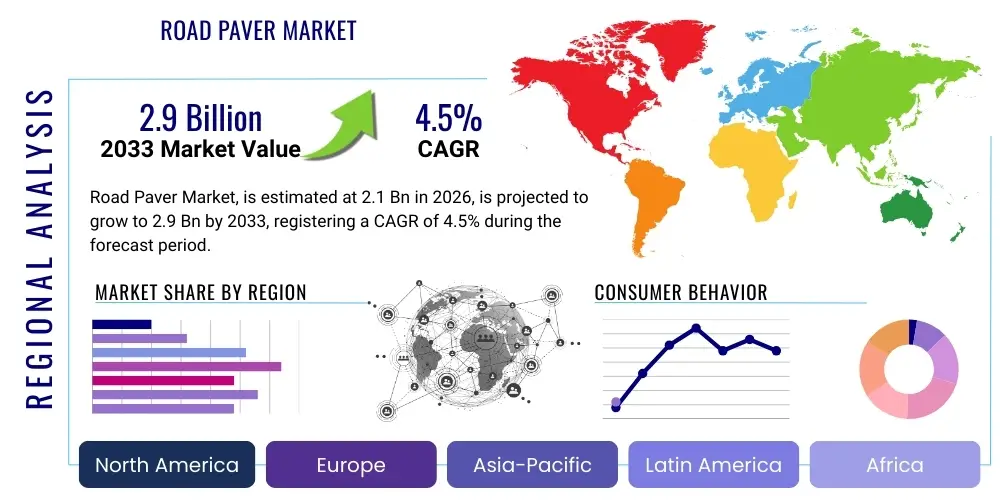

Road Paver Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441228 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Road Paver Market Size

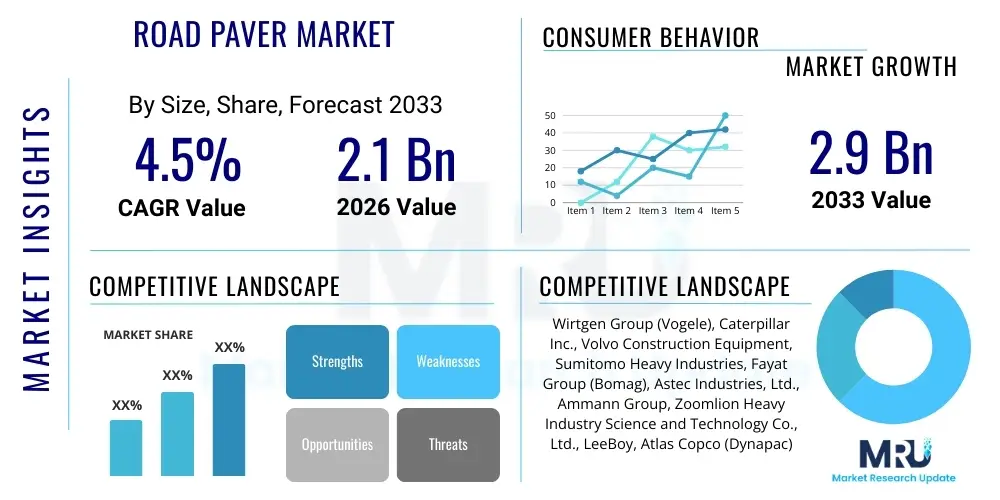

The Road Paver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Road Paver Market introduction

The Road Paver Market encompasses the manufacturing, distribution, and utilization of heavy construction machinery specifically designed for laying asphalt concrete, cement concrete, or other granular materials onto roadbeds, ensuring uniform density and surface finish. These machines are critical components in both new infrastructure development and maintenance projects globally. Modern road pavers, including both tracked and wheeled variants, are increasingly equipped with sophisticated technologies such as automatic screed control, sonic sensors, and GPS guidance systems to enhance precision, material consumption efficiency, and project quality. The primary function remains the creation of smooth, durable road surfaces capable of withstanding various traffic loads and environmental conditions, making them indispensable assets for national and regional transportation networks.

Major applications of road pavers span across several infrastructure sectors, including large-scale highway construction, urban road rehabilitation, airport runway paving, and specialized residential street development. The versatility of pavers, defined by their ability to handle different paving widths and material types, contributes significantly to their market demand. Benefits derived from using advanced road pavers include accelerated construction timelines, superior pavement quality, reduced labor requirements, and optimized material usage, directly translating to lower long-term maintenance costs for infrastructure owners. Furthermore, improvements in paver technology are focusing on reducing emissions and noise levels, aligning with global sustainability mandates and increasingly stringent environmental regulations.

The primary driving forces underpinning the sustained growth of the Road Paver Market include aggressive governmental investments in public infrastructure stimulus packages worldwide, particularly in developing economies focused on expanding their road networks. Rapid urbanization globally necessitates continuous upgrading and expansion of urban road infrastructure, driving demand for maneuverable, efficient paving equipment. The replacement cycle of aging machinery, coupled with the mandatory adoption of newer, more productive models that meet contemporary emission standards, further stimulates market movement. These factors collectively establish a robust demand environment for road paver manufacturers, emphasizing innovation in fuel efficiency, operational automation, and enhanced durability.

Road Paver Market Executive Summary

The global Road Paver Market is characterized by intense competition and rapid technological evolution, primarily driven by large-scale public-private partnerships focused on infrastructure expansion. Business trends indicate a strong move towards equipment digitalization, incorporating telematics, predictive maintenance analytics, and remote diagnostics to maximize uptime and operational efficiency for contractors. Key market participants are strategically investing in R&D to develop hybrid and electric road paver models, addressing the rising cost of fuel and the global push toward carbon neutrality in the construction sector. Mergers and acquisitions remain a core strategy for geographical expansion and portfolio diversification, allowing leading players to solidify their presence across emerging markets and gain access to specialized paving technologies.

Regionally, the Asia Pacific (APAC) sector stands as the most dynamic market, fueled by massive government expenditures on high-speed rail and expressway networks, notably in China, India, and Southeast Asian nations. North America and Europe, while being mature markets, exhibit steady demand driven by extensive road maintenance and refurbishment projects, mandated infrastructure longevity requirements, and the necessity to replace older fleets with high-specification, emission-compliant models. The Middle East and Africa (MEA) region also presents significant growth opportunities, spurred by ambitious mega-projects related to urban development and mineral transport infrastructure, demanding large-scale, high-capacity road pavers capable of operating effectively in challenging climatic conditions.

Segmentation trends highlight the increasing preference for sophisticated tracked pavers in large highway projects due to their superior traction and stability, offering higher paving consistency. Concurrently, wheeled pavers maintain strong traction in urban and municipal applications where maneuverability and speed are prioritized. Within the technology segment, automatic screed control systems are becoming standard, offering unprecedented precision in pavement thickness and grade, thereby reducing material wastage and ensuring compliance with stringent engineering specifications. Furthermore, the rising demand for medium and large operating width pavers reflects the trend toward fewer passes and faster project completion rates, especially critical in competitive contracting environments where time efficiency is paramount.

AI Impact Analysis on Road Paver Market

Common user questions regarding AI in the Road Paver Market predominantly revolve around how artificial intelligence can transform operational efficiency, predict equipment failures, and enable fully autonomous paving operations. Users frequently inquire about the feasibility and return on investment (ROI) of integrating AI-powered sensors for real-time quality control, asking whether AI can truly guarantee zero defects in pavement density and smoothness. Another major area of concern is the skill gap—how AI adoption will necessitate new training protocols for heavy equipment operators and maintenance crews. These questions indicate a market expectation that AI will move beyond basic telematics to provide prescriptive guidance, enabling contractors to optimize material mix, track crew performance, and ensure regulatory compliance with minimal human intervention.

AI's primary influence is expected in enhancing predictive maintenance and optimizing material logistics. By analyzing vast datasets generated by onboard telematics—including engine performance, vibration levels, and hydraulic system pressure—AI algorithms can forecast component failure hours with high accuracy, drastically reducing unplanned downtime. This capability transitions maintenance from reactive to predictive, a critical factor for contractors operating under tight deadlines. Furthermore, AI systems are being trained to process real-time sensor data from the paving process (such as thermal mapping and density measurements) to automatically adjust paver settings, including screed temperature and vibration amplitude, ensuring optimal paving conditions continuously.

The long-term impact of AI lies in facilitating truly autonomous road construction sites. While initial steps involve semi-autonomous features like automated steering and grade control, the ultimate goal is platooning and synchronized operation of multiple machines (pavers, rollers, and material feeders) managed by a central AI system. This synchronization ensures continuous paving without material shortages or unnecessary stops, which are detrimental to pavement quality. Although full autonomy faces regulatory hurdles and requires sophisticated V2X (Vehicle-to-Everything) communication, the groundwork laid by current AI-driven optimization tools positions the road paver market for a significant leap in productivity and precision engineering within the forecast period.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast component failure, minimizing unplanned downtime and maximizing fleet utilization.

- Real-Time Paving Optimization: AI dynamically adjusts screed settings, material flow, and compaction parameters based on real-time surface quality measurements (e.g., thermal and density mapping).

- Autonomous Operation Development: Facilitation of automated steering and eventual synchronized platooning of pavers and rollers for continuous, high-quality pavement laying.

- Optimized Material Logistics: AI manages the flow of asphalt mix from batch plants to the paving site, preventing idling and ensuring steady material supply.

- Improved Crew Safety: AI-powered collision avoidance and proximity sensing reduce the risk of accidents in complex construction environments.

DRO & Impact Forces Of Road Paver Market

The dynamics of the Road Paver Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectories. The most significant driver is the global commitment to modernizing and expanding transportation infrastructure, particularly in rapidly urbanizing regions of Asia and Africa, coupled with necessary maintenance projects in mature economies. This demand is reinforced by governmental stimulus spending aimed at economic recovery through infrastructure investments. However, the market faces strong headwinds from restraints, primarily the high initial capital investment required for advanced paver models and the increasing complexity of maintenance due to integrated electronics and emission control systems. Furthermore, the persistent shortage of skilled operators capable of managing these sophisticated machines limits the adoption rate in certain geographic areas.

Opportunities for market growth are strongly linked to technological advancements. The shift towards hybrid and electric powertrain technologies offers a significant opportunity to mitigate operational costs related to fuel consumption and adhere to stricter urban emission standards, opening new avenues for municipal contracts. The adoption of advanced telematics, IoT integration, and Building Information Modeling (BIM) allows contractors to achieve unprecedented levels of project management efficiency and quality assurance, thereby creating a competitive advantage. Manufacturers are also seizing the opportunity to offer comprehensive service contracts and training programs, transforming their role from equipment suppliers to full-service construction technology partners.

These forces exert substantial impact on market participants. The positive impact force stemming from infrastructure spending mandates continuous innovation in capacity and efficiency, pressuring manufacturers to shorten design cycles. Conversely, the high cost of compliance with TIER 4 Final and Stage V emission standards acts as a limiting force, especially for smaller market players who struggle to absorb the R&D costs. The increasing focus on sustainability (an opportunity) demands lighter, quieter, and more fuel-efficient machines, which fundamentally alters manufacturing priorities and supply chain relationships, requiring collaborations with technology providers specializing in automation and battery technology.

- Drivers: Accelerated governmental infrastructure spending; high demand for road maintenance and rehabilitation in mature economies; rapid urbanization globally necessitating new road networks; mandatory replacement cycles for outdated, inefficient equipment.

- Restraints: High initial purchase cost of sophisticated road pavers; complexity and cost associated with maintenance of advanced electronic systems; shortage of adequately trained and skilled paver operators globally; stringent and evolving emission regulations impacting equipment design.

- Opportunities: Development and adoption of electric and hybrid paver models; integration of AI, IoT, and telematics for enhanced operational management and predictive maintenance; expansion into fast-growing infrastructure markets in APAC and MEA; utilization of alternative paving materials requiring specialized machinery adaptations.

- Impact Forces: Government stimulus packages (High Positive Impact); Raw material price volatility (Medium Negative Impact); Technological differentiation and patent protection (Medium Positive Impact); Emission standard compliance costs (High Negative Impact on entry barriers).

Segmentation Analysis

The Road Paver Market segmentation is crucial for understanding specific consumer requirements and regional preferences within the construction industry. The market is primarily segmented based on the type of machine (tracked vs. wheeled), operating width (small, medium, large), application, and technology used (e.g., screed type, automation level). Analyzing these segments reveals varying growth rates and demand drivers; for instance, tracked pavers typically dominate high-volume highway projects due to their superior stability and traction over varied terrains, while wheeled pavers are favored in smaller urban and municipal projects where mobility and transport speed between jobs are critical considerations.

The operating width segment reflects the scale of infrastructure investment in a given region. Large pavers (greater than 8 meters working width) are indispensable for national highway projects and airport runways where continuous, wide-area paving is required to minimize joints and maximize pavement quality. Conversely, small and medium pavers (less than 4.5 meters) are the workhorses of residential development and utility trench paving, requiring greater precision and maneuverability in confined spaces. This differential demand profile compels manufacturers to maintain a diversified portfolio tailored to specific contractor needs and project scales.

Application-based segmentation, spanning from large-scale highways to specialized airport runways, further illustrates the customization required in paver design. Airport paving, for example, demands extremely high precision and consistency, often necessitating specialized screeds and highly accurate grade control systems like 3D paving technology, which goes beyond standard GPS. This level of specialization drives innovation within the technology segment, pushing manufacturers toward incorporating highly sensitive sensors and complex data integration capabilities to meet the most stringent specifications required by public infrastructure contracts globally.

- By Type:

- Tracked Pavers

- Wheeled Pavers

- By Operating Width:

- Small Pavers (up to 4.5 meters)

- Medium Pavers (4.5 to 7.5 meters)

- Large Pavers (above 7.5 meters)

- By Application:

- Highway Construction

- Urban Roadways and Streets

- Residential Projects

- Airport Runways and Aprons

- By Technology:

- Mechanical Pavers

- Automatic/Screed Control Pavers

- 3D Paving Systems Integrated Pavers

Value Chain Analysis For Road Paver Market

The value chain of the Road Paver Market begins with the upstream sourcing of raw materials, primarily specialized steel alloys for structural components, high-durability engine components, and sophisticated electronic control units (ECUs). Manufacturers rely on a globally interconnected network of suppliers for engines (meeting stringent emission standards), hydraulic systems, and complex electrical components, with specialization often concentrated in Europe and North America. The key challenge in the upstream segment is maintaining cost stability amidst volatility in steel prices and ensuring the timely supply of high-specification, custom-engineered parts required for modern paver systems, which are increasingly reliant on digital integration.

The core manufacturing and assembly stage involves high precision engineering, focusing on the paver chassis, engine integration, and the crucial screed system development—the most technically critical part determining pavement quality. Manufacturers often internalize the design and production of proprietary screeds and control systems to maintain a competitive edge. Distribution channels are highly structured, relying on a mix of direct sales to large governmental bodies or major contracting firms, and extensive networks of independent dealers or regional representatives for smaller contractors and after-sales support. The direct channel ensures strong customer relationship management for key accounts, while the dealer network provides necessary local service, financing options, and parts supply.

Downstream activities include utilization by construction contractors (the end-users) and extensive after-market services, which represent a significant revenue stream for manufacturers. After-sales support encompasses parts supply, preventative maintenance contracts, and advanced technical training for operators. The shift toward telematics and predictive diagnostics is transforming the downstream process, allowing manufacturers to remotely monitor machine health and proactively schedule service, thereby optimizing the total cost of ownership (TCO) for the end-user. Effective management of the distribution channel, balancing direct sales efficiency with the reach and support capacity of the dealer network, is paramount for success in this capital-intensive market.

Road Paver Market Potential Customers

The primary customers for road pavers are large civil engineering and construction firms that execute government-tendered infrastructure projects. These firms require high-capacity, reliable, and technologically advanced pavers to bid competitively on extensive projects like national highways, expressways, and airport construction where adherence to strict quality metrics and completion deadlines is non-negotiable. Their purchasing decisions are driven by factors such as machine reliability, fuel efficiency, maximum paving width, and the accuracy of automated grade and slope control systems, ensuring compliance with rigorous public works standards.

A secondary, yet rapidly growing, customer base includes municipal governments and regional public works departments, especially those responsible for urban road maintenance, residential street repairs, and utility trench reinstatement. These entities often favor smaller, more maneuverable wheeled pavers that can navigate congested urban environments efficiently and are easier to transport between localized job sites. While they may purchase fewer units, their recurring demand for replacement and specialized equipment ensures a stable market segment, with purchasing criteria prioritizing ease of use, lower emissions for urban operation, and local service support.

Furthermore, specialized infrastructure developers, such as private airport operators or industrial park developers, represent niche but high-value customers. These buyers require custom solutions, often involving 3D paving technology, to meet highly specific structural and surface requirements, demanding the most sophisticated paver models available. Financing options, comprehensive warranty packages, and rapid availability of parts and technical expertise are crucial components influencing the final purchasing decisions across all customer segments, emphasizing the importance of a robust manufacturer-dealer relationship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wirtgen Group (Vogele), Caterpillar Inc., Volvo Construction Equipment, Sumitomo Heavy Industries, Fayat Group (Bomag), Astec Industries, Ltd., Ammann Group, Zoomlion Heavy Industry Science and Technology Co., Ltd., LeeBoy, Atlas Copco (Dynapac), Sany Heavy Equipment, XCMG Construction Machinery, CNH Industrial (Case), HANTA Machinery Co., Ltd., Liugong Machinery, Terex Corporation, Pave-Mark Corporation, Sakai Heavy Industries, Pavement Technology Inc., Power Curbers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road Paver Market Key Technology Landscape

The technological landscape of the Road Paver Market is rapidly evolving, driven by the need for higher precision, reduced environmental impact, and greater operational efficiency. A foundational technology is the integration of high-resolution GPS (Global Positioning System) and GNSS (Global Navigation Satellite System) for precise positioning and grade control, moving paving operations from manual string lines to digital models. This integration, often referred to as 3D Paving, allows the paver to precisely follow a complex digital terrain model (DTM), ensuring the final pavement layer is laid to millimeter accuracy, which is crucial for maximizing pavement life and material efficiency.

Another critical technological development is the pervasive use of telematics and Internet of Things (IoT) sensors. These systems monitor key machine parameters—including engine load, fuel consumption, material temperature in the hopper, and vibration settings—transmitting data in real-time to fleet managers. This data enables predictive maintenance planning, remote diagnostics, and optimization of operational logistics, fundamentally lowering the Total Cost of Ownership (TCO) for contractors. Furthermore, thermal imaging technology integrated into the paver's screed is used to monitor the asphalt mat temperature continuously, ensuring that compaction occurs within the optimal thermal window, a critical factor for long-term pavement durability.

The industry is also witnessing significant investment in alternative power sources, specifically the development of hybrid and fully electric road pavers. These innovations respond directly to regulatory pressure regarding noise and emissions, particularly in urban and nighttime construction scenarios. Electric pavers offer drastically reduced operational noise and zero local emissions, providing a competitive advantage for contractors working on projects with strict environmental clauses. While battery technology development remains a key challenge, manufacturers are actively introducing hybrid models that utilize electric power for ancillary functions like the screed heating and vibrators, while retaining diesel engines for primary propulsion, representing a transitional phase toward complete electrification.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, primarily driven by massive government-led infrastructure programs in China, India, and Southeast Asia. Countries like India are heavily investing in the Bharatmala Pariyojana and similar large-scale road connectivity projects, creating robust demand for high-capacity tracked pavers (Large Pavers). The focus here is on rapid network expansion and the replacement of existing infrastructure, favoring efficiency and sheer throughput.

- North America: The North American market is highly mature but stable, fueled by state and federal investments in maintaining the existing interstate highway system and municipal infrastructure updates, often governed by long-term funding acts. Demand is characterized by a strong preference for high-tech, emissions-compliant machinery (Tier 4 Final engines) and advanced paving technologies such as automated grade control and telematics, reflecting a market where precision and environmental compliance supersede volume expansion.

- Europe: Europe is characterized by stringent environmental regulations (Stage V emission standards) and a focus on road quality and noise reduction, particularly in Western and Central European countries. The market demand is heavily centered around rehabilitation and urban renewal projects, driving the adoption of specialized, smaller, and more maneuverable pavers, alongside the quickest uptake of electric and hybrid models due to high diesel costs and strict urban zero-emission zones.

- Latin America: This region offers moderate growth potential, highly dependent on commodity prices and governmental stability. Key markets like Brazil and Mexico drive demand through localized infrastructure improvements and expansion of resource-extraction related road networks. Affordability and ruggedness are prioritized, often leading to a mix of new and refurbished equipment purchases.

- Middle East and Africa (MEA): Growth in MEA is spearheaded by major urban and economic diversification projects in the Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia’s Vision 2030). These ambitious projects require ultra-large, high-specification pavers capable of withstanding extreme heat and handling specialized desert-friendly paving materials, making it a high-value, albeit volatile, segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road Paver Market.- Wirtgen Group (Vogele)

- Caterpillar Inc.

- Volvo Construction Equipment

- Sumitomo Heavy Industries

- Fayat Group (Bomag)

- Astec Industries, Ltd.

- Ammann Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- LeeBoy

- Atlas Copco (Dynapac)

- Sany Heavy Equipment

- XCMG Construction Machinery

- CNH Industrial (Case)

- HANTA Machinery Co., Ltd.

- Liugong Machinery

- Terex Corporation

- Pave-Mark Corporation

- Sakai Heavy Industries

- Pavement Technology Inc.

- Power Curbers

Frequently Asked Questions

Analyze common user questions about the Road Paver market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for tracked versus wheeled road pavers?

Tracked pavers are seeing high demand for large-scale, high-specification projects like highways and airport runways due to superior traction, stability, and higher paving weight capacity. Wheeled pavers are preferred in urban and municipal projects where greater mobility, faster transport speeds between sites, and better maneuverability in confined spaces are essential purchasing criteria.

How do emission standards like Tier 4 Final and Stage V impact road paver manufacturing and costs?

These stringent global emission standards necessitate significant technological upgrades, including the integration of complex engine after-treatment systems (e.g., DPFs and SCR). This increases the complexity of manufacturing, raises the initial purchase price of new equipment, and drives R&D investment towards hybrid and electric paver development to achieve compliance while maintaining performance.

What role does 3D paving technology play in modern road construction?

3D paving technology utilizes GPS/GNSS and digital terrain models (DTMs) to achieve millimeter-level accuracy in laying pavement thickness and grade, eliminating the need for traditional string lines. This technology minimizes material wastage, significantly improves pavement quality consistency, and accelerates project completion times, especially for complex geometries like interchange ramps.

Which geographical region offers the most significant growth opportunities for paver sales?

The Asia Pacific (APAC) region, specifically emerging economies like India and Indonesia, offers the most significant growth opportunities. This is driven by large, sustained governmental investments in expanding road networks, coupled with rapid urbanization that mandates continuous development of new expressways and city road infrastructure.

What are the primary operational benefits of integrating telematics into road paver fleets?

Telematics integration provides real-time data on machine performance, operational status, and geographical location. Key benefits include enabling advanced predictive maintenance scheduling, reducing unplanned downtime, optimizing fuel consumption through performance monitoring, and improving fleet security and utilization rates for enhanced project profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager