Removable Boat Stand Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441131 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Removable Boat Stand Market Size

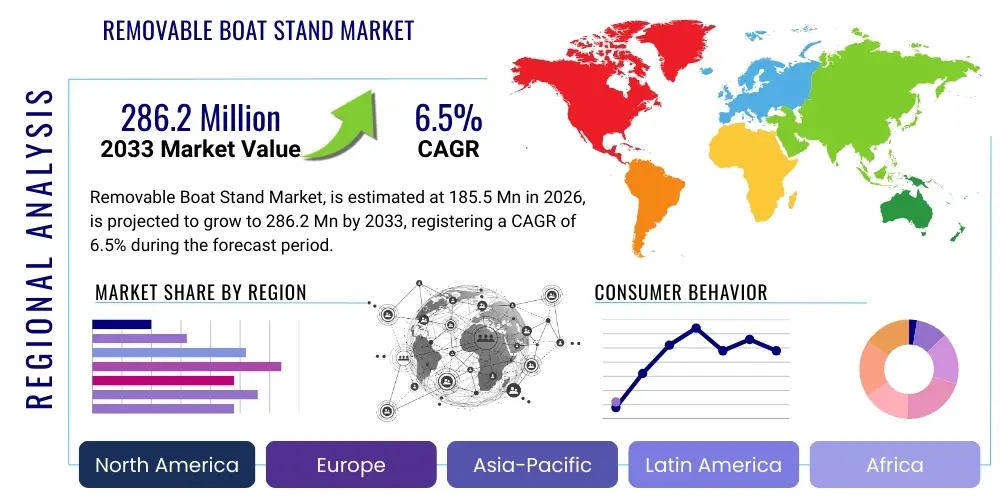

The Removable Boat Stand Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $286.2 Million by the end of the forecast period in 2033.

Removable Boat Stand Market introduction

The Removable Boat Stand Market encompasses specialized equipment designed for the secure and temporary storage, maintenance, and display of marine vessels, ranging from small dinghies and jet skis to larger yachts undergoing shipyard repairs. These stands are distinct from permanent boat cradles due to their portability, modular design, and ease of assembly and disassembly. The fundamental product is engineered to offer superior stability and weight distribution, preventing hull damage during periods when the vessel is out of the water, a critical factor for fiberglass and composite hulls. Key applications include winter storage preparation, routine bottom cleaning, hull painting, engine maintenance requiring dry dock access, and transportation facilitation. The market primarily serves marine service providers, boat owners, marinas, and repair facilities requiring flexible dry-docking solutions that optimize space usage and operational efficiency.

The core benefits driving adoption revolve around operational flexibility and cost efficiency. Unlike fixed cradles, removable stands allow facilities, particularly smaller marinas or private owners, to adapt their storage layout based on seasonal demand or specific repair needs. Their modular nature minimizes storage footprint when not in use, a significant advantage in high-value real estate areas surrounding coastal facilities. Furthermore, modern removable stands often incorporate adjustable components, such as height and width modifications, allowing them to accommodate a wide variety of hull shapes—keeled sailboats, pontoon boats, and deep-V powerboats—with a single set of equipment, thereby maximizing utility and reducing inventory requirements for service providers. This adaptability is increasingly favored by professional boatyards seeking efficient turnaround times for haul-out services.

Major driving factors include the steady global expansion of recreational boating and yacht ownership, particularly in emerging economies and established marine markets like North America and Europe. Increased awareness among boat owners regarding the necessity of proper winterization and maintenance procedures to preserve vessel value and integrity fuels demand for secure support systems. Regulatory changes requiring higher safety standards in boat storage and repair facilities also prompt investments in certified, high-load-bearing removable stands. Technological advancements in material science, leading to lighter yet stronger aluminum and composite stands, further enhances their portability and ease of handling, accelerating replacement cycles for older, heavier steel equipment. The growth of boat rental and shared ownership schemes also contributes, as these commercial entities require frequent haul-outs for rigorous maintenance schedules.

Removable Boat Stand Market Executive Summary

The Removable Boat Stand Market is characterized by robust demand driven by maritime infrastructure modernization and an expanding global recreational fleet. Business trends highlight a strong shift toward high-tensile, corrosion-resistant materials, specifically marine-grade aluminum and engineered plastics, replacing traditional galvanized steel to improve longevity and reduce labor costs associated with manual handling. Key manufacturers are focusing on modular systems that integrate seamlessly with lifting equipment (travel lifts, cranes), prioritizing compliance with international safety standards such as ISO 14001 for environmental management in shipyard operations. Strategic mergers and acquisitions among smaller, niche manufacturers specializing in specific hull types (e.g., catamaran stands) are observed, aiming to consolidate expertise and achieve economies of scale in distribution across global maritime hubs.

Regional trends indicate North America and Europe as mature markets demanding premium, highly adjustable, and specialized boat stands, often integrated with smart monitoring systems for load bearing. The APAC region, particularly countries like China, South Korea, and emerging coastal tourism markets in Southeast Asia, is exhibiting the highest growth rate, fueled by rapid urbanization, increased disposable income supporting recreational purchases, and significant governmental investment in developing new marinas and coastal infrastructure. Latin America and MEA show nascent potential, with demand concentrated around major port cities and tourism centers where professional marine maintenance services are expanding, favoring cost-effective, durable steel stands initially, before transitioning to lighter alternatives.

Segment trends demonstrate strong growth in the specialized stand category tailored for unique hull geometries, such as stands optimized for multihulls (catamarans and trimarans) and vessels utilizing hydrofoils, requiring precise points of support. The heavy-duty segment (designed for vessels over 50 feet) is experiencing increased demand due to the global trend of purchasing larger recreational yachts. In terms of end-use, the commercial repair yard segment maintains market dominance, but the direct-to-consumer (D2C) segment, catering to individual boat owners needing storage solutions for smaller to medium-sized vessels on private property, is rapidly gaining traction, driven by e-commerce penetration and accessible modular designs.

AI Impact Analysis on Removable Boat Stand Market

Users frequently inquire about how AI and automation can revolutionize the traditionally manual processes associated with dry-docking and boat stand management. Common questions focus on predictive maintenance of stand components, optimizing shipyard logistics (e.g., determining the most space-efficient arrangement of vessels using stands), and the potential for autonomous stand deployment and adjustment. Concerns often revolve around the high initial investment cost required to integrate sensors and advanced software into standard, rugged marine equipment. Expectations include improved safety protocols by eliminating human error in weight calculation and load distribution, enhancing the lifespan of both the stand and the supported vessel, and drastically improving the efficiency of marina operations during peak season haul-outs.

The primary influence of AI in the Removable Boat Stand Market lies in logistics optimization and structural integrity monitoring. Advanced machine learning algorithms can analyze real-time data from integrated load cells and sensors within the stand system to predict stress points, potential fatigue in materials, or improper vessel placement. This predictive capability allows maintenance teams to preemptively service stands, reducing the risk of catastrophic failure during storage. Furthermore, AI-driven spatial planning software utilizes digital twin models of the shipyard layout to automatically calculate the optimal placement and configuration of different sized stands for various vessels, maximizing storage density without compromising safety clearance or accessibility for service teams.

While the physical stand structure remains low-tech, the management infrastructure surrounding it is ripe for digitalization. Generative AI tools are being used in the design phase to simulate extreme environmental conditions (e.g., high winds, seismic activity in dry storage) and optimize stand geometries for maximum stability using minimal material, leading to lighter, more cost-effective products. Integration with marina management systems (MMS) allows for automated inventory tracking of stand components, scheduling of haul-out services based on stand availability, and providing automated, certified load distribution reports to regulatory bodies and insurance providers, enhancing transparency and reducing administrative overhead associated with traditional manual record-keeping.

- Enhanced predictive maintenance scheduling for stand hardware.

- Automated load distribution calculation and real-time stability monitoring.

- Optimization of shipyard layout and storage density using spatial AI.

- Generative design for lightweight and high-strength modular stand components.

- Seamless integration with Marina Management Systems (MMS) for operational efficiency.

DRO & Impact Forces Of Removable Boat Stand Market

The market dynamic is heavily influenced by a balanced interplay of infrastructural needs, regulatory pressures, and material innovation. Key drivers include the mandatory requirement for dry-docking large vessels, the expansion of global yacht charter services demanding rigorous, frequent maintenance, and continuous improvements in stand ergonomics making setup faster and safer for labor. Restraints primarily involve the high upfront cost of premium, certified stand systems, particularly those made from specialized marine alloys, and the significant logistical challenge of storing non-collapsible stands when not in use. Opportunities emerge from developing specialized solutions for niche markets like superyacht refit yards and harnessing renewable composite materials. Impact forces show that while global economic stability affects discretionary recreational purchases, regulatory mandates regarding safe haul-out procedures provide consistent underlying demand for certified equipment.

Drivers: A major driver is the increasing complexity and size of modern recreational vessels, which necessitate specialized, precisely engineered stands to support vulnerable areas like propulsion systems (e.g., pod drives) and sensitive hull materials (e.g., carbon fiber). The growth in global maritime tourism directly correlates with the need for enhanced repair and maintenance facilities worldwide, all requiring robust and reliable haul-out support equipment. Furthermore, advancements in health and safety regulations, requiring professional marinas to minimize manual lifting and ensure proper weight distribution to prevent workplace accidents and structural damage, mandates investment in certified, high-quality removable stands over improvised or outdated wooden cradles.

Restraints: The most significant restraint is the initial capital expenditure associated with high-capacity, modular stand systems, especially for smaller, independent marinas or individual boat owners. The perceived durability of older, heavier steel stands often delays replacement cycles, despite the operational inefficiencies and corrosion risks they present. Additionally, the fragmented nature of the global market, with numerous regional manufacturers adhering to varying local standards, can complicate international procurement and standardization efforts for global marine service chains. Supply chain volatility affecting the price and availability of key materials like high-grade aluminum and specialized coatings also poses a continuous challenge.

Opportunities: Opportunities abound in the development of highly adaptable, universally compatible stand systems capable of supporting diverse hull forms without extensive modification, streamlining inventory management. The rise of hybrid and electric propulsion vessels creates a niche demand for stands designed to handle novel weight distributions inherent in large battery banks. Furthermore, the concept of "Stand-as-a-Service," where manufacturers offer lease or rental agreements for high-capacity stands to temporary refit projects or seasonal marinas, represents a strong untapped business model. Expanding into emerging coastal markets where marine infrastructure development is subsidized by government initiatives offers long-term growth potential.

Segmentation Analysis

The Removable Boat Stand Market is meticulously segmented based on the material utilized in construction, the capacity or size of the vessel supported, the specific design type, and the primary end-use application. This segmentation aids manufacturers in tailoring product specifications to meet the rigorous demands of various end-users, ranging from small-scale private users to large, integrated shipyard operations. The differentiation by material—Steel, Aluminum, or Composite—is critical, as it directly impacts product cost, portability, resistance to corrosion in salt-water environments, and overall load-bearing capability, with aluminum and composites gaining prominence for their lightweight strength and enhanced durability.

Segmentation by vessel size (e.g., Small, Medium, Large, Superyacht) ensures that the stands are engineered with appropriate safety factors and adjustment ranges specific to the hydrodynamic profile and weight distribution typical of those size categories. Design type segmentation is vital, separating standard keel stands from specialized supports required for specific structures like stern drives, pontoons, or fixed keels, each demanding a unique structural configuration to safely distribute forces across the hull. The commercial end-use segment, encompassing professional marinas and repair yards, dominates the market share due to the high volume of stand purchases and the necessity for robust, industry-certified equipment.

The market structure reflects a tendency toward specialization, where certain manufacturers focus exclusively on high-capacity yacht stands while others prioritize volume sales of multi-purpose, medium-sized stands for mass-market powerboats. This structure ensures that regulatory compliance—a core requirement, especially in North American and European markets—is met across all product ranges. The ongoing trend is towards modularity within these segments, allowing users to combine components (e.g., varying lengths of base rails with different heights of upright supports) to create bespoke setups, further driving flexibility and minimizing operational inventory costs across diverse fleets.

- By Material:

- Marine-Grade Steel (Galvanized or Powder-Coated)

- High-Tensile Aluminum Alloys

- Composite/Engineered Plastics

- By Capacity/Vessel Size:

- Small (Vessels under 25 feet)

- Medium (Vessels 25–50 feet)

- Large (Vessels 50–100 feet)

- Superyacht/Mega Yacht (Vessels over 100 feet)

- By Design Type:

- Standard Keel Stands (Adjustable and Fixed)

- Hull Stands/Side Supports

- Specialized Stands (e.g., Catamaran, Pontoon, Trailerable)

- By End-Use Application:

- Commercial Marinas and Shipyards

- Independent Boat Repair and Service Facilities

- Private/Individual Boat Owners

- Government and Military Vessels

Value Chain Analysis For Removable Boat Stand Market

The value chain for the Removable Boat Stand Market begins with the upstream sourcing of raw materials, primarily high-grade marine steel (often galvanized or stainless), specialized aluminum alloys (like 6061 or 5083 series for corrosion resistance), and, increasingly, advanced engineering composites and plastics. Quality control at this stage is paramount, as the load-bearing capacity and longevity of the final product depend heavily on the material integrity and certified tensile strength. Key upstream activities involve smelting, rolling, and extruding processes, often requiring specialized suppliers capable of providing marine-certified materials resistant to continuous saltwater exposure and UV degradation. Relationships between manufacturers and metal suppliers are critical, often involving long-term contracts to stabilize input costs and ensure material specifications meet stringent safety standards.

The midstream involves design, manufacturing, and assembly. Manufacturers invest heavily in Computer-Aided Design (CAD) and Finite Element Analysis (FEA) to simulate load bearing and optimize structural design, adhering to ISO and local maritime authority standards. Fabrication processes include precision cutting, welding (especially for aluminum and steel components), specialized corrosion protection treatments (like hot-dip galvanizing or advanced powder coating), and assembly of modular parts, including jacks, threaded rods, and pivot heads. Efficiency in the midstream production is focused on minimizing fabrication waste and implementing lean manufacturing techniques to handle the variety of product lines required for different vessel types, from heavy keel stands to lightweight side supports.

Downstream activities center on distribution, sales, installation support, and after-sales service. Distribution channels are bifurcated into direct sales to large shipyards and commercial marinas, and indirect sales through specialized marine equipment wholesalers, distributors, and a growing segment via e-commerce platforms targeting individual boat owners and smaller facilities. Direct sales typically involve customized solutions and bulk orders, while indirect channels provide wider geographical reach and streamlined logistics for standardized products. Installation and training services are crucial, as improper stand setup is a leading cause of failure; thus, manufacturers often provide detailed operational manuals and professional setup guidance, contributing significantly to customer satisfaction and long-term brand loyalty.

- Upstream Analysis: Raw material procurement (marine-grade metals, coatings, plastics), quality assurance testing, and supply chain logistics for specialized alloys.

- Midstream Analysis: Product design (CAD/FEA), fabrication (welding, machining), corrosion protection application, modular component assembly, and rigorous testing for capacity certification.

- Downstream Analysis: Distribution via specialized marine wholesalers, direct sales to large commercial yards, e-commerce penetration, post-sale maintenance, and technical training.

- Distribution Channel: A mix of specialized B2B distributors (indirect) and manufacturer sales teams engaging directly with major marine infrastructure projects (direct).

Removable Boat Stand Market Potential Customers

The primary customer base for Removable Boat Stands is segmented into professional commercial users requiring high-volume, certified equipment and the growing population of individual boat owners seeking reliable, space-saving storage solutions. Commercial Marinas and Shipyards represent the largest purchasing segment, as they require extensive inventories of varying stand capacities to handle seasonal haul-outs, winter storage preparation, and continuous repair work for hundreds of vessels. These professional entities prioritize safety certifications, durability, ease of adjustment (reducing labor time), and compatibility with their existing infrastructure, such as travel lifts and mobile cranes. Their purchasing decisions are highly centralized and influenced by regulatory compliance requirements and long-term cost of ownership, favoring robust, high-capacity aluminum or heavily galvanized steel systems designed for continuous heavy use.

Independent Boat Repair and Service Facilities constitute the secondary commercial segment. These customers often require greater versatility due to handling a wider, less predictable range of vessel types and sizes, including historic vessels or specialized racing yachts. They seek modular kits that offer maximum adaptability and minimal footprint storage when not supporting a boat. Their purchasing power is generally lower than large shipyards, leading them to balance investment cost with operational necessity, sometimes preferring durable steel stands over premium aluminum, provided the safety standards are met. This segment is highly responsive to specialized product offerings, such as stands designed specifically for lifting engines or servicing complicated stern assemblies.

The third major customer group, Private/Individual Boat Owners, is a rapidly expanding segment driven by DIY maintenance trends and the increasing cost of professional storage. These customers typically own smaller to medium-sized powerboats or sailboats and seek stands for long-term storage on their private property or community storage lots. Their primary needs focus on ease of assembly, affordability, safety, and compact storage when disassembled. They are the target audience for lightweight, sometimes composite-based, highly portable stand systems sold primarily through retail channels and e-commerce platforms, requiring simple, unambiguous instruction manuals and minimal specialized tooling for setup. Growth in this segment is strongly tied to the general growth of recreational vessel ownership globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $286.2 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HydroHoist International, Inc., Brownell Boat Stands, Marina Accessories Inc., Marine Travelift, Inc., Golden Boat Lifts, Padebco Custom Boat Stands, Yacht Cradle, SeaWorld Marine, Hi-Tide Boat Lifts, ShoreMaster, EZ Dock, Taylor Made Products, Sunstream Boat Lifts, Safe-T-Stand, Shoreline Marine |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Removable Boat Stand Market Key Technology Landscape

The technological landscape of the Removable Boat Stand Market is primarily centered around advanced material science and precision engineering aimed at enhancing structural integrity, reducing weight, and maximizing adjustability. A significant technological shift involves the transition from traditional heavy steel fabrication to utilization of high-strength, marine-grade aluminum alloys, which offers superior corrosion resistance and significantly lighter components, reducing the labor burden during setup and transport. Manufacturers are adopting advanced welding techniques, such as friction stir welding, to ensure the joints in aluminum stands maintain peak structural load capacity. Furthermore, protective coatings have evolved beyond simple galvanization to include multi-layer epoxy and ceramic-based powder coatings that drastically extend the operational life of steel components in harsh marine environments, thus improving the return on investment for commercial users.

Innovation in modularity and quick-release mechanisms is also a crucial technological advancement. Modern boat stands increasingly feature telescopic legs and highly precise, self-locking screw jack systems that allow for minute adjustments in height and pitch, essential for safely supporting irregularly shaped hulls or vessels with complex fin keels. The integration of patented, non-slip rubber or polymer head pads is essential, using specialized material compositions designed to grip various hull materials (including delicate gelcoats and anti-fouling paints) without causing abrasion or concentrated stress points. This focus on interface technology ensures the stand transfers the vessel's weight evenly across the hull structure, critical for warranty compliance.

The emerging technological frontier involves incorporating sensor technology and digitalization into the stand ecosystem. Although not inherently part of the stand itself, the integration of load cells within the stand feet provides real-time data on weight distribution, allowing operators to verify safe and balanced placement via a mobile application or central marina management system. This fusion of rugged mechanical engineering with digital monitoring enhances safety compliance and optimizes the utilization of dry storage space. Furthermore, sophisticated manufacturing techniques, including robotic welding and automated assembly lines, ensure consistent production quality across all components, a necessity for maintaining load capacity certifications globally.

Regional Highlights

- North America: This region, comprising the United States and Canada, represents a mature and dominant market for Removable Boat Stands, characterized by high disposable income fueling recreational vessel ownership and a long coastline necessitating extensive marine service infrastructure. Demand here is focused on premium products, specifically lightweight aluminum stands and highly specialized support systems for large yachts (over 80 feet). Stringent insurance and safety regulations mandate the use of certified, tested equipment, driving higher average selling prices. The Great Lakes region and the coastal areas of Florida and California are the largest consumption centers, exhibiting a high adoption rate of technologically advanced, sensor-ready stand systems.

- Europe: Europe maintains a strong presence, particularly in Mediterranean countries (e.g., Italy, France, Spain) and Northern European nations (e.g., UK, Netherlands) known for their historical reliance on maritime transport and highly developed leisure boating cultures. The European market prioritizes environmentally conscious materials and compliance with CE regulations. There is strong demand for specialized stands catering to traditional sailboat designs and superyacht refit facilities. Germany and the Netherlands are key manufacturing centers, focusing on high-precision engineering and corrosion-resistant solutions for harsh coastal environments.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by burgeoning middle classes in China, Australia, and Southeast Asian nations investing heavily in coastal infrastructure and recreational marine tourism. While the initial market favored cost-effective steel stands, there is a swift transition towards higher-quality, durable aluminum systems as economic stability improves and safety standards converge towards international norms. Government initiatives to promote marine leisure and develop new marinas in areas like Vietnam and Thailand are fueling exponential market expansion, particularly in the medium-capacity segment (25–50 feet).

- Latin America (LATAM): The market in LATAM is localized and growing, focused primarily around key marine hubs in Brazil, Mexico, and the Caribbean. Demand is generally driven by tourism-related maintenance needs and is highly price-sensitive. Basic, robust, galvanized steel stands form the foundation of the market, though increasing foreign investment in marina development is slowly introducing demand for more sophisticated, high-capacity equipment suitable for international charter vessels and private luxury yachts visiting the region.

- Middle East and Africa (MEA): This region is characterized by high-value, niche demand centered in the UAE (Dubai, Abu Dhabi) and Qatar, driven by the superyacht market and luxury marina developments. The MEA market requires bespoke, high-capacity stands capable of supporting mega yachts, emphasizing rapid deployment and retrieval. Africa's demand is limited to coastal repair facilities and port infrastructure, often relying on imported, durable, and low-maintenance stand systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Removable Boat Stand Market.- Brownell Boat Stands

- HydroHoist International, Inc.

- Marine Travelift, Inc.

- Golden Boat Lifts

- Padebco Custom Boat Stands

- Yacht Cradle

- Marina Accessories Inc.

- SeaWorld Marine

- ShoreMaster

- Hi-Tide Boat Lifts

- EZ Dock

- Taylor Made Products

- Sunstream Boat Lifts

- Safe-T-Stand

- Shoreline Marine

- Trafalgar Group

- Cradlepoint Marine Systems

- United Marine Products

- Marine Jacks

- Advanced Marine Engineering

Frequently Asked Questions

Analyze common user questions about the Removable Boat Stand market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used for removable boat stands and why?

The primary materials are marine-grade steel (for durability and cost-effectiveness) and high-tensile aluminum alloys (for superior corrosion resistance and reduced weight). Aluminum is increasingly preferred in professional settings due to lower labor handling costs and longevity in saltwater environments.

How do I determine the correct capacity and number of removable stands needed for my vessel?

The required capacity depends on the vessel's displacement (total weight) and hull shape. Experts advise using manufacturer specifications, often requiring 6 to 10 stands for typical sailboats or powerboats, ensuring the total stand capacity exceeds the vessel's weight by a substantial safety margin, typically 1.5x the weight.

Are aluminum boat stands superior to steel stands, considering the higher cost?

Aluminum stands offer greater superiority in terms of lightweight handling, which improves labor efficiency, and exceptional natural corrosion resistance, leading to a much longer lifespan and lower total cost of ownership in harsh marine climates, offsetting the higher initial purchase price compared to galvanized steel.

What is the main purpose of adjustable screw jacks and specialized head pads on boat stands?

Adjustable screw jacks allow for precise height and pitch modifications necessary to accommodate diverse hull geometries and ensure balanced weight distribution. Specialized head pads (often non-slip rubber) protect the delicate hull surface from concentrated pressure points and abrasion during storage.

How do safety regulations impact the purchasing decisions for commercial marinas?

Commercial marinas must adhere to strict international and local safety standards regarding vessel support during dry dock. Regulations mandate the use of certified, load-tested stands and proper operational procedures. Non-compliance can lead to insurance voids or regulatory fines, thus driving investment toward high-quality, certified systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager