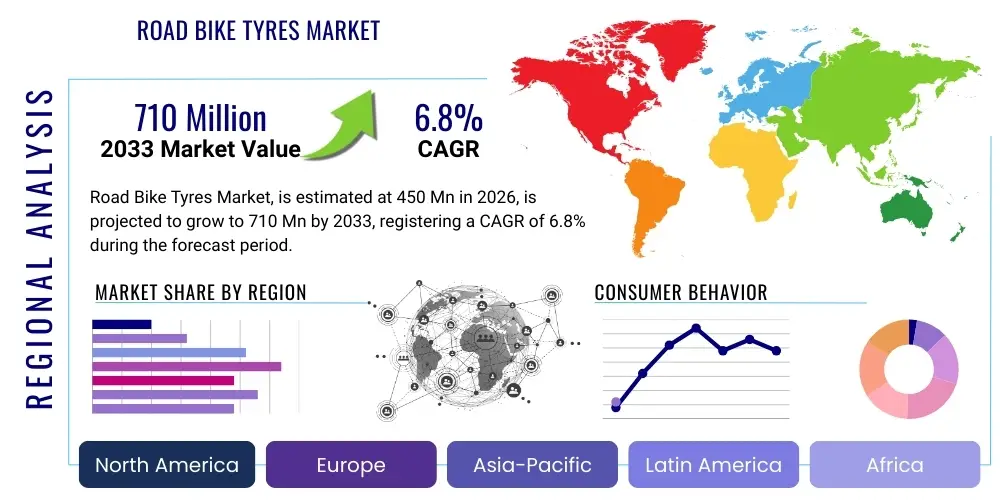

Road Bike Tyres Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443296 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Road Bike Tyres Market Size

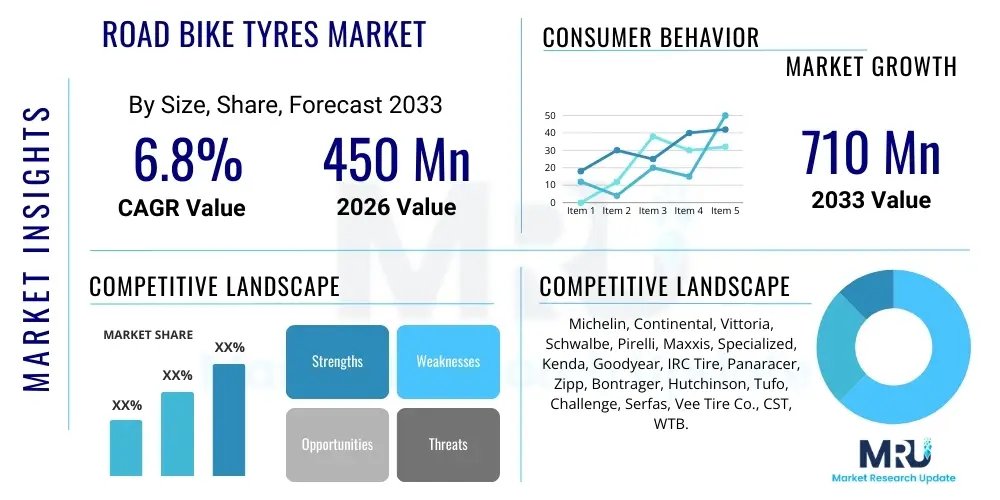

The Road Bike Tyres Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global emphasis on health, fitness, and sustainable transportation methods. The road cycling segment, particularly amateur racing and high-performance endurance riding, continues to drive demand for premium, technologically advanced tyre solutions that offer superior grip, rolling resistance, and puncture protection. The maturation of tubeless technology, transitioning from mountain biking to becoming the standard in high-end road cycling, represents a significant value addition to the market size.

Market expansion is also heavily influenced by fluctuating raw material costs, primarily synthetic and natural rubber, alongside advancements in carcass construction and compound chemistry. Manufacturers are continually investing in research and development (R&D) to optimize the balance between speed (low rolling resistance) and durability (mileage and puncture resistance), which are often conflicting requirements in tyre design. The steady replacement cycle of tyres, coupled with the rising number of cyclists globally—especially in emerging economies where cycling culture is gaining momentum—ensures a consistent revenue stream for both Original Equipment Manufacturers (OEMs) and the crucial Aftermarket segment. These factors collectively contribute to a robust long-term outlook for the sector, making it an attractive area for investment in material science and digital integration, specifically focusing on lightweight and aerodynamic properties.

Road Bike Tyres Market introduction

The Road Bike Tyres Market encompasses the global production and distribution of pneumatic tyres designed specifically for use on road bicycles, including racing, endurance, and gravel applications. These products are crucial components determining bicycle performance, safety, and rider comfort, engineered to withstand high pressures and minimize rolling resistance on paved or moderately maintained surfaces. Major applications range from competitive professional cycling events and intensive amateur training to daily commuting and recreational fitness rides. Key benefits include improved speed through reduced friction, enhanced cornering stability due to specialized tread patterns and compounds, and increased puncture resistance via advanced sidewall protection layers. Driving factors include the global surge in cycling adoption as a leisure and health activity, government initiatives promoting cycling infrastructure, and continuous technological innovation focusing on tubeless compatibility and advanced material science, such as graphene-infused rubber compounds, which enhance durability and speed simultaneously.

The modern road bike tyre is a complex piece of engineering, categorized primarily by construction type: clincher, tubular, and the increasingly dominant tubeless ready configurations. Product evolution is characterized by a push towards wider tyre formats (25mm to 32mm) which, counterintuitively, often improve aerodynamics, comfort, and grip without sacrificing rolling speed when paired with appropriately wide rims. This shift necessitates constant material refinement to reduce weight while maintaining structural integrity under varied load and thermal conditions. The aftermarket segment dominates revenue generation as cyclists frequently replace tyres based on wear, season, or specific event requirements, often seeking higher performance alternatives than those supplied as original equipment.

Road Bike Tyres Market Executive Summary

The Road Bike Tyres Market exhibits dynamic business trends characterized by rapid technological assimilation, particularly the widespread adoption of tubeless technology across mid-to-high-end product lines, necessitating new manufacturing protocols and sealant integration solutions. Strategic alliances between tyre manufacturers and major bicycle brands (OEMs) are common, securing placement on new model year bikes and influencing consumer aftermarket preferences. Regionally, Europe and North America currently hold the largest market shares due to established cycling cultures, high disposable incomes facilitating premium product purchases, and extensive professional racing circuits, though the Asia Pacific (APAC) region is forecasted to show the highest growth rate, fueled by urbanization, improved infrastructure, and a burgeoning middle class adopting cycling for fitness and transport. Segment trends are dominated by the Clincher segment in terms of volume due to its historical prevalence and cost-effectiveness, while the Tubeless segment drives value growth, reflecting consumer demand for performance attributes like lower rolling pressure and superior protection against flats. Material science innovation, specifically in advanced rubber compounds and puncture-resistant layers, remains the primary differentiating factor among competitors, leading to a highly competitive landscape focused on brand loyalty and performance validation through professional endorsements.

AI Impact Analysis on Road Bike Tyres Market

Common user questions regarding AI's impact on the Road Bike Tyres Market center primarily on how machine learning algorithms can optimize material composition for specific performance metrics (e.g., maximizing grip on wet surfaces while minimizing rolling resistance), the potential for smart tyre technology integrating embedded sensors for real-time pressure and wear monitoring, and the use of predictive analytics in manufacturing to reduce waste and improve quality consistency. Users are concerned about the cost implications of AI-driven manufacturing and product design but are highly receptive to the potential for personalized tyre recommendations based on riding style, weight, and typical terrain. The analysis reveals a core expectation that AI will move tyre development beyond traditional empirical testing into high-fidelity simulation and optimization, leading to a new generation of hyper-specialized products tailored for niche cycling disciplines, thereby enhancing rider safety and maximizing performance efficiency.

- Material Optimization: AI algorithms analyze vast datasets of material properties (polymers, fillers, additives) to design novel rubber compounds achieving optimal balances between rolling resistance, durability, and wet grip, drastically reducing R&D cycles.

- Predictive Wear and Maintenance: Integration of tiny, low-power sensors and AI processing enables real-time monitoring of tyre pressure and wear patterns, alerting riders to maintenance needs before failure, enhancing safety and extending product life.

- Manufacturing Efficiency: Machine learning optimizes factory floor operations, predicting equipment failures, refining curing processes, and ensuring consistent quality control across batches, reducing defects and energy consumption.

- Personalized Product Recommendations: AI analyzes rider telemetry data (speed, power, lean angle) to recommend the exact tyre model, pressure, and width combination for peak performance based on individual riding profiles and typical environmental conditions.

- Aerodynamic Simulation: Advanced computational fluid dynamics (CFD) simulations driven by AI rapidly assess the aerodynamic interaction between the tyre shape, rim, and bicycle frame, optimizing profiles for marginal gains in speed.

DRO & Impact Forces Of Road Bike Tyres Market

The Road Bike Tyres Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces dictating market evolution. Primary drivers include the global expansion of cycling as a competitive sport and recreational activity, coupled with persistent technological demand for better performance, particularly in puncture resistance and reduced rolling friction. Restraints primarily involve the high volatility and increasing cost of raw materials, especially petrochemical derivatives required for synthetic rubber and carbon black, alongside significant competition from lower-cost manufacturers, often leading to margin compression in the non-premium segments. Opportunities are strongly linked to the expansion of tubeless systems into mainstream markets, the growing popularity of gravel and all-road cycling requiring hybrid tyre solutions, and the integration of smart technologies for performance monitoring. These forces mandate continuous innovation; companies that successfully leverage material science to offer superior durability at competitive prices, while securing efficient distribution channels, are best positioned for growth.

Driving the market forward is the constant consumer pursuit of marginal gains in performance, compelling manufacturers to invest heavily in advanced compound development, such as the use of silica and graphene to enhance grip and longevity simultaneously. Furthermore, the regulatory environment in many developed nations, which encourages cycling through infrastructure investment and safety mandates, indirectly boosts tyre sales. However, the market faces significant headwinds from counterfeiting and the challenge of managing diverse inventory needs stemming from the proliferation of tyre sizes and rim standards (e.g., hookless rims), which require highly specific tyre bead designs. Successful market navigation hinges on exploiting niche opportunities like high-end track cycling and commuter performance segments, while mitigating supply chain risks associated with global logistics and fluctuating commodity prices.

Segmentation Analysis

The Road Bike Tyres Market is meticulously segmented based on key criteria including construction type, material composition, application, and distribution channel, reflecting the diverse needs of the global cycling community. Analyzing these segments provides critical insights into market dynamics, identifying high-growth areas and segments facing maturation. The segmentation by Construction Type—Clincher, Tubular, and Tubeless—is perhaps the most defining characteristic, highlighting the fundamental shift occurring in performance cycling toward tubeless systems for their superior efficiency and safety benefits. Material segmentation focuses on the core rubber compounds (natural vs. synthetic) and the inclusion of advanced fillers like silica and graphene, which differentiate premium products based on performance attributes like elasticity, rebound, and abrasion resistance. Application segmentation distinguishes between the demanding requirements of professional racing versus the high-mileage expectations of endurance or commuting riders, driving tailored product development across the industry spectrum.

- By Construction Type:

- Clincher (Standard)

- Tubular

- Tubeless Ready/Tubeless

- By Material:

- Natural Rubber Based

- Synthetic Rubber Based

- Advanced Composites (Graphene, Silica Enhanced)

- By Application:

- Racing and Competition

- Endurance and Training

- Commuting and Leisure

- Gravel/All-Road (Hybrid Segment)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket Retail (Online, Specialty Stores, Mass Merchandisers)

- By Width (mm):

- 23mm and Below

- 25mm to 28mm (Sweet Spot)

- 29mm and Above (Gravel and Wider Road)

Value Chain Analysis For Road Bike Tyres Market

The Road Bike Tyres value chain commences with the upstream supply side, dominated by chemical and rubber producers supplying natural rubber latex, synthetic polymers (e.g., SBR, BR), carbon black, silica, and textile/aramid fibers used for casing and puncture belts. Volatility in commodity markets at this stage critically impacts downstream manufacturing costs and product pricing. The core manufacturing process involves highly specialized machinery for mixing compounds, calendering rubber sheets, cutting carcass layers, and molding/curing the final tyre structure. Efficient supply chain management and vertical integration, where companies control compound formulation, are vital competitive advantages. The distribution phase then splits into two primary avenues: Direct sales to Original Equipment Manufacturers (OEMs), who mount tyres onto new bicycles, and the Aftermarket, which involves indirect distribution through specialized cycling retailers, online e-commerce platforms, and large sporting goods chains. The aftermarket is particularly crucial as it represents the replacement market, characterized by high brand loyalty and reliance on expert advice from specialty store staff. Downstream activities involve professional installers, mechanics, and, ultimately, the end-user cyclist, whose feedback drives quality improvement and product innovation.

The upstream segment involves rigorous quality control for raw materials, as the performance characteristics of the final tyre—such as grip in varying temperatures or resistance to abrasion—are largely determined by the precision of the rubber compound mixture. Key challenges at this stage include ethical sourcing of natural rubber and ensuring sustainable manufacturing practices. Moving into the central manufacturing process, automation and precision engineering are paramount, especially in the production of high thread count per inch (TPI) casings required for premium performance tyres. These casings, often made from cotton or poly-cotton blends or advanced nylon, dramatically influence the tyre's suppleness and rolling resistance. Intellectual property protection surrounding specialized tread patterns and proprietary rubber formulas forms a critical aspect of competitive advantage within this stage of the value chain, safeguarding investments in R&D.

Road Bike Tyres Market Potential Customers

The potential customer base for the Road Bike Tyres Market is highly segmented, ranging from professional cycling teams and elite athletes seeking marginal performance gains to casual commuters prioritizing durability and affordability. Primary end-users include competitive cyclists participating in sanctioned road races, criteriums, and time trials, who require the lightest and lowest rolling resistance tyres, often opting for tubular or high-end tubeless models. A significantly larger segment is the amateur enthusiast and endurance rider, who prioritize a balance of puncture protection, longevity, and comfort, typically purchasing mid-to-high-tier clincher or tubeless tyres with wider profiles (28mm to 32mm). Furthermore, daily commuters represent a growing segment, demanding robust, high-mileage tyres with excellent wet-weather grip and robust protection against urban debris, where cost-effectiveness and reliability are key purchasing criteria. Finally, Original Equipment Manufacturers (OEMs) constitute a major institutional buyer base, purchasing tyres in bulk for integration into mass-produced bicycle models, heavily influenced by unit cost, brand reputation, and consistent supply reliability.

The diversification of cycling into niche markets, such as gravel and cyclocross, has also expanded the customer base, requiring specialized, often wider tyres that bridge the gap between pure road speed and off-road traction. These customers value versatility and durability in mixed terrain conditions, prompting manufacturers to develop dedicated tread patterns and stronger sidewalls. Digital commerce has further broadened accessibility, attracting global consumers who rely on online reviews and performance data to inform purchases. Targeting strategies must differentiate between the highly price-sensitive commuting segment and the performance-driven enthusiast, who often exhibits higher brand loyalty to premium labels known for professional racing success and advanced material science credentials. Ultimately, the market is sustained by the inevitable wear cycle of rubber, ensuring a steady, recurring demand from all these customer categories, making retention strategies centered on product longevity and consistent quality essential for long-term revenue generation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Continental, Vittoria, Schwalbe, Pirelli, Maxxis, Specialized, Kenda, Goodyear, IRC Tire, Panaracer, Zipp, Bontrager, Hutchinson, Tufo, Challenge, Serfas, Vee Tire Co., CST, WTB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road Bike Tyres Market Key Technology Landscape

The technological landscape of the Road Bike Tyres Market is rapidly evolving, driven primarily by the need to balance conflicting performance metrics: speed, durability, and comfort. A major foundational technology shift is the industry-wide move toward Tubeless Ready (TLR) systems, which require complex bead designs and sealant compatibility, offering lower rolling resistance and superior puncture protection compared to traditional clinchers. Material science innovations are central, particularly the integration of advanced nano-materials like graphene and specialized silica compounds into rubber matrices. Graphene, for instance, significantly enhances both wet grip and mileage without compromising speed, fundamentally altering the performance envelope of modern road tyres. Furthermore, the construction of the tyre carcass is constantly being refined, with manufacturers employing high thread count per inch (TPI) materials, often exceeding 300 TPI, to create lighter, more supple sidewalls that conform better to road surfaces, thereby improving comfort and reducing rolling friction, while simultaneously incorporating proprietary puncture protection belts made from aramid or Vectran fibers beneath the tread.

Another area of intense R&D focuses on aerodynamic optimization. Tyres are increasingly designed in conjunction with specific rim profiles (System Integration), ensuring smooth airflow transition between the rim edge and the tyre sidewall, thereby minimizing drag coefficients. This trend has accelerated the adoption of wider tyres, which, when paired with modern wide rims, often prove to be more aerodynamically efficient than older, narrower setups. Beyond physical materials and construction, digital technologies are emerging, including smart tyre concepts embedding low-power sensors for real-time data capture of pressure and temperature. This data, often transmitted via Bluetooth or NFC to bicycle computers, allows riders and mechanics to make immediate, informed adjustments, maximizing safety and performance. This sensor integration, although nascent, represents the future convergence of cycling hardware with the Internet of Things (IoT), enhancing the user experience and potentially feeding data back into AI-driven performance optimization models.

Regional Highlights

- Europe: Europe stands as the dominant market for road bike tyres, characterized by deep-rooted cycling culture, a high prevalence of professional cycling teams, and strong government support for cycling infrastructure in countries like the Netherlands, Belgium, and Germany. The demand for premium, high-performance tyres (tubular and tubeless) is exceptionally high here, driven by affluent consumer bases and strict quality expectations associated with European manufacturing standards. Replacement demand is consistently robust due to the dense population of avid cyclists and variable weather conditions necessitating specialized seasonal tyres.

- North America (NA): North America represents a significant and rapidly growing market, particularly influenced by the proliferation of endurance cycling, amateur racing, and the explosive growth of the gravel cycling segment, which demands durable, wider road tyres. The market is characterized by high adoption rates of new technology, such as tubeless systems, and strong brand loyalty to international premium brands. E-commerce distribution channels are highly influential, reflecting consumers' preference for accessing product reviews and technical specifications online before purchase.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising disposable incomes, rapid urbanization leading to increased commuting by bicycle, and the emergence of competitive cycling culture in nations like China, Japan, and South Korea. While the segment is currently dominated by high-volume, cost-effective clincher tyres, the demand for mid-range and premium tubeless products is accelerating, driven by the professional racing scene in the region and increasing health consciousness among the urban populace.

- Latin America (LATAM): The LATAM market, while smaller, shows potential growth primarily driven by the use of bicycles for essential transportation and the rise of local competitive events. Price sensitivity is a major factor, leading to a focus on durable, affordable tyre solutions. Infrastructure challenges often necessitate robust tyre construction capable of handling less-than-ideal road conditions.

- Middle East and Africa (MEA): This region is niche, with demand concentrated in affluent urban centers for recreational and fitness cycling. Growth is primarily limited by climate conditions in some areas, but strategic investments in high-end leisure sports infrastructure are slowly boosting the demand for quality road cycling products, including high-performance tyres suitable for hot, dry conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road Bike Tyres Market.- Continental AG

- Michelin Group

- Vittoria S.p.A.

- Schwalbe (Ralf Bohle GmbH)

- Pirelli & C. S.p.A.

- Maxxis International (Cheng Shin Rubber Ind. Co. Ltd.)

- Specialized Bicycle Components

- Kenda Rubber Industrial Co., Ltd.

- Goodyear Tire & Rubber Company (Licensee)

- IRC Tire (Inoue Rubber Co. Ltd.)

- Panaracer Corporation

- Zipp (SRAM Corporation)

- Bontrager (Trek Bicycle Corporation)

- Hutchinson SA

- Tufo (Continental subsidiary)

- Challenge Tyres

- Serfas

- Vee Tire Co.

- CST (Cheng Shin Rubber Ind. Co. Ltd.)

- WTB (Wilderness Trail Bikes)

Frequently Asked Questions

Analyze common user questions about the Road Bike Tyres market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of tubeless road bike tyres?

The primary driver is the superior performance balance offered by tubeless technology, including lower rolling resistance due to the elimination of the inner tube friction, enhanced comfort from lower running pressures, and significantly improved puncture protection provided by integrated liquid sealant, leading to fewer ride interruptions.

How does graphene technology impact modern road bike tyre performance?

Graphene, when integrated into rubber compounds, significantly improves performance across multiple metrics simultaneously. It enhances both wet and dry grip while substantially increasing mileage and resistance to cuts and abrasions, offering a better compromise between speed (low rolling resistance) and durability.

Which geographical region holds the largest market share for high-performance road bike tyres?

Europe currently holds the largest market share for high-performance road bike tyres, attributed to the continent's established and pervasive cycling culture, extensive professional racing circuits, and a consumer base with high demand for premium, technologically advanced components.

What are the main advantages of using wider road bike tyres (28mm and above)?

Wider road tyres offer increased air volume, which permits lower operating pressures, resulting in improved ride comfort, better traction and stability, and potentially lower rolling resistance and better aerodynamics when paired correctly with modern wide rims, contrary to historical assumptions.

Is the aftermarket segment or the OEM segment more critical for revenue generation in this market?

The Aftermarket segment is generally more critical for revenue generation. While OEM sales provide high volume, the Aftermarket dictates premium pricing and consistent, recurring sales driven by the mandatory replacement cycle of worn tyres, often allowing consumers to upgrade to higher-performance products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager