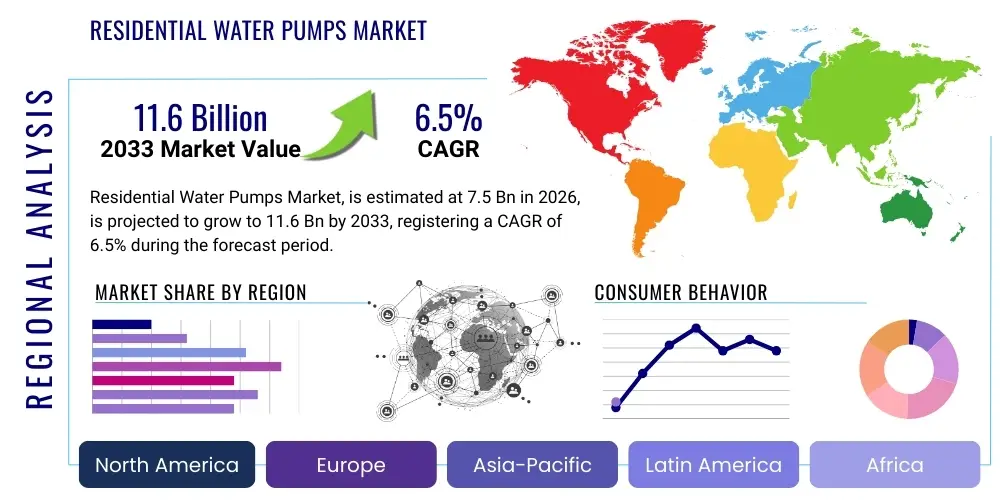

Residential Water Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441001 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Residential Water Pumps Market Size

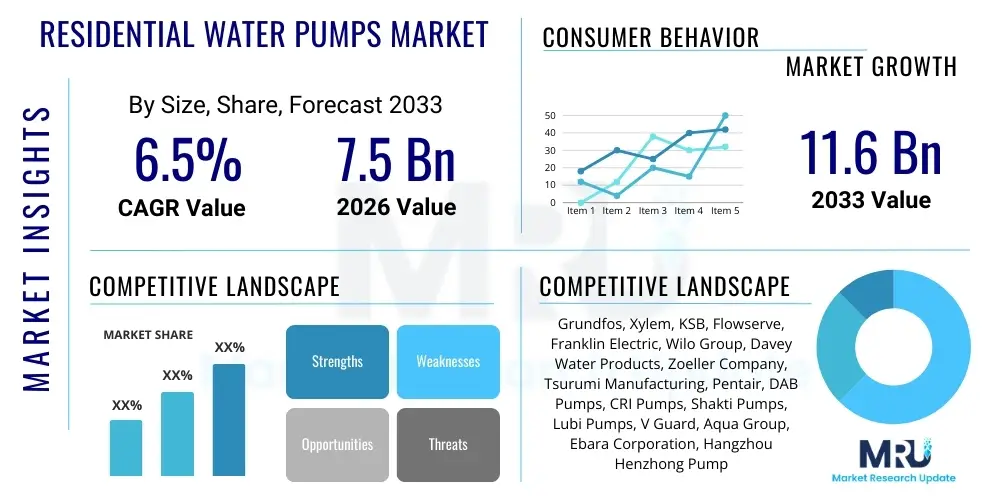

The Residential Water Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing global urbanization trends, heightened demand for reliable domestic water supply systems, and the accelerating integration of energy-efficient and smart pump technologies into modern residential infrastructure. The transition from traditional manual systems to automated, high-pressure residential water solutions, particularly in rapidly developing economies, significantly contributes to this forecasted growth trajectory.

Residential Water Pumps Market introduction

Residential Water Pumps are electromechanical devices fundamentally designed to facilitate the movement of water for various domestic applications, encompassing clean water supply, wastewater disposal, pressure boosting, and irrigation of residential landscapes. These essential systems manage the fluid mechanics required to ensure adequate water flow and pressure within a household, drawing water from sources such as wells, municipal mains, or reservoirs and distributing it throughout the property. Key product categories include submersible pumps, jet pumps, booster pumps, and circulating pumps, each optimized for specific functional requirements related to head pressure, flow rate, and installation environment. The technological evolution in this sector emphasizes enhanced reliability, reduced noise levels, and superior energy efficiency, aligning with global sustainability mandates and consumer preferences for lower operational costs.

Major applications of residential water pumps span critical household functions. These include primary water supply from groundwater sources, essential pressure boosting in high-rise or poorly pressurized urban dwellings, and managing effective drainage and sewage ejection, particularly in basement environments or areas prone to flooding. Furthermore, sophisticated variable speed drive (VSD) pumps are increasingly adopted for maintaining consistent water pressure regardless of simultaneous household demands, thereby significantly improving user comfort and reducing overall system wear. The immediate benefits derived from the implementation of modern residential pump systems include enhanced water security, optimized energy consumption through intelligent control systems, and improved compliance with local sanitation and building codes, positioning these pumps as indispensable components of contemporary residential development.

The market is actively driven by several concurrent macro- and micro-economic factors. Crucially, relentless population growth coupled with massive urbanization, particularly across Asia Pacific and specific regions of Latin America and Africa, necessitates new residential construction and associated reliable water infrastructure. Furthermore, aging existing infrastructure in developed nations requires substantial replacement and modernization, favoring the adoption of newer, more durable, and efficient pump models. Regulatory pressures promoting sustainability, such as stringent minimum efficiency requirements set by bodies like the European Union and the U.S. Department of Energy, compel manufacturers to innovate, pushing the market towards high-efficiency motors and IoT-enabled smart controls, thereby acting as strong market accelerators.

Residential Water Pumps Market Executive Summary

The global Residential Water Pumps Market is characterized by a definitive shift towards technologically advanced pumping solutions, dominated by energy efficiency mandates and smart home integration trends. Business trends indicate strong merger and acquisition activity among key industry players focused on expanding geographical reach and consolidating core competencies in smart technology. Manufacturers are heavily investing in permanent magnet motors (PMMs) and Variable Speed Drive (VSD) technologies to meet rising consumer demand for reduced electricity consumption and quiet operation. Furthermore, the market is seeing increased penetration of specialized pumps for greywater recycling and rainwater harvesting, reflecting a growing consumer focus on water conservation and resilience against drought conditions, fundamentally altering product development priorities and supply chain logistics to favor sustainable materials.

Regionally, the Asia Pacific (APAC) sector stands as the undisputed engine of growth, propelled by unprecedented rates of new housing construction, substantial government investment in sanitation infrastructure, and rapidly expanding middle-class consumption power which demands higher quality home appliances. North America and Europe, while representing mature markets, exhibit strong demand driven primarily by replacement cycles and mandatory regulatory upgrades focusing on achieving Z-E (Zero Energy) readiness in residential buildings. These mature regions are the primary adopters of high-margin smart pumps capable of remote diagnostics and proactive maintenance scheduling. Emerging economies within Latin America and the Middle East and Africa (MEA) are registering significant demand for basic, robust, and affordable submersible and jet pumps for primary water access, supported by governmental programs aimed at improving basic utilities access.

Segment trends reveal that the Submersible Pump category maintains market leadership due to its versatility and critical role in deep well applications, particularly in rural and semi-urban settings reliant on groundwater. However, the Booster Pump segment is projected to record the highest growth CAGR, driven by the proliferation of multi-story residential complexes and the need to maintain uniform water pressure across complex internal distribution networks. In terms of technology, electronic control systems and integrated sensors are becoming standard features, moving away from simple mechanical switches. This intelligent integration allows for sophisticated flow management and fault detection, which is increasingly valued by system installers and end-users for ensuring system longevity and operational consistency, further driving segmentation towards VSD-equipped units.

AI Impact Analysis on Residential Water Pumps Market

User queries regarding AI integration in residential pumps frequently center on operational efficiency, predictive failure detection, and optimization of energy usage in real-time scenarios. Common concerns revolve around the complexity and cost associated with implementing AI-enabled control units, data privacy implications arising from continuous monitoring, and the necessity of specialized maintenance skills for these advanced systems. Users are keenly interested in understanding how AI algorithms can effectively analyze complex usage patterns to automatically adjust pump speeds and cycles, thereby minimizing electricity expenditure and extending equipment lifespan significantly. Expectations focus on AI providing a truly autonomous water management experience, reducing manual intervention, and offering proactive alerts regarding potential system faults such as minor leaks or cavitation before they result in catastrophic failures, fundamentally shifting the maintenance paradigm from reactive to predictive.

The integration of Artificial Intelligence and sophisticated machine learning algorithms is profoundly enhancing the intelligence and reliability of residential water pump systems, marking a paradigm shift in domestic water management. AI processes the vast streams of data generated by embedded IoT sensors—including pressure, temperature, vibration, and flow rates—to develop highly accurate predictive models for system behavior. This capability allows the pump control unit to not only react instantly to changes in household water demand but also to anticipate future requirements based on learned usage patterns, optimizing energy consumption far beyond the capabilities of traditional fixed-speed or even basic VSD systems. Furthermore, AI-driven diagnostics significantly improve system resilience by distinguishing between normal operational variance and genuine mechanical anomalies, ensuring high uptime.

Crucially, AI applications extend beyond mere efficiency to system optimization and integration within the broader smart home ecosystem. AI algorithms facilitate seamless communication between the pump, smart irrigation controllers, and other water-consuming appliances, orchestrating supply to match prioritized demand while minimizing stress on the municipal or well supply. For instance, an AI-enabled pump can learn the optimal pressure curve required for a specific plumbing layout, minimizing surge and reducing noise pollution. While the initial capital expenditure for AI-enabled pumps remains higher, the long-term operational savings derived from drastically reduced energy consumption, early fault mitigation, and extended component life cycle provide a compelling Total Cost of Ownership (TCO) argument, accelerating its adoption in high-end and efficiency-conscious markets globally.

- Enhanced Predictive Maintenance: AI analyzes vibration and thermal signatures to anticipate mechanical failures, enabling preventative action.

- Dynamic Energy Optimization: Machine learning algorithms adjust pump operating parameters in real-time based on historical demand patterns and current usage.

- Autonomous System Calibration: AI self-calibrates pump settings post-installation, optimizing head pressure and flow efficiency relative to specific plumbing characteristics.

- Improved Fault Isolation: Advanced diagnostics quickly pinpoint the location and nature of system faults (e.g., blockages, dry running, or electrical issues).

- Integration with Smart Grids: Allows pumps to operate optimally during off-peak electricity pricing or integrate with home solar energy production schedules.

DRO & Impact Forces Of Residential Water Pumps Market

The dynamics of the Residential Water Pumps Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively determining the impact forces shaping its trajectory. The primary driving forces include rapid global population expansion and resultant urbanization, which directly necessitates new construction and reliable water distribution systems. Alongside this, governmental mandates promoting energy efficiency and sustainable resource management compel industry transition towards high-efficiency pumps, particularly in developed markets. Restraints often revolve around the high initial cost associated with advanced VSD and smart pumps, posing adoption barriers in price-sensitive markets. Furthermore, the market faces constraints related to the volatility in raw material prices, particularly for metals like copper and stainless steel used in high-performance components, and the inherent energy consumption of electric motors, despite efficiency improvements.

Opportunities are largely concentrated in the development and proliferation of solar-powered residential pump systems, offering a viable solution for off-grid or remote locations with unreliable electricity access, tapping into a vast underserved market. Another significant opportunity lies in the rapid expansion of IoT and smart home platforms, where water pumps become integrated, controllable, and fully diagnostic components of the residential ecosystem, offering added value through remote monitoring and integration with home security or conservation programs. These opportunities encourage strategic partnerships between pump manufacturers and technology providers. The collective impact forces push the industry towards continuous innovation, where regulatory compliance and consumer demand for lower lifetime operational costs act as powerful accelerators for technological adoption, favoring companies investing heavily in R&D for next-generation efficient fluid management systems.

Segmentation Analysis

The Residential Water Pumps Market is comprehensively segmented based on product type, application, power rating, and technological features, providing granular insights into demand patterns and competitive positioning. Segmentation by Product Type differentiates between the mechanics and installation methods, encompassing Submersible Pumps, which are designed to be fully submerged for deep well and sump applications, Jet Pumps, primarily used for shallower wells and drawing water over short distances, and Booster Pumps, which increase pressure within existing piping systems. Application segmentation highlights the diverse end-uses, ranging from primary household water supply and drainage systems to dedicated landscape irrigation and specialized water treatment applications, dictating the required pump capacity and material resistance to different water qualities. These segments reflect varied consumer needs and regulatory landscapes, necessitating a highly diversified product portfolio from leading manufacturers.

- By Product Type:

- Submersible Pumps (Well Pumps, Sump Pumps, Sewage Ejector Pumps)

- Jet Pumps (Shallow Well Jet Pumps, Convertible Jet Pumps, Deep Well Jet Pumps)

- Booster Pumps

- Circulator Pumps

- Centrifugal Pumps

- By Application:

- Household Water Supply (Primary & Secondary Systems)

- Lawn and Garden Irrigation

- Wastewater and Drainage Management (Sump and Sewage)

- Pressure Boosting

- Rainwater Harvesting Systems

- By Power Rating:

- Low Power (Below 0.5 HP)

- Medium Power (0.5 HP to 2 HP)

- High Power (Above 2 HP)

- By Technology:

- Fixed Speed Pumps

- Variable Speed Drive (VSD) Pumps

Value Chain Analysis For Residential Water Pumps Market

The value chain for residential water pumps begins with critical upstream activities centered on sourcing specialized raw materials and components, including high-grade cast iron, stainless steel, aluminum, advanced engineered plastics for impellers and housings, and sophisticated electronics for motor control units and sensors. Key upstream suppliers include material providers, specialized motor manufacturers (particularly for Permanent Magnet Synchronous Motors or PMSMs), and semiconductor firms that supply VSD components. Quality control and material science innovation at this stage are crucial determinants of the pump's durability, efficiency, and resistance to corrosion, directly influencing the final cost structure and longevity. Strong supplier relationships are vital to mitigate risks associated with fluctuating commodity prices and ensure a steady supply of high-precision components required for modern pump manufacturing.

The midstream phase involves the core manufacturing, assembly, and rigorous testing of the pump units. Manufacturers increasingly focus on implementing lean manufacturing practices and high levels of automation to maintain competitive pricing and precision assembly. Significant value is added during the incorporation of smart technologies, where firmware development and integration of IoT connectivity hardware transform a standard pump into an intelligent system. Downstream activities involve distribution, marketing, and installation. The distribution channel is multifaceted, relying heavily on specialized plumbing wholesale distributors, large DIY retail chains (especially in developed markets), and direct relationships with residential builders and construction firms. The choice of channel often depends on the product complexity; standard fixed-speed pumps frequently move through mass retail, while advanced VSD systems require specialized wholesale and installer training.

The distribution network is crucial for market penetration and customer support. Direct channels often serve large-scale residential development projects, providing customized solutions and technical support directly from the manufacturer. Indirect channels, primarily through wholesalers and retailers, offer broader geographical reach and inventory access for individual homeowners and smaller contractors. Successful downstream management requires robust technical support and certified installer programs to ensure proper sizing, installation, and commissioning of the pumps, particularly the sophisticated electronic models. Post-sale activities, including spare parts availability, warranty fulfillment, and localized repair services, complete the value chain, heavily influencing brand loyalty and overall market reputation in a sector where reliability is paramount to end-users.

Residential Water Pumps Market Potential Customers

The primary end-users and buyers of residential water pumps encompass a diverse group ranging from large-scale property developers to individual homeowners, segmented based on their purchasing motivation and technical requirements. Large residential construction companies and housing developers constitute a major customer segment, procuring pumps in bulk for new housing projects. These buyers prioritize cost-effectiveness, energy compliance with building codes, durability, and ease of installation, often seeking integrated solutions for entire subdivisions. For them, selection criteria are governed by strict engineering specifications and total lifecycle cost, favoring manufacturers capable of providing consistent quality and volume at scale. This B2B segment is characterized by long sales cycles and high-volume orders, typically routed through direct manufacturer sales teams or specialized project distributors.

A second substantial customer base is the professional plumbing and HVAC contractors, who act as intermediaries, advising homeowners and small-scale renovators on replacement and upgrade decisions. These contractors require reliable products that minimize callback risks and offer quick installation times, often stocking popular models acquired through regional wholesalers. They are highly influenced by manufacturer training, technical documentation clarity, and the availability of local spare parts. Individual homeowners represent the third segment, typically purchasing pumps for replacement (failed units) or small upgrades (e.g., adding a booster pump). Homeowner purchases are often driven by brand reputation, perceived reliability, retail availability, and ease of use, making the retail and e-commerce distribution channels critical for reaching this segment effectively, often relying on simplified product ranges and strong consumer guarantees.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Xylem, KSB, Flowserve, Franklin Electric, Wilo Group, Davey Water Products, Zoeller Company, Tsurumi Manufacturing, Pentair, DAB Pumps, CRI Pumps, Shakti Pumps, Lubi Pumps, V Guard, Aqua Group, Ebara Corporation, Hangzhou Henzhong Pump, Shanghai Kaiquan Pump, Varem S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Water Pumps Market Key Technology Landscape

The contemporary technological landscape of the Residential Water Pumps Market is defined by the rigorous pursuit of energy efficiency, digital intelligence, and material science innovation aimed at enhancing pump reliability and longevity. Crucially, the deployment of Variable Speed Drives (VSDs), also known as Variable Frequency Drives (VFDs), represents the most impactful technology shift. VSDs allow the pump motor speed to dynamically match the exact hydraulic requirements of the system, reducing power consumption drastically compared to traditional fixed-speed motors that constantly run at maximum capacity, often causing excessive pressure and energy waste. This technology is vital for pressure boosting and circulator applications where demand fluctuates significantly throughout the day, ensuring precise control and substantial cost savings for the end-user, thereby aligning with global sustainability goals and regulatory standards.

Alongside VSDs, the adoption of advanced motor technologies, specifically Permanent Magnet Synchronous Motors (PMSMs) and electronically commutated (EC) motors, is rapidly displacing older asynchronous induction motors. These high-efficiency motors provide superior torque density and efficiency across a broader operational range, minimizing heat generation and reducing overall size and weight of the pump unit. Furthermore, the integration of Internet of Things (IoT) connectivity is transforming the functionality of residential pumps. IoT allows for remote monitoring, diagnostic checks, and firmware updates via mobile applications or cloud platforms. This connectivity empowers both homeowners and service providers with real-time operational data, facilitating proactive maintenance, flow monitoring, and seamless integration into larger smart home automation systems, providing unprecedented control and transparency over water usage.

Material science is another critical technological pillar, particularly concerning durability and water quality. Manufacturers are increasingly utilizing corrosion-resistant materials such as engineered composites, highly durable stainless steel, and specialized ceramics for critical components like impellers, seals, and shafts. This focus on advanced materials mitigates wear and tear caused by abrasive particles or chemically aggressive water sources, substantially extending the pump’s operational lifespan and reducing maintenance frequency. Furthermore, innovation in noise reduction technology, including sophisticated hydraulic designs and vibration dampening mounts, addresses a key consumer comfort factor, making modern pumps much quieter and suitable for installation within living spaces or confined utility areas, reflecting a market trend toward discreet and high-performance operation.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, technology adoption, and competitive intensity across the Residential Water Pumps Market, influenced heavily by local building codes, climate conditions, and economic development levels.

- Asia Pacific (APAC): This region is the primary growth engine, fueled by the accelerating pace of residential construction in economic powerhouses like China, India, and Southeast Asian nations. Demand is driven by fundamental infrastructure needs, including reliable water supply systems for newly urbanized populations. While price sensitivity remains a factor, there is a rapidly increasing adoption rate of mid-range and high-efficiency pumps in tier-one cities due to rising energy costs and a growing focus on sustainability compliance. APAC often sees high demand for robust submersible pumps for groundwater reliance and drainage solutions for monsoon-prone areas.

- North America (NA): Characterized as a mature market, demand in North America is driven primarily by replacement cycles and rigorous safety/efficiency standards imposed by federal and state regulations. Consumers here show a strong preference for smart, IoT-enabled booster and well pumps, emphasizing features like remote diagnostics, high energy ratings (e.g., Energy Star), and quiet operation. The established infrastructure means the market focuses on premium upgrades and integrating pumps into sophisticated home automation systems rather than large-scale new installations, demanding high technical specifications.

- Europe: The European market is highly regulated, dominated by strict mandates on energy efficiency (e.g., ErP Directive requirements), leading to high penetration of VSD and EC motor technologies, particularly in circulator pumps for heating and cooling systems. Sustainability is a major driver, resulting in significant uptake of pumps for rainwater harvesting and greywater recycling systems. The market is fragmented but competitive, with a strong focus on high-quality engineering, compact design, and compliance with stringent noise pollution regulations, making it a hub for premium product innovation.

- Latin America (LATAM): Growth in LATAM is driven by fluctuating economic conditions but shows consistent demand, particularly for jet and submersible pumps, due to unreliable municipal water pressure and dependence on private well systems in many areas. Market penetration of advanced VSD technology is accelerating in major urban centers like Brazil and Mexico, but basic, robust, and cost-effective pumps remain essential for wider regional coverage. Infrastructure investment in water access is a key governmental priority, influencing purchasing patterns.

- Middle East and Africa (MEA): This region demonstrates mixed demand. The Middle East, with its wealth, focuses on sophisticated pressure-boosting systems for large villas and high-rise developments, often demanding durable pumps resistant to harsh desert climates and high water salinity. Africa presents significant opportunities in off-grid solutions, driving the demand for solar-powered submersible pumps for reliable clean water access in rural and remote residential communities, often supported by international development aid and localized governmental initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Water Pumps Market.- Grundfos

- Xylem

- KSB SE & Co. KGaA

- Flowserve Corporation

- Franklin Electric Co., Inc.

- Wilo Group

- Davey Water Products

- Zoeller Company

- Tsurumi Manufacturing Co., Ltd.

- Pentair plc

- DAB Pumps S.p.A.

- CRI Pumps Private Limited

- Shakti Pumps (India) Limited

- Lubi Pumps

- V Guard Industries Ltd.

- Aqua Group

- Ebara Corporation

- Hangzhou Henzhong Pump Co., Ltd.

- Shanghai Kaiquan Pump (Group) Co., Ltd.

- Varem S.p.A.

Frequently Asked Questions

Analyze common user questions about the Residential Water Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Variable Speed Drive (VSD) residential water pumps?

The primary factor driving VSD pump adoption is the significant reduction in energy consumption and operational costs achieved by dynamically matching motor speed to fluctuating household water demand, ensuring optimal pressure while minimizing electricity use and system wear.

How does the integration of IoT technology benefit residential pump users and installers?

IoT integration provides users with enhanced system control, real-time performance monitoring, and fault notifications via mobile apps. Installers benefit from remote diagnostics capabilities, simplifying troubleshooting, optimizing maintenance schedules, and reducing service call times.

Which geographical region is expected to exhibit the fastest growth rate in the residential pump market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by expansive residential construction linked to rapid urbanization, increasing per capita income, and substantial government investments in improving core sanitation and water supply infrastructure.

What are the main differences between a submersible pump and a jet pump for residential use?

Submersible pumps operate fully submerged in the water source (wells or sumps) and are highly efficient for deep water retrieval. Jet pumps are installed above ground and use an injector mechanism to draw water, making them typically suited for shallower wells and booster applications.

What key material advancements are enhancing the durability of modern residential water pumps?

Durability is enhanced through the use of high-grade stainless steel, advanced engineered composite plastics, and corrosion-resistant ceramics for impellers and seals. These materials improve resistance to abrasion, chemical corrosion, and mineral buildup, thereby extending the pump's service life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager