Rental Uniforms or Workwear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442806 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Rental Uniforms or Workwear Market Size

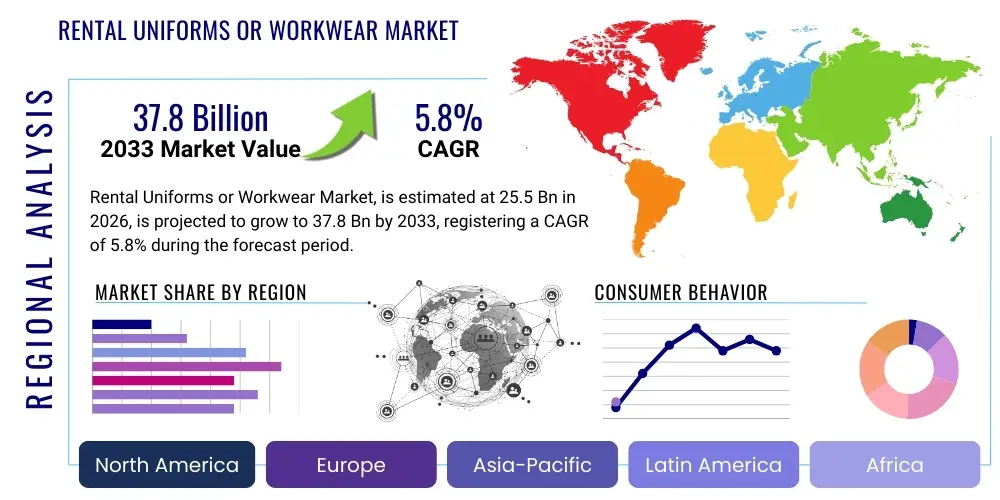

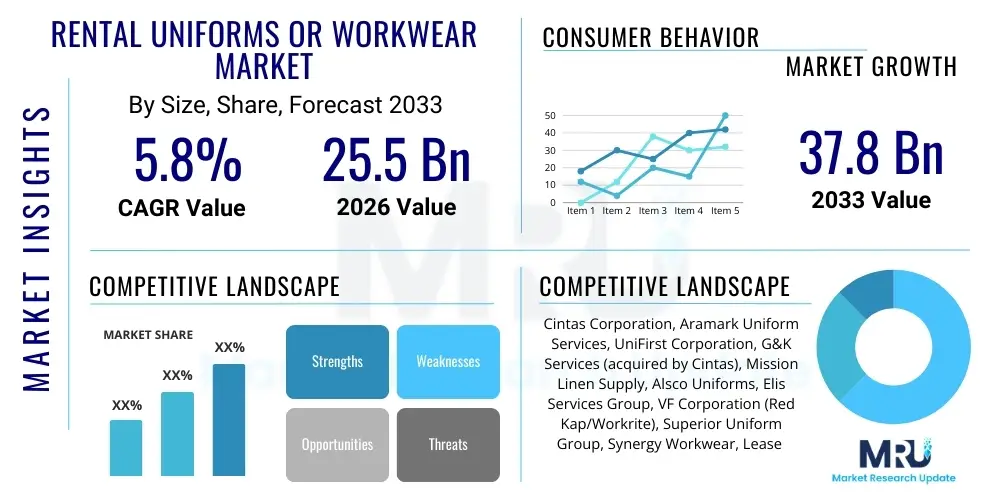

The Rental Uniforms or Workwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

The steady expansion of the Rental Uniforms or Workwear Market is intrinsically linked to global industrial safety regulations and the increasing outsourcing of non-core business functions. Companies across manufacturing, healthcare, and hospitality sectors recognize that renting workwear offers substantial benefits, including guaranteed compliance with safety standards (e.g., NFPA, ANSI) and reduced capital expenditure associated with purchasing, maintaining, and replacing garments. Furthermore, the emphasis on corporate branding and professional image in client-facing roles drives sustained demand for high-quality, consistently maintained rental apparel, thereby ensuring predictable revenue streams for service providers.

Market maturation is characterized by technological integration, primarily focused on inventory management, laundry efficiency, and digitized tracking (RFID). These advancements enhance the efficiency of rental cycles, minimize shrinkage, and allow service providers to offer highly customized solutions tailored to specific industry needs, such as specialized cleanroom garments or high-visibility safety wear. The shift toward sustainable textiles and environmentally friendly laundering practices is also shaping market growth, attracting corporate clients committed to Environmental, Social, and Governance (ESG) mandates, positioning the market for robust long-term expansion anchored in operational excellence and regulatory adherence.

Rental Uniforms or Workwear Market introduction

The Rental Uniforms or Workwear Market encompasses the business of providing, laundering, repairing, and managing standardized professional attire and protective clothing on a contractual basis to various industries. This service model allows businesses to bypass the complexities of internal textile management, ensuring that employees consistently possess compliant, clean, and functional garments. Key products range from standard corporate apparel, industrial uniforms, high-visibility clothing, fire-resistant (FR) garments, specialized medical scrubs, and cleanroom apparel. The primary applications span heavy manufacturing, construction, food processing, hospitality, automotive repair, and the burgeoning clean energy sector, where safety and hygiene are paramount operational concerns.

The core benefits derived from utilizing rental workwear services include optimized cost management, enhanced operational focus, and guaranteed compliance with strict industry safety and sanitation regulations. Companies gain predictability in their operational expenditure (OpEx) while maintaining a high standard of professional presentation, which positively impacts corporate image and employee morale. Driving factors fueling this market expansion include stringent regulatory enforcement regarding occupational safety, the increasing complexity of specialized uniform requirements (e.g., specialized anti-static or chemical-resistant fabrics), and the overarching trend among large enterprises to outsource non-value-added logistics functions to expert third-party providers. Furthermore, concerns regarding cross-contamination in sensitive environments, such as pharmaceutical and food production, necessitate professional laundering services, which rental companies are uniquely positioned to deliver.

The sophisticated logistics capabilities developed by major rental providers—including efficient route optimization, automated sizing adjustments, and meticulous garment tracking—have significantly improved service quality and client retention. The market is undergoing a structural shift toward full-service rental programs that integrate uniform maintenance with safety training and inventory audits, offering a comprehensive solution package. As global industrial activity stabilizes and expands, particularly in emerging economies characterized by rapid urbanization and infrastructure development, the demand for compliant and standardized protective workwear rental programs is expected to accelerate, positioning the sector as an essential component of the modern industrial economy.

Rental Uniforms or Workwear Market Executive Summary

The Rental Uniforms or Workwear Market is exhibiting strong resilience and growth, driven primarily by elevated global standards for workplace safety and hygiene, coupled with the economic appeal of OpEx vs. CapEx models for apparel management. Key business trends indicate significant consolidation among mid-tier regional players, as industry leaders seek to integrate specialized niche providers—particularly those excelling in technologically advanced segments like FR clothing or cleanroom apparel—to offer a broader, vertically integrated service portfolio. Service customization, facilitated by advanced data analytics and RFID technology, is becoming a primary competitive differentiator, enabling providers to offer precise inventory levels and rapid response times, thereby maximizing customer satisfaction and extending contract durations across multi-national accounts.

Regionally, North America and Europe maintain dominance due to established safety regulations (OSHA, EU Directives) and high labor costs that favor outsourcing efficiency. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid industrialization, burgeoning manufacturing hubs in countries like China and India, and the gradual adoption of Western-style safety protocols. Regulatory harmonization within economic blocs is streamlining the expansion of multinational rental providers, though local logistical complexities and diverse cultural preferences regarding workwear necessitate tailored regional strategies. Emerging markets in Latin America and the Middle East are beginning to adopt formal rental programs, moving away from in-house management, catalyzed by major international construction and energy projects.

Segment trends reveal that the Industrial/Manufacturing segment remains the largest revenue contributor, consistently requiring heavy-duty and highly protective workwear. Concurrently, the Healthcare segment is experiencing accelerated growth following global health crises, emphasizing stringent infection control measures which mandates specialized, certified laundry services. Furthermore, the emergence of eco-friendly and sustainable uniform options, utilizing recycled or responsibly sourced textiles, is carving out a high-growth niche within the segmentation structure. The service model's inherent efficiency in maintaining garment longevity aligns perfectly with corporate sustainability goals, making managed rental programs an attractive environmental choice across all end-user categories, promising long-term stability and high-value contracts in specialized segments.

AI Impact Analysis on Rental Uniforms or Workwear Market

User queries regarding AI's influence in the rental uniform sector center heavily on themes of operational efficiency, predictive inventory management, and personalized service delivery. Key concerns revolve around the potential for AI-driven automation to displace human labor in logistics and sorting centers, the accuracy of predictive modeling for seasonal or regulatory shifts in demand, and the data privacy implications of embedding smart sensors or RFID tags for tracking. Expectations are focused on AI's ability to minimize garment loss (shrinkage), optimize complex laundry scheduling to reduce water/energy consumption, and enhance compliance monitoring by automatically flagging non-standard uniform usage or wear-and-tear requiring replacement. Users anticipate AI will fundamentally transform supply chain visibility from collection point to re-delivery.

Artificial Intelligence, particularly through machine learning algorithms applied to large datasets generated by RFID tracking and logistics software, is poised to revolutionize the operational backbone of the rental workwear industry. AI enables highly accurate demand forecasting, moving beyond simple historical averages to incorporate variables like economic forecasts, seasonal employment fluctuations, client expansion plans, and even regulatory changes, allowing rental companies to optimize stock levels and minimize holding costs. Furthermore, AI enhances route planning and truck packing efficiency by dynamically adjusting based on real-time traffic, delivery time constraints, and predicted return volumes, thus significantly reducing fuel consumption and labor hours, contributing directly to higher profit margins.

Beyond logistics, AI is being deployed in quality control and garment lifecycle management. Computer vision systems equipped with AI algorithms can rapidly scan returned garments to identify minor tears, stains, or needed repairs with greater consistency and speed than human inspectors, initiating automated repair workflows. This preventative maintenance extends the serviceable life of high-value items, such as specialized FR uniforms, improving the return on investment. The future impact lies in creating hyper-personalized service agreements, where AI analyzes usage patterns per employee or department, ensuring optimal fit and necessary specialization without direct client micromanagement, solidifying the rental provider's role as a proactive compliance partner rather than merely a supplier.

- Enhanced Predictive Demand Forecasting: AI algorithms analyze historical use, seasonal trends, and client growth signals to optimize inventory levels and material sourcing.

- Optimized Laundry and Logistics Routing: Machine learning determines the most fuel-efficient delivery and pickup routes, integrating real-time traffic and delivery windows.

- Automated Quality Control and Maintenance: Computer vision systems use AI to rapidly identify defects, wear-and-tear, and quality issues on returned garments, triggering repair or replacement.

- Reduced Shrinkage via Pattern Recognition: AI analyzes RFID/sensor data to identify unusual loss patterns or misuse, alerting management proactively to potential inventory theft or misplacement.

- Personalized Garment Assignment and Sizing: AI models predict necessary size changes or specialized uniform requirements based on employee profiles and job roles, improving fit and compliance.

- Sustainable Operations Planning: AI optimizes water, energy, and chemical usage in industrial laundering processes based on fabric type and soil level, supporting ESG objectives.

DRO & Impact Forces Of Rental Uniforms or Workwear Market

The Rental Uniforms or Workwear Market is propelled by stringent regulatory frameworks mandating employee safety, particularly in hazardous environments, creating a non-negotiable demand for certified protective apparel. Restraints predominantly involve the high initial investment required for sophisticated industrial laundering machinery, RFID infrastructure, and large textile inventories, alongside the logistical complexity of managing millions of unique garments across dispersed client sites. Opportunities abound in geographical expansion into industrializing nations, developing hyper-specialized rental packages for niche sectors like renewable energy maintenance, and integrating sustainable textile recycling programs. The primary impact forces include the increasing global emphasis on occupational health and safety (OHS) compliance and the concurrent economic incentive for businesses to convert CapEx to OpEx, guaranteeing market stability and consistent long-term growth.

Drivers for market growth are multifaceted, anchored by the expansion of industrial and service sectors globally. In manufacturing, chemical, and oil & gas industries, the necessity for specialized Personal Protective Equipment (PPE) that meets standards like NFPA 2112 or EN ISO 11612—often complex and expensive to maintain internally—solidifies the value proposition of rental services. Additionally, the labor market trend toward outsourcing facilities management and non-core services strengthens the market. However, significant challenges arise from the vulnerability of the textile supply chain to volatile raw material pricing, particularly cotton and specialized synthetic fibers, which can erode profit margins if not managed through strong long-term supplier contracts. Furthermore, smaller, regional businesses may perceive the long-term contract structure of rental programs as financially restrictive compared to direct purchase, demanding flexible contract innovations from providers.

The market environment presents substantial opportunities for innovation, particularly through digital transformation. The adoption of IoT and blockchain technologies can significantly enhance supply chain transparency, offering clients verifiable assurance regarding the cleaning protocols and material origin, which is crucial for high-security or hygienic applications (e.g., aerospace or pharmaceutical manufacturing). The increasing focus on employee well-being offers providers a chance to differentiate through ergonomic uniform designs and smart textiles that monitor physiological data. The collective impact forces—regulatory push for safety, economic pull for efficiency, and technological advances enabling sophisticated management—create a highly favorable environment for market leaders capable of scaling operations and integrating advanced digital tracking technologies, ensuring that the trajectory of growth remains positive and resilient against minor economic fluctuations.

Segmentation Analysis

The Rental Uniforms or Workwear Market is broadly segmented based on Material Type, Product Type, End-Use Industry, and Service Model, reflecting the diverse and specialized needs across the industrial landscape. Segmentation analysis is critical for service providers to tailor their offerings, ensuring compliance and specialized function. For instance, the distinction between disposable and reusable garments dictates operational logistics and environmental strategy, while the end-use segmentation dictates the required certifications and regulatory adherence, such as HACCP compliance for food processing vs. electrical arc flash protection for utility workers. Understanding these granular divisions allows for precise targeting of marketing efforts and resource allocation, optimizing inventory turnover and service profitability.

The key driving segment remains Product Type, where specialized categories like fire-resistant (FR) and high-visibility workwear command higher rental rates due to their material complexity and mandatory maintenance protocols. Growth within the Material Type segment is accelerating toward synthetic blends and specialized technical textiles (e.g., antistatic, microbial protection), driven by advancements in fabric technology that offer improved comfort, durability, and enhanced protective capabilities. Geographically, segmentation helps identify high-growth areas, with APAC rapidly increasing its share in the industrial workwear segment, reflecting its role as a global manufacturing center, while North America and Europe continue to dominate the highly specialized and certified protective clothing segments, particularly in nuclear, chemical, and healthcare applications.

The Service Model segmentation, differentiating between full-service rental (laundering, repair, delivery, inventory) and direct sale models, highlights the increasing preference for the comprehensive, full-service approach among large enterprises seeking streamlined operations and predictable costs. Further sub-segmentation within End-Use Industries, such as breaking down the "Industrial" segment into specific sub-sectors like automotive, aerospace, or heavy machinery, reveals nuanced demand patterns related to specific oil resistance, durability, and specialized stain removal requirements. This granular view confirms the market's trajectory toward highly customized, segment-specific service contracts rather than standardized volume-based agreements.

- By Product Type:

- Industrial Workwear (General Manufacturing, Heavy Industry)

- Protective Clothing (Fire-Resistant, Chemical Resistant, High-Visibility)

- Medical & Healthcare Uniforms (Scrubs, Patient Gowns, Lab Coats)

- Corporate & Service Uniforms (Hospitality, Retail, Office)

- Cleanroom Apparel (Non-Woven, Specialized Microfiber)

- By Material Type:

- Cotton and Cotton Blends

- Synthetic Fabrics (Polyester, Nylon, Rayon)

- Technical Textiles (Aramid, Modacrylic, Specialized Protective Fibers)

- By End-Use Industry:

- Manufacturing (Automotive, Aerospace, Machinery)

- Food & Beverage Processing (F&B)

- Healthcare & Pharmaceutical

- Construction & Utility

- Oil & Gas and Mining

- Hospitality & Retail

- By Service Model:

- Full-Service Rental Programs

- Laundering and Repair Services Only

- Direct Sale with Maintenance Contract

Value Chain Analysis For Rental Uniforms or Workwear Market

The value chain for the Rental Uniforms or Workwear Market begins with the upstream procurement of raw materials, involving sourcing textiles (cotton, synthetic fibers, specialized protective materials) and chemicals (detergents, stain treatments). This phase is crucial for ensuring garment quality, longevity, and regulatory compliance, with major rental firms engaging in direct, long-term contracts with textile mills to manage cost volatility and guarantee supply of specialized fabrics like FR material. Upstream innovation focuses heavily on developing sustainable and highly durable technical textiles, integrating smart technology components such as RFID chips during the manufacturing process, optimizing the initial capital investment and lifetime cost of the garment.

The core midstream activities involve garment manufacturing, customization (sizing, logo application), and the establishment of robust industrial laundry and maintenance facilities. Rental companies differentiate themselves through the efficiency and sophistication of their operational logistics, which includes advanced sorting technologies, energy-efficient laundering processes, and meticulous quality control procedures necessary to preserve the protective properties of specialized workwear. The critical bottleneck often lies in maintaining the required quality across diverse client needs—from sterilizing medical scrubs to preserving the fire-retardant properties of heavy industrial wear—demanding substantial investment in specialized machinery and highly trained personnel capable of handling complex cleaning protocols.

The downstream component is defined by distribution and service delivery, encompassing direct and indirect channels. Direct channels involve the rental company managing the entire client relationship, including delivery, pickup, inventory tracking, and billing, providing a highly integrated service favored by large corporate clients. Indirect channels might involve third-party logistics (3PL) providers for geographical reach or partnerships with uniform distributors for niche markets. The final value proposition delivered to the end-user is not just the garment, but the guaranteed continuity of supply and compliance assurance, facilitated by route management software and customer service platforms, ensuring high client retention rates which are vital for sustained market profitability.

Rental Uniforms or Workwear Market Potential Customers

Potential customers for the Rental Uniforms or Workwear Market span a wide spectrum of industrial, service, and institutional organizations that require standardized, durable, and often protective employee attire. The most significant segment of buyers comprises large-scale manufacturing and industrial facilities, particularly those in automotive, chemical processing, heavy machinery, and metal fabrication, where regulatory mandates concerning safety (e.g., arc flash protection, high visibility) are strictly enforced. These organizations prioritize full-service rental models to offload the specialized upkeep required for protective equipment, ensuring continuous regulatory compliance and minimizing liability risks, making them high-volume, high-value contractual clients with extensive requirements for inventory tracking and detailed usage reports.

Another major category of potential customers includes the healthcare and food processing sectors. Healthcare facilities, ranging from hospitals and clinics to pharmaceutical laboratories, require rigorous sterilization protocols for uniforms (scrubs, patient gowns, cleanroom suits) to prevent cross-contamination, a capability that specialized rental laundry services provide more efficiently than in-house operations. Similarly, the food and beverage industry, mandated by strict hygiene standards (HACCP), relies on rental companies for the consistent supply and sanitary cleaning of employee apparel to maintain product safety and audit readiness. The shift towards large integrated hospital systems and centralized food production facilities further consolidates buying power, favoring national or international rental providers capable of scaling rapidly.

Additionally, the rapidly growing hospitality, retail, and transportation sectors represent important, though less safety-critical, customer bases. These businesses leverage rental uniforms primarily for brand consistency, professional image projection, and employee morale, valuing the service provider's ability to handle rapid employee turnover and seasonal staffing fluctuations with efficient sizing and replacement services. Utility companies, construction firms, and governmental organizations (e.g., municipal works, public safety) also constitute essential clientele, often requiring specialized, durable uniforms designed for harsh outdoor environments and public interaction, further broadening the market's addressable client base across both white-collar service and blue-collar operational domains globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cintas Corporation, Aramark Uniform Services, UniFirst Corporation, G&K Services (acquired by Cintas), Mission Linen Supply, Alsco Uniforms, Elis Services Group, VF Corporation (Red Kap/Workrite), Superior Uniform Group, Synergy Workwear, Lease Endosser, Rentokil Initial plc, Berendsen Textil Service, Lindstrom Group, A. Lauterbach & Co. GmbH, Vestis Corporation, Service Wear Apparel, ImageFIRST Healthcare Laundry Specialists, Admiral Linen and Uniform Service, TRSA Member Companies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rental Uniforms or Workwear Market Key Technology Landscape

The technological landscape of the Rental Uniforms or Workwear Market is increasingly defined by the integration of digital tracking and automation systems, moving far beyond traditional barcoding methods. Radio Frequency Identification (RFID) technology stands as the foundational digital tool, embedded directly into garments to facilitate automated sorting, accurate inventory counts, and detailed usage tracking at every stage of the rental cycle—from pickup and processing to storage and re-delivery. This technological shift addresses the perennial problem of garment shrinkage and misplacement, providing service providers with unprecedented granular control over their assets and enabling them to offer clients detailed, verifiable reports on uniform whereabouts and cleaning history, critical for compliance auditing in sensitive industries.

Further technological advancements focus heavily on optimizing the industrial laundering process, which is the operational heart of the business model. Modern laundry facilities utilize sophisticated automation software for batch washing, water recycling, and precise chemical dosing, significantly reducing environmental impact and operational costs. IoT sensors monitor machine performance, temperature, and water quality in real-time, ensuring optimal cleaning efficacy while preserving the specialized protective qualities of fabrics like FR material, which require specific wash cycles. The adoption of robotic handling systems in large sorting centers further streamlines operations, reducing manual labor requirements and minimizing the risk of human error during the high-volume processing phase.

The emerging landscape includes the development and deployment of smart textiles and data analytics platforms. Smart workwear, while still nascent, involves integrating sensors capable of monitoring employee safety metrics (e.g., temperature, proximity to hazards) or tracking physical exertion. On the data front, predictive analytics platforms leverage the vast amounts of usage data collected via RFID and route management software to refine demand forecasting, personalize maintenance schedules, and identify potential points of failure in the supply chain before they impact client service levels. This blend of physical tracking, automated processing, and intelligent data utilization transforms rental service providers into technologically driven supply chain partners.

Regional Highlights

- North America: This region dominates the global market, driven by highly developed regulatory infrastructure, particularly OSHA (Occupational Safety and Health Administration) standards, which mandate the use of certified protective workwear in sectors like construction, oil & gas, and heavy manufacturing. The market here is mature, characterized by high service penetration and strong competition among major national players offering advanced, full-service contracts that incorporate complex compliance documentation and sophisticated inventory management systems (RFID). Key growth areas include the expansion of the cleanroom and pharmaceutical segments, alongside robust demand for specialized FR clothing in the energy sector.

- Europe: Europe represents a highly specialized and fragmented market, with strong emphasis on national labor laws and EU directives regarding worker protection (e.g., PPE Directive). Germany, the UK, and France are the major revenue contributors, focusing heavily on sustainability initiatives, leading the adoption of eco-friendly laundering practices and recycled textiles. The market features strong regional players alongside major multinational corporations, with competition centering on quality certification, speed of service, and adherence to specific national safety codes. The healthcare and automotive manufacturing sectors are significant, valuing durability and high-specification cleanliness standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrialization, increasing foreign direct investment in manufacturing, and rising awareness of occupational safety standards, particularly in China, India, and Southeast Asia. While the market initially featured high levels of direct purchase, the trend is shifting towards rental models as local businesses scale up and seek professional solutions for uniform management and hygiene control. The key challenge remains the varying levels of regulatory enforcement across countries, though adoption is accelerating in export-oriented industries requiring international compliance (e.g., textiles and electronics manufacturing).

- Latin America (LATAM): This region offers considerable untapped potential, particularly in resource-intensive economies like Brazil and Mexico (oil & gas, mining, large-scale agriculture). Market growth is currently hampered by economic volatility and slower adoption of formal safety regulations compared to North America. However, major international corporations operating in the region often import global standards, driving localized demand for compliant rental services. Opportunities exist for focused market penetration through partnerships with local distributors and offering localized service packages tailored to specific industrial clusters.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around major infrastructure projects, oil & gas operations, and rapidly developing urban centers, especially within the Gulf Cooperation Council (GCC) countries. The demand is heavily skewed towards specialized protective clothing suitable for extreme environmental conditions (heat, dust) and high visibility. The African market is embryonic but offers long-term growth prospects as industrialization and mining activities expand, requiring reliable, certified protective wear management services. Investment in regional laundry infrastructure is a key precursor to market acceleration here.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rental Uniforms or Workwear Market.- Cintas Corporation

- Aramark Uniform Services

- UniFirst Corporation

- Elis Services Group

- Alsco Uniforms

- Mission Linen Supply

- Lindstrom Group

- Superior Uniform Group

- Rentokil Initial plc (including Berendsen Textil Service)

- Vestis Corporation

- ImageFIRST Healthcare Laundry Specialists

- A. Lauterbach & Co. GmbH

- Synergy Workwear

- Service Wear Apparel

- VF Corporation (Workwear division)

- Admiral Linen and Uniform Service

- Tingley Rubber Corporation

- Dickies (through licensee rental programs)

- PPL Industries

- Workwear Group

Frequently Asked Questions

Analyze common user questions about the Rental Uniforms or Workwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Rental Uniforms Market?

The primary driver is the rigorous enforcement of occupational safety and health (OSH) regulations globally, compelling businesses—especially in high-risk sectors like manufacturing and energy—to use certified protective workwear that is consistently maintained, which rental providers guarantee more effectively than in-house management.

How does RFID technology benefit rental uniform service providers?

RFID technology significantly benefits service providers by enabling real-time, automated tracking of individual garments throughout the entire laundering and delivery cycle, drastically reducing shrinkage, optimizing inventory levels, and providing verifiable proof of cleaning and maintenance for regulatory compliance audits.

Which end-use industry holds the largest market share for rental uniforms?

The Industrial and Manufacturing sector holds the largest market share due to its high volume of employees and the necessity for specialized, heavy-duty protective clothing, including fire-resistant (FR) and high-visibility garments, which require expert management and upkeep.

What role does sustainability play in the contemporary rental workwear industry?

Sustainability is a crucial factor, driving providers to adopt water and energy-efficient industrial laundering systems, utilize environmentally friendly detergents, and increasingly incorporate durable, recycled, or ethically sourced technical textiles into their uniform offerings to align with corporate client ESG goals.

What is the key difference between the North American and APAC rental markets?

The North American market is mature, dominated by full-service contracts driven by stringent established regulations. The APAC market, while growing fastest, is still in an emerging phase, transitioning from direct uniform purchases to rental models as regional industrial safety standards rapidly improve and scale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager