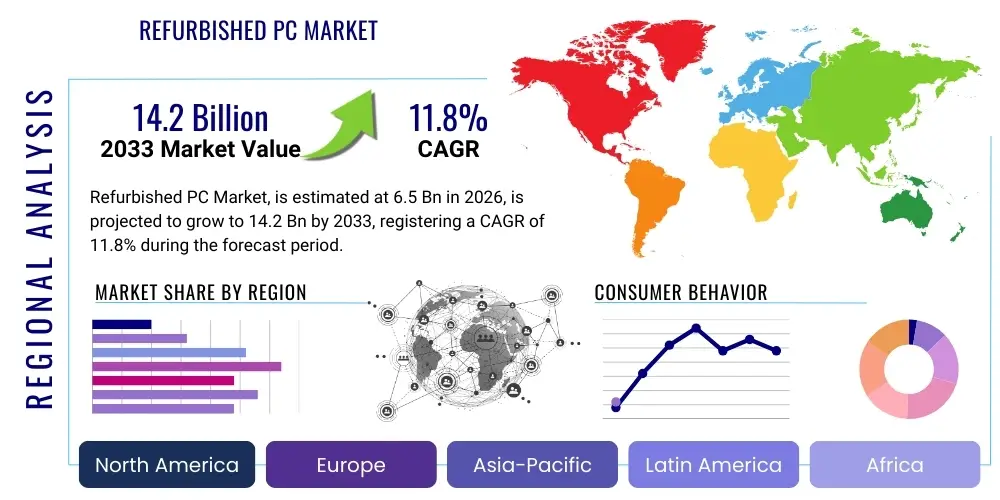

Refurbished PC Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442747 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Refurbished PC Market Size

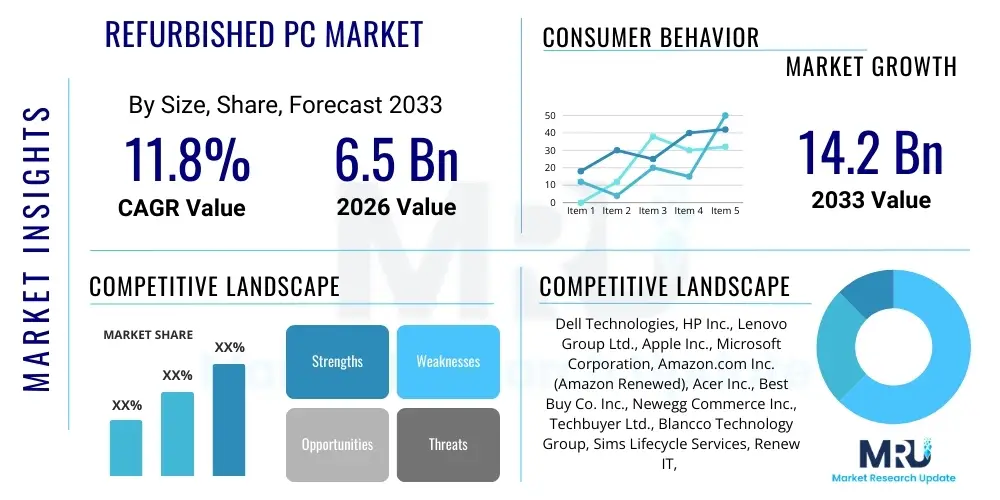

The Refurbished PC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. This robust expansion is fueled by increasing environmental awareness, the growing adoption of circular economy models across enterprises, and significant cost savings realized by small and medium-sized enterprises (SMEs) and educational institutions globally. The high replacement rate of enterprise hardware cycles contributes substantially to a consistent supply of high-quality used devices suitable for refurbishment and resale.

The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 14.2 Billion by the end of the forecast period in 2033. This growth trajectory reflects a fundamental shift in consumer and corporate perception, moving away from viewing refurbished products merely as low-cost alternatives toward recognizing them as reliable, sustainable, and high-value IT assets. Furthermore, stringent regulatory frameworks concerning electronic waste (e-waste) management in developed economies are propelling investment in professional refurbishment infrastructure, thereby enhancing product quality and consumer trust.

Refurbished PC Market introduction

The Refurbished PC Market encompasses the trade of personal computers—including desktops, laptops, and workstations—that have been previously used, subjected to rigorous diagnostic testing, repaired, upgraded (if necessary), wiped of all previous data, and restored to a working condition suitable for resale. These products are often certified by Original Equipment Manufacturers (OEMs), third-party refurbishers, or specialized IT asset disposition (ITAD) firms. Major applications span across educational technology initiatives, corporate fleet renewal programs targeting Total Cost of Ownership (TCO) reduction, government agencies requiring affordable secure computing solutions, and individual consumers seeking budget-friendly, high-performance computing.

The primary benefits driving market expansion include substantial cost savings, typically offering equivalent performance to new models at 30% to 60% lower prices, and significant environmental advantages related to reducing e-waste and minimizing the carbon footprint associated with new device manufacturing. Refurbished PCs play a critical role in promoting digital inclusion by making computing accessible to lower-income demographics and emerging economies. Product descriptions focus heavily on the grade (e.g., A-Grade, B-Grade) of refurbishment, warranty coverage, and the performance specifications relative to new devices.

Key driving factors accelerating the adoption of refurbished PCs include the increasing penetration of the internet in developing regions, the necessity for flexible and rapidly scalable IT infrastructure, especially in remote work environments, and strong governmental focus on sustainability goals. The consistent release of new operating systems and demanding software applications necessitates periodic hardware upgrades, generating a predictable supply pipeline for the refurbishment industry. Moreover, certified refurbishment programs instill consumer confidence through standardized processes and extended warranty offers, mitigating historical concerns regarding product reliability.

Refurbished PC Market Executive Summary

The Refurbished PC Market is experiencing dynamic growth, characterized by crucial business trends focusing on vertical integration within the ITAD ecosystem and the expansion of subscription-based models for refurbished hardware, often termed "Device as a Service" (DaaS). Major IT players are increasingly establishing dedicated certified pre-owned (CPO) programs to capture value from their existing installed base, ensuring quality control and brand consistency. Business trends also highlight the shift towards higher-specification refurbished equipment, such as gaming laptops and professional workstations, driven by demand from specialized segments needing powerful yet affordable hardware. Effective data sanitization and regulatory compliance (e.g., GDPR, CCPA) are becoming core competitive differentiators for leading refurbishers, enhancing corporate trust.

Regional trends indicate North America and Europe currently dominate the market due to mature e-waste regulations, high consumer acceptance of refurbished goods, and established IT infrastructure allowing for efficient collection and redistribution. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid digitization, massive educational technology investments (particularly in India and Southeast Asia), and a high concentration of SMEs prioritizing cost-efficient hardware scaling. Latin America and the Middle East and Africa (MEA) are emerging as significant consumption hubs, relying on imported refurbished equipment to close the digital gap, though supply chain logistics remain a challenge in these geographies.

Segmentation trends show that the Laptop segment holds the largest market share, driven by the enduring need for portability and the high volume of corporate laptop refreshes. In terms of end-users, the Corporate/Enterprise segment remains the dominant revenue generator, continuously seeking economies of scale through bulk purchases of certified refurbished desktops and thin clients. Conversely, the Educational sector is the fastest-growing segment, utilizing refurbished PCs to equip student labs and facilitate remote learning initiatives effectively. Distribution channel evolution is marked by the growing prominence of dedicated e-commerce platforms and online marketplaces specializing in refurbished IT equipment, offering greater transparency and wider geographic reach compared to traditional retail channels.

AI Impact Analysis on Refurbished PC Market

User inquiries regarding AI's influence on the Refurbished PC market center on several key themes: how AI might automate the refurbishment process, whether AI-driven diagnostic tools will improve product reliability, and if the accelerated demand for AI-capable hardware (AI PCs) will quickly obsolete current non-AI devices, thereby flooding the refurbished market. Users are keenly interested in the longevity and relevance of refurbished equipment in an increasingly AI-driven computing landscape. The core concern revolves around performance compatibility—will today's refurbished hardware be capable of running future AI applications efficiently? Conversely, there is optimism that AI could revolutionize inventory management and pricing strategies within the secondary market, leading to more competitive offerings and reduced operational costs for refurbishers.

The direct impact of Artificial Intelligence (AI) algorithms is significantly optimizing the operational efficiency of the refurbishment value chain. AI is being deployed in sophisticated diagnostic tools that can rapidly and accurately identify component failures, estimate remaining component lifespan, and determine the optimal grade and resale price of a device, far surpassing the speed and consistency of manual testing. This automation reduces labor costs and dramatically shortens the turnaround time from acquisition to resale. Furthermore, predictive analytics, leveraging machine learning, is helping refurbishers forecast demand patterns across different regions and specifications, ensuring optimized inventory levels and minimizing obsolescence risk, which is critical for maintaining healthy profit margins in a price-sensitive market.

On the demand side, the emergence of AI-specific hardware, such as Neural Processing Units (NPUs) in newer PCs, creates a dichotomy in the market. While the immediate demand for cutting-edge AI computation will drive consumers towards new devices, the vast majority of mainstream computing tasks (e.g., word processing, standard enterprise applications, web browsing) do not require NPU capabilities. This segmentation ensures a sustained, high-volume market for refurbished standard PCs. However, AI also facilitates enhanced customer service and personalization within the refurbished sector, with intelligent chatbots and recommendation engines guiding buyers to the exact specifications they need, thereby boosting consumer confidence and reducing return rates.

- AI-driven automated diagnostics improve testing speed and accuracy, enhancing product quality and reliability.

- Predictive analytics optimize inventory forecasting, reducing holding costs and maximizing resale profits.

- Accelerated obsolescence of non-AI specialized hardware potentially increases the supply of older, yet highly functional, PCs for refurbishment.

- Machine learning algorithms enable dynamic pricing strategies based on real-time market supply and demand factors.

- AI-enhanced customer support systems improve the buying experience and build trust in refurbished product warranties.

- AI assists in sophisticated data sanitization verification, ensuring compliance with strict data privacy regulations.

DRO & Impact Forces Of Refurbished PC Market

The Refurbished PC Market’s trajectory is heavily influenced by a confluence of driving factors, structural restraints, and emerging opportunities, collectively representing the impact forces that dictate market momentum. Key drivers include the overwhelming financial advantage refurbished devices offer to budget-conscious enterprises and consumers, coupled with the burgeoning global commitment to environmental, social, and governance (ESG) criteria. The circular economy model, where resources are kept in use for as long as possible, strongly favors the refurbished sector, incentivizing corporate IT asset management practices. Restraints primarily revolve around persistent consumer perception issues regarding the reliability and longevity of used hardware, alongside challenges related to the fragmentation of the global refurbishment supply chain, making quality standardization difficult across diverse providers. Opportunities lie in expanding into nascent geographic markets, leveraging leasing and subscription services, and integrating advanced blockchain technologies for transparent product history tracking.

Drivers: Sustainability mandates and corporate responsibility initiatives are forcing large organizations to adopt sustainable IT procurement policies, directly favoring refurbished devices. Furthermore, the standardization and improvements in the professional refurbishment process, including advanced testing protocols and cosmetic grading, have significantly narrowed the quality gap between new and refurbished PCs. The cyclical nature of technology upgrades, particularly the move towards hybrid work models necessitating flexible hardware deployment, continuously generates a high-quality supply of off-lease corporate equipment. These factors combine to lower the perceived risk of purchasing pre-owned IT assets, driving mainstream acceptance.

Restraints: A significant barrier to growth is the limited and often inconsistent warranty coverage provided by non-OEM refurbishers, which remains a psychological deterrent for corporate buyers accustomed to comprehensive manufacturer warranties. The risk associated with data security—specifically ensuring 100% data sanitization compliant with international standards—is another major concern that complicates bulk enterprise procurement. Additionally, rapid technological advancements, especially in areas like battery technology and processor efficiency, mean that older refurbished models may suffer from noticeable performance disparities compared to the latest generation, limiting their appeal to high-demand professional users.

Opportunities: The expansion of "refurbishment as a service" models, where companies manage the entire lifecycle of equipment for a recurring fee, provides a lucrative growth avenue. Emerging markets, characterized by rapid industrialization and a high demand for affordable entry-level computing, present untapped consumption potential. Strategic partnerships between OEMs and certified third-party refurbishers can further legitimize the secondary market, ensuring a continuous supply of proprietary components for repair and enhancing brand endorsement. Finally, the education sector’s sustained funding for digital learning tools represents a robust, recurring opportunity for large-scale deployments of refurbished PCs.

Segmentation Analysis

The Refurbished PC Market is systematically segmented based on Product Type, Application, End-User, and Distribution Channel to provide granular insights into market dynamics and consumption patterns. Product segmentation distinguishes between the stationary nature of Desktops and the mobility offered by Laptops, alongside the specialized performance capabilities of Workstations. Application segmentation highlights the different environments where these PCs are utilized, such as corporate administration, educational settings, and complex industrial operations. Analyzing the End-User segments—ranging from large Enterprises and Government bodies to individual Consumers and SMEs—is crucial for understanding demand elasticity and procurement requirements across different organizational scales. The Distribution Channel analysis identifies the primary routes to market, contrasting the roles of OEM certified programs, specialized e-commerce platforms, and traditional physical retailers.

This structured approach allows stakeholders to identify the highest-growth segments and tailor their operational strategies accordingly. For instance, the high-volume, low-margin nature of consumer sales via online marketplaces contrasts sharply with the high-value, quality-assured bulk purchases made by corporate end-users through specialized ITAD providers. Understanding the interplay between these segments is vital. For example, the increasing demand for refurbished Laptops in the Education segment often bypasses traditional retail channels, relying instead on direct tender processes managed by large refurbishing firms that can handle bulk customization and deployment services.

The refinement of segmentation practices reflects the increasing maturity of the market. Detailed grading standards now inform pricing within the product segments, ensuring buyers know the cosmetic and functional state of the device they are purchasing. Furthermore, the rise of specialized applications, such as high-performance computing (HPC) for data analytics leveraging refurbished workstations, is opening new niche markets that command higher price points, demonstrating the market's evolution beyond simple low-cost replacement strategies toward performance-focused, sustainable IT solutions.

- Product Type: Desktops, Laptops, Workstations

- Application: Corporate Use, Educational Institutions, Residential/Home Use, Industrial Operations

- End-User: Large Enterprises, Small and Medium-sized Enterprises (SMEs), Government & Public Sector, Educational Institutions, Individual Consumers

- Distribution Channel: OEM Certified Refurbished Stores, Specialized E-commerce Platforms, Brick-and-Mortar Retailers, Third-Party IT Asset Disposition (ITAD) Firms

Value Chain Analysis For Refurbished PC Market

The value chain for the Refurbished PC Market is fundamentally cyclical, beginning with upstream hardware sourcing and concluding with the downstream distribution to the end-user. Upstream activities are dominated by IT Asset Disposition (ITAD) firms and corporate lease returns. Large enterprises replace IT equipment every 3-5 years, providing a consistent, large volume of high-quality feedstock. The integrity of the upstream process hinges on efficient collection logistics and secure data sanitization (wiping all sensitive information) before the device enters the refurbishment stage. Crucially, the upstream quality dictates the potential refurbishment grade and profitability downstream.

The core refurbishment process involves disassembly, detailed component testing, repair or replacement of faulty parts, necessary upgrades (e.g., SSD installation, RAM expansion), reassembly, and rigorous quality assurance checks, often culminating in the application of a new operating system license. Midstream activities are characterized by specialized skills in diagnostics and repair, with certification often being a prerequisite for dealing with major corporate clients. The efficiency of this stage significantly impacts the final product cost and turnaround time, utilizing standardized testing software and streamlined repair workflows to maximize throughput.

Downstream analysis focuses on bringing the refurbished product to the final buyer through various distribution channels. Direct distribution includes OEM certified stores (e.g., Dell Outlet, HP Renew) and large third-party refurbishers selling directly to enterprises (B2B contracts). Indirect distribution utilizes specialized e-commerce platforms (like Amazon Renewed or dedicated refurbished marketplaces), national electronics retailers, and local IT resellers catering to SMEs and individual consumers. The growing penetration of online platforms is lowering geographical barriers, allowing global access to refurbished inventory and enhancing price transparency across the market.

Refurbished PC Market Potential Customers

The Refurbished PC Market attracts a diverse array of end-users whose primary motivations are typically either cost reduction, sustainable procurement, or a blend of both. Large Enterprises and Corporate entities represent significant bulk purchasers, utilizing certified refurbished desktops and thin clients for non-intensive tasks or for outfitting temporary project teams. Their purchasing decisions are highly influenced by verifiable quality assurance protocols, standardized warranties, and the environmental benefits (ESG reporting) associated with circular IT. These corporate buyers often engage in direct contracts with large ITAD firms or OEMs for consistent supply and support.

Small and Medium-sized Enterprises (SMEs) constitute a massive and rapidly expanding customer base. Facing intense budget constraints, SMEs rely on refurbished PCs to scale their operations without incurring substantial capital expenditures on new equipment. For SMEs, the key drivers are the TCO reduction and the ability to purchase higher-specification hardware (e.g., professional-grade business laptops) that would otherwise be unaffordable new. They primarily source equipment through specialized online marketplaces and local resellers who offer tailored support packages suitable for smaller organizations.

Furthermore, the Education and Government sectors are high-volume, mission-critical consumers. Educational institutions, from primary schools to universities, purchase large batches of refurbished laptops and desktops to equip student labs and facilitate remote learning programs, prioritizing durability and volume pricing. Individual Consumers, ranging from students to casual home users, represent the final major segment, typically seeking reliable computers for general tasks, attracted by significant discounts and the convenience of online purchasing options offered by major e-commerce retailers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies, HP Inc., Lenovo Group Ltd., Apple Inc., Microsoft Corporation, Amazon.com Inc. (Amazon Renewed), Acer Inc., Best Buy Co. Inc., Newegg Commerce Inc., Techbuyer Ltd., Blancco Technology Group, Sims Lifecycle Services, Renew IT, Forerunner Technologies, Micro Center, GreenTek Solutions, Tier1 Asset Management, CompuGroup Medical, Ingram Micro, Arrow Electronics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refurbished PC Market Key Technology Landscape

The technological landscape supporting the Refurbished PC Market is primarily defined by advanced diagnostic software, rigorous data sanitization utilities, and sophisticated inventory management systems. Automated testing platforms are essential, utilizing machine learning algorithms to conduct comprehensive component checks (CPU, RAM, storage, battery health) quickly and consistently. These systems significantly reduce manual labor and ensure that refurbished devices meet specific grading criteria, thereby increasing consumer trust. The evolution of these diagnostic tools, moving from simple boot checks to deep-level hardware stress testing, is crucial for maintaining the quality differentiation that justifies certified status and extended warranties.

Data sanitization technology represents a foundational element of the refurbishment process, particularly when dealing with corporate and governmental assets. Compliance requires the use of certified wiping software that adheres to global standards such as NIST SP 800-88 or GDPR mandates, ensuring that zero residual data is recoverable. Innovations in blockchain technology are also beginning to impact this sector, offering immutable, tamper-proof records of the device's history, including ownership changes, repair logs, and sanitization certifications. This transparency is highly valuable for corporate procurement officers seeking verified chain-of-custody documentation.

Furthermore, technology enabling efficient logistics and inventory management, often leveraging cloud-based ERP systems, is optimizing the scaling capabilities of refurbishers. These systems track thousands of individual assets through the repair pipeline, automate dynamic pricing based on real-time component costs and market demand, and streamline cross-border shipping and customs compliance. The integration of predictive maintenance sensors and remote monitoring software, though still nascent, suggests future refurbished PCs could offer enhanced reliability monitoring, further mitigating the historical risk perception associated with used equipment.

Regional Highlights

North America: North America holds a leading position in the Refurbished PC Market, driven by high technology penetration rates, robust corporate refresh cycles, and mature IT Asset Disposition (ITAD) infrastructure. The region benefits from a culturally accepting consumer base for refurbished electronics and stringent environmental regulations promoting e-waste reduction. The US market, in particular, features strong competition among major OEMs (Dell, HP) and large specialized third-party refurbishers, with a high volume of sales flowing through platforms like Amazon Renewed. Corporate demand is characterized by sophisticated procurement practices focusing on verified data security and compliance, often requiring R2 or e-Stewards certified refurbishers. The emphasis here is on quality, compliance, and leveraging refurbished equipment for advanced enterprise use cases.

Europe: The European market demonstrates significant traction, heavily influenced by the European Union’s commitment to the circular economy and ambitious sustainability targets. Regulations like the Waste Electrical and Electronic Equipment (WEEE) Directive encourage responsible recycling and refurbishment, creating a favorable regulatory environment. Western European nations, including Germany, the UK, and France, exhibit high levels of market maturity, with strong consumer awareness regarding the environmental benefits of purchasing refurbished goods. The region is seeing rapid growth in the "refurbishment as a service" model, especially catering to educational and public sector tenders, where TCO and sustainability metrics are heavily weighted in procurement decisions. Warranty standardization and cross-border logistics efficiency are key focus areas for regional players.

Asia Pacific (APAC): APAC is poised to be the fastest-growing region, propelled by massive population growth, expanding digital literacy programs, and explosive SME growth across emerging economies such as India, Indonesia, and Vietnam. While the primary driver in developed APAC nations (Japan, South Korea) is corporate IT refresh cycles, the demand in developing countries is overwhelmingly driven by affordability and the necessity for basic computing access. This region presents unique logistical challenges due to fragmented supply chains and varying quality standards; however, government initiatives to subsidize technology in education are creating substantial, recurring demand for low-cost refurbished laptops and desktops, making APAC crucial for future volume growth.

Latin America and Middle East & Africa (MEA): These regions represent emerging opportunities characterized by high price sensitivity and increasing internet penetration. Refurbished PCs are critical enablers of digital transformation in these markets, often imported from North America and Europe. In MEA, particularly in urban centers and oil-rich nations, there is growing corporate and governmental procurement focused on cost-effective IT scaling, while consumer demand remains high for basic functionality. Latin America benefits from closer proximity to established refurbishment hubs, enabling quicker logistics, though macroeconomic instability and currency fluctuation often complicate large-scale transactions and pricing strategies. Investment in local repair and refurbishment centers is essential to mitigate import reliance and capture greater regional value.

- North America: Market leader due to mature ITAD infrastructure, strong corporate refresh cycles, and high consumer acceptance, emphasizing quality and data compliance.

- Europe: High growth fueled by strict EU circular economy policies, WEEE directive adherence, and rapid adoption of IT-as-a-Service models utilizing refurbished hardware.

- Asia Pacific (APAC): Fastest-growing region driven by massive SME expansion, governmental educational initiatives, and affordability demands in emerging markets.

- Latin America and MEA: Emerging markets characterized by high price sensitivity, reliance on imported inventory, and critical need for affordable computing access to bridge the digital divide.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refurbished PC Market.- Dell Technologies

- HP Inc.

- Lenovo Group Ltd.

- Apple Inc.

- Microsoft Corporation

- Amazon.com Inc. (Amazon Renewed)

- Acer Inc.

- Best Buy Co. Inc.

- Newegg Commerce Inc.

- Techbuyer Ltd.

- Blancco Technology Group

- Sims Lifecycle Services

- Renew IT

- Forerunner Technologies

- Micro Center

- GreenTek Solutions

- Tier1 Asset Management

- CompuGroup Medical

- Ingram Micro

- Arrow Electronics

Frequently Asked Questions

Analyze common user questions about the Refurbished PC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a Used PC and a Certified Refurbished PC?

A Used PC is typically sold 'as-is' without significant testing or warranty. A Certified Refurbished PC undergoes a multi-step process including deep diagnostics, necessary repairs/upgrades, professional data sanitization, and cosmetic restoration, usually backed by a warranty from the OEM or certified refurbisher, ensuring reliability.

Are refurbished PCs reliable, and do they come with warranties?

Yes, professionally refurbished PCs are highly reliable, often performing near-new specifications. Most reputable sellers, especially OEM certified programs and specialized e-commerce sites, offer warranties ranging from 90 days up to one year, mitigating reliability concerns for corporate and individual buyers.

How does the purchase of refurbished PCs impact sustainability and ESG goals?

Purchasing refurbished PCs significantly contributes to sustainability by extending the hardware lifecycle, drastically reducing electronic waste (e-waste), and decreasing the carbon footprint associated with mining raw materials and manufacturing new units. This directly supports corporate Environmental, Social, and Governance (ESG) reporting objectives.

Which segment of the refurbished PC market is growing the fastest?

The Laptop segment continues to hold the largest market share, but the Educational Institution End-User segment is currently growing the fastest, driven by large-scale public sector initiatives globally seeking cost-effective and scalable IT solutions for distance and classroom learning programs.

What are the key data security concerns when buying refurbished enterprise hardware?

The main concern is ensuring complete and verifiable data sanitization from the previous owner. Leading refurbishers utilize specialized software certified to standards like NIST 800-88 to guarantee the permanent destruction of all sensitive information, providing corporate clients with necessary compliance documentation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager