Reservoir Simulation Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441632 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Reservoir Simulation Software Market Size

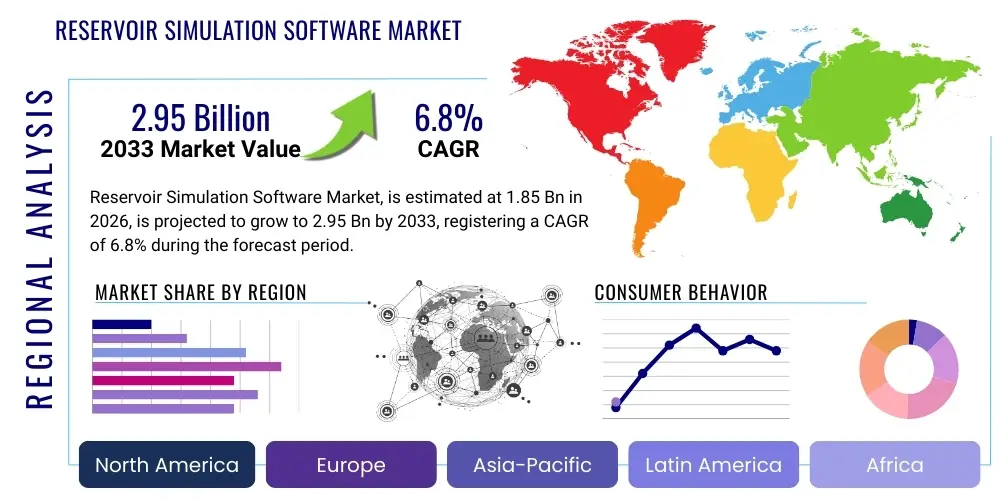

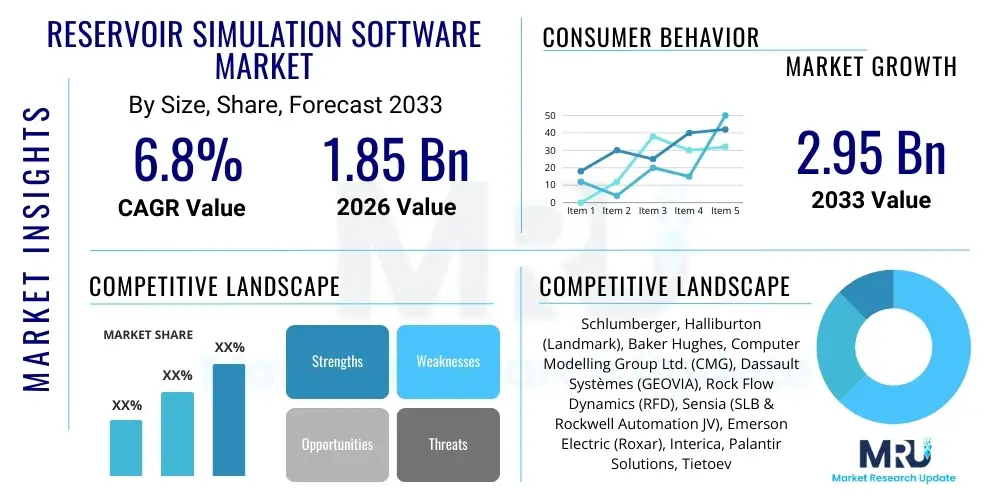

The Reservoir Simulation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing complexity of hydrocarbon reservoirs, necessitating advanced modeling techniques to optimize recovery factors and minimize operational risks associated with deepwater and unconventional resource extraction. Furthermore, the global emphasis on carbon capture and storage (CCS) initiatives is opening new application frontiers for reservoir simulation tools, requiring high-fidelity models for long-term storage integrity assessment.

Reservoir Simulation Software Market introduction

The Reservoir Simulation Software Market encompasses specialized computational tools designed to model and predict the flow of fluids (oil, gas, water, and contaminants) through porous media under various production and injection scenarios. This software relies on sophisticated numerical algorithms to solve complex differential equations governing multiphase fluid movement within geological structures, providing critical insights for subsurface engineers and geoscientists. Key applications include optimizing primary, secondary, and tertiary recovery methods (Enhanced Oil Recovery - EOR), evaluating the feasibility of field development plans, and managing reservoir risk. These tools enable operators to make informed, data-driven decisions regarding well placement, production rates, and capital investment, directly impacting the profitability and longevity of oil and gas assets globally.

The primary function of reservoir simulation is to create a dynamic model that accurately represents the historical performance of a reservoir and, critically, forecasts its future behavior under different operational strategies, such as waterflooding, gas injection, or chemical EOR. Product descriptions typically involve high-performance computing capabilities, support for millions of grid cells (including unstructured grids), and integration with geological modeling and petrophysical data packages. Major benefits derived from adopting this technology include significant reduction in exploration uncertainty, optimized production profiles leading to higher recovery factors, reduced environmental footprint through efficient resource utilization, and enhanced economic planning for long-term field operations. The necessity of maximizing recovery from mature fields, coupled with the rising global energy demand and the challenging nature of newly discovered deepwater and unconventional reserves, acts as a pivotal driving factor for continuous innovation and market expansion in the reservoir simulation domain.

Driving factors propelling this market include the global trend toward digitalization and integrated asset modeling, where reservoir simulation acts as the central hub for linking seismic data, well logs, and production data. Additionally, regulatory pressures demanding meticulous environmental reporting and optimized resource management further incentivize operators to adopt rigorous simulation practices. The continuous advancement in computational power, particularly the accessibility of High-Performance Computing (HPC) and cloud-based simulation platforms, is reducing turnaround times and lowering the barrier to entry for smaller independent operators. These technological advancements ensure that reservoir simulation remains an indispensable tool in the upstream energy sector, extending its relevance beyond traditional hydrocarbon extraction into emerging areas like geothermal energy production and subsurface CO2 storage modeling.

Reservoir Simulation Software Market Executive Summary

The global Reservoir Simulation Software Market is characterized by robust growth, primarily fueled by the increasing need for optimizing production from complex and mature oil and gas fields and the expanding application scope into carbon management. Business trends indicate a significant shift towards cloud-based and Software-as-a-Service (SaaS) deployment models, offering scalability and reduced capital expenditure compared to traditional on-premise licensing. Key vendors are intensely focused on integrating Artificial Intelligence (AI) and Machine Learning (ML) capabilities into their simulation platforms to accelerate history matching processes, improve uncertainty quantification, and enhance predictive maintenance planning for subsurface assets. Mergers and acquisitions, particularly involving large software providers acquiring niche AI modeling firms, are shaping the competitive landscape, emphasizing the convergence of traditional physics-based simulation with data-driven predictive analytics to achieve higher fidelity and faster decision cycles.

Regionally, North America maintains its dominance in market share, driven by substantial investments in unconventional resources, particularly shale oil and gas, where rapid drilling and complex hydraulic fracturing optimization require sophisticated modeling tools. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, stimulated by significant deepwater exploration activities in countries like India, China, and Malaysia, alongside the increasing adoption of EOR techniques in established fields. The Middle East and Africa (MEA) region also contributes substantially, largely due to major National Oil Companies (NOCs) implementing large-scale digitalization programs aimed at maximizing recovery from mega-fields and ensuring long-term energy security through advanced reservoir monitoring and simulation strategies, often leveraging multi-million cell models.

Segment trends highlight the Software component maintaining the largest share, although the Services segment, encompassing consulting, implementation, and advanced technical support, is experiencing faster growth, reflecting the specialized expertise required to utilize these complex tools effectively. By deployment type, while on-premise installations remain critical for large Integrated Oil Companies (IOCs) with strict data sovereignty requirements, the Cloud segment is seeing accelerated adoption across small and medium enterprises (SMEs) due to its cost-effectiveness and scalability for running massive parallel simulations. Application-wise, Enhanced Oil Recovery (EOR) simulation continues to be the most critical segment, given the global imperative to boost recovery factors, followed closely by field development planning and reserves estimation, where accurate future performance prediction is paramount for financial reporting and investment decisions.

AI Impact Analysis on Reservoir Simulation Software Market

User inquiries regarding AI's impact on reservoir simulation frequently revolve around how Artificial Intelligence can overcome the historical trade-off between model complexity and simulation runtime. Common questions explore the integration of Machine Learning (ML) for parameter estimation (e.g., permeability distribution), automating the tedious history matching process, and the potential for surrogate modeling (creating fast, data-driven proxies for complex physics-based models). Users are keen to understand if AI can significantly improve uncertainty quantification by enabling faster execution of numerous simulation runs (Monte Carlo analysis) and how neural networks can handle the immense data generated by high-resolution geological models. A central theme is the expectation that AI will transition reservoir simulation from a computationally intensive, expert-driven task to a more automated, real-time decision-making tool, specifically for dynamic optimization and smart field management, raising concerns about the validation and interpretability of AI-generated results compared to traditional numerical methods.

The key themes emerging from this analysis confirm that AI is not replacing traditional reservoir simulation but rather augmenting its capabilities dramatically. By leveraging advanced deep learning techniques, operators can significantly reduce the computational burden associated with iterative processes like history matching, which traditionally consumed months of expert time. AI models, trained on vast datasets of previous simulation runs or real-time production data, can quickly identify optimal reservoir parameters and forecast performance much faster than conventional solvers. This convergence—where physics-based simulation provides the ground truth and ML algorithms provide speed and pattern recognition—is creating 'hybrid simulators' that promise unparalleled efficiency and accuracy, directly addressing the industry's demand for faster decision cycles in high-stakes operational environments, such as managing complex deepwater infrastructure or optimizing multilateral wells.

The market expects AI to democratize access to sophisticated simulation capabilities. By automating routine tasks and creating user-friendly interfaces powered by intelligent assistants, the bottleneck of requiring highly specialized simulation engineers can be reduced. Furthermore, AI is crucial for processing the massive influx of data from smart wells and IoT sensors deployed across the field, feeding these dynamic measurements back into the simulation model for near real-time updates—a concept known as the Digital Twin. While the initial investment in integrating AI platforms is high, the anticipated returns in terms of optimized production (increased recovery factor) and reduced operational downtime solidify AI as the primary technological accelerant for the reservoir simulation software market over the next decade, fundamentally changing how subsurface risk and potential are assessed.

- Accelerated History Matching: Machine learning algorithms rapidly adjust simulation parameters to match historical production data, drastically reducing expert effort and cycle time.

- Surrogate Modeling: Creation of high-speed, data-driven proxy models for rapid uncertainty quantification and sensitivity analysis, circumventing lengthy physics-based runs.

- Automated Grid Generation: AI assists in optimizing complex geological gridding (e.g., fault representation, unstructured grids) for enhanced accuracy.

- Real-Time Optimization: Integration of AI with simulation models enables dynamic decision-making for fluid injection rates and well controls in smart fields.

- Improved Uncertainty Quantification (UQ): Faster execution of probabilistic simulations (Monte Carlo) to better define the range of potential outcomes and associated risks.

- Enhanced Data Integration: AI facilitates seamless ingestion and quality control of diverse data sources (seismic, production, petrophysics) into the simulation environment.

DRO & Impact Forces Of Reservoir Simulation Software Market

The Reservoir Simulation Software Market is shaped by a powerful confluence of Driving forces, inherent Restraints, attractive Opportunities, and overarching Impact forces that collectively dictate market direction and investment cycles. The primary drivers include the escalating global demand for advanced hydrocarbon recovery techniques, especially EOR, which mandates highly accurate predictive modeling to justify costly chemical or CO2 injection projects. Simultaneously, the constraint of high initial capital expenditure for software licenses and the shortage of highly skilled reservoir engineering professionals capable of mastering complex simulation tools act as significant restraints, particularly for smaller independent operators. However, the emergence of cloud computing and SaaS subscription models presents a key opportunity to mitigate these high upfront costs and scale computing resources dynamically. Impact forces such as volatile crude oil prices and increasing regulatory scrutiny on environmental performance compel operators to adopt simulation for optimal resource stewardship and risk mitigation, ensuring market resilience despite fluctuating commodity cycles.

Detailed analysis of the Drivers reveals that the shift toward extracting resources from increasingly complex geological formations—such as tight sandstones, deepwater unconventionals, and fractured basement reservoirs—makes empirical methods obsolete, thereby mandating simulation tools capable of handling complex physics (e.g., geomechanics coupling, thermal effects). Furthermore, the drive for operational efficiency and sustainability compels operators to utilize simulation for optimizing existing infrastructure, maximizing asset life, and supporting compliance with strict methane emission reduction targets. Conversely, the market faces strong Restraints, most notably the computational intensity required for high-resolution models, which often limits the feasibility of comprehensive uncertainty analysis. Data heterogeneity and the inherent uncertainty in input geological models also restrict the ultimate accuracy of any simulation, requiring advanced statistical techniques and expert judgment, which adds complexity and cost to project execution, slowing widespread adoption in less capitalized regions.

The most compelling Opportunities lie in the diversification of simulation applications beyond conventional oil and gas. The rapid growth in Carbon Capture, Utilization, and Storage (CCUS) requires rigorous, long-term reservoir simulation to model CO2 plume migration, pressure buildup, and caprock integrity over decades or centuries, creating a substantial new market segment. Geothermal energy exploration and production also rely heavily on thermal-hydraulic simulation tools adapted from the oil and gas industry. The pervasive Impact Forces, often driven by macro-economic and geopolitical factors, include the fluctuating investment cycles in the upstream sector; when oil prices are low, discretionary spending on new software licenses may decrease, but the need for operational efficiency through simulation increases. Ultimately, the requirement for robust risk assessment for capital projects in uncertain global energy transitions ensures that reservoir simulation remains a mission-critical technology, positioned strongly for continuous innovation and growth.

Segmentation Analysis

The Reservoir Simulation Software Market is comprehensively segmented based on its offering, deployment model, application type, and regional adoption patterns, providing a structured view of the market dynamics and targeted growth areas. The segmentation based on offering distinguishes between the core Software component, which includes licensing and maintenance of the simulation engine, and the crucial Services segment, which involves specialized consulting, model building, technical support, and training necessary for effective deployment. By understanding the relative growth rates of these two components, stakeholders can tailor their strategies, noting the increasing reliance on specialized services to interpret and validate complex simulation outputs. Furthermore, the deployment model split between On-Premise and Cloud environments dictates procurement methods and operational flexibility, reflecting the industry's ongoing digital transformation towards scalable, high-performance computing resources accessible globally.

Application-based segmentation is crucial as it highlights the primary use cases that drive demand, with Enhanced Oil Recovery (EOR) consistently leading the market due to the intense focus on increasing recovery factors from aging fields worldwide. EOR simulation requires the most complex physics modeling, including thermal, compositional, and polymer flooding effects. Other significant applications include Field Development Planning (FDP), where early-stage reservoir models guide multi-billion dollar investment decisions, and Reserves Estimation, a mandated process for financial reporting. The diversity in these applications demonstrates the foundational role simulation plays across the entire reservoir management lifecycle, from initial discovery through abandonment. Analyzing these segments reveals that while FDP and Reserves Estimation are stable, mandatory segments, the EOR segment offers the highest growth potential driven by technological advancements and economic incentives to maximize production from existing assets rather than relying solely on high-cost frontier exploration.

The technological advancement trajectory dictates that the segmentation by software type—distinguishing between Black Oil, Compositional, and Thermal simulators—remains highly relevant. Black Oil models, being the simplest and fastest, are used for preliminary analysis, while Compositional models are essential for gas condensate and volatile oil reservoirs where fluid phase behavior changes significantly with pressure. Thermal simulators are required for heavy oil and steam injection EOR projects. This granular segmentation allows vendors to align their product roadmaps with specific reservoir challenges and ensures that operators select the appropriate computational complexity necessary for their particular asset type and operational goal, optimizing both time and computational resources. The overall market maturity is evident in the stable distribution of demand across these technical segments, indicating a sustained need for a diversified portfolio of simulation capabilities.

- By Offering:

- Software (Licensing, Maintenance)

- Services (Consulting, Integration, Training, Technical Support)

- By Deployment Model:

- On-Premise (In-house servers, proprietary data centers)

- Cloud-Based (SaaS, Public Cloud, Private Cloud)

- By Application:

- Enhanced Oil Recovery (EOR) Simulation

- Field Development Planning (FDP)

- Reserves Estimation and Certification

- Production Optimization and Monitoring

- Carbon Capture and Storage (CCS) Modeling

- By Software Type:

- Black Oil Simulators

- Compositional Simulators

- Thermal Simulators (Steam Injection, SAGD)

- Geothermal and Specialized Simulators

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Reservoir Simulation Software Market

The value chain for the Reservoir Simulation Software Market begins with intensive Upstream Analysis, focused heavily on Research and Development (R&D) and the creation of highly sophisticated numerical algorithms, including advanced solvers for highly non-linear partial differential equations that govern fluid flow. This initial phase requires deep expertise in applied mathematics, computational physics, and petroleum engineering. Software developers, often collaborating closely with academic institutions and major oil companies, invest heavily in parallelization techniques (utilizing GPUs and multi-core CPUs) and developing robust graphical user interfaces (GUIs) and pre- and post-processing tools. The value proposition at this stage is intellectual property and the creation of highly efficient, accurate, and scalable simulation engines capable of handling millions of grid blocks and complex fluid properties. Companies must constantly update their code base to incorporate new physical models, such as complex geochemistry or coupled geomechanics, to maintain relevance in a technologically demanding market.

The Midstream phase involves the commercialization and Distribution Channel strategies. This typically involves software licensing (perpetual or subscription-based), often structured around the number of concurrent users or the complexity of the simulation modules required (e.g., compositional vs. black oil). The distribution model includes both Direct Sales channels, where vendors interact directly with major Integrated Oil Companies (IOCs) and National Oil Companies (NOCs) through dedicated sales and technical support teams, and Indirect Channels, which utilize value-added resellers (VARs) and specialized engineering consulting firms, particularly in geographically challenging or niche markets. Crucially, the quality of technical support and dedicated customer success programs forms a critical link in the value chain, as the successful deployment of reservoir simulation software hinges on expert technical assistance during initial model setup, history matching, and interpretation of complex results, thereby embedding the vendor within the client's operational workflow.

The Downstream Analysis centers on the End-User/Buyer utilization and the ultimate impact on field profitability. End-users (reservoir engineers, asset managers) integrate the software outputs into field development decisions, production forecasts, and economic evaluation reports. This phase is characterized by intense data input (seismic, well logs, production history) and interpretation, where the software's ability to seamlessly integrate with upstream data management systems (e.g., subsurface databases, modeling tools) is paramount. Feedback from end-users regarding software performance, usability, and the need for new physical models drives the R&D cycle, completing the value chain loop. Moreover, the services component, including outsourced modeling projects performed by consulting firms, plays a vital role in the downstream value addition, providing expert analysis to operators lacking specialized internal resources or requiring third-party verification for reserves certification. The shift to cloud-based platforms is streamlining the delivery and usage aspects of this downstream analysis by allowing on-demand access to high-performance computing resources.

Reservoir Simulation Software Market Potential Customers

The potential customer base for the Reservoir Simulation Software Market is diverse, primarily composed of organizations heavily invested in the exploration, development, and production of subsurface energy resources, or those involved in managing subsurface storage. The core customers are multinational Integrated Oil Companies (IOCs) such as ExxonMobil, Shell, BP, and Chevron, who maintain extensive global asset portfolios and possess dedicated internal reservoir engineering teams. These IOCs require comprehensive, high-end simulation packages capable of modeling highly complex, multi-billion dollar deepwater and unconventional projects, focusing on robust compositional and thermal simulation capabilities. They are motivated by the need for meticulous risk management, maximizing shareholder value through optimal recovery factors, and standardized global operational practices, often requiring enterprise-level perpetual licenses or private cloud deployments.

Equally critical are the National Oil Companies (NOCs) in regions like the Middle East (e.g., Saudi Aramco, ADNOC), Asia (e.g., CNPC, Petrobras), and Russia (e.g., Rosneft). NOCs are often the single largest investors in reservoir management technology globally, driven by national energy security goals and the need to manage massive, often mature, mega-fields. Their purchase decisions prioritize long-term technical support, technology transfer, and customized solutions, including Arabic or local language interfaces, and frequently require large-scale, multi-year service contracts alongside software licensing. The high volume of data and the scale of their operations mandate the use of the most advanced parallel computing and high-resolution modeling features available in the market.

Beyond the major operators, the customer segment includes independent oil and gas exploration and production companies (Independents), particularly those focusing on niche areas like U.S. shale plays or smaller international conventional fields. For these smaller companies, the cost-effectiveness and scalability of cloud-based SaaS models are highly appealing, allowing them to access advanced simulation capabilities without the heavy upfront investment in hardware and specialized IT infrastructure. Furthermore, specialized engineering consulting firms (e.g., Schlumberger Consulting Services, specialized boutique firms) are significant buyers and users of this software, utilizing licenses to provide reservoir modeling, reserves estimation, and third-party verification services to operators lacking in-house capacity. Finally, government regulatory bodies and academic research institutions represent an emerging customer base, particularly for applications related to carbon sequestration modeling and independent verification of reserve reports.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Halliburton (Landmark), Baker Hughes, Computer Modelling Group Ltd. (CMG), Dassault Systèmes (GEOVIA), Rock Flow Dynamics (RFD), Sensia (SLB & Rockwell Automation JV), Emerson Electric (Roxar), Interica, Palantir Solutions, Tietoevry, Ouroboro, Weatherford International, Stone Ridge Technology (SRT), Petroleum Experts (Petex) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reservoir Simulation Software Market Key Technology Landscape

The Reservoir Simulation Software Market is defined by continuous technological evolution, driven by the dual needs for higher fidelity modeling and increased computational speed. A cornerstone of this landscape is the adoption of advanced numerical solvers, moving beyond basic finite difference methods to incorporate finite element methods and sophisticated unstructured gridding techniques. These advanced methods are essential for accurately modeling complex geological features, such as fault networks, highly deviated wells, and intricate hydraulic fracture geometries that characterize unconventional reservoirs. Furthermore, the integration of advanced thermodynamic models, including Equations of State (EOS) for compositional simulation, ensures that the software can precisely predict complex fluid phase behavior crucial for high-pressure/high-temperature and gas condensate reservoirs, which represents a significant technological challenge and competitive differentiator among leading software providers.

High-Performance Computing (HPC) and Cloud Architecture represent the most impactful technological shifts in the deployment of reservoir simulation. The market has embraced massive parallel computing, utilizing both multi-core CPUs and Graphics Processing Units (GPUs) to run simulations that previously took weeks, now in a matter of hours. This acceleration is critical for performing timely uncertainty quantification (UQ) studies, which require thousands of simulation runs. Cloud-based simulation platforms, offered as SaaS, provide on-demand access to this HPC power, eliminating the need for operators to purchase and maintain expensive internal computing clusters, thereby increasing computational throughput and reducing IT overhead. This cloud transition is facilitating the creation of 'Digital Twins' of reservoirs, where simulation models are continuously updated with real-time field data, requiring robust, scalable, and secure cloud infrastructure tailored for the energy sector.

The synergistic integration of simulation software with Big Data Analytics and Artificial Intelligence (AI) is rapidly defining the next generation of reservoir modeling. AI and Machine Learning techniques are being deployed to automate the most time-consuming aspects of reservoir simulation, including history matching, automatic parameter tuning, and geological model upscaling. Data analytics platforms are crucial for processing the vast amounts of input data (well logs, seismic attributes, production history) and the resulting outputs from large simulation ensembles. Key software vendors are also focusing on creating open architecture platforms that allow seamless coupling with specialized third-party software—such as geomechanics or advanced hydraulic fracturing simulators—through Application Programming Interfaces (APIs). This openness promotes innovation and allows users to build comprehensive, integrated workflows that address specific, highly technical challenges beyond the scope of a single simulation package.

Regional Highlights

The Reservoir Simulation Software Market exhibits pronounced regional variations in growth drivers, technological maturity, and application focus, closely mirroring upstream capital expenditure patterns. North America, encompassing the U.S. and Canada, currently holds the largest market share, driven primarily by the sustained activity in unconventional resource development, particularly shale gas and tight oil. The high complexity associated with optimizing hydraulic fracturing, managing complex well interference, and maximizing recovery from mature conventional fields in the Gulf of Mexico necessitates widespread adoption of compositional and geomechanics-coupled simulation tools. Furthermore, North America is a global leader in integrating AI and cloud computing into reservoir workflows, benefiting from a robust IT infrastructure and a highly specialized workforce. Regulatory push for accurate emissions reporting and growing CCUS projects also bolster demand for environmental and subsurface storage modeling in this region.

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by two primary factors: escalating energy demand necessitating increased domestic production, and significant deepwater exploration activities in countries like Australia, Malaysia, and India. While countries like China are heavily investing in both conventional and challenging unconventional resources, the overall market penetration of advanced simulation tools is still accelerating compared to North America. Government-backed digitalization initiatives within key NOCs in APAC are driving large-scale software procurement and service contracts. The regional focus is expanding rapidly beyond traditional black oil modeling to encompass sophisticated EOR techniques (e.g., polymer and miscible gas flooding) and detailed field development planning for recently sanctioned large-scale offshore projects, leading to high capital investment in simulation capability acquisition.

The Middle East and Africa (MEA) region is a critical market, dominated by large National Oil Companies (NOCs) managing some of the world's largest, most mature fields. The market here is characterized by highly consolidated procurement cycles, where long-term contracts for software and services are common. The imperative is to maintain current production levels through advanced IOR/EOR schemes and manage the significant geological uncertainties associated with vast carbonate reservoirs. MEA also presents unique application demands, such as handling sulfur content and managing massive water injection projects, requiring specialized simulation physics. Europe, while having a smaller market share focused on the declining North Sea basin, maintains high technical relevance through its leadership in energy transition technologies, driving demand for simulation tools specifically for environmental applications, including advanced CCUS, geothermal modeling, and detailed environmental impact assessment related to platform decommissioning.

- North America: Market leader due to intense unconventional resource exploitation (shale) and early adoption of cloud-based HPC solutions. Focus on geomechanics and hydraulic fracture optimization.

- Asia Pacific (APAC): Fastest growing region, driven by deepwater exploration, rising energy needs, and state-led digitalization programs in China, India, and Southeast Asia. High demand for EOR modeling.

- Middle East and Africa (MEA): Large, stable market dominated by NOCs focusing on maximizing recovery from mega-fields through sophisticated IOR/EOR methods and large-scale, high-resolution modeling projects.

- Europe: Stable demand focused on decommissioning planning, environmental modeling, and leadership in CCUS and geothermal energy simulation applications.

- Latin America (LATAM): Growth tied to offshore pre-salt developments in Brazil and complex heavy oil assets in Venezuela, requiring advanced compositional and thermal simulation capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reservoir Simulation Software Market.- Schlumberger Limited

- Halliburton Company (Landmark Software and Services)

- Baker Hughes Company

- Computer Modelling Group Ltd. (CMG)

- Dassault Systèmes SE (GEOVIA)

- Rock Flow Dynamics (RFD)

- Emerson Electric Co. (Roxar)

- Stone Ridge Technology (SRT)

- Petroleum Experts (Petex)

- Interica Ltd.

- Palantir Solutions

- Tietoevry Corporation

- Ouroboro

- Weatherford International plc

- Paradigm (Emerson)

- Oceaneering International, Inc.

- Petro-Simulator AS

- Ovation Data Services

- Cognite AS

- CALSEP

Frequently Asked Questions

Analyze common user questions about the Reservoir Simulation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Reservoir Simulation Software Market?

The primary factor driving market growth is the increasing geological complexity and maturity of global hydrocarbon assets, necessitating advanced simulation tools to optimize Enhanced Oil Recovery (EOR) techniques and accurately manage high-risk, high-cost deepwater and unconventional extraction projects, thereby maximizing economic recovery.

How is cloud computing impacting the deployment model for reservoir simulation?

Cloud computing is significantly accelerating adoption by reducing the prohibitive upfront capital expenditure associated with purchasing and maintaining internal High-Performance Computing (HPC) clusters. Cloud-based Software-as-a-Service (SaaS) models offer scalability, faster processing, and improved collaboration, making advanced simulation accessible to a wider range of independent operators and smaller firms.

Which application segment shows the most significant potential for market expansion?

The application segment for Carbon Capture and Storage (CCS) modeling and geothermal energy simulation is poised for the most significant expansion. As global economies shift toward energy transition, specialized reservoir simulation is critical for modeling long-term CO2 plume migration, storage integrity, and thermal fluid dynamics for non-hydrocarbon energy projects.

What role does Artificial Intelligence play in the latest reservoir simulation software?

AI, specifically Machine Learning (ML), plays a transformative role by accelerating computational tasks such as history matching, optimizing parameter selection for geological models, and creating fast surrogate models (proxy models) for rapid uncertainty quantification, effectively reducing simulation cycle times from weeks to hours.

Why does North America hold the largest market share in Reservoir Simulation Software?

North America maintains the largest market share due to its intense focus on unconventional resource development, requiring complex geomechanics-coupled simulation for hydraulic fracturing optimization, robust technology integration, and extensive deployment of digitalization initiatives across mature and new fields, particularly within the shale basins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager