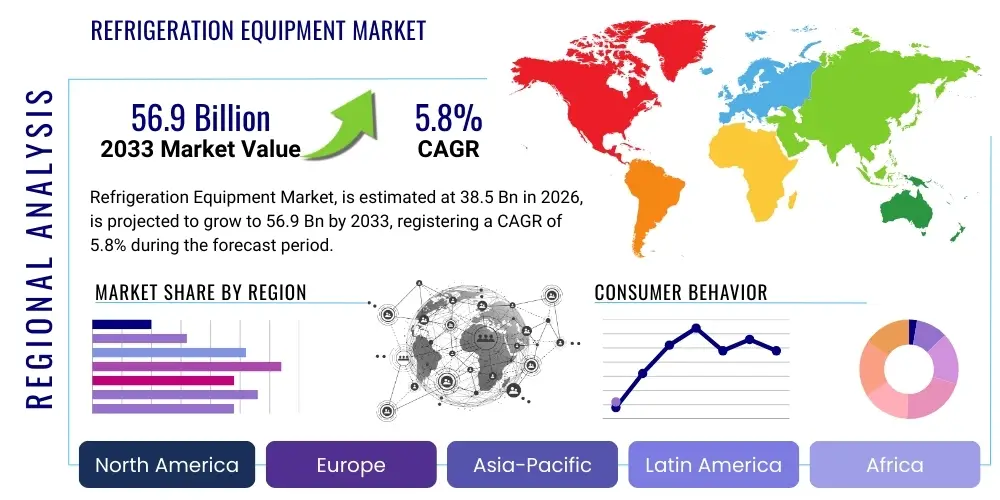

Refrigeration Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441097 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Refrigeration Equipment Market Size

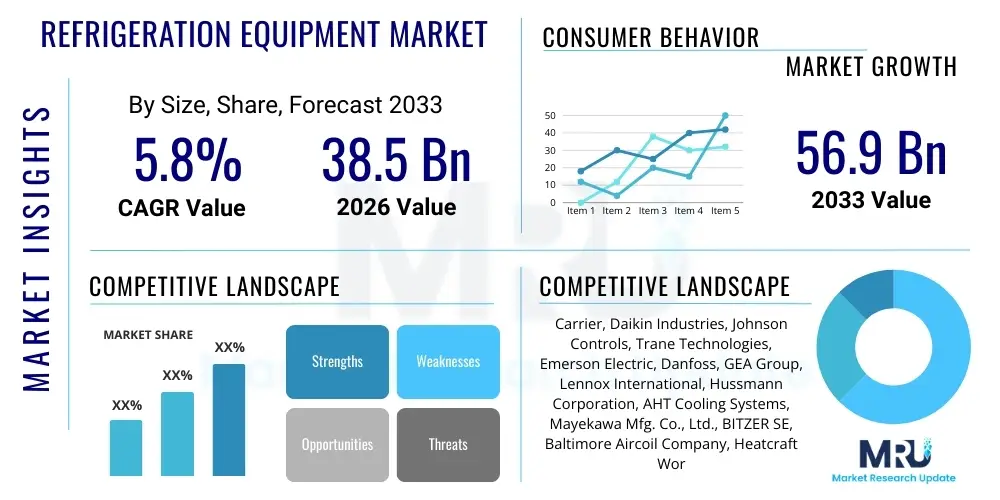

The Refrigeration Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $56.9 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by persistent demand from the global food logistics sector, particularly the cold chain infrastructure development in emerging economies, coupled with increasing regulatory pressures favoring energy-efficient and low-Global Warming Potential (GWP) refrigeration systems. The essential nature of refrigeration across diverse industrial, commercial, and residential applications ensures continuous investment and technological advancement within this market space.

Refrigeration Equipment Market introduction

The Refrigeration Equipment Market encompasses all systems and components essential for maintaining temperatures below ambient levels, serving crucial functions in preservation, conditioning, and industrial processes. This includes, but is not limited to, industrial refrigeration systems, commercial refrigeration equipment such as display cases and walk-in coolers, and transport refrigeration units. Products range from complex large-scale compressors and condensers used in chemical plants and massive food storage facilities to smaller, localized cooling units found in retail settings. The core function of this equipment is to transfer heat from a low-temperature region to a high-temperature region, typically utilizing mechanical compression cycles or absorption technologies. Given the global imperative for food security and pharmaceutical efficacy, the reliability and efficiency of refrigeration equipment are paramount, driving significant technological investment into digital monitoring and optimized system designs.

Major applications for refrigeration equipment span critical sectors. In the Food & Beverage industry, it is indispensable for processing, storage, and distribution, ensuring product safety and longevity across the supply chain, from farm to fork. The Pharmaceutical and Healthcare sectors rely heavily on ultra-low temperature (ULT) freezers and controlled cold rooms for storing sensitive vaccines, biological samples, and critical medications, a requirement magnified by the logistics demands of modern biologics. Furthermore, the burgeoning demand for processed foods, coupled with urbanization and the expansion of organized retail across Asia Pacific and Latin America, consistently fuels the need for advanced commercial refrigeration infrastructure. Industrial applications, such as chemical processing and petrochemical cooling, also represent a significant, high-value segment due to the requirement for highly specialized and robust cooling solutions tailored to extreme operating conditions and stringent safety protocols.

Key driving factors accelerating market expansion include stringent global environmental regulations, notably the phase-down of hydrofluorocarbons (HFCs) under the Kigali Amendment, which necessitates the adoption of natural refrigerants like CO2 (R-744), ammonia (R-717), and hydrocarbons. This regulatory push fosters innovation towards sustainable and energy-efficient designs. Additionally, the proliferation of large-scale data centers requires sophisticated cooling solutions to manage heat generated by high-density server racks, pushing the envelope in precision climate control. Benefits derived from modern refrigeration technology include reduced energy consumption, minimizing operational costs for end-users; extended shelf life for perishable goods, reducing global food waste; and enhanced precision in temperature management, which is vital for complex industrial and scientific processes. The convergence of IoT, AI, and refrigeration systems further offers capabilities for predictive maintenance and real-time performance optimization, maximizing system uptime and reducing total cost of ownership.

Refrigeration Equipment Market Executive Summary

The global Refrigeration Equipment Market is characterized by robust expansion driven primarily by foundational business trends, dynamic regional developments, and transformative segmentation shifts. Business trends highlight a pronounced shift towards sustainability, compelling manufacturers to invest heavily in products utilizing natural refrigerants (such as ammonia and CO2) and integrating advanced inverter and variable speed drive technologies to enhance energy efficiency. This focus on green technology is not merely compliance-driven but is increasingly becoming a competitive differentiator, attracting significant capital expenditure in R&D for next-generation cooling systems. The consolidation of the cold chain logistics sector, particularly in response to the growing e-commerce penetration for perishable goods, mandates resilient and scalable refrigeration solutions, driving bulk procurement and long-term service contracts. Furthermore, the digitalization of maintenance protocols through remote monitoring is streamlining operations and reducing downtime across all application segments.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market segment, primarily propelled by rapid urbanization, substantial infrastructural investments in cold storage facilities, and rising disposable incomes fueling demand for refrigerated products. Countries like China and India are undergoing massive overhauls of their traditional food supply chains, rapidly integrating modern refrigeration technologies. North America and Europe, while mature, remain dominant in adopting highly sophisticated, low-GWP, and highly efficient systems, often dictated by stringent regional environmental mandates and sophisticated end-user expectations in pharmaceutical and high-end commercial retail. Conversely, Latin America and the Middle East & Africa (MEA) exhibit burgeoning potential, particularly in temperature-controlled transport and primary food preservation segments, stimulated by government initiatives aimed at reducing post-harvest losses and improving public health standards related to food handling.

Segmentation trends indicate strong growth in the refrigerated transport sector, reflecting the complex global supply chains necessary for vaccines and specialty foods. Within equipment types, compressor technology, specifically variable speed compressors, is witnessing accelerating adoption due to superior part-load efficiency, directly addressing the demand for reduced operational expenses. By refrigerant type, the transition away from high-GWP HFCs is overwhelmingly boosting the adoption of systems utilizing natural refrigerants, particularly CO2 systems in supermarket applications and ammonia systems in large-scale industrial chilling. The commercial segment, encompassing supermarkets, convenience stores, and foodservice establishments, continues to hold the largest market share, though the pharmaceutical and biomedical segment is expected to show the highest growth rate due to escalating complexity in drug temperature requirements and global health crises necessitating rapid, reliable cold chain deployment.

AI Impact Analysis on Refrigeration Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Refrigeration Equipment Market predominantly revolve around three key areas: predictive maintenance capabilities, energy consumption optimization, and supply chain efficiency improvements. Users are keenly interested in how AI algorithms can leverage vast datasets generated by IoT-enabled refrigeration units—such as temperature fluctuations, compressor cycles, and ambient conditions—to forecast component failures before they occur, thus minimizing costly unplanned downtime. A second major theme concerns the ability of AI to dynamically adjust cooling cycles based on real-time demand and external factors (like electricity pricing or weather patterns), leading to significant reductions in energy expenditure, which is a massive operational cost driver in this industry. Finally, supply chain stakeholders seek assurances regarding AI’s role in optimizing cold chain routes and monitoring integrity, ensuring regulatory compliance and product quality from manufacturing floor to final consumer. This collective user interest confirms that AI is not viewed as a replacement technology but rather as a critical enhancement layer for increasing efficiency, reliability, and sustainability across the installed base of refrigeration assets.

The integration of AI into modern refrigeration controls moves beyond simple automation; it introduces intelligent decision-making at the hardware level. Advanced machine learning models can identify subtle anomalies in system performance that traditional threshold monitoring might miss, such as slight increases in vibration or minor deviations in superheat values, translating these insights into actionable maintenance alerts. This proactive approach significantly extends the lifespan of expensive components like compressors and heat exchangers, fundamentally altering service models from reactive repair to preventative servicing. Furthermore, AI-driven diagnostics enable highly specialized remote technical support, allowing complex system issues to be resolved without requiring immediate on-site deployment, improving service response times and global maintenance efficiency, especially for geographically dispersed cold chain networks. The continuous learning capabilities of these AI systems ensure that efficiency gains compound over time, making assets smarter and more adaptive to evolving operational demands and environmental conditions.

Looking forward, the influence of Generative AI is expected to streamline the design phase of new refrigeration equipment. AI can simulate complex thermal dynamics and optimize component layouts (such as coil design and airflow management) far quicker than traditional simulation methods, leading to shorter product development cycles and highly efficient, customized solutions. For end-users, this translates into quicker deployment of energy-optimized custom cold rooms and specialized transport units. The data generated by AI-managed fleets also creates high-fidelity operational benchmarks, enabling better procurement decisions and capital planning for businesses relying on extensive refrigeration infrastructure. The shift from fixed set points to dynamic, predictive climate control, orchestrated by AI, represents the next major leap in cold chain management, prioritizing both energy savings and guaranteed temperature integrity.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by analyzing operational data to forecast component failure.

- Energy Optimization: Machine learning algorithms dynamically adjust cooling cycles based on real-time energy prices and thermal load.

- Enhanced Cold Chain Visibility: AI monitors temperature integrity across complex logistics routes, ensuring product safety and compliance.

- Fault Detection and Diagnostics (FDD): Automatically identifies performance degradation and optimizes system parameters remotely.

- Optimized Design and Simulation: Generative AI accelerates the design of energy-efficient heat exchangers and system layouts.

- Refrigerant Leak Detection: Sophisticated sensors combined with AI minimize environmental impact by quickly flagging and isolating minor leaks.

DRO & Impact Forces Of Refrigeration Equipment Market

The Refrigeration Equipment Market dynamics are shaped by a powerful combination of Driving Forces, Restraints, and Opportunities (DRO), which collectively dictate market trajectory and investment priorities. Driving forces are predominantly centered around the globalization of the food supply chain, increasing consumer demand for perishable and frozen goods, and the critical need for reliable pharmaceutical cold chains globally, especially following large-scale immunization efforts. Simultaneously, stringent regulatory mandates, particularly those phasing out high-GWP refrigerants (HFCs), force market participants towards technological innovation in natural refrigerant systems, inadvertently creating a massive replacement cycle opportunity. However, these powerful drivers are countered by significant restraints, primarily the high initial capital investment required for installing advanced, energy-efficient refrigeration systems, particularly those utilizing complex CO2 booster technology. The market also grapples with a persistent shortage of skilled technicians capable of installing and servicing these highly specialized, next-generation systems, particularly in developing economies.

Opportunities within the market are numerous and often align directly with global sustainability goals. The burgeoning demand for district cooling and thermal energy storage systems presents a high-growth avenue, leveraging large-scale refrigeration infrastructure for utility efficiency. The integration of IoT and cloud connectivity offers significant opportunities for manufacturers to transition towards lucrative service-based models (Refrigeration-as-a-Service), offering optimized maintenance and guaranteed uptime rather than just selling hardware. The shift towards sustainable refrigerants, while initially a regulatory burden, opens up vast competitive advantages for companies that successfully master ammonia, CO2, and hydrocarbon system design and deployment. Furthermore, the expansion of cold storage warehousing, fueled by e-commerce logistics, necessitates continuous investment in high-density, automated cold room technologies that maximize storage efficiency per unit of energy consumed. The strategic interplay between these forces demands manufacturers prioritize investment in R&D for both component efficiency and digital service offerings to maintain market competitiveness.

The impact forces influencing the market are multifaceted, ranging from technological breakthroughs in component efficiency (e.g., magnetic bearing compressors) to macroeconomic factors like fluctuating energy costs and geopolitical stability affecting supply chains. Regulatory impact forces, such as global carbon taxation schemes and refrigerant phase-down schedules, exert a direct and immediate influence on product design, necessitating rapid retooling and supply chain adjustments. Environmental impact forces are also critically shaping consumer and corporate purchasing decisions, with a clear preference emerging for products with demonstrably low environmental footprints, pushing the industry towards life cycle assessment (LCA) compliance. The collective pressure from these impact forces ensures that market stability is intrinsically linked to continuous innovation, forcing stakeholders to adopt flexible manufacturing processes and prioritize sustainable, future-proof product portfolios to mitigate both regulatory and competitive risks in the long term. These forces necessitate strategic partnerships between equipment manufacturers, component suppliers, and end-users to co-develop solutions tailored for specific regional environmental and operational challenges, such as high ambient temperature performance in tropical zones.

Segmentation Analysis

The Refrigeration Equipment Market is segmented across multiple dimensions, including equipment type, refrigerant type, application, and end-user, providing a granular view of specific demand drivers and technological focus areas. The equipment type segmentation highlights the technological complexity of the industry, ranging from fundamental components like compressors and heat exchangers to highly specialized finished goods such as cryogenic freezers and industrial chillers. Application segmentation is crucial as it dictates the required scale, temperature precision, and regulatory compliance level, with the massive food and beverage sector contrasted against the ultra-precise demands of the pharmaceutical cold chain. Analyzing these segments is essential for manufacturers to tailor their marketing strategies, product development efforts, and geographical expansion plans, ensuring that solutions meet the specific operational thresholds and regulatory environments of disparate user groups. The dynamic shifts within segments, especially the rapid growth witnessed in centralized cooling systems and transport refrigeration, reflect broader changes in urbanization patterns and global commerce logistics.

- Equipment Type

- Compressors (Screw, Reciprocating, Scroll, Centrifugal)

- Condensing Units

- Evaporators and Heat Exchangers

- Control and Monitoring Devices

- Accessories and Components (Valves, Filters, Tubing)

- Refrigerant Type

- Fluorocarbons (R-134a, R-404A, R-410A - decreasing share)

- Natural Refrigerants (Ammonia (R-717), Carbon Dioxide (R-744), Hydrocarbons (Propane, Isobutane))

- Others (e.g., HFOs)

- Application

- Industrial Refrigeration (Large warehouses, Chemical plants, Breweries)

- Commercial Refrigeration (Supermarkets, Restaurants, Convenience Stores)

- Transport Refrigeration (Trucks, Trailers, Shipping Containers, Rail)

- Residential Refrigeration

- End-User

- Food & Beverage Processing and Manufacturing

- Chemical and Petrochemical Industry

- Healthcare and Pharmaceuticals (Vaccine storage, Blood banks)

- Logistics and Cold Chain

- Retail and Supermarkets

- Data Centers and IT Infrastructure

Value Chain Analysis For Refrigeration Equipment Market

The value chain for the Refrigeration Equipment Market is complex, involving several distinct stages from raw material sourcing to final installation and aftermarket services, each adding specific value and cost. The upstream segment begins with raw material suppliers, predominantly metals (copper, aluminum, steel) for heat exchangers and components, and specialized chemical companies providing refrigerants and lubricants. Manufacturers of core components, such as compressors (the heart of the system) and microprocessors for controls, form a critical second tier. The quality and efficiency of these components dictate the performance of the final equipment. Strong upstream relationships are essential for managing supply chain resilience, especially given the volatility of metal commodity prices and the specialized nature of low-GWP refrigerant production. Manufacturers at this stage heavily invest in R&D to improve compressor efficiencies (e.g., variable speed drives) and material robustness to handle new, high-pressure natural refrigerants like CO2, ensuring compliance with evolving safety standards.

The manufacturing stage involves the assembly of these components into finished products, ranging from standard commercial display cases to bespoke industrial chilling plants. This stage is characterized by high capital investment in assembly lines, specialized welding techniques, and quality control systems to ensure system integrity, particularly concerning leak prevention. Direct distribution channels, where large industrial equipment manufacturers sell and install systems directly to major clients (e.g., pharmaceutical giants or large food processors), ensure specialized system design and integration control. Conversely, indirect distribution utilizes a network of wholesale distributors, specialized HVAC/R contractors, and retail partners, predominantly for standardized commercial and residential units. The effectiveness of the indirect channel hinges on the technical competency of the contractor network, which often requires significant training provided by the equipment manufacturers to handle new refrigerant technologies and smart controls effectively.

The downstream segment includes installation, commissioning, and, most importantly, the lucrative aftermarket service. Installation requires specialized technical skills, particularly for complex industrial and CO2 cascade systems, often leading to service contracts that guarantee system uptime and regulatory compliance. The aftermarket—covering maintenance, repair, retrofitting, and replacement parts—represents a stable and high-margin revenue stream. This segment is increasingly incorporating digital technologies, where remote monitoring and AI-driven diagnostics facilitate predictive maintenance, reducing the total cost of ownership for end-users. The critical nature of refrigeration equipment means that reliability is prioritized, making service quality a non-negotiable factor in the downstream value proposition. Strategic alliances between equipment OEMs and specialized service providers are common to ensure comprehensive national or global service coverage, especially for multinational cold chain operators.

Refrigeration Equipment Market Potential Customers

The potential customer base for the Refrigeration Equipment Market is extremely diverse, reflecting the essentiality of temperature control across modern economic activities. End-users fall broadly into three major categories: industrial, commercial, and transport. Industrial customers, often large-scale corporations in the food processing, beverage manufacturing, and chemical sectors, require high-capacity, robust, and often custom-engineered cooling systems designed for continuous operation and strict regulatory environments. These buyers prioritize total energy efficiency, redundancy, and system longevity, viewing refrigeration equipment as a core production asset. Specific buyers include large meat processing plants, major pharmaceutical manufacturers needing precise temperature mapping for drug stability, and chemical facilities requiring exothermic reaction cooling management. Their purchasing decisions are typically long-cycle, capital expenditure processes involving complex tenders and detailed performance specifications, often favoring direct procurement and integrated service agreements with OEMs.

The commercial segment constitutes the largest volume of potential customers, comprising supermarkets, hypermarkets, convenience stores, restaurants, and hospitality businesses. These end-users typically purchase standardized equipment, such as display cases, freezers, ice machines, and walk-in coolers, often through indirect distribution channels. Key drivers for commercial customers include aesthetics, minimal footprint, ease of maintenance, and compliance with local food safety regulations. Supermarkets, in particular, are rapidly adopting advanced, centralized transcritical CO2 systems to comply with F-Gas regulations and demonstrate corporate sustainability commitment, driving significant retrofitting cycles. These customers are highly sensitive to energy consumption, as refrigeration often represents the single largest electricity expense in their operational budget, making efficiency claims a crucial differentiator in vendor selection processes.

The third critical segment is the logistics and transport sector, requiring highly specialized refrigeration units for mobile applications, including refrigerated trucks, railway cars, air cargo containers, and marine containers (reefers). Buyers here are trucking companies, third-party logistics (3PL) providers specializing in cold chain transport, and global shipping lines. Their primary needs revolve around robust reliability under vibration and varied ambient conditions, precise temperature logging, and maximum fuel efficiency (or battery longevity for electric units). The pharmaceutical cold chain expansion, especially for temperature-sensitive biologics, has further specialized this buyer segment, requiring specialized validation and monitoring technologies integrated into the transport units. These purchasing decisions emphasize integrated telematics and remote monitoring capabilities to ensure integrity throughout the transit process, mitigating risks associated with high-value, sensitive cargo.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $56.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carrier, Daikin Industries, Johnson Controls, Trane Technologies, Emerson Electric, Danfoss, GEA Group, Lennox International, Hussmann Corporation, AHT Cooling Systems, Mayekawa Mfg. Co., Ltd., BITZER SE, Baltimore Aircoil Company, Heatcraft Worldwide Refrigeration, Rivacold, LU-VE Group, Koxka, True Manufacturing, Epta S.p.A., Hoshizaki Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refrigeration Equipment Market Key Technology Landscape

The technological landscape of the Refrigeration Equipment Market is rapidly evolving, driven primarily by the dual pressures of environmental compliance and the demand for enhanced energy efficiency. A pivotal technology involves the sophisticated management of natural refrigerants. Specifically, transcritical CO2 (R-744) booster systems have become the standard for new commercial installations in regions with strict F-Gas regulations, requiring advanced pressure control, gas cooler technology, and parallel compression to maintain high efficiency, especially in warmer climates. Ammonia (R-717) systems continue to dominate large-scale industrial refrigeration due to their superior thermodynamic efficiency and zero GWP, with ongoing innovation focused on low-charge ammonia systems to enhance safety and reduce installation complexity. The design of heat exchangers is also advancing, utilizing microchannel and plate-and-frame architectures to maximize heat transfer efficiency with smaller refrigerant volumes, contributing significantly to system compactness and material savings.

Digitalization and connectivity represent the second major pillar of technological advancement. The proliferation of IoT sensors and networked control systems allows for real-time monitoring of every critical parameter, from oil level and pressure differential to energy usage and ambient humidity. This data is fed into sophisticated Building Management Systems (BMS) and cloud-based platforms, enabling remote diagnostics, proactive fault detection, and precise performance benchmarking. This connectivity facilitates the transition to predictive maintenance models, which utilize machine learning algorithms to anticipate component stress and schedule service before a failure occurs, maximizing operational uptime. Furthermore, the integration of Variable Speed Drive (VSD) technology in compressors and fans is now standard practice, allowing the refrigeration capacity to modulate precisely according to the cooling load, leading to significant reductions in seasonal energy consumption compared to traditional fixed-speed systems.

Emerging technologies, though still nascent, hold promise for future market disruption. Magnetic bearing compressors eliminate mechanical friction, offering unparalleled efficiency, reduced noise, and extended operational life, suitable for high-end industrial and specialized applications. Thermal energy storage (TES) systems are increasingly being integrated, utilizing stored cooling capacity (e.g., in ice or chilled water) during off-peak hours when electricity is cheaper, and discharging it during peak demand, optimizing utility management for large facilities. Additionally, advancements in insulation materials, such as vacuum insulated panels (VIPs), are improving the thermal performance of cabinets and cold rooms, reducing the necessary refrigeration capacity and thereby cutting both capital and operating costs. The synergy between high-efficiency hardware, smart controls, and sustainable refrigerants defines the current technological competitive advantage within this capital-intensive market.

Regional Highlights

- Asia Pacific (APAC): Dominance and Rapid Expansion

The APAC region is anticipated to be the primary engine of market growth, driven by massive investments in infrastructure, particularly cold chain development in emerging economies like China, India, and Southeast Asian nations. Rapid urbanization and the shift towards organized retail and e-commerce for groceries necessitate a corresponding expansion of cold storage warehousing and transport refrigeration units. Government initiatives to minimize post-harvest losses and improve food safety standards further mandate the adoption of modern, reliable refrigeration technology. While the market initially focused on cost-effectiveness, there is a clear and accelerating pivot towards energy-efficient and low-GWP systems, especially as regional regulatory frameworks begin to tighten in line with global environmental treaties. Japan, South Korea, and Australia remain key markets for sophisticated, energy-optimized equipment.

- North America: Maturity and Efficiency Mandates

North America represents a mature, high-value market characterized by high consumer standards and extremely stringent energy efficiency regulations, such as those mandated by the Department of Energy (DOE) and regional standards like California’s Air Resources Board (CARB). The market is heavily focused on retrofitting existing commercial installations with natural refrigerant solutions (primarily CO2) and integrating advanced IoT and AI systems for performance optimization. High labor costs and the criticality of cold chain logistics in the pharmaceutical sector (especially around vaccine and biologic storage) drive demand for highly reliable, sophisticated equipment that minimizes the need for manual intervention and guarantees temperature stability. The industrial sector continues to invest in large-scale ammonia systems, prioritizing safety enhancements through low-charge designs and robust containment.

- Europe: Regulatory Leadership and Natural Refrigerants

Europe stands as the global leader in the adoption of natural refrigerant technologies, largely due to the rigorous enforcement of the F-Gas Regulation, which aggressively phases down high-GWP refrigerants. This regulatory environment has fundamentally transformed the market, leading to near-universal adoption of transcritical CO2 systems in new supermarkets and strong growth in industrial ammonia systems. European manufacturers often pioneer energy recovery solutions integrated into refrigeration systems, using waste heat for space heating or domestic hot water, further boosting system efficiency and sustainability credentials. Northern and Western Europe possess the highest density of advanced cooling systems, while Eastern Europe represents a significant opportunity for technology transfer and modernization of existing infrastructure, driven by EU harmonization standards and investment grants.

- Latin America (LATAM): Infrastructure Catch-Up and Commercial Growth

The LATAM market is experiencing steady growth, fueled by improving economic conditions, expanding retail chains (especially in Brazil, Mexico, and Chile), and increasing foreign investment in food processing facilities. The need to improve logistics infrastructure, particularly reliable cold chain transport connecting remote agricultural areas to urban centers, is a primary driver. While cost remains a significant factor, there is increasing awareness and slow integration of natural refrigerant systems, often motivated by multinational corporate sustainability policies rather than immediate local regulation. The market demand is heavily concentrated in commercial display cases and basic cold storage solutions, but the transport refrigeration segment is expanding rapidly to meet the demands of global food exports.

- Middle East and Africa (MEA): Climate Challenges and Project-Based Demand

The MEA region presents unique challenges due to extremely high ambient temperatures, demanding highly robust and specialized refrigeration equipment optimized for efficiency under severe thermal loads. Demand is largely project-based, driven by massive construction projects (e.g., new cities, major food distribution hubs) and significant investment in the oil and gas sector requiring process cooling. Countries in the Gulf Cooperation Council (GCC) are investing heavily in food security initiatives, leading to the construction of large climate-controlled warehouses. While sustainability is rising on the agenda, system reliability and high performance in hot climates are currently the paramount concerns, driving innovation in adiabatic cooling and specialized component engineering to maintain performance margins.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refrigeration Equipment Market.- Carrier

- Daikin Industries

- Johnson Controls

- Trane Technologies

- Emerson Electric

- Danfoss

- GEA Group

- Lennox International

- Hussmann Corporation

- AHT Cooling Systems

- Mayekawa Mfg. Co., Ltd.

- BITZER SE

- Baltimore Aircoil Company

- Heatcraft Worldwide Refrigeration

- Rivacold

- LU-VE Group

- Koxka

- True Manufacturing

- Epta S.p.A.

- Hoshizaki Corporation

Frequently Asked Questions

Analyze common user questions about the Refrigeration Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards natural refrigerants in the market?

The primary driver is global regulatory compliance, specifically the Kigali Amendment to the Montreal Protocol and the European Union’s F-Gas Regulation, which mandate the phase-down of high Global Warming Potential (GWP) Hydrofluorocarbons (HFCs). Natural refrigerants like CO2 and ammonia offer near-zero GWP, making them future-proof sustainable alternatives.

How is energy efficiency being improved in new refrigeration equipment?

Energy efficiency is enhanced through the widespread adoption of Variable Speed Drive (VSD) compressors, microchannel heat exchangers, advanced electronic expansion valves (EEVs), and the integration of IoT and AI controls for dynamic load matching and predictive optimization.

Which application segment holds the largest market share?

The Commercial Refrigeration segment, encompassing supermarkets, convenience stores, and foodservice establishments, currently holds the largest market share globally due to the vast volume of retail outlets requiring controlled cooling for perishable goods and beverages.

What is the main challenge facing the large-scale industrial refrigeration sector?

The key challenge for large-scale industrial refrigeration, which heavily relies on ammonia, is mitigating safety risks and addressing the high initial capital investment required for complex, specialized, and low-charge ammonia system designs to meet stringent safety standards.

How does the expansion of e-commerce influence the refrigeration market?

The rapid expansion of e-commerce, particularly for fresh and frozen groceries (e-grocery), significantly increases the demand for centralized cold storage warehouses (fulfillment centers) and specialized, last-mile refrigerated transport solutions for delivery fleets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Refrigeration Equipment Market Size Report By Type (Transport Refrigeration Equipment, Refrigerators and Freezers, Beverage Refrigerators, Others), By Application (Food Service, Food and Beverage Retail, Food and Beverage Distribution, Food and Beverage Production, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Commercial Refrigeration Equipment Market Statistics 2025 Analysis By Application (Food Service, Food and Beverage Retail, Food and Beverage Distribution, Food and Beverage Production), By Type (Transport Refrigeration Equipment, Refrigerators and Freezers, Beverage Refrigerators), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Road Transport Refrigeration Equipment Market Statistics 2025 Analysis By Application (Food/Beverages, Pharmaceuticals/Chemicals, Plants/Flowers), By Type (Van Refrigeration System and Bodies, Truck Refrigeration System and Bodies, Trailer Refrigeration System and Bodies), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Commercial Refrigeration Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Open air cases, Coffin cases, Rozen closed door cases, Others), By Application (Food Industry, Pharmaceutical Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager