Road Asset Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441709 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Road Asset Management Software Market Size

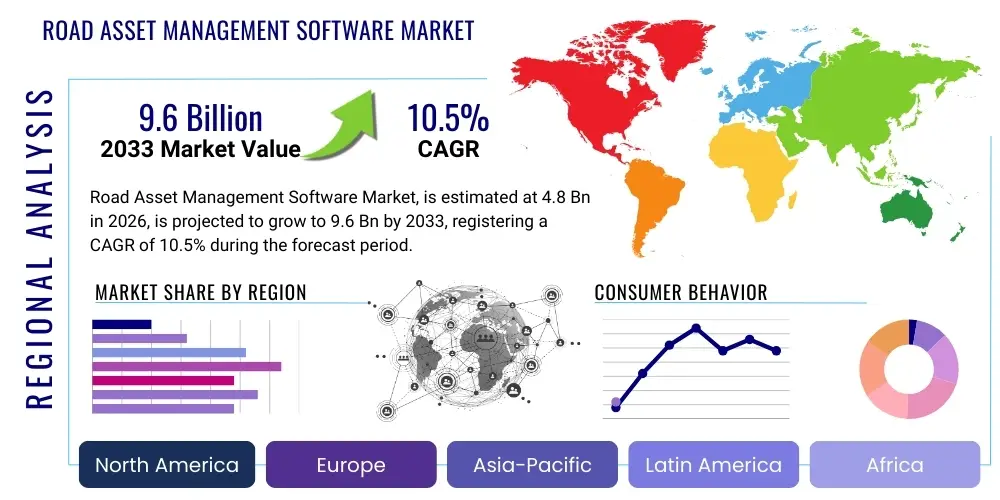

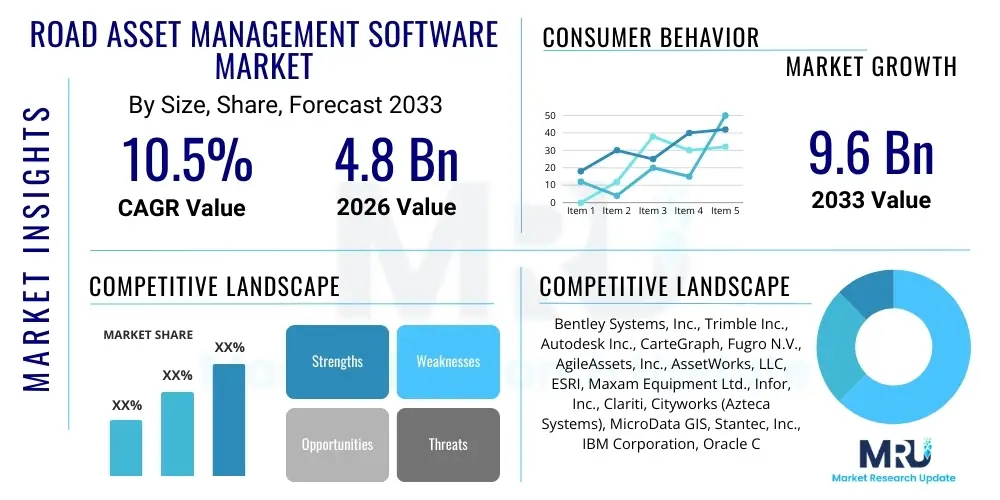

The Road Asset Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Road Asset Management Software Market introduction

The Road Asset Management Software (RAMS) Market encompasses dedicated digital solutions designed to help government bodies, transportation departments, and private infrastructure owners optimize the life cycle and performance of road networks and related assets such as pavements, bridges, tunnels, traffic signals, and signage. These sophisticated platforms facilitate comprehensive data collection, storage, analysis, and reporting, moving road management beyond reactive repair towards proactive, data-driven maintenance strategies. RAMS solutions integrate various inputs, including Geographic Information Systems (GIS), sensor data, drone imagery, and historical maintenance records, to create a holistic view of asset condition and projected deterioration, thereby enabling optimized capital expenditure planning and regulatory compliance.

The primary function of RAMS is to enhance the longevity and safety of critical transportation infrastructure while ensuring efficient allocation of public funds. By providing predictive analytics capabilities, the software helps stakeholders determine the most cost-effective intervention strategies, minimizing total ownership costs over the asset’s lifespan. Major applications include network-level planning, project-level prioritization, condition assessment modeling, and financial reporting. The widespread adoption of these solutions is driven by the global imperative to manage aging infrastructure, coupled with increasing governmental mandates for transparency and accountability in public works spending.

Key benefits derived from implementing RAMS include reduced maintenance backlogs, improved safety indices due to timely repairs, enhanced network resiliency against environmental stresses, and significant operational efficiencies gained through automated workflow management and mobile data collection. Furthermore, RAMS platforms support long-term strategic planning by simulating various investment scenarios, ensuring that infrastructure investments align with broader economic and sustainability objectives. The transition towards cloud-based and mobile-accessible platforms is accelerating, offering greater flexibility and scalability to diverse governmental and organizational sizes.

Road Asset Management Software Market Executive Summary

The Road Asset Management Software Market is undergoing a rapid evolution, primarily driven by increasing urbanization and the critical need for digital transformation in infrastructure maintenance worldwide. Current business trends indicate a strong pivot towards Software-as-a-Service (SaaS) models, offering governmental agencies and infrastructure owners lower upfront costs and easier integration with existing enterprise resource planning (ERP) systems. There is also a notable trend toward incorporating sophisticated analytical tools, such as predictive modeling and Digital Twin capabilities, moving software functionalities far beyond simple inventory management to complex scenario planning and prescriptive maintenance recommendations. Consolidation among major vendors and strategic partnerships focused on integrating IoT and spatial data platforms characterize the competitive landscape.

Regionally, North America and Europe remain the largest markets, characterized by mature infrastructure networks and strict regulatory frameworks demanding continuous condition monitoring and reporting. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period, fueled by massive government investments in new road construction, coupled with the need to modernize existing, rapidly expanding urban road networks. Countries like India and China are prioritizing smart city initiatives, creating vast opportunities for scalable RAMS implementation. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily adopting solutions for large-scale, newly developed highway and concession projects, often mandated by build-operate-transfer (BOT) agreements.

In terms of segmentation, the Cloud deployment segment is dominating new installations due to its inherent advantages in scalability, remote access, and lower capital expenditure, making it particularly attractive to smaller municipal organizations. Conversely, larger, established governmental departments still often prefer On-premise solutions due to strict data security requirements and existing legacy IT infrastructure. Application-wise, pavement management systems represent the largest segment, given the high frequency of wear and tear, but the fastest growth is observed in structural asset management (bridges and tunnels), reflecting growing concerns over the condition and safety of complex, high-value structures globally. The Services segment, particularly consulting and integration services, is crucial for market expansion, ensuring successful platform adoption and customization across varied regulatory environments.

AI Impact Analysis on Road Asset Management Software Market

Common user inquiries regarding AI’s influence on the Road Asset Management Software Market frequently center on its ability to transition maintenance practices from reactive to truly predictive, minimizing costly emergency repairs and optimizing capital expenditure cycles. Users are keen to understand how AI can handle the massive influx of unstructured data—specifically images, videos from drone inspections, and high-frequency sensor readings—to automate fault detection and classification, thus reducing the reliance on manual visual inspections which are often inconsistent and subjective. Key concerns often revolve around the accuracy and bias of AI models trained on regional data, the initial investment required for sophisticated AI infrastructure, and the potential displacement of skilled human inspectors. Expectations are high that AI will significantly lower operational costs while improving the reliability and safety of infrastructure networks through unparalleled analytical depth and speed.

The integration of Artificial Intelligence, particularly machine learning (ML) and deep learning (DL) techniques, is revolutionizing RAMS by providing capabilities far beyond traditional statistical modeling. AI algorithms are now capable of processing complex spatial and temporal datasets to predict infrastructure deterioration curves with high precision, factoring in environmental variables, traffic load, and historical repair efficacy. This predictive capability allows asset managers to schedule maintenance precisely when it is most economically beneficial—the sweet spot between structural failure and preventative overkill. Furthermore, AI facilitates the automatic identification of defects, such as cracks, potholes, and spalling, from high-resolution imagery captured by mobile mapping systems or Unmanned Aerial Vehicles (UAVs), drastically speeding up condition assessments and enhancing data granularity.

AI also plays a critical role in optimizing resource allocation and work order generation. By synthesizing maintenance requirements across an entire road network, AI can recommend prioritized intervention lists that maximize the Network Health Index (NHI) within a defined budget constraint, solving complex optimization problems that are intractable for human planners. Vendors are increasingly embedding AI modules directly into RAMS platforms, offering features like natural language processing (NLP) for efficient report generation and conversational interfaces for accessing key asset intelligence. The adoption of AI is mandatory for achieving true smart infrastructure management, promising substantial improvements in efficiency, accuracy, and overall network performance.

- Predictive Maintenance Scheduling: AI utilizes machine learning models to accurately forecast asset deterioration based on traffic, climate, and material properties, optimizing the timing of intervention.

- Automated Condition Assessment: Deep learning processes imagery (drone, mobile LiDAR) to automatically detect, classify, and quantify surface and structural defects (e.g., crack width, severity of rutting).

- Enhanced Data Fusion: AI integrates disparate data sources—GIS, IoT sensors, weather data, and historical maintenance logs—to provide a unified, context-aware view of asset health.

- Optimized Budget Allocation: Machine learning algorithms model various funding scenarios to prioritize projects that yield the highest return on investment (ROI) in terms of safety and structural longevity.

- Digital Twin Development: AI supports the continuous calibration and updating of digital twins of road assets, ensuring simulations remain accurate reflections of real-world conditions.

- Risk Scoring and Safety Prediction: Algorithms assess structural integrity and potential failure risks, contributing to proactive public safety measures and timely closure warnings.

DRO & Impact Forces Of Road Asset Management Software Market

The market dynamics for Road Asset Management Software are significantly shaped by a confluence of accelerating drivers and persistent restraints, creating opportunities that depend heavily on technological adaptation and supportive government policies. The fundamental driving force is the global deterioration of existing civil infrastructure, often decades past its design life, necessitating immediate, strategic, and data-backed investment decisions. Simultaneously, high initial implementation costs and challenges related to integrating disparate legacy systems act as major restraints, particularly for smaller municipal organizations with limited IT budgets or organizational resistance to change. The overall market trajectory, however, is being propelled forward by technological opportunities centered on the proliferation of IoT sensors, mobile computing, and the maturity of cloud services, which collectively offer pathways to more affordable and scalable deployment models.

Drivers: Intensifying global urbanization strains existing road networks, demanding sophisticated management tools to maintain traffic flow and structural integrity. Furthermore, there is growing legislative pressure and public demand for transparency in infrastructure spending, compelling government agencies to adopt auditable, data-driven software solutions like RAMS. The regulatory environment, particularly in mature markets, increasingly mandates specific standards for asset condition reporting and safety compliance, making RAMS an essential tool rather than an optional investment. The capability of RAMS to transition management from reactive (fixing failures) to preventative (avoiding failures) offers substantial, quantifiable long-term cost savings, accelerating adoption.

Restraints: The primary restraint remains the high initial capital expenditure associated with purchasing sophisticated software licenses, integrating the platform, and training personnel. Moreover, many infrastructure owners operate using siloed data systems, leading to interoperability challenges when trying to centralize asset data into a single RAMS platform. Data quality and completeness are significant hurdles; if input data from historical records or outdated inspection methods is poor, the predictive models generated by the software will yield unreliable results. Additionally, securing sensitive infrastructure data in a cloud environment presents security concerns that can deter adoption, especially in regions with strict data sovereignty laws.

Opportunities: Significant growth opportunities lie in the integration of RAMS with emerging technologies such as Building Information Modeling (BIM) and Digital Twins, creating comprehensive virtual replicas for lifecycle management. The market is ripe for modular, AI-enabled solutions that cater specifically to non-pavement assets (e.g., drainage systems, smart lighting, traffic control systems), extending the scope of traditional road management. Developing countries offer vast untapped potential as they embark on major infrastructure development and modernization projects, often leaping directly to advanced, cloud-based solutions. Strategic partnerships between RAMS vendors and consulting engineering firms to provide complete, integrated infrastructure management services will also unlock new revenue streams.

- Drivers:

- Aging global infrastructure demanding strategic maintenance.

- Increased government accountability and regulatory mandates for infrastructure safety and spending transparency.

- Rapid urbanization leading to greater strain and complexity in road networks.

- Restraints:

- High initial investment costs and complexity of large-scale system integration.

- Lack of standardized data collection protocols and poor quality of legacy asset data.

- Organizational resistance to technology adoption and shortage of specialized staff.

- Opportunities:

- Integration with IoT, Mobile Mapping, and BIM for enhanced data capture and visualization.

- Expansion into emerging markets undertaking major infrastructure build-outs.

- Development of specialized solutions for ancillary assets (traffic furniture, drainage).

- Impact Forces:

- Technological advancements (AI/ML) accelerate predictive capabilities (Positive).

- Economic volatility impacts public works budgets, potentially delaying large contracts (Negative).

- Increasing environmental pressures drive demand for resilient infrastructure modeling (Positive).

Segmentation Analysis

The Road Asset Management Software market is segmented across several critical dimensions, including deployment mode, component, organization size, and specific application areas, reflecting the diversity of user needs and operational scale globally. The segmentation by deployment mode—Cloud vs. On-premise—is crucial, as it dictates the accessibility, scalability, and security architecture of the solution. While large governmental agencies often favor On-premise for perceived control over sensitive data, the overwhelming momentum favors the Cloud segment due to its operational agility, subscription-based pricing models, and rapid deployment capabilities, which are particularly attractive to smaller municipal bodies and private concessionaires.

Further analysis by component reveals a vital distinction between core software platforms and the associated professional and managed services required for successful implementation. While the software segment drives innovation through new features like AI and spatial analytics, the services segment—encompassing installation, customization, data migration, and training—often constitutes a significant portion of the total contract value and is essential for ensuring high user adoption and long-term customer satisfaction. The complexity of integrating RAMS with diverse governmental systems necessitates ongoing consulting support, sustaining the high growth of the services component.

The segmentation by application highlights where the immediate strategic focus and budget allocation lie within asset owners. Pavement management systems currently hold the largest market share globally because pavements represent the most significant physical asset and require frequent assessment and repair. However, the structural segment (bridges and tunnels) is experiencing the highest growth rate, driven by regulatory urgency following high-profile structural failures and the realization that sophisticated tools are required to manage these high-risk, high-cost assets. Understanding these segments is key for vendors to tailor offerings, such as developing specialized analytical modules optimized for material stress modeling in structural components versus performance index calculation for pavements.

- By Component:

- Software (Core RAMS platforms, GIS modules, Predictive analytics)

- Services (Consulting, Implementation and Integration, Managed Services, Training and Support)

- By Deployment Mode:

- On-premise

- Cloud-based (SaaS)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises (National/State Agencies)

- By Application:

- Pavement Management Systems

- Bridge and Tunnel Management Systems (Structural Assets)

- Ancillary Asset Management (Guardrails, Signage, Lighting, Drainage)

- Work Order and Maintenance Management

Value Chain Analysis For Road Asset Management Software Market

The value chain for the Road Asset Management Software market commences with upstream activities focusing on fundamental research and development (R&D), particularly in spatial data handling, predictive modeling algorithms, and software architecture design (SaaS vs. proprietary). This stage involves high technical expertise in GIS, civil engineering, and data science, where vendors develop core intellectual property and ensure compliance with global engineering standards. Key activities include sourcing high-resolution mapping data, integrating APIs for hardware (IoT, drones), and defining the software’s modular structure, ensuring it can handle vast datasets efficiently and securely while remaining flexible for customization based on regional needs.

Midstream activities primarily encompass core software development, system integration, and professional services. System integrators and specialized IT consulting firms play a crucial role, bridging the gap between the standardized software offering and the complex, specific requirements of government clients. These firms handle data migration from legacy systems, customization of analytical models to fit local pavement types and deterioration rates, and ensuring interoperability with financial and ERP systems. The distribution channel is often hybrid: large national agencies frequently rely on direct sales and procurement processes with Tier 1 vendors, while smaller municipalities and regional clients typically utilize Value-Added Resellers (VARs) or regional technology partners who provide localized support and implementation expertise.

The downstream component involves the end-user deployment, ongoing support, and managed services. This phase focuses heavily on training asset managers, field crews, and IT staff to effectively utilize the platform for daily operations, data capture via mobile apps, and strategic planning. Customer feedback at this stage is vital, driving subsequent R&D cycles for bug fixes and feature enhancements, particularly concerning the accuracy of AI predictions and the usability of field collection tools. Direct distribution allows vendors to maintain close relationships and offer highly specialized, long-term maintenance contracts, whereas indirect channels (VARs) offer geographical reach and localized deployment expertise, ensuring the value proposition is realized throughout the asset lifecycle.

Road Asset Management Software Market Potential Customers

The primary customers for Road Asset Management Software are public sector entities responsible for maintaining transportation networks, ranging from national departments of transportation to local municipal bodies. These entities require comprehensive tools to manage large, disparate portfolios of assets, meet regulatory performance targets, and demonstrate fiscal responsibility in infrastructure spending. National and State Departments of Transportation (DOTs) represent the largest customers, often needing enterprise-level, highly customized systems capable of handling millions of data points across thousands of miles of high-volume roadways, bridges, and tunnels, often favoring robust On-premise or secure private cloud solutions.

Beyond traditional governmental bodies, private infrastructure owners and concessionaires constitute a rapidly growing customer segment. Companies operating under Public-Private Partnership (PPP) or Build-Operate-Transfer (BOT) models for highways, toll roads, and tunnels have a strong financial incentive to maximize asset life and minimize operational costs to enhance profitability over the contract period. These private operators typically prioritize solutions that offer high levels of efficiency, advanced predictive modeling, and integration with real-time operational data, often preferring flexible Cloud-based subscription models for speed of deployment and integration with their corporate finance systems.

Furthermore, Engineering, Procurement, and Construction (EPC) firms, along with specialized transportation consulting firms, act as significant purchasers and influencers of RAMS, particularly during the design and construction phases of new projects or when managing long-term maintenance contracts on behalf of government clients. These firms utilize RAMS functionality for design optimization, lifecycle cost analysis, and ensuring that new assets are commissioned with comprehensive digital records. Thus, the target audience spans regulatory bodies requiring compliance reporting, public agencies focused on service delivery, and private firms driven by operational profitability and efficient capital maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bentley Systems, Inc., Trimble Inc., Autodesk Inc., CarteGraph, Fugro N.V., AgileAssets, Inc., AssetWorks, LLC, ESRI, Maxam Equipment Ltd., Infor, Inc., Clariti, Cityworks (Azteca Systems), MicroData GIS, Stantec, Inc., IBM Corporation, Oracle Corporation, PTV Group, Deighton Associates Ltd., Assetic Pty Ltd., Vision Asset Management. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road Asset Management Software Market Key Technology Landscape

The technological evolution of the Road Asset Management Software market is primarily defined by the convergence of spatial intelligence, remote sensing, and advanced computing infrastructures. Geographic Information Systems (GIS) form the foundational layer, providing the mapping and spatial framework necessary to locate, visualize, and analyze assets accurately. Modern RAMS solutions are deeply integrated with high-precision GIS, allowing asset condition data to be tied directly to location coordinates, thus enhancing data integrity and enabling sophisticated spatial analysis like proximity analysis and network connectivity modeling. The shift towards web-based and mobile GIS platforms ensures field crews can access and update asset data in real-time, drastically reducing the latency between inspection and data availability for analysis.

The increasing ubiquity of the Internet of Things (IoT) sensors and connected devices is fundamentally altering how road asset data is collected. Permanent monitoring systems installed on bridges and critical pavement sections provide continuous, real-time data on parameters like vibration, stress, temperature, and traffic load. This high-frequency data influx is essential for training and validating the next generation of predictive analytical models powered by AI and machine learning. Furthermore, remote sensing technologies, including mobile LiDAR (Light Detection and Ranging) and drone-based photogrammetry, are automating the collection of highly detailed surface condition data, replacing tedious manual inspections and generating comprehensive Digital Twins of road infrastructure.

Cloud computing infrastructure, predominantly provided through public cloud services (Azure, AWS, Google Cloud), is the backbone supporting the scalability and processing power required for these massive datasets. Cloud deployment facilitates rapid data storage, on-demand analytical processing, and secure accessibility for decentralized governmental agencies. Digital Twins—virtual replicas of physical road assets—are emerging as a critical technological capability, combining real-time IoT data with historical RAMS information and BIM models to simulate maintenance impacts and long-term performance under various scenarios. This integration of GIS, IoT, AI, and Cloud computing defines the technological competitive edge in the current market, driving efficiency and predictive accuracy.

Regional Highlights

- North America: This region is characterized by high market maturity, significant investment in high-value infrastructure (bridges, tunnels), and strict regulatory frameworks, such as federal mandates for highway performance monitoring and asset inventory. The US market dominates, driven by aging infrastructure and substantial funding allocated through programs aimed at infrastructure modernization. Adoption rates are high across federal, state, and local DOTs, with a strong preference for advanced predictive analytics and AI integration to optimize already vast road networks. Canada also represents a strong market, focusing heavily on climate resilience modeling in RAMS.

- Europe: The European market is highly fragmented but sophisticated, driven by national and EU-level initiatives focused on standardization and cross-border infrastructure management (e.g., TEN-T network). Western European countries (Germany, UK, France) exhibit strong RAMS adoption, favoring solutions compliant with international standards like ISO 55000. There is a notable focus on integrating RAMS with BIM for comprehensive lifecycle management and prioritizing sustainable maintenance practices, leading to a strong uptake of predictive and scenario-planning modules.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by massive governmental expenditure on new urban and inter-city road development, especially in rapidly industrializing nations such as China, India, and Southeast Asian countries. Market growth is dual-faceted: implementing RAMS for newly built, smart infrastructure projects and modernizing legacy systems in established urban centers. Cloud adoption is particularly strong here due to scalability requirements and the ability to leapfrog older, costly on-premise IT infrastructure. Competition is intensifying as local vendors compete with global market leaders.

- Latin America (LATAM): The LATAM market is emerging, driven primarily by private concessionaires managing key toll roads and highways under PPP models, particularly in Brazil, Mexico, and Chile. These private entities require RAMS to meet performance metrics stipulated in concession contracts, focusing on operational efficiency and transparent reporting. Governmental adoption is slower but accelerating, supported by international development bank funding aimed at enhancing public infrastructure quality and anti-corruption measures through transparent spending enabled by RAMS.

- Middle East and Africa (MEA): The MEA region shows robust growth, especially in the GCC countries (UAE, Saudi Arabia, Qatar), fueled by massive investment in futuristic infrastructure projects, smart cities, and diversified economic growth plans. RAMS is critical for managing newly developed, high-specification road networks and ensuring resilience against extreme environmental conditions (heat, sand). Africa remains a nascent market, with adoption concentrated around large urban centers and infrastructure projects backed by foreign direct investment or development aid, focusing mainly on basic inventory and condition assessment modules.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road Asset Management Software Market.- Bentley Systems, Inc.

- Trimble Inc.

- Autodesk Inc.

- CarteGraph

- Fugro N.V.

- AgileAssets, Inc.

- AssetWorks, LLC

- ESRI

- Maxam Equipment Ltd.

- Infor, Inc.

- Clariti

- Cityworks (Azteca Systems)

- MicroData GIS

- Stantec, Inc.

- IBM Corporation

- Oracle Corporation

- PTV Group

- Deighton Associates Ltd.

- Assetic Pty Ltd.

- Vision Asset Management

Frequently Asked Questions

Analyze common user questions about the Road Asset Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Road Asset Management Software (RAMS) and why is it essential?

RAMS is a specialized digital platform used by infrastructure owners to manage the lifecycle of roads and related assets. It is essential because it shifts maintenance from reactive repair to proactive, data-driven planning, optimizing budget allocation, ensuring regulatory compliance, and maximizing infrastructure longevity and safety.

How does AI contribute to modern Road Asset Management?

AI, specifically machine learning, processes vast amounts of data (imagery, sensor readings) to automate defect detection, predict future asset deterioration curves, and optimize complex work order scheduling, resulting in precise maintenance timing and significant cost reductions for DOTs.

Is Cloud or On-premise deployment preferred for RAMS?

While On-premise solutions are used by large entities needing stringent security control over legacy data, Cloud-based (SaaS) deployment is increasingly preferred due to its scalability, lower upfront capital expenditure, rapid deployment, and enhanced accessibility for mobile field crews and regional offices.

What are the primary challenges limiting the adoption of RAMS?

Key challenges include the high initial cost of implementation, complexity in integrating RAMS with existing governmental IT legacy systems, and the organizational hurdle of ensuring high-quality, standardized data collection practices across vast road networks.

Which application segment within RAMS is experiencing the fastest growth?

While Pavement Management remains the largest segment, structural asset management (Bridge and Tunnel Management Systems) is demonstrating the fastest growth rate, driven by urgent regulatory demands and the critical safety implications associated with high-value complex infrastructure failures globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager