. The integration of Internet of Things (IoT) sensors for remote monitoring and predictive maintenance further enhances the value proposition of modern display cases, assuring minimal downtime and optimal operating efficiency for demanding retail environments.

Refrigerated Display Cases Market Executive Summary

The global Refrigerated Display Cases Market is characterized by a strong momentum driven by sustainability mandates and the aggressive expansion of the grocery retail sector, particularly in Asia Pacific. Business trends indicate a marked shift towards highly efficient remote systems that utilize natural refrigerants, enabling retailers to consolidate cooling infrastructure and achieve compliance with F-gas regulations. Manufacturers are focusing heavily on integrating smart technologies, including advanced defrost cycles, variable speed compressors (VSCs), and sophisticated cloud-based monitoring platforms to provide actionable data on inventory, energy use, and predictive maintenance needs. This technological integration is transforming RDCs from simple storage units into critical operational tools that influence both supply chain efficiency and consumer engagement.

Regional trends highlight the Asia Pacific market as the fastest-growing segment, propelled by rapid infrastructure development, increasing disposable incomes, and the modernization of traditional retail formats into large supermarket chains. North America and Europe, while mature, are experiencing significant replacement cycles, primarily driven by the mandatory adoption of low Global Warming Potential (GWP) refrigerants and the strong corporate commitment to achieving Net Zero operational targets. Segments trends demonstrate a robust demand for vertical multideck cases, which offer excellent product visibility and maximum use of floor space, crucial for high-density retail environments. The shift from open cases to models featuring glass doors or lids is also accelerating globally, mandated by energy efficiency standards aimed at reducing energy losses from refrigeration systems.

In terms of product type, remote refrigeration systems hold a dominant market share due to their superior efficiency for large installations and the centralization of cooling processes away from the sales floor. However, plug-in units are gaining traction in small and medium-sized enterprises (SMEs) and specialized stores due to lower initial capital expenditure and ease of movement. Competitive dynamics are fostering innovation, forcing key players to offer modular designs and flexible leasing models to meet the diverse requirements of the global retail landscape. Successful market penetration relies increasingly on demonstrating measurable reductions in Total Cost of Ownership (TCO) achieved through energy savings and enhanced product preservation capabilities.

AI Impact Analysis on Refrigerated Display Cases Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Refrigerated Display Cases Market predominantly center on how AI can optimize operational expenditure, enhance food safety, and enable dynamic merchandising. Key themes include the feasibility of AI-driven predictive maintenance to prevent costly cold chain failures, the application of machine learning algorithms for precise temperature and humidity control based on environmental load (e.g., peak shopping hours or ambient temperature fluctuations), and the potential for integrating RDC data with wider retail inventory and Point-of-Sale (POS) systems. Users are also concerned about the implementation costs and the required data infrastructure necessary to leverage AI for dynamic pricing and spoilage prediction, seeking scalable solutions that justify the initial investment in smart RDC hardware.

AI's primary influence is moving RDCs toward highly autonomous operation. By analyzing sensor data streams (temperature, humidity, door opening frequency, compressor load), AI models can detect subtle anomalies that precede equipment failure, allowing for just-in-time servicing rather than reactive repairs, thus minimizing product loss. Furthermore, machine learning optimizes defrost cycles. Traditional cases operate on fixed time schedules, often defrosting unnecessarily; AI determines the precise requirement based on frost buildup and ambient conditions, significantly conserving energy. This optimization addresses the core concern of retailers: maximizing efficiency while ensuring regulatory compliance regarding food preservation temperatures.

Beyond technical operation, AI plays a crucial role in retail strategy. Computer vision integrated into smart display cases can monitor stock levels in real-time, automatically triggering reordering alerts or adjusting lighting and promotional displays to influence consumer behavior. Dynamic pricing algorithms can utilize RDC performance data alongside POS and inventory metrics to adjust prices for items nearing their expiration dates, minimizing waste and maximizing revenue. This convergence of refrigeration technology, data analytics, and retail operations elevates the RDC from a static piece of equipment to a critical node in the smart store ecosystem, addressing user expectations for holistic, data-driven cold chain management solutions.

- Implementation of predictive maintenance algorithms to anticipate compressor or system failures.

- Dynamic control of refrigeration cycles optimizing energy consumption based on real-time load and ambient conditions.

- AI-driven inventory monitoring using computer vision to track stock levels and trigger automated replenishment alerts.

- Optimization of defrost cycles based on actual frost accumulation, reducing unnecessary energy expenditure.

- Integration with dynamic pricing systems to minimize food waste by adjusting prices for near-expiry products.

DRO & Impact Forces Of Refrigerated Display Cases Market

The Refrigerated Display Cases Market is currently propelled by stringent energy efficiency regulations and the robust expansion of organized food retail globally, particularly in emerging economies where cold chain infrastructure is rapidly modernizing. A key driver is the consumer shift towards convenient, packaged, and high-value perishable goods, necessitating reliable, aesthetically pleasing display solutions. However, the market faces significant restraints, including the high initial capital expenditure required for advanced, natural refrigerant-based systems and the complexity associated with installing and maintaining CO2 systems, which require specialized technical expertise. Opportunities abound in the development of modular, flexible RDC designs suitable for rapidly evolving retail formats, alongside the commercialization of highly efficient, low-GWP refrigerants and advanced IoT connectivity to enable smart store management, collectively summarizing the core dynamics of Drivers, Restraints, and Opportunities shaping the industry trajectory.

The impact forces driving growth are primarily the increasing focus on sustainability and compliance. The Kigali Amendment to the Montreal Protocol and various regional F-gas regulations are phasing down high-GWP hydrofluorocarbons (HFCs), compelling retailers worldwide to invest in new equipment utilizing natural refrigerants like R290 (Propane) and R744 (CO2). This regulatory push creates a massive replacement market opportunity. Simultaneously, energy costs remain a substantial operational expense for retailers; therefore, the adoption of energy-efficient technologies such as variable speed compressors (VSCs), advanced polyurethane insulation, and high-efficiency glass doors is strongly encouraged by government subsidies and utility rebates, acting as powerful financial drivers for technology adoption.

Conversely, the primary restraining force is economic. While highly efficient systems offer a lower Total Cost of Ownership (TCO) over their lifespan, the initial acquisition price is significantly higher than older, conventional units, posing a barrier to entry or modernization for smaller, independent retailers. Furthermore, the reliance on complex electronic controls and the need for specialized technicians to service advanced refrigeration systems, particularly transcritical CO2 installations, limit rapid widespread adoption in regions with underdeveloped technical infrastructure. Nonetheless, the long-term opportunity lies in modular, standardized component manufacturing and training initiatives aimed at standardizing the installation and service protocols for natural refrigerant systems, mitigating current complexity concerns and unlocking significant future market potential through regulatory alignment.

Segmentation Analysis

The Refrigerated Display Cases Market is segmented based on various technical and application criteria, reflecting the diverse needs of the global retail environment. Key segmentation parameters include product type (plug-in vs. remote), design (vertical, horizontal, hybrid), refrigerant type (natural vs. synthetic), and end-use application (supermarkets, convenience stores, restaurants). The product type segmentation is critical, with remote systems dominating large-format stores due to their efficiency and centralized cooling, while plug-in units are favored by smaller retailers for their flexibility. Design segmentation highlights the rise of vertical cases for optimal product merchandising. The most dynamic segmentation factor is the refrigerant type, where the mandated transition towards natural refrigerants is driving profound technological shifts across all segments, ensuring long-term sustainability and operational compliance.

- By Product Type: Plug-in, Remote

- By Design: Vertical (Multideck), Horizontal (Island/Chest), Hybrid

- By End-Use Application: Supermarkets & Hypermarkets, Convenience Stores, Specialty Food Stores (e.g., Bakeries, Delicatessens), Restaurants & Hotels, Pharmaceutical/Medical Retail

- By Refrigerant Type: Natural Refrigerants (CO2, Propane, Ammonia), Synthetic Refrigerants (HFCs, HFOs)

Value Chain Analysis For Refrigerated Display Cases Market

The value chain for Refrigerated Display Cases is inherently complex and capital-intensive, starting with the sourcing of specialized, high-performance components. Upstream analysis focuses on securing key raw materials such as corrosion-resistant metals (steel, aluminum), specialized tempered glass, high-density insulation materials (polyurethane foam), and high-efficiency refrigeration machinery, including variable speed compressors, specialized heat exchangers, and precise electronic controls. The transition to natural refrigerants necessitates highly specialized supplier relationships to ensure component compatibility with elevated pressures (for CO2) or flammability requirements (for Propane). Manufacturing is driven by modular design, thermal engineering expertise, and strict quality control, ensuring compliance with global energy consumption standards (e.g., Energy Star, EcoDesign directives).

The manufacturing stage transforms these sourced components into highly efficient, aesthetically optimized retail solutions. Distribution channels are specialized due to the large size, weight, and fragility of the cases, often requiring complex, specialized logistics and installation teams. For large supermarket chains requiring remote systems, the distribution is often direct from the manufacturer or through highly qualified engineering contractors who manage the entire cold room installation, piping, and system integration. Indirect channels utilize specialized equipment distributors who cater to smaller, independent retailers needing standardized plug-in models. The complexity and high value of the product demand a stringent, controlled distribution process to maintain product integrity and installation quality.

The downstream component of the value chain is dominated by post-sale service and maintenance, which is critical for retailers to ensure minimal disruption and product loss. The integration of IoT and cloud monitoring has transformed this segment, enabling manufacturers to offer predictive maintenance contracts based on real-time operational data. This proactive service model reduces the Total Cost of Ownership (TCO) for the customer, solidifies long-term manufacturer-client relationships, and addresses the critical need for rapid intervention when temperature deviations occur. The overall value chain is highly integrated, with strategic success dependent on managing energy efficiency and regulatory compliance from material sourcing through to end-of-life recycling.

Refrigerated Display Cases Market Potential Customers

The primary customers for Refrigerated Display Cases are entities within the organized food and beverage retail sector, encompassing a wide array of store formats requiring controlled temperature environments for merchandising perishable goods. Supermarkets and hypermarkets constitute the largest buying segment, characterized by high volume procurement of customized, large-scale remote refrigeration systems that prioritize energy efficiency and aesthetic integration into vast store layouts. These customers demand advanced features such as glass doors, energy-optimized defrosting, and comprehensive monitoring capabilities, viewing RDCs as core infrastructure investments that directly impact food quality and operational expenses.

A second major customer category includes convenience stores, smaller retail outlets, and gas station marts, which typically opt for flexible, smaller footprint plug-in units. For this segment, ease of installation, mobility, and lower initial capital outlay are key purchasing criteria. These buyers often prioritize models designed for impulse purchases, such as beverage coolers and small chilled food merchandisers. Furthermore, specialized end-users such as delicatessens, bakeries, butcher shops, and high-end hotels and restaurants represent niche markets, requiring highly specialized, often aesthetically premium, service counters and bespoke display solutions that enhance the customer viewing experience while maintaining precise environmental conditions for specific products.

The growing pharmaceutical retail sector also represents an emerging customer base, particularly for specialized refrigerated display cabinets designed to meet stringent medical storage requirements (e.g., vaccines and temperature-sensitive medications). Purchasing decisions across all segments are increasingly influenced by regulatory compliance related to food safety and environmental standards (such as refrigerant type). The shift towards e-commerce fulfillment centers and dark stores, requiring efficient, high-density storage RDCs, also expands the potential customer landscape beyond traditional front-of-house retail environments, demanding robust, industrial-grade refrigerated storage solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 17.9 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epta S.p.A., Carrier Commercial Refrigeration, Hussmann Corporation (Panasonic), AHT Cooling Systems GmbH (Daikin), Viessmann Refrigeration Solutions, Dover Corporation, Lennox International Inc., Frigoglass S.A.I.C., Arneg S.p.A., True Manufacturing Co., Inc., Zero Zone, Inc., Kysor Warren (Heatcraft), Sanden Holdings Corporation, ISA S.p.A., Ugur Cooling, Haier Group, Metalfrio Solutions S.A., Foster Refrigerator, Vestfrost Solutions, Tecfrigo S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigerated Display Cases Market Key Technology Landscape

The technology landscape of the Refrigerated Display Cases Market is rapidly evolving, driven by the imperative to achieve superior energy efficiency and regulatory compliance concerning refrigerants. Central to this evolution is the widespread adoption of natural refrigerants, predominantly R744 (CO2) in transcritical booster systems for large-scale remote installations, and R290 (Propane) in highly efficient plug-in units. These natural refrigerant systems necessitate specialized componentry, including high-pressure components for CO2 and spark-proof electrical systems for R290, representing a significant technological shift away from traditional HFC-based vapor compression systems.

Alongside the refrigerant transition, digitalization through IoT integration is a cornerstone technology. Smart RDCs are equipped with an array of sensors for monitoring temperature, door openings, energy usage, and compressor health. This data is relayed to cloud platforms, enabling retailers to perform remote diagnostics, optimize operational parameters dynamically, and implement predictive maintenance schedules, significantly reducing operational downtime and preventing costly food spoilage. Advanced electronic expansion valves (EEVs) and variable speed compressors (VSCs) further enhance the precision and efficiency of cooling cycles, allowing the system to modulate cooling capacity precisely according to the actual thermal load, resulting in substantial energy savings compared to fixed-speed alternatives.

Furthermore, innovations in cabinet design, materials science, and lighting are contributing significantly to efficiency. High-performance insulation materials, such as vacuum insulated panels (VIPs), are being incorporated to minimize heat leakage, especially in low-temperature freezers. The mandated adoption of glass doors or lids on multideck cases in many regions drastically reduces cold air spillage. Finally, LED lighting has replaced conventional fluorescent tubes, reducing both electrical consumption and the heat load generated inside the cabinet, thereby lowering the overall cooling demand and enhancing the aesthetic presentation of the perishable goods on display.

Regional Highlights

The market dynamics for Refrigerated Display Cases vary significantly across major geographical regions, influenced by regulatory frameworks, climate conditions, and the maturity of the retail sector. Europe stands as a global leader in the adoption of advanced, natural refrigerant technology, driven by the stringent EU F-gas regulations, which mandate the phase-down of high-GWP refrigerants. This region exhibits high demand for transcritical CO2 systems in supermarkets, positioning it at the forefront of sustainable refrigeration innovation and replacement cycles.

North America is characterized by high replacement demand and a strong focus on high-efficiency, standardized plug-in units favored by convenience store chains, coupled with the continued investment in large-scale remote systems by major grocery retailers. Regulatory shifts, particularly at the state level (e.g., California’s environmental standards), are accelerating the shift towards HFO and natural refrigerant solutions, though the vast, spread-out geography presents unique challenges for centralized servicing and maintenance networks.

Asia Pacific (APAC) represents the largest growth engine, fueled by rapid urbanization and the explosion of modern retail infrastructure in countries like China, India, and Southeast Asia. The demand here is primarily for new installations, often bypassing older HFC technology in favor of modern, energy-efficient solutions, making it a critical market for global manufacturers. Latin America and the Middle East & Africa (MEA) markets are growing steadily, driven by rising organized retail penetration and the necessity to secure stable cold chain integrity in challenging climatic conditions, leading to growing adoption of robust, high-performance refrigeration solutions.

- Europe: Regulatory leader; highest penetration of CO2 transcritical systems due to F-gas phase-down; focus on energy efficiency standards (EcoDesign).

- North America: High replacement market; strong uptake of plug-in units; state-level regulations driving low-GWP refrigerant adoption.

- Asia Pacific (APAC): Fastest-growing market; high demand for new installations driven by supermarket expansion and urbanization; significant opportunities for natural refrigerant technology adoption.

- Latin America: Growing organized retail presence; increasing demand for reliable cold chain solutions across diverse climatic zones.

- Middle East & Africa (MEA): Focus on robust, high-durability systems to handle extreme ambient temperatures; infrastructure development supporting retail expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigerated Display Cases Market.- Epta S.p.A.

- Carrier Commercial Refrigeration

- Hussmann Corporation (Panasonic)

- AHT Cooling Systems GmbH (Daikin)

- Viessmann Refrigeration Solutions

- Dover Corporation

- Lennox International Inc.

- Frigoglass S.A.I.C.

- Arneg S.p.A.

- True Manufacturing Co., Inc.

- Zero Zone, Inc.

- Kysor Warren (Heatcraft)

- Sanden Holdings Corporation

- ISA S.p.A.

- Ugur Cooling

- Haier Group

- Metalfrio Solutions S.A.

- Foster Refrigerator

- Vestfrost Solutions

- Tecfrigo S.p.A.

Frequently Asked Questions

Analyze common user questions about the Refrigerated Display Cases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards natural refrigerants in RDCs?

The primary driver is global environmental policy, specifically the Kigali Amendment and regional F-gas regulations, which mandate the phase-down of high Global Warming Potential (GWP) hydrofluorocarbons (HFCs). Natural refrigerants like CO2 (R744) and Propane (R290) offer ultra-low GWP solutions, aligning retailers with sustainability goals and ensuring long-term regulatory compliance.

How do smart RDCs contribute to reduced operational costs?

Smart Refrigerated Display Cases (RDCs) integrate IoT sensors and software to enable predictive maintenance, dynamic temperature control, and optimized defrost cycles. This technology minimizes unnecessary energy consumption, prevents catastrophic equipment failures, and significantly reduces food spoilage, leading to a substantial decrease in the Total Cost of Ownership (TCO).

What is the difference between plug-in and remote refrigerated display cases?

Plug-in (self-contained) RDCs have their cooling systems built directly into the unit, offering flexibility and easy installation, typically used by convenience stores. Remote RDCs utilize a centralized refrigeration rack system located away from the sales floor, providing superior energy efficiency and capacity for large hypermarkets, minimizing heat and noise within the store environment.

Which geographical region is showing the highest growth rate for RDCs?

The Asia Pacific (APAC) region exhibits the highest growth rate due to rapid urbanization, the expansion of organized retail chains (supermarkets and hypermarkets), and increasing consumer demand for packaged perishable goods, driving substantial investment in new cold chain infrastructure and RDC installations.

Are glass doors mandatory for refrigerated display cases?

While not universally mandatory, glass doors are increasingly being adopted or required by efficiency standards in major markets (e.g., Europe and parts of North America). They drastically improve energy efficiency by preventing cold air spillage compared to open cases, reducing the unit's energy consumption by up to 50% or more, thus becoming the industry standard for new installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Refrigerated Display Cases Market Statistics 2025 Analysis By Application (Beverages, Food, Medicine), By Type (Chilled Type, Frozen Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Refrigerated Display Cases (RDC) Glasses Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Glass, Double Glass), By Application (Cake Shop, Restaurant, Supermarket), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager