Rider Floor Scrubber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443277 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Rider Floor Scrubber Market Size

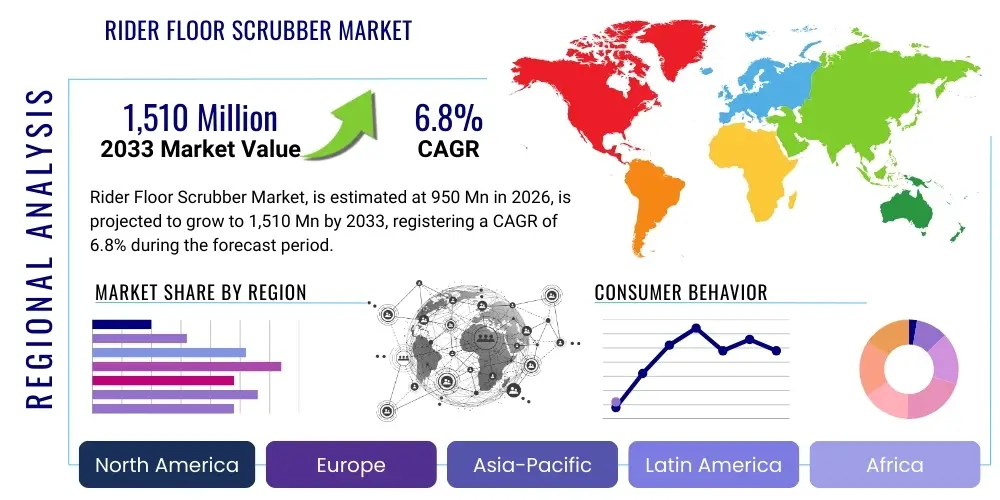

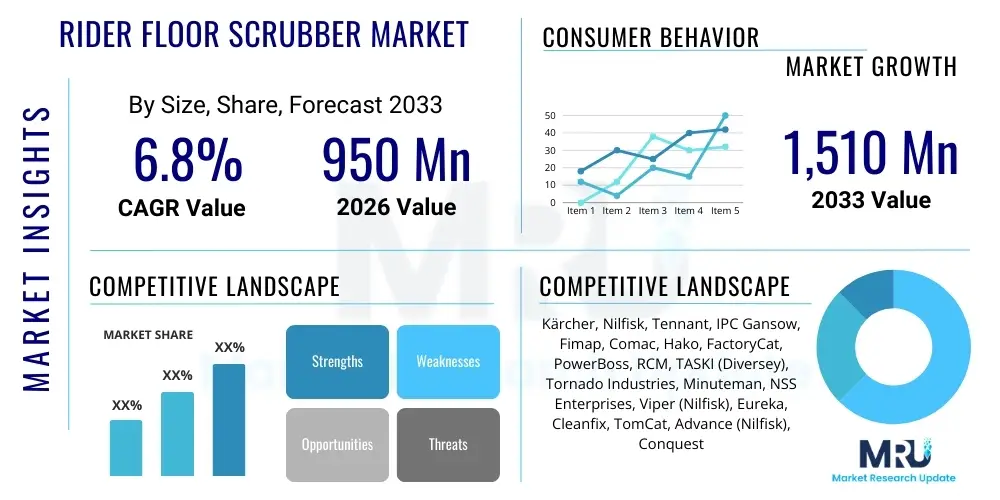

The Rider Floor Scrubber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,510 million by the end of the forecast period in 2033.

Rider Floor Scrubber Market introduction

The Rider Floor Scrubber Market encompasses heavy-duty cleaning equipment designed for efficient and large-scale hard floor maintenance across various sectors, including industrial, commercial, and institutional environments. These powerful machines are characterized by their onboard seating arrangement, which allows an operator to manage cleaning operations over extended periods without the physical fatigue associated with walk-behind equipment. The design integrates high-capacity solution and recovery tanks, robust brush or pad systems, and powerful vacuum motors necessary for simultaneously scrubbing a large area and immediately extracting the spent cleaning solution. The primary purpose is to ensure deep cleaning, sanitization, and immediate floor drying, which is crucial for maintaining operational safety and hygiene standards in environments prone to heavy soiling, such as manufacturing lines and massive logistics hubs. The mechanical complexity often involves advanced fluid management systems for precise chemical dosing and integrated filtration to protect mechanical components, thereby extending the machine’s operational lifespan under strenuous conditions.

The product scope ranges from medium-sized units, suitable for large retail spaces and educational campuses, to colossal industrial models capable of cleaning millions of square feet per week, often utilized in aviation hangars or distribution centers. Major applications span high-traffic areas like international airports, large retail distribution centers handling e-commerce fulfillment, specialized hospital wings requiring stringent infection control protocols, and educational campuses covering vast internal roadways and public areas. Operational efficiency is measured by the scrubber’s productivity rate—square feet cleaned per hour—a metric heavily influenced by brush width, travel speed, and battery longevity. The latest generation of rider scrubbers features sophisticated telemetry and diagnostic capabilities, allowing facility managers to remotely monitor performance metrics, ensure compliance with cleaning schedules, and optimize routes for peak coverage, thereby enhancing the Return on Investment (ROI) significantly compared to legacy mechanical systems.

Key benefits driving market adoption include a dramatic reduction in labor expenditure, which constitutes the largest portion of facility maintenance budgets, coupled with the ability to deliver consistently high and auditable cleaning quality. The reduction in repetitive strain injuries and improved worker morale resulting from the shift from manual to mechanized cleaning further supports adoption. Driving factors accelerating market expansion include the sustained, exponential growth of the global e-commerce sector requiring more enormous warehouse footprints, increasingly rigorous hygiene standards mandated by regulatory bodies like the CDC and OSHA, and global urbanization leading to the construction of large-scale public infrastructure. Furthermore, the inherent safety advantages of immediate water recovery—reducing slip and fall hazards—are making rider scrubbers indispensable in high-volume public access areas. The industry is currently pivoting towards autonomous functionality to tackle chronic labor scarcity issues faced by facility management professionals across developed economies.

Rider Floor Scrubber Market Executive Summary

The Rider Floor Scrubber Market is defined by intense competition and rapid technological integration, propelled primarily by the need for labor efficiency and verifiable hygiene compliance. Current business trends indicate a strong move toward fleet electrification, with Lithium-ion battery technology becoming the standard due to its operational superiority and environmental benefits. Key market participants are investing heavily in connectivity, transforming scrubbers into IoT-enabled assets that transmit performance data, facilitating predictive maintenance, and integrating seamlessly into existing Building Management Systems (BMS). Furthermore, a notable financial trend involves the proliferation of equipment-as-a-service (EaaS) and comprehensive maintenance lease agreements. These subscription models mitigate the high initial capital expenditure (CapEx) burden for end-users, shifting the procurement decision from asset ownership to operational expenditure (OpEx), thereby broadening the addressable market, particularly among small and medium-sized enterprises (SMEs) within the commercial sector. Strategic partnerships between scrubber manufacturers and major facility service providers are also consolidating market influence and distribution channels globally.

Geographically, market trends are highly segmented by economic maturity and labor costs. North America and Europe, characterized by mature industrial bases and exceptionally high hourly wages, are the primary drivers for the adoption of premium robotic and highly automated rider scrubbers, where the automation ROI is realized most rapidly. These regions exhibit advanced market characteristics, including sophisticated telematics penetration and a mature ecosystem of ancillary services. Conversely, the Asia Pacific (APAC) region is poised for the highest growth trajectory, underpinned by vast infrastructure development projects, including massive warehousing complexes and rapid industrialization, particularly in emerging economies. While pricing sensitivity is higher in parts of APAC, the sheer scale of newly constructed facilities mandates the use of large rider machines. Latin America and the Middle East and Africa (MEA) present fluctuating market conditions, yet show consistent demand driven by resource extraction operations and burgeoning tourism and transport infrastructure, favoring durable and easily maintained equipment capable of operating under challenging environmental conditions, such as extreme heat and high dust levels.

Analysis of market segment trends underscores the categorical shift toward autonomous operation. While manual rider scrubbers still dominate the installed base, the robotic/autonomous segment is expanding rapidly, promising disruption across the institutional and logistics applications. Medium to large machine segments (29 inches and above) command the majority of the market value, directly correlating with the need for high-productivity solutions in large-format facilities. Power source segmentation clearly favors advanced battery technology, with Li-ion adoption accelerating due to its negligible memory effect and rapid recharging capabilities, vital for continuous 24/7 operations typical in e-commerce fulfillment centers. Application analysis confirms that the Warehouse & Logistics segment is the primary engine of demand growth, closely followed by Institutional cleaning, driven by compliance requirements. Manufacturers are strategically tailoring features, such as integrated HEPA filtration and ultra-quiet operation, to capture specialized high-value segments like data centers and critical care hospital environments.

AI Impact Analysis on Rider Floor Scrubber Market

Common user inquiries regarding AI in the Rider Floor Scrubber Market primarily focus on translating technological sophistication into tangible economic benefits. Users frequently ask about the accuracy and reliability of real-time obstacle detection and avoidance algorithms in dynamic environments, specifically whether AI-driven navigation can truly handle unexpected scenarios—such as moving forklifts or sudden human traffic—without constant manual intervention or safety shutdowns. There is significant interest in quantifying the ROI provided by autonomous fleets, necessitating clear data on labor hours saved, reduction in cleaning supply usage due to optimized dosing, and increased asset utilization. Users also express concerns related to system security and data ownership, as networked, intelligent scrubbers generate sensitive floor mapping data and operational metrics that facility managers must ensure remain proprietary and protected from cyber threats. Furthermore, buyers often seek confirmation that AI can genuinely optimize the cleaning quality by distinguishing between light dust and heavy spills, rather than following a static path regardless of the actual floor condition.

The practical application of Artificial Intelligence is moving rider scrubbers beyond simple programming into genuine cognitive cleaning platforms. AI algorithms process inputs from complex sensor arrays—including advanced stereo vision cameras and 3D LiDAR—to execute sophisticated sensor fusion. This allows the machine to build and constantly update a high-definition environmental map, facilitating precise localization (even when GPS is unavailable indoors) and making real-time, path-planning decisions. For instance, if an area is designated as high-traffic, the AI can prioritize it or schedule deep cleaning cycles autonomously based on occupancy data received from the facility’s Wi-Fi network or external sensors. Crucially, Machine Learning (ML) models are employed to analyze cleaning output metrics against input parameters (speed, water flow, pressure) to continuously refine the efficiency profile of the machine, ensuring optimal performance while minimizing battery drain and resource waste. This self-optimization capability is a core feature differentiating high-end robotic models.

The strategic impact of AI centers on enabling true fleet intelligence and data-driven facility management. AI systems analyze aggregated fleet data—potentially across thousands of machines operating globally—to identify performance outliers, predict equipment wear patterns, and generate actionable insights for facility optimization. This results in AI-powered predictive maintenance, which shifts the service model from reactive fixes to proactive component replacement, dramatically increasing the machine's operational lifespan and minimizing expensive unscheduled downtime. Furthermore, AI facilitates regulatory compliance by meticulously logging every cleaning cycle, recording the exact location, time, and resources utilized, generating tamper-proof documentation vital for sectors like healthcare and food processing. This integration of AI elevates the rider scrubber from a utility appliance to a core component of a facility’s overall digital operational strategy, justifying the substantial initial investment through guaranteed operational continuity and verifiable performance metrics over its lifetime.

- AI enables highly precise, dynamic navigation and obstacle avoidance in complex environments, crucial for shared industrial spaces.

- Machine learning optimizes cleaning parameters (water, detergent, pressure) based on real-time soil detection, enhancing resource efficiency and sustainability.

- Predictive maintenance algorithms analyze operational data to forecast component failures, drastically increasing machine uptime and reducing maintenance costs.

- Autonomous scheduling and centralized fleet management are handled by AI systems, optimizing deployment across vast, multi-zone facilities.

- Data analytics derived from AI systems provide facility managers with verifiable compliance reports and quantifiable hygiene metrics essential for audit purposes.

DRO & Impact Forces Of Rider Floor Scrubber Market

The market trajectory is significantly dictated by powerful economic and regulatory drivers, notably the sustained, global increase in hourly labor wages, making manual cleaning operations financially prohibitive for large floor areas. This driver is exacerbated by chronic labor shortages in many developed nations, forcing businesses to invest in high-capacity automation to maintain operational standards without relying on extensive human resources. Complementing this is the explosive growth of the logistics and e-commerce sector; every new distribution center or fulfillment warehouse represents massive, previously non-existent floor space that requires mechanized cleaning, driving exponential demand for large rider scrubbers. Furthermore, regulatory tightening in hygiene standards, particularly post-pandemic, mandates the use of equipment capable of verifiable deep cleaning and often includes requirements for low-emission and quiet operations, favoring advanced electric and technologically superior rider systems over outdated models.

Restraints primarily revolve around the initial acquisition cost, especially for high-end robotic or specialized industrial riders, which can be prohibitive for smaller organizations or those with constrained CapEx budgets. While the ROI over five years is often favorable, the upfront investment hurdle remains significant. Additionally, the increasing technological complexity, especially with integrated IoT and AI systems, necessitates specialized and frequently updated technical training for in-house maintenance teams, leading to dependency on manufacturer service contracts or specialized third-party technicians. Opportunity, however, lies in several areas: the rapid proliferation of high-density Lithium-ion batteries enhances performance and enables 24/7 operation with minimal downtime, creating competitive product differentiation. Niche market penetration in highly regulated environments such as clean rooms, data centers, and cold storage facilities, which require custom-engineered features like temperature-hardened components or specialized non-particulate emitting brushes, also represents a high-value opportunity space. Moreover, emerging markets offer vast potential as their infrastructure and industrial sectors mature and embrace mechanized cleaning for efficiency gains.

The impact forces influencing competition are intensely technology-driven. Constant innovation in sensor technology, battery chemistry, and AI navigation puts significant pressure on manufacturers to maintain R&D investments or risk rapid product obsolescence, especially in the premium segments. Regulatory forces regarding environmental impact (water usage, chemical disposal, noise pollution) necessitate continuous product redesign to comply with evolving global standards such as ISO 14001. Economic forces, particularly volatility in global commodity prices (steel, specialized polymers, semiconductors), directly affect manufacturing costs and final pricing, demanding robust supply chain risk management. The shift towards powerful service and maintenance ecosystems—where service revenue becomes a major profit center—also constitutes a competitive force, requiring vendors to build sophisticated, global support networks capable of handling complex software and hardware issues remotely and efficiently, ensuring machine uptime remains above industry benchmarks.

Segmentation Analysis

The Rider Floor Scrubber Market segmentation provides a critical framework for understanding diverse customer needs and precise market dynamics across the entire cleaning equipment spectrum. Segmentation by machine size—categorized generally into Small, Medium, and Large (or Ultra-Large)—is directly proportional to the floor area the unit is designed to service and the throughput efficiency required. Small riders are optimized for maneuverability and fit into tight spaces, typical of congested retail backrooms or hallways. Medium riders represent the workhorse of the segment, balancing capacity and agility for tasks in shopping malls and mid-sized warehouses. Conversely, Large riders, often with scrubbing path widths exceeding 40 inches, are exclusively designed for maximizing coverage in vast, unobstructed industrial settings like aircraft hangars, convention centers, and primary logistics hubs, where minimal downtime and maximum productivity are non-negotiable operational priorities.

Segmentation by power source is perhaps the most defining technological differentiator in modern scrubbers. Battery-powered models currently dominate the market share due to their superior mobility, silent operation, and zero local emissions, making them ideal for indoor environments, particularly in healthcare and food processing. The rapid adoption of high-performance Lithium-ion batteries over legacy Lead-Acid options is further driving this segment, addressing historic limitations of runtime and charge cycling. The niche segment of hybrid power (often combining battery with propane or diesel generators) caters almost exclusively to extremely large, often outdoor or unventilated industrial sites where electrical charging infrastructure is scarce or where continuous, multi-shift operation is essential without the ability to pause for recharging. Brush configuration segmentation—disc versus cylindrical—reflects the cleaning task: disc scrubbers are generalists offering superb scrubbing and polishing, while cylindrical scrubbers offer superior debris collection and deeper cleaning on structured floors, effectively performing a light sweep and scrub simultaneously, catering specifically to manufacturing environments with heavy particulate loads.

The application segmentation reveals the distinct demand characteristics of end-user verticals. The Warehouse & Logistics segment demands speed and autonomy, seeking equipment capable of 24/7 operation with minimal human interaction, justifying investment in autonomous robotic fleets. The Industrial & Manufacturing segment requires rugged construction, resistance to corrosive chemicals, and the capacity to handle heavy soil loads. In contrast, the Institutional segment, which includes healthcare and education, places critical emphasis on hygienic performance validation (e.g., bacteria removal rates) and low noise emission, favoring machines with advanced water purification and sanitization features. This granular segmentation allows manufacturers to fine-tune product offerings—such as equipping hospital scrubbers with UV-C light sterilization kits or heavy-duty industrial models with enhanced impact protection features—to precisely align with the specialized operational needs and regulatory compliance mandates of each core customer group, maximizing market penetration and perceived value.

- By Type:

- Small (Up to 28 inches cleaning path)

- Medium (29-38 inches cleaning path)

- Large (Over 38 inches cleaning path)

- Robotic/Autonomous

- By Power Source:

- Battery-Powered (Lithium-ion, Lead-Acid)

- Hybrid (Electric/Gas or Propane – Niche Industrial Use)

- By Brush Configuration:

- Disc

- Cylindrical

- By Application/End-User:

- Industrial & Manufacturing

- Warehouse & Logistics

- Commercial (Retail, Malls, Offices)

- Institutional (Hospitals, Schools, Government)

- Transportation Hubs (Airports, Train Stations)

- Food & Beverage Processing

Value Chain Analysis For Rider Floor Scrubber Market

The commencement of the Rider Floor Scrubber value chain lies in the highly specialized upstream phase, which involves the sourcing of critical, high-technology components that define modern machine performance. Beyond standard steel and plastic fabrication materials, the most significant value accretion occurs through securing advanced components: high-torque, variable-speed electric motors; proprietary control boards and programmable logic controllers (PLCs); and the increasingly critical sensor suites (LiDAR, ultrasonic transducers, cameras) necessary for autonomous functionality. A robust and reliable supply chain for high-energy density Lithium-ion battery packs, often involving international partnerships with major battery producers, is vital, as battery performance is a key competitive metric. Upstream analysis also considers intellectual property related to fluid dynamics for optimized water recovery and specialized material science for durable, long-life brushes and squeegees. Manufacturers must manage significant operational risk associated with global semiconductor and electronic component availability, making secure, long-term supplier agreements paramount for production continuity and cost stability.

The midstream phase, involving manufacturing and assembly, centers on lean production techniques to manage the complexity of integrating diverse mechanical, electrical, and software systems. Market leaders leverage advanced robotic assembly processes to ensure consistency and precision in chassis welding and component installation. Quality control at this stage is intensive, focusing not only on mechanical integrity but also on the functional reliability of the electronic and software systems, particularly for autonomous models requiring rigorous testing of navigation and safety protocols. The downstream value chain is fundamentally structured around distribution channels, split between highly technical direct sales teams handling customized industrial accounts, and extensive indirect dealer networks. Direct channels excel at large fleet sales and providing specialized consultation on infrastructure integration. Conversely, dealer networks provide essential local inventory, immediate parts supply, and localized service capabilities, which significantly influence the perceived Total Cost of Ownership (TCO) for regional buyers who prioritize rapid response times for maintenance and repair.

The critical element distinguishing profitable market players in the downstream flow is the sophistication of their aftermarket service operation. Service contracts, sales of genuine spare parts (including wear items like brushes, squeegees, and filters), and remote diagnostic services generate substantial, high-margin recurring revenue streams throughout the product’s 8-to-15-year lifecycle. For advanced robotic scrubbers, service provision now includes software updates, over-the-air firmware improvements, and remote technical support for complex navigational issues, fundamentally requiring a digital service infrastructure rather than purely mechanical expertise. The indirect channel also utilizes specialized distribution partnerships with cleaning chemical providers and large-scale facilities management companies, allowing manufacturers to penetrate markets without developing a wholly owned global sales force. Effective logistics and inventory management across the downstream is necessary to ensure that spare parts reach customers quickly, directly impacting machine uptime—the most valued metric for commercial end-users.

Rider Floor Scrubber Market Potential Customers

The core constituency of potential customers for Rider Floor Scrubbers is concentrated within sectors characterized by massive floor space and high operational demands, where cleaning cannot interrupt primary business activities. The Industrial and Logistics sectors represent the most crucial customer base, including third-party logistics (3PL) providers, e-commerce giants, and major manufacturing firms (automotive, aerospace, heavy machinery). These customers purchase based on ruggedness, battery life required for 10+ hour shifts, and the machine's ability to handle heavy debris and chemical contaminants. Their facilities often exceed hundreds of thousands of square feet, making manual or walk-behind cleaning economically unfeasible. Purchasing decisions are data-driven, heavily influenced by verifiable metrics such as square feet cleaned per hour and low TCO, often necessitating advanced connectivity features for fleet tracking and performance auditing across multi-site operations.

The Institutional segment constitutes a vital and steadily growing customer base, specifically encompassing healthcare providers (hospitals, clinics), large educational institutions (universities, K-12 districts), and government facilities (military bases, convention centers). For healthcare environments, the paramount concern is infection control and verifiable sanitization, leading to demand for scrubbers with integrated chemical dosing accuracy, quiet operation to avoid disturbing patients, and certification features ensuring compliance with hospital-grade hygiene protocols. Educational facilities focus on durability and ease of use, coupled with low noise emissions for use during operational school hours. These organizations often rely on publicly funded budget cycles, which can lead to larger, less frequent bulk purchases, often influenced by mandates for sustainable and energy-efficient equipment, favoring Lithium-ion powered units with water recycling capabilities.

Lastly, the Commercial sector, including large retail chains, shopping malls, and major commercial office complexes, forms a high-volume, though often price-sensitive, customer group. Retail customers require aesthetic cleanliness in customer-facing areas and high maneuverability to navigate around display fixtures and seasonal traffic patterns. Fast response to spills and the necessity for immediate drying are critical to maintaining customer safety and minimizing business interruption. This segment increasingly explores leasing and rental options to manage seasonal peak cleaning demands without committing to large capital expenditures. The unique cleaning challenges of specialized commercial facilities, such as data centers which require non-particulate emitting operation and stringent static control, further necessitate tailored product features, creating lucrative, high-barrier-to-entry opportunities for leading manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,510 million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kärcher, Nilfisk, Tennant, IPC Gansow, Fimap, Comac, Hako, FactoryCat, PowerBoss, RCM, TASKI (Diversey), Tornado Industries, Minuteman, NSS Enterprises, Viper (Nilfisk), Eureka, Cleanfix, TomCat, Advance (Nilfisk), Conquest |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rider Floor Scrubber Market Key Technology Landscape

The current technology landscape is overwhelmingly dominated by the integration of robotics, complex sensor systems, and cloud connectivity, fundamentally redefining the capabilities of rider scrubbers. The development of reliable, sophisticated autonomous navigation is central, relying on advanced Simultaneous Localization and Mapping (SLAM) algorithms coupled with sensor fusion from multiple modalities, including rotating LiDAR for long-range environmental awareness, ultrasonic sensors for close-proximity object detection, and high-resolution cameras for detailed floor assessment. Manufacturers are dedicating substantial R&D resources to improving the robustness of these systems, ensuring seamless transitions between different floor types and lighting conditions, and achieving operational safety certifications necessary for deployment in crowded, human-centric environments. Furthermore, teleoperation and remote override capabilities, often managed via dedicated 5G or high-speed Wi-Fi networks, are becoming standard features, enabling technicians to troubleshoot or guide the machine remotely if it encounters an unforeseen navigational challenge.

The efficiency of operation is critically dependent on advancements in power technology. The widespread adoption of Lithium-ion batteries marks a crucial technological milestone, offering significant improvements in energy density, reduced weight, and the capacity for opportunity charging—meaning the machine can be topped up during short breaks without damaging battery health, a severe limitation of older Lead-Acid chemistries. Beyond the battery itself, sophisticated Battery Management Systems (BMS) are vital, employing smart algorithms to optimize charge and discharge cycles, monitor thermal conditions, and communicate precise operational metrics to the operator and fleet manager. Some cutting-edge industrial models are exploring regenerative braking systems, capturing kinetic energy during deceleration to return energy to the battery pack, further extending runtime. This focus on maximizing energy efficiency directly translates into higher operational square footage cleaned per charge cycle, drastically improving productivity metrics for end-users.

The third major technological pillar is connectivity, powered by the Internet of Things (IoT). Every contemporary rider scrubber is essentially a mobile data collection unit, utilizing integrated telematics to stream vast quantities of operational data to proprietary cloud platforms. This allows for predictive maintenance systems that analyze mechanical component vibrations, motor temperatures, and consumption rates to schedule maintenance proactively before a critical failure occurs, maximizing machine uptime—a primary customer concern. Material science also contributes significantly; manufacturers are implementing lightweight, high-strength composite materials to reduce the overall weight of the scrubber, improving maneuverability and energy efficiency. Finally, advanced fluid systems utilizing highly precise electronic dosing pumps ensure exact chemical concentration, reducing waste and cost, while integrated multi-stage water filtration and recycling systems minimize the frequency of tank refills, aligning the technology with stringent global sustainability goals.

Regional Highlights

- North America: This region is a mature and technology-leading market characterized by high labor costs and stringent occupational safety standards. Demand is dominated by vast warehouse and logistics operations, especially driven by major e-commerce players, and the robust healthcare sector. North America leads globally in the adoption of autonomous rider scrubbers, sophisticated fleet management software, and high-performance Lithium-ion electric equipment. Regulatory drivers often push manufacturers towards green cleaning technologies, favoring high-efficiency water and chemical management systems to reduce environmental impact.

- Europe: Europe exhibits strong, steady growth driven by its robust industrial manufacturing base (especially Germany and Italy) and extremely high regulatory standards governing facility hygiene, particularly within the sensitive food and beverage and pharmaceutical sectors. Western European markets show high penetration rates for advanced rider scrubbers, with a distinct preference for low noise levels suitable for cleaning during operational hours in dense retail environments and public transport hubs. Central and Eastern Europe are increasingly adopting larger rider models as industrialization and facility modernization accelerate.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, propelled by rapid urbanization, massive infrastructural expansion (new airports, metro systems, industrial parks), and the exponential growth of e-commerce necessitating enormous warehouse construction in markets like China, India, Japan, and Australia. While initial purchase price sensitivity exists, rising labor costs and the sheer scale of cleaning requirements are rapidly driving acceptance of high-capacity rider scrubbers. This region is a major manufacturing hub for both components and finished cleaning equipment, impacting global supply chains significantly.

- Latin America (LATAM): Growth in LATAM is characterized by cyclical demand, primarily concentrated in industrialized areas of Brazil, Mexico, and Chile, driven by mining, manufacturing, and port logistics. Demand is focused on durable, robust machines suitable for challenging, sometimes inconsistent operational environments, often prioritizing mechanical ruggedness and ease of straightforward field maintenance over cutting-edge technological integrations like advanced robotics. Economic stability variations often favor flexible purchasing models like long-term leasing or rental agreements for large equipment.

- Middle East and Africa (MEA): The MEA region is witnessing high capital investment driven by government-led mega infrastructure projects (e.g., hospitality, transport hubs, smart cities in the GCC states). These projects demand consistent, premium cleaning standards, fueling rapid investment in high-end, large-capacity rider scrubbers. Climate control and heat-tolerance features for both mechanical components and battery systems are critical technical differentiators for scrubbers operating in the extreme temperatures characteristic of this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rider Floor Scrubber Market.- Kärcher

- Nilfisk

- Tennant Company

- IPC Gansow

- Fimap S.p.A.

- Comac SpA

- Hako GmbH

- FactoryCat (R.P.S. Corporation)

- PowerBoss (A Member of the Kärcher Group)

- RCM S.p.A.

- TASKI (Diversey Holdings)

- Tornado Industries

- Minuteman International

- NSS Enterprises

- Viper Industrial Products (A Nilfisk Brand)

- Eureka S.p.A.

- Cleanfix Reinigungssysteme AG

- TomCat (R.P.S. Corporation)

- Advance (A Nilfisk Brand)

- Conquest Equipment

Frequently Asked Questions

Analyze common user questions about the Rider Floor Scrubber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Rider Floor Scrubber Market?

The Rider Floor Scrubber Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, significantly driven by increasing industrial automation demands and escalating labor costs globally.

How is the rise of autonomous technology impacting the market?

Autonomous technology, powered by advanced AI and sensor fusion, is transforming the market by enabling robotic rider scrubbers to perform consistent, unsupervised cleaning, thereby addressing critical labor shortages and dramatically improving operational efficiency and fleet utilization in large facilities like warehouses and airports.

Which application segment holds the largest market share and why?

The Industrial & Manufacturing sector, closely followed by Warehouse & Logistics, currently holds the largest revenue share. This dominance is due to the sheer size of these facilities, the demanding nature of the cleaning tasks, and the necessity for high-throughput, reliable mechanized cleaning to maintain continuous operational flow and safety standards.

What are the primary advantages of Lithium-ion batteries over traditional power sources in rider scrubbers?

Lithium-ion batteries offer superior operational advantages, including significantly faster charging times, extended non-stop runtimes, reduced machine weight, zero maintenance requirements, and a much longer lifecycle, ultimately lowering the total cost of ownership (TCO) and maximizing daily productivity.

What role does IoT play in modern rider floor scrubbers?

IoT enables connectivity and data transmission, transforming scrubbers into smart assets. This connectivity facilitates real-time performance monitoring, remote diagnostics, route optimization, and, crucially, AI-driven predictive maintenance, ensuring high machine uptime and providing auditable compliance data to facility managers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager