Restaurant Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442476 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Restaurant Software Market Size

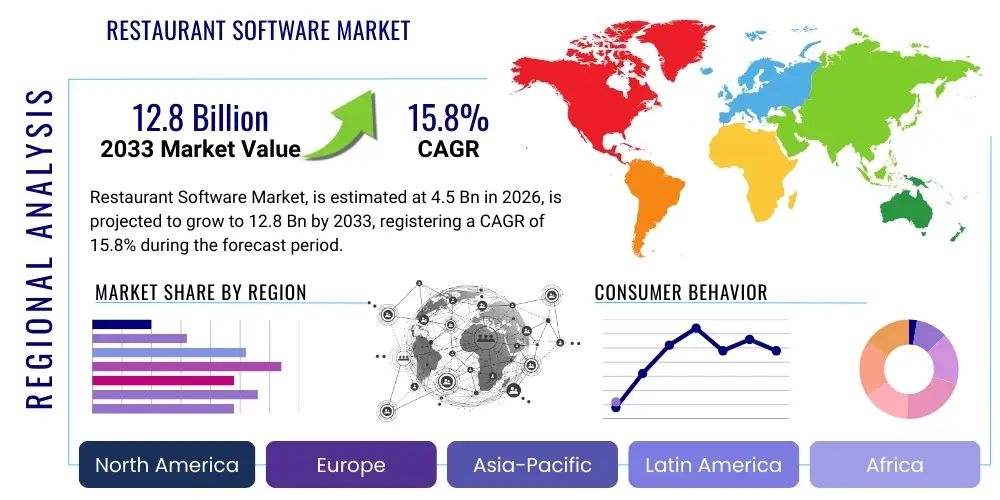

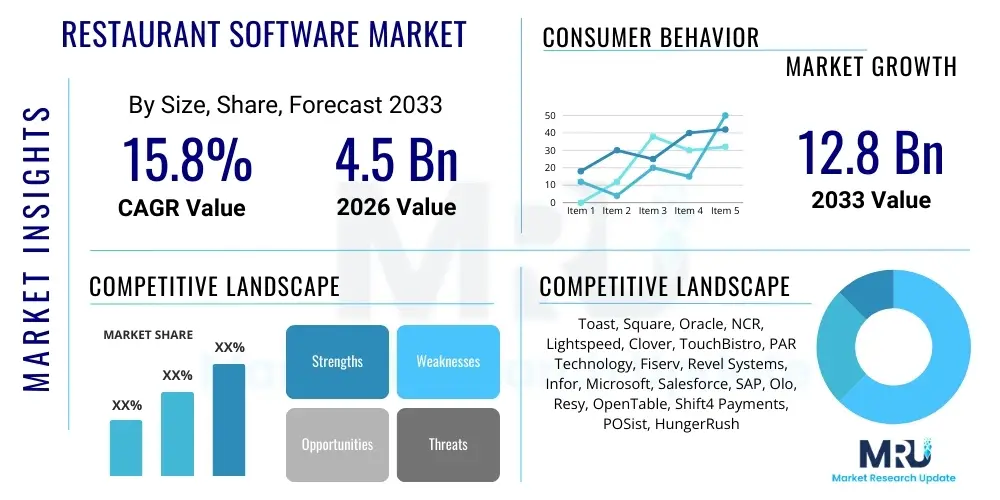

The Restaurant Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% (CAGR) between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global shift toward digital operations, coupled with the critical need for operational efficiency and seamless customer experience management within the highly competitive food service industry. The adoption rate is significantly higher in developed economies, although emerging markets are rapidly catching up due to increased internet penetration and investment in hospitality infrastructure.

Restaurant Software Market introduction

The Restaurant Software Market encompasses a diverse ecosystem of digital tools and platforms designed to manage, automate, and optimize various operational aspects of food service establishments, ranging from quick-service restaurants (QSRs) and fine dining venues to cafes and ghost kitchens. This software suite typically includes Point-of-Sale (POS) systems, inventory management modules, customer relationship management (CRM) tools, reservation and table management systems, and increasingly sophisticated back-of-house solutions like kitchen display systems (KDS) and labor scheduling applications. The fundamental purpose of this technology is to centralize management functions, reduce human error, and provide actionable data insights necessary for strategic decision-making in a high-volume, low-margin industry.

Major applications of restaurant software are diverse, spanning front-of-house activities such as order taking, payment processing, and loyalty program management, to complex back-of-house tasks including supply chain tracking, waste reduction analysis, and employee performance monitoring. The rise of integrated cloud-based platforms (SaaS) has allowed smaller, independent restaurants to access enterprise-level functionalities previously available only to large chains. Furthermore, the imperative for restaurants to manage multiple channels—including in-house dining, delivery aggregators, proprietary online ordering, and curbside pickup—has cemented software as the central nervous system of modern restaurant operations.

The core benefits driving this market’s rapid growth include improved speed of service, enhanced data security, better resource allocation, and a direct increase in revenue potential through optimized pricing and reduced operational friction. Key driving factors are the explosive growth of third-party food delivery services, necessitating robust integration capabilities; the ongoing global labor shortage, which mandates automation for efficiency; and the growing consumer demand for personalized and swift digital interactions. Regulatory changes regarding data handling and minimum wage increases also compel operators to invest in sophisticated software solutions that ensure compliance and optimize labor costs.

Restaurant Software Market Executive Summary

The Restaurant Software Market is currently experiencing robust momentum, characterized by intense competition among established enterprise solution providers and innovative cloud-native startups. Key business trends indicate a strong pivot towards unified commerce platforms that offer end-to-end integration, moving away from disparate, siloed systems. Investors are keenly focusing on companies that master AI-driven personalized marketing and predictive inventory management, which deliver substantial ROI improvements for restaurant operators. Mergers and acquisitions are frequent, as larger firms seek to acquire specialized functionalities, such as advanced reservation systems or cutting-edge kitchen automation technologies, consolidating the vendor landscape while simultaneously enhancing product breadth.

Regionally, North America maintains market dominance due to high technological maturity, significant spending power, and early adoption of cloud and mobile POS systems. However, the Asia Pacific (APAC) region is projected to register the highest growth rate throughout the forecast period, fueled by rapid urbanization, the proliferation of digital payments, and the massive scale of markets like China and India, which are rapidly transitioning their vast restaurant industries to digital platforms. European growth remains steady, driven primarily by regulatory compliance requirements (e.g., GDPR) and the sustained demand for sophisticated table and loyalty management tools in high-end hospitality sectors. Emerging markets in Latin America and MEA are seeing substantial adoption, largely skipping legacy systems and moving directly to mobile-first, cloud-based solutions.

Segment trends reveal that the Point-of-Sale (POS) segment remains the largest component of the market, though specialized segments like Online Ordering & Delivery Management and Inventory & Supply Chain Management are exhibiting exponential growth. Cloud-based deployment (SaaS) decisively dominates the market over on-premise installations, favored for its flexibility, lower initial capital expenditure, and ease of automated updates. Quick Service Restaurants (QSRs) represent the most voluminous end-user segment due to their high transaction frequency, yet Fine Dining and Full-Service Restaurants (FSRs) are driving demand for advanced features like dynamic pricing algorithms and sophisticated customer experience tools, thereby driving up the average contract value within those sub-segments.

AI Impact Analysis on Restaurant Software Market

Common user inquiries regarding AI in the restaurant software domain revolve around automation replacing human labor, the accuracy of predictive analytics, personalization capabilities, and the cost-effectiveness of implementation. Users frequently question whether AI can truly manage dynamic pricing strategies effectively and how machine learning algorithms ensure optimal staffing levels in real-time. The summarized consensus highlights a strong expectation that AI will move beyond simple chatbot functions to become an indispensable tool for operational efficiency and revenue optimization. Key themes center on leveraging large language models (LLMs) for automated customer service, using predictive maintenance for kitchen equipment, and applying deep learning to forecast demand, minimizing food waste, and significantly enhancing the overall profit margins of restaurants.

- AI-Powered Predictive Inventory Management: Algorithms analyze historical sales, seasonal trends, and upcoming events to optimize purchasing, drastically reducing spoilage and holding costs.

- Dynamic Pricing Optimization: Machine learning models adjust menu prices in real-time based on current demand, time of day, competitor pricing, and inventory levels to maximize profitability per transaction.

- Enhanced Customer Personalization: AI analyzes purchase history and loyalty data to generate personalized marketing offers, menu recommendations, and customized dining experiences.

- Automated Order Taking and Customer Service: Voice AI and generative models are used in drive-thrus, phone ordering systems, and integrated chatbots to handle complex orders without human intervention, improving speed and accuracy.

- Labor Scheduling and Optimization: AI anticipates staffing needs based on predicted transaction volumes, ensuring optimal coverage while adhering to complex labor laws and minimizing overtime expenditure.

- Kitchen Workflow Optimization: Computer vision and machine learning optimize cooking times, monitor food quality, and streamline the flow of orders through the Kitchen Display System (KDS), accelerating throughput during peak hours.

DRO & Impact Forces Of Restaurant Software Market

The Restaurant Software Market is significantly shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces (IF). Key drivers include the mandatory shift towards digital menus and contactless ordering post-pandemic, the massive expansion of the food delivery ecosystem requiring robust integration, and the critical need for restaurateurs to derive actionable data from daily operations to combat soaring labor and supply chain costs. These factors collectively push operators towards integrated, cloud-based software solutions that promise comprehensive control and efficiency, fundamentally altering the traditional business model of hospitality.

However, the market growth faces notable restraints, primarily centered around high initial implementation costs for small and independent restaurants, which may lack the necessary capital or technical expertise for complex deployments. Furthermore, concerns regarding data security, particularly the protection of sensitive customer and payment information (PCI compliance), remain a significant barrier. The fragmentation of the technology landscape, where compatibility issues arise between various specialized software modules (e.g., POS, loyalty, reservation), often hinders seamless integration, forcing operators to deal with multiple vendors and complex interfaces.

Opportunities abound, specifically in the development of hyper-specialized solutions for emerging market niches such as ghost kitchens, virtual brands, and dark stores, which require highly optimized, low-overhead software stacks. The increasing maturation of AI and IoT technologies provides an opportunity for vendors to develop predictive maintenance tools, voice ordering systems, and fully automated robotic kitchen management software. The collective impact force is overwhelmingly positive, driven by the global imperative for digital transformation, suggesting that while initial hurdles exist, the long-term strategic necessity of these solutions ensures sustained high growth and market consolidation around platforms offering the greatest ease of integration and comprehensive feature sets.

Segmentation Analysis

The Restaurant Software Market is meticulously segmented based on solution type, deployment model, end-user type, and core business function, allowing for a precise understanding of adoption trends and investment foci. This structure enables market participants to tailor their offerings to specific operational needs, whether focusing on high-volume QSRs requiring rapid transaction processing or fine-dining establishments needing sophisticated table management and guest data analytics. The ongoing trend is towards the blending of these segments through integrated platforms, where individual components (e.g., POS, KDS, CRM) are sold as modular parts of a unified cloud-based ecosystem.

- By Solution Type:

- Point-of-Sale (POS) Systems

- Inventory Management Software

- Table and Reservation Management

- Labor Management and Scheduling

- Customer Relationship Management (CRM)

- Reporting and Analytics

- Kitchen Display Systems (KDS)

- Online Ordering and Delivery Management

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By End-User Type:

- Quick Service Restaurants (QSRs)

- Full-Service Restaurants (FSRs)

- Cafes and Bars

- Ghost Kitchens and Virtual Restaurants

- Institutional Food Services

- By Application:

- Front of House (FOH) Management

- Back of House (BOH) Management

- Enterprise Management

Value Chain Analysis For Restaurant Software Market

The value chain for the Restaurant Software Market begins with upstream activities focused on core software development, intellectual property creation, and the establishment of robust, scalable cloud infrastructure. This stage involves significant investment in R&D, particularly in machine learning, API development for seamless third-party integration, and ensuring stringent security protocols (PCI, GDPR compliance). Key players at this stage are often large technology vendors (e.g., Microsoft, AWS) providing foundational cloud services, alongside specialized software development firms creating the proprietary algorithms and user interfaces that define the final product.

The midstream analysis concentrates on the distribution channel, which is pivotal to market reach. Distribution is segmented into direct sales, involving in-house sales teams targeting large chains and enterprises for bespoke deployments, and indirect channels, predominantly utilizing authorized resellers, certified technology partners, and marketplace integrations. The Software-as-a-Service (SaaS) model heavily favors indirect and online distribution, allowing smaller vendors to reach a global clientele efficiently. Integration specialists, who customize the software to specific restaurant environments and hardware (e.g., receipt printers, payment terminals), play a crucial role in delivering value and ensuring successful adoption.

Downstream activities involve implementation, maintenance, and ongoing customer support, delivered directly to the end-users. This stage is crucial for customer retention and feedback loops, which inform future software updates. The restaurant software ecosystem requires continuous updates to comply with evolving payment standards, tax regulations, and changing consumer technology expectations (e.g., mobile wallets, QR code ordering). The end of the value chain sees the software generating operational efficiency and revenue growth for the restaurant, thereby completing the value proposition and justifying the subscription costs.

Restaurant Software Market Potential Customers

The potential customer base for restaurant software is expansive, encompassing the entire spectrum of food service establishments globally, ranging from single-location independent businesses to multinational restaurant conglomerates. The primary objective for all these end-users is mitigating operational complexities while maximizing profitability and enhancing the guest experience. The adoption propensity varies significantly: large chains prioritize enterprise resource planning (ERP) capabilities and centralized data management across hundreds of locations, while small businesses prioritize affordability, ease of use, and quick implementation, often opting for subscription-based, all-in-one cloud solutions.

A significant segment of buyers comprises Quick Service Restaurants (QSRs) and fast-casual chains, characterized by high transaction volumes and a critical need for speedy, accurate service, making them prime customers for advanced POS, KDS, and mobile ordering systems. This segment demands software that can efficiently handle drive-thru optimization, menu board integration, and complex loyalty programs. Their purchasing decisions are heavily influenced by the software’s ability to minimize transaction time and seamlessly integrate with third-party delivery aggregators like Uber Eats and DoorDash.

Conversely, Full-Service Restaurants (FSRs), fine dining establishments, and high-end hotels prioritize software that enhances the guest experience and optimizes table turnover. Their demand focuses on sophisticated reservation management (e.g., yielding tools, waitlist management), detailed CRM features for personalized service, and robust back-of-house tools for managing complex menu engineering and wine inventory. Emerging segments, such as ghost kitchens, represent a rapidly growing customer base, demanding specialized, low-overhead software designed exclusively for delivery optimization and virtual brand management, often prioritizing API accessibility over traditional front-of-house features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toast, Square, Oracle, NCR, Lightspeed, Clover, TouchBistro, PAR Technology, Fiserv, Revel Systems, Infor, Microsoft, Salesforce, SAP, Olo, Resy, OpenTable, Shift4 Payments, POSist, HungerRush |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Restaurant Software Market Key Technology Landscape

The Restaurant Software Market is currently defined by the pervasive adoption of cloud-based Software-as-a-Service (SaaS) models, which represent the fundamental shift from localized, expensive systems to subscription-based, accessible platforms. This cloud migration facilitates real-time data synchronization across multiple locations, improves system scalability to handle unexpected volume spikes, and drastically simplifies the deployment and update process, significantly reducing the Total Cost of Ownership (TCO) for operators. Furthermore, the reliance on open Application Programming Interfaces (APIs) has become standard, enabling various niche software vendors (e.g., specialized payroll, loyalty, or beverage management tools) to easily integrate their offerings, promoting a highly customizable ecosystem rather than a rigid, monolithic system.

The rapid advancement of mobile technology and Internet of Things (IoT) sensors is fundamentally transforming physical operations. Mobile POS systems, often running on tablets, enable staff to take orders directly at the table, accelerating service and improving order accuracy. IoT devices are increasingly integrated into the software stack, monitoring refrigerator temperatures, optimizing energy consumption, and providing machine-level data for predictive maintenance. This convergence of mobile flexibility and hardware connectivity ensures that operational data flows continuously into the centralized software platform, creating a genuine digital twin of the restaurant environment for deep analysis.

Finally, Artificial Intelligence (AI) and Machine Learning (ML) are evolving from auxiliary features to core technological differentiators. Beyond basic reporting, modern restaurant software leverages ML for advanced demand forecasting, ensuring that inventory and staffing perfectly match anticipated needs, thereby minimizing food waste and unnecessary labor costs. Payment technology, including contactless NFC payments, digital wallets, and proprietary QR code ordering systems, is integrated directly into the POS software, streamlining the checkout process and enhancing security. These technological advancements collectively drive the software’s capability from merely recording transactions to proactively optimizing complex operational logistics.

Regional Highlights

North America currently commands the largest market share, driven by a high concentration of sophisticated restaurant chains, favorable economic conditions supporting technological investment, and the early and aggressive adoption of integrated cloud POS and mobile ordering solutions, particularly in the United States. High labor costs in this region serve as a powerful impetus for continuous investment in automation software, from self-ordering kiosks to AI-driven scheduling. The presence of major industry players like Toast, NCR, and Oracle further solidifies the region's technological leadership, acting as an innovation incubator for the global market.

The Asia Pacific (APAC) region is poised to exhibit the most rapid Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is attributed to the enormous population density, rising disposable incomes, rapid digital penetration (especially mobile payments), and the substantial growth of the middle-class consumer base demanding high-quality, tech-enabled food service. Countries like China and India, with their massive and fragmented restaurant sectors, are transitioning directly to advanced cloud-based systems, skipping older legacy hardware. Government initiatives supporting digitalization and e-commerce also provide a powerful tailwind for market expansion.

Europe represents a mature but steady growth market, characterized by strong demand for compliance-focused software that adheres to rigorous data privacy regulations (e.g., GDPR) and specific national taxation requirements. Adoption is high in the hospitality-heavy markets of Western Europe, focusing on reservation systems and advanced CRM capabilities for premium dining experiences. Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions, where growth is currently concentrated in urban centers and driven by mobile-first strategies. The establishment of localized, affordable SaaS solutions tailored to regional payment habits and connectivity challenges is key to unlocking the full market potential in these developing territories.

- North America: Market leader; high adoption of unified POS platforms; demand driven by high labor costs and enterprise chain requirements.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization, mobile payment adoption, and significant digital transformation in mass markets (China, India).

- Europe: Stable growth; focus on regulatory compliance (GDPR), sophisticated loyalty programs, and reservation management for high-end dining.

- Latin America (LATAM): Emerging market; rapid adoption of mobile-first solutions; growth centered around major metropolitan hubs.

- Middle East and Africa (MEA): Growth stimulated by tourism and hospitality infrastructure investment; increasing demand for localized cloud solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Restaurant Software Market, analyzing their product portfolios, strategic initiatives, regional presence, and competitive positioning.- Toast

- Square (Block, Inc.)

- Oracle Corporation

- NCR Corporation

- Lightspeed Commerce Inc.

- Clover (Fiserv, Inc.)

- TouchBistro

- PAR Technology Corporation

- Revel Systems

- Infor

- Microsoft Corporation

- Salesforce

- SAP SE

- Olo Inc.

- Resy (American Express)

- OpenTable (Booking Holdings)

- Shift4 Payments

- POSist Technologies Pvt. Ltd.

- HungerRush

- Aldelo L.P.

Frequently Asked Questions

Analyze common user questions about the Restaurant Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of cloud-based restaurant software solutions?

The primary driver is the need for operational flexibility and real-time data accessibility across multiple locations, coupled with the lower initial capital expenditure (CapEx) associated with SaaS models compared to traditional on-premise infrastructure. Cloud solutions also facilitate crucial integration with third-party delivery platforms and mobile ordering channels.

How is AI specifically impacting inventory and supply chain management in restaurants?

AI significantly impacts inventory by enabling predictive demand forecasting, which analyzes historical sales and external variables (like weather or events) to precisely calculate necessary stock levels. This minimizes food waste, optimizes storage, and prevents costly stockouts, thereby directly improving margins.

Which geographical region is anticipated to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid digital transformation, increasing urbanization, massive investments in hospitality infrastructure, and high consumer reliance on mobile digital payment systems.

What are the key differences between FOH and BOH software solutions?

Front of House (FOH) software primarily manages customer-facing tasks like Point-of-Sale (POS) transactions, table management, reservations, and loyalty programs. Back of House (BOH) software focuses on internal operational efficiency, including inventory tracking, labor scheduling, kitchen display systems (KDS), and supply chain logistics.

What is the most significant restraint challenging the market adoption of restaurant software?

The most significant restraint is the high initial implementation cost and the complexity of integrating diverse software modules from various vendors, particularly for smaller, independent restaurant operators who often lack specialized IT support and sufficient operational budget for full-scale system upgrades.

What role does cybersecurity play in the restaurant software market?

Cybersecurity is critical, especially concerning PCI compliance and the protection of customer payment data. Modern software must employ robust encryption and multi-factor authentication to mitigate risks associated with frequent, high-volume transactions and maintain regulatory adherence, which is vital for operator trust and consumer confidence.

How do ghost kitchens influence the demand for specialized software?

Ghost kitchens drive demand for highly specialized software focused solely on BOH efficiency, multi-brand order aggregation, and direct integration with multiple third-party delivery services. They require scalable, low-cost solutions that minimize physical FOH features and maximize virtual brand management capabilities.

What emerging technology is poised to redefine the restaurant ordering process?

Voice AI and conversational interfaces are poised to redefine ordering, particularly in drive-thrus and mobile applications, allowing customers to place complex orders naturally and efficiently. This technology leverages Generative AI to improve accuracy and speed without requiring human staff intervention.

In the Value Chain, where is the most intensive R&D investment concentrated?

The most intensive R&D investment is concentrated in upstream activities, focusing on developing proprietary algorithms for AI-driven predictive analytics, enhancing API robustness for partner integration, and ensuring stringent data security and regulatory compliance frameworks for global deployment.

Which end-user segment accounts for the highest volume of software transactions?

Quick Service Restaurants (QSRs) and fast-casual dining establishments account for the highest volume of transactions due to their high throughput, rapid turnover, and reliance on speed-of-service, necessitating highly efficient and robust Point-of-Sale (POS) and Kitchen Display Systems (KDS).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager