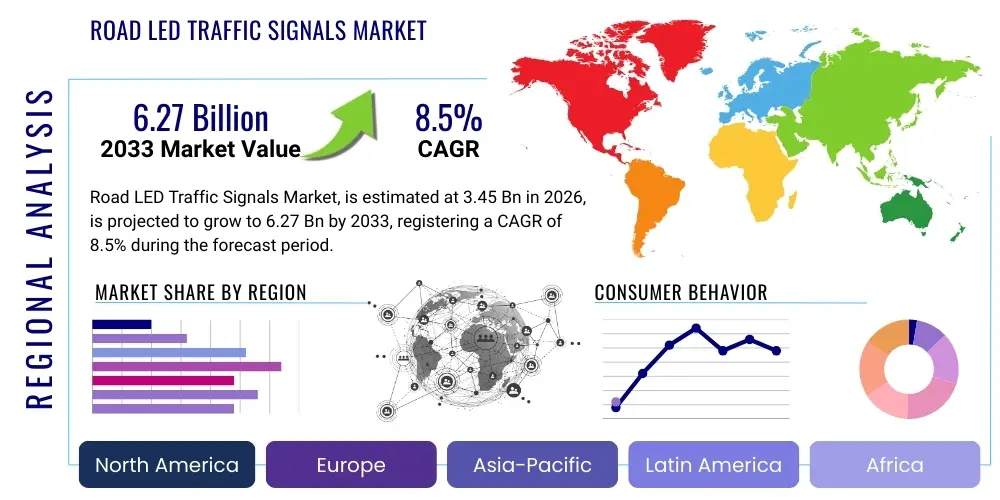

Road LED Traffic Signals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441767 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Road LED Traffic Signals Market Size

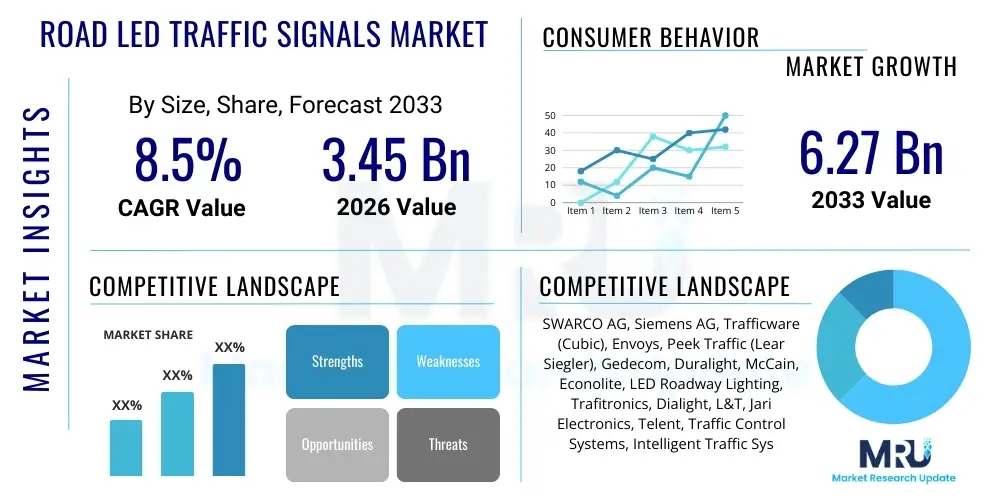

The Road LED Traffic Signals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.45 Billion in 2026 and is projected to reach USD 6.27 Billion by the end of the forecast period in 2033.

Road LED Traffic Signals Market introduction

The Road LED Traffic Signals Market encompasses the manufacturing, distribution, and implementation of high-efficiency light-emitting diode (LED) based signaling devices used for vehicular and pedestrian traffic management across global road networks. These modern signaling systems replace traditional incandescent lights, offering substantial advantages in terms of energy consumption, operational lifespan, and visibility under various weather conditions. The product description centers on highly reliable, energy-saving optical systems that meet stringent international safety and performance standards (such as MUTCD and EN 12368). Key components include high-flux LEDs, robust polycarbonate or aluminum housings, sophisticated driver circuitry, and often, communication interfaces for integration into Intelligent Transportation Systems (ITS).

Major applications for road LED traffic signals span urban intersections, highway ramp metering, pedestrian crossings, railway grade crossings, and specialized lane control systems. Their adoption is critically driven by governmental mandates aimed at reducing carbon footprints and enhancing public safety. The superior longevity of LED signals significantly reduces maintenance costs and labor associated with frequent bulb replacement, thereby improving operational expenditure profiles for municipal and state transportation authorities. Furthermore, the directional nature and customizable intensity of LED lights allow for better optimization of signal visibility, especially during bright daylight hours, contributing directly to accident reduction statistics.

The principal benefits derived from utilizing LED traffic signals include dramatic reductions in power consumption, often exceeding 80% compared to incandescent bulbs, and an operational lifespan extending up to 10 years, minimizing signal outage risks. Driving factors compelling market growth include the rapid global urbanization leading to increased traffic congestion, the widespread development of Smart City infrastructure projects focused on connectivity and efficiency, and continuous technological advancements in LED performance (such as improved spectral output and decreased thermal degradation). Regulatory pushes towards sustainable infrastructure development further underpin the robust demand for these energy-efficient solutions.

Road LED Traffic Signals Market Executive Summary

The market for Road LED Traffic Signals is currently experiencing robust growth, primarily propelled by global infrastructural modernization initiatives and stringent regulatory frameworks mandating energy efficiency. Key business trends indicate a strong shift towards connected signal systems, leveraging IoT protocols to enable real-time communication between traffic signals, centralized control centers, and increasingly, connected vehicles. This technological integration is fostering new revenue streams in maintenance services and software subscriptions related to traffic optimization algorithms. Manufacturers are focusing on modular designs, enabling easier integration of features such as pedestrian sensors, conflict monitoring systems, and adaptive signal timing capabilities, thereby increasing the overall value proposition of the products.

From a regional perspective, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid infrastructural development in economies like China and India, coupled with massive government investments in new smart road construction. North America and Europe, characterized by established infrastructure, are primarily driven by replacement cycles, system retrofitting, and the implementation of advanced adaptive traffic management systems, emphasizing high-performance, complex controllers and integrated V2X (Vehicle-to-Everything) communication readiness. Emerging markets in Latin America and MEA are beginning to adopt LED technology rapidly, moving directly from outdated systems to highly efficient LED installations, often bypassing intermediate technologies, supported by international funding for sustainable development projects.

Segmentation trends highlight the increasing demand for advanced vehicle detection signals and pedestrian countdown timers (PCTs), which directly contribute to enhanced safety and traffic flow efficiency. Technology-wise, the transition from basic LED modules to fully integrated, intelligent signal heads capable of dynamic dimming and remote diagnostic reporting is defining the premium segment. Furthermore, the market shows strong traction in specialized applications, such as emergency vehicle preemption systems (EVPS) and transit signal priority (TSP), which utilize connectivity features inherent in modern LED signaling infrastructure to manage priority movements effectively within congested urban environments, leading to higher average selling prices and greater market sophistication.

AI Impact Analysis on Road LED Traffic Signals Market

User inquiries regarding AI's influence on the Road LED Traffic Signals Market predominantly revolve around three core themes: the transition from fixed timing to truly adaptive signal control, the role of AI in predictive maintenance and operational reliability, and the implications for urban planning and traffic optimization. Users are highly interested in how Machine Learning (ML) algorithms utilize complex real-time data from sensors, cameras, and connected vehicles to dynamically adjust signal phases, anticipating congestion before it occurs, which directly impacts the need for traditional fixed-cycle traffic controllers. Concerns often surface regarding the security and resilience of these AI-driven systems and the necessary infrastructure investment required for high-speed data processing and communication protocols to support true real-time adaptation.

The application of AI transcends simple adaptive control; it is fundamentally altering the product lifecycle and service delivery model within the traffic signal industry. AI-powered predictive analytics monitor the health and performance of individual LED signal heads and associated controller hardware, identifying potential failures days or weeks in advance. This capability drastically improves uptime and shifts maintenance models from reactive repairs to scheduled, preventative interventions. Furthermore, generative AI models are increasingly being explored for simulating complex traffic flow scenarios, allowing transportation planners to optimize intersection layouts and signal phasing strategies virtually before physical deployment, reducing trial-and-error costs associated with traditional planning methods.

Ultimately, AI is positioning the Road LED Traffic Signal not merely as a light source, but as a crucial sensor node within a larger, self-optimizing urban network. The integration of computer vision and deep learning allows signals to accurately classify different road users (vehicles, bicycles, pedestrians) and adjust timings based on specific demand patterns, rather than simple presence detection. This capability ensures greater equity in road usage and maximizes throughput. This convergence of hardware efficiency (LEDs) and software intelligence (AI/ML) is accelerating the market toward fully autonomous traffic management systems, creating a significant competitive edge for manufacturers who successfully embed these intelligence features into their signal solutions.

- AI enables highly adaptive traffic signal control by processing real-time sensor data (computer vision, loops, radar) to optimize phasing and minimize delays dynamically.

- Predictive maintenance analytics, driven by ML, forecast potential signal failures (e.g., power supply degradation, LED cluster dimming) to ensure proactive repair and maximize system reliability.

- Enhanced pedestrian and cyclist safety through AI-driven object detection and classification, allowing for immediate and customized response to vulnerable road users.

- Optimization of urban mobility through simulation and scenario planning using generative AI models to validate signal timing plans before implementation.

- Facilitation of V2X communication and autonomous vehicle integration by providing high-fidelity, real-time traffic state information from the intelligent signal infrastructure.

- AI-driven energy management features allow for smart dimming and personalized light intensity adjustments based on ambient light and traffic volume, enhancing energy savings beyond standard LED benefits.

DRO & Impact Forces Of Road LED Traffic Signals Market

The Road LED Traffic Signals Market is influenced by a dynamic interplay of factors encompassing technological innovation, regulatory support, economic viability, and inherent infrastructure challenges. The primary drivers (D) include global energy efficiency mandates, rapid smart city development focusing on ITS implementation, and the proven longevity and reliability of LED technology, which provide compelling total cost of ownership (TCO) advantages over traditional incandescent systems. These drivers are fundamentally reshaping infrastructure investment priorities globally, favoring modern, connected signaling solutions that offer both environmental and economic benefits to city authorities.

However, the market faces notable restraints (R), such as the high initial capital investment required for wholesale conversion projects, especially in financially constrained developing regions. Furthermore, the complexity associated with integrating new, sophisticated LED signal systems with legacy, often proprietary, traffic control infrastructure poses significant technical and operational hurdles. Concerns related to potential system vulnerability stemming from increased connectivity, particularly cyber security risks within intelligent traffic networks, also act as a dampener on rapid, uncritical adoption, necessitating robust security protocols and standards development.

Significant opportunities (O) exist in the expansion of high-end intelligent traffic solutions, particularly in the deployment of adaptive traffic control systems (ATCS) utilizing deep learning and edge computing. The growing trend toward modularity and standardization offers avenues for streamlined production and easier retrofitting, opening up emerging markets. The market is increasingly impacted by forces such as the rapid decline in LED component costs, regulatory alignment pushing for standardized communication protocols (Impact Force 1), accelerating urbanization rates (Impact Force 2), and sustained public demand for reduced traffic congestion and enhanced road safety (Impact Force 3), all of which create a positive feedback loop driving sustained market expansion and technological iteration.

Segmentation Analysis

The Road LED Traffic Signals Market is comprehensively segmented based on product type, application, technology, and geography, enabling a detailed assessment of market dynamics and targeted investment strategies. The primary differentiation often lies between full traffic signal heads (complete replacement units), and retrofitting kits (LED modules designed to replace incandescent lamps within existing signal housing), reflecting diverse purchasing strategies by municipalities based on the age and condition of their current infrastructure. The evolution of signaling technology is strongly influencing the product mix, favoring integrated solutions that combine lighting, sensors, and communication capabilities into a single, cohesive unit designed for intelligent transportation environments.

Segmentation by application highlights distinct market requirements for general vehicular traffic control, complex intersection management, and dedicated pedestrian crossings. Complex intersection applications often demand high-end controllers and advanced features such as conflict monitoring and phase optimization software, representing a high-value segment. Furthermore, the segmentation by technology details the move from simple fixed-timed systems to fully adaptive and interconnected (networked) systems, emphasizing the criticality of communication standards (e.g., NEMA, UTMC) and sensor integration (e.g., radar, loop detectors, video) in the purchasing decision-making process. Geographic segmentation remains crucial, reflecting differing levels of infrastructural maturity, regulatory requirements, and budget allocations across regions.

Understanding these segments allows stakeholders to tailor product offerings effectively. For instance, manufacturers targeting developing economies may focus on durable, cost-effective retrofitting kits, while those focusing on mature markets concentrate on sophisticated, high-definition signal heads that are V2X compatible and integrated with cloud-based traffic analytics platforms. This nuanced market view supports strategic resource allocation, focusing R&D efforts on areas such as power efficiency improvements (lowering standby power consumption) and enhancing cyber resilience, which are increasingly important competitive factors across all major segments.

- By Product Type:

- Full Traffic Signal Heads (New Installations)

- Retrofit Kits/Modules (Replacement/Upgrade)

- Traffic Signal Components (Lenses, Housings, Controllers, Visors)

- By Signal Type:

- Vehicular Signals (Circular, Arrow, Lane Control)

- Pedestrian Signals (Countdown Timers, Hand/Man Symbols)

- Specialized Signals (Railroad Crossing Signals, Emergency Preemption Indicators)

- By Technology/Functionality:

- Fixed-Time Signals (Basic LED units)

- Semi-Actuated Signals

- Fully Adaptive Traffic Control Systems (ATCS)

- Connected and Networked Signals (V2X readiness)

- By Installation Location:

- Urban Intersections

- Highways and Freeways (Ramp Metering)

- Crosswalks and Pedestrian Zones

Value Chain Analysis For Road LED Traffic Signals Market

The value chain for the Road LED Traffic Signals Market is highly structured, beginning with the production of core electronic and optical components and concluding with governmental procurement and long-term maintenance services. Upstream analysis focuses on the supply of raw materials, particularly high-brightness LED chips (based on materials like Gallium Nitride), polycarbonate plastics for housing and lenses, and advanced microprocessors necessary for integrated controller boards. Key suppliers include specialized semiconductor companies and electronic component manufacturers. Price volatility and supply chain resilience concerning these critical electronic components, particularly after global disruptions, significantly influence the final product cost and manufacturing lead times. Manufacturers must maintain strategic relationships with these upstream suppliers to ensure stable, high-quality component flow.

The midstream stage involves the core manufacturing process, where signal heads are assembled, tested, and certified according to relevant national and international standards (e.g., CE, UL, ITE). This stage is characterized by high precision engineering to ensure optimal light dispersion, thermal management, and ingress protection (IP rating) against environmental factors. Distribution channels are varied, incorporating direct sales to large municipal or federal transportation authorities for major infrastructure projects, and indirect channels relying on specialized system integrators, electrical contractors, and regional distributors who often bundle the LED signals with controllers, poles, and installation services. The selection of the distribution channel often depends on the scale and complexity of the project.

Downstream analysis centers on the end-users—primarily government agencies, state departments of transportation, and municipal public works departments responsible for urban infrastructure. The long-term profitability of the market increasingly relies on post-installation services, including software updates for adaptive systems, remote diagnostics, and preventative maintenance contracts. The direct channel offers greater control over branding and pricing but requires significant in-house sales and engineering support, whereas the indirect channel facilitates broader market penetration, particularly in fragmented local markets. System integrators play a crucial role in the downstream segment, often responsible for the final commissioning and integration of disparate traffic control elements, including VMS boards, sensors, and the LED signal heads, into a unified ITS platform.

Road LED Traffic Signals Market Potential Customers

The primary customers and end-users of Road LED Traffic Signals are public sector entities tasked with managing, regulating, and maintaining urban and interurban road infrastructure. These entities include federal, state, and local departments of transportation (DOTs) and municipal public works departments. Their purchasing decisions are typically governed by multi-year capital improvement plans, federal and state safety mandates, and access to funding streams dedicated to infrastructure modernization, energy conservation, and smart city development. The shift toward modernizing infrastructure guarantees a continuous demand from these governmental bodies, particularly for replacement and retrofitting projects in aging metropolitan areas.

Beyond traditional governmental buyers, the market also targets specific quasi-public and private entities. These include operators of privately managed toll roads, large airport authorities responsible for ground traffic, major industrial campuses, and large-scale developers of smart residential communities or business parks who require internal traffic management systems compliant with public standards. These commercial buyers seek high reliability and systems that integrate seamlessly with local public infrastructure, often prioritizing advanced features like customized programming and rapid deployment capabilities to minimize disruption during construction phases. The emphasis for all buyers remains on long-term cost-effectiveness, proven product reliability, and compliance with stringent operational standards.

Furthermore, international development banks and aid organizations also act as significant indirect buyers, funding infrastructure projects in developing nations. In these scenarios, the procurement often involves bulk purchasing of standardized, durable LED signal systems through large international tenders. Ultimately, the buying process is characterized by extensive specification development, competitive tendering, and a long sales cycle, with the final selection heavily weighted toward manufacturers who can demonstrate superior product lifecycle support, energy savings projections, and a successful track record in implementing complex ITS projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.45 Billion |

| Market Forecast in 2033 | USD 6.27 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SWARCO AG, Siemens AG, Trafficware (Cubic), Envoys, Peek Traffic (Lear Siegler), Gedecom, Duralight, McCain, Econolite, LED Roadway Lighting, Trafitronics, Dialight, L&T, Jari Electronics, Telent, Traffic Control Systems, Intelligent Traffic Systems, Iteris, Kapsch TrafficCom, Xinghua Traffic Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road LED Traffic Signals Market Key Technology Landscape

The technology landscape of the Road LED Traffic Signals Market is rapidly evolving beyond simple illumination toward integrated smart sensing and communication capabilities, fundamentally transforming the signal head into an Internet of Things (IoT) node. Core technologies revolve around the optimization of high-power LED arrays, requiring sophisticated thermal management systems to ensure long-term chromaticity stability and light output efficiency, particularly in extreme temperature environments. Key advancements include the adoption of high-efficiency optics, such as parabolic reflectors and specialized lens designs, that maximize signal visibility while adhering to strict luminance uniformity standards, ensuring compliance with global regulatory bodies like the ITE (Institute of Transportation Engineers) and CEN (European Committee for Standardization).

Crucially, the market is defined by the proliferation of Intelligent Transportation Systems (ITS) components embedded directly within the signal infrastructure. This includes advanced controller technologies utilizing high-speed microcontrollers capable of running complex adaptive algorithms (e.g., SCOOT, SCATS) and facilitating V2X communication (based on DSRC or C-V2X protocols). Edge computing capabilities are becoming standard, allowing signals to process local sensor data (from embedded cameras, radar, and lidar) in real-time, reducing latency, and enabling instantaneous adaptation to changes in traffic flow or incident detection without relying entirely on centralized servers. Power efficiency improvements also remain a core technological focus, with developments in low-power electronics and optimized dimming strategies to minimize energy consumption during low-traffic periods.

The integration of advanced diagnostics and monitoring protocols, often cloud-connected, forms a vital part of the current technological trend. Modern LED traffic signals are equipped with communication modules (cellular, fiber optic, or mesh wireless networks) that enable remote monitoring of operational status, energy usage, and component health. This capability not only facilitates predictive maintenance but also provides valuable traffic data back to central management systems for macro-level network optimization and urban planning. The continued drive toward standardized, interoperable communication interfaces ensures that solutions from various vendors can interact seamlessly, which is a major procurement requirement for large metropolitan areas transitioning toward integrated Smart City architectures.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market segment, primarily driven by massive government-led investments in foundational infrastructure and Smart City projects, particularly in rapidly urbanizing nations like China, India, and Southeast Asian countries. The focus here is on both new installation capacity and large-scale modernization projects to combat severe urban congestion. Regulatory standards are catching up quickly, favoring energy-efficient LED technology over older incandescent units, especially in major provincial capital cities.

- North America (NA): North America is a mature market characterized by a consistent demand for replacement and technology upgrades. The focus is heavily on implementing advanced Adaptive Traffic Control Systems (ATCS) and integrating LED signals with emerging V2X communication technologies to prepare for autonomous vehicle deployment. Standardization (ITE) and reliability are key procurement factors, with significant expenditure directed towards cybersecurity features for networked controllers.

- Europe: European market growth is steady, bolstered by rigorous EU energy efficiency directives and a strong emphasis on pedestrian and cyclist safety. Countries such as Germany, the UK, and the Netherlands lead in adopting sophisticated, highly interconnected traffic management systems (utilizing protocols like SCOOT and SCATS). Retrofitting existing infrastructure with highly durable and fault-tolerant LED systems is a major market activity, supported by centralized EU funding mechanisms for green transportation initiatives.

- Latin America (LATAM): The LATAM region, including Brazil and Mexico, is experiencing strong adoption, migrating from legacy systems to energy-efficient LED solutions driven by economic imperatives to reduce high electricity costs and improve operational lifecycles. Market penetration is variable, often relying on international funding or public-private partnerships (PPPs) to finance large infrastructure upgrade tenders, focusing initially on major metropolitan corridors.

- Middle East and Africa (MEA): The Middle East is a dynamic market, particularly the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia), which are investing heavily in futuristic, greenfield smart cities and large-scale infrastructure projects (e.g., NEOM). These projects demand state-of-the-art, often specialized LED signal systems capable of withstanding extreme desert climates. The African market is primarily driven by essential infrastructural development, with LED adoption accelerating in key economic hubs as a cost-effective, durable solution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road LED Traffic Signals Market.- SWARCO AG

- Siemens AG

- Trafficware (Cubic)

- Econolite Group, Inc.

- Peek Traffic (Lear Siegler)

- McCain, Inc.

- Duralight Traffic Systems

- Dialight plc

- Kapsch TrafficCom AG

- Iteris, Inc.

- LED Roadway Lighting Ltd.

- Gedecom Traffic Control Systems

- Larsen & Toubro (L&T) Limited

- Jari Electronics Private Limited

- Telent Technology Services Ltd.

- TransCore (Roper Technologies)

- Xinghua Traffic Technology Co., Ltd.

- Yunnan Traffic Technology Co., Ltd.

- VER-MAC

- ClearSignal Traffic Systems

Frequently Asked Questions

Analyze common user questions about the Road LED Traffic Signals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Road LED Traffic Signals globally?

The primary factor driving global adoption is the significant reduction in energy consumption and maintenance costs offered by LED technology. LEDs provide superior energy efficiency (up to 90% savings compared to incandescent) and an operational life exceeding 10 years, aligning with worldwide governmental mandates for sustainable and cost-effective infrastructure management.

How does V2X communication readiness impact the future of LED traffic signals?

V2X (Vehicle-to-Everything) readiness transforms the signal head into a critical communication node within Intelligent Transportation Systems (ITS). It allows LED signals to exchange real-time status data (e.g., current phase, timing) directly with connected and autonomous vehicles, enhancing safety, optimizing traffic flow, and preparing urban networks for self-driving mobility.

What are the main technological differences between fixed-time and adaptive LED signal systems?

Fixed-time LED signals operate on predefined, unchanging schedules, regardless of real traffic volume. Adaptive systems, conversely, utilize AI and real-time sensor data (cameras, loops) to dynamically adjust phase lengths and sequencing instantly, maximizing road throughput and significantly reducing queuing and delays in congested urban areas.

What is the typical lifespan and return on investment (ROI) for municipal adoption of LED traffic signals?

LED traffic signals typically have a lifespan of 6 to 10 years, significantly exceeding the 1–2 year life of incandescent bulbs. The ROI is generally achieved quickly, often within 2–4 years, driven primarily by cumulative savings from drastically reduced electricity bills and minimized labor costs associated with routine bulb replacement and maintenance.

Which geographical region holds the largest potential for market expansion?

The Asia Pacific (APAC) region, led by China and India, holds the largest potential for expansion due to rapid urbanization, immense population growth, and high governmental spending on new smart infrastructure development, coupled with extensive modernization efforts to replace legacy signaling equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager