Rigid Transparent Plastics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442858 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Rigid Transparent Plastics Market Size

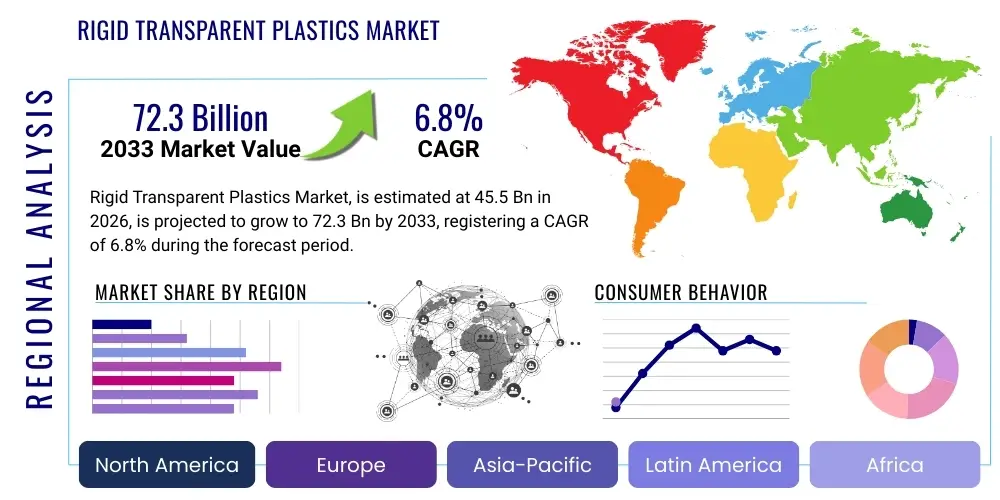

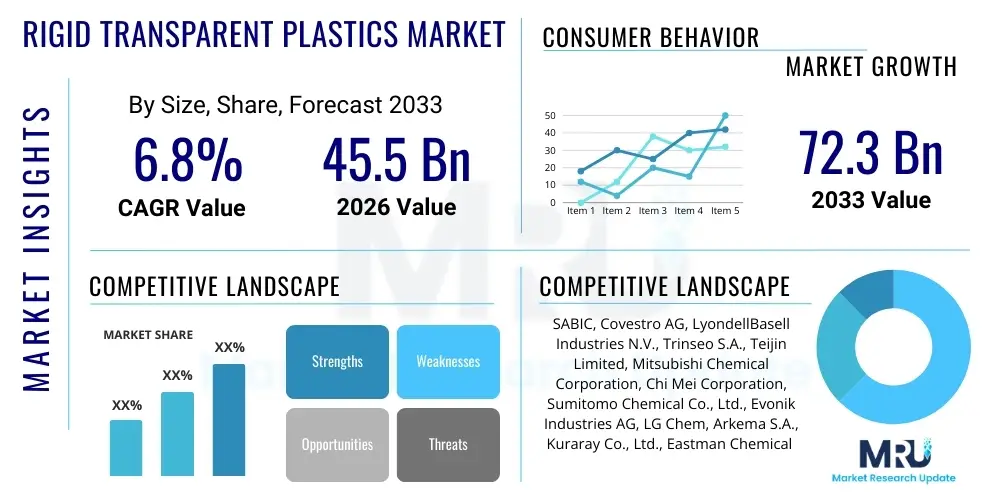

The Rigid Transparent Plastics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 72.3 Billion by the end of the forecast period in 2033.

Rigid Transparent Plastics Market introduction

The Rigid Transparent Plastics Market encompasses the production, distribution, and consumption of high-performance plastic materials characterized by their stiffness, clarity, and resistance to impact. These materials are crucial components across various industries, replacing traditional materials like glass and metal due to their superior combination of light weight, durability, and optical transparency. Key product types include Polycarbonate (PC), Polymethyl Methacrylate (PMMA), and specialized Copolyesters, each offering unique thermal and mechanical properties tailored for specific high-demand applications. The rising consumer demand for visually appealing, sustainable, and high-integrity packaging solutions is fundamentally accelerating market expansion globally, particularly in sectors where visibility and product protection are paramount.

Major applications for rigid transparent plastics span critical sectors such as packaging, automotive, electronics, and medical devices. In packaging, these plastics ensure product visibility while providing excellent barrier properties for food and beverages. Within the automotive industry, they are increasingly utilized for lightweight glazing, sunroofs, and headlamp lenses, contributing to fuel efficiency and enhanced design aesthetics. The primary benefits driving adoption include high dimensional stability, exceptional light transmission, inherent impact strength, and often, chemical resistance, making them ideal for sterile or high-stress environments. Furthermore, innovations focusing on bio-based and recyclable transparent polymers are addressing growing sustainability concerns, solidifying their role as essential materials for future industrial designs.

The market growth is primarily driven by the increasing urbanization and expansion of the global middle class, which fuels demand for packaged consumer goods and advanced electronic devices. Technological advancements in molding and processing techniques allow manufacturers to produce complex shapes and thinner wall sections, optimizing material use while maintaining structural integrity. Moreover, stringent safety regulations concerning automotive components and medical supplies necessitate the use of high-clarity, fracture-resistant materials, directly benefiting the rigid transparent plastics sector. The continuous replacement of conventional materials, spurred by cost-effectiveness and performance improvements, remains a core growth catalyst, especially in construction and spectacle manufacturing.

Rigid Transparent Plastics Market Executive Summary

The Rigid Transparent Plastics Market is characterized by robust growth, driven primarily by technological advancements in polymer science and escalating demand from high-growth industries such as specialized packaging and electric vehicle manufacturing. A significant business trend involves strategic capacity expansion and vertical integration by major petrochemical companies to secure raw material supply chains and optimize production efficiency. Furthermore, there is a pronounced shift towards high-performance and specialty grades, such particularly those with enhanced scratch resistance and UV stability, enabling deeper penetration into premium architectural and automotive exterior applications. Collaborations between polymer producers and material converters are essential for developing application-specific formulations that meet complex regulatory requirements, particularly those related to food contact and biocompatibility.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, primarily due to rapid industrialization, large-scale infrastructural development projects, and the presence of major electronics and automotive manufacturing hubs, especially in China and India. North America and Europe, while mature markets, exhibit steady growth fueled by the demand for advanced medical devices and the rigorous adoption of sustainable, high-recycled content (HRC) transparent plastics. Regulatory pressures in these developed regions often dictate material innovation, pushing manufacturers toward biodegradable or closed-loop recycling solutions, influencing global material standards. Latin America and the Middle East and Africa (LAMEA) are emerging markets experiencing strong uptake driven by expanding construction sectors and increased investment in modern consumer packaging lines.

Segment trends highlight the dominance of Polycarbonate (PC) and Polymethyl Methacrylate (PMMA) due to their unparalleled strength and optical clarity, respectively. However, the Polyethylene Terephthalate (PET) segment is witnessing exponential growth, particularly in packaging, due to its cost-effectiveness, excellent recyclability, and compliance with food safety standards. Application-wise, the Packaging segment retains the largest market share, but the Automotive segment is projected to record the highest CAGR, driven by the shift towards lightweight materials to compensate for the weight of battery packs in Electric Vehicles (EVs). Innovation is concentrated on developing high-flow, thin-wall materials suitable for intricate injection molding processes, reducing cycle times and overall manufacturing costs across all major end-use sectors.

AI Impact Analysis on Rigid Transparent Plastics Market

User queries regarding AI's influence in the Rigid Transparent Plastics market frequently center on how machine learning can optimize material formulation, predict product performance under stress, and revolutionize factory floor automation. Common themes include the use of AI for simulating polymer characteristics before costly physical testing, integrating smart sensors for quality control in high-speed extrusion and molding processes, and optimizing supply chain logistics for raw materials like Bisphenol A (BPA) or Methyl Methacrylate (MMA). Users are keen to understand how AI-driven predictive maintenance can minimize downtime in continuous manufacturing processes, thereby enhancing overall equipment effectiveness (OEE) and reducing production waste, a critical factor for high-volume, low-margin plastic manufacturing.

The application of Artificial Intelligence is fundamentally transforming the manufacturing lifecycle of rigid transparent plastics, moving production processes toward a highly optimized and data-driven paradigm. AI algorithms are instrumental in material science research, accelerating the discovery of novel polymer blends with superior optical and mechanical properties, such as enhanced UV resistance or improved flow characteristics for intricate parts. Furthermore, deep learning models are being deployed in quality assurance systems, using computer vision to inspect injection-molded or extruded products in real-time, identifying microscopic defects, inclusions, or stress fractures that human inspectors might miss, significantly improving the yield of high-specification transparent components used in medical and aerospace applications.

In the operational sphere, AI optimizes energy consumption and minimizes utility costs by learning complex correlations between machine parameters (temperature, pressure, cycle time) and environmental variables. This level of optimization is crucial for energy-intensive processes like polymerization and large-scale injection molding. Supply chain management benefits profoundly from AI-driven forecasting models that predict fluctuations in feedstock prices and demand shifts, allowing manufacturers to strategically manage inventory and hedging strategies. Ultimately, AI enables greater customization and quicker turnaround times, aligning manufacturing capabilities with the volatile demands of highly segmented end-use markets.

- AI optimizes polymer formulation design, reducing R&D cycles by simulating material performance characteristics.

- Machine vision systems utilize AI for 100% real-time quality inspection, defect detection, and minimization of material waste during molding.

- Predictive maintenance algorithms deployed on production equipment reduce unplanned downtime and extend asset lifecycles in continuous operations.

- AI-driven supply chain management improves raw material procurement efficiency and mitigates risk associated with price volatility.

- Machine learning models optimize processing parameters (temperature, pressure) for energy efficiency and improved component uniformity.

DRO & Impact Forces Of Rigid Transparent Plastics Market

The Rigid Transparent Plastics Market is propelled by powerful growth drivers centered on innovation and application substitution, yet it faces significant constraints, primarily related to environmental scrutiny and feedstock dependence. The central impact forces include the aggressive global trend towards lightweighting in transportation and construction, mandated by energy efficiency regulations. Concurrently, the increasing complexity of medical devices and diagnostic tools necessitates highly specialized, sterilizable, and optically pure plastic enclosures and components. The market's resilience is challenged by fluctuations in crude oil prices, which directly impact the cost structure of monomers like styrene, ethylene, and propylene derivatives, and mounting regulatory pressure concerning the disposal and recycling of single-use and multilayer transparent packaging, demanding continuous investment in advanced recycling infrastructure and novel bio-based alternatives.

Key drivers include the burgeoning demand for high-end consumer electronics (smart displays, transparent casings) and the widespread adoption of modern, clear architectural glazing that offers better insulation and light transmission than traditional materials. The opportunity landscape is vast, centered on sustainable innovation, specifically the commercialization of bio-based transparent plastics (e.g., bio-PC or bio-PET) and the development of robust chemical recycling pathways that allow complex polymers to be reverted back to high-purity monomers. Furthermore, untapped potential exists in emerging applications like transparent solar panels and advanced optical storage media, requiring stringent material specifications that only high-grade rigid transparent plastics can fulfill. Manufacturers focusing on these niche high-value areas are poised for superior margins and market positioning.

Restraints are dominated by the environmental stigma associated with plastics and the high initial cost of performance grades such as specialty Polycarbonate relative to commodity polymers or glass. The volatile pricing structure of crude oil derivatives creates instability in manufacturing costs, making long-term forecasting difficult for producers. Impact forces, which shape the competitive dynamics, involve the continuous pressure from regulators to enhance circularity and increase the recycled content in finished products, forcing companies to invest heavily in sorting, mechanical recycling, and chemical depolymerization technologies. Competitive intensity is high, characterized by continuous product differentiation based on optical performance, scratch resistance, and flame retardancy, compelling key players to maintain robust R&D pipelines to sustain technological leadership.

Segmentation Analysis

The Rigid Transparent Plastics Market is meticulously segmented based on the type of material, the specific application area, and geographical region. This segmentation provides a granular view of market dynamics, highlighting growth pockets and areas of strategic investment. The Material segment determines fundamental properties such as impact resistance, clarity, and thermal stability, with Polycarbonate and Polymethyl Methacrylate leading the high-performance category. The Application segment defines consumption patterns, showing strong dominance from the massive packaging industry, followed by rapidly expanding sectors like automotive and construction, where substitution of glass is a primary driver. Understanding these segment interactions is crucial for optimizing product portfolios and tailoring marketing strategies to meet industry-specific requirements.

The evolution within these segments reflects underlying industry trends. For instance, within the packaging segment, there is a clear shift toward thinner, lighter PET bottles and trays, optimizing logistical efficiency and minimizing material usage, driven largely by e-commerce demands. Conversely, the medical segment demands high-grade PC and PMMA polymers that meet strict biocompatibility and sterilization standards (e.g., gamma radiation resistance). Regional segmentation underscores the APAC region’s unparalleled manufacturing scale, contrasting with North America and Europe's focus on specialty, high-margin applications and sustainability mandates, providing a dual mandate for global market participants: efficiency in the East and innovation in the West.

- By Material Type:

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyethylene Terephthalate (PET)

- Copolyester (e.g., PCTG, PETG)

- Polyvinyl Chloride (PVC)

- Others (e.g., Polystyrene (PS), Styrene-Acrylonitrile (SAN))

- By Application:

- Packaging (Food & Beverage, Personal Care, Consumer Goods)

- Automotive (Glazing, Lighting, Interior Components)

- Construction (Sheets, Windows, Skylights, Architectural Glazing)

- Electrical & Electronics (Displays, Housings, Optical Media)

- Medical & Healthcare (Syringes, Dialysis Components, Labware)

- Others (e.g., Eyewear, Appliances, Furniture)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Rigid Transparent Plastics Market

The value chain of the Rigid Transparent Plastics Market begins with upstream activities involving the extraction and refinement of crude oil and natural gas, which serve as the primary feedstock for monomers such as Bisphenol A (BPA) for PC, Methyl Methacrylate (MMA) for PMMA, and purified Terephthalic Acid (PTA) for PET. Large-scale chemical manufacturers dominate this initial stage, characterized by high capital investment and complex synthesis processes. The stability and pricing of these raw materials critically influence the profitability of downstream polymer producers. Strong integration between petrochemical giants and polymer manufacturers is a crucial competitive advantage, ensuring steady supply and cost control in the highly volatile commodity market.

The core midstream activity is polymerization, where monomers are processed into rigid transparent plastic resins (pellets or sheets). This stage requires specialized technology, including bulk polymerization or suspension polymerization reactors, to achieve the desired molecular weight, clarity, and processing characteristics. Downstream processing involves converters, molders, and extruders who transform the plastic resins into finished or semi-finished goods—such as clear films, bottles, lenses, or complex automotive parts—using high-precision techniques like injection molding, blow molding, and thermoforming. These converters often operate closer to end-users, requiring flexibility and high technical expertise to meet customized specifications for clarity, thickness, and dimensional accuracy.

Distribution channels for rigid transparent plastics are diverse, encompassing both direct and indirect routes. Direct sales are common for large-volume contracts, particularly between polymer producers and major end-users in the automotive, construction, and high-volume packaging sectors, ensuring technical support and tailored supply agreements. Indirect channels involve regional distributors, specialized compounders, and wholesalers who serve smaller manufacturers and various localized markets, offering logistics services, inventory management, and specialized compounding of additives (e.g., UV stabilizers, anti-scratch coatings). The complexity of the product, particularly custom-grade PMMA or specialized PC, favors direct distribution where technical consultation is essential, while commodity resins like bulk PET often utilize extensive indirect distributor networks for broad market reach.

Rigid Transparent Plastics Market Potential Customers

The potential customers for the Rigid Transparent Plastics Market are highly diverse, spanning essential industries that prioritize visibility, protection, and lightweighting. The largest segment of buyers consists of Fast-Moving Consumer Goods (FMCG) companies and beverage producers who require billions of transparent bottles, containers, and packaging films annually, primarily utilizing PET and Copolyesters. These buyers demand materials that comply with stringent food contact regulations, offer excellent gas barrier properties, and facilitate high-speed filling lines, making material cost and recyclability critical purchasing factors. The shift towards aesthetic and safety-conscious packaging further emphasizes the demand for high-clarity, impact-resistant rigid plastics over alternatives.

A second major customer category includes Original Equipment Manufacturers (OEMs) in the automotive and electronics sectors. Automotive OEMs, including manufacturers of electric vehicles and traditional combustion engine cars, are critical consumers of high-performance Polycarbonate for advanced exterior lighting, transparent glazing, and robust interior panels designed to withstand extreme temperatures and impacts. Electronics manufacturers rely on rigid transparent plastics for device displays, touchscreens, protective housings, and optical media, requiring materials with superior optical properties and scratch resistance, such as optical-grade PMMA and specialized PC resins. These buyers often engage in long-term supply contracts requiring materials engineered to precise mechanical and thermal specifications.

Furthermore, the medical and construction industries represent high-value potential customers. Healthcare institutions and medical device manufacturers purchase specialized transparent plastics for single-use syringes, labware, diagnostic equipment components, and drug delivery systems, where biocompatibility, sterilization tolerance, and chemical inertness are non-negotiable. Construction firms utilize large volumes of transparent PC and PMMA sheets for architectural glazing, protective barriers, and sound insulation panels, driven by the materials' combination of light transmission and superior resistance to weather and vandalism. These customers often demand certification and traceability, focusing procurement decisions on reliable suppliers capable of meeting stringent quality management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 72.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SABIC, Covestro AG, LyondellBasell Industries N.V., Trinseo S.A., Teijin Limited, Mitsubishi Chemical Corporation, Chi Mei Corporation, Sumitomo Chemical Co., Ltd., Evonik Industries AG, LG Chem, Arkema S.A., Kuraray Co., Ltd., Eastman Chemical Company, A.Schulman, Inc., Formosa Plastics Corporation, INEOS Styrolution Group GmbH, RTP Company, Hexcel Corporation, Toray Industries, Inc., and Entec Polymers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rigid Transparent Plastics Market Key Technology Landscape

The technological landscape for rigid transparent plastics is continuously evolving, focusing primarily on optimizing polymerization processes, enhancing material performance characteristics, and addressing sustainability challenges. For Polycarbonate (PC), technological efforts are directed towards non-phosgene manufacturing routes to mitigate environmental risks associated with hazardous chemicals, alongside developing high-flow grades suitable for intricate, thin-wall injection molding parts required by the electronics sector. In the realm of Polymethyl Methacrylate (PMMA), continuous cast and cell cast technologies are being refined to produce sheets with extremely high optical quality and minimal internal stress, catering to advanced display and architectural applications. Furthermore, co-extrusion technology is vital, enabling the layering of different polymer types to achieve multifunctional transparent sheets, often combining a rigid core with a protective, scratch-resistant surface layer.

A major area of innovation is in surface modification and coating technologies. Manufacturers are increasingly utilizing advanced plasma treatment, UV-curing, and hard-coating techniques (such as those involving silicone or nano-particle additives) to enhance the scratch resistance and weatherability of PC and PMMA, thereby extending their utility in outdoor and high-wear environments like automotive headlights and public transport glazing. These coatings are crucial for enabling these plastics to effectively substitute traditional glass, matching or exceeding its durability under operational conditions. Furthermore, the development of functional materials, such as transparent conductive polymers and anti-fog coatings, is expanding the application scope into smart windows, sensor covers, and specialized medical instrumentation, adding significant value beyond mere optical clarity and structural support.

In response to global sustainability mandates, technological advancements in chemical recycling, particularly for PET and PC, are becoming foundational. Depolymerization techniques are being perfected to break down complex plastic waste back into original monomers of high purity, which can then be repolymerized into virgin-quality transparent resins. This closed-loop approach drastically reduces reliance on fossil fuels and minimizes landfill waste, offering a compelling competitive edge for companies that successfully commercialize these processes. Additionally, research into bio-based plastics derived from renewable feedstocks, while still nascent in high-performance rigid segments like PC, represents a critical long-term technological trajectory aimed at achieving carbon neutrality and satisfying the growing consumer demand for sustainable material solutions across all major end-use sectors.

Regional Highlights

- Asia Pacific (APAC): Dominance and Rapid Expansion

The APAC region commands the largest share of the Rigid Transparent Plastics Market and is projected to exhibit the highest growth rate during the forecast period. This dominance is intrinsically linked to the region’s status as a global manufacturing powerhouse for electronics, automotive components, and consumer goods, particularly driven by economies like China, India, Japan, and South Korea. Rapid urbanization and infrastructure development, especially the massive construction projects utilizing transparent sheets for modern architecture and sound barriers, fuel robust demand for PC and PMMA. Furthermore, the burgeoning middle class in countries like India and Southeast Asia is driving explosive growth in packaged food and beverage consumption, resulting in significant uptake of PET and specialized transparent packaging films. The presence of low-cost labor and supportive governmental policies encouraging industrial output makes APAC the most attractive region for capacity expansion by both regional and international polymer producers, leading to intense competition and high production volumes. The strategic location of major component supply chains reinforces its pivotal role in the global market ecosystem, continuously setting the benchmark for price and production efficiency.

The regional market is heavily influenced by domestic players who possess significant scale and technological capabilities, such as those in Taiwan and mainland China, resulting in efficient supply chains but also creating pressure on global pricing. Local manufacturers are increasingly investing in high-quality polymerization plants to cater to the growing demand for specialty applications, moving beyond basic commodity grades. However, the region also faces growing challenges related to environmental regulation and waste management, particularly concerning single-use plastics. This pressure is slowly accelerating the adoption of recycled PET (rPET) and forcing industries to seek innovative solutions for multilayer and hard-to-recycle transparent polymers, signaling a future shift towards circular economy practices, albeit at a slower pace than in Europe or North America. - North America: Innovation and Medical Sector Focus

North America holds a substantial market share, driven primarily by high-value applications in the medical, aerospace, and advanced automotive industries. The region’s demand is characterized by a strong emphasis on high-performance polymers, strict regulatory compliance (FDA/EPA), and a willingness to adopt novel, high-cost transparent plastics with superior characteristics such as improved chemical resistance or extreme temperature tolerance. The medical device manufacturing cluster, particularly in the U.S., is a major consumer of specialized transparent PC and PMMA for surgical tools, labware, and diagnostic enclosures, requiring materials that can withstand rigorous sterilization procedures without degradation. This focus on specialty and regulated applications ensures that the average selling price of transparent plastics in North America is generally higher than the global average, prioritizing quality and certification over sheer volume.

Technological innovation, particularly in areas like advanced material compounding and additive manufacturing (3D printing of transparent parts), is a key growth driver. The region is also at the forefront of the sustainability movement, with significant corporate commitments driving demand for transparent plastics incorporating post-consumer recycled content (PCR) or certified bio-based origins. Major U.S.-based companies are investing heavily in chemical recycling infrastructure to establish closed-loop systems for PC and PET, positioning the region as a leader in material circularity. While the volume growth may not match APAC, the value-driven nature of the North American market ensures continued financial strength and technological relevance, dictating future trends in performance and sustainability standards. - Europe: Strict Sustainability Mandates and Automotive Lightweighting

Europe is a mature market known for its stringent environmental regulations, particularly those originating from the European Union (EU) mandates on plastic packaging and waste reduction, driving rapid adoption of sustainable transparent solutions. The region's growth is largely fueled by the robust automotive sector, which utilizes transparent plastics extensively for vehicle lightweighting—a critical factor in meeting strict EU emission standards and enhancing the efficiency of electric vehicles. PC glazing, lightweight headlamps, and specialized interior components are key applications contributing to consistent demand. Furthermore, the construction sector sees steady growth, utilizing high-performance PMMA and PC for energy-efficient architectural glazing and safety barriers in public infrastructure.

The European market is pioneering the implementation of circular economy principles. Regulations such as the Packaging and Packaging Waste Regulation (PPWR) are forcing brand owners and plastic converters to dramatically increase the recycled content in their transparent packaging, boosting the market for chemically recycled and high-purity mechanical rPET. This regulatory environment compels European manufacturers to invest continuously in cutting-edge sorting and recycling technologies. Although economic volatility and high energy costs pose operational challenges, the unwavering commitment to sustainability and high technical standards maintains Europe’s position as a critical, high-value consumer and technological incubator for rigid transparent plastics, particularly in segments requiring certified eco-friendly attributes. - Latin America (LATAM) and Middle East & Africa (MEA): Emerging Demand and Infrastructure Growth

The LATAM and MEA regions represent emerging markets characterized by accelerating industrialization and infrastructural development. Demand in Latin America, particularly in Brazil and Mexico, is heavily concentrated in the packaging sector, driven by increasing per capita consumption of packaged goods and beverages, utilizing cost-effective PET. Economic modernization and rising disposable incomes are creating opportunities for higher-value transparent plastics in construction and consumer electronics assembly. However, market growth in LATAM is often susceptible to economic volatility and local currency fluctuations, posing a challenge to consistent import and investment strategies.

The Middle East, driven by significant petrochemical investment, is a major producer of raw materials and base polymers (including PET and PC), leveraging abundant access to hydrocarbon feedstocks. The demand side is spurred by massive construction projects and investment in modern healthcare infrastructure, driving the requirement for high-durability, weather-resistant transparent plastics. Africa's market is nascent but growing, primarily focused on basic packaging needs. Both MEA and LATAM are focused on building self-sufficiency in polymer production to reduce reliance on imports, signaling future expansion in downstream converting capacities and establishing regional supply chains for rigid transparent plastics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rigid Transparent Plastics Market.- SABIC

- Covestro AG

- LyondellBasell Industries N.V.

- Trinseo S.A.

- Teijin Limited

- Mitsubishi Chemical Corporation

- Chi Mei Corporation

- Sumitomo Chemical Co., Ltd.

- Evonik Industries AG

- LG Chem

- Arkema S.A.

- Kuraray Co., Ltd.

- Eastman Chemical Company

- A.Schulman, Inc. (now part of LyondellBasell)

- Formosa Plastics Corporation

- INEOS Styrolution Group GmbH

- RTP Company

- Hexcel Corporation

- Toray Industries, Inc.

- Entec Polymers

Frequently Asked Questions

Analyze common user questions about the Rigid Transparent Plastics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Rigid Transparent Plastics Market?

The central growth driver is the increasing demand for lightweight, high-performance materials in the automotive and packaging industries, primarily driven by regulatory pressures for fuel efficiency and the global rise in packaged consumer goods consumption. The substitution of traditional heavy materials like glass with transparent plastics (e.g., PC and PMMA) is key to this expansion, offering superior impact resistance and clarity.

Which material segment holds the largest market share in terms of volume and why?

Polyethylene Terephthalate (PET) holds the largest market share by volume, predominantly due to its ubiquitous use in the food and beverage packaging industry (bottles, containers). PET is favored for its excellent barrier properties, recyclability, cost-effectiveness, and compliance with food safety standards, making it the dominant material in high-volume, commodity transparent applications worldwide.

How is the focus on sustainability impacting the production and consumption of these plastics?

Sustainability mandates are profoundly impacting the market by compelling manufacturers to invest heavily in advanced chemical recycling technologies for polymers like PET and PC, enabling closed-loop systems. There is also escalating demand for transparent plastics derived from bio-based feedstocks and those containing verified Post-Consumer Recycled (PCR) content, especially in North America and Europe.

What are the main application challenges for Rigid Transparent Plastics in the automotive sector?

In the automotive sector, the main challenges include achieving superior abrasion and scratch resistance comparable to glass, and ensuring long-term UV stability and weatherability for exterior components like glazing and lighting systems. Specialized hard coatings and high-performance polymer grades are critical technological solutions addressing these rigorous durability requirements.

Which geographical region offers the highest growth potential for Rigid Transparent Plastics through 2033?

Asia Pacific (APAC), particularly China and India, offers the highest growth potential. This growth is sustained by rapid urbanization, massive infrastructure development, expansion of domestic electronics manufacturing, and exponential growth in consumer spending on packaged goods, leading to unparalleled scale in plastic production and consumption capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager