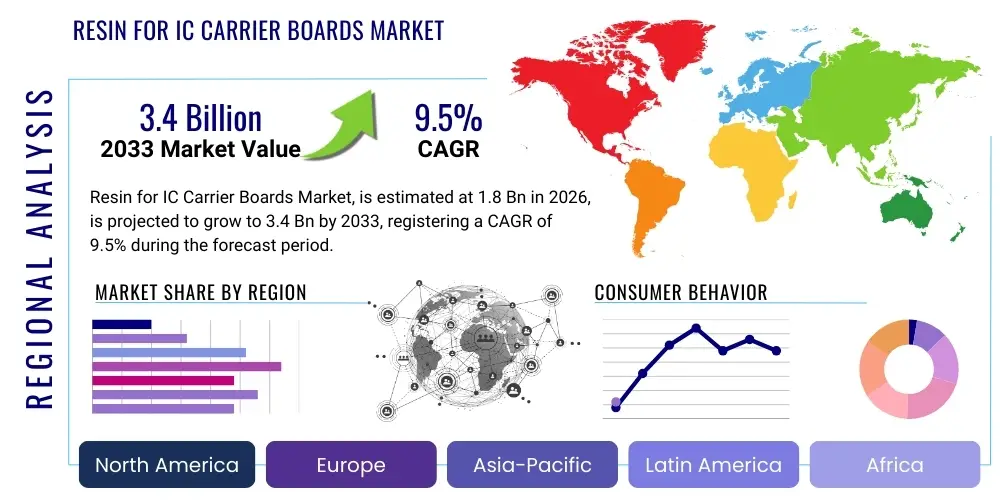

Resin for IC Carrier Boards Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441079 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Resin for IC Carrier Boards Market Size

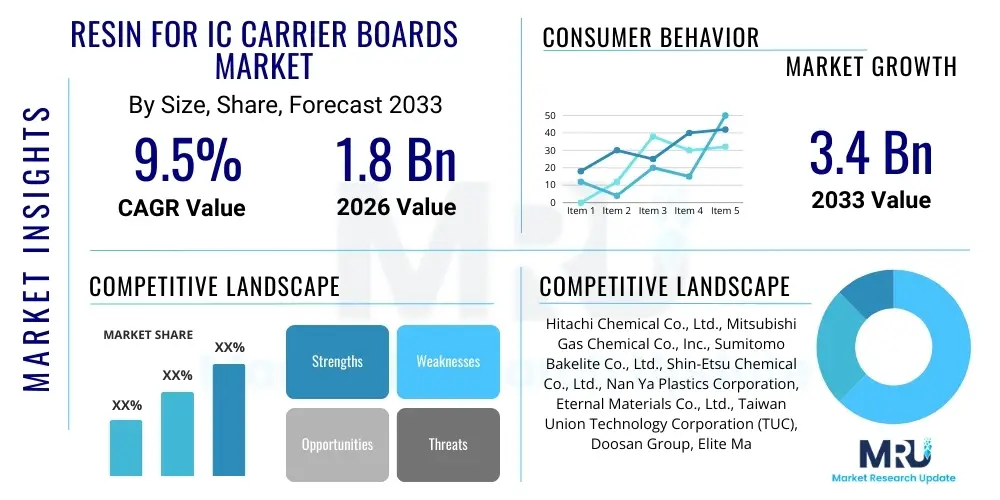

The Resin for IC Carrier Boards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Resin for IC Carrier Boards Market introduction

The Resin for IC Carrier Boards market encompasses specialized polymeric materials crucial for manufacturing substrates used in advanced integrated circuits (ICs), particularly in high-performance computing, communication, and consumer electronics. These resins form the foundational insulating layers and structural matrices for complex multi-layer substrates, ensuring signal integrity, thermal management, and mechanical stability necessary for sophisticated semiconductor packaging techniques like Ball Grid Array (BGA), Chip Scale Package (CSP), and Flip Chip (FC) applications. The performance criteria for these resins are exceptionally stringent, requiring ultra-low dielectric constant (Dk) and dissipation factor (Df) to minimize signal loss at high frequencies, excellent thermal resistance (Tg), and outstanding dimensional stability during complex manufacturing processes.

Product descriptions within this category typically involve thermosetting resins such as Bismaleimide Triazine (BT) resin, advanced epoxy resins (often halogen-free types), polyimide, and newer low-dielectric thermosets designed specifically for high-speed data transmission environments. BT resins have traditionally dominated the high-end market due to their superior thermal and mechanical properties, making them ideal for high-layer count substrates. However, the burgeoning demand for higher frequency applications (5G/6G infrastructure, AI accelerators) is driving innovation toward modified polyimide and hydrocarbon-based resins that offer even lower Dk/Df values, facilitating faster data throughput and reduced power consumption in the final packaged device.

Major applications of these specialty resins are heavily concentrated in areas driving global digital transformation, including server infrastructure, data centers, mobile devices (smartphones, tablets), and advanced automotive electronics (ADAS systems). The primary benefits derived from using specialized resins include enhanced reliability under high operating temperatures, superior resistance to moisture and chemical exposure, and critically, the enabling of ultra-fine line technology necessary for shrinking IC package sizes while increasing interconnection density. Market growth is fundamentally driven by the relentless miniaturization of semiconductor devices, the widespread rollout of 5G technology necessitating high-speed, low-loss materials, and the explosive expansion of cloud computing and Artificial Intelligence (AI) requiring ever more powerful and thermally robust IC packages.

Resin for IC Carrier Boards Market Executive Summary

The Resin for IC Carrier Boards market is characterized by intense technological competition and a strong correlation with the global semiconductor market cycle. Current business trends show a significant pivot towards materials optimized for advanced packaging technologies, such as Chiplet architectures and heterogeneous integration. This shift is increasing the demand for resins capable of supporting Substrate-Like PCB (SLP) standards and ultra-thin core materials. Furthermore, environmental, social, and governance (ESG) pressures are accelerating the transition away from traditional brominated flame retardants, making halogen-free and eco-friendly resin compositions a critical growth driver and a key differentiator among manufacturers, necessitating substantial R&D investment into novel polymer formulations that maintain performance parity.

Regional trends indicate that the Asia Pacific (APAC) region remains the undisputed epicenter of demand and manufacturing for IC carrier boards, driven by the concentration of leading Original Equipment Manufacturers (OEMs), semiconductor foundries, and advanced packaging houses, particularly in countries like China, Taiwan, South Korea, and Japan. While manufacturing dominance resides in APAC, North America and Europe continue to be crucial innovation hubs, dictating specifications for high-end server and specialized military/aerospace applications, thereby influencing the adoption trajectory of premium, high-performance resin types. Geopolitical dynamics, particularly trade tensions concerning semiconductor supply chains, are prompting strategic investment in localized manufacturing capabilities outside of traditional APAC hubs, potentially diversifying future demand distribution.

Segment trends reveal that the BT Resin segment, though mature, maintains a strong foothold in high-reliability applications, but the Epoxy Resin segment (especially those modified for low Dk/Df) is rapidly gaining market share due to its cost-effectiveness and flexibility in processing for standard computing applications. The most dynamic growth is observed in specialty materials, including advanced thermoplastic polymers and polyimide blends, targeting next-generation substrates required for high-frequency millimeter-wave applications and high-density interconnection (HDI) requirements in advanced mobile processors. The increasing prevalence of complex substrate structures, such such as those used in Fan-Out Wafer Level Packaging (FOWLP) and Advanced BGA, ensures continuous demand for high-performance bonding films and prepregs derived from these specialized resin types.

AI Impact Analysis on Resin for IC Carrier Boards Market

Common user questions regarding AI's impact on the Resin for IC Carrier Boards Market often center on whether the increased computational demands of AI and machine learning (ML) workloads will mandate entirely new material specifications or simply accelerate the adoption of existing high-end solutions. Users frequently inquire about the feasibility of standard substrate materials meeting the thermal and electrical performance requirements of advanced AI processors (like GPUs and specialized ASICs), which generate immense heat and require ultra-low latency signaling. Key concerns revolve around the role of AI in material discovery—can AI algorithms expedite the creation of new polymers with superior properties?—and how the widespread deployment of AI infrastructure (data centers) influences overall volume demand versus requiring specialized, niche resin types.

The overarching theme is a significant acceleration of technological requirements. AI processing units require high-density interconnects and robust thermal dissipation capabilities far exceeding general-purpose CPUs. This necessitates carrier boards built with resins exhibiting superior thermal conductivity (to quickly transfer heat away from the chip) and extremely tight control over dielectric properties across a wide frequency spectrum to handle the enormous parallel data streams. AI adoption is not just increasing the quantity of carrier boards needed; it is fundamentally elevating the performance floor, rendering standard or legacy resin materials unsuitable for next-generation AI accelerators, thus focusing demand squarely on ultra-low-loss and high-Tg resins.

Consequently, the market is bracing for increased strain on the supply chain for high-purity raw materials used in advanced resins, particularly given that the performance window for these materials is narrowing dramatically. AI's requirement for high-layer count packages and integrated power delivery structures translates directly into demand for specialized thin core and prepreg materials that offer excellent uniformity and minimal structural defects, driving material producers to utilize AI and ML techniques in quality control and process optimization to meet stringent specifications and improve yield rates.

- AI algorithms necessitate ultra-low Dk/Df resins for high-speed signal integrity in server and data center IC carrier boards.

- Increased heat generation by AI processors accelerates demand for high-Tg (glass transition temperature) and thermally conductive resin systems.

- AI application expansion drives volume growth for advanced packaging substrates, moving away from standard FR-4 towards BT, Polyimide, and advanced hydrocarbon resins.

- AI and Machine Learning are being employed in material science R&D to simulate and discover novel polymer structures suitable for extreme electrical and thermal conditions.

- Demand surge for high-density interconnect (HDI) substrates used in edge AI devices mandates resins with excellent fine-line patterning capability and dimensional stability.

DRO & Impact Forces Of Resin for IC Carrier Boards Market

The market for resins used in IC carrier boards is governed by complex interplay of technological push and regulatory restraint, impacting its trajectory significantly. Major drivers include the rapid global adoption of 5G and impending 6G infrastructure, which demands materials capable of handling millimeter-wave frequencies efficiently, and the massive ongoing investment in data centers fueled by cloud computing and AI. These applications require high-layer count, multi-functional substrates, creating sustained, high-value demand for advanced materials like low-loss BT and specialized epoxy formulations. Furthermore, the persistent trend of device miniaturization (increasing transistor density) compels substrate manufacturers to adopt thinner, more dimensionally stable resins capable of supporting ultra-fine line circuit traces and high aspect ratio through-holes.

However, the market faces several inherent restraints. The primary constraint is the high cost and complex synthesis process associated with high-performance, ultra-low-loss resins, which limits their application primarily to premium or mission-critical electronics. This technological barrier makes it difficult for new entrants to compete effectively. Another significant restraint is the cyclical nature of the semiconductor industry; market fluctuations, inventory corrections, and capital expenditure variations by major foundries can abruptly curb demand for substrate materials. Additionally, stringent quality control requirements and the long qualification cycles (often 12-24 months) necessary for new materials to gain acceptance by major IC manufacturers impede rapid market penetration of innovative resin chemistries, slowing down necessary material evolution.

Opportunities abound in emerging technological niches and shifts in the global supply chain. The proliferation of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) creates a high-reliability segment demanding thermally robust resins for power electronics and control units, a segment less vulnerable to typical consumer electronics cycles. Furthermore, the development of sustainable, bio-based, and recyclable resin systems presents a major long-term opportunity, aligning with corporate ESG goals globally. The most impactful opportunities are tied directly to heterogeneous integration and advanced chiplet packaging, demanding specialized film adhesives and encapsulants alongside core substrate materials. The impact forces are thus heavily weighted toward technological necessity, where the performance needs of the downstream semiconductor industry act as an inescapable gravitational pull, forcing resin suppliers to innovate rapidly, despite the associated complexity and cost hurdles.

Segmentation Analysis

The Resin for IC Carrier Boards market is strategically segmented based on factors such as the chemical composition of the resin, the type of IC package it supports, and the specific application sector, allowing for a detailed analysis of market dynamics across various performance tiers. The chemical type segmentation—which includes BT, Epoxy, Polyimide, and others—is critical as it dictates the inherent electrical, thermal, and mechanical properties of the resulting carrier board. Application segmentation, spanning Consumer Electronics, Automotive, Communications Infrastructure, and Enterprise Hardware, helps identify the key volume drivers versus the high-margin, high-specification segments.

Understanding these segmentations provides clarity on where innovation is most required. For instance, the demand for resins in advanced flip-chip BGA packages necessitates high-end materials, whereas standard BGA and CSP packages might rely on cost-optimized epoxy variants. The market structure inherently favors materials that offer a superior balance of performance and processing efficiency, highlighting the ongoing tension between cost control and achieving ultra-low dielectric properties required for next-generation bandwidth demands. The segmentation into regional markets further emphasizes the concentration of both supply and demand within the Asia Pacific region, though niche, high-value activities persist in North America and Europe.

- By Resin Type:

- BT (Bismaleimide Triazine) Resin

- Epoxy Resin (Standard and Low Dk/Df Modified)

- Polyimide Resin

- Hydrocarbon Resins (e.g., PPO/PPE Blends)

- Other Specialty Thermosets

- By Application:

- Communication and Networking Equipment (5G/6G Base Stations, Routers)

- Consumer Electronics (Smartphones, Wearables, Laptops)

- Enterprise Hardware (Servers, Data Centers, Storage Devices)

- Automotive Electronics (ADAS, Infotainment, Power Control)

- Industrial and Medical Devices

- By Packaging Type:

- BGA (Ball Grid Array) Substrates

- CSP (Chip Scale Package) Substrates

- Flip Chip (FC) Substrates

- FOWLP (Fan-Out Wafer Level Package) Materials

- Substrate-Like PCB (SLP) Materials

Value Chain Analysis For Resin for IC Carrier Boards Market

The value chain for Resin for IC Carrier Boards is intricate, beginning with specialized chemical synthesis upstream and culminating in the integration into advanced electronic systems downstream. Upstream analysis involves the procurement and processing of highly purified raw materials, such as specific monomers (e.g., BPA, cynate esters, maleimides) and performance-enhancing additives (e.g., catalysts, curing agents, fillers, reinforcing fibers like specialized glass cloth). Key upstream suppliers are major chemical companies that specialize in high-performance polymer intermediates. The complexity and purity requirements of these raw materials directly influence the final cost and performance attributes of the resin, making this a critical, high-barrier entry point in the chain.

The midstream of the value chain is dominated by resin formulators and prepreg/laminate manufacturers. Resin formulators synthesize the raw chemicals into proprietary resin varnishes, customizing properties like viscosity, thermal stability, and dielectric performance. These varnishes are then supplied to laminate manufacturers who impregnate woven glass fabrics or non-woven substrates (prepregs) or coat copper foils to produce the foundational laminates and films used for IC carrier boards. This step requires advanced manufacturing precision and is highly concentrated among a few global suppliers, especially in Asia, given the capital intensity of the manufacturing process and the need for rigorous quality assurance protocols to minimize defects that could compromise signal integrity.

Downstream analysis covers the IC substrate manufacturers (who fabricate the multilayer boards from the laminates), the OSAT (Outsourced Semiconductor Assembly and Test) companies, and finally, the OEMs (Original Equipment Manufacturers) who integrate the packaged chips into final electronic products. Distribution channels are typically direct, high-touch relationships between resin/laminate suppliers and the specialized IC substrate manufacturers, often involving joint development agreements to ensure material compliance with future IC roadmaps. Indirect channels are less common but may involve specialized distributors handling smaller volumes or niche regional customers. The effectiveness of the distribution channel is judged heavily by rapid delivery and technical support, given the just-in-time nature of high-volume electronics production.

Resin for IC Carrier Boards Market Potential Customers

The primary end-users and buyers of Resin for IC Carrier Boards are the specialized manufacturers of IC substrates, often referred to as PCB/Substrate fabricators, who utilize the resins (in the form of liquid varnishes or prepregs/films) to construct the core layers of the carrier boards. These customers operate under extremely tight tolerance specifications mandated by major semiconductor companies. Their purchasing decisions are driven not by cost alone, but overwhelmingly by material qualification status, reliability data, batch-to-batch consistency, and the resin's ability to support micro-via formation, fine-line etching, and laser drilling techniques essential for advanced packaging.

Secondary, yet highly influential, customers include the leading multinational Integrated Device Manufacturers (IDMs) and Fabless Semiconductor Companies (e.g., those producing CPUs, GPUs, and specialized ASICs). While they do not directly purchase the bulk resin, they set the stringent material specifications and vendor approval lists (AVLs) that dictate which resin types and suppliers the substrate fabricators must use. Therefore, a successful market strategy for resin suppliers requires direct engagement and qualification efforts with these powerful downstream entities to secure placement on approved materials lists, ensuring long-term volume demand.

The ultimate downstream consumers of the final packaged ICs—such as global consumer electronics giants, telecommunication equipment providers, and automotive tier-one suppliers—also exert pressure through their product requirements (e.g., thinner devices, higher operating speeds, longer lifespan). The shift towards advanced packaging and higher integration mandates that resin selection is a collaborative process spanning the entire value chain, where the end-product requirements ultimately cascade down to define the performance specifications for the foundational resin material, ensuring that potential customers span from specialized fabricators to major global OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | CAGR 9.5 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Chemical Co., Ltd., Mitsubishi Gas Chemical Co., Inc., Sumitomo Bakelite Co., Ltd., Shin-Etsu Chemical Co., Ltd., Nan Ya Plastics Corporation, Eternal Materials Co., Ltd., Taiwan Union Technology Corporation (TUC), Doosan Group, Elite Materials Co., Ltd. (EMC), Showa Denko Materials Co., Ltd. (formerly Hitachi Chemical), Panasonic Corporation, Huntsman Corporation, Dow Inc., DIC Corporation, AGC Inc., Sheng Yi Technology Co., Ltd., ITEQ Corporation, V-TAC Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Resin for IC Carrier Boards Market Key Technology Landscape

The technological landscape of the Resin for IC Carrier Boards market is defined by the constant evolution of substrate materials to meet escalating semiconductor performance demands, primarily focusing on enhancing electrical performance, improving thermal stability, and enabling micro-fabrication capabilities. A cornerstone technology involves developing ultra-low dielectric constant (Dk) and dissipation factor (Df) resins, often achieved through modifying traditional thermosets like epoxy or BT with fluorinated polymers or specialized low-polar hydrocarbon monomers. This low-loss characteristic is essential for maintaining signal integrity and minimizing power leakage in high-frequency applications (above 10 GHz), which are now common in 5G and data center environments. The shift towards thinner core materials necessitates resins that cure quickly, possess exceptional dimensional stability post-lamination, and exhibit minimal coefficient of thermal expansion (CTE) mismatch with silicon chips.

Another crucial technological area is the development of materials suitable for advanced manufacturing processes, particularly in the realm of high-density interconnection (HDI). This includes resins optimized for laser ablation and plasma etching to create ultra-fine vias (micro-vias) and complex multilayer structures with feature sizes often below 30 micrometers. New photodefinable dielectric resins (PDDs) and specialized bonding films are critical here, allowing for precise lithographic patterning that facilitates the complex routings required for advanced BGA and CSP packages. Furthermore, to address the immense heat generated by modern ICs, technology focuses heavily on enhancing thermal management through the introduction of specialized ceramic fillers or conductive additives into the resin matrix without compromising electrical performance, thus improving the overall thermal conductivity of the carrier board material system.

The industry is also seeing significant advancements in environmentally conscious resin systems, driven by the global push for sustainability. This involves developing non-halogenated resins that achieve flame retardancy (meeting UL 94 V-0 standards) through phosphorus or nitrogen-based chemistry, offering a safe alternative to brominated flame retardants while maintaining superior performance. Coupled with this, there is ongoing research into optimizing resin adhesion to advanced copper foil types (like low-roughness or reverse-treated foils) to support fine-line processing, as well as innovations in resin compositions that facilitate substrate thinning processes (e.g., back-grinding) without inducing structural failures, enabling the creation of extremely thin, high-layer count substrates essential for compact, high-performance computing devices.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for Resin for IC Carrier Boards, accounting for the largest share of both consumption and production capacity globally. This dominance is attributed to the presence of major semiconductor foundries, leading OSAT companies, and high-volume consumer electronics manufacturing hubs in Taiwan, South Korea, China, and Japan. Taiwan, in particular, hosts world-leading IC substrate fabricators, driving intense demand for advanced low-Dk/Df BT and epoxy resins tailored for Flip Chip BGA and SLP applications. The high demand for 5G infrastructure deployment and the rapid expansion of domestic data centers further solidify APAC's position as the primary growth engine. Innovation in resin technology, though often originating elsewhere, sees its fastest and largest-scale commercial adoption within this region, necessitating robust and localized supply chain management by material producers.

- North America: North America represents a high-value, specification-driven market, focusing heavily on research, design, and manufacturing of premium, specialized ICs for high-performance computing (HPC), AI accelerators, defense, and aerospace applications. While manufacturing volume is lower compared to APAC, the region drives the demand for the most technologically advanced and highest-cost resins (e.g., highly specialized polyimides and low-loss hydrocarbon materials) due to the stringent performance requirements in military and high-end server hardware. Major technology companies in Silicon Valley and Texas dictate the long-term material roadmaps for complex packaging, ensuring that North America acts as a critical hub for material qualification and high-margin, custom resin sales.

- Europe: The European market, while smaller than APAC and North America, is significant for its strengths in high-reliability industrial automation, sophisticated automotive electronics, and specialized telecommunications infrastructure. Demand for IC carrier board resins here is characterized by a strong emphasis on thermal management, long-term reliability, and adherence to strict environmental regulations (e.g., REACH compliance), driving the adoption of high-Tg, halogen-free epoxy, and specialized ceramic-filled resins. Germany, France, and the Nordic countries are key markets, focusing on applications that require extreme durability and extended operational life, making the qualification process for new resins exceptionally rigorous and reliability-focused.

- Latin America (LATAM) and Middle East & Africa (MEA): LATAM and MEA currently hold marginal market shares but are recognized as rapidly emerging markets, particularly for standard-to-mid-range resin types used in consumer electronics assembly and expanding telecommunications infrastructure (4G/5G rollout). Growth in these regions is largely contingent upon foreign direct investment in electronics assembly plants and the maturation of local digital economies. Demand is primarily driven by cost-efficiency and established technology platforms, though MEA’s increasing investment in data centers (especially in the UAE and Saudi Arabia) signals potential future growth in demand for high-performance server-grade resins. Infrastructure development, rather than high-end technological innovation, dictates current consumption patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Resin for IC Carrier Boards Market.- Hitachi Chemical Co., Ltd. (now Showa Denko Materials Co., Ltd.)

- Mitsubishi Gas Chemical Co., Inc. (MGC)

- Sumitomo Bakelite Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Nan Ya Plastics Corporation

- Eternal Materials Co., Ltd.

- Taiwan Union Technology Corporation (TUC)

- Doosan Group

- Elite Materials Co., Ltd. (EMC)

- Panasonic Corporation

- Huntsman Corporation

- Dow Inc.

- DIC Corporation

- AGC Inc.

- Sheng Yi Technology Co., Ltd.

- ITEQ Corporation

- Kingboard Laminates Holdings Ltd.

- Rogers Corporation

- Ventec International Group

- Synergy Materials (V-TAC)

Frequently Asked Questions

Analyze common user questions about the Resin for IC Carrier Boards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of resin in an IC carrier board, and which types dominate the market?

The primary function of the resin is to serve as the dielectric (insulating) material that binds the conductive layers (copper) together in a multilayer substrate, providing crucial electrical insulation, mechanical stability, and thermal resistance. The market is primarily dominated by BT (Bismaleimide Triazine) resins, modified Epoxy resins (especially low Dk/Df variants), and specialized Polyimide formulations, selected based on the required electrical frequency performance and thermal operating conditions of the packaged IC.

How is 5G technology influencing the material requirements for IC carrier board resins?

5G technology, particularly at higher frequencies (sub-6 GHz and millimeter-wave), necessitates resins with significantly lower Dielectric Constant (Dk) and Dissipation Factor (Df). High Df leads to unacceptable signal loss at 5G operational speeds. Consequently, 5G demands are shifting the market away from standard epoxy towards high-performance, ultra-low-loss materials like specialized hydrocarbon polymers and advanced BT derivatives to ensure signal integrity and power efficiency in base stations and mobile devices.

What are the key thermal management challenges addressed by advanced carrier board resins?

Modern ICs, especially GPUs and AI processors, generate intense localized heat. Advanced resins must possess a high Glass Transition Temperature (Tg) to maintain mechanical integrity under extreme operating temperatures and high current density. Furthermore, innovative resins incorporate ceramic or other high-conductivity fillers to enhance the thermal conductivity (TC) of the substrate itself, facilitating efficient heat spreading and transfer away from the sensitive semiconductor die.

Why is the Asia Pacific region the leading market for these specialized resins?

The Asia Pacific region leads due to the vast concentration of the global semiconductor supply chain, including the major IC substrate fabricators (e.g., in Taiwan, South Korea), high-volume electronics assembly houses, and leading OSAT providers. The region benefits from established infrastructure and expertise necessary for manufacturing these complex multilayer substrates at scale, driving the highest volume demand for raw resin materials globally.

What distinguishes resins used for Flip Chip (FC) packaging from those used in standard BGA?

Resins for Flip Chip packaging require superior mechanical and dimensional stability to withstand the high stress imposed by the soldering process and the subsequent Coefficient of Thermal Expansion (CTE) mismatch between the silicon die and the carrier board. They must also support ultra-fine line trace widths and high-layer counts necessary for dense FC interconnects, often requiring higher-purity, lower-viscosity BT or customized epoxy formulations compared to standard BGA substrates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager