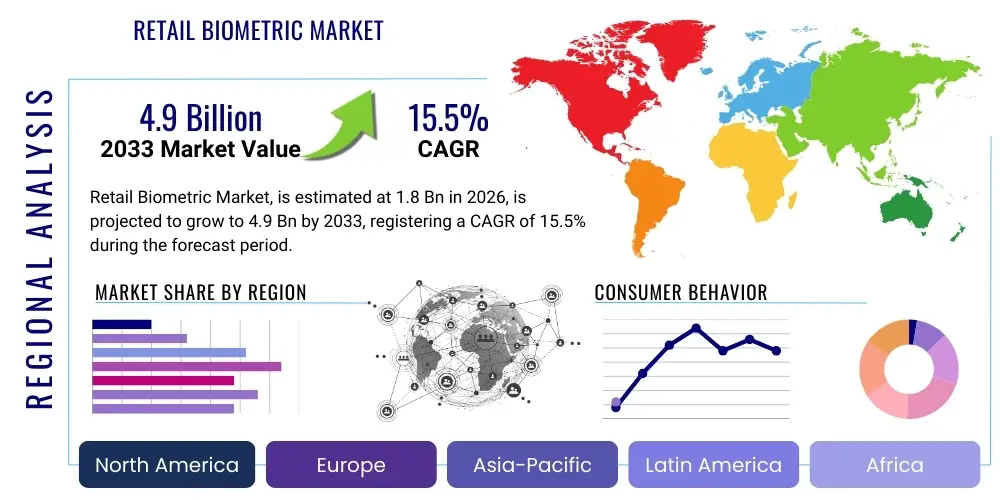

Retail Biometric Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441785 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Retail Biometric Market Size

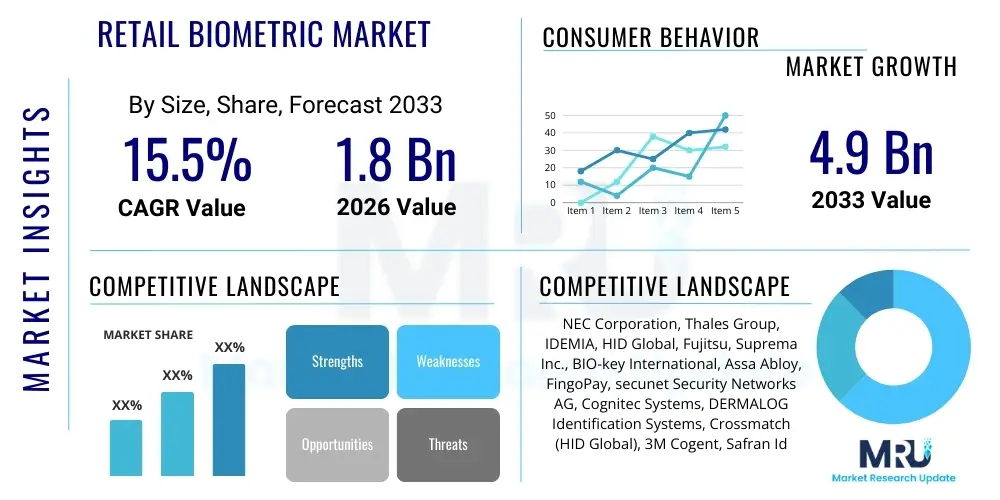

The Retail Biometric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Retail Biometric Market introduction

The Retail Biometric Market encompasses the deployment of various biometric technologies—such as facial recognition, fingerprint scanning, iris recognition, and voice biometrics—within the retail sector to enhance security, improve operational efficiency, and personalize customer experiences. These systems are integral for managing secure access control, verifying employee identities, preventing internal theft, and facilitating frictionless payment processes like 'pay-by-face' or fingerprint checkout. The core product offering includes hardware (scanners, cameras, sensors) and sophisticated software platforms that utilize deep learning algorithms to match and verify identity data against secure databases.

Major applications of biometric systems in retail extend beyond point-of-sale (POS) systems to include supply chain management, inventory tracking, time and attendance monitoring for staff, and sophisticated loss prevention strategies in high-traffic areas. By providing undeniable proof of identity, biometrics significantly reduces instances of fraud, shrink, and unauthorized access to sensitive data or restricted inventory. This adoption is driven primarily by the global shift towards digital transformation, the increasing volume of high-value transactions, and the urgent need for robust security measures that traditional password or key-card systems cannot reliably provide.

The primary benefits fueling market growth include enhanced speed and convenience for consumers, leading to higher customer satisfaction and loyalty, alongside substantial cost savings for retailers through reduced fraud losses and optimized labor management. Driving factors include the increasing affordability and accuracy of biometric sensors, the proliferation of omnichannel retail strategies requiring seamless customer identification across platforms, and the regulatory environment pushing for stronger data security protocols in financial transactions, positioning biometrics as a critical infrastructure component for modern commerce.

Retail Biometric Market Executive Summary

The Retail Biometric Market is experiencing rapid expansion, fueled by strong business trends centered on combating retail shrink, enhancing the efficiency of workforce management, and transitioning to entirely frictionless shopping experiences. Key trends involve the integration of multi-modal biometric solutions, combining technologies like facial and voice recognition for superior accuracy and reliability, moving away from single-factor authentication. Retailers are increasingly adopting biometrics not just for security but as a competitive tool to enable highly personalized interactions and streamline payment processes, particularly in high-volume environments like supermarkets and fast-casual dining.

Regionally, North America leads the adoption curve due to high expenditure on advanced retail infrastructure and early regulatory frameworks supporting digital identity verification. However, Asia Pacific is emerging as the fastest-growing market, propelled by rapid urbanization, significant investment in smart city projects, and the widespread consumer acceptance of mobile biometric payments, especially in countries like China and India. European adoption remains steady, heavily guided by stringent data privacy regulations such as GDPR, which mandates solutions that prioritize data minimization and user consent.

Segment trends highlight the dominance of facial recognition technology, driven by its non-contact nature and ease of deployment via existing camera infrastructure, making it highly effective for both loss prevention and customer behavior analytics. The component segment sees software and services growing fastest, reflecting the shift toward sophisticated cloud-based platforms offering real-time data processing and identity management solutions crucial for large-scale retail chains. Applications in payment processing and access control are critical drivers, demonstrating the immediate Return on Investment (ROI) derived from securing financial transactions and sensitive back-office areas.

AI Impact Analysis on Retail Biometric Market

Common user questions regarding AI's influence on the Retail Biometric Market frequently revolve around data privacy, the accuracy of deep learning algorithms in varying environmental conditions (e.g., lighting, partial obstruction), and the potential for bias or discrimination in facial recognition systems. Users are also keenly interested in how AI enhances proactive loss prevention—moving beyond simple identification to predictive behavioral analysis. The overarching expectation is that AI, specifically machine learning and deep learning, must deliver near-perfect accuracy while simultaneously ensuring compliance with evolving global privacy mandates, creating a dichotomy between utility and ethical application.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the retail biometric landscape, moving systems from mere identification tools to predictive security and personalized commerce engines. AI algorithms significantly improve the accuracy of biometric matching, particularly in complex retail environments where lighting changes, occlusions (masks, hats), or diverse crowd densities challenge traditional systems. Furthermore, AI enables behavioral biometrics, where systems analyze non-physical patterns—such as typing rhythm or walking gait—providing an additional, passive layer of security that is extremely difficult to spoof and highly valuable for detecting subtle employee misconduct or sophisticated fraud attempts.

For retailers, AI’s greatest impact lies in its ability to process vast streams of biometric data in real-time to detect anomalies and predict potential shrinkage events before they occur. For example, ML models can learn 'normal' customer and employee movement patterns, flagging deviations that indicate potential shoplifting or misuse of privileges. This predictive capability shifts the function of biometrics from reactive reporting to proactive intervention, optimizing security personnel deployment and significantly reducing inventory losses. Moreover, AI powers the seamless customer journey, recognizing repeat customers instantly to trigger personalized offers or enable ultra-fast, entirely contactless checkout experiences, thus bridging security needs with commercial goals.

- AI enhances liveness detection, making systems resistant to spoofing attempts using photos or masks.

- Machine Learning optimizes biometric template matching speed and accuracy across diverse populations and demographics.

- Deep learning models facilitate predictive loss prevention by analyzing real-time video and access data to flag unusual behavior patterns.

- AI enables seamless integration of multi-modal biometrics, processing inputs from facial, voice, and gait recognition simultaneously.

- Generative AI tools are used in scenario planning and training of biometric systems to improve robustness against emerging security threats.

DRO & Impact Forces Of Retail Biometric Market

The Retail Biometric Market is propelled by powerful macro and micro forces centered around efficiency, security, and consumer convenience. The primary drivers include the escalating global threat of retail fraud and organized retail crime, which necessitates sophisticated identity verification tools. Simultaneously, consumer demand for frictionless experiences, particularly in payment and loyalty programs, pushes retailers to adopt high-speed, contactless identification methods like facial recognition. Restraints largely focus on public apprehension regarding data privacy and the sensitivity of biometric information, alongside the high initial capital investment required for deploying integrated biometric infrastructure across large retail footprints. Opportunities exist in the development of regulatory sandboxes that encourage secure biometric innovation and the expansion of multi-modal and cloud-based solutions tailored for Small and Medium-sized Enterprises (SMEs) that currently rely on legacy systems.

Impact forces currently shape the market direction decisively. The increasing accuracy and decreasing cost of hardware components, particularly high-resolution cameras and sensors, lower the barrier to entry for retailers globally. However, the regulatory environment presents a complex challenge; while governments mandate stronger security, they concurrently impose strict regulations (like GDPR and CCPA) on handling personal data, forcing vendors to invest heavily in privacy-by-design frameworks. Technological forces, specifically the maturity of AI and edge computing, are having the most immediate impact, allowing for highly localized processing of biometric data, which addresses privacy concerns by minimizing data transmission over networks and enabling faster response times at the point of action, such as checkout counters or secure stockrooms.

Another significant opportunity is the convergence of biometrics with IoT and Augmented Reality (AR) in the retail environment. Biometrics can enable hyper-personalized shelf displays or customized digital assistants based on immediate customer identification, linking the physical shopping experience directly to their digital profile. Conversely, a major constraint remains the lack of universally standardized interoperability protocols, making large-scale deployment across diverse vendor systems complex and expensive. Successful market navigation requires vendors to emphasize transparent data handling, strong encryption, and demonstrable ROI derived from decreased shrink and improved operational flow.

Segmentation Analysis

The Retail Biometric Market is systematically segmented across several critical dimensions, including technology type, component, application, and geographic region, allowing for detailed analysis of adoption patterns and growth trajectories. The technology segmentation highlights the shift from traditional fingerprint and hand geometry methods toward sophisticated, non-contact modalities such as facial, iris, and voice recognition, driven by hygienic concerns and speed requirements. The market is also segmented by component, distinguishing between the tangible hardware (scanners, terminals) and the crucial software and services necessary for processing, secure storage, and maintaining the accuracy of biometric templates.

- By Technology Type:

- Facial Recognition

- Fingerprint Recognition

- Iris Recognition

- Voice Recognition

- Palm and Vein Recognition

- Behavioral Biometrics

- By Component:

- Hardware (Sensors, Scanners, Terminals)

- Software (Identity Management, Analytics Platforms)

- Services (Integration, Maintenance, Consulting)

- By Application:

- Point-of-Sale (POS) and Payment Processing

- Access Control and Workforce Management (Time & Attendance)

- Loss Prevention and Surveillance

- Customer Relationship Management (CRM) and Personalization

- By Retail Type:

- Grocery and Supermarkets

- Department Stores and Specialty Retail

- Convenience Stores and Gas Stations

- E-commerce and Omnichannel Retail

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Retail Biometric Market

The value chain for the Retail Biometric Market begins with upstream activities dominated by component manufacturers, who develop and produce the specialized hardware, including sophisticated image sensors, biometric chips, and specialized capture devices. These suppliers are critical as the accuracy and performance of the entire system depend directly on the quality and miniaturization capabilities of the sensor technology. This upstream segment is characterized by high R&D intensity, focusing on improving liveness detection and optimizing components for low-cost, high-volume production necessary for mass retail deployment. Key players in this stage often hold proprietary patents regarding imaging algorithms and data compression techniques.

Moving downstream, the value chain involves two major steps: the biometric solution providers (software and system integrators) and the retailers themselves. Solution providers develop the core algorithms, identity management software, and security platforms, specializing in integrating various biometric modalities with existing retail infrastructure (e.g., POS terminals, security cameras, HR systems). These integrators often provide highly customized solutions tailored to specific retail formats, addressing unique challenges such as high employee turnover or rapid transaction speeds. Their role is pivotal in ensuring seamless installation, ongoing maintenance, and adherence to regional data protection mandates.

Distribution channels in the market are mixed, relying heavily on indirect channels such as specialized IT VARs (Value-Added Resellers) and security system distributors who possess expertise in retail deployment logistics and regulatory compliance. Direct sales are usually reserved for large, multinational retail chains requiring bespoke enterprise-level integrations and long-term service contracts directly from the primary technology vendor. The final stage involves the end-user adoption by various retail types, where successful deployment hinges on training staff, consumer acceptance, and the seamless functioning of the technology to drive operational efficiencies and security improvements, demonstrating a rapid return on investment through reduced shrink and enhanced throughput.

Retail Biometric Market Potential Customers

The primary potential customers and end-users of retail biometric solutions are diverse retail entities seeking to mitigate security risks, optimize labor costs, and modernize customer interaction. This includes large multinational grocery and hypermarket chains that require robust systems for inventory control, preventing employee theft at the back office, and streamlining the checkout process using contactless payment options. These high-volume retailers prioritize solutions that can handle massive data throughput while maintaining high levels of accuracy and speed, making them the largest consumer segment for advanced facial and fingerprint recognition systems.

Specialty retail stores, particularly those dealing in high-value goods (e.g., jewelry, electronics), represent another critical customer segment focusing intensely on loss prevention and asset protection. For these buyers, biometrics are crucial for limiting access to restricted stock areas and ensuring that only authorized personnel handle sensitive inventory. Furthermore, convenience stores and gas stations, often characterized by low-staff environments and frequent small transactions, adopt biometrics for secure access control during off-hours and to authenticate employees processing cash transactions, thereby addressing high rates of internal and external theft.

A rapidly emerging customer segment includes e-commerce platforms and omnichannel retailers. While physical biometrics are applied in brick-and-mortar locations, these companies are increasingly interested in behavioral biometrics to authenticate users during online checkouts, reduce chargebacks, and combat account takeovers. For omnichannel retailers, biometrics provide a unified identity platform, ensuring a seamless and secure personalized experience whether the customer is browsing online, picking up an order in-store, or utilizing loyalty points, linking physical and digital identity securely and conveniently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NEC Corporation, Thales Group, IDEMIA, HID Global, Fujitsu, Suprema Inc., BIO-key International, Assa Abloy, FingoPay, secunet Security Networks AG, Cognitec Systems, DERMALOG Identification Systems, Crossmatch (HID Global), 3M Cogent, Safran Identity & Security, Precise Biometrics, Gemalto, Aware Inc., FacePhi, Ayonix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retail Biometric Market Key Technology Landscape

The technological landscape of the Retail Biometric Market is characterized by a rapid evolution toward multi-modal and non-contact identification systems, significantly enhancing both security and user convenience. Facial recognition, powered by deep learning neural networks, remains the dominant technology due to its passive nature and ease of integration into existing retail surveillance infrastructure. Modern facial recognition systems incorporate advanced liveness detection algorithms to distinguish between a live person and a photograph or video replay, addressing a crucial security vulnerability and ensuring a higher level of trust in authentication processes, particularly for high-value transactions or access to critical systems.

Another crucial technological development is the implementation of cloud-based biometric platforms and edge computing capabilities. Cloud platforms allow large retail chains to manage and synchronize biometric templates across thousands of global locations efficiently, providing centralized identity management and real-time security updates. Simultaneously, edge computing—processing biometric data locally on the camera or terminal device before transmission—is rapidly gaining traction. This approach minimizes latency, accelerates authentication speed crucial for high-throughput retail environments, and, critically, mitigates privacy concerns by processing data locally, potentially deleting the raw biometric image immediately after template extraction, aligning with stringent data privacy standards.

Furthermore, behavioral biometrics is emerging as a critical complementary technology, often used for continuous authentication in mobile retail applications or employee workstations. By analyzing unique patterns like keyboard dynamics, mouse movements, or interaction speeds, these systems provide a layer of security that operates seamlessly in the background. The trend towards integrating these technologies into a unified, zero-trust security architecture ensures that every identity interaction—from accessing the store server room to completing a payment—is verified continuously, moving beyond the simple one-time authentication model to provide pervasive security coverage throughout the retail ecosystem.

Regional Highlights

The global retail biometric market exhibits distinct growth patterns and adoption drivers across major geographic regions, primarily influenced by local regulatory environments, consumer technology readiness, and prevailing retail infrastructure maturity.

North America maintains its lead in market revenue due to the presence of large retail chains with substantial technology budgets and a high incidence of sophisticated retail crime, driving investment in advanced loss prevention systems. Early adoption of facial recognition for surveillance and the rapid expansion of contactless payment infrastructure, particularly in the US and Canada, support this dominance. The region benefits from technological readiness and a competitive vendor landscape, although compliance with varying state-level privacy laws (like CCPA) presents ongoing challenges for large-scale deployment.

Asia Pacific (APAC) is projected to be the fastest-growing region, characterized by massive government investment in smart retail and smart city initiatives, particularly in China, South Korea, and India. High population density and consumer willingness to adopt new technologies, especially mobile and facial payment systems, facilitate rapid market penetration. The vast, fragmented retail landscape in APAC, ranging from modern malls to traditional markets, creates diverse application requirements, driving innovation in cost-effective and scalable biometric solutions suitable for both large enterprises and micro-retailers.

Europe’s market growth is steady but significantly shaped by the General Data Protection Regulation (GDPR). European retailers prioritize biometric solutions that emphasize data minimization, explicit consent, and robust encryption, leading to a focus on technologies like vein mapping or anonymous biometric recognition that do not store identifiable personal data. Countries such as Germany and the UK show strong adoption in workforce management and secure access control, focusing heavily on internal operational efficiency and regulatory compliance over broad-scale customer-facing personalization.

- North America: Early adoption, driven by large retailers combating shrink; strong focus on facial recognition and secure payment infrastructure; robust technological ecosystem.

- Asia Pacific (APAC): Highest growth potential, fueled by smart city investments and high consumer acceptance of mobile biometric payments (e.g., Alipay, WeChat Pay); rapid expansion in organized retail sector.

- Europe: Growth moderated by strict GDPR compliance requirements; emphasis on employee access control and systems using anonymized biometric templates; high demand for secure, privacy-preserving solutions.

- Latin America (LATAM): Emerging market driven by the need for better security infrastructure against high fraud rates; initial focus on banking biometrics translating into retail security applications.

- Middle East and Africa (MEA): Growth centered on high-end luxury retail and critical infrastructure security; driven by government visions for advanced digital economies; significant investment in surveillance and access control technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retail Biometric Market.- NEC Corporation

- Thales Group

- IDEMIA

- HID Global

- Fujitsu

- Suprema Inc.

- BIO-key International

- Assa Abloy

- FingoPay

- secunet Security Networks AG

- Cognitec Systems

- DERMALOG Identification Systems

- Crossmatch (HID Global)

- 3M Cogent

- Safran Identity & Security

- Precise Biometrics

- Gemalto (Thales Group)

- Aware Inc.

- FacePhi

- Ayonix

Frequently Asked Questions

Analyze common user questions about the Retail Biometric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most adopted biometric technology in the retail sector today?

Facial recognition is the most adopted biometric technology, primarily due to its versatility in loss prevention (surveillance) and its non-contact nature, making it ideal for high-throughput applications like frictionless payments and time & attendance tracking.

How does the Retail Biometric Market address data privacy concerns?

The market addresses privacy through techniques like template hashing, encryption, and edge computing. Template hashing converts biometric data into non-reversible, anonymous codes, and edge computing processes data locally, minimizing the transmission of sensitive personal information over networks, ensuring compliance with regulations like GDPR.

What is 'retail shrink' and how do biometrics reduce it?

Retail shrink refers to inventory loss caused by theft, fraud, or administrative errors. Biometrics reduce shrink by ensuring secure access control to sensitive inventory areas and eliminating 'buddy punching' (time and attendance fraud) among employees, thereby tackling internal theft, which is a major component of overall shrink.

What role does AI play in improving the accuracy of retail biometric systems?

AI, specifically deep learning, significantly improves accuracy by enhancing liveness detection to prevent spoofing and optimizing algorithms to correctly identify individuals despite varying factors such as changes in lighting, angles, or partial facial obstructions (e.g., masks or sunglasses), ensuring reliable performance in dynamic retail environments.

Which application segment shows the highest growth potential in the forecast period?

The Point-of-Sale (POS) and Payment Processing application segment is projected to show the highest growth potential, driven by the strong consumer demand for seamless, frictionless, and secure payment methods, such as 'pay-by-face' or fingerprint-enabled mobile payment platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager