Rheumatoid Arthritis Diagnosis Tests Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442506 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Rheumatoid Arthritis Diagnosis Tests Market Size

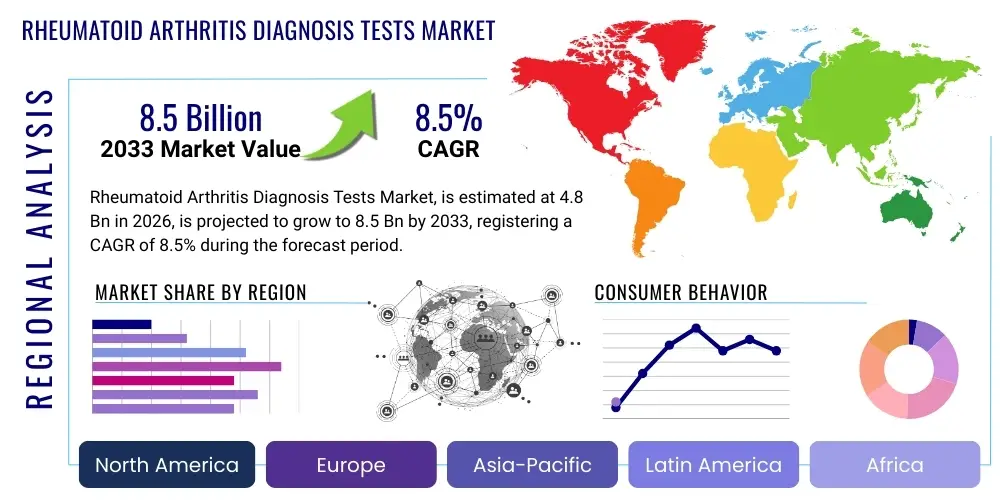

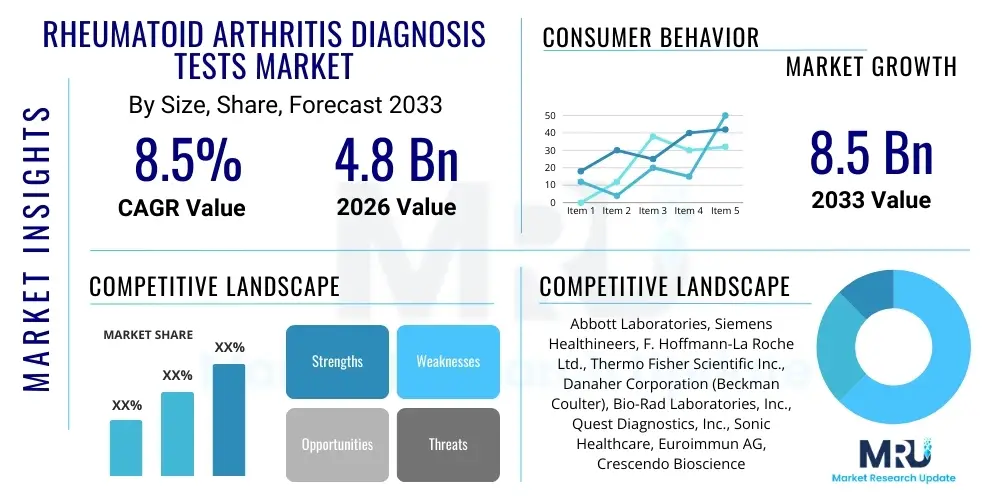

The Rheumatoid Arthritis Diagnosis Tests Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.5 Billion by the end of the forecast period in 2033.

Rheumatoid Arthritis Diagnosis Tests Market introduction

The Rheumatoid Arthritis (RA) Diagnosis Tests Market encompasses various laboratory assays and imaging technologies used for the early detection, monitoring, and differentiation of RA from other arthritic conditions. RA is a chronic autoimmune disease primarily affecting the joints, and timely and accurate diagnosis is crucial for preventing irreversible joint damage and improving long-term patient outcomes. Products within this market range from conventional serological tests, such as those detecting Rheumatoid Factor (RF) and Anti-Citrullinated Protein Antibodies (ACPA), to highly specialized molecular and genetic markers that offer enhanced specificity and sensitivity, particularly in the critical window of early disease presentation.

The core applications of these diagnostic tests lie in confirming clinical suspicion, establishing disease prognosis, and guiding therapeutic strategies. The market benefits significantly from ongoing advancements in immunoassay technology, including ELISA and chemiluminescence platforms, which enable high-throughput testing and automation in clinical laboratories. Furthermore, the increasing global prevalence of RA, coupled with heightened awareness among healthcare professionals regarding the importance of early diagnosis, acts as a pivotal driving factor. The shift towards personalized medicine also necessitates sophisticated diagnostic tools to predict patient response to disease-modifying anti-rheumatic drugs (DMARDs) and biologics, thereby fueling market expansion across developed and emerging economies.

Rheumatoid Arthritis Diagnosis Tests Market Executive Summary

The Rheumatoid Arthritis Diagnosis Tests Market is characterized by robust innovation driven by the demand for non-invasive, high-accuracy screening tools. Business trends indicate a strong focus on strategic mergers and acquisitions among major diagnostic players to consolidate market share and expand geographical reach, particularly in the high-growth Asia Pacific region. Furthermore, collaboration between diagnostic manufacturers and pharmaceutical companies is accelerating the development of companion diagnostics aimed at optimizing targeted RA treatments. The market is also witnessing increasing adoption of multiplex assays and point-of-care (POC) testing devices, which offer faster turnaround times and improved accessibility outside centralized laboratory settings.

Regionally, North America maintains the largest market share due to sophisticated healthcare infrastructure, high healthcare expenditure, and the early adoption of advanced diagnostic technologies and personalized medicine approaches. However, the Asia Pacific region is projected to exhibit the fastest growth rate, fueled by improving healthcare access, rising awareness of autoimmune diseases, and increasing government investments in diagnostic infrastructure in countries like China and India. Segment-wise, the serological testing segment, particularly assays for ACPA, dominates the market due to their high specificity and inclusion in established diagnostic criteria. Simultaneously, the molecular diagnostics segment is experiencing rapid growth, driven by research into novel biomarkers that aid in early differential diagnosis and prognosis assessment, offering significant opportunities for market diversification.

AI Impact Analysis on Rheumatoid Arthritis Diagnosis Tests Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in RA diagnostics primarily center on its ability to enhance diagnostic accuracy, streamline workflow, and predict treatment response. Users frequently ask how AI-driven image analysis (e.g., X-ray, MRI, ultrasound) can detect subtle joint damage earlier than conventional methods, and whether machine learning algorithms can integrate complex clinical, genetic, and laboratory data (RF, ACPA, ESR, CRP) to provide a probabilistic diagnosis of RA. Key concerns also revolve around data security, regulatory hurdles for AI-based diagnostic software, and the validation of algorithms across diverse patient populations. The overarching expectation is that AI will move RA diagnosis from a subjective, criteria-based process toward a highly accurate, automated, and predictive workflow.

AI is fundamentally transforming the interpretation phase of RA diagnosis, shifting the focus from manual review to augmented intelligence. Machine learning models are being trained on vast datasets of patient records and imaging studies to identify subtle patterns indicative of early RA or predicting flares. This capability not only reduces inter-observer variability in clinical assessment but also optimizes resource allocation within diagnostic laboratories by prioritizing high-risk samples. Furthermore, AI is crucial in biomarker discovery, rapidly processing complex 'omics data (genomics, proteomics) to identify new biological signatures of the disease, which will eventually lead to the development of next-generation molecular diagnostic tests with higher predictive value, thereby creating highly specialized market niches for software and analytical services.

- AI-Enhanced Imaging Analysis: Automated detection of erosions and synovitis using machine learning applied to conventional radiography, ultrasound, and MRI scans.

- Predictive Modeling: Integration of clinical variables, serological markers (RF/ACPA), and genetic data to forecast disease progression and therapeutic responsiveness.

- Laboratory Workflow Optimization: AI-driven scheduling and resource management within high-throughput diagnostic labs, reducing processing time and error rates.

- Biomarker Discovery: Acceleration of research into novel molecular targets by analyzing large-scale multi-modal patient data.

- Decision Support Systems (DSS): Implementation of AI tools to assist clinicians in adhering to diagnostic criteria and selecting appropriate treatment pathways.

DRO & Impact Forces Of Rheumatoid Arthritis Diagnosis Tests Market

The Rheumatoid Arthritis Diagnosis Tests Market is shaped by a dynamic interplay of factors. Key drivers include the rising global incidence and prevalence of RA, particularly in aging populations, and the established medical consensus that early diagnosis drastically improves patient outcomes, driving demand for sensitive screening tools. Restraints predominantly involve the high cost associated with advanced molecular diagnostics and specialized imaging techniques, alongside the challenges in standardization and reimbursement policies across various healthcare systems, especially in developing regions. Opportunities emerge from the increasing focus on personalized medicine, which necessitates the discovery and commercialization of highly specific companion diagnostics, and the growing trend toward decentralized testing, enabling the market for point-of-care devices to flourish.

The impact forces influencing this market relate heavily to technological advances and regulatory pressures. Advances in high-throughput automation platforms (e.g., fully automated immunoassay analyzers) significantly reduce the turnaround time for common tests like RF and ACPA, making them more cost-effective and accessible. Simultaneously, stringent regulatory requirements, particularly concerning the validation of novel biomarkers and companion diagnostics by agencies such as the FDA and EMA, impose barriers to entry and lengthen the time-to-market for new products. Overall, the dominant force remains the increasing clinical utility of specific markers, especially ACPA, which has become the gold standard, gradually diminishing the relative importance of less specific markers like traditional RF testing, thus reshaping product portfolios across major market participants.

Segmentation Analysis

The Rheumatoid Arthritis Diagnosis Tests Market is comprehensively segmented based on product type, test type, end user, and disease stage, offering a granular view of market dynamics and opportunities. Product segmentation highlights the dominance of assay kits, which form the consumable core of diagnostic testing, though instruments and software (especially those supporting high-throughput automation and AI analysis) represent crucial capital investments. Test type segmentation reveals a mature serological market contrasted by a high-growth molecular segment. Furthermore, understanding the primary end users, ranging from large centralized hospitals to specialized diagnostic laboratories, dictates the scale and format of the required diagnostic solutions, while segmentation by disease stage emphasizes the crucial need for highly sensitive markers optimized for early detection.

- By Product:

- Assay Kits and Reagents

- Instruments (Automated Analyzers, Readers)

- Software and Services

- By Test Type:

- Serology Tests (Rheumatoid Factor (RF), Anti-Citrullinated Protein Antibodies (ACPA), Anti-Modified Citrullinated Vimentin (MCV))

- Molecular Diagnostics and Biomarkers (Genetic markers, specific protein assays)

- Inflammatory Markers (ESR, CRP)

- By End User:

- Hospitals and Clinics

- Diagnostic Laboratories (Centralized and Reference Labs)

- Research and Academic Institutions

- By Disease Stage:

- Early Stage Diagnosis

- Established and Late Stage Monitoring

Value Chain Analysis For Rheumatoid Arthritis Diagnosis Tests Market

The value chain for the RA Diagnosis Tests Market starts with upstream activities involving the sourcing and development of raw materials, primarily antigens, antibodies, and specialized biochemical reagents critical for assay development. This stage is dominated by specialized biotechnology and life sciences companies focusing heavily on purity and yield, as the quality of these components directly impacts the specificity and sensitivity of the final diagnostic product. Research and development activities, which include clinical trials and biomarker validation, form a crucial component of the upstream value proposition, often involving collaboration between academic institutions and primary manufacturers to ensure the clinical relevance of new tests.

Midstream activities encompass the manufacturing, assembly, and quality control of assay kits and diagnostic instruments. Major diagnostic companies invest heavily in automated manufacturing facilities and global supply chain management to ensure consistent production volumes and adherence to rigorous regulatory standards (e.g., ISO certifications). Distribution and logistics constitute the primary downstream element, requiring specialized infrastructure for cold chain management, particularly for temperature-sensitive reagents and biological samples. This involves both direct sales channels to large hospital networks and indirect distribution through regional distributors and reference laboratories, ensuring broad market access.

The distribution channel is predominantly indirect, utilizing established networks of large commercial reference laboratories (like Quest Diagnostics or Sonic Healthcare) that process the vast majority of serological and inflammatory markers. However, direct sales are common for high-value instrument placements and accompanying long-term service contracts with major hospital systems. The final step involves the delivery of accurate test results to clinicians, who then interpret these findings alongside clinical symptoms to formulate a diagnosis and treatment plan, thereby linking the diagnostic chain directly to patient care and therapeutic outcomes.

Rheumatoid Arthritis Diagnosis Tests Market Potential Customers

The primary end-users and buyers in the Rheumatoid Arthritis Diagnosis Tests Market are multifaceted, reflecting the diversity of healthcare delivery systems globally. Hospitals, particularly those with rheumatology and immunology departments, represent significant customers, frequently utilizing integrated automated platforms for high-volume testing of RF, ACPA, and inflammatory markers. These institutions prioritize efficiency, integration with Electronic Health Records (EHRs), and reliable instrument uptime, making them attractive targets for comprehensive solutions offered by global diagnostic giants.

Diagnostic laboratories, encompassing large commercial reference laboratories and smaller regional labs, constitute the largest volume consumers of RA diagnosis tests. Reference labs act as the central processing hubs for samples collected across multiple clinics and hospitals, driving immense demand for cost-effective, high-throughput assay kits and advanced automation systems. Their buying decisions are heavily influenced by test volume capacity, cost per test, and the ability to integrate specialized molecular and biomarker tests into their routine offerings to maintain a competitive edge and attract outsourcing business from smaller healthcare providers.

Furthermore, research and academic institutions represent a critical segment, focusing less on routine clinical volume and more on cutting-edge, specialized assays for biomarker validation and drug development support. These customers often require customized, low-volume kits, specialized molecular analysis tools, and bioinformatics software, particularly those supporting studies related to personalized medicine and early disease pathogenesis. The growth in clinical trials for new RA treatments also bolsters demand from Contract Research Organizations (CROs) that require reliable and standardized diagnostic panels for patient stratification and monitoring efficacy endpoints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, Inc., Quest Diagnostics, Inc., Sonic Healthcare, Euroimmun AG, Crescendo Bioscience (Myriad Genetics), Eli Lilly and Company, Bristol-Myers Squibb, Sanofi, QIAGEN N.V., Trinity Biotech Plc, Alere Inc. (now Abbott), DiaSorin S.p.A., Grifols S.A., Luminex Corporation, SEKISUI MEDICAL CO., LTD. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rheumatoid Arthritis Diagnosis Tests Market Key Technology Landscape

The technology landscape of the Rheumatoid Arthritis Diagnosis Tests Market is primarily defined by continuous advancements in immunoassay platforms and the emerging prominence of molecular diagnostics. Traditional serology relies heavily on Enzyme-Linked Immunosorbent Assay (ELISA) and Chemiluminescence Immunoassay (CLIA) technologies, which offer high sensitivity, automation, and throughput necessary for large commercial laboratories. Manufacturers are focusing on developing fully automated, random-access analyzers that can handle multiple tests simultaneously, minimizing manual handling and reducing the potential for error. The integration of proprietary magnetic particle separation techniques further enhances the precision and speed of these automated platforms, solidifying their dominance in the serological testing segment.

Molecular diagnostics represent the high-growth technological frontier. This includes techniques such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) applied to identifying genetic risk factors (e.g., HLA alleles) or specific RNA/miRNA profiles linked to RA severity and therapeutic non-response. The technological shift is towards integrating multi-analyte profiling, where a single test can assess various biomarkers—serological, inflammatory, and genetic—to provide a more comprehensive risk assessment and differential diagnosis. This holistic approach is crucial for distinguishing RA from conditions like psoriatic arthritis or osteoarthritis early in the disease course.

Furthermore, the development of Point-of-Care (POC) testing technology is rapidly influencing market accessibility. Compact, portable immunoassay systems utilizing lateral flow technology or microfluidics are enabling quicker results outside centralized labs, particularly in primary care settings and remote areas. Although POC devices currently offer slightly lower sensitivity compared to reference lab instruments, continuous technological refinement focused on increasing assay stability and minimizing sample preparation is driving their adoption, offering a decentralized diagnostic solution that aligns with modern healthcare accessibility goals.

Regional Highlights

- North America: Dominates the global market share, largely due to high prevalence rates of RA, robust reimbursement policies facilitating the use of advanced diagnostics (including molecular tests), and the presence of major key players and extensive research infrastructure. The U.S. leads in the adoption of personalized medicine approaches and companion diagnostics for RA treatment stratification.

- Europe: Represents the second-largest market, characterized by stringent regulatory standards (e.g., IVDR compliance) and a strong emphasis on evidence-based medicine. Countries such as Germany, the UK, and France show high utilization rates of established serological markers and are rapidly integrating advanced imaging techniques and molecular panels supported by national healthcare systems.

- Asia Pacific (APAC): Projected to be the fastest-growing region driven by unmet clinical needs, rapidly improving healthcare infrastructure, and increasing disposable income leading to higher healthcare expenditure. Growing public awareness and government initiatives aimed at controlling non-communicable diseases, coupled with substantial patient populations in China and India, are fueling the demand for cost-effective, high-volume diagnostic solutions.

- Latin America (LATAM): Growth is primarily concentrated in Brazil and Mexico, propelled by expanding access to healthcare services and investments in modernizing laboratory infrastructure. Market penetration remains lower for high-cost molecular tests, with strong reliance on basic serological assays.

- Middle East and Africa (MEA): This region is an emerging market, driven by increasing awareness of autoimmune diseases and improvements in oil-rich Gulf Cooperation Council (GCC) countries’ healthcare spending. However, political instability and fragmented healthcare systems in certain African nations pose challenges to widespread diagnostic test adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rheumatoid Arthritis Diagnosis Tests Market.- Abbott Laboratories

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Beckman Coulter)

- Bio-Rad Laboratories, Inc.

- Quest Diagnostics, Inc.

- Sonic Healthcare

- Euroimmun AG

- Crescendo Bioscience (Myriad Genetics)

- Eli Lilly and Company

- Bristol-Myers Squibb

- Sanofi

- QIAGEN N.V.

- Trinity Biotech Plc

- DiaSorin S.p.A.

- Grifols S.A.

- Luminex Corporation

- SEKISUI MEDICAL CO., LTD.

- Ortho Clinical Diagnostics (now QuidelOrtho)

Frequently Asked Questions

Analyze common user questions about the Rheumatoid Arthritis Diagnosis Tests market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate test for early Rheumatoid Arthritis diagnosis?

The most specific test for early RA is the Anti-Citrullinated Protein Antibody (ACPA) test. While Rheumatoid Factor (RF) is common, ACPA is highly specific and often present years before symptoms, making it crucial for timely intervention and classification according to ACR/EULAR criteria.

How is personalized medicine impacting the RA diagnosis market?

Personalized medicine necessitates the development of sophisticated companion diagnostics that predict patient response to targeted biological therapies. This drives demand for molecular and multi-biomarker panels to tailor treatment plans, moving beyond simple diagnostic confirmation to therapeutic guidance.

What role do inflammatory markers like ESR and CRP play in RA diagnosis?

Erythrocyte Sedimentation Rate (ESR) and C-Reactive Protein (CRP) are non-specific inflammatory markers used primarily for monitoring disease activity, treatment efficacy, and prognosis. While not sufficient for definitive diagnosis, they are essential complements to serological tests (RF/ACPA) for assessing disease burden.

Which geographical region exhibits the highest growth potential for RA diagnosis tests?

The Asia Pacific (APAC) region is forecasted to display the highest growth CAGR, driven by rapidly improving healthcare access, increasing prevalence of RA, and significant investments in diagnostic infrastructure across major emerging economies like China and India.

Are point-of-care (POC) tests becoming viable alternatives for RA diagnosis?

POC tests are rapidly gaining traction, offering fast, decentralized results for common markers like RF and CRP. While currently focused on screening and monitoring, ongoing technological advancements aim to boost sensitivity and incorporate more specific markers, making them increasingly viable for primary care settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager