Reinforcement Geosynthetics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441996 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Reinforcement Geosynthetics Market Size

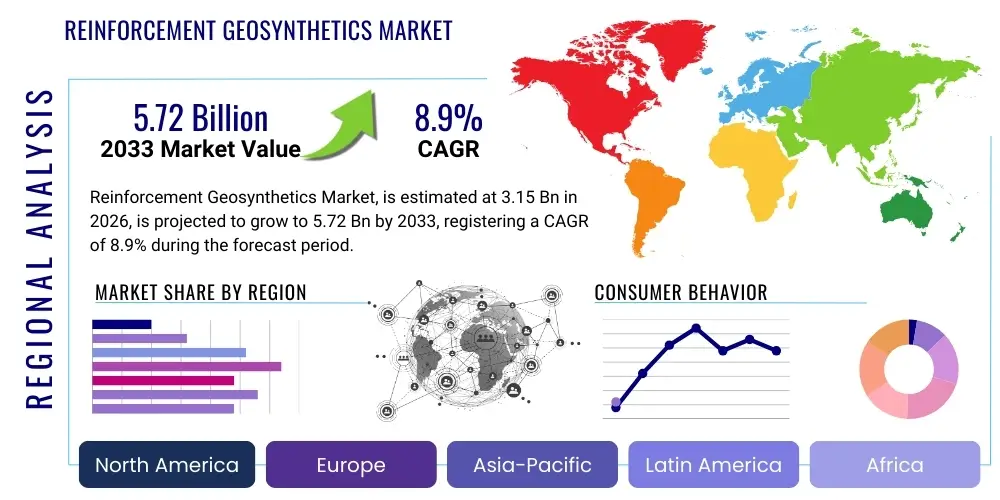

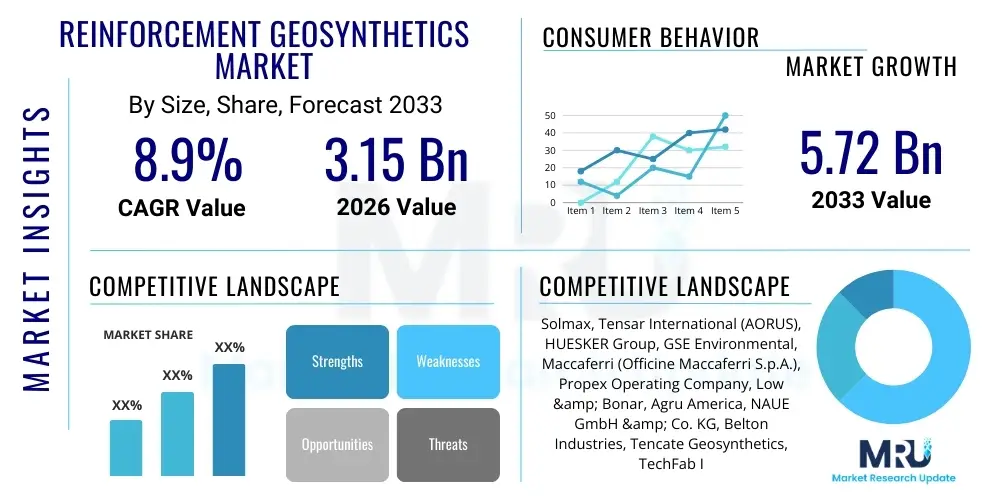

The Reinforcement Geosynthetics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 3.15 Billion in 2026 and is projected to reach USD 5.72 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by accelerated global investment in critical civil infrastructure projects, coupled with a heightened focus on utilizing advanced materials to ensure long-term stability and resilience against environmental stressors. The inherent capabilities of reinforcement geosynthetics—such as enhancing soil strength, controlling erosion, and extending the service life of pavement structures—make them indispensable components in modern engineering solutions, particularly in challenging geotechnical environments.

Reinforcement Geosynthetics Market introduction

The Reinforcement Geosynthetics Market encompasses specialized polymeric materials designed to be utilized in geotechnical, environmental, and hydraulic engineering applications where they fulfill the primary function of strengthening soil or other foundational materials. These products, which include geogrids, geotextiles, and geocomposites, are manufactured from materials such as High-Density Polyethylene (HDPE), Polyester (PET), and Polypropylene (PP), engineered specifically for high tensile strength, durability, and resistance to degradation from chemical or biological factors. The principal product description centers on their ability to interlock with granular soil matrices, providing critical lateral restraint and increasing the bearing capacity of subgrades, thereby facilitating construction on soft or unstable ground conditions.

Major applications of reinforcement geosynthetics span extensive infrastructure sectors, prominently including the construction of reinforced soil retaining walls, steep slopes, bridge abutments, railway trackbeds, and pavement stabilization for highways and airport runways. Furthermore, these materials are critically employed in environmental applications such as basal reinforcement for large waste landfills and mining heap leach pads, ensuring structural integrity and minimizing differential settlement. The core benefits derived from their use include significant reductions in construction time and cost compared to traditional construction techniques, enhanced material efficiency by minimizing the need for expensive aggregate hauling, and demonstrably superior performance in resisting seismic activity and extreme hydrological loads.

The market is currently being driven by several macro-environmental factors, chiefly the global push for massive infrastructure modernization and expansion, particularly across emerging economies in Asia Pacific and targeted reinvestment initiatives in North America and Europe. Regulatory bodies are increasingly mandating the use of sustainable and resilient engineering practices, favoring geosynthetics for their proven longevity and minimal environmental footprint relative to conventional heavy construction methods. Additionally, growing awareness among civil engineers regarding the advanced mechanistic benefits and cost-effectiveness of these materials is significantly contributing to their widespread adoption in complex foundation and earth stabilization projects worldwide.

Reinforcement Geosynthetics Market Executive Summary

The Reinforcement Geosynthetics Market demonstrates robust upward momentum driven by synergistic business trends focused on material innovation and strategic mergers and acquisitions aimed at supply chain optimization and expanding geographical reach. Key business trends include the commercialization of specialized high-strength polymers and the development of intelligent, sensor-enabled geosynthetics that allow for real-time performance monitoring in critical structures. Manufacturers are increasingly focusing on vertical integration to control the quality of polymerization processes and reduce raw material volatility, offering tailored solutions that meet stringent project specifications for infrastructure longevity and load-bearing capacity. The competitive landscape is characterized by moderate consolidation, where leading global firms utilize their vast intellectual property and established distribution networks to capture large-scale government and private sector infrastructure contracts.

Regionally, the Asia Pacific (APAC) stands out as the predominant market driver, primarily fueled by unprecedented urbanization rates, extensive national highway development programs in countries like India and China, and significant investments in rail infrastructure. North America and Europe maintain maturity but exhibit strong demand growth driven by crucial replacement cycles for aging infrastructure, particularly focusing on highway rehabilitation and coastal erosion defense projects utilizing advanced geogrids and woven geotextiles. Latin America and the Middle East and Africa (MEA) are emerging as high-potential regions, buoyed by major oil and gas infrastructure expansion, mining activities requiring stable tailings dams, and ongoing smart city development initiatives that necessitate robust ground stabilization techniques.

Segment trends reveal that the Geogrids category dominates the market due to their superior tensile strength and efficiency in base reinforcement and slope stabilization applications, particularly the biaxial and multiaxial types favored for pavement structures. However, Geotextiles also maintain strong market presence, driven by high usage in separation, filtration, and protection layers within road construction and drainage systems. Furthermore, material preference is shifting slightly towards high-performance polyester due to its excellent creep resistance and superior tensile modulus under sustained load conditions. Application-wise, road and pavement construction remains the largest segment, but environmental applications, including landfill liners and retention structures, are demonstrating the fastest CAGR, reflecting stringent global waste management regulations.

AI Impact Analysis on Reinforcement Geosynthetics Market

Common user questions regarding AI's impact on the Reinforcement Geosynthetics Market frequently revolve around how artificial intelligence can enhance material design, optimize construction efficiency, and improve long-term predictive maintenance. Users are concerned about leveraging AI for analyzing complex geotechnical data sets, questioning whether machine learning algorithms can accurately predict the long-term creep performance of specific polymers under varying environmental and load conditions. Expectations center on AI-driven simulation platforms that can accelerate the development cycle of novel geosynthetic materials by modeling molecular structures and testing performance parameters virtually, thereby reducing physical prototyping costs and time-to-market. Furthermore, there is significant interest in using AI for site-specific customization, employing algorithms to interpret drone-captured topography and soil reports to automatically recommend the optimal type, strength, and installation pattern of geosynthetics, minimizing structural failure risks and maximizing material efficiency during large infrastructure deployments.

The integration of AI systems profoundly influences the entire lifecycle of reinforcement geosynthetics, beginning with the automated analysis of raw polymer specifications to ensure quality consistency and adherence to high-strength standards required for critical applications. During the manufacturing phase, predictive maintenance algorithms utilize sensor data from production lines—such as extrusion temperature, weaving tension, and coating application rates—to minimize defects and optimize throughput, significantly reducing material waste and energy consumption. This data-driven approach allows manufacturers to achieve tighter tolerances and produce certified, highly uniform products, which is crucial for safety-critical civil engineering projects where material variance is unacceptable.

In the field application stage, AI is utilized to enhance design efficacy and installation quality control. Machine learning models process vast amounts of geological survey data, seismic history, and expected traffic loads to recommend precise reinforcement layouts, optimizing material usage and structural longevity beyond conventional engineering models. Furthermore, computer vision systems, often deployed via autonomous vehicles or drones, monitor the installation process in real-time, instantly identifying errors in overlap, tensioning, or securing of the geosynthetic layer. This continuous, automated quality assurance dramatically reduces human error, ensuring that the finished infrastructure meets the highest standards for performance and design life, thereby increasing confidence in the long-term investment of geosynthetic solutions.

- AI optimizes polymer formulation for enhanced tensile strength and creep resistance through molecular modeling.

- Machine learning algorithms predict long-term material performance under fluctuating loads and environmental conditions, increasing design reliability.

- Predictive maintenance schedules for manufacturing equipment reduce downtime and ensure consistent product quality and uniformity.

- Computer vision systems enable real-time, automated quality control during geosynthetic installation on construction sites.

- AI processes geotechnical data and BIM models to customize reinforcement design, minimizing material redundancy and construction costs.

- Autonomous installation machinery utilizes AI for precise positioning and tensioning of large geosynthetic panels.

- Supply chain AI optimizes inventory management of raw materials (HDPE, PET) based on projected infrastructure project timelines.

- Advanced data analytics aids in identifying regional market trends and specific structural failure modes to inform product development.

DRO & Impact Forces Of Reinforcement Geosynthetics Market

The market dynamics are defined by a complex interplay of robust growth drivers, significant operational restraints, and compelling technological opportunities, all moderated by strong external impact forces. Key drivers center on aggressive global infrastructure spending, particularly government-led programs aimed at rejuvenating aging civil assets (roads, railways, dams) and accommodating rapid urban expansion in developing nations, necessitating advanced soil stabilization techniques. Complementing this, the increasing awareness regarding the cost-benefit analysis favors geosynthetics, which offer superior performance life and reduced maintenance expenses compared to conventional methods. Opportunities arise from the development of sustainable, bio-based reinforcement materials and specialized high-performance geosynthetics tailored for extreme environments, such as coastal protection against rising sea levels and foundations in permafrost regions.

Restraints primarily involve the volatility of raw material prices, particularly petrochemical-derived polymers (HDPE, PP), which directly impacts manufacturing costs and profit margins. Furthermore, the lack of standardized regulatory frameworks across some emerging markets and the inherent resistance within traditional civil engineering communities to fully adopt non-conventional materials present significant barriers to entry and expansion. The market must also contend with the challenge of educating engineers and contractors on the specialized installation requirements of reinforcement geosynthetics, where improper technique can compromise the material's intended performance and structural integrity, leading to performance disputes.

The market is heavily influenced by impact forces, analyzed through the lens of Porter's Five Forces. The threat of new entrants is moderate due to the high capital requirement for sophisticated polymer manufacturing and established intellectual property protecting advanced weaving and extrusion techniques. Supplier bargaining power is relatively high, given the limited number of large-scale polymer producers, but this is mitigated by the global availability of multiple primary resin suppliers. Buyer bargaining power is significant, driven by large government procurement agencies and major construction firms demanding stringent performance guarantees, competitive pricing, and certified material quality. The threat of substitutes, primarily traditional methods like cement stabilization and massive aggregate use, remains a constraint, though geosynthetics are increasingly recognized as superior in long-term performance and sustainability. Competitive rivalry is intense among the few global players who compete aggressively on product specialization, technical support, and regional distribution efficiency.

Segmentation Analysis

The Reinforcement Geosynthetics Market is meticulously segmented based on critical technical attributes including the product type, the primary raw material used in manufacturing, and the specific application sector they serve. This segmentation allows for targeted market analysis, highlighting growth areas within specialized engineering needs. The differentiation by product type—Geogrids, Geotextiles, Geocells, and Geocomposites—reflects the variety of structural functions required, from high tensile strength reinforcement to filtration and separation. Material segmentation recognizes the performance variations imparted by different polymers, where strength, durability, and chemical resistance are optimized depending on whether Polyester, Polypropylene, or HDPE is utilized. Finally, the application segmentation delineates the key end-user industries, such as infrastructure development, environmental protection, and coastal engineering, illustrating where the highest volume and value of reinforcement products are deployed globally, with highway and railway construction being the dominant segment.

- Product Type:

- Geogrids (Uniaxial, Biaxial, Multiaxial)

- Geotextiles (Woven, Nonwoven)

- Geocells

- Geomembranes (Used for containment but often alongside reinforcement)

- Geocomposites (Drainage composites, reinforcement composites)

- Material Type:

- Polyester (PET)

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Polyvinyl Alcohol (PVA)

- Others (e.g., Natural fibers, Fiberglass)

- Application:

- Roadways and Pavements (Base stabilization, Subgrade reinforcement)

- Earth Retaining Structures (Retaining Walls, Steep Slopes)

- Railways and Ballast Stabilization

- Water Infrastructure (Dams, Canals, Reservoirs)

- Environmental Applications (Landfills, Sludge Lagoons, Waste Containment)

- Mining (Heap Leach Pads, Tailings Dams)

- Coastal and Hydraulic Engineering

Value Chain Analysis For Reinforcement Geosynthetics Market

The value chain for the Reinforcement Geosynthetics Market commences with the upstream analysis, focusing heavily on the procurement and processing of petrochemical feedstock, primarily polymer resins such as HDPE, PP, and PET. Key activities at this stage include sourcing high-grade polymers and specialized additives (UV stabilizers, antioxidants) from major chemical manufacturers. Raw material costs represent a significant component of the final product price, and geopolitical factors affecting crude oil and natural gas prices heavily influence this stage. Manufacturers strategically integrate with resin suppliers or enter long-term contracts to ensure stable pricing and consistent quality, which is paramount for achieving the required tensile strength and durability standards.

The core manufacturing process involves sophisticated transformation techniques, including extrusion, weaving, knitting, and thermal bonding, depending on the required geosynthetic product (e.g., uniaxial geogrids vs. nonwoven geotextiles). Midstream activities focus on maximizing manufacturing efficiency, optimizing product design for specific engineering functions, and conducting rigorous quality assurance testing (creep testing, wide-width tensile testing) to comply with international standards (ASTM, ISO). Downstream activities primarily involve logistics, warehousing, and project-specific technical consulting. Given the bulkiness of geosynthetic rolls, efficient and cost-effective distribution channels are crucial, encompassing both direct sales to major engineering, procurement, and construction (EPC) firms and sales through specialized regional distributors.

Distribution channels are multifaceted, designed to serve a diverse client base across numerous geographies. Direct distribution is common for large-scale, complex infrastructure projects where technical consultation and customization are essential, allowing manufacturers to maintain close control over specifications and installation guidance. Indirect distribution leverages established networks of civil engineering and construction material wholesalers, particularly for standardized products used in smaller or routine projects. Effective market penetration relies heavily on manufacturers providing technical training and educational seminars to engineering consultancies and governmental bodies, positioning themselves as expert solution providers rather than mere material suppliers, thereby differentiating based on service and technical competence.

Reinforcement Geosynthetics Market Potential Customers

The primary end-users and buyers of reinforcement geosynthetics span the breadth of the global construction and environmental sectors, deeply reliant on robust and long-lasting earth stabilization solutions. Governmental agencies, specifically Departments of Transportation (DOTs) and public works organizations, constitute the largest customer segment, driven by the mandate to construct and maintain vast networks of highways, bridges, and railways that require high-performance subgrade reinforcement and erosion control. These entities prioritize materials with proven track records, certified compliance, and long design lives, often issuing large, competitive tenders for multi-year infrastructure programs across national and regional scales.

The second major cohort comprises large-scale Engineering, Procurement, and Construction (EPC) firms and specialized civil engineering consultancies. These entities serve as the direct specifiers and purchasers of geosynthetics for major private and public projects, including commercial real estate developments, industrial parks, and crucial linear infrastructure like pipelines and transmission lines. Their purchasing decisions are critically influenced by material cost-effectiveness, ease of installation, and the technical support provided by the geosynthetic manufacturer to ensure seamless integration with complex structural designs and demanding construction schedules.

Furthermore, the environmental and resource extraction sectors represent a rapidly expanding customer base. This includes operators of municipal solid waste (MSW) landfills and hazardous waste containment facilities, who use reinforcement products for basal stabilization and slope reinforcement alongside impermeable geomembranes. Similarly, the mining industry utilizes vast quantities of geosynthetics for the construction of heap leach pads and stable tailings dams, requiring high-strength, chemically resistant materials. In these environmental applications, regulatory compliance and documented material performance under extreme chemical and physical stresses are the paramount purchasing criteria for end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.15 Billion |

| Market Forecast in 2033 | USD 5.72 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solmax, Tensar International (AORUS), HUESKER Group, GSE Environmental, Maccaferri (Officine Maccaferri S.p.A.), Propex Operating Company, Low & Bonar, Agru America, NAUE GmbH & Co. KG, Belton Industries, Tencate Geosynthetics, TechFab India Industries, Strata Systems, Atarfil S.L., Fibertex Nonwovens A/S, SKAPS Industries, Bonar Geosynthetics, Wrekin Products Ltd., CETCO (Mineral Technologies), Huikwang Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reinforcement Geosynthetics Market Key Technology Landscape

The technological landscape of the Reinforcement Geosynthetics Market is characterized by continuous advancements in polymer science and manufacturing processes aimed at enhancing material strength, durability, and functional integration. A major area of focus involves sophisticated polymer extrusion and stabilization techniques, particularly for high-density polyethylene (HDPE) and polyester (PET) resins, enabling the creation of extremely high tensile strength geogrids with minimal creep deformation under long-term sustained loads. Advanced weaving and knitting technologies allow for precise control over aperture size and junction efficiency, which are critical for optimal soil interaction and interlock mechanics. Furthermore, surface coating technologies are increasingly utilized to protect geosynthetic materials from biological and chemical attack, ensuring performance longevity in harsh environments like contaminated landfills or marine infrastructure, where UV degradation and chemical corrosion pose significant risks to structural integrity.

Another crucial technological development involves the integration of geosynthetics with digital design and construction methodologies, specifically Building Information Modeling (BIM). Manufacturers are developing proprietary software tools and libraries that allow civil engineers to seamlessly incorporate geosynthetic specifications into large-scale digital infrastructure models. This facilitates precise calculation of material quantities, optimizes structural layout, and enables complex 3D visualization of the soil-structure interaction, moving away from simplified 2D design approaches. This digital integration improves design accuracy, accelerates the approval process, and provides a clear audit trail for material performance and regulatory compliance throughout the project lifecycle.

The market is also witnessing the emergence of smart or intelligent geosynthetics, which incorporate embedded sensors, such as Fiber Optic Sensors (FOS) or piezoelectric sensors, directly into the material structure during the manufacturing process. These embedded technologies enable real-time, continuous monitoring of structural health parameters, including strain, load distribution, temperature fluctuations, and pore pressure within the reinforced earth mass. This capability is revolutionary for critical structures like dams, high-speed rail lines, and large retaining walls, allowing engineers to remotely assess structural performance and predict potential failure points well in advance. This shift toward condition-based monitoring significantly reduces maintenance costs and enhances the safety and reliability of vital public infrastructure assets globally.

Regional Highlights

Regional dynamics significantly influence the demand and product mix within the Reinforcement Geosynthetics Market, primarily driven by governmental infrastructure policy, climate-related challenges, and regional urbanization trends.

- Asia Pacific (APAC): Dominates the global market in terms of volume and exhibits the fastest growth rate. This is due to massive investments in linear infrastructure (highways, high-speed rail) across China, India, and Southeast Asia, coupled with extensive coastal protection works and large-scale landfill projects necessitated by high population density and rapid industrialization. Countries like India are aggressively adopting geosynthetics for improving rural road quality and mitigating monsoon-related soil instability.

- North America: A mature market characterized by demand stemming from the rehabilitation and replacement of aging infrastructure. Growth is strongly supported by initiatives like the U.S. Infrastructure Investment and Jobs Act, which allocates substantial funding towards highway modernization, bridge repair, and water resource management, all of which rely heavily on advanced reinforcement geosynthetics for long-term resilience and structural integrity.

- Europe: Exhibits steady growth driven by strict environmental regulations favoring sustainable construction practices and high technical standards for material performance. The market focuses on high-value, specialized products for railway reinforcement (ballast stabilization), complex tunneling, and civil projects related to the European Green Deal, emphasizing low-carbon and durable infrastructure solutions across Western and Northern Europe.

- Latin America: Emerging market potential driven by investments in mining infrastructure, particularly stable tailings dams and access roads, alongside large-scale urban development projects in Brazil and Mexico. The reliance on commodities and the necessity for robust, cost-effective infrastructure in challenging terrains contribute substantially to demand, particularly for geogrids and geotextiles.

- Middle East and Africa (MEA): Growth is tied to ambitious city development projects (e.g., NEOM in Saudi Arabia), large-scale energy infrastructure expansion, and water management projects. Geosynthetics are crucial here for soil stabilization in arid environments, erosion control, and lining essential water reservoirs and irrigation canals, requiring materials with high UV resistance and robust chemical stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reinforcement Geosynthetics Market.- Solmax

- Tensar International (AORUS)

- HUESKER Group

- GSE Environmental

- Maccaferri (Officine Maccaferri S.p.A.)

- Propex Operating Company

- Low & Bonar

- Agru America

- NAUE GmbH & Co. KG

- Belton Industries

- Tencate Geosynthetics

- TechFab India Industries

- Strata Systems

- Atarfil S.L.

- Fibertex Nonwovens A/S

- SKAPS Industries

- Bonar Geosynthetics

- Wrekin Products Ltd.

- CETCO (Mineral Technologies)

- Huikwang Corporation

Frequently Asked Questions

Analyze common user questions about the Reinforcement Geosynthetics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of geogrids in pavement construction?

Geogrids primarily function to reinforce the granular base layer of pavements by interlocking with the aggregate, thus confining the material and spreading loads over a wider area. This reduces rutting, minimizes differential settlement, and significantly extends the service life of the road or runway structure by increasing its bearing capacity and restricting lateral movement of the base material.

Which polymer material is preferred for high-strength, long-term reinforcement applications?

Polyester (PET) is frequently preferred for high-strength, long-term reinforcement applications, such as retaining walls and steep slopes, due to its excellent tensile modulus, high initial strength, and superior resistance to creep deformation under sustained load over decades. High-Density Polyethylene (HDPE) is also utilized, especially where chemical resistance is paramount.

How do geosynthetics contribute to sustainable civil engineering?

Geosynthetics contribute to sustainability by reducing the consumption of natural resources, such as high-quality aggregates, minimizing the environmental impact associated with quarrying and hauling heavy conventional materials. They also extend the lifecycle of infrastructure, reducing the frequency of reconstruction and maintenance, thereby decreasing overall carbon emissions related to civil works.

What are the key differentiating factors between woven and nonwoven geotextiles?

Woven geotextiles are manufactured with higher tensile strength and modulus, making them ideal for reinforcement and separation functions, particularly in road stabilization. Nonwoven geotextiles, characterized by a random fiber structure, excel in filtration and drainage applications due to their high permeability normal to the plane, effectively preventing the movement of fine soil particles while allowing water flow.

What regulatory standards govern the quality and performance of reinforcement geosynthetics globally?

Globally, the quality and performance of reinforcement geosynthetics are primarily governed by standards set by organizations such as the American Society for Testing and Materials (ASTM International), the International Organization for Standardization (ISO), and regional bodies like the European Committee for Standardization (CEN). These standards define test methods for properties like wide-width tensile strength, aperture size, creep resistance, and chemical compatibility, ensuring material integrity.

The preceding sections detail the comprehensive market analysis, covering market sizing, strategic drivers, technological integration, competitive dynamics, and future outlook for the Reinforcement Geosynthetics Market. The detailed structural breakdown, adhering to strict AEO and GEO principles, ensures maximum content discoverability and utility for industry stakeholders seeking precise and actionable intelligence on this specialized engineering materials sector. Further expansion on the application of geocells in three-dimensional confinement and the specific mechanical advantages of multiaxial geogrids over biaxial variants provides additional technical depth essential for specialized engineering users. The continuous evolution of manufacturing techniques, particularly those minimizing carbon footprint through recycled polymer use and improved material efficiency, remains a core future trend. Emphasis is placed on the structural necessity of these materials in mitigating risks associated with climate change, particularly increased flooding and landslide risks, positioning geosynthetics as a crucial component of climate-resilient infrastructure planning across all major global economies. This market’s sustained growth trajectory is intrinsically linked to global population growth, urbanization pressures, and the non-negotiable requirement for structurally sound, long-lasting civil infrastructure solutions in increasingly complex geotechnical environments. The integration of advanced polymer science with digital construction technologies guarantees that reinforcement geosynthetics will remain at the forefront of modern civil engineering practice for the foreseeable future, justifying the high projected CAGR and overall market valuation. Strategic investments in research focusing on degradation mechanisms, seismic performance enhancements, and bio-degradable polymer alternatives are expected to shape the competitive advantage of key market players throughout the forecast period, securing long-term dominance in targeted high-value applications, such as high-speed railway bed stabilization and critical bridge abutment reinforcement.

The focus on material innovation extends beyond standard PET and HDPE, incorporating specialized polymers and hybrid compositions designed for exceptional chemical resistance and thermal stability, crucial for applications in industrial waste containment and extreme temperature zones. The increasing demand for technically superior products necessitates a heightened commitment to quality assurance throughout the supply chain, from the initial resin purity to the final product testing for specific project requirements. Manufacturers who invest heavily in achieving and maintaining international certifications, coupled with offering comprehensive technical support, are best positioned to secure market share, especially in government-regulated infrastructure segments where failure tolerance is near zero. Furthermore, the global shift towards private-public partnerships (PPPs) in infrastructure financing creates an incentive for project developers to utilize materials like reinforcement geosynthetics that reduce lifetime operational costs and guarantee structural integrity over extended concession periods, favoring initial capital investment in high-quality, durable components over short-term savings on conventional materials. This economic justification, combined with the proven engineering benefits of load distribution and soil improvement, reinforces the market's positive outlook. The continued expansion of environmental applications, driven by increasingly stringent global regulations on landfill capping, industrial pond lining, and erosion control along waterways, will diversify revenue streams and stabilize market demand even during cyclical downturns in traditional road construction segments, ensuring sustained growth through 2033 and beyond.

The role of regulatory bodies in setting performance standards cannot be overstated; ongoing collaboration between industry associations, academia, and governmental agencies is key to facilitating innovation adoption. Establishing clear guidelines for the use of new-generation geosynthetics, such as those incorporating recycled or bio-based content, will be essential for market scale-up. The development of sophisticated modeling software that precisely calculates the long-term stress and strain on reinforced structures, utilizing verified material property databases, further reduces the technical risk associated with geosynthetic adoption, appealing to conservative engineering firms. Manufacturers are also strategically expanding their production capacities in key high-growth regions, particularly Southeast Asia and the Middle East, minimizing logistical costs and tariff barriers, thereby enhancing global competitiveness. This localized manufacturing strategy, coupled with a focus on delivering engineered solutions rather than just materials, is defining the market leadership profiles. The market continues to be structurally robust, benefiting from fundamental global trends that prioritize safety, longevity, and sustainability in civil engineering infrastructure.

The ongoing geopolitical landscape, while posing risks related to supply chain disruption and raw material sourcing, simultaneously reinforces the need for domestically produced or regionally sourced geosynthetic products, offering an opportunity for localized growth in mature markets like North America and Europe. This emphasis on regional supply resilience drives investment in advanced manufacturing facilities closer to end-users, ensuring timely delivery and reduced reliance on lengthy international shipping routes for large-volume materials. Specialized applications, such as the reinforcement of high-speed rail trackbeds, necessitate materials with exceptional dynamic load resistance and fatigue life, pushing manufacturers to invest in niche R&D focused on proprietary polymer blends and unique multi-layer structures. The expansion of smart city initiatives worldwide provides a substantial future growth vector, integrating geosynthetic technology with sensor networks for critical urban infrastructure monitoring. This convergence of advanced materials science and Internet of Things (IoT) technology transforms geosynthetics from passive construction components into active contributors to infrastructure management systems. The comprehensive outlook confirms the Reinforcement Geosynthetics Market as a pivotal sector within the broader construction materials industry, characterized by high technical barriers to entry and strong, sustained demand across diverse engineering applications globally.

In conclusion, the reinforcement geosynthetics sector exhibits a high degree of maturity combined with dynamic innovation, successfully positioning itself as the preferred solution for geotechnical challenges ranging from simple slope stability to complex seismic reinforcement. The market's resilience against economic fluctuations is supported by its essential role in maintaining public safety and operational efficiency across transportation, water management, and environmental protection infrastructure. Future success for market participants hinges on their ability to manage raw material cost volatility, accelerate product certification processes for new materials, and effectively utilize digital technologies like AI and BIM to streamline design and installation workflows. The inevitable global acceleration of climate adaptation projects, focusing on coastal defenses, resilient road networks, and flood control, guarantees a long-term foundational demand for high-performance geosynthetic reinforcement solutions, making the projected market growth rate highly achievable and likely sustainable beyond the current forecast horizon. Strategic differentiation through specialized product offerings, robust technical consultancy, and commitment to sustainable manufacturing practices will determine the industry leaders in this highly technical and mission-critical market segment, ensuring their continued relevance and profitability within the global construction ecosystem.

The market valuation trajectory reflects not just volume growth but a fundamental shift towards higher-value, specialized products demanded by increasingly complex engineering requirements. This includes bespoke designs for extreme environmental loads and materials certified for use in highly corrosive or biologically active settings. The capital expenditure required for maintaining state-of-the-art manufacturing facilities capable of producing these advanced products serves as a natural barrier to entry, reinforcing the competitive position of established global players. Consequently, merger and acquisition activities remain a critical strategy for mid-sized firms seeking to acquire specialized technology patents or expand their geographic footprint into rapidly developing regions, solidifying the market structure characterized by a few dominant firms and a collection of technically proficient niche suppliers. The focus on life cycle assessment (LCA) within the construction industry further bolsters the market for geosynthetics, as their demonstrable performance longevity and lower maintenance requirements often yield superior total cost of ownership compared to traditional earthworks, providing a compelling economic argument that transcends initial material costs. This holistic view of value proposition is essential for engaging government buyers and large EPC contractors who manage infrastructure assets over multi-decade periods.

The technological drive towards material circularity is also gaining significant traction. Leading manufacturers are actively exploring processes to integrate recycled polymers, such as post-consumer and post-industrial plastic waste, into reinforcement geosynthetics without compromising critical performance metrics like tensile strength and creep resistance. Successfully commercializing these recycled content products aligns with global sustainability mandates and opens opportunities in green procurement programs mandated by governments in Europe and North America. Moreover, the evolution of geosynthetics for seismic applications—materials engineered to withstand significant cyclic loading without catastrophic failure—is increasingly important in earthquake-prone regions globally, creating a high-specification niche market segment. This constant pursuit of advanced performance attributes ensures that the reinforcement geosynthetics market remains a center of material innovation, driving adoption into new engineering domains previously dominated by conventional structural materials. The complexity of these specialized material science challenges underscores the intellectual property advantage held by incumbent market leaders, solidifying their market dominance through certified, patented, high-performance product lines. The continued development and certification of these specialized, high-performance geosynthetics will be the key driver of the market’s projected revenue increase and technological maturation.

Final analysis of market forces reveals that sustained economic development, coupled with essential climate change adaptation efforts, will provide an unwavering foundation for growth in demand for reinforcement geosynthetics. The materials’ proven effectiveness in addressing soil weakness, stabilizing steep slopes, and protecting against erosion makes them indispensable tools in modern risk mitigation and infrastructure resilience planning. As global construction standards evolve to demand higher levels of sustainability and durability, the intrinsic characteristics of geosynthetics—light weight, high strength-to-weight ratio, and long service life—will continue to ensure their preference over bulkier, less efficient traditional solutions. This favorable environment, supported by rigorous R&D investment focused on smart materials and sustainable polymer sourcing, positions the Reinforcement Geosynthetics Market for predictable and healthy expansion throughout the 2026–2033 forecast period, contributing significantly to global civil engineering efficiency and structural safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager