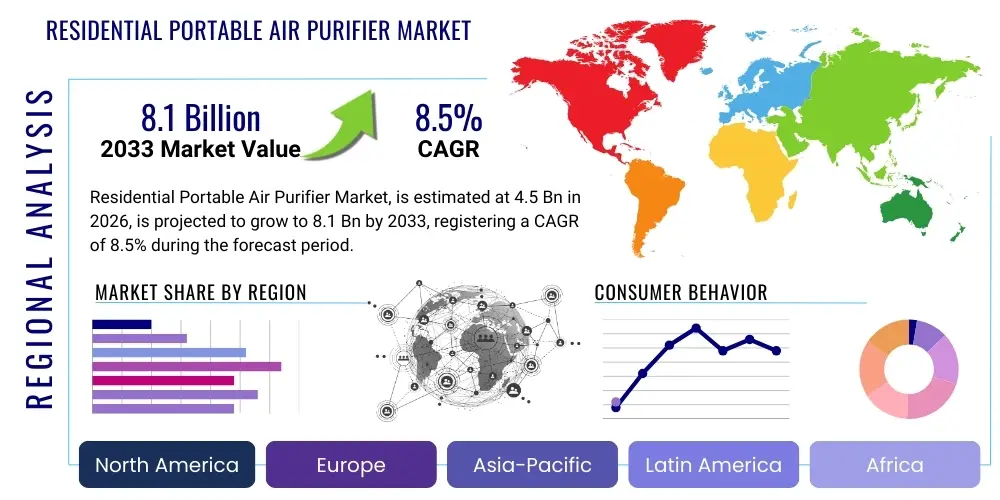

Residential Portable Air Purifier Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442781 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Residential Portable Air Purifier Market Size

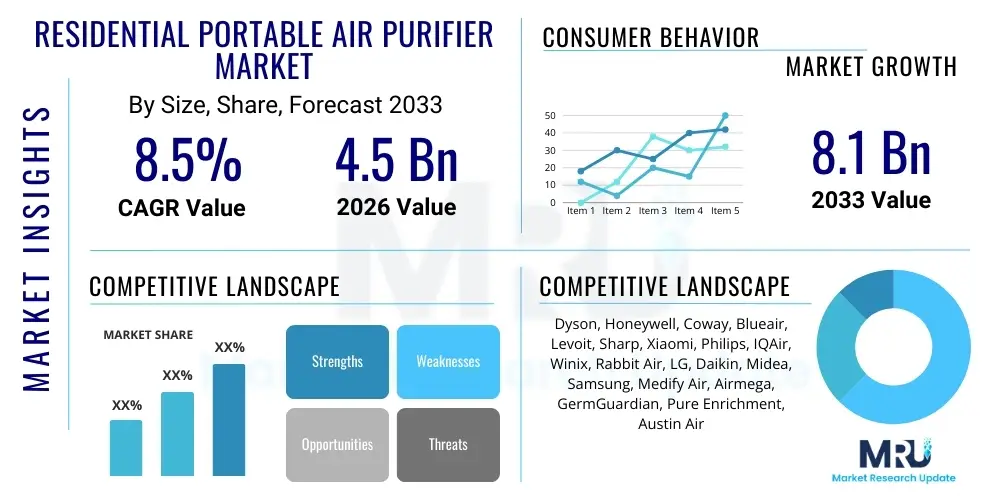

The Residential Portable Air Purifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Residential Portable Air Purifier Market introduction

The Residential Portable Air Purifier Market encompasses the sales and distribution of movable devices designed to filter and clean indoor air within residential settings such as homes, apartments, and dormitories. These devices are engineered to remove common indoor air contaminants, including dust, pollen, pet dander, mold spores, volatile organic compounds (VOCs), and airborne pathogens, thereby enhancing overall air quality and occupant well-being. The core function relies on various filtration technologies—predominantly High-Efficiency Particulate Air (HEPA) filters, coupled with activated carbon and often supplemented by UV-C light or ionizers—to capture or neutralize pollutants. The rising global awareness regarding the adverse health effects of indoor air pollution, especially concerning respiratory conditions and allergies, serves as the primary impetus for market expansion across developed and developing economies. Furthermore, increasing urbanization, coupled with phenomena like wildfire smoke and seasonal allergen surges, makes portable air purification an essential component of modern household health infrastructure.

The product category is characterized by significant technological diversification, catering to different room sizes, aesthetic preferences, and budget constraints. Modern portable air purifiers are increasingly integrating smart technology, offering features such as Wi-Fi connectivity, app control, real-time air quality monitoring, and automatic operational adjustments based on sensor readings. Major applications center around creating designated "clean zones" within residential units, particularly in bedrooms, living areas, and home offices where occupants spend the majority of their time. The primary target consumer base includes allergy sufferers, families with young children or elderly members, and pet owners, all seeking proactive measures to mitigate exposure to environmental health hazards. The market landscape is highly competitive, driven by continuous innovation focusing on improving filtration efficacy, energy efficiency, noise reduction, and sleek, minimalist design suitable for contemporary residential interiors.

Key benefits derived from the adoption of residential portable air purifiers include symptomatic relief for individuals suffering from asthma and allergies, the reduction of odors and airborne germs, and an overall improvement in respiratory health outcomes. Driving factors are multifaceted, ranging from public health crises that highlight the transmission risks of airborne viruses to sustained media coverage detailing the detrimental quality of indoor air, often found to be two to five times more polluted than outdoor air. Regulatory standards in various regions emphasizing better energy consumption and material safety for consumer electronics also influence product development, pushing manufacturers toward sustainable and certified high-performance units. The convenience and versatility offered by portable units, which can be easily moved between rooms, contribute significantly to their enduring appeal over fixed HVAC-integrated solutions.

Residential Portable Air Purifier Market Executive Summary

The Residential Portable Air Purifier Market is experiencing robust growth driven by escalating public health consciousness concerning respiratory illnesses and persistent threats from environmental factors such as pollution and allergens. Business trends indicate a definitive shift toward premiumization, with consumers increasingly favoring devices that offer advanced multi-stage filtration systems (HEPA + Activated Carbon + specialized filters for VOCs), coupled with IoT integration for seamless home automation. Strategic mergers and acquisitions, alongside partnerships between technology firms and HVAC specialists, are shaping the competitive dynamics, focusing on expanding distribution reach and improving supply chain resilience. Manufacturers are prioritizing innovation in filter longevity and energy efficiency to reduce the total cost of ownership, thereby appealing to a broader demographic. Furthermore, subscription models for replacement filters are gaining traction, establishing recurring revenue streams and enhancing customer loyalty in this maintenance-intensive sector.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by severe ambient air quality issues in densely populated urban centers, particularly in China and India, alongside rising disposable incomes that enable consumers to invest in health-enhancing appliances. North America and Europe, while mature markets, demonstrate sustained demand driven by allergy awareness, stringent indoor air quality standards, and the rapid adoption of smart home technology. Market expansion in Latin America and the Middle East & Africa (MEA) is accelerating, albeit from a smaller base, primarily due to increased construction activities, changing lifestyles, and a growing recognition of indoor air pollution sources. These regions show strong potential for entry-level and mid-range products, emphasizing robust filtration capabilities and ease of use over complex smart features.

Segment-wise, the HEPA technology segment dominates due to its superior efficacy in capturing ultrafine particulate matter (PM2.5), which is crucial for addressing common indoor air quality concerns. However, hybrid technologies incorporating UV-C sterilization and plasma/ionic methods are rapidly increasing their market share, particularly in response to consumer demand for germ and virus mitigation solutions. The medium-sized room coverage segment (200-400 sq. ft.) holds the largest proportion of the market, reflecting the typical room dimensions in modern residential architecture, while the premium market is characterized by high-throughput purifiers designed for open-plan living spaces. Distribution channels are undergoing a transformation, with e-commerce platforms experiencing accelerated growth, offering consumers broader product comparisons, transparent pricing, and direct-to-consumer accessibility, supplementing traditional big-box retail channels.

AI Impact Analysis on Residential Portable Air Purifier Market

Analysis of common user questions reveals significant interest centered on how artificial intelligence (AI) can transcend basic automation and fundamentally redefine air purification. Key user inquiries frequently address: "How does AI make purifiers truly smarter?" "Can AI predict air quality deterioration before it happens?" and "How will machine learning optimize filter life and replacement cycles?" Users expect AI to move beyond reactive filtering—turning on when pollution is detected—towards predictive air quality management, personalized health profiles based on breathing patterns or environmental sensitivities, and seamless integration into complex smart home ecosystems. Concerns often revolve around data privacy, the accuracy of advanced sensors used by AI systems, and the potential increase in the initial cost of AI-enabled devices. The underlying expectation is that AI should lead to unprecedented efficiency, energy savings, and a 'set-it-and-forget-it' user experience, ensuring optimal air quality without continuous manual intervention or excessive energy consumption.

The core theme summarizing AI's influence is the transition from a passive cleaning appliance to an active, intelligent health monitoring and response system. AI algorithms process vast amounts of sensor data (PM2.5, VOCs, temperature, humidity, external environmental data) collected both internally and externally via cloud services. This allows for nuanced decision-making, such as adjusting fan speed incrementally based on the predicted rate of pollution decay or modulating performance to minimize noise during sleeping hours while maintaining requisite filtration levels. Furthermore, deep learning models are instrumental in identifying subtle changes in air quality profiles indicative of specific events, like cooking fumes versus chemical off-gassing, enabling the purifier to apply the most effective filtration setting immediately. This level of personalized, adaptive performance is unattainable with traditional reactive logic boards, fundamentally enhancing the value proposition for high-end residential users seeking maximum health assurance.

The commercial impact of AI is profound, enabling manufacturers to differentiate their products substantially in a crowded market. AI-driven predictive maintenance utilizes machine learning to analyze usage patterns, filter saturation data, and environmental factors to accurately estimate the remaining lifespan of filters, notifying the user precisely when a replacement is needed, maximizing efficiency, and reducing operational guesswork. This optimization capability not only improves customer satisfaction but also fosters greater energy efficiency by ensuring the device only operates at the precise intensity required to maintain the desired air quality threshold, yielding long-term utility savings. Companies leveraging AI in their portable purifiers are thus positioned as technological leaders, providing superior performance metrics and data-driven insights back to the consumer, solidifying their competitive advantage in the smart home ecosystem segment.

- AI-driven Predictive Filtration: Utilizing machine learning to anticipate pollution events (e.g., predicted pollen count, high traffic periods) and preemptively adjust operating modes.

- Personalized Health Profiles: Analyzing user habits and external data to create optimal indoor air quality settings tailored to individual family members' respiratory needs.

- Optimized Energy Consumption: Minimizing fan power usage while maximizing contaminant removal efficiency through continuous algorithmic adjustments.

- Real-time Diagnostic and Maintenance Alerts: Analyzing sensor data for component degradation, predicting filter life accurately, and facilitating proactive servicing.

- Seamless Smart Home Integration: Enhancing compatibility with major IoT platforms (e.g., Alexa, Google Home) for unified voice command and centralized management.

- Advanced Sensor Fusion: Improving the accuracy and specificity of pollutant detection by integrating and interpreting data from multiple sensor types (VOCs, particulate, CO2) using deep learning models.

DRO & Impact Forces Of Residential Portable Air Purifier Market

The Residential Portable Air Purifier Market is defined by powerful growth drivers stemming primarily from acute health awareness and deteriorating environmental conditions, balanced by structural restraints such as high initial cost and ongoing maintenance expenses, while presenting significant opportunities in technological convergence and geographical expansion. The central driving force is the pervasive public fear and demonstrable evidence linking poor indoor air quality to serious health issues, including asthma, COPD, and cardiovascular diseases, amplified by global events like the COVID-19 pandemic, which underscored the critical importance of air sanitation. Simultaneously, market growth is tempered by consumer resistance related to the required frequency and cost of proprietary filter replacements, which can accumulate significantly over the device lifespan, positioning some high-end units as luxury items rather than household necessities. The overall market trajectory, however, is significantly positive, as rising disposable incomes, urbanization, and continuous product miniaturization and performance improvement combine to generate a powerful positive impact force, reshaping consumer expectations regarding essential household appliances and solidifying the purifier's role as a non-negotiable health device.

Drivers: Intensifying outdoor air pollution (smog, wildfire smoke) penetrating residential spaces necessitates robust indoor protection, alongside rising incidences of respiratory allergies and asthma globally, compelling households to invest in mitigating factors. The continuous proliferation of building materials and household products that off-gas Volatile Organic Compounds (VOCs) creates a persistent internal source of contamination that standard ventilation cannot fully address. Furthermore, the increasing adoption of smart home technology facilitates easier use and integration of purifiers, moving them from niche appliances to mainstream consumer electronics. Restraints: Significant inhibitors include the high purchase price of premium, certified purifiers employing advanced HEPA and multi-stage filtration technologies, which remains a barrier to entry for lower-income segments. The ongoing financial burden of specialized replacement filters, proprietary to specific brands and models, leads to consumer frustration and sometimes encourages the use of devices beyond their effective filter life. Additionally, consumer skepticism regarding the true efficacy of various ionization or ozone-generating technologies, often fueled by conflicting marketing claims, can slow adoption rates.

Opportunities: Major opportunities reside in expanding into underserved markets, particularly rural areas in developing nations where environmental awareness is increasing but product penetration remains low. The convergence of air purification with smart diagnostics, such as personalized health recommendations derived from air quality data, opens up lucrative partnerships with healthcare providers and wellness platforms. Developing highly sustainable, washable, or longer-lasting filter media, potentially incorporating nanofiber technology, represents a significant avenue for manufacturers to address the key restraint of high maintenance cost and environmental waste. The market also benefits substantially from regulatory pushes in various regions, demanding stricter energy efficiency standards and performance transparency (e.g., CADR ratings), which favors technology-leading manufacturers. These combined forces ensure that while short-term challenges exist, the long-term structural demand for cleaner indoor air promises sustained high growth rates, especially for differentiated, feature-rich products.

Segmentation Analysis

The Residential Portable Air Purifier Market is meticulously segmented based on key functional attributes, technological applications, and end-user behavior, providing a granular view of consumer preferences and market dynamics. Understanding these segments is crucial for strategic positioning, allowing manufacturers to tailor products for specific needs, such as coverage area requirements or targeted pollutant removal mechanisms. The primary segmentation dimensions include the type of technology employed for filtration, the physical area the device is designed to cover (measured in square footage), and the predominant distribution channel utilized for sales and customer engagement. HEPA technology remains the foundational standard across all segments, but niche demands drive growth in specialized sub-segments like UV-C sterilization for microbial inactivation and advanced activated carbon filters targeting heavy VOC loads commonly found in newly renovated homes or urban environments. This granular structure helps identify high-growth pockets, particularly within the smart and large-room coverage categories, reflecting the trend toward open-plan living and technological integration.

- By Technology:

- HEPA (High-Efficiency Particulate Air)

- Activated Carbon

- Ionic Filters/Ionizers

- UV-C Technology

- Ozone Generators (Niche/Declining)

- Hybrid/Multi-Stage Filtration Systems

- By Coverage Area:

- Small Room (Up to 200 sq. ft.)

- Medium Room (201 - 400 sq. ft.)

- Large Room (401 - 700 sq. ft.)

- Extra Large Room (Above 700 sq. ft.)

- By Distribution Channel:

- Offline (Retail Stores, Hypermarkets, Department Stores)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

- By End-User Application:

- Single-Family Homes

- Apartments/Condominiums

- Dormitories/Shared Housing

Value Chain Analysis For Residential Portable Air Purifier Market

The value chain for the Residential Portable Air Purifier Market begins with the upstream procurement of essential raw materials and specialized components, focusing heavily on filter media, sensor technology, motors, and plastic or metal housing materials. Upstream analysis highlights a strong reliance on specialized suppliers for HEPA filter media (often requiring specific certifications) and high-precision air quality sensors, which are critical determinants of the final product's performance and cost. Innovation at this stage centers on developing sustainable, high-efficiency filter materials and miniaturized, highly accurate sensor arrays crucial for smart functionality. Manufacturers must manage complex global supply chains, often sourcing components from specialized regions in Asia, placing a premium on resilient logistics and quality control to ensure component integrity and minimize manufacturing defects.

Moving downstream, the chain involves manufacturing, assembly, branding, and ultimately, market distribution. Manufacturing processes are increasingly automated to maintain scale and precision, with key operational efficiency goals including reducing noise output and optimizing fan designs. Distribution channels are bifurcated into direct and indirect routes. Indirect distribution, leveraging major offline retail chains (hypermarkets, electronics stores) and established online marketplaces (Amazon, JD.com), accounts for the largest volume of sales, relying on strong channel partnerships and volume discounting. Direct channels, primarily through branded e-commerce websites, allow manufacturers better control over pricing, brand messaging, and direct customer relationships, often utilized for launching premium or technologically advanced models and managing recurring filter subscriptions.

The post-sale value chain includes customer support, warranties, and, most importantly, the high-margin revenue stream associated with proprietary filter replacement sales. This ongoing relationship is critical for maximizing customer lifetime value. Furthermore, the increasing complexity of smart purifiers necessitates robust technical support and over-the-air firmware updates (OTAs) to maintain optimal functionality and security. Effective management of the distribution logistics, particularly for bulky items, and streamlining the filter replacement process are key competitive differentiators. Companies that successfully leverage both online accessibility and physical retail presence for demonstration and immediate purchase tend to achieve broader market penetration and higher overall profitability across the entire product lifecycle.

Residential Portable Air Purifier Market Potential Customers

Potential customers for residential portable air purifiers span a wide demographic, unified by a concern for personal or family health and well-being, specifically related to respiratory health. The primary end-users are households seeking preventative measures against common indoor allergens and pollutants. This segment includes young families with infants or toddlers, where minimizing exposure to dust mites, pet dander, and VOCs is prioritized for developmental health. Another substantial customer segment comprises individuals diagnosed with allergic rhinitis, asthma, or other Chronic Obstructive Pulmonary Diseases (COPD), who rely on air purification to manage symptoms and reduce reliance on medication, viewing the device as a necessary medical aid rather than a consumer luxury.

Beyond health-driven motivations, a growing segment of tech-savvy urban dwellers and homeowners constitutes a key buying group. These customers prioritize high-end, aesthetically pleasing devices that integrate seamlessly into a smart home environment, offering features like Wi-Fi connectivity, app control, and real-time air quality reporting. They often inhabit environments exposed to high levels of external pollution (e.g., city centers, areas near industrial zones) or persistent irritants like wildfire smoke. This group is less price-sensitive and focuses on certified Clean Air Delivery Rate (CADR) and verified performance against specific pollutants, demanding robust, high-capacity purifiers capable of handling large, open living spaces.

Finally, a significant emerging customer base includes pet owners, who specifically require purifiers with exceptional odor control capabilities (activated carbon filters) and superior filtration efficiency against pet dander and hair. Also included are renters and individuals in temporary housing (dormitories, shared apartments) who favor the portability and non-permanent nature of the devices over installing centralized HVAC solutions. These diverse customer profiles necessitate manufacturers to offer a tiered product line, from entry-level, reliable HEPA units for essential use to premium, feature-rich systems designed for specific lifestyle and health requirements, ensuring market coverage across all price points and functional needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dyson, Honeywell, Coway, Blueair, Levoit, Sharp, Xiaomi, Philips, IQAir, Winix, Rabbit Air, LG, Daikin, Midea, Samsung, Medify Air, Airmega, GermGuardian, Pure Enrichment, Austin Air |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Portable Air Purifier Market Key Technology Landscape

The technology landscape of the Residential Portable Air Purifier Market is dominated by multi-stage filtration systems designed to capture pollutants across a broad spectrum of sizes and types. The HEPA filter remains the undisputed core technology, mandated by consumer expectation for particulate removal efficiency, capturing 99.97% of airborne particles 0.3 micrometers in size. Manufacturers are continuously refining HEPA filters to be thinner, quieter, and more resistant to microbial growth, often incorporating proprietary modifications like True HEPA or H13 grade filters for enhanced performance against ultrafine particles (PM2.5 and smaller). This foundational technology is almost universally paired with an activated carbon filter, which uses adsorption to neutralize gases, odors, and Volatile Organic Compounds (VOCs), critical components in addressing smells from cooking, pets, and household chemicals. The effectiveness of the carbon stage is determined by the volume and quality (e.g., granular versus pelleted) of the carbon used.

Beyond mechanical filtration, supplemental technologies are increasingly common to offer comprehensive air sanitation. UV-C (Ultraviolet C) germicidal irradiation is employed in many models, particularly those marketed toward allergy and asthma sufferers, to inactivate airborne viruses, bacteria, and mold spores caught on the filter media, preventing secondary contamination and boosting public confidence regarding pathogen mitigation. Ionic purification and plasmawave technologies, while controversial in the past due to potential ozone production, have been refined significantly, now offering ozone-safe methods to charge particles, causing them to clump together or stick to surfaces, improving the overall filtration burden on mechanical filters. However, marketing and consumer acceptance of these technologies still require transparent disclosure of ozone emissions, adhering strictly to standards set by bodies like the California Air Resources Board (CARB).

The most significant technological evolution involves the integration of high-precision smart sensors and IoT capabilities. Modern purifiers incorporate laser-based particulate matter sensors (PM2.5/PM10), advanced VOC sensors, and environmental monitors (humidity/temperature). These sensors feed data to integrated microprocessors and cloud-based AI algorithms, enabling automated operation, remote monitoring via mobile applications, and integration into broader smart home ecosystems (e.g., connecting air quality data to smart thermostats or smart lighting systems). Future technological development is heavily focused on creating silent, high-CADR motors, developing maintenance-free pre-filter technologies, and applying advanced nanotechnology to filter media for highly selective pollutant removal (e.g., specific chemical vapors), thereby increasing efficiency and reducing the cost and frequency of maintenance for the residential user base.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, fundamentally driven by severe ambient air pollution in major economies like China, India, and Southeast Asia, leading to critical health concerns. Rapid urbanization, increasing industrial output, and dense populations contribute to highly polluted indoor environments. High market penetration is further supported by rising disposable incomes and proactive governmental initiatives promoting healthy living standards. The region exhibits high demand for high-CADR purifiers suitable for continuous operation and feature-rich smart devices integrated with local smart home protocols.

- North America: This region represents a mature yet dynamic market, characterized by high consumer awareness, strong regulatory standards (e.g., Energy Star certification), and a high propensity for adopting smart technology. Market growth is sustained by the severe impact of seasonal allergies and recurring phenomena like large-scale wildfire smoke exposure in the Western United States and Canada, which necessitates high-performance HEPA filtration. Demand is strong for premium, design-focused brands offering long warranties and superior customer service.

- Europe: Europe demonstrates steady growth, influenced primarily by stringent EU regulations regarding indoor air quality in modern, highly insulated buildings, where ventilation can be limited. The market is highly fragmented, with strong demand for energy-efficient, quiet, and aesthetically pleasing devices (Scandinavian design influence). Central and Western European countries show high adoption rates, driven by concerns over VOCs from building materials and household chemicals, placing a premium on advanced carbon filtration systems.

- Latin America (LATAM): LATAM is an emerging market characterized by increasing health awareness and middle-class expansion, particularly in Brazil and Mexico. The market is price-sensitive, with strong interest in mid-range, effective HEPA units. Growth is driven by local pollution challenges and the desire to mitigate the spread of endemic pathogens, positioning portable purifiers as essential health tools rather than luxury goods, requiring localized distribution and affordable entry points.

- Middle East and Africa (MEA): This region shows nascent but accelerating growth, fueled by extreme environmental factors such as sandstorms, high desert dust levels, and significant construction activity leading to airborne debris. High energy costs in the region necessitate a focus on energy efficiency. The affluent Gulf Cooperation Council (GCC) countries drive demand for high-capacity, luxury-segment smart purifiers, while broader African adoption is constrained by price sensitivity and electricity access reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Portable Air Purifier Market.- Dyson

- Honeywell International Inc.

- Coway Co., Ltd.

- Blueair (Unilever)

- Levoit (Vesync Co., Ltd)

- Sharp Corporation

- Xiaomi Corporation

- Koninklijke Philips N.V.

- IQAir North America Inc.

- Winix America Inc.

- Rabbit Air

- LG Electronics

- Daikin Industries, Ltd.

- Midea Group

- Samsung Electronics Co., Ltd.

- Medify Air

- Airmega

- GermGuardian (Guardian Technologies)

- Pure Enrichment

- Austin Air Systems

Frequently Asked Questions

Analyze common user questions about the Residential Portable Air Purifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most crucial factor determining a portable air purifier's effectiveness?

The effectiveness is primarily determined by the unit's Clean Air Delivery Rate (CADR) for specific pollutants (smoke, dust, pollen) relative to the size of the room, coupled with the quality and certified grade of its HEPA and Activated Carbon filters. A high CADR ensures faster and more efficient air cleaning.

How frequently should HEPA filters in residential air purifiers be replaced?

HEPA filters generally require replacement every 6 to 12 months, depending heavily on the filter quality, ambient air pollution levels, and the intensity and frequency of device usage. Modern smart purifiers use AI to monitor usage and sensor data, providing precise, real-time alerts for replacement.

Are portable air purifiers effective against airborne viruses and bacteria, including COVID-19 particles?

Yes, high-grade True HEPA filters (H13 or better) are effective at capturing airborne virus particles and aerosols, including those associated with COVID-19, because these particles typically attach to larger respiratory droplets which fall within the effective capture range of the filter medium (0.3 microns). Supplementary UV-C technology can further inactivate biological contaminants.

What is the difference between HEPA and activated carbon technology, and do I need both?

HEPA technology is designed to mechanically filter and trap particulate matter (dust, pollen, dander). Activated carbon technology uses adsorption to chemically neutralize gaseous pollutants, odors, and Volatile Organic Compounds (VOCs). Both are essential for comprehensive indoor air quality management in residential settings.

Is the high upfront cost of smart air purifiers justified by their features?

The higher cost is justified for users prioritizing maximum efficiency, convenience, and health data insights. Smart purifiers offer automated operation, optimized energy consumption, predictive filter maintenance, and remote control capabilities via mobile apps, providing a superior user experience and lower long-term running costs through efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager