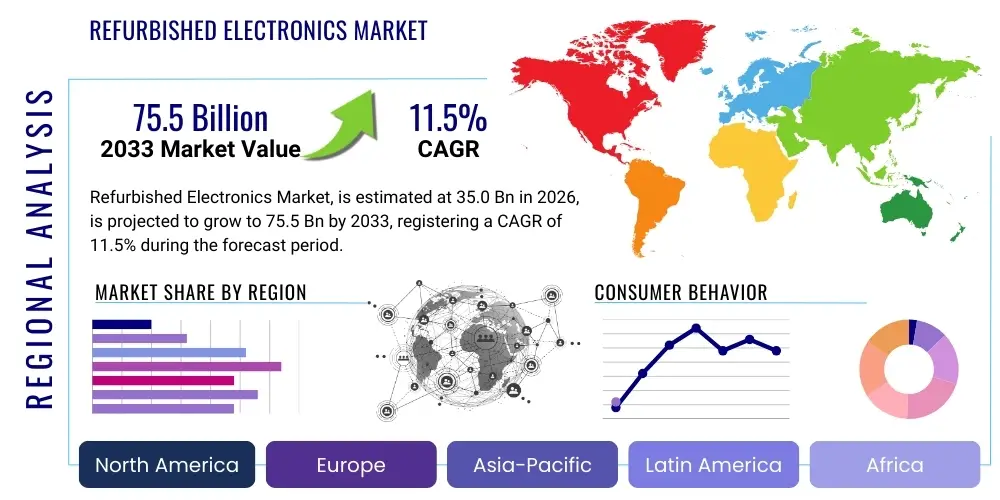

Refurbished Electronics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443242 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Refurbished Electronics Market Size

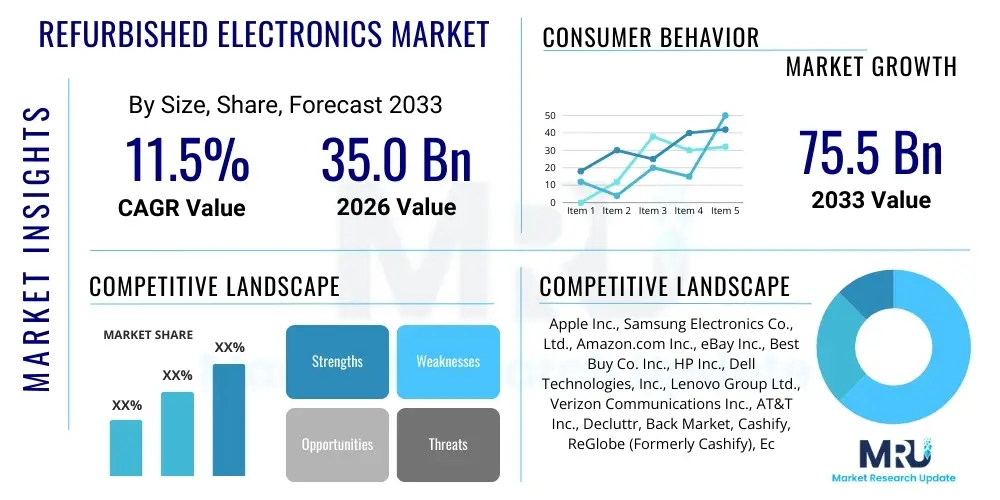

The Refurbished Electronics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 35.0 Billion in 2026 and is projected to reach USD 75.5 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by increasing consumer awareness regarding sustainability, the high cost of new premium devices, and the robust growth of organized re-commerce platforms which instill greater trust and reliability in refurbished products.

The valuation reflects a significant shift in consumer purchasing habits, particularly across emerging economies and amongst younger, environmentally conscious demographics. Furthermore, the standardization of refurbishment processes, including rigorous testing and certification programs implemented by Original Equipment Manufacturers (OEMs) and certified third-party refurbishers, has improved product quality and extended device lifecycles, thereby enhancing the market's overall credibility. The growing availability of financing and insurance options specific to refurbished goods also contributes significantly to this projected growth trajectory.

Refurbished Electronics Market introduction

The Refurbished Electronics Market encompasses the trade of previously owned electronic devices that have undergone professional inspection, testing, repair, and restoration to fully functional condition, often with cosmetic improvements and a warranty. These products span a wide range, including smartphones, laptops, tablets, and gaming consoles. The primary objective of refurbishment is to restore a device's performance characteristics to 'like-new' standards, offering consumers a cost-effective alternative to purchasing new equipment.

Major applications of refurbished electronics include personal use, educational institutions seeking affordable technology adoption, and commercial enterprises optimizing IT expenditure through bulk purchasing of certified pre-owned equipment. The key benefits driving market adoption are substantial cost savings (typically 30% to 70% less than new), reduced environmental impact through e-waste mitigation and resource conservation, and access to premium brands and models that might otherwise be unaffordable for budget-conscious consumers. The increasing efficiency of global reverse logistics and the establishment of robust grading systems are crucial factors supporting market maturity.

Driving factors propelling this market include global economic uncertainty fostering frugality, rapid technological obsolescence leading to a high supply of relatively new used devices, and government regulations promoting circular economy initiatives. The expansion of dedicated online marketplaces, such as Back Market and specialized OEM trade-in programs, provides streamlined, trustworthy channels for both sellers and buyers, reducing the perceived risk historically associated with second-hand purchases. Moreover, the enhanced battery and component longevity in modern electronics ensures refurbished devices maintain high performance for extended periods, further validating their value proposition.

Refurbished Electronics Market Executive Summary

The Refurbished Electronics Market is characterized by accelerating business trends focused on organizational consolidation, strategic OEM involvement, and enhanced supply chain transparency. A key business trend involves major retailers and telecommunication providers integrating device trade-in and refurbishment services directly into their core offerings, capturing the device lifecycle value. Furthermore, third-party logistics providers are specializing in reverse logistics, leveraging advanced data analytics to efficiently grade, price, and distribute refurbished inventory globally, thereby minimizing processing time and maximizing profitability. Investment in automated testing and cosmetic restoration facilities is also peaking to meet escalating demand while maintaining quality standards at scale.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive population bases seeking affordable entry into digital ecosystems, particularly in India and Southeast Asia. North America and Europe, however, remain the largest revenue contributors, characterized by established infrastructure for device collection (trade-ins, enterprise asset management) and high consumer confidence in certified refurbished goods, supported by strong regulatory frameworks guaranteeing consumer rights. Specific trends show strong demand for refurbished smartphones in APAC and high demand for refurbished enterprise IT equipment (laptops, servers) in North America and Europe, aligning with corporate sustainability mandates.

Segment trends reveal that the smartphone category dominates the market share due to high replacement cycles and standardized refurbishment processes. However, the refurbished laptop and tablet segments are experiencing significant growth, driven by the lingering effects of remote work and distance learning needs, requiring powerful, yet budget-friendly computing solutions. The segmentation by sales channel emphasizes the dominance of e-commerce platforms, offering expansive inventory, competitive pricing, and enhanced transparency through customer reviews and verified seller profiles, which significantly mitigates buyer uncertainty compared to traditional informal channels.

AI Impact Analysis on Refurbished Electronics Market

User inquiries concerning AI's role in the Refurbished Electronics Market frequently center on automation efficiency, pricing accuracy, and fraud prevention. Key themes include how AI can standardize the highly subjective process of device grading, whether machine learning models can predict residual value more accurately than traditional methods, and how generative AI might assist in managing complex global inventory and consumer demand forecasting. Users express expectations that AI will not only streamline the technical refurbishment process but also fundamentally improve buyer confidence by making the quality assessment and pricing mechanisms transparent and objective. Concerns often revolve around data privacy when devices are wiped and the cost implications of implementing sophisticated AI-driven diagnostics across small-to-medium refurbishment enterprises.

- AI-driven automated diagnostic testing: Utilizing machine vision and deep learning algorithms to rapidly and accurately assess the functional and cosmetic condition of returned devices, dramatically reducing manual inspection time and human error.

- Predictive pricing and residual value estimation: Machine Learning models analyze historical sales data, component pricing fluctuations, market demand signals, and device degradation rates to generate dynamic, optimized resale prices, maximizing profit margins and inventory turnover.

- Enhanced data sanitization verification: AI systems monitor and certify secure data wiping processes, ensuring compliance with global privacy regulations (e.g., GDPR, CCPA) and providing certified proof of erasure to incoming buyers.

- Optimized inventory management and demand forecasting: Predictive analytics forecast regional demand for specific refurbished models, allowing companies to strategically position inventory and plan procurement (trade-ins, wholesale acquisitions) months in advance.

- Personalized marketing and recommendation engines: AI tailors product recommendations based on individual consumer purchasing history, budget constraints, and desired device specifications, improving conversion rates on e-commerce platforms.

- Automated cosmetic repair and grading: Robotics integrated with machine vision systems perform precise cosmetic repairs and apply standardized grading (A, B, C), ensuring consistency across millions of units processed annually.

- Supply chain risk mitigation: AI monitors geopolitical events, component availability, and logistics bottlenecks, suggesting alternative sourcing or distribution routes to maintain a steady flow of refurbishable devices.

DRO & Impact Forces Of Refurbished Electronics Market

The Refurbished Electronics Market is shaped by a powerful interplay of Drivers, Restraints, Opportunities, and strategic Impact Forces. Key drivers include the ever-increasing average selling price of new flagship devices, making refurbished options a financially pragmatic choice for a vast consumer base globally, and the rising global mandate for environmental sustainability, where consumers actively seek products aligned with circular economy principles. Furthermore, technological improvements in battery life and component durability extend the usable lifespan of electronics, enhancing the value proposition of certified pre-owned devices. These forces collectively exert significant upward pressure on market growth, pushing refurbishers toward scale and professionalization.

However, the market faces significant restraints, primarily stemming from persistent consumer skepticism regarding product quality and the long-term reliability of refurbished goods compared to new ones, particularly in less organized regional markets. The fragmentation of the reverse logistics supply chain presents operational hurdles, making standardized sourcing and quality control challenging across different geographical regions. Additionally, warranty periods offered on refurbished items often remain shorter than those for new products, acting as a deterrent for risk-averse institutional buyers. Counterfeit components and unauthorized repair operations also pose reputational risks to certified refurbishers, potentially undermining market confidence.

Opportunities for exponential growth lie in penetrating emerging markets through localized refurbishment centers and accessible digital platforms, coupled with strategic partnerships with major wireless carriers for high-volume trade-in programs. The expansion into niche product categories, such as high-end medical electronics and specialized industrial computing equipment, presents lucrative avenues beyond traditional consumer goods. The strongest impact force on the market is the increasing involvement of Original Equipment Manufacturers (OEMs), who lend immense credibility and technical expertise to the refurbishment process. When OEMs offer certified pre-owned programs, they validate the quality standard for the entire ecosystem, boosting consumer trust and setting higher benchmarks for third-party competitors, thus professionalizing the entire industry landscape.

Segmentation Analysis

The Refurbished Electronics Market segmentation provides a critical view of market dynamics, revealing where demand is concentrated across product categories, end-user profiles, and distribution mechanisms. This analysis is crucial for market participants to tailor their inventory acquisition, refurbishment protocols, and go-to-market strategies. Segmentation by Product Type highlights the technological complexity and replacement frequency of different devices; smartphones dominate due to short upgrade cycles, while laptops and enterprise equipment represent high-value, sustained demand. Segmentation by End-User differentiates between high-volume commercial purchasers seeking IT asset management solutions and individual consumers prioritizing affordability and environmental impact.

Further segmentation by Sales Channel reveals the structural shift toward digitized commerce. E-commerce platforms, offering comprehensive transparency regarding device history and grading, alongside competitive pricing, have usurped traditional informal retail channels. This digital transition is vital for mitigating fraud risk and expanding geographical reach. Understanding these segments allows refurbishers to optimize their logistics—for instance, focusing higher-grade inventory on established OEM channels or premium e-commerce platforms, while diverting lower-grade, functional inventory to specialized regional repair shops or wholesale distributors catering to value-conscious markets. The sustained demand from educational sectors post-pandemic further solidifies the institutional segment's importance for specific categories like tablets and low-to-mid-range laptops.

- By Product Type:

- Refurbished Smartphones

- Refurbished Laptops

- Refurbished Desktops and Servers

- Refurbished Tablets

- Refurbished Gaming Consoles

- Refurbished Wearable Devices and Accessories

- By End-User:

- Personal/Individual Consumers

- Commercial Enterprises (SMEs and Large Corporations)

- Educational Institutions

- Healthcare Providers

- By Sales Channel:

- Online Platforms (E-commerce Marketplaces, Dedicated Re-commerce Sites)

- Offline Retail Stores (Carrier Stores, Authorized Resellers)

- OEM and Manufacturer Direct Channels (Certified Pre-Owned Programs)

Value Chain Analysis For Refurbished Electronics Market

The value chain for the Refurbished Electronics Market is inherently complex, starting far upstream with the acquisition of devices through diverse avenues such as customer trade-in programs, carrier lease returns, corporate IT asset disposal (ITAD), and wholesale procurement from liquidators. Upstream analysis focuses on effective sourcing and reverse logistics efficiency, crucial for maintaining a competitive edge. The complexity lies in accurately assessing the condition and authenticity of devices upon acquisition, which directly influences the subsequent cost of refurbishment and final resale price. Efficient collection and preliminary grading processes are critical bottlenecks that dictate the velocity and quality of the entire chain. Organizations that successfully integrate trade-in systems with carrier networks possess a significant advantage in securing high-quality, high-volume inventory.

The core midstream activities involve detailed inspection, standardized testing, repair, data wiping, and certification—the actual refurbishment process. This phase heavily relies on specialized technical labor, access to authentic spare parts, and proprietary diagnostic software. Companies operating in this segment invest heavily in technology, including automation and AI-driven diagnostics, to reduce labor costs and increase consistency across batches. Quality assurance and the granting of robust warranties are integral to generating consumer trust and moving the product into higher-value downstream channels. The consistency of grading (e.g., A-grade vs. B-grade) is a key value differentiator established at this stage.

Downstream analysis concerns distribution channels, encompassing both direct and indirect sales. Direct channels, primarily OEM Certified Pre-Owned (CPO) websites and dedicated re-commerce platforms like Back Market or Swappa, offer the highest margins and direct control over the customer experience. Indirect channels involve distributing through large e-commerce marketplaces (Amazon, eBay), regional wholesale distributors, and carrier-partnered retail stores. The choice of distribution channel dictates pricing strategy, logistical requirements, and target customer profile. Effective value realization in the downstream segment requires sophisticated digital marketing and robust customer support to handle post-sale inquiries and warranty claims, ensuring high customer lifetime value in a competitive environment.

Refurbished Electronics Market Potential Customers

The potential customers for refurbished electronics are broadly segmented into three primary groups: highly price-sensitive individual consumers, budget-conscious institutional buyers, and sustainability-driven corporate entities. Individual consumers represent the largest segment, encompassing students, lower-to-middle income families, and tech enthusiasts seeking premium or older flagship models they cannot afford new. These buyers are typically active on large e-commerce marketplaces and prioritize financial savings, provided the product comes with a dependable warranty and verifiable quality grading. Their purchasing decisions are highly influenced by transparent seller ratings and detailed product descriptions outlining any cosmetic imperfections.

Institutional buyers, including K-12 schools, universities, and small to mid-sized enterprises (SMEs), represent the high-volume segment. These entities require large quantities of reliable, standardized equipment—such as laptops and tablets—for deployment in classrooms or offices, where maximizing ROI on IT infrastructure is paramount. These customers often procure devices through IT Asset Disposition (ITAD) programs or direct contracts with certified refurbishers, demanding bulk discounts, standardized configuration services, and enterprise-level warranties and support. For them, the cost efficiency achieved through refurbishment allows for wider technological access across their organizations.

Finally, a rapidly growing segment consists of large corporations and government agencies increasingly driven by Environmental, Social, and Governance (ESG) mandates. These buyers specifically utilize refurbished and certified pre-owned IT equipment to meet corporate sustainability goals and demonstrate commitment to the circular economy. While price remains important, their primary criteria often include verifiable data sanitization procedures, proof of certified refurbishment standards (ISO compliance), and detailed reporting on the environmental impact savings achieved by choosing refurbished over new. This segment is crucial for the high-end refurbished server and commercial networking equipment market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.0 Billion |

| Market Forecast in 2033 | USD 75.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Samsung Electronics Co., Ltd., Amazon.com Inc., eBay Inc., Best Buy Co. Inc., HP Inc., Dell Technologies, Inc., Lenovo Group Ltd., Verizon Communications Inc., AT&T Inc., Decluttr, Back Market, Cashify, ReGlobe (Formerly Cashify), EcoATM, Renewed, Foxconn Technology Group, Greentoe, Swappa, Glyde. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refurbished Electronics Market Key Technology Landscape

The technological landscape driving the Refurbished Electronics Market focuses intensely on automation, standardization, and certified data security, aiming to industrialize what was historically a decentralized, manual process. Core technologies revolve around proprietary diagnostic software capable of running comprehensive, multi-point hardware checks in minutes, identifying component failures, battery health degradation, and sensor calibration issues with high precision. These tools replace subjective human inspection, providing objective data required for standardized grading systems. Furthermore, advanced laser engraving and specialized cosmetic repair machinery are used to efficiently address scratches, dents, and wear-and-tear, restoring devices to aesthetically pleasing 'like-new' conditions at scale.

A critical technological pillar is certified data sanitization. Companies utilize specialized software and hardware solutions compliant with international standards (e.g., NIST 800-88, DoD 5220.22-M) to guarantee the complete and irreversible erasure of user data, eliminating privacy risks—a mandatory requirement, particularly for corporate and institutional trade-ins. Blockchain technology is also beginning to emerge, offering immutable records of a device's provenance, repair history, and chain of custody, significantly enhancing transparency and combating the sale of counterfeit parts. This technological application builds trust and supports premium pricing for certified devices.

Finally, sophisticated Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS) tailored for reverse logistics are essential. These platforms manage the complexity of inventory that flows backward, often requiring segregation based on repair necessity, parts sourcing, and ultimate destination (resale, recycling, or parts harvesting). Integration of AI and machine learning into these systems allows for dynamic scheduling of repair queues, optimizing technician utilization, and predicting the optimal time to sell inventory based on real-time market fluctuations, moving the entire refurbishment lifecycle towards a predictable, factory-like environment rather than a reactive repair shop model.

Regional Highlights

Regional dynamics are critical to understanding the segmentation and operational complexities of the Refurbished Electronics Market, as device preferences, regulatory frameworks, and consumer trust levels vary significantly across geographies. North America (NA) represents the most mature and organized market, characterized by extensive carrier trade-in programs, established IT Asset Disposition (ITAD) infrastructure for corporate devices, and high consumer confidence in certified refurbished products, largely due to strong legal protections and robust warranty offerings. The US and Canada maintain high average replacement rates for new flagship devices, ensuring a steady, high-quality supply of recent models into the secondary market. Furthermore, major e-commerce players and OEMs dominate the sales channels here, driving competitive pricing and quality assurances. Institutional demand, particularly in educational and government sectors, is a major consumption driver for refurbished IT hardware.

Europe stands out due to its stringent environmental regulations, particularly the emphasis on the Circular Economy Action Plan, which actively incentivizes repair, reuse, and refurbishment. Countries like Germany, France, and the UK have seen exponential growth in dedicated re-commerce platforms, supported by consumer movements favoring sustainable consumption. The regulatory environment, especially GDPR, places enormous pressure on refurbishers to ensure certified data destruction, leading to higher investments in secure data wiping technologies. While the supply chain benefits from high-quality European manufacturing standards, the fragmented nature of logistics across the Eurozone presents specific challenges for scalable cross-border refurbishment operations, pushing companies toward decentralized regional hubs.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven primarily by demographic scale and the rising disposable income in developing nations like India, Indonesia, and Vietnam. In these markets, refurbished devices—especially smartphones and entry-level laptops—serve as the primary access point to digital technology for a large portion of the population. The market is highly price-sensitive, with local players dominating the supply chain and often relying on informal or semi-formal refurbishment processes. However, increasing standardization, driven by the entry of global players and the establishment of local OEM CPO programs, is gradually improving quality assurance. China, while a massive manufacturing hub, primarily focuses on component harvesting and domestic recirculation, contrasting with high-volume certified sales seen in mature Western markets.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions facing unique supply challenges, largely relying on imported used devices from North America and Europe. In LATAM, economic volatility makes refurbished electronics an essential affordability solution, creating strong demand, though regulatory environments can be complex. In MEA, particularly in the UAE and Saudi Arabia, demand for premium refurbished devices is high, serving a consumer base that desires luxury brands at reduced prices. The challenge in these regions involves logistics, tariff barriers, and establishing consumer trust in the absence of deeply entrenched standardized refurbishment certifications, leading to greater volatility in product quality compared to NA or Europe. Growth is often concentrated in high-urban centers with better access to organized retail and digital payment infrastructure.

- North America (NA): Characterized by high maturity, dominated by OEM and carrier trade-in programs, robust ITAD sector, and strong consumer confidence in certified pre-owned devices, especially smartphones and corporate IT hardware.

- Europe: Growth fueled by strong governmental focus on the Circular Economy, leading to high consumer adoption rates and stringent data privacy requirements (GDPR) driving investment in certified data sanitization technologies.

- Asia Pacific (APAC): Fastest-growing market due to immense population and high price sensitivity; primary growth drivers are access to affordable smartphones and entry-level laptops in emerging economies.

- Latin America (LATAM): Demand driven by economic necessity; market relies on imports of used devices, requiring localized refurbishment efforts and addressing logistical complexities.

- Middle East & Africa (MEA): Growing segment for high-end refurbished luxury electronics; market faces challenges related to supply chain stability and the establishment of local quality certification standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refurbished Electronics Market.- Apple Inc. (via Apple Certified Pre-Owned)

- Samsung Electronics Co., Ltd. (via Samsung Certified Re-Newed)

- Amazon.com Inc. (via Amazon Renewed program)

- eBay Inc. (major marketplace facilitator)

- Best Buy Co. Inc.

- HP Inc.

- Dell Technologies, Inc.

- Lenovo Group Ltd.

- Verizon Communications Inc. (major carrier trade-in provider)

- AT&T Inc.

- Decluttr

- Back Market

- Cashify

- ReGlobe (India-based refurbishment platform)

- EcoATM (automated trade-in kiosks)

- Renewed (e-commerce platform)

- Foxconn Technology Group (major manufacturing and refurbishment service provider)

- Greentoe

- Swappa

- Glyde

Frequently Asked Questions

Analyze common user questions about the Refurbished Electronics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between refurbished and used electronics?

Refurbished electronics have undergone professional inspection, certified repair, rigorous testing, and data sanitization, ensuring full functionality and often including a warranty. Used or pre-owned items are typically sold as-is without professional certification or guaranteed repairs, carrying a higher risk regarding quality and operational integrity.

How do manufacturers ensure the quality of Certified Pre-Owned (CPO) devices?

CPO programs mandate strict, multi-point diagnostic testing that matches the standards for new products. This involves using proprietary software for hardware checks, replacement of faulty or degraded components (like batteries), secure data wiping, and applying an official manufacturer warranty, typically ranging from 90 days to one year.

What impact does purchasing refurbished electronics have on environmental sustainability?

Buying refurbished electronics significantly contributes to the circular economy by reducing electronic waste (e-waste) and conserving natural resources. It extends the useful life of devices, thereby decreasing the carbon emissions and energy consumption associated with manufacturing new units.

Are refurbished electronics eligible for the latest operating system and security updates?

Yes, refurbished electronics are typically fully functional and capable of receiving all official software and security updates from the original manufacturer (e.g., Apple iOS, Google Android, Microsoft Windows), provided the device model is still within the manufacturer's supported update lifecycle.

What is the expected Compound Annual Growth Rate (CAGR) for the Refurbished Electronics Market?

The Refurbished Electronics Market is projected to grow substantially at a Compound Annual Growth Rate (CAGR) of 11.5% between the forecast period of 2026 and 2033, driven by cost savings, increased e-commerce adoption, and corporate sustainability mandates globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager