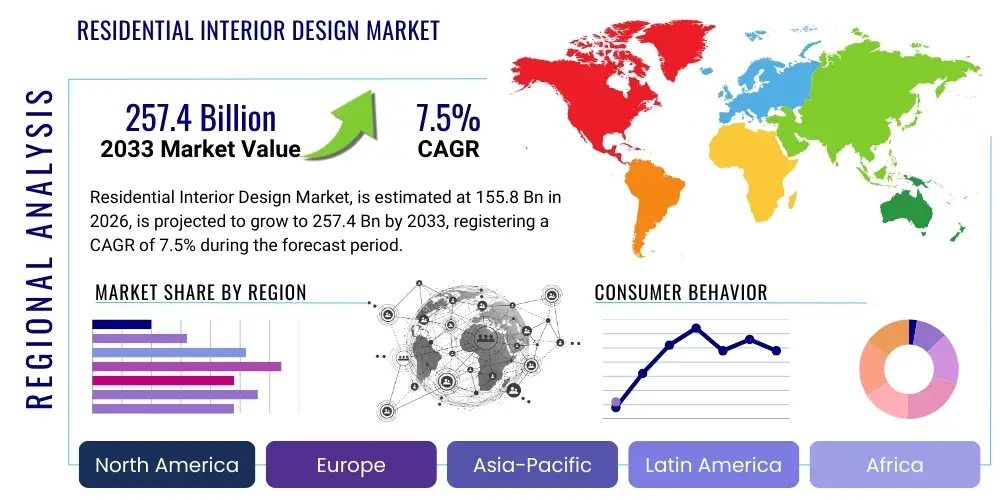

Residential Interior Design Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441925 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Residential Interior Design Market Size

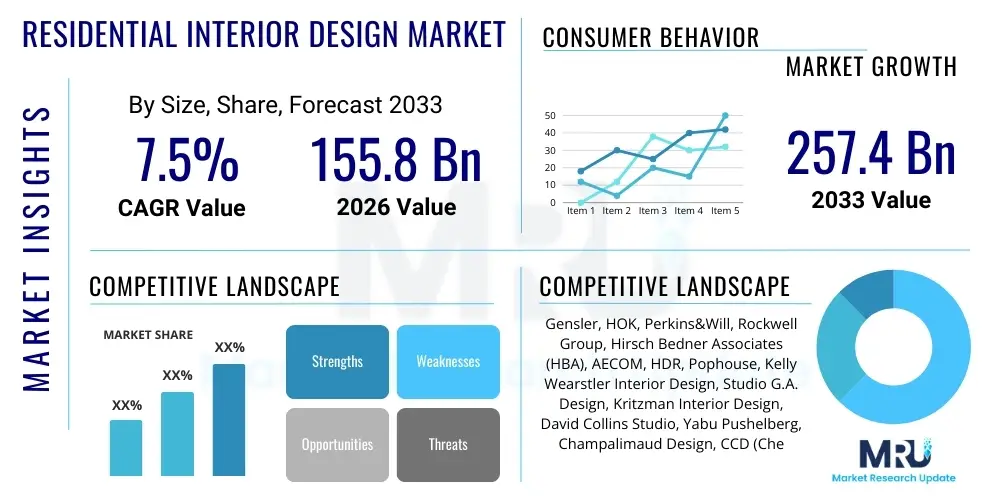

The Residential Interior Design Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 155.8 Billion in 2026 and is projected to reach USD 257.4 Billion by the end of the forecast period in 2033.

Residential Interior Design Market introduction

The Residential Interior Design Market encompasses professional services dedicated to planning, designing, and executing the interiors of private residences, including single-family homes, apartments, villas, and holiday homes. These services range from conceptual development, spatial planning, material selection, furnishing procurement, and project management, catering to aesthetic, functional, and safety requirements. The core product is the transformation of living spaces into environments optimized for occupant well-being and lifestyle. Driven by increasing urbanization, rising disposable incomes in emerging economies, and a growing consumer focus on customized, high-quality living environments, the market is undergoing rapid evolution, integrating sustainable practices and technological tools like Virtual Reality (VR) visualization to enhance client experience and design precision.

Major applications of residential interior design include comprehensive renovation projects, designing interiors for newly constructed properties, and targeted space enhancements such as kitchen and bathroom remodels. Key benefits derived by consumers include optimized space utilization, increased property value, improved comfort and functionality, and the creation of highly personalized environments that reflect individual style and preferences. The integration of smart home technology and biophilic design principles further drives the perceived value of professional design services. Consumers are increasingly seeking holistic solutions that combine aesthetics with technological integration and sustainability, positioning interior designers as essential consultants in the modern housing ecosystem.

The market is significantly driven by macroeconomic factors such as global wealth accumulation, particularly among High-Net-Worth Individuals (HNWIs) who demand luxury, personalized services, and the rapid pace of real estate development in densely populated urban centers across Asia Pacific and the Middle East. Furthermore, increased media exposure through platforms showcasing design trends (e.g., social media, specialized home décor programs) fuels consumer awareness and demand for aesthetically pleasing and professionally executed interiors. The post-pandemic shift, emphasizing homes as multi-functional spaces for work, leisure, and wellness, has accelerated demand for professional design services capable of creating flexible and optimized residential environments.

Residential Interior Design Market Executive Summary

The global Residential Interior Design Market is characterized by robust growth, propelled primarily by significant technological advancements and a structural shift toward customization and sustainability. Business trends indicate a strong movement toward digital design platforms, offering clients real-time visualization through Virtual Reality (VR) and Augmented Reality (AR), thereby streamlining the design process and minimizing potential costly revisions. Key players are increasingly focusing on vertical integration, establishing partnerships with furniture manufacturers and material suppliers to offer end-to-end solutions, enhancing profit margins, and ensuring supply chain reliability. Modular and prefabricated design components are also emerging as a major business trend, addressing the need for faster, cost-effective, and flexible design solutions, particularly within the mid-range and mass-market segments.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing region, driven by rapid urbanization, substantial middle-class expansion, and large-scale residential construction projects in countries like China and India. North America and Europe maintain dominance in terms of market value, primarily due to high consumer spending power and mature markets that favor luxury, specialized, and sustainable design services. European trends strongly emphasize heritage conservation, eco-friendly materials, and timeless design aesthetics, whereas North American trends lean toward integrated smart home technology, open-concept living, and digitally driven design consultation. The Middle East exhibits strong growth spurred by high-value real estate development and demand for bespoke, opulent interiors.

Segment trends show that the Renovation/Remodeling segment is expected to outpace new construction design services, largely due to aging housing stock in developed economies and a consumer preference for upgrading existing homes rather than relocating. By property type, Apartments/Condominiums hold the largest market share globally, reflecting global urbanization patterns and the density of multi-family housing projects. In terms of design style, Modern and Transitional styles remain the most sought after due to their clean lines, versatility, and broad appeal, although customized, niche styles incorporating local cultural aesthetics are gaining traction, driven by millennial consumers seeking unique identities for their living spaces.

AI Impact Analysis on Residential Interior Design Market

User queries regarding AI's impact on residential interior design center predominantly on four major themes: the potential for hyper-personalization, the automation of repetitive tasks, the fear of job displacement for human designers, and the integration of AI tools (like generative design platforms) into existing design workflows. Users are keen to understand how AI can analyze vast datasets of design trends, client preferences, and ergonomic factors to generate optimal layout options instantly. Concerns often revolve around the ability of AI to replicate human creativity, empathy, and the nuanced understanding of a client's specific emotional connection to their home. Overall, the summarized expectation is that AI will function as a powerful assistant—a 'co-designer'—enhancing efficiency and personalization, rather than completely replacing the professional human element.

The primary influence of Artificial Intelligence lies in accelerating the conceptualization and visualization phase of residential projects. Generative AI tools are now capable of producing mood boards, initial 3D renderings, and spatial arrangements based on simple text prompts or uploaded images of existing spaces, dramatically reducing the time spent on preliminary drafts. This capability allows designers to present multiple, highly refined options to clients faster, improving client engagement and satisfaction. Furthermore, AI algorithms are becoming proficient at optimizing functional elements, such as calculating optimal lighting levels, predicting material durability based on usage patterns, and ensuring compliance with local building codes, thereby embedding a higher degree of technical precision into the early design stages.

Beyond design conceptualization, AI profoundly impacts the back-end logistics and management within the residential design ecosystem. AI-driven project management tools enhance supply chain coordination by predicting material delays, optimizing procurement schedules, and managing vendor communications, leading to better cost control and adherence to project timelines. Personalized shopping experiences are also driven by AI, which recommends furnishings and decor items tailored precisely to the generated design plans and the client’s budget, often integrating with e-commerce platforms. This shift elevates the designer's role from a meticulous draftsman to a strategic project orchestrator and curator, focusing their human expertise on critical client relationship management and complex problem-solving.

- AI-powered Generative Design: Automated creation of initial layout options, color palettes, and mood boards based on input constraints and preferred styles.

- Hyper-Personalization: Algorithms analyze client behavior, aesthetic history, and functional needs to suggest tailor-made design solutions.

- Workflow Automation: AI manages material sourcing, inventory tracking, budgeting, and timeline scheduling, minimizing administrative overhead.

- Predictive Trend Analysis: AI evaluates global market data and social media trends to inform designers about emerging popular styles and material choices.

- Enhanced Visualization: Integration of AI with VR/AR tools for realistic, immersive client previews and instant modifications to 3D models.

- Optimized Space Planning: AI determines optimal ergonomic arrangements and furniture placement based on spatial dimensions and usage objectives.

DRO & Impact Forces Of Residential Interior Design Market

The Residential Interior Design Market is subject to a complex interplay of Drivers, Restraints, and Opportunities that define its growth trajectory and competitive landscape. Key drivers include rising global disposable incomes, particularly in emerging economies, which directly translate into greater consumer willingness to invest in aesthetic and functional home improvements. Simultaneously, the persistent trend of rapid urbanization necessitates creative solutions for maximizing space efficiency in smaller apartments and condominiums, amplifying the need for professional spatial planning services. Opportunities are prominently visible in the convergence of sustainability and technology, where the demand for eco-friendly materials and energy-efficient designs, coupled with the integration of AI and VR, opens new avenues for specialized service offerings.

However, market expansion faces notable restraints, primarily encompassing economic volatility and fluctuating material costs. The interior design industry is highly sensitive to macroeconomic shifts; during economic downturns, discretionary spending on home aesthetics is often the first area consumers curtail. Furthermore, supply chain disruptions and the rising costs of raw materials (such as timber, metals, and specialized finishes) exert significant pressure on project budgets and timelines, leading to client resistance or project deferral. The lack of standardized certification and the high level of market fragmentation, characterized by numerous small independent designers, also pose challenges for large firms seeking scalable operational models and consistent quality control across regions.

The core impact forces shaping the market revolve around technological disruption and shifting demographic preferences. The advent of sophisticated design software, accessible 3D printing for customized fixtures, and immersive visualization tools are forcing traditional design firms to rapidly digitize their services or risk obsolescence. Concurrently, demographic changes, such as the increasing influence of millennials and Generation Z—who prioritize digital experiences, ethical sourcing, and flexible, multi-functional spaces—are redefining service expectations. Successful firms must therefore strategically leverage digital platforms for client acquisition and integrate sustainable, certified materials into their core offerings to maintain relevance and achieve market leadership amidst intense competition and evolving consumer demands.

Segmentation Analysis

The Residential Interior Design Market is meticulously segmented based on key operational characteristics including Service Type, Property Type, Design Style, and End-User. This multi-faceted segmentation allows market participants to tailor their offerings precisely to distinct consumer needs and market demands. The segmentation by Service Type differentiates between comprehensive new construction design—where the designer is involved from the ground up—and renovation/remodeling projects, which involve updating existing structures. Analyzing these segments is crucial for understanding investment flows, as new construction correlates strongly with real estate cycles, while renovation is more resistant to economic volatility, driven by homeowner satisfaction and aging housing stock.

Further granularity is achieved through segmentation by Property Type, acknowledging the unique functional and aesthetic challenges posed by different housing forms, such as apartments, independent homes (villas/bungalows), and luxury high-rise condos. Designers specializing in apartments often focus on space maximization and modular solutions, whereas those handling independent homes cater to large-scale custom architecture and external landscape integration. Design Style segmentation, including Modern, Traditional, Transitional, and Contemporary, reflects the diverse global aesthetic preferences, influencing material selection, furnishing choices, and overall project cost structures. The End-User segmentation, dividing the market between HNWI/Luxury Clients and Middle-Class/Mass Market consumers, determines pricing strategies and the depth of personalization required for projects.

Understanding these segments aids in strategic positioning. For instance, firms targeting the luxury segment must invest heavily in exclusive, custom materials and highly specialized design teams, often dealing with complex, multi-year projects. Conversely, firms targeting the mass market benefit from efficiency gains through standardized procedures, leveraging e-design platforms and off-the-shelf component sourcing. The fastest-growing segment often shifts regionally; for example, in established North American markets, high-end, sustainable renovation services dominate, while in rapidly developing APAC markets, new construction and apartment design segments exhibit the highest expansion rates.

- By Service Type:

- New Construction Design

- Renovation and Remodeling Services

- E-Design Services (Online Consultation)

- By Property Type:

- Apartments and Condominiums

- Independent Houses (Villas, Bungalows)

- Luxury Homes (High-End Custom Projects)

- Holiday Homes and Secondary Residences

- By Design Style:

- Modern and Minimalist

- Traditional and Classic

- Transitional

- Contemporary

- Industrial

- Eclectic

- By End-User:

- High-Net-Worth Individuals (HNWI)

- Middle-Income Homeowners

- Real Estate Developers (Bulk Contracts)

Value Chain Analysis For Residential Interior Design Market

The Value Chain for the Residential Interior Design Market is highly intricate, starting with upstream suppliers and culminating in the client handover. Upstream activities are dominated by raw material producers and manufacturers of essential components, including wood, glass, ceramics, textiles, and specialized hardware. These suppliers feed into the secondary manufacturing level, which produces furniture, lighting fixtures, plumbing fixtures, and custom cabinetry. The relationships at this stage are crucial, as designers rely heavily on the quality, sustainability certifications, and delivery timelines provided by these upstream partners. Strategic sourcing and establishing long-term supplier partnerships are vital for mitigating supply chain risks and ensuring material exclusivity for high-end projects.

The core value creation lies in the central design and management phase, executed by professional interior design firms or independent designers. This phase encompasses conceptual design, detailed drawing creation (often using Building Information Modeling - BIM software), project budgeting, and regulatory compliance checks. The distribution channel plays a dual role: direct distribution involves designers procuring materials directly from manufacturers or wholesalers, often benefiting from trade discounts; indirect distribution utilizes showrooms, specialized retailers, and e-commerce platforms, offering greater variety but potentially higher costs. Effective communication and project coordination between the design firm and general contractors are critical downstream activities that determine project success, quality control, and timely delivery.

Downstream analysis focuses on project execution, installation, and post-completion services. The general contractor (GC) manages the physical construction and installation process, working closely with various subcontractors (electricians, plumbers, painters). The increasing prominence of e-design services represents a shift in the distribution model, providing indirect, digital consultation and often relying on client self-management for procurement and installation. For high-value projects, designers often act as procurement agents, managing the entire purchasing process (Direct). For standard projects, clients may purchase furnishings through retailers recommended by the designer (Indirect). Success hinges on seamless integration between the creative vision, logistical execution, and final client satisfaction reviews.

Residential Interior Design Market Potential Customers

The primary customers in the Residential Interior Design Market are heterogeneous, segmented by wealth, lifestyle, and project scope, yet they uniformly seek expertise to transform their living spaces. High-Net-Worth Individuals (HNWIs) constitute a highly lucrative customer segment, requiring bespoke, luxury, and complex design services for primary residences and expansive secondary properties. These customers prioritize exclusivity, high-end customization, certified sustainable and rare materials, and often demand complete turnkey solutions where the designer manages all aspects from conceptualization to final furnishing placement. For this segment, the interior designer serves as a curator of lifestyle and an architectural consultant, often collaborating with international artists and artisans to create unique, statement environments.

A second major customer group includes the growing segment of middle-to-upper-middle-class homeowners who engage design services primarily for renovation or optimization projects, driven by life changes such as starting a family, transitioning to remote work, or preparing a property for resale. This group is highly cost-conscious but values functional efficiency and modern aesthetics. They increasingly utilize flexible service models, such as e-design platforms, which offer professional guidance at a lower cost point than full-service firms. Designers targeting this demographic must emphasize value engineering, speed of execution, and the integration of affordable yet stylish components, often focusing on standardized materials and modular furniture systems.

Furthermore, Real Estate Developers represent a critical B2B customer segment, contracting designers for large-scale projects, including entire apartment complexes, luxury condominiums, and planned housing developments. Developers seek design solutions that are scalable, marketable, and cost-effective, aiming to maximize unit appeal and sales velocity. Designers in this segment specialize in creating cohesive, repeatable, yet appealing interior concepts that align with the developer’s branding and target buyer demographic. The key purchase criteria for developers are project reliability, ability to meet tight construction schedules, and proven success in creating aspirational model homes that drive purchaser interest.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.8 Billion |

| Market Forecast in 2033 | USD 257.4 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gensler, HOK, Perkins&Will, Rockwell Group, Hirsch Bedner Associates (HBA), AECOM, HDR, Pophouse, Kelly Wearstler Interior Design, Studio G.A. Design, Kritzman Interior Design, David Collins Studio, Yabu Pushelberg, Champalimaud Design, CCD (Cheng Chung Design), AB Concept, Wilson Associates, Meyer Davis, Fiona Barratt Interiors, Roman and Williams. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Interior Design Market Key Technology Landscape

The technological landscape of the Residential Interior Design Market is rapidly shifting towards immersive digital tools that enhance both designer efficiency and client engagement. Building Information Modeling (BIM) software remains foundational, moving beyond mere 3D drafting to intelligent model creation that incorporates material properties, cost estimates, and clash detection, significantly improving project accuracy and reducing construction waste. Furthermore, advanced rendering engines and cloud-based collaborative platforms are essential, allowing geographically dispersed teams (designers, architects, and engineers) to work concurrently on complex residential projects. The adoption of these sophisticated software suites is becoming a key differentiator, enabling firms to manage large-scale portfolios and deliver highly precise documentation necessary for construction.

The integration of Virtual Reality (VR) and Augmented Reality (AR) constitutes a breakthrough in client visualization and decision-making. VR headsets allow clients to walk through a proposed space before construction begins, experiencing spatial relationships, lighting conditions, and material textures in a fully immersive environment, dramatically minimizing guesswork and fostering confidence in design choices. AR applications, usable via smartphones or tablets, allow designers and clients to superimpose digital furniture and décor onto real-world spaces, streamlining the selection and placement process. This technological leap addresses one of the market’s perennial challenges: bridging the gap between two-dimensional plans and the client's three-dimensional comprehension of the finished project.

Beyond visualization, the rise of specialized technology focused on sustainability and customization is redefining material sourcing and execution. Digital fabrication techniques, including large-format 3D printing, are enabling the bespoke creation of complex interior elements like unique light fixtures, custom tile patterns, and personalized hardware on demand, bypassing traditional manufacturing constraints. Moreover, intelligent project management software, often incorporating AI for scheduling and risk prediction, is optimizing the logistical aspects of design implementation. This reliance on advanced technology ensures designers can meet the escalating consumer demand for highly customized, sustainable, and rapidly executed residential projects while maintaining budget controls.

Regional Highlights

- North America (U.S. and Canada): This region holds a significant market share characterized by early adoption of technology, high consumer spending power, and a strong trend towards smart home integration. Demand is particularly robust for full-service luxury residential design and sophisticated renovation projects involving sustainability certifications (e.g., LEED). The U.S. market is highly competitive, driven by renowned international design firms and a mature e-design services market capitalizing on digital platforms for nationwide reach.

- Europe (Germany, U.K., France, Italy): The European market emphasizes quality, heritage preservation, and stringent sustainability regulations. Western European countries exhibit high demand for timeless, high-quality materials and craftsmanship. The U.K. remains a hub for luxury residential design, while Nordic countries lead in sustainable, functional, and minimalist aesthetics. Regulatory environments favoring energy-efficient design necessitate specialized knowledge among firms operating here.

- Asia Pacific (APAC - China, India, Japan, South Korea): APAC is the fastest-growing market, primarily fueled by rapid urbanization, massive residential construction booms, and the exponential growth of the middle class in China and India. Design demand focuses heavily on high-density apartment design, space-saving solutions, and the incorporation of local cultural elements. Investment in design services is increasing as real estate developers recognize the marketability of professionally designed interiors.

- Latin America (LATAM - Brazil, Mexico): The market is characterized by varied economic stability, leading to fluctuating demand. Growth is concentrated in major urban centers, driven by HNWIs and real estate developers seeking contemporary and luxury design solutions. Local materials and distinct regional architectural styles play a crucial role, with an increasing interest in sustainable building practices.

- Middle East and Africa (MEA): The MEA market, particularly the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), demonstrates exceptional demand for ultra-luxury, bespoke residential interiors, often involving large-scale, opulent villas and high-end residential towers. These projects typically demand international design standards, requiring firms specialized in high-end global procurement and elaborate custom features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Interior Design Market.- Gensler

- HOK

- Perkins&Will

- Rockwell Group

- Hirsch Bedner Associates (HBA)

- AECOM

- HDR

- Pophouse

- Kelly Wearstler Interior Design

- Studio G.A. Design

- Kritzman Interior Design

- David Collins Studio

- Yabu Pushelberg

- Champalimaud Design

- CCD (Cheng Chung Design)

- AB Concept

- Wilson Associates

- Meyer Davis

- Fiona Barratt Interiors

- Roman and Williams

Frequently Asked Questions

Analyze common user questions about the Residential Interior Design market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Residential Interior Design Market?

The Residential Interior Design Market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033, driven by increasing urbanization and global disposable income levels, indicating robust expansion in the sector.

How is AI impacting the personalization capabilities within residential design?

AI significantly enhances personalization by analyzing vast consumer data, ergonomic requirements, and design trends to instantly generate highly customized spatial layouts, material recommendations, and visual concepts, making the design process faster and more client-specific.

Which geographical region is currently demonstrating the highest growth potential in this market?

The Asia Pacific (APAC) region, particularly driven by large-scale urban development and the rapid expansion of the middle class in countries like China and India, is projected to be the fastest-growing market segment during the forecast period.

What are the primary drivers fueling the demand for professional residential interior design services?

Key market drivers include the growing consumer preference for functional and aesthetically optimized smart homes, increasing disposable income globally, and the rising demand for comprehensive renovation and remodeling services for aging housing stock.

Are sustainability and green design principles major trends in residential interiors?

Yes, sustainability is a critical market opportunity. Consumers are increasingly demanding eco-friendly materials, energy-efficient design solutions, and certifications (e.g., LEED or WELL standards), pushing design firms to integrate sustainable sourcing and biophilic design concepts into their core offerings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager