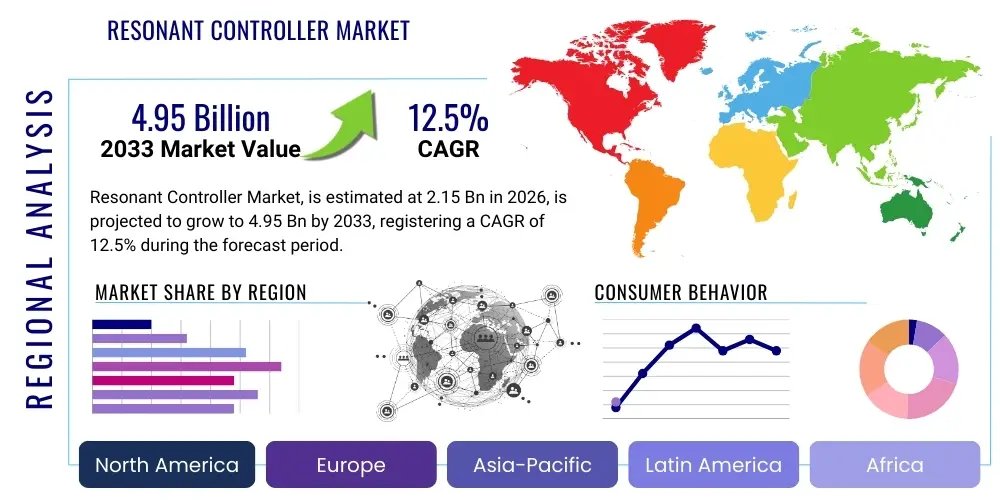

Resonant Controller Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443303 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Resonant Controller Market Size

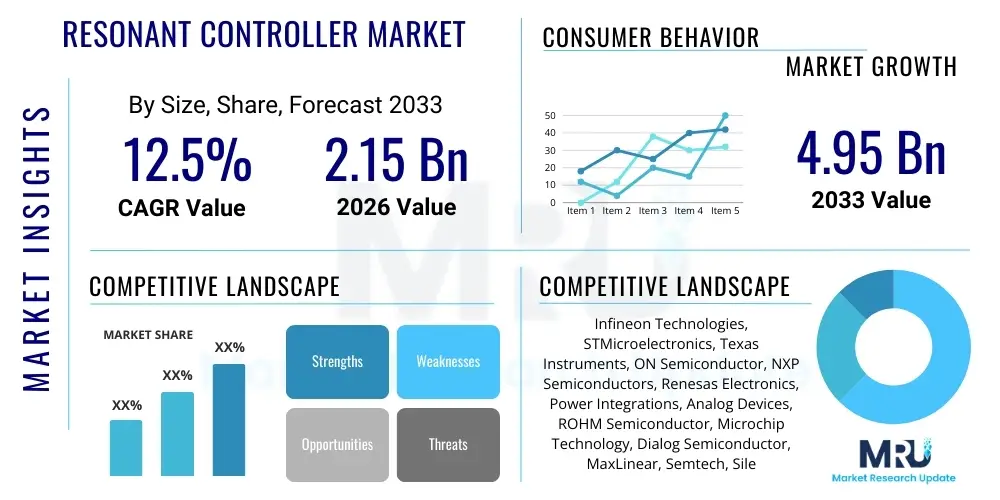

The Resonant Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $4.95 Billion by the end of the forecast period in 2033.

Resonant Controller Market introduction

The Resonant Controller Market encompasses specialized integrated circuits (ICs) designed to manage power conversion using resonant topologies, primarily LLC (Inductor-Inductor-Capacitor) and other variations like series or parallel resonant converters. These controllers are crucial components in modern power supplies, where the demand for higher efficiency, increased power density, and reduced electromagnetic interference (EMI) is paramount. Resonant conversion differs significantly from traditional pulse width modulation (PWM) by utilizing the natural resonance of an LC circuit, allowing switching components to turn on and off when the voltage or current is zero (Zero Voltage Switching or Zero Current Switching), drastically minimizing switching losses. This technological advancement is foundational for high-performance applications across various sectors, ensuring stable and reliable power delivery even under demanding operational conditions.

The core product offering includes various configurations, ranging from dedicated LLC resonant controllers to combined power factor correction (PFC) and resonant half-bridge controller ICs. Major applications span high-power consumer electronics, such as 8K TVs and gaming laptops, large-scale industrial machinery, renewable energy infrastructure like solar inverters, and critical infrastructure components, most notably in data centers and telecommunications equipment. The immediate benefits derived from adopting resonant controllers are multi-fold: enhanced system efficiency, particularly at higher switching frequencies; smaller physical size dueability to the reduction in passive component requirements; and superior thermal performance, which increases system reliability and longevity. These features collectively position resonant controllers as essential drivers for the next generation of power supply unit (PSU) design.

Driving factors propelling this market include stringent global energy efficiency regulations, such as those mandated by the 80 PLUS certification scheme for server power supplies, and the escalating power requirements of new technological deployments, particularly in cloud computing and electric vehicle charging infrastructure. As data center power consumption continues its exponential increase, the marginal efficiency gains offered by resonant topologies translate into substantial operational cost savings and reduced cooling demands. Furthermore, the proliferation of USB-PD (Power Delivery) and fast-charging standards in consumer devices necessitates highly efficient, compact power adapters, where resonant control offers an optimal balance between size, cost, and efficiency. The ongoing transition towards Wide Bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), further synergizes with resonant topologies, enabling even higher switching frequencies and pushing the boundaries of power density achievable in commercial products.

Resonant Controller Market Executive Summary

The Resonant Controller Market is characterized by robust growth driven fundamentally by the global push for energy efficiency and the proliferation of power-hungry digital infrastructure. Business trends indicate a strong movement toward integration, where manufacturers are increasingly offering highly integrated combo ICs that incorporate PFC stages alongside resonant control, simplifying design complexity for original equipment manufacturers (OEMs). Strategic alliances and intellectual property battles focused on high-frequency switching techniques are shaping the competitive landscape, emphasizing the shift toward solutions compatible with Wide Bandgap semiconductor technologies (GaN and SiC). Pricing pressure remains a constant, especially in the high-volume consumer electronics segment, requiring suppliers to continually optimize manufacturing processes and integrate advanced features like burst mode operation for light-load efficiency improvements. The rising adoption of advanced digital control platforms is also a defining trend, offering greater flexibility and optimization capability compared to traditional analog resonant controllers.

Regionally, Asia Pacific (APAC) dominates the market share due to its entrenched position as the global manufacturing hub for consumer electronics, computing hardware, and electric vehicle components. Countries like China, Taiwan, South Korea, and Japan host major power supply manufacturers and technology adopters, creating immediate and significant demand. North America and Europe, while representing smaller volume markets, are key drivers for high-end, specialized applications, particularly in hyperscale data centers, medical devices, and high-reliability industrial power systems, where compliance with stringent efficiency and safety standards is paramount. The regulatory push for higher efficiency in these Western regions acts as a critical motivator for innovation. Emerging markets in Latin America and MEA are seeing accelerating adoption, primarily tied to local infrastructure development projects, including expansion of telecom networks and increasing deployment of localized solar power solutions requiring high-efficiency inverter technology.

Segment trends highlight the dominance of the LLC resonant topology due to its excellent regulation characteristics, wide input voltage range capability, and relatively straightforward implementation compared to full-bridge resonant types. The consumer electronics application segment maintains the largest volume share, fueled by the replacement cycle and the adoption of high-wattage fast chargers. However, the data center and telecom segment is exhibiting the fastest growth trajectory, correlating directly with the massive infrastructure investment required for 5G deployment, artificial intelligence processing, and cloud service expansion. Within the product type segmentation, the shift toward highly integrated combo controllers (PFC + Resonant) is noticeable, offering OEMs a consolidated solution that reduces component count, board space, and overall system costs, thereby accelerating time-to-market for new power supply designs that must meet rigorous efficiency targets.

AI Impact Analysis on Resonant Controller Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Resonant Controller Market center on whether AI will facilitate fully automated power supply design, if machine learning algorithms can optimize controller performance in real-time, and how AI deployment in data centers affects power demand patterns. Users are keen to understand if AI-driven diagnostics will enhance reliability and predictive maintenance for power systems utilizing resonant technology. The key themes emerging from this analysis reveal strong expectations regarding the role of AI in design optimization (reducing iteration cycles and complexity), real-time efficiency maximization (dynamic frequency control based on load profile), and addressing the overwhelming power density demands driven by AI accelerators (GPUs, TPUs) in hyperscale environments. There is a general consensus that AI will not replace the fundamental resonant IC, but rather enhance the surrounding digital control mechanisms and the design process itself, making power systems smarter and more adaptable.

- AI-driven Digital Control: Implementation of machine learning algorithms within digital resonant controllers for real-time optimization of switching frequency, achieving peak efficiency across diverse load conditions.

- Automated Design and Simulation: Use of AI tools to rapidly simulate and optimize resonant tank components (L, Lr, Cr) and control loop parameters, significantly reducing power supply development time.

- Increased Power Density Demand: AI training clusters and inference servers require extremely high power densities (kW per rack), necessitating the use of the most efficient resonant topologies managed by advanced controllers.

- Predictive Maintenance: AI integration for monitoring controller telemetry, enabling early fault detection, and ensuring high reliability essential for mission-critical AI computing infrastructure.

- Adaptive Load Management: Utilizing AI to predict future load requirements in data center environments, allowing the resonant controller to proactively adjust operating modes (e.g., burst mode activation) for optimized power delivery.

DRO & Impact Forces Of Resonant Controller Market

The Resonant Controller Market is fundamentally shaped by a synergistic combination of technical requirements and global infrastructure trends. Key drivers include the relentless pursuit of energy efficiency, mandated by regulatory bodies worldwide, which resonant controllers address through their inherent low-loss Zero Voltage Switching capability. Furthermore, the massive infrastructural build-out required for 5G telecommunications, cloud computing, and high-performance computing (HPC) environments fuels demand for high-reliability, high-power-density PSUs where resonant topologies are mandatory. Restraints, conversely, include the comparatively complex design process of resonant power supplies compared to traditional PWM circuits, requiring specialized engineering expertise and complex loop compensation networks, although integrated ICs are mitigating this complexity. Another restraint is the performance volatility under extremely light load conditions, which necessitates the implementation of specialized control modes (like burst mode or skip cycles) to maintain efficiency and regulation, adding layers of complexity and cost.

Opportunities for market expansion are significant, primarily driven by the electrification of the automotive sector, particularly the rapid growth of Electric Vehicle (EV) charging infrastructure (on-board chargers and high-power fast chargers), which demands robust, highly efficient DC-DC conversion systems employing resonant control. The ongoing transition toward Wide Bandgap (WBG) semiconductors (GaN and SiC) presents a powerful opportunity, as these materials enable switching frequencies far beyond the capability of traditional silicon MOSFETs, maximizing the benefits of resonant operation, leading to vastly smaller and lighter power supplies. Impact forces are predominantly technical and regulatory: the transition to WBG materials significantly increases the performance ceiling, while global energy efficiency standards (e.g., EU CoC, US DOE, 80 PLUS Titanium) continuously exert pressure on manufacturers to adopt the most advanced topologies like LLC resonant converters. The rapid adoption of digital control methodologies, enabling highly flexible and programmable resonant controllers, acts as a pivotal force accelerating innovation and easing integration challenges.

The delicate balance between performance optimization and cost constraint is a major impact force in the high-volume consumer segment. While resonant controllers offer superior performance, their slightly higher bill of materials (BOM) compared to simpler topologies means market penetration depends heavily on manufacturers’ ability to integrate features and optimize costs through mass production. The necessity for high-reliability components in industrial and medical applications also mandates the use of proven resonant control ICs, driven by quality standards (ISO, IEC) which act as a powerful, non-negotiable impact force. Overall, the market momentum is strongly positive, largely overshadowing the constraints through technological advancement and the overwhelming economic necessity of maximizing energy utilization in increasingly complex and powerful electronic systems.

Segmentation Analysis

The Resonant Controller Market is strategically segmented based on the core technology implemented (type), the power level and configuration (topology), and the end-use application, providing a granular view of market dynamics and adoption patterns. The segmentation by type primarily differentiates between pure resonant control ICs and highly integrated PFC/Resonant combo solutions, reflecting the industry's drive toward simplification and increased functionality in a single package. Topology segmentation focuses on the structural implementation of the resonant tank, with LLC and half-bridge configurations dominating due to their performance advantages in medium to high-power applications. Understanding these segments is crucial for market participants to tailor their product offerings, focusing either on high-volume, cost-sensitive consumer electronics or specialized, high-reliability industrial and automotive power management systems where performance and robustness are the primary criteria for adoption.

- By Type:

- LLC Resonant Controllers (Pure ICs)

- PFC/Resonant Combo Controllers

- Series Resonant Controllers

- Parallel Resonant Controllers

- By Topology:

- Half-Bridge Resonant Converters

- Full-Bridge Resonant Converters

- Push-Pull Resonant Converters

- By Application:

- Consumer Electronics (Adapters, TVs, Gaming Consoles)

- Data Centers & Telecom (Server PSUs, 5G Base Stations)

- Automotive (On-Board Chargers, DC-DC Converters)

- Industrial Power (LED Lighting, Welding Equipment, Battery Chargers)

- Renewable Energy Systems (Solar Inverters, Wind Power Conversion)

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Resonant Controller Market

The value chain for the Resonant Controller Market begins with the upstream segment, dominated by silicon wafer fabrication, specialized semiconductor manufacturing, and intellectual property development related to advanced power control algorithms. Key upstream suppliers include specialized foundries and IP vendors who license core resonant control technologies. The core manufacturing stage involves the design, fabrication, assembly, and testing of the integrated circuit (IC) packages by major semiconductor companies. This phase requires significant investment in cleanroom facilities and high-precision packaging technologies to ensure the reliability required for high-frequency switching environments. Innovation at this stage, particularly leveraging WBG materials, is critical for competitive differentiation and market leadership.

The midstream of the value chain involves Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) who integrate these resonant controller ICs into complete power supply units (PSUs), adapters, and converters. These companies, often concentrated in the APAC region, are responsible for designing the resonant tank (inductors and capacitors), optimizing the layout for minimal EMI, and meeting specific regulatory compliance standards. The distribution channel is bifurcated into direct sales to large, strategic OEMs (common for automotive and hyperscale data center projects) and indirect distribution through franchised and independent electronics distributors. These distributors play a crucial role in providing logistical support, stocking, and technical assistance to smaller and medium-sized power supply manufacturers globally.

The downstream segment consists of the end-users across diverse applications: data center operators purchasing server PSUs, automotive manufacturers implementing on-board charging systems, and consumer electronics brands incorporating high-efficiency adapters. The feedback loop from the downstream is vital, informing upstream IC developers about real-world performance requirements, reliability issues, and the need for new features such as advanced diagnostics or improved light-load efficiency. The indirect channel often includes system integrators and electrical contractors who specify and install power systems in industrial and energy applications, linking the core component manufacturers to the final operational environment. The efficiency of the logistics and technical support provided across this chain directly impacts the time-to-market for complex, high-performance power products utilizing resonant control.

Resonant Controller Market Potential Customers

Potential customers for Resonant Controllers are defined by any entity requiring highly efficient and reliable high-power density switching power supplies, ranging from miniature chargers to large grid-scale converters. Primary end-users include manufacturers of high-end consumer electronics (e.g., manufacturers of large OLED/QLED displays, gaming PCs, and rapid charging adapters) where thermal constraints and efficiency requirements are critical competitive differentiators. A second, rapidly growing customer segment is the hyperscale data center industry, encompassing cloud service providers and server manufacturers who demand 80 PLUS Platinum and Titanium certified PSUs to minimize operational expenditure and maximize power utilization effectiveness (PUE). The transition to 48V bus architectures in data centers further necessitates advanced resonant conversion stages.

The automotive industry represents a high-value customer base, focusing on two key applications: on-board chargers (OBCs) for Electric Vehicles (EVs) and high-voltage DC-DC converters required for battery management and auxiliary power systems. Reliability and extreme temperature operation are non-negotiable requirements in this sector. Finally, industrial power supply manufacturers and renewable energy system providers, including those producing solar inverters (PV inverters) and energy storage systems (ESS), constitute another major segment. These customers prioritize long lifespan, robust fault protection, and high efficiency across wide operating voltage ranges, making resonant control technology an indispensable choice for maximizing energy harvest and system uptime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $4.95 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies, STMicroelectronics, Texas Instruments, ON Semiconductor, NXP Semiconductors, Renesas Electronics, Power Integrations, Analog Devices, ROHM Semiconductor, Microchip Technology, Dialog Semiconductor, MaxLinear, Semtech, Silergy Corp, Diodes Incorporated, Toshiba, TDK Corp, Allegro MicroSystems, M&M Semiconductors, Global Power Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Resonant Controller Market Key Technology Landscape

The technological landscape of the Resonant Controller Market is rapidly evolving, moving beyond purely analog control to highly sophisticated mixed-signal and fully digital architectures. Analog resonant controllers, while cost-effective and proven, are being augmented or replaced by digital signal processing (DSP) based controllers. These digital controllers offer superior performance characteristics, particularly in managing complex resonant topologies across wide input and output voltage ranges, and provide the flexibility necessary to implement advanced features like adaptive dead-time control, proprietary burst modes for optimal light-load efficiency, and comprehensive protection mechanisms. The core technology centers around achieving precise Zero Voltage Switching (ZVS) or Zero Current Switching (ZCS) across the entire load range, minimizing the dissipative losses associated with traditional hard-switching converters.

A major technological inflection point is the increasing synergy between resonant control ICs and Wide Bandgap (WBG) semiconductors, namely Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials boast superior switching speed, lower conduction losses, and higher temperature tolerance compared to standard silicon MOSFETs. Resonant controllers are specifically designed to maximize the inherent benefits of GaN and SiC, enabling designers to push switching frequencies into the megahertz range. This frequency increase allows for a substantial reduction in the size of magnetic components (inductors and transformers), leading directly to higher power density—a critical requirement for modern data center and automotive applications. Semiconductor manufacturers are actively developing gate drivers and controller ICs optimized specifically for the unique driving characteristics of these WBG devices.

Furthermore, the integration trend continues to drive innovation. Modern Resonant Controller ICs often incorporate multiple functionalities on a single chip, such as Power Factor Correction (PFC) circuitry, high-voltage startup circuits, and comprehensive fault monitoring features. This integration simplifies board layout, reduces component count, and significantly enhances overall system reliability. Advanced packaging technologies are also playing a role, improving thermal dissipation and enabling higher power handling capabilities within a smaller footprint. The technological competition is focused on patented control algorithms that can dynamically adjust switching parameters based on real-time load changes and component temperature variations, ensuring sustained peak efficiency and reliability throughout the operational lifecycle of the power supply unit.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the Resonant Controller Market due to its unparalleled dominance in global electronics manufacturing. Countries like China, South Korea, Taiwan, and Japan host the majority of Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) for consumer electronics, computing hardware, and electric vehicle components. Rapid industrialization, massive investments in renewable energy infrastructure (particularly solar inverters), and the ongoing build-out of 5G networks in countries like India and Southeast Asia ensure sustained high volume growth. The technological adoption rate is extremely high, often driven by intense cost competition and the necessity to meet export standards for Europe and North America.

- North America: North America is characterized by significant demand for high-end, specialized resonant controllers, particularly driven by hyperscale data centers (Amazon, Google, Microsoft, Meta), telecommunications backbone infrastructure, and the rapidly scaling Electric Vehicle ecosystem. Although manufacturing volume is lower than in APAC, the market here is focused on premium components, strict reliability standards, and the early adoption of cutting-edge technologies like 48V resonant converters and GaN-optimized controllers. Regulatory requirements for 80 PLUS Titanium efficiency in data centers are a key market driver.

- Europe: The European market is highly regulated, prioritizing stringent energy efficiency standards (ErP directives) and environmental compliance. This regulatory environment fuels the adoption of high-efficiency resonant controllers across industrial automation, high-reliability medical devices, and sophisticated electric vehicle charging solutions. Countries such as Germany, the UK, and France are leaders in adopting smart grid technologies and advanced manufacturing, ensuring steady demand for robust, high-performance power management solutions.

- Latin America (LATAM): The LATAM region represents an emerging growth area, with market expansion primarily linked to infrastructure development projects, including urbanization, data center establishment in major economies like Brazil and Mexico, and significant penetration of telecom services. Demand is focused on cost-effective, yet reliable, resonant solutions suitable for local power grid conditions and telecom base station power supplies.

- Middle East and Africa (MEA): The MEA region's growth is largely tied to oil & gas infrastructure modernization, smart city initiatives (e.g., in the UAE and Saudi Arabia), and substantial investments in solar power generation. These projects require resilient and high-efficiency resonant controllers, particularly in off-grid or remote power applications where minimizing losses and maximizing system reliability are paramount.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Resonant Controller Market.- Infineon Technologies

- STMicroelectronics

- Texas Instruments

- ON Semiconductor

- NXP Semiconductors

- Renesas Electronics

- Power Integrations

- Analog Devices

- ROHM Semiconductor

- Microchip Technology

- Dialog Semiconductor

- MaxLinear

- Semtech

- Silergy Corp

- Diodes Incorporated

- Toshiba

- TDK Corp

- Allegro MicroSystems

- M&M Semiconductors

- Global Power Technology

Frequently Asked Questions

Analyze common user questions about the Resonant Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Resonant Controller and why is it essential for modern power supplies?

A Resonant Controller is an integrated circuit (IC) that manages power conversion using resonant tank circuits (LC combinations). It is essential because it enables Zero Voltage Switching (ZVS) or Zero Current Switching (ZCS), drastically reducing energy losses and heat generation, thereby achieving higher power density and peak efficiency required for modern electronics and data centers.

How do Wide Bandgap (WBG) semiconductors impact the future of resonant control technology?

WBG semiconductors, such as GaN and SiC, significantly enhance resonant control by allowing for much higher switching frequencies than traditional silicon. This compatibility leads to smaller, lighter power supplies with improved efficiency, directly meeting the industry need for increased power density in applications like EV chargers and server power supplies.

Which application segment drives the highest growth rate in the Resonant Controller Market?

The Data Centers & Telecom segment, particularly driven by hyperscale cloud expansion, 5G infrastructure deployment, and the demand for ultra-high-efficiency server power supply units (PSUs), is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period.

What are the primary challenges restraining mass adoption of resonant controller technology?

The main restraints include the inherent complexity of designing and tuning the resonant tank circuit compared to traditional PWM circuits, requiring specialized engineering expertise, and the necessity to manage reduced efficiency performance specifically under extremely light load conditions.

What is the estimated market size and forecast growth rate for the Resonant Controller Market?

The Resonant Controller Market is estimated at $2.15 Billion in 2026 and is projected to reach $4.95 Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager