Rhenium and Molybdenum Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442622 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Rhenium and Molybdenum Market Size

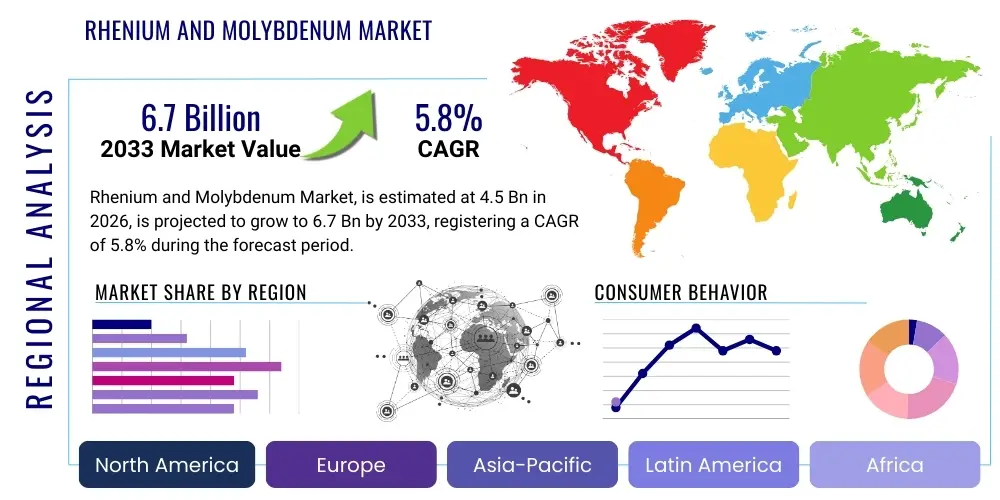

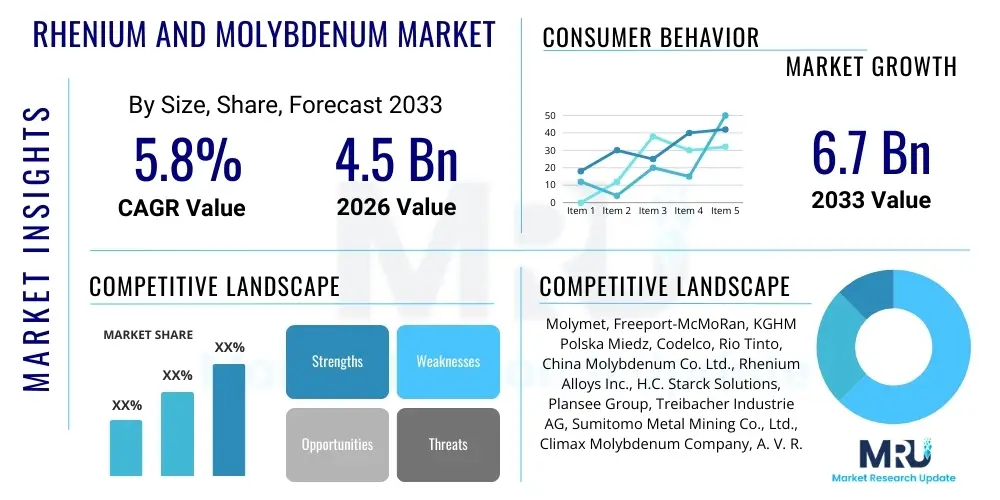

The Rhenium and Molybdenum Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This steady growth trajectory is primarily fueled by increasing demand for high-performance alloys in the aerospace and defense sectors, coupled with the critical role Molybdenum plays in steel production, chemical catalysis, and energy applications, particularly in burgeoning economies across Asia Pacific.

Market valuation reflects the indispensable nature of these refractory metals in extreme environments, necessitating consistent supply chain security and technological innovation in extraction and processing. Rhenium, known for its ultra-high melting point and resistance to creep, remains critical for jet engine turbine blades, while Molybdenum's versatility spans from construction materials to medical imaging equipment. The market size calculation incorporates revenues derived from various forms, including pure metal, alloys, powders, and chemical compounds (e.g., Molybdenum trioxide and Rhenium heptoxide).

Furthermore, volatility in commodity prices and geopolitical shifts significantly influence the market valuation, creating opportunities for strategic stockpiling and long-term procurement contracts. Investment in primary production sites, particularly those focused on copper porphyry deposits which often yield Rhenium as a byproduct, and dedicated Molybdenum mines, are foundational to maintaining market stability and achieving the projected growth figures. The emphasis on clean energy technologies, such as concentrated solar power and advanced nuclear reactors, further embeds these metals into high-value industrial ecosystems, ensuring sustained market expansion throughout the forecast period.

Rhenium and Molybdenum Market Introduction

The Rhenium and Molybdenum Market encompasses the production, processing, distribution, and application of two distinct, yet often co-produced, refractory metals critical to high-technology industries. Rhenium (Re) is one of the densest and highest-melting-point elements, primarily utilized in high-temperature superalloys for aerospace turbine engines and as a platinum-rhenium catalyst in petroleum reforming. Molybdenum (Mo) is a versatile transition metal prized for its strength, corrosion resistance, and high melting point, making it essential for steel alloying, chemical processing, and electronic applications. The interplay between these metals in terms of shared extraction processes (primarily as byproducts of copper mining) and complementary industrial applications defines the structure of this specialized market.

Major applications driving market demand include the fabrication of aircraft engine components, missile parts, liquid rocket nozzles (Rhenium), and the manufacture of stainless steel, tool steels, and chemical catalysts (Molybdenum). The primary benefits derived from these materials include enhanced operational efficiency, superior thermal stability, and prolonged service life under extreme mechanical and thermal stress, factors critical for safety and performance in the defense and energy sectors. The market is propelled by persistent advancements in gas turbine technology, which continuously push the boundaries of operating temperatures, necessitating higher concentrations of Rhenium-based superalloys, and the global industrial expansion that demands high-strength, durable steel alloys where Molybdenum acts as a crucial hardening agent.

Driving factors sustaining market momentum include accelerating military modernization programs globally, particularly in North America and Asia, which mandates continuous investment in advanced jet propulsion systems. Furthermore, the push towards stringent environmental regulations boosts the demand for Molybdenum-based desulfurization catalysts in the oil and gas industry. Conversely, the market faces constraints related to supply concentration, as Rhenium production is largely reliant on a few copper mines, and the high purification costs associated with both metals. Opportunities lie in expanding recycling infrastructure for high-value scrap materials and developing alternative extraction technologies that decouple production from copper price fluctuations, ensuring a resilient supply chain for critical technology developers worldwide.

Rhenium and Molybdenum Market Executive Summary

The Rhenium and Molybdenum market demonstrates robust growth potential, driven by non-discretionary defense spending and increasing industrialization across emerging economies. Business trends indicate a strategic focus on vertical integration among key producers, aiming to control the supply chain from initial extraction through to specialized alloy fabrication, thereby mitigating price volatility and ensuring material quality for highly sensitive end-use applications like aviation and petrochemical refining. Technological investments are centering on enhancing metal recovery rates from complex ores and improving recycling efficiency for Rhenium-containing superalloys, which represents a critical element of future sustainable supply. Global geopolitical tensions continue to influence inventory management, prompting significant consumer nations to secure long-term contracts and diversify sourcing options to safeguard against supply disruptions.

Regional trends highlight the dominance of North America and Europe due to the established presence of major aerospace and defense manufacturers who are the largest consumers of Rhenium superalloys. However, the Asia Pacific region is emerging as the fastest-growing market segment for Molybdenum, fueled by exponential growth in infrastructure development, automotive manufacturing, and chemical processing in countries like China, India, and South Korea, which require vast quantities of high-strength steel and catalysts. Latin America and the Middle East and Africa contribute significantly to the supply side, particularly Chile, Peru, and parts of the former Soviet Union, which house major copper-Molybdenum deposits, making global resource management a pivotal factor in regional market dynamics.

Segmentation trends reveal that superalloys dominate the Rhenium application segment, while the steel and alloys category holds the largest share in the Molybdenum segment, reflecting the differing primary end-user profiles. The powder metallurgy segment is experiencing rapid expansion, driven by additive manufacturing (3D printing) processes that require highly refined metal powders for intricate and lightweight components. In terms of end-users, aerospace remains the most critical high-value sector for Rhenium, whereas the oil & gas and chemical industries are substantial, steady consumers of Molybdenum, particularly in catalyst form. Future market direction hinges on the successful introduction of new high-temperature materials and advancements in refining techniques to meet increasingly demanding specifications.

AI Impact Analysis on Rhenium and Molybdenum Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Rhenium and Molybdenum market reveals a primary focus on supply chain optimization, predictive maintenance in mining operations, and material science innovation. Users frequently inquire about how AI can predict commodity price fluctuations, improve ore sorting efficiency to maximize yields of rare byproducts like Rhenium, and accelerate the discovery of novel Molybdenum alloys with enhanced properties. Key themes center around operational efficiency gains, reducing environmental footprint through optimized processes, and leveraging machine learning to analyze large datasets from catalytic processes to improve reaction kinetics and material longevity. Concerns often involve the initial investment required for sophisticated AI deployment and the specialized talent needed to manage these advanced systems in traditional mining and metallurgical settings.

The implementation of AI is poised to revolutionize the highly capital-intensive and geographically dispersed nature of Rhenium and Molybdenum extraction and processing. Predictive analytics, utilizing sensor data from heavy machinery and flotation circuits, allows operators to anticipate equipment failures, minimize unplanned downtime, and optimize energy consumption—all critical factors in reducing the high operating costs associated with refractory metal production. Furthermore, machine learning algorithms are being employed to analyze geological survey data and identify new, economically viable deposits, significantly improving exploration success rates, which is crucial for securing long-term supply, especially for byproduct Rhenium. AI-driven optimization also extends into the end-user application sphere, where simulations can predict the performance and lifespan of Rhenium superalloys under varying flight conditions, leading to faster design iterations and safer product deployment.

In the realm of material science, generative AI models are accelerating the discovery and development of next-generation Molybdenum-based catalysts and alloys. These algorithms can screen millions of potential material compositions virtually, identifying promising candidates that meet specific industrial criteria, such as superior hydrogen production efficiency or extreme corrosion resistance, much faster than traditional laboratory experimentation. This capability not only saves time and resources but also expands the addressable market for these metals by enabling entirely new application pathways. Consequently, AI acts as a multiplier effect, enhancing both the supply side's efficiency and the demand side's innovation, fundamentally altering the competitive landscape by rewarding companies that successfully integrate these sophisticated analytical tools into their core operations.

- AI-driven optimization of flotation processes enhances Rhenium and Molybdenum recovery rates from complex sulfide ores.

- Predictive maintenance analytics reduce operational downtime in mining and refining facilities, improving throughput reliability.

- Machine learning algorithms forecast commodity price volatility, aiding strategic procurement and inventory management decisions.

- Generative AI accelerates the development of novel Rhenium superalloys and Molybdenum catalysts for high-performance applications.

- Automation powered by AI improves safety compliance and operational consistency in hazardous metallurgical environments.

DRO & Impact Forces Of Rhenium and Molybdenum Market

The Rhenium and Molybdenum market is shaped by a complex interplay of internal and external forces, categorized by Drivers, Restraints, and Opportunities (DRO), which collectively constitute the overall Impact Forces. A primary driver is the non-substitutability of Rhenium in single-crystal high-pressure turbine blades for advanced jet engines, dictating its necessity for aerospace OEMs. This is coupled with the pervasive demand for Molybdenum in construction and energy infrastructure, particularly in high-quality steel alloys required for pipelines and seismic-resistant structures. These demand pillars ensure consistent underlying market activity, regardless of short-term economic fluctuations. The impact forces are also significantly influenced by global energy policy, as Molybdenum is integral to catalysts used in petroleum desulfurization, and Rhenium is key to processes refining cleaner fuels, tying market success directly to regulatory trends favoring environmental remediation.

Conversely, significant restraints hinder accelerated growth. The most pronounced is the highly concentrated and inelastic supply chain for Rhenium, which is primarily sourced as a minor byproduct of copper mining, making its availability sensitive to copper market dynamics rather than its own demand. Price volatility is a major impact force, creating procurement challenges and necessitating substantial hedging strategies for end-users. Regulatory hurdles surrounding the transportation and storage of certain chemical forms of these metals also add complexity. Furthermore, the development of potential substitute materials, particularly ceramic matrix composites (CMCs) in the aerospace sector, poses a long-term restraint, although these substitutes currently lack the proven performance longevity of Rhenium superalloys in extreme stress environments, particularly for rotating parts.

Opportunities for market expansion revolve around enhancing material circularity and diversification. Increased investment in high-efficiency recycling technologies for spent superalloys presents a significant opportunity to stabilize Rhenium supply and reduce reliance on primary extraction. Simultaneously, the expanding clean energy sector provides new avenues for Molybdenum utilization in electric vehicle components, solar photovoltaic systems, and solid oxide fuel cells. Strategic joint ventures between producers and specialty alloy manufacturers, aimed at securing dedicated supply streams and developing proprietary, high-performance alloys, are key strategic opportunities currently defining market maneuvering and leveraging latent demand in emerging defense and specialized industrial applications.

- Drivers: Accelerated aerospace and defense spending; Essentiality of Molybdenum in high-strength steel for infrastructure; Increasing demand for high-performance catalysts in refining.

- Restraints: High dependency of Rhenium supply on copper mining operations; Significant price volatility and supply chain concentration risk; High energy intensity and environmental costs associated with extraction and refining.

- Opportunity: Growth in recycling technologies for Rhenium superalloys; Expansion into new applications within the clean energy and additive manufacturing sectors; Exploration of untapped secondary Molybdenum deposits.

- Impact forces: Geopolitical stability affecting primary mining regions; Technological breakthroughs in material substitution (e.g., CMCs); Regulatory mandates on emissions driving catalyst demand.

Segmentation Analysis

The Rhenium and Molybdenum market is meticulously segmented based on product type, application, and end-user industry to provide a granular view of demand dynamics and market penetration across various sectors. This segmentation highlights the distinct commercial pathways for the two metals, reflecting their inherent differences in physical properties and functional roles. Molybdenum, characterized by high volume and diverse applications, is primarily segmented by its forms such as Molybdenum Trioxide, Ferromolybdenum, and Molybdenum Metal, catering predominantly to steel and chemical industries. In contrast, Rhenium segmentation focuses heavily on highly refined forms like pure metal powder and specialized compounds, critical almost exclusively for aerospace and petroleum catalysis, reflecting its low-volume, high-value status.

Detailed analysis of the product type segmentation reveals that Molybdenum Oxide and Ferromolybdenum account for the bulk of the market share for Molybdenum due to their direct use in steelmaking and alloy production. For Rhenium, superalloys remain the dominant application segment, driving the demand for high-purity Rhenium metal. End-user segmentation further clarifies demand patterns: the Construction and Automotive sectors are the largest volume consumers of Molybdenum due to steel requirements, while the Aerospace and Defense sector dictates pricing and innovation for the Rhenium market. Understanding these intricate segments is crucial for stakeholders to tailor production strategies and allocate resources effectively, ensuring alignment with high-growth end-user requirements.

Geographically, market segmentation reflects consumption intensity versus production source. While production is concentrated in specific regions (e.g., Chile, China, U.S.), consumption is widespread, driven by industrialized nations. The continuous technological evolution in material processing, including advanced powder metallurgy techniques for 3D printing of refractory components, introduces new sub-segments related to specific powder grades. Furthermore, the catalysis segment is becoming increasingly complex, segmented by specific catalytic processes such as hydrodesulfurization (HDS) and selective catalytic reduction (SCR), which utilize different grades of Molybdenum and Rhenium compounds, thereby diversifying the market structure away from traditional bulk commodity trading towards specialized chemical supply chains.

- By Product Type (Molybdenum): Ferromolybdenum, Molybdenum Trioxide, Molybdenum Metal, Molybdenum Chemicals (Lubricants, Pigments).

- By Product Type (Rhenium): Rhenium Powder, Rhenium Metal, Rhenium Superalloys, Rhenium Chemicals (Heptoxide, Perrenate).

- By Application (Molybdenum): Metallurgy (Steel & Alloys), Catalysts, Electronics and Lighting, Lubricants, High-Temperature Furnace Parts.

- By Application (Rhenium): Superalloys (Jet Engines), Petroleum Catalysts (Platforming), Filaments and Electrical Contacts, Targets for X-ray Tubes.

- By End-User Industry: Aerospace & Defense, Oil & Gas, Chemical & Petrochemical, Construction, Automotive, Energy & Power.

Value Chain Analysis For Rhenium and Molybdenum Market

The value chain for Rhenium and Molybdenum is inherently complex, starting from upstream mining operations and extending through highly specialized metallurgical processing to various downstream industrial applications. Upstream analysis focuses on the extraction phase, where Molybdenum is primarily sourced from dedicated mines (Molybdenite) or co-produced with copper. Rhenium, conversely, is almost exclusively recovered as a minor byproduct during the roasting of Molybdenum concentrates derived from copper porphyry deposits. This inherent link makes the Rhenium supply chain highly sensitive to copper market dynamics. Key upstream activities involve geophysical exploration, ore crushing, flotation, and initial concentration, requiring significant capital investment and geological expertise to maximize recovery efficiency of both primary and byproduct metals.

The midstream segment involves sophisticated refining and material preparation. For Molybdenum, this includes converting concentrates into Molybdenum trioxide (MoS3), which is then processed into ferromolybdenum for steel alloying or purified into various chemical forms. For Rhenium, concentrates undergo complex hydrometallurgical or pyrometallurgical steps to produce ammonium perrhenate (APR), the key intermediate, which is then reduced to high-purity Rhenium powder or metal. This refining stage is critical as the quality and purity requirements for aerospace-grade Rhenium superalloys are extremely stringent. The distribution channel in the midstream is handled by a limited number of specialized global trading houses and direct sales arms of major integrated producers, facilitating the global transfer of concentrates and refined products.

Downstream analysis covers the transformation of refined metals into final products and their distribution to end-users. Direct distribution channels are prevalent for high-value Rhenium components, where specialty alloy producers sell turbine blades or catalysts directly to aerospace OEMs (e.g., GE, Rolls-Royce) or petrochemical companies. Indirect distribution channels dominate the high-volume Molybdenum market, involving specialized steel mills, foundries, and chemical manufacturers who utilize ferromolybdenum or Molybdenum chemicals, often purchased through distributors or metal exchanges. The value addition at this stage is massive, as the basic metal is transformed into high-performance components or catalytic systems, representing the final link before the material enters its operational service life in critical infrastructure.

Rhenium and Molybdenum Market Potential Customers

Potential customers for Rhenium and Molybdenum span across highly technical and large-scale industrial sectors, driven by the unique properties these metals offer in demanding operational environments. The primary end-users, particularly for Rhenium, are Original Equipment Manufacturers (OEMs) within the global Aerospace and Defense industries, specifically those manufacturing high-performance turbine engines for commercial and military aircraft, where Rhenium superalloys are non-negotiable for achieving peak thermal efficiency and thrust-to-weight ratios. Additionally, major petrochemical refining companies constitute a significant customer base for both metals, utilizing platinum-rhenium catalysts for high-yield naphtha reforming and Molybdenum disulfide and trioxide as crucial components in hydrodesulfurization (HDS) processes to meet cleaner fuel standards. These customers prioritize long-term supply contracts, material certification, and consistent purity levels.

The bulk demand, driven largely by Molybdenum, originates from the global metallurgical sector, including integrated steel producers and specialized alloy manufacturers. These customers purchase large volumes of ferromolybdenum for the production of stainless steel, tool steels, and high-strength low-alloy (HSLA) steels essential for construction, automotive manufacturing (especially in electric vehicle chassis components), and oil and gas pipeline infrastructure. Furthermore, the electronics and semiconductor industry represents a growing, high-tech customer segment, utilizing Molybdenum for sputter targets in flat-panel displays and thin-film transistors, valued for its thermal stability and electrical conductivity. These customers typically require materials in ultra-high purity powder or sheet form, reflecting the shift towards sophisticated manufacturing techniques.

A crucial emerging customer segment includes companies involved in additive manufacturing (3D printing) and next-generation energy technologies. Additive manufacturing firms utilize specialized, spherical Rhenium and Molybdenum powders for producing intricate components for medical devices and aerospace prototypes, valuing the material’s ability to handle complex geometries. In the energy sector, developers of Concentrated Solar Power (CSP) systems, high-temperature furnace manufacturers, and research institutions focused on nuclear fusion reactors are increasingly incorporating Molybdenum and its alloys for their superior performance under intense heat and radiation, signaling a sustained, long-term growth trajectory in specialized institutional demand and securing a future customer pipeline in advanced technological development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Molymet, Freeport-McMoRan, KGHM Polska Miedz, Codelco, Rio Tinto, China Molybdenum Co. Ltd., Rhenium Alloys Inc., H.C. Starck Solutions, Plansee Group, Treibacher Industrie AG, Sumitomo Metal Mining Co., Ltd., Climax Molybdenum Company, A. V. R. Advanced Vacuum Refractory GmbH, Umicore, American Elements, JX Nippon Mining & Metals Corporation, Molycorp Inc., Global Tungsten & Powders (GTP), Fubao Technology, Sanar Metal Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rhenium and Molybdenum Market Key Technology Landscape

The Rhenium and Molybdenum market's technological landscape is defined by continuous innovation in primary processing, material synthesis, and high-performance application engineering. A critical area of development is the enhanced recovery technology in primary production. Due to Rhenium being a byproduct, advancements in hydrometallurgy and solvent extraction techniques are essential to improve recovery yields from low-grade Molybdenum concentrates and minimize environmental waste. Modern refining processes utilize advanced ion-exchange resins and selective precipitation methods to achieve the ultra-high purity levels (99.999%) required for catalysts and aerospace components. For Molybdenum, technological focus includes optimizing the roasting process to produce Molybdenum trioxide efficiently and developing cleaner methods for producing ferromolybdenum with reduced carbon footprints, addressing sustainability concerns inherent in heavy metallurgy.

In material preparation, the adoption of advanced powder metallurgy is a game-changer, particularly for Rhenium. Specialized atomization and classification techniques are used to produce highly spherical, narrow particle size distribution powders suitable for Additive Manufacturing (AM). This technology allows for the creation of intricate, near-net-shape components for jet engines and rocket parts, minimizing the costly machining losses associated with these expensive materials. Furthermore, the synthesis of Molybdenum-based nanocatalysts and complex Molybdenum sulfide lubricants (MoS2) utilizes precision chemical vapor deposition (CVD) and physical vapor deposition (PVD) techniques, driving the market toward miniaturized, highly efficient material systems for electronics and demanding tribological applications.

Finally, end-user manufacturing technologies profoundly influence demand. The casting of single-crystal Rhenium superalloys remains a highly complex and proprietary process involving vacuum induction melting and directional solidification techniques to achieve superior mechanical properties and creep resistance vital for turbine blades operating above 1700°C. For Molybdenum applications, the development of high-speed steel alloying processes and novel protective coatings, often Molybdenum-based, for corrosion resistance in harsh chemical environments is a key technological driver. Ongoing research in developing high-temperature Molybdenum-Tungsten alloys and refractory metal matrix composites (RMMCs) ensures the sustained technological relevance of both Rhenium and Molybdenum in the next generation of high-power industrial and defense systems, setting the stage for future market growth.

Regional Highlights

Regional dynamics play a crucial role in shaping the Rhenium and Molybdenum market, influenced primarily by the geographic concentration of mining activity versus the dispersion of high-tech end-use manufacturing. North America and Europe currently represent the most substantial consumer markets, particularly for high-value Rhenium components, owing to the dominant presence of global aerospace and defense primes such as Boeing, Lockheed Martin, Airbus, and Rolls-Royce. The stringent performance requirements and substantial R&D budgets in these regions fuel continuous demand for Rhenium superalloys and high-purity Molybdenum components used in sophisticated military and commercial aviation programs. Regulatory stability and established recycling infrastructure in North America also contribute to its market maturity and premium pricing structure for these refractory metals, making it a critical hub for innovation and specialized material trading.

The Asia Pacific (APAC) region stands out as the fastest-growing market, predominantly driven by massive consumption of Molybdenum. This expansion is directly linked to the rapid infrastructure development, urbanization, and industrial growth in China, India, and Southeast Asian nations, requiring vast quantities of high-strength steel (ferromolybdenum). China, in particular, is a dual-force, acting as a major global producer of both Molybdenum and, increasingly, a significant consumer across multiple industries, including electronics, automotive, and domestic defense programs. While Rhenium consumption in APAC is currently lower than in the West, the rising indigenous aerospace capabilities in countries like China and India are projected to substantially increase regional Rhenium demand, shifting the balance of global consumption over the forecast period and demanding closer scrutiny from international suppliers seeking growth.

Latin America, specifically Chile and Peru, is strategically vital due to its massive copper porphyry deposits, which serve as the world's leading source of Molybdenum and, consequentially, Rhenium as a byproduct. These regions are market influencers not primarily through consumption, but through their role as essential raw material suppliers, making their political and operational stability paramount to global supply security. The Middle East and Africa (MEA) region, driven by substantial investment in petrochemical refining and power generation infrastructure, maintains steady demand for Molybdenum-based catalysts and corrosion-resistant alloys for oil and gas infrastructure. While not a major production center, the region's energy sector investments ensure consistent high-volume consumption of specialized Molybdenum products, particularly in Saudi Arabia and the UAE, emphasizing the interconnected nature of global commodity and energy markets.

- North America: Dominant consumer of Rhenium, driven by major aerospace and defense OEMs (e.g., U.S. and Canadian defense contracts); Mature market for specialized alloys and high-purity materials.

- Europe: Key consumer market for both Rhenium (Airbus, European defense initiatives) and Molybdenum (steel, chemical catalysts); Strong focus on advanced material research and recycling initiatives.

- Asia Pacific (APAC): Fastest-growing market, primarily for Molybdenum in steel, construction, and electronics (China, India, South Korea); Emerging Rhenium demand driven by developing domestic aerospace capabilities.

- Latin America: Critical source region (Chile, Peru) for both Molybdenum and Rhenium; Market influenced heavily by global copper and commodity prices and trade flows.

- Middle East and Africa (MEA): Consistent consumer of Molybdenum catalysts and alloys for large-scale petrochemical refining and energy infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rhenium and Molybdenum Market.- Molymet

- Freeport-McMoRan

- KGHM Polska Miedz

- Codelco

- Rio Tinto

- China Molybdenum Co. Ltd.

- Rhenium Alloys Inc.

- H.C. Starck Solutions

- Plansee Group

- Treibacher Industrie AG

- Sumitomo Metal Mining Co., Ltd.

- Climax Molybdenum Company

- A. V. R. Advanced Vacuum Refractory GmbH

- Umicore

- American Elements

- JX Nippon Mining & Metals Corporation

- Molycorp Inc.

- Global Tungsten & Powders (GTP)

- Fubao Technology

- Sanar Metal Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rhenium and Molybdenum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for Rhenium in the current market?

The primary driver for Rhenium demand is the global aerospace and defense sector, specifically the need for high-performance, nickel-based superalloys used in single-crystal turbine blades of advanced jet engines, where Rhenium’s unique creep resistance is indispensable for high-temperature operation.

How does the supply chain concentration impact Molybdenum and Rhenium pricing?

Rhenium supply is highly concentrated and reliant on copper mining byproducts, leading to inelastic supply and significant price volatility. Molybdenum pricing, while more stable, is influenced by the production decisions of a few large integrated mining companies and global steel market activity.

What role does Molybdenum play in sustainable energy and clean technology?

Molybdenum is crucial in sustainable energy through its use in advanced catalysts for hydrodesulfurization (creating cleaner fuels), components in thin-film solar photovoltaic cells, and as an alloying agent in high-strength steels required for wind turbine towers and electric vehicle construction.

Which geographical region dominates the consumption of Molybdenum?

The Asia Pacific (APAC) region, led by China, dominates global Molybdenum consumption due to extensive use in high-volume industries like steel production for infrastructure development, construction, and automotive manufacturing.

Is recycling a viable solution to stabilize the Rhenium market supply?

Yes, recycling of end-of-life Rhenium superalloy scrap, particularly from retired jet engine blades, is highly viable and increasingly crucial for stabilizing the Rhenium market supply, offering a necessary supplement to the constrained primary production from copper mining byproducts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager