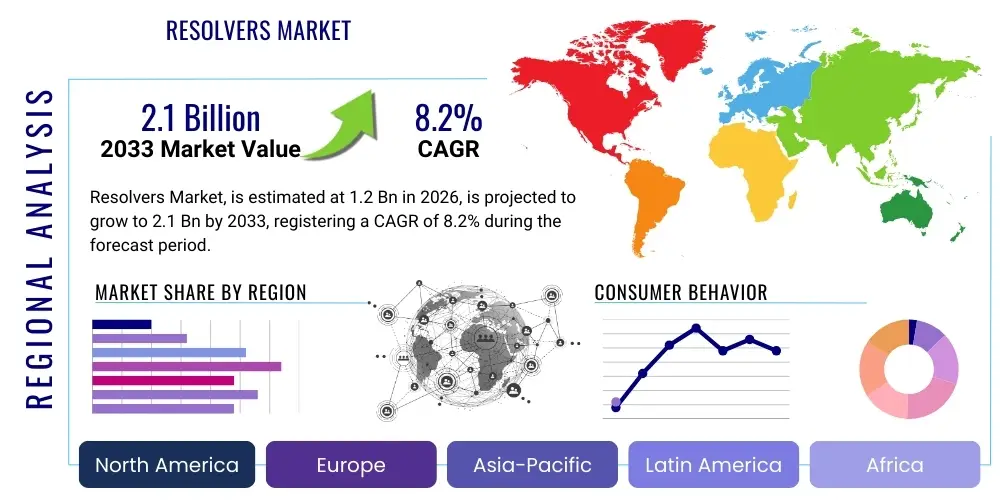

Resolvers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442916 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Resolvers Market Size

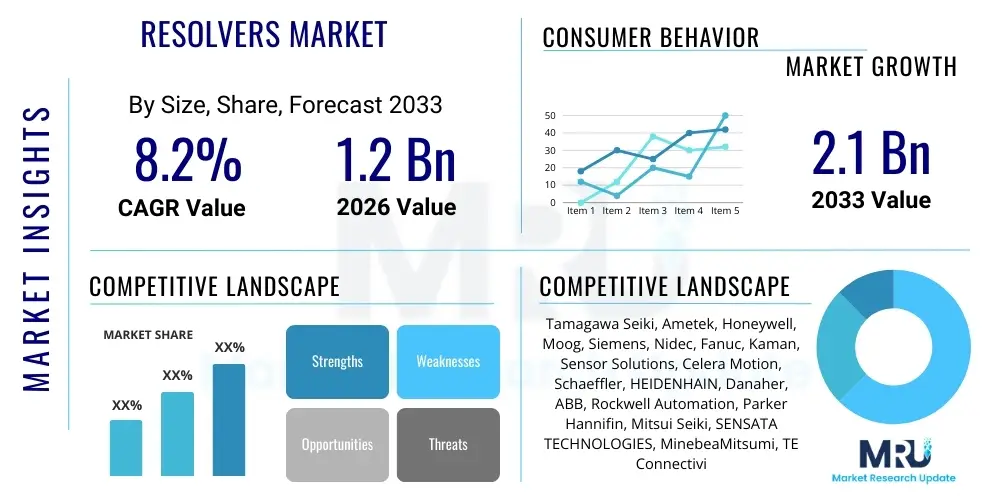

The Resolvers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for high-precision motion control solutions across critical industrial sectors, particularly automotive electrification and sophisticated robotics, where reliability under extreme operating conditions is paramount. The increasing adoption of Industry 4.0 principles, necessitating accurate feedback mechanisms, further solidifies this upward trajectory.

Resolvers Market introduction

The Resolvers Market encompasses advanced electromechanical transducers that determine the angular position of a rotating shaft, converting mechanical angular position into an electrical signal proportional to the sine and cosine of the angle. These devices are fundamentally differential transformers renowned for their rugged design, high immunity to electrical noise, temperature variations, and vibration, making them indispensable in harsh operating environments where magnetic encoders often fail. Major applications span critical areas such as aerospace and defense, high-speed rail, industrial robotics, automated manufacturing systems, and the burgeoning electric vehicle (EV) sector, specifically for traction motor control and steering systems. The primary benefits of using resolvers include exceptional reliability, high accuracy over a wide temperature range, and inherent analog signal processing capabilities which offer excellent noise immunity. Driving factors propelling market growth include rapid advancements in industrial automation driven by global productivity demands, stringent safety standards in transportation and defense, and significant governmental and private sector investment in electrified powertrain technologies globally.

Resolvers Market Executive Summary

The Resolvers Market is characterized by intense technological evolution focusing on miniaturization and enhanced integration capabilities, which is significantly shaping business trends towards customized solutions for specific high-reliability applications, such as surgical robotics and autonomous vehicles. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive manufacturing investments in China, Japan, and South Korea, coupled with ambitious electric vehicle production targets in these economies. North America and Europe, while mature, demonstrate sustained demand through modernization of legacy industrial infrastructure and heightened defense expenditure. Segment trends indicate a strong shift towards brushless resolvers due to their superior longevity and maintenance-free operation, alongside an increasing preference for frameless resolvers which offer seamless integration directly into motor housings, reducing system complexity and overall footprint. Furthermore, the automotive segment, particularly the EV component, is poised for explosive growth, necessitating large-scale production capabilities and cost optimization strategies among leading resolver manufacturers to meet mass market demand effectively and competitively.

AI Impact Analysis on Resolvers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Resolvers Market frequently center on whether AI-driven predictive maintenance systems can leverage resolver data more effectively, how AI might integrate with resolver-based control loops for enhanced system performance, and if advanced AI algorithms will necessitate higher resolution or digital output formats from future resolver designs. Users are particularly keen on understanding AI's role in optimizing the control of complex multi-axis robotic systems and improving the energy efficiency of electric vehicle powertrains managed by resolver feedback. The consensus suggests that while AI will not replace the fundamental mechanical function of resolvers, it will drastically increase the value of the data generated. AI algorithms will be instrumental in processing resolver signals to detect subtle deviations indicative of mechanical wear, predict failures long before they occur, and dynamically adjust motor control parameters for peak performance, thus extending equipment lifespan and ensuring uninterrupted operation in critical industrial environments.

- AI enables highly accurate predictive maintenance by analyzing sinusoidal resolver feedback for anomaly detection.

- Integration of AI control algorithms optimizes motor torque and speed control in complex EV and robotics applications.

- AI drives the requirement for high-speed, noise-resistant digital conversion of resolver analog signals for real-time processing.

- Machine learning enhances calibration and compensation routines, improving overall system precision beyond traditional limits.

- AI facilitates the development of truly autonomous systems by providing highly reliable position data essential for decision-making under variable load conditions.

DRO & Impact Forces Of Resolvers Market

The Resolvers Market is primarily driven by the stringent requirements for reliability in harsh conditions prevalent across defense, heavy industry, and energy sectors, coupled with the global acceleration of electric vehicle manufacturing, where resolvers are critical for determining rotor position and speed in traction motors. Restraints include the higher unit cost and greater size compared to increasingly sophisticated optical and magnetic encoders, which pose competition, particularly in less demanding industrial environments. Furthermore, the complexity associated with integrating the required analog-to-digital converter (RDC) circuitry can sometimes present a technical barrier for smaller application developers. Opportunities abound in the development of highly integrated, miniaturized resolver solutions suitable for medical robotics and precision aerospace applications, alongside leveraging magnetic technology advancements to improve resolution capabilities without compromising ruggedness. The overall impact forces are overwhelmingly positive, characterized by high demand elasticity in the EV sector and critical infrastructure maintenance, compelling manufacturers to focus on scalability and cost reduction while maintaining the inherent robustness that defines resolver technology.

Segmentation Analysis

The Resolvers Market is meticulously segmented based on key structural and functional parameters, reflecting the diverse application landscape requiring varying levels of precision, durability, and integration methods. Segmentation by type differentiates between units based on their operational mechanism, highlighting the distinction between brush and brushless designs, where brushless technology is gaining dominant market share due to its superior lifespan and zero maintenance requirements. Segmentation by format addresses mechanical configuration, catering to specific installation needs, whether integrated directly into a motor (frameless) or housed externally (cased). Furthermore, the application and end-use segmentation reveal the concentration of demand in high-growth areas like specialized industrial machinery and the transformative electric vehicle sector, providing clear directional indicators for strategic product development and market penetration efforts across various global economies.

- By Type:

- Brushless Resolvers

- Brush Resolvers (Contact Type)

- By Format:

- Pancake Resolvers

- Frameless Resolvers (Kit Resolvers)

- Cased Resolvers (Housed Resolvers)

- By Application:

- Industrial Automation & Robotics

- Aerospace & Defense

- Automotive (EVs and Hybrid Vehicles)

- Medical Devices (Surgical Robotics)

- Machine Tools

- By End-Use Industry:

- Manufacturing & Processing

- Energy & Power Generation

- Transportation & Logistics

- Healthcare

Value Chain Analysis For Resolvers Market

The Value Chain for the Resolvers Market begins with the upstream analysis, involving the procurement of critical raw materials, primarily specialized magnetic materials, high-grade copper wire, and precision-machined steel and aluminum alloys necessary for the stator and rotor assemblies. Key suppliers in this phase focus on material purity and consistency, which directly impacts the resolver's accuracy and thermal stability. The subsequent manufacturing phase involves high-precision winding, encapsulation, and rigorous testing, requiring sophisticated cleanroom environments and specialized fabrication techniques. Downstream analysis focuses on the integration of the resolver into the final motion control system. This requires close collaboration between resolver manufacturers and system integrators, particularly in the robotics and electric vehicle sectors, where seamless mechanical and electrical interface is crucial. Distribution channels are typically a mix of direct sales to large Original Equipment Manufacturers (OEMs), especially those in defense and aerospace, and indirect distribution through specialized industrial component distributors and value-added resellers who provide localized technical support and inventory management for the broad industrial customer base.

Resolvers Market Potential Customers

The primary potential customers and end-users of resolvers span high-stakes industries where precision, ruggedness, and long-term reliability are non-negotiable operational requirements. The largest current segment of buyers comprises major manufacturers in the Electric Vehicle (EV) industry, requiring high-reliability position sensing for traction motors and vehicle stability control systems, including global automotive Tier 1 suppliers and major EV assembly companies. Industrial automation represents another critical customer base, specifically companies integrating high-payload industrial robots, CNC machinery, and complex automated assembly lines (aligned with Industry 4.0 modernization efforts). Furthermore, military and defense contractors constitute a high-value customer group, utilizing resolvers in critical applications such as radar antennae positioning, gun turret control, and missile guidance systems, valuing the resolver's ability to operate flawlessly under extreme temperature and vibration stress. Medical device manufacturers, particularly those developing advanced surgical robots, represent a rapidly growing niche where miniaturization and extreme precision dictate component selection, making high-quality resolvers a preferred choice over sensitive optical alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.1 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tamagawa Seiki, Ametek, Honeywell, Moog, Siemens, Nidec, Fanuc, Kaman, Sensor Solutions, Celera Motion, Schaeffler, HEIDENHAIN, Danaher, ABB, Rockwell Automation, Parker Hannifin, Mitsui Seiki, SENSATA TECHNOLOGIES, MinebeaMitsumi, TE Connectivity |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Resolvers Market Key Technology Landscape

The technology landscape of the Resolvers Market is characterized by continuous refinement aimed at improving accuracy, reducing physical size, and enhancing signal processing capabilities. A central focus is the advancement of magnetic sensing technologies and optimized winding techniques, ensuring tighter manufacturing tolerances which directly correlate to higher angular precision and lower electrical noise sensitivity across operational temperature extremes. Modern technological trends emphasize the development of frameless resolver kits, which are specifically engineered for integration into compact spaces within motor housings, minimizing inertia and complexity. These kits require highly robust construction capable of withstanding the high temperatures generated within electric motors. Furthermore, the integration of advanced Resolver-to-Digital Converters (RDCs) is crucial; contemporary RDCs incorporate sophisticated algorithms that compensate for phase shift errors and amplitude variations, providing high-resolution digital output (e.g., 18 to 21 bits) necessary for highly precise closed-loop control systems. There is also a nascent trend toward smart resolvers that integrate onboard diagnostics and networking capabilities, facilitating predictive maintenance and adherence to industrial communication standards like EtherCAT and PROFINET, streamlining their adoption in complex automated factories.

Regional Highlights

The geographical analysis of the Resolvers Market reveals significant divergence in growth drivers and market maturity across key global regions, largely dictated by industrial investment cycles, automotive electrification rates, and defense spending patterns.

- Asia Pacific (APAC): APAC dominates the global market and is expected to maintain the highest CAGR throughout the forecast period. This growth is predominantly fueled by massive investments in EV manufacturing hubs (especially China, Japan, and South Korea) and aggressive expansion in industrial automation and robotics infrastructure. China's state-led initiatives in high-speed rail and machine tool manufacturing further solidify its position as the largest regional market for resolvers, demanding high-volume, reliable components.

- North America: North America represents a mature but technologically advanced market, characterized by consistent demand from the aerospace and defense sectors, which prioritize military-grade ruggedness and precision. The regional market is also strongly influenced by the adoption of advanced robotics in logistics and manufacturing, coupled with the rapid scaling of domestic EV production facilities and R&D centers in the US.

- Europe: Europe is a key region driven by stringent industrial safety standards and widespread adoption of Industry 4.0 technologies, particularly in Germany and Italy. Demand is robust in high-precision machine tools, medical devices, and the established European automotive sector transitioning toward electrification. Strategic focus here remains on precision engineering and highly customized resolver solutions for specialized machinery.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions are emerging markets for resolvers, with demand concentrated in energy production (oil and gas), mining, and initial industrial automation projects. While smaller in size, growth is steady, particularly in countries investing heavily in infrastructure modernization and localized manufacturing capabilities, focusing on ruggedized cased resolvers suitable for challenging operational environments typical of these regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Resolvers Market.- Tamagawa Seiki

- Ametek

- Honeywell

- Moog

- Siemens

- Nidec

- Fanuc

- Kaman

- Sensor Solutions

- Celera Motion

- Schaeffler

- HEIDENHAIN

- Danaher

- ABB

- Rockwell Automation

- Parker Hannifin

- Mitsui Seiki

- SENSATA TECHNOLOGIES

- MinebeaMitsumi

- TE Connectivity

Frequently Asked Questions

Analyze common user questions about the Resolvers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a resolver over an encoder in industrial applications?

The primary advantage of a resolver is its exceptional robustness and resistance to harsh environmental factors, including extreme temperatures, vibration, and electromagnetic interference, making it the preferred choice for critical, high-reliability applications such as aerospace, defense, and EV traction motors where failure is not permissible.

How is the Electric Vehicle (EV) sector influencing the demand for resolvers?

The EV sector is the single largest growth catalyst, demanding high-volume brushless resolvers for precise control and feedback in traction motors, power steering, and braking systems, leveraging their high accuracy and reliability in high-speed, high-temperature operating conditions inherent to electric powertrains.

What are Frameless Resolvers and why are they gaining market share?

Frameless (or Kit) Resolvers consist of separate rotor and stator assemblies designed for direct integration into the motor or machine structure. They are gaining market share because they minimize the mechanical footprint, reduce system inertia, and simplify assembly, which is crucial for compact robotics and integrated automotive components.

What technological advancements are crucial for improving resolver accuracy?

Crucial technological advancements involve optimized winding geometry, enhanced magnetic material quality, and the integration of high-resolution Resolver-to-Digital Converters (RDCs) with sophisticated error compensation algorithms. These innovations enable higher digital output precision (up to 21 bits) and reduced phase shift errors.

Which geographical region holds the largest market share for resolvers?

Asia Pacific (APAC) currently holds the largest market share, driven overwhelmingly by expansive manufacturing automation initiatives, particularly in China and South Korea, coupled with the rapid escalation of Electric Vehicle (EV) production within the region.

The Resolvers Market is positioned for substantial growth, reflecting its irreplaceable role in ensuring precision and safety across the next generation of industrial and mobility systems. Investment in miniaturization and seamless digital integration will define competitive success over the forecast period, emphasizing the strategic importance of reliable angular position sensing.

Technological refinement in magnetic sensing is paramount, aiming to enhance the signal-to-noise ratio in high-speed applications. Manufacturers are increasingly focusing on materials science to develop alloys that maintain magnetic stability across extremely wide temperature ranges, critical for under-hood automotive applications and deep-sea or space exploration systems. Furthermore, the integration of smart features, such as built-in temperature monitoring and self-calibration routines, is transforming the traditional resolver into a more integrated sensor package, offering valuable diagnostic information back to the central control unit without external hardware. This trend towards intelligence at the sensor level is a direct response to the demands of complex, interconnected industrial environments operating under the principles of Industrial IoT (IIoT).

Within the defense and aerospace segments, the emphasis remains on developing redundant resolver systems, often incorporating dual or triple windings, to ensure operational continuity even if a single component fails. These highly specialized, high-cost units comply with stringent regulatory standards (e.g., DO-160, MIL-STD) and represent a stable, high-margin revenue stream for market leaders. In contrast, the automotive segment requires resolvers optimized for high-volume, low-cost production, driving manufacturers to standardize designs and automate production processes to meet the economic demands of the global EV supply chain. This bifurcation of market requirements—high-volume cost optimization versus ultra-high reliability customization—is a defining characteristic of the current competitive landscape.

The shift towards brushless technology is almost complete across most high-end applications due to the fundamental mechanical limitations of brush-type resolvers, which suffer from wear and require periodic maintenance. Brushless resolvers, utilizing magnetic coupling, offer infinite life under ideal conditions and significantly reduce overall system maintenance costs. This longevity translates into a lower total cost of ownership (TCO) for end-users, further accelerating the transition. Future research is concentrating on non-contact sensing methods that can further reduce the size and weight of resolvers without compromising the inherent angular accuracy, particularly important for drone and lightweight robotics applications where power-to-weight ratio is a critical design constraint.

The segmentation by format, particularly the rise of frameless resolvers, signifies a broader industry trend toward component integration. By removing the need for a separate housing, frameless resolvers allow system designers to incorporate position sensing directly into the motor assembly, often saving space and improving thermal coupling, which aids in sensor protection. This capability is highly valued by motor manufacturers seeking to differentiate their offerings by providing pre-integrated, "smart" motor units. Cased resolvers, while declining in relative market share, maintain their niche in legacy systems and in applications where ease of replacement and standardization of mounting features are higher priorities than miniaturization.

The industrial automation application segment is experiencing profound growth, driven by investments in high-speed pick-and-place robotics and collaborative robots (cobots). Resolvers are essential here for providing reliable joint position feedback, ensuring the safety and repeatability required for high-throughput manufacturing processes. The demand for resolvers in these fields is closely linked to global capital expenditure cycles in the manufacturing sector and the persistent need for increased automation to counteract rising labor costs worldwide, particularly in developed economies that are adopting sophisticated robotic solutions to maintain global competitiveness.

In terms of regional dynamics, the APAC region's growth is inherently linked to its industrial capacity. Countries like India and Vietnam are emerging as secondary growth poles, complementing the dominant markets of China and Japan, as global supply chains diversify. These emerging economies are rapidly industrializing, leading to significant uptake of machine tools and basic automation equipment that utilize standard resolver technology. This geographical expansion means resolver manufacturers must establish localized sales, distribution, and technical support networks across a wider array of developing nations to capture this burgeoning demand efficiently and effectively.

The key players in the market are engaged in a competitive strategy focusing on patenting novel winding techniques, developing custom RDC chips, and securing long-term supply contracts with major automotive OEMs. Strategic acquisitions of smaller specialized sensor technology companies are common, aimed at expanding intellectual property portfolios and gaining rapid access to new vertical markets such as specialized medical devices. Pricing pressure, particularly in the mass-market EV segment, necessitates rigorous cost control and high-volume manufacturing excellence, distinguishing global leaders who can balance precision engineering with aggressive cost structures.

The impact of AI, while indirect, is transformative. AI's ability to interpret and utilize resolver data for real-time motor efficiency optimization is creating new performance benchmarks in EV range and industrial throughput. Instead of simply providing angular position, the resolver is becoming a critical data source for AI-driven maintenance scheduling and energy management, thereby elevating the perceived value of the component within the overall system architecture and solidifying its role as a fundamental enabling technology for advanced motion control applications in the coming decade and beyond. This integration ensures that the resolver market remains dynamic and technologically relevant, despite the rise of alternative sensing technologies.

The energy and power generation end-use segment relies heavily on resolvers for turbine pitch control, wind farm yaw control, and monitoring critical valves in nuclear and thermal power plants. In these environments, reliability is paramount, and the resolver’s inherent resistance to temperature fluctuations and contamination makes it a superior choice compared to high-resolution optical encoders which can fail in dusty or humid conditions. The long operational lifespan of energy infrastructure dictates that components chosen must possess maximum mean time between failures (MTBF), a metric where resolvers consistently outperform many magnetic or optical alternatives, securing steady demand from this infrastructure segment globally.

Market stakeholders must continuously invest in research focusing on lightweight composite materials for resolver housings and rotors, especially for airborne and portable applications. Reducing weight without sacrificing mechanical integrity is a constant engineering challenge that, if successfully addressed, opens lucrative opportunities in UAV (Unmanned Aerial Vehicle) and advanced robotics markets. Furthermore, addressing the integration complexity remains key; standardized digital interfaces and integrated chip-on-board RDC solutions are increasingly demanded by system integrators to minimize development time and potential integration errors, ensuring faster time-to-market for final products utilizing resolver technology.

In summary, the future of the Resolvers Market is secured by its foundational robustness in extreme conditions, driven by mandatory adoption in high-growth, mission-critical sectors like electric vehicles and advanced aerospace. While competitive pressure from encoders exists, the technological trajectory of resolvers, focusing on digital integration, miniaturization, and advanced magnetic compensation techniques, ensures sustained relevance and strong market performance through 2033.

The global regulatory environment, particularly mandates concerning industrial safety (e.g., ISO standards for functional safety in robotics) and environmental resilience in transportation, further fortifies the demand for resolvers. Because they offer continuous absolute position feedback without battery reliance, they are intrinsically favored in applications requiring high safety integrity levels (SIL). This regulatory advantage provides a structural barrier against competing technologies that may offer high resolution but lack the inherent electromagnetic robustness required for compliance in safety-critical machinery. Manufacturers are leveraging these certifications and standards compliance as a key competitive differentiator in their marketing and sales strategies, particularly within the heavily regulated European and North American industrial sectors.

The expansion of the industrial robotics segment is moving beyond traditional articulated arms into new categories, such as mobile industrial robots (AMRs) and automated guided vehicles (AGVs). These systems rely on high-precision resolvers not just for joint articulation but also for wheel motor control and critical braking systems, requiring resolvers that are robust enough to handle shocks and vibrations encountered during autonomous navigation on a factory floor. This diversification of application within automation broadens the resolver's addressable market and stimulates development for new form factors suitable for wheel-based motor integration, a significant area of current product innovation among key players.

Finally, the competitive intensity is driving consolidation in the market. Larger automation and sensor conglomerates are acquiring specialized resolver manufacturers to internalize the critical technology needed for their advanced motor and control system offerings. This consolidation aims to optimize supply chains and integrate resolver design directly with motor design, leading to superior, pre-calibrated motion packages. For end-users, this trend promises simpler procurement and guaranteed compatibility, reinforcing the market position of vertically integrated companies capable of supplying both the motor and the high-precision resolver feedback system as a unified solution. This move toward systems integration is a critical business trend shaping the industry's investment priorities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Resolvers Market Size Report By Type (Brushless Resolvers, Brushed Resolvers), By Application (Military/Aerospace, Automotive, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Resolvers Market Statistics 2025 Analysis By Application (Military/Aerospace, Automotive, Industrial), By Type (Brushless Resolvers, Brushed Resolvers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager