Retailer Turnstile Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443496 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Retailer Turnstile Market Size

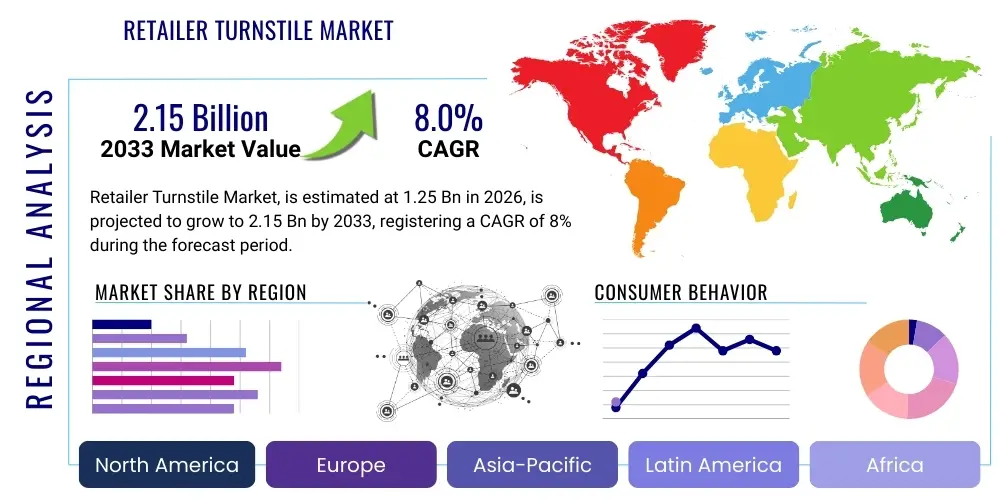

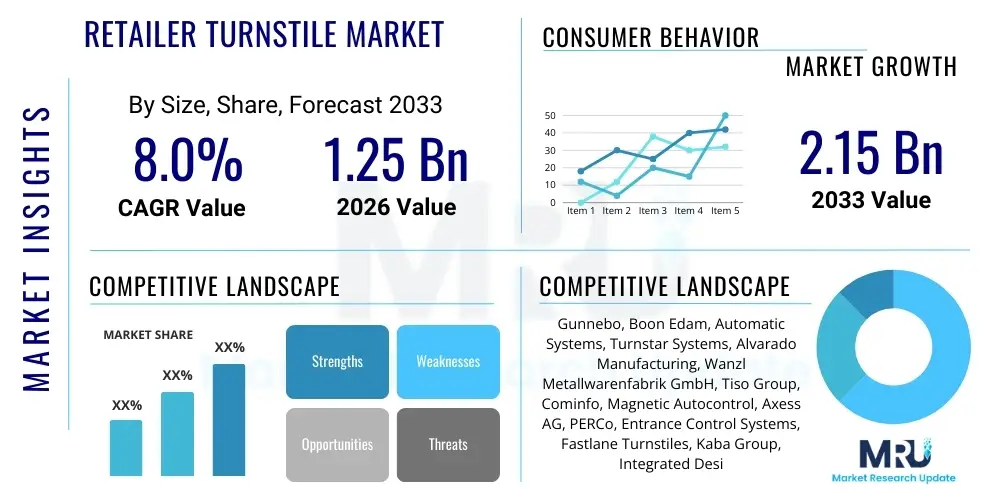

The Retailer Turnstile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.0% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global retail shrinkage rates, which necessitate sophisticated loss prevention mechanisms beyond traditional security guards and surveillance systems. Retailers, particularly those operating large-format stores such as hypermarkets and DIY centers, are increasingly viewing automated access control as a crucial investment to manage customer flow, prevent unauthorized entry into sensitive areas (like stockrooms), and deter opportunistic theft at entry/exit points.

The maturation of smart retail infrastructure plays a significant role in market expansion. Modern retailer turnstiles are no longer purely mechanical barriers; they are integrated components of the store's IoT ecosystem, linking seamlessly with inventory management systems, Point of Sale (POS) data, and facial recognition technologies. This shift transforms turnstiles from simple entry barriers into data collection points and operational efficiency tools. Furthermore, compliance requirements regarding staff-only access and regulatory standards for emergency egress are mandating the adoption of reliable, certified turnstile solutions across diverse retail formats, ensuring both security and safety protocols are met simultaneously.

Retailer Turnstile Market introduction

The Retailer Turnstile Market encompasses the manufacturing, distribution, and implementation of physical barrier systems designed specifically for retail environments to control pedestrian traffic flow, enhance security, and mitigate product loss (shrinkage). These devices range from simple mechanical tripod turnstiles used for counting and directing ingress, to sophisticated speed gates and full-height barriers integrated with biometric or RFID readers for controlled access into secure employee zones. The core objective of these solutions in a retail context is to manage the flow of customers and personnel efficiently, ensuring only authorized movement occurs, particularly at entrances, exits, fitting rooms, and internal inventory storage areas.

Major applications of retailer turnstiles include entrance management in large hypermarkets, directional control in checkout areas to ensure one-way flow, access restriction to employee breakrooms and stock holding facilities, and integration with Electronic Article Surveillance (EAS) systems to prevent item removal. Key benefits derived by retailers include a demonstrable reduction in shoplifting and internal theft, improved queue management during peak hours, accurate pedestrian counting for operational planning, and the creation of a defined, secure perimeter. The primary driving factors for market growth include the increasing complexity of organized retail crime, the global expansion of large-format retail chains requiring standardized security solutions, and the demand for contactless, automated access methods spurred by health safety concerns and digital transformation initiatives.

The product description spans various technological levels, from basic mechanical models requiring manual resetting to fully automatic systems utilizing optical sensors and motorized barriers. Product differentiation is increasingly focused on aesthetics, integration capability (compatibility with existing security software), and throughput speed, as modern retailers prioritize a seamless customer experience while maintaining stringent security standards. This market is highly sensitive to technological innovation, favoring solutions that can provide actionable data on traffic patterns and integrate artificial intelligence for predictive security management.

Retailer Turnstile Market Executive Summary

The Retailer Turnstile Market is poised for substantial growth, driven by fundamental shifts in business operations and security mandates within the global retail sector. Key business trends indicate a strong movement away from traditional mechanical barriers toward technologically advanced, aesthetically pleasing access solutions such as optical turnstiles and speed gates. Retailers are prioritizing solutions that offer high throughput without impeding the customer experience, leading to increased investment in biometric and mobile credential-based access for staff areas. Furthermore, the convergence of physical security and operational data analytics is a major strategic trend, positioning turnstiles as integral data sensors rather than mere physical obstacles, feeding insights into workforce management and peak hour planning systems.

Regionally, Asia Pacific (APAC) represents the fastest-growing market segment due to the rapid expansion of organized retail infrastructure, particularly in developing economies like China and India, where new shopping centers and mega-malls are being constructed at scale. North America and Europe, characterized by high labor costs and sophisticated security demands, demonstrate higher adoption rates of automated and integrated systems, focusing on smart, frictionless access control and adherence to strict fire and safety regulations. Segment trends highlight that the adoption of access control turnstiles is highest in hypermarkets and supermarkets, which face the largest scale of inventory shrinkage, although specialty stores and luxury retail are increasingly adopting high-end, discreet optical barriers to manage exclusive customer flow and protect high-value merchandise.

The market landscape is competitive, featuring established security hardware manufacturers alongside specialized turnstile producers who are innovating rapidly in sensor technology and software integration. Successfully navigating this market requires companies to offer modular systems that can adapt to different store formats and integrate effortlessly with existing retail management platforms. Sustained growth will rely on addressing the dual challenge of reducing high upfront capital expenditure for smaller retailers while delivering scalable, high-security solutions for global retail giants, ultimately maximizing loss prevention return on investment (ROI).

AI Impact Analysis on Retailer Turnstile Market

User queries regarding the impact of Artificial Intelligence (AI) on the Retailer Turnstile Market frequently center on its role in proactive loss prevention, seamless authentication, and predictive maintenance. Users are concerned with how AI can move the turnstile beyond simple physical gating toward an intelligent decision-making tool. Key themes include the integration of AI-powered facial recognition for rapid, secure employee access, the use of computer vision algorithms to detect "tailgating" or unauthorized passage attempts with much higher accuracy than traditional sensors, and the application of machine learning (ML) to analyze traffic patterns and anomalies, optimizing staffing and security resource deployment in real-time. Expectations revolve around creating a truly frictionless retail environment where security is invisible yet highly effective.

The application of AI significantly enhances the intelligence and effectiveness of modern turnstile systems, fundamentally transforming their function from passive barriers to active security decision points. AI algorithms are used to process sensor data (optical, weight, pressure) instantaneously, distinguishing authorized users from potential threats and dramatically minimizing false alarms. This high level of real-time situational awareness ensures compliance with strict security protocols, especially in high-traffic or high-risk retail areas like cash vaults or pharmaceutical counters. Furthermore, AI contributes substantially to operational efficiency by analyzing ingress and egress data to predict peak congestion times, allowing retailers to dynamically adjust the operational mode of the turnstiles (e.g., higher throughput settings) and optimize associated customer service staff deployment.

Beyond security and operational optimization, AI is a powerful tool for predictive maintenance and systems health monitoring within the turnstile market. Machine learning models analyze historical operational data—such as motor stress, cycle counts, and component performance under various environmental conditions—to anticipate potential mechanical failures before they occur. This transition from reactive repairs to predictive maintenance minimizes downtime, which is critical in a retail setting where constant, reliable access control is essential for business continuity and customer satisfaction. The long-term impact of AI integration is expected to raise the standard for security hardware performance and reliability while reducing the total cost of ownership for retailers.

- AI-Powered Tailgating Detection: Utilization of computer vision and ML models for enhanced, hyper-accurate detection of unauthorized simultaneous entries (tailgating) at speed gates and optical turnstiles.

- Biometric Authentication Acceleration: AI speeds up and enhances the reliability of facial and iris recognition integration for staff access, ensuring faster throughput and preventing identity fraud.

- Predictive Operational Maintenance: Machine learning algorithms analyze system performance data (motor wear, sensor drift) to forecast component failures, scheduling preventative servicing and maximizing uptime.

- Traffic Flow Optimization: AI analyzes real-time and historical pedestrian data to dynamically adjust barrier opening/closing speeds and manage directional flow during peak retail hours.

- Anomaly Detection in Customer Behavior: AI monitors flow rates and unexpected patterns at turnstiles to flag suspicious activity related to potential organized retail crime, notifying security staff instantly.

- Integration with Retail Loss Prevention Platforms: AI facilitates seamless data exchange between the turnstile system and central Loss Prevention (LP) software, providing rich context for security incident reporting.

DRO & Impact Forces Of Retailer Turnstile Market

The Retailer Turnstile Market is influenced by a dynamic interplay of factors that both accelerate and restrain its growth, creating specific opportunities shaped by strong impact forces. Drivers primarily include the persistent and rising global threat of retail shrinkage, driven by both external theft and internal fraud, compelling retailers to invest in robust physical deterrents and controlled access systems. Technological advancements, particularly in integrating turnstiles with IoT, mobile credentials, and sophisticated sensing technologies, further accelerate adoption by offering higher security, improved operational data, and a better user experience. Restraints, however, include the substantial initial capital expenditure required for sophisticated, multi-site installations, as well as aesthetic concerns where retailers fear that aggressive security hardware might detract from a welcoming store environment. Additionally, concerns regarding data privacy and the complexity of integrating diverse systems across older retail infrastructure pose implementation challenges.

Opportunities for growth are concentrated within the smart retail sector, where contactless access solutions and automated systems are rapidly gaining traction. There is a significant opportunity in providing modular, scalable turnstile systems tailored specifically for small to medium-sized retailers who have historically relied on less advanced security measures but are now facing increasing loss rates. Furthermore, expanding geographical reach into emerging markets, where rapid commercial real estate development is underway, presents substantial long-term growth prospects. The impact forces are characterized by strong regulatory compliance pressure regarding accessibility standards (ADA compliance) and fire/emergency egress, which necessitates specialized and certified turnstile designs, pushing manufacturers toward high safety standards.

The strongest impact force remains the economic imperative of loss prevention ROI. Retailers view turnstiles not merely as costs but as investments that directly correlate with reduced inventory loss and improved operational control. This drives the market toward high-specification products offering demonstrable security improvements and integration capabilities. Conversely, market adoption is constrained by the need for customized solutions that fit highly varied architectural and brand requirements, demanding flexibility and bespoke engineering from turnstile manufacturers, which can increase production costs and complexity.

Segmentation Analysis

The Retailer Turnstile Market is segmented comprehensively based on the type of product deployed, the underlying technology used for authentication and control, and the specific application or end-user category within the retail industry. Analyzing these segments provides strategic insights into which solutions are gaining traction and where investment is being channeled. Segmentation by type differentiates between mechanical barriers, which are cost-effective but lower on security features, and advanced optical turnstiles or speed gates, which prioritize high throughput, aesthetics, and sophisticated sensor technology for enhanced security. Geographic segmentation highlights the disparity in adoption rates and preferred technology between mature markets (e.g., North America, Western Europe) favoring integrated, high-security systems, and rapidly developing markets (e.g., APAC, MEA) focusing on basic, robust solutions for mass deployment.

- By Product Type:

- Tripod Turnstiles (Half-Height)

- Full-Height Turnstiles (Maximum security, primarily for external inventory access or warehouse boundaries)

- Optical Turnstiles (Sensor-based, barrier-free access control for aesthetic retail entrances)

- Speed Gates (Motorized barriers, high throughput for employee entry/exit)

- Barrier Gates (Used often in checkout or cart retrieval areas)

- By Technology:

- Mechanical/Manual Turnstiles

- Semi-Automatic Turnstiles

- Fully Automatic Turnstiles (Motorized operation)

- Biometric Integrated Turnstiles (Fingerprint, Facial Recognition)

- RFID/NFC/Mobile Credential Integrated Turnstiles

- By Application/End-User:

- Hypermarkets and Supermarkets (Highest volume adoption)

- Convenience and Small Grocery Stores

- Department Stores and Specialty Retail

- DIY and Home Improvement Stores

- Luxury and High-End Boutiques

- Retail Warehouses and Distribution Centers (Staff Access)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Retailer Turnstile Market

The value chain of the Retailer Turnstile Market begins with upstream suppliers providing critical raw materials and specialized components. Upstream analysis focuses on vendors of stainless steel, specialized alloys, and polycarbonate materials used for the physical barrier structure, alongside sophisticated electronics suppliers providing motors, optical sensors (IR and laser), microprocessors, and biometric readers. Key upstream activities involve precision engineering and rigorous quality control to ensure mechanical durability and electronic reliability, as turnstiles operate in demanding, high-cycle environments. Strategic relationships with key component manufacturers, especially for IoT communication modules and authentication hardware, are crucial for maintaining a technological edge and managing supply chain resilience.

Midstream activities involve the design, manufacturing, and assembly of the final turnstile units, often requiring specialized fabrication processes and system integration expertise to merge mechanical barriers with electronic control units. Manufacturers typically manage strict quality assurance processes and conduct extensive testing for throughput efficiency, reliability, and compliance with safety standards (e.g., emergency break-away mechanisms). Downstream analysis focuses on the distribution channels and end-user implementation. Products are distributed both directly to large retail chains, often involving custom project management and bulk installation agreements, and indirectly through security system integrators, value-added resellers (VARs), and specialized physical security distributors. These integrators handle site assessment, installation, software configuration, and post-sales maintenance, playing a vital role in ensuring seamless integration with the retailer's existing security and IT infrastructure.

Direct sales channels are preferred by major global retailers seeking centralized procurement and customized solutions across hundreds of locations, allowing manufacturers to maintain direct control over pricing and service delivery. Indirect channels are crucial for reaching smaller regional retailers and providing specialized installation services, leveraging the local expertise of VARs. The effectiveness of the downstream channel is measured by the quality of installation and maintenance support, as turnstile downtime can severely impact retail operations and security. Post-installation service contracts and software updates, often provided by the distribution channel, represent a crucial revenue stream and relationship builder within the value chain.

Retailer Turnstile Market Potential Customers

Potential customers for the Retailer Turnstile Market primarily include institutions characterized by high pedestrian traffic volume, a critical need for loss prevention, and complex operational requirements related to staff and customer flow management. The predominant buyers are large, multinational retail conglomerates operating hypermarkets and supermarkets, such as Walmart, Carrefour, and Tesco, which require standardized security systems across their vast store portfolios to combat substantial inventory shrinkage and manage thousands of daily visitors. These organizations prioritize fully automatic speed gates and high-security full-height turnstiles for warehouse access due to their superior deterrence and integration capabilities with central security management systems.

Beyond mass-market retail, potential customers include specialty retail chains, particularly electronics stores, jewelry outlets, and apparel retailers, which utilize optical turnstiles or discreet half-height barriers to subtly guide traffic flow, control access to fitting rooms, and manage exclusive entrances for loyalty program members. These end-users value aesthetics and seamless integration into the store design, often preferring systems that offer sophisticated, silent operation. Furthermore, retail park developers and shopping mall operators constitute another significant customer base, purchasing turnstiles for managing access to shared facilities, staff-only tunnels, and specialized public entrances or exits requiring control and counting functionality.

A growing segment of potential customers includes quick-service restaurants (QSRs) and convenience store chains that are increasingly adopting compact, robust turnstiles to secure employee-only areas, control late-night access, and prevent unauthorized entry into food preparation zones. The evolving retail landscape, characterized by hybrid online-offline models, also drives demand from retail distribution centers and fulfillment warehouses, where strict access control using biometric turnstiles is essential to monitor thousands of employees, contract workers, and delivery personnel, safeguarding high-value inventory against internal theft.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | CAGR 8.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gunnebo, Boon Edam, Automatic Systems, Turnstar Systems, Alvarado Manufacturing, Wanzl Metallwarenfabrik GmbH, Tiso Group, Cominfo, Magnetic Autocontrol, Axess AG, PERCo, Entrance Control Systems, Fastlane Turnstiles, Kaba Group, Integrated Design, Centurion Systems, Orion Entrance Control, Inc., RotaTech, Shenzhen Hesiyun Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retailer Turnstile Market Key Technology Landscape

The technological evolution within the Retailer Turnstile Market is moving rapidly towards sophisticated, integrated, and frictionless access solutions, capitalizing heavily on the Internet of Things (IoT) and advanced sensor technologies. The foundation of this landscape includes high-precision optical sensor arrays, often employing multiple infrared beams, which are crucial for accurate pedestrian detection and prevention of tailgating in modern speed gates. This technology ensures high throughput while maintaining stringent security levels. Furthermore, the motors and control mechanisms have become highly specialized, allowing for rapid barrier movement, smooth operation, and immediate reversal or "break-away" functionality required for emergency egress according to international safety standards (e.g., European norms).

A major focus is the integration of diverse authentication technologies directly into the turnstile head unit. Biometric systems, particularly facial recognition and fingerprint scanners, are increasingly deployed in staff-only entrances, offering high security and eliminating the costs associated with traditional key cards or badges. Simultaneously, the proliferation of Mobile Credential Technology (NFC and BLE) allows employees and registered customers to use their smartphones for hands-free access, enhancing convenience and speeding up entry processes. These authentication technologies are intrinsically linked to secure backend software platforms that manage access privileges in real-time and provide audit trails for security monitoring and compliance reporting.

The strategic deployment of IoT connectivity transforms the turnstile into a smart device within the retail network. Turnstiles now communicate operational status, cycle counts, and security alerts wirelessly to central security management systems and cloud-based analytical platforms. This capability enables remote diagnostics, proactive fault reporting, and the collection of valuable pedestrian traffic data, which can be analyzed using AI/ML tools to optimize store operations. This shift towards a connected ecosystem ensures that turnstiles are future-proof, capable of adapting to evolving security threats and integrating with future smart retail technologies such as robotic surveillance or advanced inventory management systems.

Regional Highlights

The global Retailer Turnstile Market exhibits varied growth patterns and technological preferences across key geographical regions, reflecting differences in regulatory environments, technological maturity, and the pace of organized retail expansion.

- North America (NA): Characterized by high labor costs and sophisticated security demands, North America is a mature market focusing heavily on optical turnstiles and speed gates for employee access and managing controlled retail environments. The region leads in adopting advanced authentication technologies, including biometric and mobile-credential-based systems, primarily driven by large multinational retail chains (e.g., grocery, DIY, department stores) seeking seamless integration with workforce management and LP platforms. Compliance with ADA (Americans with Disabilities Act) standards drives innovation in accessible and wide-lane turnstile designs.

- Europe: This region demonstrates steady growth, highly influenced by stringent safety and security regulations, particularly the emphasis on emergency egress compliance (EN standards). Western Europe shows high adoption rates for aesthetically pleasing, subtle access control solutions, often integrated into high-end retail architecture. Eastern and Central Europe are experiencing rapid modernization of retail infrastructure, fueling demand for both robust full-height barriers for external security and modern, half-height solutions for customer flow management.

- Asia Pacific (APAC): APAC is the fastest-growing market, driven by the massive expansion of organized retail, large-scale commercial real estate development, and rising disposable incomes leading to increased consumer traffic. Countries like China, India, and Southeast Asian nations are deploying turnstiles aggressively in new hypermarkets, mass transit retail hubs, and large shopping centers. While mechanical and semi-automatic tripod turnstiles maintain high market penetration due to cost-effectiveness, the premium segment is rapidly embracing biometric technology, particularly for staff access in tech-forward retail distribution centers.

- Latin America (LATAM): Growth is primarily fueled by security concerns and the need to mitigate high rates of external and internal theft (shrinkage). The market favors durable, reliable solutions, including full-height turnstiles for strong physical deterrence, particularly in areas susceptible to security breaches. Cost sensitivity remains a factor, balancing the need for security with budget constraints, leading to a focus on reliable semi-automatic solutions and proven mechanical barriers.

- Middle East and Africa (MEA): Marked by substantial investment in luxury retail and ambitious commercial infrastructure projects (e.g., Dubai, Riyadh), the MEA market shows significant demand for high-end, customized turnstile solutions, often incorporating premium materials and advanced security features suitable for high-profile retail environments and large integrated retail complexes. African nations are seeing gradual adoption, particularly in South Africa, driven by the expansion of formal grocery chains and banking retail outlets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retailer Turnstile Market.- Gunnebo AB

- Boon Edam International B.V.

- Automatic Systems S.A.

- Wanzl Metallwarenfabrik GmbH

- Alvarado Manufacturing Co.

- PERCo Group

- Cominfo a.s.

- Magnetic Autocontrol GmbH (FAAC Group)

- Tiso Group

- Turnstar Systems (Pty) Ltd

- Entrance Control Systems Inc. (ECS)

- Fastlane Turnstiles (Integrated Design Limited)

- Axess AG

- Kaba Group (dormakaba)

- Centurion Systems (Pty) Ltd

- Orion Entrance Control, Inc.

- Rotaturn Security Products

- Shenzhen Hesiyun Technology Co., Ltd.

- JCM Global

- Gotschlich GmbH

Frequently Asked Questions

Analyze common user questions about the Retailer Turnstile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of turnstiles in retail loss prevention strategies?

The primary function is physical access control and deterrence. Turnstiles create a defined boundary, ensuring that all pedestrians—both customers and staff—enter and exit through designated, monitored points, significantly mitigating opportunistic shoplifting and unauthorized access to inventory-sensitive areas. They are essential tools for traffic management and counting.

How do optical turnstiles differ from traditional tripod turnstiles in a retail setting?

Optical turnstiles utilize infrared sensors to detect movement without physical barriers, prioritizing high throughput, aesthetics, and a frictionless experience, often used in front-of-house areas. Tripod turnstiles, conversely, use mechanical arms that physically pivot, offering a more explicit barrier and stronger deterrence, commonly used for staff entrances or trolley control areas.

Is the integration of biometric technology becoming standard for retailer turnstiles?

Biometric integration, particularly facial recognition and fingerprint scanning, is rapidly becoming the standard for securing internal, staff-only areas (stockrooms, server rooms) in large retail chains. This is driven by the need for enhanced internal security, rapid identity verification, and eliminating the administrative hassle of managing access cards or keys.

What is the typical Return on Investment (ROI) period for a modern retailer turnstile system?

The ROI period varies significantly based on the retailer's pre-installation shrinkage rate and the solution’s complexity. However, retailers often report positive ROI within 18 to 36 months, primarily achieved through substantial reductions in inventory loss (shrinkage) and improved operational efficiency in managing employee time and attendance.

How do retailer turnstiles comply with international safety regulations like emergency egress?

Modern retailer turnstiles are engineered with mandatory emergency features, such as 'break-away' or 'drop-arm' mechanisms that automatically retract or collapse upon receiving a signal from the fire alarm system or a manual emergency button. This ensures rapid, unobstructed evacuation of the premises, complying with strict international fire and life safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager